Abstract

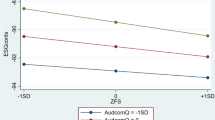

Prior studies document that managerial overconfidence potentially increases the risk of financial misstatements, and that overconfident managers purchase lower quality audits and pay lower audit fees. As a part of the research that evaluates the information value of managerial characteristics to auditors, our study examines how the relationship between managerial overconfidence and audit fees is impacted by managerial ability, and board and audit committee effectiveness in the post-Sarbanes–Oxley (post-SOX) environment. In general, we find a significantly positive relationship between managerial overconfidence and audit fees consistent with the supply-side risk based perspective of audit pricing. However, this relationship is significantly attenuated in higher managerial ability firms where overconfident managers are better able to make proper accounting estimates and judgements required for producing reliable financial statements, and synthesize firm-specific information into appropriate forward looking projections. We find that on an average, the overconfident firms with higher managerial ability pay 6.3% lower audit fees than the overconfident firms with lower managerial ability. Our analyses further show that board characteristics positively impact the relationship between managerial overconfidence and audit fees, suggesting that stronger board monitoring increases the demand for higher quality audits to mitigate the reporting risk of the overconfident firms. On an average, the firms with managerial overconfidence pay additional 9.3% higher audit fees when they are subject to stronger and more effective board oversight. However, we find weaker evidence on the effect of audit committee characteristics on audit fees of the overconfident firms. Our primary results hold for a battery of supplemental tests including the tests using propensity-score matched sample. The study contributes to audit fee and corporate governance literature, and has useful implications for regulators, accounting practitioners, and auditors.

Similar content being viewed by others

Notes

Prior studies indicate that characteristics of senior managers are often evaluated in client screening, acceptance and audit planning decisions (Kiziria et al. 2005; Johnson et al. 2013; Krishnan and Wang 2015). Kiziria et al. (2005) even suggest that without management integrity or ‘tone at the top’, the most proficient internal controls may not be effective in reducing financial misstatements. In a quasi-experimental setting, Johnson et al. (2013) find that narcissistic client behavior and fraud motivation are positively related to auditors’ fraud risk assessments.

Simunic and Stein (1996) suggest that total audit costs include a “resource cost and an expected liability loss component.” Resource cost increases with an increase in audit effort to minimize audit risk, and the proportion of liability loss component (ex-ante risk premium) increases with an increase in probable ex-post litigation loss liability (i.e., increased business risk). Auditors respond to higher audit and business risk by increasing audit investment and by charging higher risk premium. Reynolds and Francis (2001) suggest that reputation protection and litigation risk dominate auditor’s reporting behavior. Wang et al. (2013) further argue that an indication of client’s inability to file reliable information on a timely basis constitutes a risk factor inducing auditor to make upward fee adjustments.

Biddle et al. (2009) demonstrate that the firms with higher reporting quality tend to deviate less from predicted investment levels. The higher reporting quality is associated with both lower under and over-investments. Therefore, the over-investment, which is viewed as a product of more aggressive and over-confident managerial decision, is more likely be associated with lower reporting quality.

MA-scores are obtained from https://community.bus.emory.edu/personal/PDEMERJ/Pages/Home.aspx. Demerjian et al. (2012) used a two-step process to estimate managerial ability. First, they employ data envelopment analysis to estimate overall firm efficiency. Second, they estimate managerial ability from firm efficiency measure by industry by regressing firm efficiency on six firm characteristics such as firm size, firm’s market share, free cash flows, firm age, business segment concentration, and foreign operations. The residuals from the regressions are the managerial ability scores. For detailed discussion of the process, please refer to Demerjian et al. (2012, 2013) and Krishnan and Wang (2015).

We restrict the sample period up to 2011 because of non-availability of managerial ability data beyond 2011 at the site: https://community.bus.emory.edu/personal/PDEMERJ/Pages/Home.aspx.

This risk-based explanation is also consistent with the fact that, on an average, 81% of our total observations are subject to high-quality Big 4 audits. Large Big 4 auditors with national and international clientele are deemed to have higher reputational capital to preserve. So, when they deal with overconfident clients and associated reporting risk that may result from overconfident managerial actions, they are likely to incorporate the higher risk of audit failure in their audit pricing decisions. As a result, they increase their engagement efforts (with more professional staff and more audit hours) to mitigate the risk at an acceptable level and/or add a risk premium in their quoted fees to cover any ex-post litigation loss liability, the effect of which is reflected in higher audit fees.

