Abstract

Using a G-5 country sample (France, Germany, Japan, the UK, and the US) from 1980 to 2007, I find new evidence of the asymmetry in firms’ mechanisms of cash holdings adjustments. They undertake different approaches to move toward their target cash holdings levels conditional on whether they have below- or above-target cash holdings. Specifically, firms with above-target cash holdings adjust mainly via changes in cash flows from financing and investing. They generally reduce their levels of equity proceeds, net debt issues and fixed asset disposal but increase their levels of equity repurchases, dividend payout, net assets from acquisitions, portfolio and short-term investments, and capital expenditures. However, firms with below-target cash holdings adjust mainly via changes in operating cash flows, i.e., they increase their levels of funds from operations but reduce their levels of working capital. The mechanisms undertaken by firms with above-target cash holdings allow them to adjust toward their target cash holdings relatively faster than those with below-target cash holdings, as they possibly incur lower costs than the mechanisms experienced by firms with below-target cash holdings. The results highlight the importance of understanding the asymmetry in firms’ mechanisms of cash holdings adjustments when analyzing how they adjust toward their target cash holdings levels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the corporate cash holdings literature, firms’ cash holdings behaviors have been examined using frameworks largely similar to those employed by studies on corporate capital structures. For example, following the trade-off theory of corporate capital structures, the trade-off viewFootnote 1 holds that firms derive their target levels of cash holdings through balancing between the marginal benefits of cash (e.g., the avoidance of costs of transaction, adverse selection, and agency of external financing and a better ability to undertake investment opportunities) and its marginal costs (e.g., opportunity costs of holding low-return assets and the increase in marginal tax rates and agency costs of managerial discretion) and actively adjust toward these over timeFootnote 2 (Opler et al. 1999; Ozkan and Ozkan 2004; Dittmar and Duchin 2010; Venkiteshwaran 2011; Jiang and Lie 2016; Orlova and Rao 2018). In addition, their adjustment speeds are generally swifter when firms have above-target cash holdings i.e., their actual levels are higher than their target levels of cash holdings than when they have below-target cash holdings i.e., their actual levels are lower than their target levels of cash holdings possibly due to lower adjustment costs (Dittmar and Duchin 2010; Jiang and Lie 2016; Orlova and Rao 2018). However, very little has been known about the mechanisms undertaken by firms to move toward their target levels of cash holdings. This paper aims to provide a comprehensive examination of the mechanisms firms choose to undertake to move toward their target levels of cash holdings conditional on whether they have below- or above-target cash holdings using a G-5 country sample (France, Germany, Japan, the UK, and the US). Yet, it seems intuitive that different firms do not undertake similar mechanisms to move toward their target levels of cash holdings as they are subject to different levels of costs of deviations from target cash holdings and costs of adjustments. Examining such mechanisms may provide a sound justification for the asymmetry in firms’ speeds of adjustments reported in the existing corporate cash holdings literature.

Although there has been some research on firms’ asymmetric adjustments toward target cash holdings i.e., different speeds of adjustments contingent on the position relative to their target cash holdings which are driven by differences in costs of deviations from target cash holdings which are defined as the differences between firms’ target levels and their actual levels of cash holdings, costs of adjustments, and levels of financial constraints (Opler et al. 1999; Dittmar and Duchin 2010; Venkiteshwaran 2011; Jiang and Lie 2016; Orlova and Rao 2018), very little has been known about the mechanisms they may undertake to adjust toward their target cash holdings. Dittmar and Duchin (2010), Jiang and Lie (2016) and Orlova and Rao (2018) show that firms with excess cash or above-target cash holdings may adjust toward their target cash holdings faster than those with a cash shortage due to lower costs of adjustments. In contrast, (Venkiteshwaran 2011) finds that cash-deficient firms or those with below-target cash holdings may adjust more quickly due to higher costs of deviations caused by their financial constraints. These studies consider the role of financial constraints, costs of adjustments and costs of deviations from targets on firms’ speeds of adjustments which are more or less related to adjustments in cash flows from financing (CFF) i.e., adjustments are made through debt issue/retirement and/or equity issue/repurchase decisions. The role of costs associated with adjustments in cash flows from operating (CFO) and cash flows from investing (CFI), however, has received almost no attention. This is surprising since firms may adjust toward their target cash holdings through adjustments in not only CFF but also CFO and CFI. For example, in addition to distributing some of their excess cash to shareholders through dividend increases or stock repurchases and retiring part of their debt, firms with excess cash may increase their net working capital (e.g., stocking more inventories, piling up more accounts receivable and reducing accounts payable) and investments (e.g., increasing capital expenditures and acquisitions)—mechanisms opposite to those undertaken by cash-deficient firms. Previous studies tend to treat these adjustments as exogenous, independent of firms’ cash and leverage management policies. I now explicitly account for these. I investigate why firms’ speeds of adjustments may vary contingent on the position relative to their target cash holdings by examining the possible mechanisms they may undertake to adjust toward their target cash holdings which include adjustments in all of the three cash flow categories.

There may be certain costs associated with adjustments in CFO. A decrease in firms’ working capital, for instance, may involve an increase in their accounts payable and/or a reduction in their accounts receivable and inventories. Increasing accounts payable may lead to worsened credit reputation, forgone cash discounts, increased administration costs and prices set by suppliers, late payment penalties, and damaged relationships with suppliers (Wu et al. 2012). According to García-Teruel and Martínez-Solano (2010), supplier financing may turn out to be more costly than other sources of financing and firms therefore try to avoid using it when possible. Meanwhile, a reduction in accounts receivable may imply stricter credit terms which then result in declined sales and worsened relationships with customers (Brealey et al. 2014). Finally, when inventories are reduced not because of better inventory management, firms may be unable to fill up their customers’ orders, suggesting high inventory shortage costs.

Similarly, adjustments in CFI may incur significant costs. Managers of cash-rich firms are likely to make value-decreasing acquisitions (Harford 2002; Harford et al. 2012) as their compensation is usually increased after these (Bliss and Rosen 2001; Harford and Li 2007). Costs of adjustments hence may be embodied in a decrease in the value of these firms. When cash-deficient firms have to give up positive NPV (net present value) investments, these costs may be the opportunity costs arising from forgone future cash flows generated by these investments, as implied by the pecking-order view.

Examining relevant costs associated with firms’ cash holdings adjustments in the G-5 countries (France, Germany, Japan, the UK, and the US) during the 1980–2007 period, consistent with the existing literature, I find that there is asymmetry in firms’ adjustments. Firms with above-target cash holdings move toward their target cash holdings faster than those with below-target cash holdings. In addition, the most important finding of my study is that there is asymmetry in the mechanisms firms undertake to move toward their target cash holdings. Specifically, I find new evidence that in addition to adjustments in CFF, firms also adjust toward their target cash holdings through adjustments in CFO and CFI. Firms with excess cash generally reduce CFF and CFO and increase CFI—mechanisms opposite to those undertaken by firms with below-target cash holdings. The mechanisms undertaken by firms with above-target cash holdings may incur lower costs for three reasons. First, costs associated with debt retirements, equity repurchases, and dividend increases (CFF) may be lower than those associated with debt and equity issues and dividend reductions (Leftwich and Zmijewski 1994; Byoun 2008). Second, a decrease in CFO is less likely to lead to costs associated with operational problems. Third, decreasing CFI or having to give up investment opportunities (e.g., to decrease capital expenditures and acquisitions) may incur huge opportunity costs associated with permanently forgone future cash flows generated by these. These together explain why firms with above-target cash holdings may adjust toward their targets faster.

