Abstract

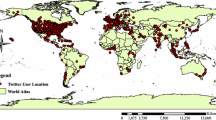

In this study, we investigate the impact of social media on future stock price crash risk. A stock price crash occurs when managers hoard bad news over an extended period and disclose all the bad news at once. Using Stocktwits data, we calculate informed tweets measure, which is the number of tweets with hyperlinks to original source of information divided by the total number of tweets. Our results demonstrate that future stock price crash risk is lower when the proportion of informed tweets is higher, suggesting that informed tweets on social media disseminate information and limit managers’ ability to hoard bad news. The results continue to hold when we address potential endogeneity issues using two-stage least squares regression, change analysis, and firm-fixed effect models. The cross-sectional analyses suggest that the effect of informed tweets on social media is stronger when the information environment is lower, further supporting the hoarding aversion effect. The results also suggest that informed tweets on social media serve as external monitoring mechanism. Controlling for alternative information acquisition channels, such as Google or the SEC EDGAR database does not change the inferences.

Similar content being viewed by others

Data availability

Social media data is a proprietary data provided by Stocktwits, Inc. Firm level data are available from the public sources cited in the text.

Notes

Bagnoli et al. (1999) obtain “whisper” forecasts from investor websites (e.g., fool.com and techstocks.com) as well as newswires.

Chang et al. (2017) analyze the effect of stock liquidity on stock price crash risk.

While we do not find any evidence that supports this argument, the study of misinformation on social media and its implications for capital markets is beyond the scope of this paper and remains an empirical question.

The correlated omitted variable bias could be a potential endogeneity issue in our setting.

Although we have not read every single tweet on Stocktwits, reading hundreds of random tweets leads us to conclude that this media platform is used for investment analysis purposes, whereby users discuss financial information of companies or macroeconomic trends.

The main variable of interest (i.e., wisdom of the crowd proxy) in Chen et al. (2014) is the fraction of negative words to the total number of words published on Seeking Alpha (SA) article. Following similar logic, we calculate the fraction of tweets with links to original information source to the total number of tweets.

In our sample, only 76 firms (i.e., 271 firm-year observations) have official Stocktwits accounts during the sample period. Majority of firms have official Twitter account.

The sample sizes for additional analyses vary due to data availability.

We follow Callen and Fang (2017) to measure the economic significance.

We use the following formula to measure the economic significance of the results: {Coefficient (INFORMED_TWEETS) x [75th percentile (INFORMED_TWEETS) – 25th percentile (INFORMED_TWEETS)]}/Mean (CRASHRISK). For NCSKEWt+1 model under Model 3:

[-0.157*(0.502–0.089)]/-0.042 = 154%. For DUVOLt+1 model under Model 4:

[-0.073*(0.502–0.089)]/-0.063 = 48%. The average is: (154% + 48%)/2 = 101%.

Merging our data with BoardEx reduces the sample size from 11,185 to 10,864 firm-year observations.

We thank Ryan Israelsen for sharing the Google search volume data used in Ben-Raphael et al. (2017). The Google search volume data is in a daily format, and we convert the data into an annual format by taking the average of the data at firm level. Then, we take the natural logarithmic transformation of the data. Alternatively, we use the maximum number of the Google search volume index and take the natural logarithmic transformation of the maximum value. The results are qualitatively similar, as reported in Table 8.

We thank Bill McDonald for making the data publicly available on his website: http://sraf.nd.edu/data/ (Loughran and McDonald 2016).

References

An H, Zhang T (2013) Stock price synchronicity, crash risk, and institutional investors. J Corp Finan 21:1–15

Antweiler W, Frank MZ (2004) Is all that talk just noise? The information content of internet stock message boards. Journal of Finance 59(3):1259–1294

Archer S (2017) A company that’s trying to teach millennial ‘noobies’ how to invest is growing like crazy. Business Insider. September 6, https://markets.businessinsider.com/news/stocks/Stocktwits-ian-rosen-teach-millennial-noobies-how-to-invest-2017-9-1002346294

Bagnoli M, Beneish MD, Watts SG (1999) Whisper forecasts of quarterly earnings per share. J Account Econ 28(1):27–50

Bartov E, Faurel L, Mohanram PS (2018) Can Twitter help predict firm-level earnings and stock returns? Accounting Review 93(3):25–57