The dependent variable, LAFEE is a log-transformed variable. So, the effect of ABILITY on audit fees and overconfidence is given by e− 0.070 = 0.933 for CAPEX, e− 0.065 = 0.937 for Over-Invest and e− 0.062 = 0.940 for Holder67. This translates into 6.7, 6.3 and 6.0% respectively lower fees for the higher managerial ability, overconfident firms relative to the lower managerial ability, overconfident firms.

The dependent variable, LAFEE is a log-transformed variable. So, the effect of BD_GSCORE on audit fees and overconfidence is given by e0.096 = 1.101 for CAPEX, e0.088 = 1.092 for Over-Invest and e0.083 = 1.086 for Holder 67. This translates into 10.1, 9.2 and 8.6% high audit fees for the higher board governance, overconfident firms relative to the lower board governance, overconfident firms.

The results complement prior studies (Schrand and Zechman 2012; Ahmed and Duellman 2013) that do not find significant governance effect on managerial overconfidence. Our findings suggest that corporate boards seek higher-quality audits from incumbent auditors to monitor financial reporting process and minimize reporting risks that are potentially associated with overconfident managerial action.

Our results are consistent with Carcello et al. (2002) where they find positive association between board variables and audit fees. But in their analyses, audit committee variables are insignificant in presence of board variables. Even, Abbott et al. (2003) find limited results for audit committee characteristics in their audit fee study; for example, they find highly significant effect of AC independence, weakly significant effect of AC expertise and insignificant effect of AC meeting in presence of board variables in analyses, where two of the three board variables, namely, board independence and board diligence are positively significant. The reason for relatively weaker results for audit committee variables is the likely increase of audit committee independence and expertise among most US corporations under the enhanced regulatory focus of SEC on audit committee effectiveness. Increased regulatory focus on audit committee strengthens the motivation and effectiveness of audit committees in performing their oversight role in financial reporting and accounting compliance process, resulting in reduction of cross-sectional variation of its quality across firms. The reduced variability across observations partly explains insignificant audit committee effect on audit fees. Please refer to the descriptive data in Table 3, Panel A which reports the standard deviation of BD_GSCORE as 1.719 and that of AC_GSCORE as 0.784.

Several variables used in the regression analyses are significantly correlated to each other. Our regression diagnostics, however, show that the variance inflation factors (VIF) and condition indices do not provide any evidence that multicollinearity is a problem. Chatterjee and Hadi (2012) indicate that the VIF in excess of 10 is an indication that collinearity may be causing problems in estimation. Belsley et al. (1980) suggest that a condition index greater than 15 indicates a possible problem and an index in excess of 30 suggests a serious multicollinearity problem among the explanatory variables in the regression. In this respect, the regression models employed in this study are well specified. The influence statistics, DEFFITS and Cook’s D, do not indicate the presence of any influential data-points that might bias the results of the study. Finally, the normal probability plots indicate that errors are normally distributed; the residual plots do not exhibit any systematic pattern of error distribution; and our auto-correlation tests indicate that errors are uncorrelated with each other.

References

Abbott LJ, Parker S, Peters GF, Raghunandan K (2003) The association between audit committee characteristics and audit fees. Audit J Pract Theory 22(2):17–32

Ahmed AS, Duellman S (2013) Managerial overconfidence and accounting conservatism. J Acc Res 51(1):1–30

Ali A, Zhang W (2015) CEO tenure and earnings management. J Acc Econ 59(1):60–79

Ashbaugh H, LaFond R, Meyhew BW (2003) Do nonaudit services compromise auditor independence? Acc Rev 78(3):611–639

Bamber L, Jiang J, Wang I (2010) What’s my style? The influence of top managers on voluntary corporate financial disclosure. Acc Rev 85(4):1131–1162

Beasley MS (1996) An empirical analysis of the relation between the board of director composition and financial statement fraud. Acc Rev 71(3):443–465

Beck MJ, Mauldin EG (2014) Who’s really in charge? Audit committee versus CFO power and audit fees. Acc Rev 89 (6):2057–2085

Bedard JC, Johnstone KM (2004) Earnings management risk, corporate governance risk and auditors’ planning and pricing decisions. Acc Rev 79(2):277–304