I perform several additional analyses and find evidence on the influence of the magnitude of firms’ deviations from targets on their target adjustments. In addition to the variation in costs of adjustments caused by different mechanisms of adjustments, I argue that the magnitude of firms’ deviations from target cash holdings is also likely to asymmetrically influence their adjustments for two reasons. First, the fixed cost component (e.g., fixed costs of debt/equity issues, permanent losses of customers and growth opportunities, etc.) associated with cash holdings adjustments may suggest that firms with too much excess cash or a large cash shortage can adjust toward their targets faster due to lower incremental costs when that fixed component can be effectively “shared” with transaction costs that incur when firms offset their large cash holdings imbalances. In contrast, those that are not sufficiently far away from their target cash holdings may have fewer incentives to offset their cash holdings imbalances. Second, agency theories would suggest that firms with too much excess cash may face higher costs associated with the free cash flow problem and hence should disgorge some of their cash, thus implying faster speeds of adjustments. Those with a large cash shortage may also adjust toward their target cash holdings faster for larger costs of deviations from target cash holdings may be in the forms of operational problems and forgone positive NPV investments. Consistent with the “shared” fixed cost argument, I find that firms with large deviations from targets adjust toward their targets faster as they may face lower incremental costs of adjustments. In addition, in support of agency theories, compared to firms with small excess cash holdings, firms with large excess cash holdings experience faster speeds of adjustments as the free cash flow problem may be more significant for them. Firms with a large cash shortage also adjust more quickly than those with a small cash shortage for they are more likely to suffer from operational problems and have to give up positive NPV investments.

In another analysis, I examine how firms’ cash holdings adjustments may be asymmetrically influenced by their major characteristics such as their precautionary motives (proxied by firm size, cash flow volatility and dividend payout), financial constraints (proxied by growth opportunities and dividend payout), and corporate life-cycle (proxied by firm age). There is evidence that firms experience faster speeds of adjustments in the presence of stronger precautionary motives (smaller firm size, higher cash flow volatility and lower dividend payout), greater financial constraints (more growth opportunities), and lower levels of maturity (younger age). However, when these factors are interacted with deviations from targets, their impact becomes relatively less significant (except for firm age), suggesting firms’ deviations from targets may be the major driver of their target adjustments.

Overall, I contribute to the corporate cash holdings literature by studying the asymmetry in the mechanisms firms undertake to move toward their target cash holdings which helps to provide a better understanding of why speeds of adjustments may vary contingent on whether firms have below- or above-target cash holdings. Contingent on having either below- or above-target cash holdings, firms may undertake different adjustments in the three groups of cash flows which may involve different levels of costs, thus leading to different speeds of adjustments i.e., firms with above-target cash holdings adjust toward their targets faster than those with below-target cash holdings as their mechanisms of adjustments may involve lower costs. The evidence on the asymmetry in the adjustments in CFO and CFI undertaken by these two groups of firms is especially novel. To the best of my knowledge, my study is the first attempt in the literature to look at that asymmetry.

The remaining of the paper is organized as follows. Section 2 presents the empirical models. Section 3 discusses the sample. Section 4 reports the main findings. Section 5 reports the additional empirical analyses. Section 6 concludes.

2 Empirical models and methods

To examine the asymmetry in the mechanisms undertaken by firms to move toward their target cash holdings conditional on the position relative to their target cash holdings, I first classify the sample firms into two groups with one consisting of firms with below- and another consisting of firms with above-target cash holdings. To do that, firms’ target levels of cash holdings \((CH_{it}^{*} )\) must be estimated and then compared to their actual levels of cash holdings to see if they have below- or above-target cash holdings (Dittmar and Duchin 2010; Jiang and Lie 2016; Orlova and Rao 2018). The unobserved \(CH_{it}^{*}\) is a function of firms’ major fundamentals, as follows:

where \(\hat{\beta }^{'}\) is a vector of parameters estimated from a fixed-effects regression of cash holdings on a vector of relevant determinants, xit:

As guided by previous studies in the current literature (Opler et al. 1999; Ozkan and Ozkan 2004; Bates et al. 2009; Jiang and Lie 2016; Orlova and Rao 2018), I include in xit eight independent variables consisting of growth opportunities, firm size, cash flow volatility, cash flow, capital expenditures, net working capital, research and development expenses, and a dividend dummy to capture whether firms pay dividends or not. \(\varepsilon_{it}\) is an error component that includes firms’ fixed effects and time effects and an i.i.d. error term. The firms’ fixed effects control for time-invariant unobservable, unique firm and/or industry characteristics that cannot be captured by xit while the time effects allow us to examine the extent at which the change in firms’ cash holdings can be effectively explained by changes in their fundamentals rather than the evolution of time (Bates et al. 2009). The relations between these eight variables included in xit and firms’ target cash holdings are as follows.

Growth opportunities (GO) This is the sum of the market value of equity or market capitalization and the book value of total debt scaled by the book value of total assets. The precautionary motive argument suggests a positive relation between firms’ growth opportunities and their cash holdings since costs associated with adverse cash flow shocks and financial distress may be more significant among high-growth firms (Opler et al. 1999; Bates et al. 2009). Due to more information asymmetries, high-growth firms are more likely to give up positive NPV investments in the presence of a cash shortage and costly external financing, thus needing to hold more cash. In contrast, low-growth firms should hold less cash to reduce the free cash flow problem (Jensen 1986).

Firm size (FS) This is the natural log of the book value of total assets measured in 1980 US$ value. There may be a negative relation between firms’ size and their cash holdings for three reasons. First, the transaction cost motive argument suggests that large firms should hold less cash due to the presence of economies of scale i.e., lower transaction costs when their noncash financial assets are converted into cash (Baumol 1952; Miller and Orr 1966; Mulligan 1997). Second, as large firm size indicates less financial distress, fewer information asymmetries and hence better access to external capital markets, in the spirit of the precautionary motive argument (Almeida et al. 2005), large firms can hold less cash. Finally, Sufi (2009) shows that large firms may have more access to bank lines of credit—a close alternative to cash, thus having less need to hoard it.

Cash flow volatility (CFV) This is the absolute value of the difference between the first difference of cash flow (% change) and the average of first differences. Consistent with the precautionary motive argument, firms with riskier cash flows should accumulate more cash to cope with potential adverse cash flow shocks in the presence of costly external financing better (Opler et al. 1999; Bates et al. 2009). This indicates a positive relation between this variable and firms’ cash holdings.

Cash flows (CF) This is operating income before depreciation minus interest expense, income taxes and total dividends paid scaled by the book value of total assets. Firms with stronger cash flows may have a better ability to accumulate more cash, as suggested by the pecking-order view. In addition, these firms may be also those with more growth opportunities and hence need to hold more cash (Opler et al. 1999; Bates et al. 2009). These together suggest a positive relation between cash flows and cash holdings.

Capital expenditures (CAPEX) This is capital expenditures scaled by the book value of total assets. There are two opposite predictions on the impact of this variable on firms’ target cash holdings. On the one hand, in line with the pecking-order view, Riddick and Whited (2009) find that firms which are making significant investments in assets may experience a temporary fall in their cash. In addition, when capital expenditures lead to an increase in assets that can serve as collaterals better (e.g., fixed assets) and hence firms’ debt capacities, they may have less need to hoard cash. These together suggest that cash holdings may be inversely related to capital expenditures. On the other hand, according to the trade-off view, it is possible that firms which are making significant capital expenditures may be high-growth ones, thus needing to hold more cash.

Net working capital (NWC) This is the difference between working capital and cash and cash equivalents scaled by the book value of total assets. As net working capital includes highly liquid assets that can be considered as close substitutes for cash (e.g., inventories and accounts receivable), firms with a higher level of net working capital are likely to hold less cash (Bates et al. 2009).

Research and development expenses (R&D) This is research and development expenses scaled by total sales. Since these expenses may be considered as a close proxy for growth opportunities and hence costs associated with financial distress and adverse cash flow shocks, the trade-off view suggests firms which are incurring more research and development expenses should hold more cash. Consistent with this view, Brown and Petersen (2011) show that in the presence of financing frictions, firms tend to depend intensively on cash to smooth their research and development expenses for adjustments in these expenses usually involve high costs (e.g., wages of highly skilled technology workers). In contrast, the financing hierarchy suggests a negative relation between such expenses and cash holdings as firms which are incurring large amounts of these may temporarily experience a fall in their cash balances.

