Abstract

The paper reviews the development of von Neumann and Morgenstern (vNM) utility theory. Kahneman and Tversky’s (KT’s) prospect theory is introduced. The vNM utility function is compared and contrasted with KT’s value function. We prove the uniqueness of two popular utility functions. First, we show that all power utility functions possess constant RRA. And, we show that all exponential utility functions have constant ARA. The paper concludes by discussing applications, strengths and weaknesses of various utility functions.

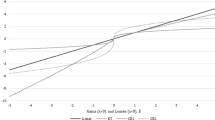

Adapted from: Bodie et al. (2011), Figure 7.8, p. 210

Similar content being viewed by others

Notes

Friedman and Savage’s (1948) article is not representative of the co-authors’ outstanding contributions to economics. Friedman and Savage (1948) and Friedman (1957, 1963) gave economics the permanent income hypothesis, consumption function, monetary economics and other important findings. Savage is also a top-notch economist. One co-author to this paper has a Ph.D. in finance and was a Federal Reserve Economist for 2 years, and he believes Milton Friedman was one of the best economists that ever walked the earth.

Markowitz’s (1952) present value is at the origin in Fig. 3. Kahneman and Tversky (KT 1979) defined the status quo to be their reference point, and it is located at the origin of their value function. These three researchers all assert that their reference point should be at the origin. Note that below KT’s Eq. (2) in their 1979 paper KT explicitly acknowledge Markowitz’s contribution to their prospect theory.

In this paper the values of \( \alpha_{1} = 1 \) and \( \alpha_{2} = 2 \) are control variables that are determined exogenously by the decision-maker rather than within the model. As a result, \( \alpha_{1} \) and \( \alpha_{2} \) do not have the meaningful shadow prices that are sometimes associated with Lagrangian multipliers.

This paper uses single period vNM utility theory. An analysis of CRRA that goes beyond the scope of this paper could use Epstein–Zin recursive utility (Epstein and Zinn 1989).

Under ordinal utility theory the negative exponential utility function is equivalent to the exponential utility function. See Norstad (2011) and Merton (1990). However, adding one to the equation would make these two utility functions differ under cardinal utility theory. In spite of the differences in their cardinal utility, the two functions behave similarly.

Non-expected utility is an alternative to expected utility analysis. See Cho and Francis (1994) for an introduction.

References

Allais M (1953) Le Comportment de L’homme rationnel devant de risque: critique des postulats et axiomes de l’ecole Americaine. Econometrica 21:503–546

Arrow KJ (1965) Aspects of the theory of risk bearing. The theory of risk aversion. Helsinki: Yrjo Jahnssonin Saatio. Reprinted in: Essays in the Theory of Risk Bearing, Markham Publication Co., Chicago, 1971, pp 90–109

Barberis N (2013a) Thirty years of prospect theory in economics: a review and assessment. J Econ Perspect 27(1):173–196

Barberis N (2013b) The psychology of tail events: progress and challenges. Am Econ Rev 103(3):611–616. https://doi.org/10.1257/aer.103.3.611

Barberis N, Xiong W (2009) What drives the disposition effect? An analysis of a long-standing preference-based explanation. J Finance LXIV(2):751–784

Bernoulli D (1954/1738) Exposition of a new theory on the measurement of risk. Econometrica 22(1):23–36. This 1738 paper was translated to English by Dr. Louise Sommer and reprinted in 1954

Bodie Z, Kane A, Marcus AJ (2011) Investments, 9th edn. McGraw-Hill Irwin, New York

Brown D, Gibbons MR (1985) A simple econometric approach for utility-based asset pricing models. J Finance 40(2):359–381

Bruhin A, Fehr-Duda H, Epper T (2010) Risk and rationality: uncovering heterogeneity in probability distortion. Econometrica 78(4):1375–1412

Cho J, Francis JC (1994) Asset pricing implications of a non-expected recursive utility function: a review. Int Rev Financ Anal 3(1):19–35

Epstein LG, Zinn SE (1989) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: a theoretical framework. Econometrica 57(4):937–969