Belsley DA, Kuh E, Welsch RE (1980) Regression diagnostics: Identifying influential data and sources of collinearity. John Wiley and Sons, Inc., Hoboken

Bernard V (1987) Cross-sectional dependence and problems in inference in market-based accounting research. J Acc Res 25(1):1–48

Biddle GC, Hilary G, Verdi RS (2009) How does financial reporting quality relate to investment efficiency? J Acc Econ 48:112–131

Carcello JV, Hermanson DR, Neal TL, Riley RA (2002) Board characteristics and audit fees. Contemp Acc Res 19(3):365–384

Cassell CA, Giroux GA, Myers LA, Omer TC (2012) The effect of corporate governance on auditor-client realignments. Audit J Pract Theory 31(2):167–188

Chao CL, Horng SM (2013) Asset write-offs discretion and accrual management in Taiwan: the role of corporate governance. Rev Quant Finance Acc 40(1):41–74

Chatterjee S, Hadi AS (2012) Regression analysis by example. John Wiley and Sons, Inc., Hoboken

Cohen JR, Hanno DM (2000) Auditors’ consideration of corporate governance and management control philosophy in preplanning and planning judgments. Audit J Pract Theory 19(2):133–146

Cohen J, Krishnamoorthy G, Wright AM (2002) Corporate governance and the audit process. Contemp Acc Res 19(4):573–594

Craswell AT, Francis JR, Taylor SL (1995) Auditor brand name reputation and industry specialization. J Acc Res 20:297–322

Craswell AT, Stokes DJ, Laughton J (2002) Auditor independence and fee dependence. J Acc Econ 33(2):253–275

Dechow PM, Sloan RG, Sweeney AP (1996) Causes and consequences of earnings manipulation: an analysis of firms subject to enforcement actions by SEC. Contemp Acc Res 13:1–36

DeFond ML, Jiambalvo J (1993) Factors related to auditor-client disagreements over income-increasing accounting accruals. Contemp Acc Res 9(2):415–431

Demerjian P, Lev B, McVay S (2012) Quantifying managerial ability: a new measure and validity tests. Manage Sci 58(7):1229–1248

Demerjian PR, Lev B, Lewis MF, McVay SE (2013) Managerial ability and earnings quality. Acc Rev 88(2):463–498

Duellman S, Hurwitz H, Sun Y (2015) Managerial overconfidence and audit fees. J Contemp Acc Econ 11(2):148–165

Dyreng S, Hanlon M, Maydew E (2010) The effect of executives on corporate tax avoidance. Acc Rev 85(4):1163–1189

Fama E, French K (1997) Industry costs of equity. J Finance Econ 43(2):153–193

Farber DB (2005) Restoring trust after fraud: does corporate governance matter? Acc Rev 80:539–561

Feng M, Ge W, Luo S, Shevlin T (2011) Why do CFOs become involved in material accounting manipulations? J Acc Econ 51:21–36

Ge W, Matsumoto D, Zhang J (2011) Do CFOs have styles of their own? An empirical investigation of the effect of individual CFOs on accounting practices. Contemp Acc Res 28(4):1141–1179

Hammersley JS, Myers LA, Zhou J (2012) The failure to remediate previously disclosed material weaknesses in internal controls. Audit J Pract Theory 31(2):73–111

Hay DC, Knechel WR, Wong N (2006) Audit fees: a meta-analysis of the effect of supply and demand attributes. Contemp Acc Res 23:141–191

Hogan CE, Wilkins MS (2008) Evidence on the audit risk model: do auditors increase audit fees in the presence of internal control deficiencies? Contemp Acc Res 25(1):219–242

Hoitash R, Hoitash U, Bedard JC (2008) Internal control quality and audit pricing under the Sarbanes–Oxley Act. Audit J Pract Theory 27(1):105–126

Houston R, Peters M, Pratt J (2005) Non-litigation risk and pricing audit services. Audit J Pract Theory 24(1):37–53

Hribar P, Yang H (2016) CEO overconfidence and management forecasting. Contemp Acc Res 33(1):204–227

Hsieh TS, Bedard JC, Johnstone KM (2014) CEO overconfidence and earnings management during shifting regulatory regimes. J Bus Finance Acc 41(9–10):1243–1268

