Abstract

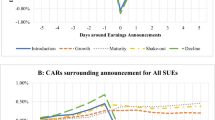

This study looks into the role of corporate life cycle on market discounts and firm performance in private placements. Using the standard event study methodology with 1854 private placements, this study finds that issuing firms on average offer discounts to their investors. While growth firms obtain higher returns around the issuance of private placements, these growth firms generate poor long run post-announcement returns. The results suggest that investors may be over-optimistic to future prospects for growth firms. As old firms generally obtain higher returns in premium offers, the evidence suggests that managers of old firms would put more efforts in managing their firms after private placements. Overall, the evidence indicates that corporate life cycle can play a role to influence firm performance in private placements. The empirical findings shed lights on the importance of corporate life cycle on firm performance in private placements.

Similar content being viewed by others

Notes

Liu et al. (2014) examine the relationship between business life cycle and price discounts in private placements. The authors find that firms in growth stage offer lower discounts in private placements relative to those in mature and decline stage. However, their study only focuses on the Taiwan market. The authors do not look into firm performance in private placements.

Krishnamurthy et al. (2005) argue that firms engaged in private placements with unregistered shares are required to specify the restricted nature of the shares. Due to the two-year resale restriction on unregistered shares, the discount may be viewed as the compensation of the lack of liquidity in private placements.

Some firms may engage in multiple private placements during the sampling period. This study also controls for multiple transactions of private placements in the sample. If firms engage in multiple private placements within 90 days prior to the announcement date, the following transaction is not included in the sample. The results are in general remain the same.

The classification of the composition score for various corporate life cycle stages is arbitrary. While prior studies point out that firms in private placements in general be small and young, I re-classify the score at 3–5 (growth), at 6–7 (mature) and 8–9 (old) as well as 3–4 (growth), 5–6 (mature) and 7–9 (old). The results do not show any significant difference.

In conjunction with prior studies, the current study also examines the issuance of common stock only. The results quantitatively remain the same. A further analysis consistently finds that growth firms obtain higher announcement returns around the issuance of private placements. As will be discussed later, the evidence consistently reveals that growth firms generate lower post-announcement returns relative to their mature and old counterparts in private placements.

The current study also follows the study of Wruck (1989) and Hertzel and Smith (1993) to calculate discount-adjusted cumulative abnormal returns \((CAR_{adj} )\). The model specification is as follow.

$$CAR_{adj} = [1/(1 - \alpha )\left] * \right[{\text{CAR}}\left] + \right[\alpha /(1 - \alpha )\left] * \right[P_{b} - P_{0} /P_{b} ]$$where CAR is a 4-day (0, + 3) cumulative abnormal returns, \(\alpha\) is the ratio of the number of shares placed to the number of shares outstanding after the placement, \(P_{b}\) is the market price at the end of the day prior to the event window (day − 1), and \(P_{0}\) is the placement price. The overall sample obtains positive discount-adjusted CAR at 2.73% % over a 4-day (0, + 3) event window around the issuance of private placements. Using a 3-day (− 1, + 1) event window, the results do not show any significant difference in discount-adjusted CAR at 2.70%. While the inconsistent results show that mature firms create higher discount-adjusted CAR over a (0, + 3) event window than growth and old firms, growth firms consistently generate higher returns than their mature and old counterparts measured by a (− 1, + 1) event window. Hence, the analysis of discount-adjusted CAR can be more sensitive to the event window selected.

References

Alli KL, Thompson DJ (1993) The wealth effect of private stock placements under regulation D. Financ Rev 28:329–350

Anthony JH, Ramesh K (1992) Association between accounting performance measures and stock prices: A test of the life cycle hypothesis. J Acc Econ 15:203–227

Arikan AM, Stulz RM (2016) Corporate acquisitions, diversification, and the firm’s life cycle. J Finance 71:139–193

Barber R, Lyon J (1997) Detecting long-run abnormal stock returns: the empirical power and specifications of test statistics. J Financ Econ 43:341–372

Barclay MJ, Holderness CG, Sheehan DP (2007) Private placements and managerial entrenchment. J Corp Finance 13:461–484

Brophy DJ, Ouimet PP, Sialm C (2009) Hedge funds as investors of last resort? Rev Financ Stud 22:541–574

Brown SJ, Warner JB (1985) Using daily stock returns: the case of event studies. J Financ Econ 14:3–31

Chakraborty I, Gantchev N (2013) Does shareholder coordination matter? Evidence from private placements. J Finan Econom 108:213–230

Chaplinsky S, Haushalter D (2010) Financing under extreme risk: contract terms and returns to private investments in public equity. Rev Financ Stud 23:2789–2820