Dividend dummies This variable is defined to be 1 for firms that pay dividends and 0 otherwise. Fazzari et al. (1988) find that financially unconstrained (possibly cash-rich) firms are more likely to pay dividends than financially constrained firms. Almeida et al. (2005) and Bates et al. (2009), however, show that firms that pay dividends may hold less cash for they may be considered by investors as less risky and hence have better access to external capital markets.

After estimating firms’ target cash holdings, I define firms as having above- or below-target cash holdings if their cash ratios in the last accounting period \((CH_{it - 1} )\) are higher than or equal to or lower than their target cash holdings levels in the last accounting period \((CH_{it - 1}^{*} )\) i.e., \(CH_{it - 1} \ge CH_{it - 1}^{*}\) or \(CH_{it - 1} < CH_{it - 1}^{*}\). The prior literature shows that firms’ speeds of adjustments vary conditional on whether they have below- or above-target cash holdings. To see how deviations from target cash holdings may asymmetrically influence firms’ target cash holdings adjustments, I follow the prior literature by introducing the following asymmetric partial adjustment model to account for the variation in firms’ speeds of adjustments.

where \(\Delta CH_{it}\) is the difference between firms’ cash ratios (e.g., cash and cash equivalents scaled by total assets) for the current \((CH_{it} )\) and the last \((CH_{it - 1} )\) accounting periods. \(CDev_{it}\) is deviations from target cash holdings and is defined as the difference between firms’ target cash holdings, \(CH_{it}^{*}\) and \(CH_{it - 1}^{{}}\)\((CDev_{it} = CH_{it}^{*} - CH_{it - 1} ).\)\(CH_{it}^{a}\)\((CH_{it}^{b} )\) indicates that firms have above-target (below-target) cash holdings in the last accounting period. Within 1 year, firms partially adjust toward their target cash holdings at the speed of adjustment \(\lambda_{1}\) (if they have above-target cash holdings) or \(\lambda_{2}\) (if they have below-target cash holdings). The current literature on corporate capital structures suggests that costs of adjustments may prevent firms from undertaking continuous leverage adjustments (Leary and Roberts 2005; Strebulaev 2007). Borrowing that line of argument, \(\lambda_{1}\) and \(\lambda_{2}\) are expected to be between 0 and 1 with a higher value indicating a faster speed of adjustment. In addition, since it may be less costly for firms to disgorge than to build up cash reserves, firms with above-target cash holdings are likely to adjust faster than those with below-target cash holdings i.e., \(\lambda_{1} > \lambda_{2} .\)

After classifying firms into two groups i.e., those with below- and those with above-target cash holdings and examining their speeds of cash holdings adjustments, the most important task is to look at how they make adjustments in each of the three cash flow categories to move toward their target cash holdings. I argue that in addition to adjustments in CFF which are determined by financial constraints and costs of external financing, firms can also adjust toward their target cash holdings by adjusting CFO and CFI. Those with above-target cash holdings may reduce CFF (e.g., to retire debt, repurchase equity, and increase dividends) and/or CFO (e.g., to reduce funds from operations and increase working capital), and/or increase CFI (e.g., to invest more in capital expenditures and make more acquisitions), mechanisms opposite to those undertaken by firms with below-target cash holdings and these different mechanisms of adjustments may have important adjustment cost implications.

First, one would expect that it is relatively less costly for firms to retire debt, repurchase equity, and increase dividends than otherwise (Leftwich and Zmijewski 1994; Byoun 2008). Second, as investment opportunities imply potential cash flows generated in the future, opportunity costs may incur when firms have to forgo positive NPV investments (e.g., to decrease capital expenditures and make fewer acquisitions) due to a cash shortage and costly external financing. Minton and Schrand (1999) find that firms’ liquidity constraints may force them to permanently forgo their investment opportunities rather than changing their timing.

Third, it may be easier and less costly for firms with above-target cash holdings to reduce CFO than for those with below-target cash holdings to increase it. In particular, the former firms can reduce CFO by increasing working capital. An increase in working capital can be achieved by increasing inventories and/or accounts receivable and/or reducing accounts payable. Compared to a decrease in inventories, an increase in inventories is less likely to cause any significant impact on firms’ ability to meet customers’ demand, thus lowering inventory shortage costs. While costs of holding inventories can be reasonably measured, it is hard to estimate costs of lost sales due to an inventory shortage (Chiang and Monahan 2005). Hence, firms may be unwilling to reduce their inventories to avoid such costs unless they can manage inventories more effectively. Next, contrary to a fall in accounts receivable which suggests tightened credit terms, an increase in these may imply firms are extending credit to their customers, thus facilitating sales. Finally, it may be easier for firms to reduce than to increase accounts payable for the reasons discussed earlier.

3 Data, sample selection and descriptive statistics

My sample includes non-financial firms in the G-5 countries for the 1980–2007 period. Similar to Jiang and Lie (2016), I stop before the financial crisis, during which period, the determinants of cash holding are quite different from those during the non-crisis period. The sample firms’ accounting data are collected from Datastream Worldscope. To run two-step SYS-GMM (System Generalized Method of Moments) regressions, the sample firms are required to have at least five consecutive annual observations. Those with SIC code from 6000 to 6999 (financial firms) and from 4000 to 4999 (utility firms) are excluded from the sample as they are heavily regulated and hence may exhibit atypical cash holdings behaviors. To remove outliers, I winsorize all the variables of interest at the 0.5% and 99.5% percentiles. Finally, I have a sample with 103,562 firm-year observations. Table 1 provides the statistics summary for the variables considered in the study. The size of the standard deviations indicates a reasonable level of variation in my sample which is comparable to that of previous studies.

4 Empirical results

4.1 Determinants of cash holdings and the asymmetry in speeds of adjustments

My unreported fixed-effects estimation results for the target cash holdings model are generally consistent with previous empirical evidence (e.g., Opler et al. 1999; Ozkan and Ozkan 2004; Dittmar and Duchin 2010; Venkiteshwaran 2011; Jiang and Lie 2016; Orlova and Rao 2018). In particular, in line with the precautionary motive argument and the trade-off view of cash holdings, firms’ cash holdings are positively related to their growth opportunities and research and development expenses. The impact of cash flow volatility is negligible. Consistent with both the transaction cost and precautionary motive arguments and the credit line argument; larger firm size reduces firms’ need to hoard cash due to the presence of economies of scale, fewer information asymmetries, and more access to bank lines of credit. There is, however, evidence that cash is positively related to cash flows which is in support of Opler et al. (1999) and Bates et al. (2009) that firms with stronger cash flows tend to accumulate more cash and may have more growth opportunities. Consistent with Fazzari et al. (1988) that financially unconstrained (possibly cash-rich) firms are likely to pay dividends, I find evidence that firms that pay dividends hoard more cash. Finally, I show that both capital expenditures and net working capital have a significant, negative impact on cash holdings. This finding is consistent with Bates et al. (2009) and Riddick and Whited (2009) that significant investments in assets may temporarily reduce firms’ cash holdings and net working capital may reduce firms’ need to hold cash since it contains highly liquid assets which can be considered as close substitutes for cash.

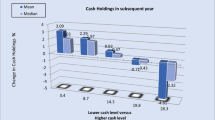

Table 2 reports the estimation results for the asymmetric partial adjustment model as specified by Eq. (3). These results strongly support the trade-off view of corporate cash holdings that there is asymmetry in firms’ speeds of adjustments. Conditional on having above-target cash holdings, firms adjust toward their target cash holdings at speeds which are both economically and statistically faster than speeds of adjustments of firms with below-target cash holdings, as indicated by the F-tests. Such evidence would suggest that on average, speeds of adjustments for firms in the five sample countries may be 13–24% faster when they have above- than when they have below-target cash holdings.