Huang HW, Parker RJ, Yan YCA, Lin YH (2014) CEO turnover and audit pricing. Acc Horiz 28(2):297–312

Huang X, Sun L (2017) Managerial ability and real earnings management. Adv Account 39:91–104

Johnson EN, Kuhn JR, Apostolou BA, Hassell JM (2013) Auditor perceptions of client narcissism as a fraud attitude risk factor. Audit J Pract Theory 32(1):203–219

Kiziria TG, Mayhew BW, Sneathen LD (2005) The impact of management integrity on audit planning and evidence. Audit J Pract Theory 24(2):49–67

Klein A (2002) Audit committee, board of director characteristic, and earnings management. J Acc Econ 33:375–400

Krishnan GV, Wang C (2015) The relations between managerial ability audit fees and going concern opinions. Audit J Pract Theory 34(3):139–160

Krishnan J, Krishnan J, Song H (2011) The effect of auditing standard no. 5 on audit fees. Audit J Pract Theory 30(4):1–27

Libby R, Luft J (1993) Determinants of judgement performance in accounting settings: ability, knowledge, motivation and environment. Account Organ Soc 18(5):425–450

Lev B, Thiagarajan SR (1993) Fundamental information analysis. J Account Res 31(2):190–215

Lyon J, Maher M (2005) The importance of business risk in setting audit fees: evidence from cases of client misconduct. J Acc Res 43(1):133–151

Malmendier U, Tate G (2005) CEO overconfidence and corporate investment. J Financ 60:2661–2700

Malmendier U, Tate G (2008) Who makes acquisition? CEO overconfidence and the market’s reaction. J Finance Econ 89:20–43

Malmendier U, Tate G, Yan J (2011) Overconfidence and early life experiences: the effect of managerial traits on corporate financial policies. J Finance 66:1687–1733

Mitra S, Hossain M, Deis DR (2007) The empirical relationship between ownership characteristics and audit fees. Rev Quant Finance Acc 28:257–285

Munsif V, Raghunandan K, Rama DV, Singhvi M (2011) Audit fees after remediation of internal control weaknesses. Acc Horiz 25(1):87–105

Presley TL, Abbott LJ (2013) CEO overconfidence and the incidence of financial statement. Adv Account 29(1):74–84

Raghunandan K, Rama DV (2006) SOX Section 404 material weakness disclosure and audit fees. Audit J Pract Theory 25(1):99–114

Reynolds JK, Francis JR (2001) Does size really matter? The influence of large clients on office-level auditor reporting decisions? J Acc Econ 30:375–400

Schrand CM, Zechman SLC (2012) Executive overconfidence and the slippery slope to financial misreporting. J Acc Econ 53:311–329

Simunic D (1980) The pricing of audit services: theory and evidence. J Acc Res 18(1):161–190

Simunic D, Stein MT (1996) The impact of litigation risk on audit pricing: a review of the economics and the evidence. Audit J Pract Theory 15(Supplement):119–134

Tsui JSL, Jaggi B, Gul FA (2001) CEO domination, growth opportunities, and their impact on audit fees. J Acc Econ 16(3):189–203

Vafeas N, Waegelein JF (2007) The association between audit committees, compensation incentives, and corporate audit fees. Rev Quant Finance Acc 28:241–255

Wang C, Raghunandan K, McEwen RA (2013) Non-timely 10-K filings and audit fees. Acc Horiz 27(4):737–755

Whisenant S, Sankaraguruswamy S, Raghunandan K (2003) Evidence on the joint determination of audit and non‐audit fees. J Acc Res 41(4):721–744

Xie B, Davidson WN, DaDalt PJ (2003) Earnings management and corporate governance: the role of the board and the audit committee. J Corp Finance 9:295–316

Author information

Authors and Affiliations

Corresponding author

Additional information

Data: The data for the study are obtained from public sources as indicated in the text.

Rights and permissions

About this article

Cite this article

Mitra, S., Jaggi, B. & Al-Hayale, T. Managerial overconfidence, ability, firm-governance and audit fees. Rev Quant Finan Acc 52, 841–870 (2019). https://doi.org/10.1007/s11156-018-0728-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-018-0728-3

Keywords

- Audit fees

- Audit risk

- Board and audit committee characteristics

- Managerial ability

- Managerial overconfidence