Frazzini A (2006) The disposition effect and underreaction to news. J Finance 61(4):2017–2046

Friedman M (1957) A theory of the consumption function. Princeton University Press, Princeton. ISBN 0-691-04182-2

Friedman M (1963) A monetary history of the united states, 1867–1960. Princeton University Press, Princeton

Friedman M, Savage LJ (1948) Utility analysis of choices involving risk. J Polit Econ 56(4):279–304. https://doi.org/10.1086/256692

Friend I, Blume ME (1975) The demand for risky assets. Am Econ Rev 65(5):900–922

Hsin CW, Kuo J, Lee CF (1994) A new measure to compare the hedging effectiveness of foreign currency futures versus options. J Futur Mark 14:685–707

Hung M-W, Wang J-Y (2005) Asset prices under prospect theory and habit formation. Rev Pac Basin Financ Mark Policies 8(1):1–29

Kahneman D (2011) Thinking fast and slow. Farrar, Straus and Giroux. ISBN 978-1-4299-6935-2.

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–291

Karson MJ, Cheng DC, Lee CF (1995) Sampling distribution of the relative risk aversion estimater: theory and applications. Rev Quant Financ Acc 5:43–54

Kraus A, Litzenberger RH (1975) Market equilibrium in a multiperiod state preference model with logarithmic utility. J Finance 30(5):1213–1227

Kroll Y, Levy H, Markowitz HM (1984) Mean–variance versus direct utility maximization. J Finance 39(1):47–83

Levy H, Markowitz HM (1979) Approximating expected utility by a function of mean and variance. Am Econ Rev 69(3):308–317

Markowitz H (1952) The utility of wealth. J Polit Econ 60(2):151–158

Markowitz H (1959) Efficient diversification of investments. Wiley, New York

Markowitz H (1991) Foundations of portfolio theory. J Finance 46(2):469–477

Merton RC (1990) Continuous-time finance. Basil Blackwell Inc, Cambridge

Nawrocki D (2014) Behavioral finance in financial market theory, utility theory, portfolio theory and the necessary statistics. J Behav Exp Finance 2:10–17

Norstad J (2011) An introduction to utility theory, a teaching note found at http://www.norstad.org, November 3, 2011 version

Odean T (1998) Are investors reluctant to realize their losses? J Finance 53(5):1775–1798

Pratt JW (1964) Risk aversion in the small and in the large. Econometrica 32(1–2):122–136

Rabin M (2000) Risk aversion and expected-utility theory: a calibration theorem. Econometrica 68(5):1281–1292

Sharpe WF (1964) Capital asset prices: a theory of market equilibrium under conditions of risk. J Finance 19(3):425–442

Sharpe WF (1966) Mutual fund performance. J Bus XXXIX(1, Part II):119–138

Sundaresan S (1983) Constant absolute risk aversion preferences and constant equilibrium interest rates. J Finance 38(1):205–212

Tversky A, Kahneman D (1981) The framing of decisions and the psychology of choice. Science 211(4481):453–458. https://doi.org/10.1126/science.7455683

Tversky A, Kahneman D (1992) Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain 5(4):297–323

von Neumann J, Morgenstern O (1944) Theory of games and economic behavior. Princeton University Press, Princeton; 2nd ed. (1947); 3rd ed (1953)

Wakker PP (2008) Explaining the characteristics of the power (CRRA) utility function. Health Econ 17(12):1329–1344

Acknowledgments

Funding was provided by Baruch College Fund.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Harel, A., Francis, J.C. & Harpaz, G. Alternative utility functions: review, analysis and comparison. Rev Quant Finan Acc 51, 785–811 (2018). https://doi.org/10.1007/s11156-017-0688-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-017-0688-z

Keywords

- von Neumann–Morgenstern (vNM) utility theory

- Expected utility theory

- Kahneman and Tversky (KT)

- Prospect theory

- Framing

- Loss aversion

- Risk aversion

- Risk taking

- Absolute risk aversion (ARA)

- Relative risk aversion (RRA)

- Subjective probabilities

- Decision weights

- Objective probabilities

- Probability weighting