4.2 Main results—the asymmetry in mechanisms of cash holdings adjustments

4.2.1 Mechanisms of adjustments among firms with above-target cash holdings

Table 3 provides detailed explanations on why firms with above-target cash holdings may adjust toward their targets faster. There is evidence that these firms reduce CFF (across firms in all countries) and CFO (except for UK firms which experience a very slight increase and US firms which see no change in CFO) but increase CFI (across firms in all countries). These mechanisms of adjustments are likely to involve lower costs of adjustments, thus allowing these firms to adjust toward their targets faster to reduce potential costs associated with the free cash flow problem. In contrast, firms with below-target cash holdings undertake opposite mechanisms (to increase CFF and CFO (across firms in all countries) but reduce CFI (except for US firms which see no change in CFI)). The magnitudes of the adjustments in each cash flow group vary significantly between these two groups of firms and will be discussed shortly.

I find that overall, firms with above-target cash holdings experience a fall in their cash balances, as can be seen from Panel A in Table 3. Be aware that Panel A of Table 3 reports the magnitudes and relative ranks of the adjustments in the three cash flow groups (CFF, CFO, and CFI) among firms with above-target cash holdings. To make it easier to compare the magnitudes of firms’ cash holdings adjustments, the changes in CFF, CFO, and CFI are taken from Panel A in Table 4 to Panel A of Table 3.

Adjustments in CFF Adjustments in CFF are significant across firms in all the sample countries (ranked 1st among French, UK, and US firms with 1.4%, 2.8%, and 2.3% of total assets in monetary terms, respectively) (Panel A of Table 3), especially UK and US firms for the magnitude of the adjustments in this cash flow group is much greater than that of the others.Footnote 3 As can be seen from Panel A of Table 4, these firms consistently experience a fall in their levels of net equity issues (0.3%, 0.7%, 0.4%, 3.1%, and 2.6% of total assets in France, Germany, Japan, the UK, and the US, respectively), which is mainly driven by the decrease in their levels of equity proceeds. In addition, French, German, and Japanese firms also see a decline in their levels of net debt issues. These together with a slight increase in levels of dividend payout then lead to a significant decrease in CFF.

Compared to their counterparts in France, Germany and Japan, UK and US firms reduce their levels of net equity issues very significantly (3.1% and 2.6% of total assets in monetary terms, respectively) and still increase their levels of net debt issues (0.5%) (Panel A of Table 4).Footnote 4 The net effect of these adjustments is therefore a fall in CFF. Interestingly, by magnitude, the increase in levels of dividend payout is smaller than the increase in levels of equity repurchases among UK and US firms (0.2% in each country). This finding is consistent with managerial perception and empirical evidence that firms’ managers prefer to distribute some of their firms’ excess cash in the way that is likely to establish less commitment (Iyer et al. 2017).

The reason why managers prefer to distribute their firms’ excess cash to shareholders in the form of share repurchases rather than dividend increases has been discussed intensively. The current literature on firms’ dividend policies since Miller and Modigliani (1961) suggests that investors tend to interpret firms’ dividend changes as an indicator of changes in their management’s view about their firms’ future prospects (Bhattacharya 1979; John and Williams 1985; Miller and Rock 1985; Best and Best 2001). An increase in dividends may indicate that firms’ managers are optimistic about their firms’ future while a fall in these implies the opposite.Footnote 5 Dividend cuts therefore may be considered as a “last resort” action for firms and investors tend to associate these with financial problems that may not reverse in the near term (Teng and Hachiya 2013). Leftwich and Zmijewski (1994) show that a dividend reduction has much more information content about changes in firms’ future operations than a dividend increase as it signals serious deterioration in firms’ long-term prospects. Hence, managers tend to be unwilling to increase dividend payments by large amounts as once they have done so, it may be tough for them to cut these latter during times of adverse cash flow shocks. Equity repurchases therefore may be a much more flexible approach to distribute firms’ excess cash to shareholders from managers’ point of view.Footnote 6

The evidence on the small change in firms’ dividend payout whether they experience above- or below-target cash holdings is particularly interesting. Apart from its implication about managers’ incentives to distribute their firms’ excess cash in the way that is likely to establish a lower level of commitment, it may also reflect firms’ attempts to smooth dividends which have been acknowledged by a vast body of the current literature on corporate dividend policies. For example, Brav et al. (2005) find that as managers tend to believe that the market is likely to put a premium on firms that have stable dividend policies due to the signaling effect of any negative changes on these, they are willing to visit costly capital markets or even give up positive NPV investments rather than cutting their dividends.Footnote 7

Adjustments in CFI Contingent on having above-target cash holdings, French and German firms adjust CFI mainly through adjustments in their portfolio investments, short-term investments, and marketable securities (Panel A of Table 4). On the contrary, as the mergers and acquisitions (M&A) markets may be more active in the UK and the US, firms in these two countries experience a significant rise in their levels of net assets from acquisitions (1.0% of total assets in monetary terms in each country). The significant increase in levels of net assets from acquisitions among UK and US firms is in support of Harford (2002) and Harford et al. (2012) that cash-rich firms are more likely to make acquisitions even when their acquisitions may be value-decreasing as their managers tend to enjoy an increase in their compensation following these acquisitions (Bliss and Rosen 2001; Harford and Li 2007). Contingent on having above-target cash holdings, firms see a decrease in their levels of fixed asset disposal. Finally, US firms with above-target cash holdings experience the most significant increase in capital expenditures among firms in the five sample countries (0.5%). This finding is consistent with the statistics reported in Table 1 that these firms on average have most growth opportunities, as suggested by their market-to-book ratios.

Adjustments in CFO Firms with above-target cash holdings in Germany and the UK experience a small change in CFO and those in the US do not see any change in it (smallest among the three cash flow groups) (Panel A of Table 3) as the increase in their levels of funds from operations closely matches with the rise in their levels of working capital (Panel A of Table 4). In contrast, the change in CFO is rather large for French and Japanese firms (0.6% and 0.9%, respectively) as their levels of working capital increase at higher rates than levels of funds from operations. The size mismatch between the rise in levels of working capital and that in levels of funds from operations among French and Japanese firms supports the view that in the presence of weak corporate governance, excess cash can be used unproductively (Dittmar and Mahrt-Smith 2007). Indeed, Ando et al. (2003) find that corporate governance among Japanese firms overall is weak and ineffective.

4.2.2 Mechanisms of adjustments among firms with below-target cash holdings

Next, I examine the mechanisms undertaken by firms with below-target cash holdings to move toward their targets. I find that these firms try to increase their cash balances, as can be seen from Panel B in Table 4. Further, there is evidence that overall firms with below-target cash holdings undertake mechanisms of adjustments opposite to those undertaken by firms with above-target cash holdings. Panel B of Table 3 reports the magnitudes and relative ranks of their adjustments in the three cash flow groups. The magnitudes of these adjustments are taken from Panel B in Table 4.

Adjustments in CFF I find that firms with below-target cash holdings adjust toward their targets by increasing CFF. However, since these firms are over-levered in the previous accounting period (BLDevt−1 > 0), as shown in Panel B of Table 4, it may be costly for them to visit external capital markets. This is probably why the magnitude of the increase in CFF is particularly small among German, Japanese, and UK firms (smallest among the three cash flow groups) (Panel B of Table 3). Due to their significant deviations from target leverage, German firms do not experience any change in their levels of net debt issues while UK firms even have to reduce them to avoid potential financial distress (Panel B of Table 4).Footnote 8

Adjustments in CFO The change in firms’ CFO becomes an important driver of their cash holdings adjustments (ranked 1st in most countries) (Panel B of Table 3) in the presence of below-target cash holdings as it may be more costly for these firms to visit capital markets. The increase in levels of funds from operations among Japanese, UK, and US firms is greater when they experience below-target than when they have above-target cash holdings. In addition, there is evidence that the magnitude of the fall in levels of working capital among firms with below-target cash holdings is much smaller than that of the increase in levels of funds from operations (except for French firms where the change in levels of working capital is more significant and Japanese firms which see almost equal changes in these two items) (Panel B of Table 4), suggesting a significant improvement in their levels of operational efficiency.

Even when firms with below-target cash holdings need to increase cash, they may be still concerned about potential impacts of a significant reduction in their working capital on their operations as the magnitude of the decrease in their levels of working capital is smaller than that of the increase in levels of working capital among firms with above-target cash holdings. The implication here is, when these firms have to reduce working capital to improve CFO (e.g., to reduce inventories and accounts receivable and/or increase accounts payable), they still need to ensure their ability to meet their customers’ demand and offer them reasonable credit terms and meet their suppliers’ credit requirements.