Behn BK, Choi JH, Kang T (2008) Audit quality and properties of analyst earnings forecasts. Accounting Review 83(2):327–349

Ben-Rephael A, Da Z, Israelsen RD (2017) It depends on where you search: Institutional investor attention and underreaction to news. Review of Financial Studies 30(9):3009–3047

Bhattacharya N (2001) Investors’ trade size and trading responses around earnings announcements: An empirical investigation. Accounting Review 76(2):221–244

Bhattacharya N, Ecker F, Olsson PM, Schipper K (2012) Direct and mediated associations among earnings quality, information asymmetry, and the cost of equity. Accounting Review 87(2):449–482

Blankespoor E, Miller GS, White HD (2014) The role of dissemination in market liquidity: evidence from firms’ use of Twitter. Account Rev 89(1):79–112

Bonson E, Torres L, Royo S, Flores F (2012) Local e-government 2.0: social media and corporate transparency in municipalities. Gov Inf Q 29(2):123–132

Borzykowski B (2016) How investors are using social media to make money. CNBC, June 9, https://www.cnbc.com/2016/06/09/how-investors-are-using-social-media-to-make-money.html

Callen JL, Fang X (2015) Religion and stock price crash risk. J Financ Quant Anal 50(1–2):169–195

Callen JL, Fang X (2017) Crash risk and the auditor–client relationship. Contemp Account Res 34(3):1715–1750

Carcello JV, Hermanson DR, Neal TL, Riley RA Jr (2002) Board characteristics and audit fees. Contemp Account Res 19(3):365–384

Chang X, Chen Y, Zolotoy L (2017) Stock liquidity and stock price crash risk. J Financ Quant Anal 52(4):1605–1637

Chen J, Hong H, Stein JC (2001) Forecasting crashes: trading volume, past returns, and conditional skewness in stock prices. J Financ Econ 61(3):345–381

Chen H, De P, Hu YJ, Hwang BH (2014) Wisdom of crowds: the value of stock opinions transmitted through social media. Rev Financ Stud 27(5):1367–1403

Choi J J, Laibson D, Metrick A (2000) Does the internet increase trading? Evidence from investor behavior in 401 (k) plans (No. w7878). National Bureau of Economic Research.

Curtis A, Richardson V J, Schmardebeck R (2016) Investor attention and the pricing of earnings news. Handbook of Sentiment Analysis in Finance

Da Z, Engelberg J, Gao P (2011) In search of attention. Journal of Finance 66(5):1461–1499

DeHaan E, Shevlin T, Thornock J (2015) Market (in) attention and the strategic scheduling and timing of earnings announcements. J Account Econ 60(1):36–55

Drake MS, Gee KH, Thornock JR (2016) March market madness: the impact of value-irrelevant events on the market pricing of earnings news. Contemp Account Res 33(1):172–203

Du H, Jiang W (2015) Do social media matter? Initial empirical evidence. J Inf Syst 29(2):51–70

Dugast J, Foucault T (2015) False news, informational efficiency, and price reversals. HEC

Eschenbrenner B, Nah FFH, Telaprolu VR (2015) Efficacy of social media utilization by public accounting firms: findings and directions for future research. J Inf Syst 29(2):5–21

Hirshleifer D, Teoh S H (2009) Thought and behavior contagion in capital markets. In Handbook of financial markets: dynamics and evolution (pp. 1–56) North-Holland

Holzer J, Bensinger G (2013) SEC Embraces Social Media. Wall Street J. April 2. https://www.wsj.com/articles/SB10001424127887323611604578398862292997352

Hutton AP, Marcus AJ, Tehranian H (2009) Opaque financial reports, R2, and crash risk. J Financ Econ 94(1):67–86

Jin L, Myers SC (2006) R2 around the world: New theory and new tests. J Financ Econ 79(2):257–292

Keim D B, von Beschwitz B, Blume M E (2013) Media-driven high frequency trading: Evidence from news analytics. Jacobs Levy Equity Management Center for Quantitative Financial Research Paper. Working Paper. https://flora.insead.edu/fichiersti_wp/inseadwp2013/2013-110.pdf

Kenski K, Conway B A (2016) Social Media and Elections. Praeger Handbook of Political Campaigning in the United States [2 volumes] 191.