Chen SS, Ho KW, Lee CF, Yeo GHH (2002) Long-run stock performance of equity-issuing firms: the case of private placements in Singapore. Rev Pac Basin Financ Mark Polic 5:417–438

Chen AS, Cheng LY, Cheng KF, Chih SW (2010) Earnings management, market discounts and the performance of private equity placements. J Bank Finance 34:1922–1932

Cheng LY, Wang MC, Chen KC (2014) Institutional investment horizons and the stock performance of private equity placements: evidence from the Taiwanese listed firms. Rev Pac Basin Financ Mark Polic 17:1–30

Chou DW, Gombola M, Liu FY (2009a) Long-run underperformance following private placements: the role of growth opportunities. Quart Rev Econ Finance 49:1113–1128

Chou DW, Gombola M, Liu FY (2009b) Earnings management and long-run stock performance following private equity placements. Rev Quant Finance Acc 34:225–245

Chuang KS (2017) Corporate life cycle, investment banks and shareholder wealth in M&As. Quart Rev Econ Finance 63:122–134

Coulton JJ, Ruddock C (2011) Corporate payout policy in Australia and a test of the life-cycle theory. Acc Finance 51:381–407

DeAngelo H, DeAngelo L, Stultz RM (2006) Dividend policy and the earned/contributed capital mix: a test of the life-cycle theory. J Financ Econ 81:227–254

DeAngelo H, DeAngelo L, Stultz RM (2010) Seasoned equity offerings, market timing, and the corporate lifecycle. J Financ Econ 95:275–295

Fama EF (1998) Market efficiency, long-term returns, and behavioral finance. J Financ Econ 49:283–306

Fenn GW (2000) Speed of issuance and the adequacy of disclosure in the 144 A high-yield debt market. J Financ Econ 56:383–405

Glegg C, Harris O, Madura N, Ngo T (2012) The impact of mispricing and asymmetry information on the price discount of private placements of common stock. Financ Rev 47:665–696

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47:153–161

Hertzel M, Smith RL (1993) Market discounts and shareholder gains for placing equity privately. J Finance 48:459–485

Hertzel M, Lemmon M, Linck JS, Rees L (2002) Long-run performance following private placements of equity. J Finance 57:2595–2617

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3:305–360

Krishnamurthy S, Spindt P, Subramaniam V, Woidtke T (2005) Does investor identity matter in equity issues? Evidence from private placements. J Financ Intermed 14:201–238

Liang HS, Jang WY (2013) Information asymmetry and monitoring in equity private placements. Quart Rev Econ Finance 53:460–475

Liang WL, Chan K, Lai WH, Wang Y (2013) Motivation for repurchases: a life cycle explanation. J Financ Serv Res 43:221–242

Liu CJ, Liu JL, Hsu CH (2014) The relationship between business life cycle and the premium/discount of private equity placements. Commer Manag Quart 15:185–222

Loughran T, Ritter JR (1995) The new issues puzzle. J Finance 50:23–51

Loughran T, Ritter JR (2000) Uniformly least powerful tests of market efficiency. J Financ Econ 55:361–389

Maynes E, Pandes A (2011) The wealth effects of reducing private placement resale restrictions. Eur Financ Manag 17:500–531

Normazia M, Hassan T, Ariff M, Shamsher M (2013) Private placement, share prices, volume and financial crisis: an emerging market study. Glob Finance J 24:203–221

Owen S, Yawson A (2010) Corporate life cycle and M&A activity. J Bank Finance 34:427–440

Ritter JR (1991) The long-run performance of initial public offerings. J Finance 46:3–27

Silber WL (1991) Discounts on restricted stock: the impact of illiquidity on stock price. Financ Anal J 47:60–64

Spiess DK, Affleck-Graves J (1995) Underperformance in ling-run stock returns following seasoned equity offerings. J Financ Econ 38:243–267

White H (1980) A heteroskedasticity-consistent matrix and direct test for heteroskedasticity. Econometrica 48:817–838

Wruck KH (1989) Equity ownership concentration and firm value: evidence from private equity financings. J Financ Econ 23:3–28

Wruck KH, Wu Y (2009) Relationships, corporate governance, and firm performance: evidence from private placements of common stock. J Corp Finance 15:30–47

Wu YL (2004) The choice of equity-selling mechanisms. J Financ Econ 74:93–119

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chuang, KS. Private placements, market discounts and firm performance: the perspective of corporate life cycle analysis. Rev Quant Finan Acc 54, 541–564 (2020). https://doi.org/10.1007/s11156-019-00798-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-019-00798-4