Adjustments in CFI The presence of below-target cash holdings forces firms, especially those which are highly over-levered and hence may have less access to capital markets (e.g., German and UK firms) to reduce CFI (except for US firms) (Panel B of Table 3). The decrease in levels of net assets from acquisitions among German and UK firms is particularly significant. The noticeable rise in German and UK firms’ levels of fixed asset disposal (Panel B of Table 4) may imply their attempts to boost operational efficiency i.e., to streamline their operations by selling less productive assets to improve both profitability and liquidity.

Overall, in support of the trade-off view, I find evidence that firms with above-target cash holdings experience faster speeds of adjustments since their mechanisms of adjustments may incur lower costs than those undertaken by firms with below-target cash holdings. These firms adjust toward their targets generally through significant changes in CFF (e.g., they generally decrease their levels of equity proceeds (all firms) and net debt issues (except for UK and US firms) but increase their levels of equity repurchases (except for French firms) and dividend payout (all firms)) and CFI (e.g., they generally increase their levels of net assets from acquisitions (all firms), portfolio and short-term investments (except for US firms), and capital expenditures (except for German firms) but reduce their levels of fixed asset disposal (all firms)) while firms with below-target cash holdings adjust mainly through changes in CFO i.e., to increase their levels of funds from operations but decrease their levels of working capital (all firms). The evidence on the asymmetry in the adjustments in CFO and CFI undertaken by these two groups of firms is especially novel. Previous studies tend to treat these adjustments as exogenous, independent of firms’ cash and leverage management policies but I now explicitly account for these to get a better insight into firms’ cash holdings adjustments.

5 Additional analyses

5.1 The asymmetry in the impact of the magnitude of deviations from targets on cash holdings adjustments

The magnitude of firms’ deviations from target cash holdings is likely to shape their target adjustments for two reasons. First, considering the magnitude of firms’ cash flow realizations, Faulkender et al. (2012) realize that the presence of large operating cash flows may encourage firms to adjust toward their target leverage faster as costs of leverage adjustments can be effectively shared with transaction costs that incur when they offset these cash flow imbalances, thus lowering the marginal costs of leverage adjustments. That line of argument can be borrowed to explain firms’ target cash holdings adjustments contingent on the magnitude of their deviations from target cash holdings. In particular, I argue that the presence of the fixed component of costs of adjustments (e.g., fixed costs of debt/equity issues, permanent losses of customers and growth opportunities, etc.) may discourage firms with small deviations to rebalance their cash. Large deviations, however, may lead to lower incremental costs of adjustments as the fixed cost component can now be effectively “shared” with transaction costs that incur when firms offset their cash holdings imbalances and hence faster speeds of adjustments.

Second, agency theories argue that firms with more free cash are more likely to experience the free cash flow problem (Jensen 1986), thus having more incentives to reduce cash to mitigate the potential costs associated with it. Firms with a large cash shortage, however, are likely to have more pressures to adjust to avoid suffering from operational problems and having to give up positive NPV investments. These costs of deviations, however, may be lower for firms with little excess cash (as managers do not have much to squander) or a small cash shortage (as the probability of experiencing operational problems and having to give up positive NPV projects is lower).

To examine the impact of the magnitude of firms’ deviations from target cash holdings on their target adjustments, I divide both firms with above-target cash holdings and those with below-target cash holdings into two subgroups using the median level of deviations from target cash holdings for each group. My approach here extends that of Dittmar and Duchin (2010) as I take into account whether firms have above- or below-target cash holdings while the authors do not. Firms with large (small) deviations may adjust more quickly (slowly) for different reasons contingent on whether they experience above or below-target cash holdings.

Here \(CH_{it}^{a} CDev_{it}^{L}\)\((CH_{it}^{a} CDev_{it}^{S} )\) indicates firms experience above-target cash holdings and the magnitude of the deviations is larger than or equal to (smaller than) the median level for their group while \(CH_{it}^{b} CDev_{it}^{L}\)\((CH_{it}^{b} CDev_{it}^{S} )\) indicates firms have below-target cash holdings and the magnitude of the deviations is larger than or equal to (smaller than) the median level for their group. \(\lambda_{1}\) may be greater than \(\lambda_{2}\) and \(\lambda_{3}\) while \(\lambda_{2}\) and \(\lambda_{3}\) may be greater than \(\lambda_{4} .\)

The impact of the magnitude of deviations from targets is reported in Table 5. I find some evidence that firms’ speeds of adjustments are also determined by how far they are away from their targets. The presence of the fixed cost component discourages US firms with small excess cash to adjust, thus leading to statistically slower speeds of adjustments compared to those of firms that have a lot of excess cash in the country. It is, however, an opposite story with Japanese firms as those with small excess cash adjust statistically faster, which is rather puzzling. Although speeds of adjustments for firms with above-target cash holdings and large deviations in France, Germany, and the UK are not statistically faster than those of firms with above-target cash holdings and small deviations, by magnitude, the former firms adjust faster, a finding to some extent in support of the “shared” fixed cost argument and agency theories on costs of deviations from target cash holdings i.e., firms with large excess cash holdings may face lower costs of adjustments but higher costs of deviations associated with the free cash flow problem.

Among firms with below-target cash holdings, although speeds of adjustments do not statistically differ between firms with large deviations and those with small deviations, by magnitude, the presence of large deviations still leads to faster speeds of adjustments (except for Japanese firms). This evidence lends some support to the earlier argument that firms with a large cash shortage may need to adjust more quickly for they are more likely to suffer from operational problems and have to give up positive NPV investments when costs of adjustments can be effectively “shared”.

I find that conditional on having large deviations from targets, firms with above-target cash holdings adjust statistically faster than those with below-target cash holdings. A similar pattern can be also found among firms with small deviations from targets i.e., firms with small excess cash adjust statistically faster than those with a small cash shortage. These findings suggest deviations from targets i.e., whether firms have above- or below-target cash holdings may be the major driver of their target adjustments, not the magnitude of these deviations.

Firms’ characteristics and actual cash holdings adjustments contingent on whether they have above- or below-target cash holdings and the magnitude of their deviations from targets reported in Table 6 can effectively shed light on why firms with large deviations from targets are likely to adjust faster than those with small ones. First, as expected, on average, firms with large deviations from targets, whether having above- or below-target cash holdings, in terms of absolute values, experience much more significant deviations from targets (from 2.8% (firms with large excess cash holdings or A-L firms in Japan) to 5.0% (A-L firms in the UK) of total assets) than those of firms with small deviations (from 0.5% (firms with small excess cash holdings or A-S firms in Japan and firms with a small cash shortage or B-S firms in all the sample countries with the exception of Japan) to 1.2% (A-S firms in the UK)). Hence, both the “shared” fixed cost argument and agency theories suggest they should undertake faster adjustments.

Second, except for French firms with above-target cash holdings and small deviations from targets, whether having above- or below-target cash holdings, firms with small deviations generally have stayed close to their target levels of leverage (especially US firms) (small BLDevt). This finding implies that the presence of fixed costs related to leverage adjustments may discourage these firms to visit external capital markets to rebalance their cash holdings via adjustments in CFF (Faulkender et al. 2012), which explains why compared to firms with large deviations, those with small ones experience much smaller changes in CFF in most cases.

In line with the view that excess cash tends to be used unproductively (Dittmar and Mahrt-Smith 2007), I find that the rise in A-L firms’ levels of working capital is much more significant than that in their levels of funds from operations as these firms collate a lot more accounts receivable and inventories while the improvement in their funds from operations is rather modest. A-L firms in Japan even experience a decline in their levels of funds from operations. However, when the magnitude of their excess cash holdings is small, they start trying to become more efficient as the growth of A-S firms’ levels of funds from operations starts exceeding that of their levels of working capital (except for A-S firms in Germany). Especially, I find that among the four groups of firms, B-L firms or those facing a large cash shortage across all the sample countries experience the largest improvement in their levels of funds from operations and the most significant reduction in their levels of working capital. Taken together, these findings imply that firms’ levels of operational efficiency vary conditional on the position relative to their target cash holdings.