Kim JB, Zhang L (2014) Financial reporting opacity and expected crash risk: evidence from implied volatility smirks. Contemp Account Res 31(3):851–875

Kim JB, Zhang L (2016) Accounting conservatism and stock price crash risk: firm-level evidence. Contemp Account Res 33(1):412–441

Kim JB, Chung R, Firth M (2003) Auditor conservatism, asymmetric monitoring, and earnings management. Contemp Account Res 20(2):323–359

Kim JB, Li Y, Zhang L (2011a) CFOs versus CEOs: Equity incentives and crashes. J Financ Econ 101(3):713–730

Kim JB, Li Y, Zhang L (2011b) Corporate tax avoidance and stock price crash risk: firm-level analysis. J Financ Econ 100(3):639–662

Kim Y, Li H, Li S (2014) Corporate social responsibility and stock price crash risk. J Bank Finance 43:1–13

Kim JB, Li X, Luo Y, Wang K (2020) Foreign investors, external monitoring, and stock price crash risk. J Acc Audit Financ 35(4):829–853

Kothari SP, Leone AJ, Wasley CE (2005) Performance matched discretionary accrual measures. J Account Econ 39(1):163–197

Kothari SP, Shu S, Wysocki PD (2009) Do managers withhold bad news? J Account Res 47(1):241–276

Larcker DF, Rusticus TO (2010) On the use of instrumental variables in accounting research. J Account Econ 49(3):186–205

Lee LF, Hutton AP, Shu S (2015) The role of social media in the capital market: evidence from consumer product recalls. J Account Res 53(2):367–404

Lehavy R, Li F, Merkley K (2011) The effect of annual report readability on analyst following and the properties of their earnings forecasts. Account Rev 86(3):1087–1115

Lobo G, Wang C, Yu X, Zhao Y (2020) Material weakness in internal controls and stock price crash risk. J Acc Audit Financ 35(1):106–138

Long H (2017) 10 best investing apps (and sites) CNN October 26. https://money.cnn.com/gallery/investing/2016/06/10/10-best-investing-apps/7.html

Loughran T, McDonald B (2016) Textual analysis in accounting and finance: a survey. J Account Res 54(4):1187–1230

Malmendier U, Shanthikumar D (2007) Are small investors naive about incentives? J Financ Econ 85(2):457–489

McCrank J, Gaffen D (2013) Hoax tweets send Audience shares atwitter. Retrieved from https://jp.reuters.com/article/us-audience-shares-idINBRE90S11T20130129

Oda S (2018) This Media Startup Is Beating the Competition with a Newsroom Run by Robots. Bloomberg, May 27, https://www.bloomberg.com/news/articles/2018-05-27/the-airline-geek-trying-to-build-a-media-giant-with-no-reporters?utm_medium=social&cmpid=socialflow-facebook-business&utm_content=business&utm_source=facebook&utm_campaign=socialflow-organic

Prokofieva M (2014) Twitter-based dissemination of corporate disclosure and the intervening effects of firms’ visibility: Evidence from Australian-listed companies. J Inf Syst 29(2):107–136

Rakowski D, Shirley S E, Stark J R (2020) Twitter activity, investor attention, and the diffusion of information. Financial Management: 1–44

Rapp A, Beitelspacher LS, Grewal D, Hughes DE (2013) Understanding social media effects across seller, retailer, and consumer interactions. J Acad Mark Sci 41(5):547–566

Robin AJ, Zhang H (2015) Do industry-specialist auditors influence stock price crash risk? Auditing J Pract Theory 34(3):47–79

Ryan HE Jr, Wiggins RA III (2004) Who is in whose pocket? Director compensation, board independence, and barriers to effective monitoring. J Financ Econ 73(3):497–524

Tetlock PC (2007) Giving content to investor sentiment: the role of media in the stock market. J Finance 62(3):1139–1168

Valsan R (2014) Social Media and Shareholder Activism. Edinburg Centre for Commercial Law, May 8, http://www.ecclblog.law.ed.ac.uk/2014/05/08/social-media-and-shareholder-activism/

Vlastelica R (2013) Second Twitter hoax in two days smacks another stock. Reuters, January 30, https://www.reuters.com/article/us-sarepta-idUSBRE90T1CF20130130

Wagner K, BLOOMBERG (2020) Read Before You RT: Twitter will ask some users to actually click a link before retweeting an article. Fortune. June 10. https://fortune.com/2020/06/10/twitter-read-before-you-rt-click-link-retweeting-stop-misinformation-jack-dorsey/