Overall, I find evidence that consistent with the “shared” fixed cost argument and agency theories, firms with large deviations from target cash holdings adjust toward their target cash holdings faster than those with small deviations. Firms with small deviations may be discouraged to undertake adjustments possibly due to higher incremental costs of adjustments and lower costs of deviations. In addition, firms with a lot of excess cash do not use it very productively while those with a large cash shortage experience a significant improvement in their levels of operational efficiency.

5.2 The asymmetry in the impact of firms’ major characteristics on cash holdings adjustments

In another analysis, I examine the impact of several firm-specific factors such as precautionary motives of cash holdings, financial constraints, and corporate life-cycle on their cash holdings adjustments. These factors may affect their levels of costs of deviations, financial constraints, and costs of adjustments. For example, Sufi (2009) shows that firm size can be a strong statistical predictor of the use of bank lines of credit as large firms are likely to have more access to this source of financing. This suggests large firms may have weaker precautionary motives and be less responsive to deviations from target cash holdings due to lower costs of deviations from target cash holdings and hence experience slower speeds of adjustments. However, it can be also argued that as these firms are likely to face lower costs of adjustments due to better access to external financing sources, they can adjust toward their targets at lower costs, thus suggesting faster adjustments. Similarly, firms with low cash flow volatility may adjust either slowly for they are less likely to be affected by negative cash flow shocks (lower costs of deviations) or quickly as they tend to be matured firms with better access to external financing sources (lower costs of adjustments). To examine how these factors affect firms’ target adjustments, I develop following partial, asymmetric cash holdings adjustment models:

where \(CH_{it}^{L} (CH_{it}^{H} )\) is a dummy variable equal to 1 for firms with small size (CH SS it ), low cash flow volatility (CH LCFV it ), low dividend payout (CH LDPO it ), low growth opportunities (CH LGO it ) or young age (CH Y it ) (big size (CH BS it ), high cash flow volatility (CH HCFV it ), high dividend payout (CH HDPO it ), high growth opportunities (CH HGO it ) or old age (CH O it )) and 0 otherwise.Footnote 9 Next, I let these firm-specific characteristics interact with firms’ deviations from target cash holdings to examine how they jointly determine firms’ target adjustments. This may allow me to identify which factors have the first-order effects on these adjustments.

The precautionary motives of cash holdings I first examine the impact of firm size by splitting the sample firms into two groups i.e., one with larger size and another with smaller size than the median size level. Panel A of Table 7 shows that large firms in Germany, Japan, the UK, and the US adjust at speeds which are statistically lower than those of small firms. This finding supports the argument that large firms with more access to external financing sources may be less concerned about deviations from targets but is contrary to the argument of Dittmar and Duchin (2010) that big firms with more access to these sources may adjust faster. I have examined the mechanisms of adjustments of the two groups of firms but obtain results that do not form any clear patterns.

The interaction between firm size and whether firms have above- or below-target cash holdings does not change the above pattern as small firms (except for French firms) overall adjust toward their targets faster whether they experience above- or below-target cash holdings except for a few cases. For example, it turns out that in the presence of below-target (above-target) cash holdings, speeds of adjustments of small firms in the UK (the US) now do not statistically differ from those of large firms in the country.Footnote 10

Next, I investigate the impact of firms’ cash flow volatility on their adjustments by splitting the sample firms into two subgroups based on the median level of cash flow volatility. Firms with riskier cash flows may face higher costs of deviations from targets as they are more likely to experience negative cash flow shocks which may strongly affect their operations (e.g., their ability to meet debt obligations, finance working capital, and undertake growth opportunities) (Opler et al. 1999; Almeida et al. 2005; Bates et al. 2009). From Panel B of Table 7, there is strong evidence that these firms adjust faster than those with low cash flow volatility, which fits nicely with the argument that these firms are more likely to be affected by negative cash flow shocks, thus facing higher costs of deviations from targets. That evidence also supports Bakke and Gu (2017) who find that diversified firms tend to hold less cash and experience less cash flow volatility, thus possibly having lower target cash holdings and fewer incentives to adjust toward their targets.

Cash flow volatility has a less pronounced impact on firms’ target cash holdings adjustments when this variable is interacted with firms’ deviations from targets. Although by magnitude, firms with high cash flow volatility adjust faster whether they have above- or below-target cash holdings (except for firms with below-target cash holdings and high cash flow volatility in Japan), their speeds of adjustments do not statistically differ from those of firms with low cash flow volatility among firms with above-target cash holdings in France, Germany, the UK, and the US and those with below-target cash holdings in France, Japan, and the UK.

Dividend payout may also influence firms’ adjustments as external investors may observe firms with higher dividend payout to be less risky, suggesting better access to capital markets and low costs of adjustments (Bates et al. 2009). Consistent with Bates et al. (2009) that the precautionary motive of cash holdings should be weaker for firms which pay more dividends, firms in France, Japan, and the UK which pay more dividends adjust statistically less quickly than those which pay less dividends (Panel C of Table 7).

When dividend payout is interacted with firms’ deviations from targets, I find some different results. For example, speeds of adjustments for French firms with high dividend payout do not statistically differ from those of firms with low dividend payout among both groups of firms with above- and those with below-target cash holdings although by magnitude, firms with low dividend payout still adjust faster. This is a similar story for firms with below-target cash holdings in Japan.

Financial constraints Financial constraints i.e., growth opportunities and dividend payout may also influence firms’ cash holdings adjustments. As I have discussed the impact of dividend payout, here I only focus on that of growth opportunities. Almeida et al. (2002) suggest that the benefit of achieving optimal cash holdings may be higher for high-growth firms since it helps them avoid situations where a cash shortage forces them to give up positive NPV investments. Agency theories, however, suggest that these firms tend to be subject to more information asymmetries which lead to less access to external capital markets i.e., less ability to adjust via CFF.

Panel D of Table 7 reveals that by magnitude, except for firms in Japan, firms in all other countries experience faster speeds of adjustments when having more growth opportunities. High-growth firms in France and the US adjust statistically faster than their low-growth counterparts. The evidence for Japanese firms is somewhat puzzling as the presence of limited growth opportunities leads to faster adjustments. The interaction between growth opportunities and deviations from targets reduces the statistical relevance of growth opportunities. For example, the presence of more growth opportunities does not lead to statistically faster speeds of adjustments among both firms with above-target cash holdings in France and the US and those with below-target cash holdings in France.

Corporate life-cycle Finally, I investigate how firms’ age may influence their target cash holdings adjustments since it can be reasonably considered as a proxy for their reputation and access to external financing sources (Diamond 1991). Dittmar and Duchin (2010) show that as firms’ age increases, the precautionary motive of cash holdings may become weaker. It is therefore likely that matured firms may hold less cash and adjust less quickly than younger firms. To test the impact of firms’ age, I divide the sample firms into two subsamples—young firms whose age is less than and matured firms whose age is higher than the median age level.

Panel E of Table 7 shows strong evidence across firms in five countries that the precautionary motive of cash holdings may be weaker for matured firms. In particular, matured firms adjust toward their targets at speeds from 0.326 (Japanese firms) to 0.440 (US firms), statistically slower than those for young firms (from 0.456 (French firms) to 0.531 (UK firms)). Letting firms’ age interact with their deviations from targets, I find that young firms adjust faster whether they experience above- or below-target cash holdings, except for a few cases i.e., speeds of adjustments for young firms in France and the UK are not statistically different from those for matured firms in these two countries in the presence of below-target cash holdings. Young firms with above-target cash holdings experience fastest speeds of adjustments among the four groups of firms.

Overall, I show that firms’ precautionary motives of cash holdings, financial constraints, and corporate life-cycle may generally influence their cash holdings adjustments although their impact tends to become less significant when I interact these factors with deviations from target cash holdings (except for firm age). The impact of deviations from target cash holdings, however, remains strong and significant even when these factors are taken into account. This suggests that firms’ deviations from target cash holdings may be the major driver of their target adjustments, not firm-specific characteristics.