Wysocki PD (1998) Cheap talk on the web: the determinants of postings on stock message boards. University of Michigan Business School Working Paper (98025)

Zhou M, Lei L, Wang J, Fan W, Wang AG (2015) Social media adoption and corporate disclosure. J Inf Syst 29(2):23–50

Acknowledgements

We gratefully acknowledge helpful comments and suggestions from Cheng-Few Lee (Editor in Chief), anonymous reviewer, John Campbell, and Sally K. Widener, as well as participants at 2018 AAA Annual Meeting, 2019 Financial Accounting and Reporting Section (FARS), 2018 Southern Finance Association (SFA) conferences, and the University of Minnesota Duluth and California State University Northridge research seminars. We thank Stocktwits, Inc., for sharing the social media data for this research. We also thank Ryan Israelsen for sharing the daily Google search volume data used in Ben-Raphael, Da, and Israelsen (2017) and Bill McDonald for making the SEC EDGAR log data, used in Loughran and McDonald (2016), available on his website. All errors remain our responsibility.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/ or publication of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Social media variables | |

INFORMED_TWEETS | Proportion of social media tweets with hyperlinks to original source of information, which is the ratio of social media tweets with hyperlinks to original source of information to the total number of tweets. Original source is the source where the Stocktwits user obtains the information |

SOCIAL_MEDIA_FIRM | An indicator variable equal to one if a company has an official Stocktwits account, and zero otherwise |

SOCIAL_MEDIA_USER | Logged transformation of the total number of users tweeting about a company's ticker symbol |

Dependent variables | |

DUVOL | Logged ratio of the standard deviation of the down sample to the standard deviation of the up sample. To identify the up and down days, we separate all the days with firm-specific daily returns above (below) the mean of the period. Then, we calculate the standard deviation for the up and down samples separately |

NCSKEW | Negative of the third moment of each stock’s firm-specific daily returns, scaled by the cubed standard deviation |

Control variables | |

DAC | The absolute value of performance-matched discretionary accruals following Kothari et al. (2005). To measure accruals-based earnings management, we use the discretionary accruals proxy developed by Jones (1991), which is adjusted for earnings performance, following Kothari et al. (2005). TACC(i,t)/A(i,t−1) = 1/A(i, t−1) + ΔREV(i,t)/A(i,t−1) + PPE(i,t)/A(i,t−1) + ROA(i,t) + e. (a) where, TACC is calculated as the change in non-cash current assets minus the change in current liabilities excluding the current portion of long-term debt, minus depreciation and amortization; ΔREV is the change in revenue; PPE is the value of property, plant, and equipment; A is the total value of assets; and ROA is income before extraordinary items divided by total assets. The nondiscretionary accruals are the fitted values from the above equation and the discretionary accruals are the deviations of actual accruals from the nondiscretionary accruals |

DTURN | Average monthly share turnover over the fiscal year minus the average monthly share turnover over the previous year, where monthly share turnover is calculated as the monthly share trading volume divided by the number of shares outstanding over a month |

KUR | Kurtosis of firm-specific daily returns over a fiscal year |

LEV | Debt-to-asset ratio, which is long-term debt scaled by total assets |

MTB | Market-to-book ratio, which is the market value of assets scaled by book value of assets |

RET | Cumulative firm-specific daily returns over a fiscal year |

ROA | Return on asset ratio, which is income before extraordinary items scaled by total assets |

SIGMA | Standard deviation of firm-specific daily returns over a fiscal year |

SIZE | Logged transformation of market value |

Other variables | |

ANALYST | Logged transformation of the number of analysts following a firm |

BOARD_INDEP | Ratio of independent board members to the total number of board members. Non-executive board members are considered independent |

Aggregate search frequency from Google Trends based on stock ticker (Da et al. 2011). We take the logged transformation of the average value during a year | |

SEC_EDGAR | Logged transformation of the total number of 10-K downloads of a firm during a year |

Rights and permissions

About this article

Cite this article

Hossain, M.M., Mammadov, B. & Vakilzadeh, H. Wisdom of the crowd and stock price crash risk: evidence from social media. Rev Quant Finan Acc 58, 709–742 (2022). https://doi.org/10.1007/s11156-021-01007-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-021-01007-x