6 Concluding remarks

Consistent with the trade-off view of corporate cash holdings, I find that there is asymmetry in not only firms’ speeds but also mechanisms of adjustments. In particular, firms with above-target cash holdings generally disgorge their excess cash by reducing CFF (across firms in all the sample countries) and CFO (except for firms in the UK and the US) but increasing CFI (across firms in all the sample countries) while those with below-target cash holdings undertake opposite mechanisms to build up their cash reserves. Since the mechanisms undertaken by the former firms may incur lower costs, they can adjust relatively faster than the latter firms. Further, firms with above-target cash holdings adjust toward their targets mainly through changes in CFF and CFI while those with below-target cash holdings undertake major adjustments in CFO. The evidence on the asymmetry in the adjustments in CFO and CFI undertaken by these two groups of firms is particularly novel. Previous studies in the area tend to treat adjustments in firms’ CFO and CFI as exogenous, independent of firms’ cash and leverage management policies but I now explicitly account for these to get a better insight into firms’ cash holdings behaviors.

In my additional analyses, I find evidence that contrary to firms with small deviations from target cash holdings, those with large deviations may undertake faster adjustments due to lower costs of adjustments and higher costs of deviations, a finding in favor of both the “shared” fixed cost argument and agency theories. Intriguingly, I find that, consistent with agency theories, firms with a lot of excess cash may not use it very effectively. This problem is particularly prominent among firms with poor corporate governance (French and Japanese firms in particular). However, when having less cash than optimal levels, firms try hard to improve their operational efficiency.

Finally, I document some evidence on the impact of firms’ precautionary motives of cash holdings, financial constraints, and corporate life-cycle on their target cash holdings adjustments. I find evidence that firms adjust toward their target cash holdings faster contingent on having smaller size, higher cash flow volatility, lower dividend payout, more growth opportunities, and younger age. When these factors are interacted with firms’ deviations from targets, however, their influence on firms’ target adjustments tends to become less significant in most cases (except for firm age), suggesting that firms’ deviations from targets may be a more important driver of their target cash holdings adjustments.

Overall, the study contributes to the cash holdings literature by focusing on the asymmetry in the mechanisms undertaken by firms to move toward their target cash holdings levels. The findings complement the existing evidence on the asymmetry in firms’ speeds of adjustments reported by previous studies within this literature.

Notes

Different from the trade-off view, the financing hierarchy view which follows the pecking-order theory of corporate capital structures suggests that firms have no optimal levels of cash holdings (Myers and Majluf 1984). There is a negative relation between their cash balances and investment opportunities as firms prefer to finance their investment opportunities with internal funds for information asymmetries may make external financing become expensive.

In line with studies on leverage rebalancing (Leary and Roberts 2005; Strebulaev 2007) that imperfect capital markets or costs of adjustments may prevent firms from undertaking continuous adjustments to rebalance their leverage, Ozkan and Ozkan (2004) find that on average, UK firms may adjust toward their target cash holdings levels at speeds of from 54 to 60% each year which are comparable to those reported by Venkiteshwaran (2011) (higher than 50%) but faster than those reported by Opler et al. (1999) (from 33 to 35%) and Dittmar and Duchin (2010) (from 20 to 40%) for US firms.

The adjustments in net equity issues among UK and US firms are more significant than those of firms in France, Germany, and France, suggesting these firms may be relatively more active in the equity market. Indeed, Öztekin (2015) shows that in countries with stronger shareholder rights and better enforcement of these rights, firms are subject to lower equity costs and have increased recourse to equity financing.

Lee and Suh (2011) find that the increase in cash holdings prior to share repurchases is obtained from the decrease in firms’ capital expenditures rather than the improvement in their operating performance.

The literature review of Allen and Michaely (2003), however, shows that the overall accumulated empirical evidence does not support the assertion of traditional dividend signaling models that dividend changes convey information about firms’ future earnings as contrary to the signaling theory’s prediction; it indicates that there is no positive link between dividend changes and future earnings.

Another potential reason is that realizing capital gains is generally more tax efficient for shareholders compared to dividends.

Firms’ incentives for dividend smoothing can be explained by information asymmetry models (e.g., coarse signaling models (Kumar 1988; Kumar and Lee 2001; Guttman et al. 2010), principal-agent models (Fudenberg and Tirole 1995; DeMarzo and Sannikov 2008), information asymmetry among investors (Brennan and Thakor 1990) and external financial constraints (Almeida et al. 2005; Bates et al. 2009), agency-based models (Jensen 1986; Allen et al. 2002; DeAngelo and DeAngelo 2007; Lambrecht and Myers 2010), and income smoothing models (Miller and Scholes 1978; Baker et al. 2007; Baker and Wurgler 2010).

I find some link between cash holdings and leverage adjustments among firms with below-target cash holdings. Over-levered firms with large deviations from target leverage may find it harder to increase levels of net debt issues. Such a link is not found among those with above-target cash holdings.

For example, in Panel A in Table 7, I divide the sample firms into two subgroups by using the median size level i.e., one with larger size (CH BS it ) and another with smaller size (CH BS it ) than the median size level of all firms. In Panel B, I also divide these firms into two subgroups but using the median level of cash flow volatility i.e., one with higher levels of cash flow volatility (CH HCFV it ) and another with lower levels of cash flow volatility (CH LCFV it ) than the median level of cash flow volatility.

Controlling for size and other firm-specific characteristics, I find strong evidence that firms with above-target cash holdings adjust statistically faster than those with below-target cash holdings.

References

Allen F, Michaely R (2003) Chapter 7—payout policy. In: Constantinides GM, Harris M, Stulz RM (eds) Handbook of the economics of finance. Elsevier, Amsterdam, pp 337–429

Allen F, Bernardo AE, Welch I (2002) A theory of dividends based on tax clienteles. J Finance 55:2499–2536

Almeida H, Campello M, Weisbach MS (2002) Corporate demand for liquidity. Working Paper, University of Illinois and New York University

Almeida H, Campello M, Weisbach MS (2005) The cash flow sensitivity of cash. J Finance 59:1777–1804

Ando A, Christelis D, Miyagawa T (2003) Inefficiency of corporate investment and distortion of savings behavior in Japan. Struct. In: Blomström M, Corbett J, Hayashi F, Kashyap A (eds) Structural Impediments to Growth in Japan, Conference held Tokyo, Japan, University of Chicago Press, pp 155–190

Baker M, Wurgler J (2010) Signaling with reference points: behavioral foundations for the Lintner model of dividends. Working Paper, New York University

Baker M, Nagel S, Wurgler J (2007) The effect of dividends on consumption. Brook Pap Econ Act Econ Stud Progr 38(1):231–292

Bakke T-E, Gu T (2017) Diversification and cash dynamics. J Finance Econ 123:580–601

Bates TW, Kahle KM, Stulz RM (2009) Why do U.S. firms hold so much more cash than they used to? J Finance 64:1985–2021

Baumol WJ (1952) The transactions demand for cash: an inventory theoretic approach. Q J Econ 66:545–556

Best RJ, Best RW (2001) Prior information and the market reaction to dividend changes. Rev Quant Finance Acc 17:361–376

Bhattacharya S (1979) Imperfect information, dividend policy, and the ‘bird in the hand’ fallacy. Bell J Econ 10:259–270

Bliss RT, Rosen RJ (2001) CEO compensation and bank mergers. J Finance Econ 61:107–138

Brav A, Graham JR, Harvey CR, Michaely R (2005) Payout policy in the 21st century. J Finance Econ 77:483–527

Brealey RA, Myers SC, Allen F (2014) Principles of corporate finance, 11th edn. McGraw-Hill/Irwin, New York

Brennan MJ, Thakor AV (1990) Shareholder preferences and dividend policy. J Finance 45:993–1018

Brown JR, Petersen BC (2011) Cash holdings and R&D smoothing. J Corp Finance 17:694–709

Byoun S (2008) How and when do firms adjust their capital structures toward targets? J Finance 63:3069–3096

Chiang W, Monahan GE (2005) Managing inventories in a two-echelon dual-channel supply chain. Eur J Oper Res 162:325–341

DeAngelo H, DeAngelo L (2007) Capital structure, payout policy, and financial flexibility. Working Paper, University of Southern California

DeMarzo PM, Sannikov Y (2008) Learning in dynamic incentive contracts. Working Paper, Stanford University

Diamond DW (1991) Monitoring and reputation: the choice between bank loans and directly placed debt. J Pol Econ 99:689–721

Dittmar A, Duchin R (2010) The dynamics of cash. Working Paper, University of Michigan

Dittmar A, Mahrt-Smith J (2007) Corporate governance and the value of cash holdings. J Finance Econ 83:599–634

Faulkender M, Flannery MJ, Hankins KW, Smith JM (2012) Cash flows and leverage adjustments. J Finance Econ 103:632–646

Fazzari SM, Hubbard GR, Petersen BC (1988) Financing constraints and corporate investment. Brook Pap Econ Act 1:141–195

Fudenberg D, Tirole J (1995) A theory of income and dividend smoothing based on incumbency rents. J Pol Econ 103:75–93

García-Teruel PJ, Martínez-Solano P (2010) A dynamic perspective on the determinants of accounts payable. Rev Quant Finance Acc 34:439–457

Guttman I, Kadan O, Kandel E (2010) Dividend stickiness and strategic pooling. Rev Finance Stud 23:4455–4495

Harford J (2002) Corporate cash reserves and acquisitions. J Finance 54:1969–1997

Harford J, Li KAI (2007) Decoupling CEO wealth and firm performance: the case of acquiring CEOs. J Finance 62:917–949

Harford J, Mansi SA, Maxwell WF (2012) Corporate governance and firm cash holdings. In: Boubaker S, Nguyen BD, Nguyen DK (eds) Corporate governance—recent developments and new trends. Springer, Berlin, pp 107–138

Iyer SR, Feng H, Rao RP (2017) Payout flexibility and capital expenditure. Rev Quant Finance Acc 49:633–659

Jensen MC (1986) Agency cost of free cash flows, corporate finance, and takeovers. Am Econ Rev 76:323–329

Jiang Z, Lie E (2016) Cash holding adjustments and managerial entrenchment. J Corp Finance 36:190–205

John K, Williams J (1985) Dividends, dilution, and taxes: a signaling equilibrium. J Finance 40:1053–1070

Kumar P (1988) Shareholder-manager conflict and the information content of dividends. Rev Finance Stud 1:111–136

Kumar P, Lee B-S (2001) Discrete dividend policy with permanent earnings. Finance Manag 30:55–76

Lambrecht BM, Myers SC (2010) A Lintner model of dividends and managerial rents. Working Paper, MIT Sloan School

Leary MT, Roberts MR (2005) Do firms rebalance their capital structure? J Finance 60:2575–2619

Lee BS, Suh J (2011) Cash holdings and share repurchases: international evidence. J Corp Finance 17:1306–1329

Leftwich R, Zmijewski ME (1994) Contemporaneous announcements of dividends and earnings. J Acc Audit Finance 9:725–762

Miller MH, Modigliani F (1961) Dividend policy, growth and the valuation of shares. J Bus 34:411–433

Miller MH, Orr D (1966) A model of the demand for money by firms. Q J Econ 80:413–435

Miller MH, Rock K (1985) Dividend policy under asymmetric information. J Finance 40:1031–1051

Miller MH, Scholes MS (1978) Dividends and taxes. J Financ Econ 6:333–364

Minton BA, Schrand C (1999) The impact of cash flow volatility on discretionary investment and the costs of debt and equity financing. J Finance Econ 54:423–460

Mulligan CB (1997) Scale economies, the value of time, and the demand for money: longitudinal evidence from firms. J Pol Econ 105:1061–1079

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Finance Econ 13:187–221

Opler T, Pinkowitz L, Stulz R, Williamson R (1999) The determinants and implications of corporate cash holdings. J Finance Econ 52:3–46

Orlova SV, Rao RP (2018) Cash holdings speed of adjustment. Int Rev Econ Finance 54:1–14

Ozkan A, Ozkan N (2004) Corporate cash holdings: an empirical investigation of UK companies. J Bank Finance 28:2103–2134

Öztekin Ö (2015) Capital structure decisions around the world: which factors are reliably important? J Finance Quant Anal 50:301–323

Riddick LA, Whited TM (2009) The corporate propensity to save. J Finance 64:1729–1766

Strebulaev IA (2007) Do tests of capital structure theory mean what they say? J Finance 62:1747–1787

Sufi A (2009) Bank lines of credit in corporate finance: an empirical analysis. Rev Finance Stud 22:1057–1088

Teng M, Hachiya T (2013) Agency problems and stock repurchases: evidence from Japan. Rev Pac Basin Finance Mark Pol 16:1–30

Venkiteshwaran V (2011) Partial adjustment toward optimal cash holding levels. Rev Finance Econ 20:113–121

Wu W, Rui OM, Wu C (2012) Trade credit, cash holdings, and financial deepening: Evidence from a transitional economy. J Bank Finance 36:2868–2883

Author information

Authors and Affiliations

Corresponding author

Appendix: Variable definition

Appendix: Variable definition

Variable | Definition |

|---|---|

Asset tangibility (AT) | Fixed assets scaled by the book value of total assets |

Balance sheet net debt (BSND) | The difference between the book value of total debt and cash and cash equivalents scaled by the book value of total assets |

Book leverage (BL) | The ratio of the book value of total debt to the book value of total assets |

Cash (CH) | Cash and cash equivalents scaled by the book value of total assets |

Cash dividends | Cash dividends paid scaled by the book value of total assets |

Cash holdings change (CH change) | The difference between cash holdings in the current and the last accounting periods scaled by the book value of total assets |

Cash flows (CF) | Operating income before depreciation minus interest expense, income taxes and total dividends paid scaled by the book value of total assets |

Cash flows from financing (CFF) | Net cash flow from financing activities (net cash receipts and disbursements resulting from reduction and/or increase in long or short term debt, proceeds from sale of stock, stock repurchased/redeemed/retired, dividends paid and other financing activities) scaled by the book value of total assets |

Cash flows from investing (CFI) | Net cash flow from investing activities (net cash receipts and disbursements resulting from capital expenditures, decrease/increase from investments, disposal of fixed assets, increase in other assets and other investing activities) scaled by the book value of total assets |

Cash flows from operating (CFO) | Net cash flow from operating activities (net cash receipts and disbursements resulting from the operations of the firm i.e., the sum of funds from operations, funds from/used for other operating activities and extraordinary items) scaled by the book value of total assets |

Cash flow volatility (CFV) | The absolute value of the difference between the first difference of cash flow (% change) and the average of first differences |

Capital expenditures (CAPEX) | Capital expenditures scaled by the book value of total assets |

Equity proceeds | Net proceeds from sale/issue of common and preferred equity scaled by the book value of total assets |

Equity repurchases | Common/preferred equity purchased, retired, converted, and redeemed scaled by the book value of total assets |

Firm size (FS) | The natural log of the book value of total assets measured in 1980 US$ value |

Growth opportunities (GO) | The market-to-book ratio (the market value of total assets (the sum of the market value of equity or market capitalization and the book value of total debt) scaled by the book value of total assets) |

Market leverage (ML) | The ratio of the book value of total debt to the market value of total assets (the sum of the market value of equity (market capitalization) plus the book value of total debt) |

Net debt issue | The sum of net long-term debt issue (long-term borrowings minus long-term debt reductions) and increase/decrease in short-term borrowing scaled by the book value of total assets |

Net equity issue | The net difference between equity proceeds and equity repurchases |

Net working capital (NWC) | The difference between working capital and cash and cash equivalents scaled by the book value of total assets |

Research and development (R&D) | Research and development expenses scaled by total sales |

Working capital | Funds from/for other operating activities scaled by the book value of total assets |

Rights and permissions