Abstract

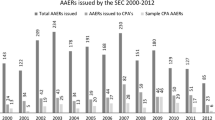

I study the impact of an SEC investigation (as captured by accounting and auditing enforcement releases) on a firm’s cost of equity capital. AAERs are often used in accounting literature as a proxy for fraudulent financial reporting. Fraudulent financial reporting should lead to an increase in cost of equity capital as a firm’s future cash flows become less certain. Overall, this study provides evidence of changes in cost of equity capital for firms targeted by an SEC AAER on the date the investigation is first made public.

Similar content being viewed by others

Notes

For example, the SEC recently announced the creation of teams of specialists focused on specific types of fraud in response to criticisms that its current, more general staff has difficulty identifying fraud involving complex transactions (Scannell 2009).

Bonner et al. (1998) suggest an increase in revenue or decrease in expenses as an example of common fraudulent activities, as opposed to overstating accounts payable as an example of uncommon fraudulent behavior.

The Sarbanes–Oxley Act of 2002 barred “revolving door” hires by preventing audit firms from auditing firms in which a company executive performed audit services for the firm within the previous one-year period (SEC 2003).

‘Market message’ is defined by the ability of the investigation to address current and emerging disclosure issues as well as the targeted firm’s level of visibility in the market (Feroz et al. 1991).

Success rate is determined by litigation successfully levied against the offender (SEC 2008). The SEC preempts litigation with an investigation at the target firm. If the SEC finds no evidence of wrong-doing, they do not proceed with litigation, thereby skewing the SEC’s litigation success rate.

All AAERs are assigned an associated litigation number by the SEC. A manual check confirmed that all AAERs within the sample contain an associated litigation number. Furthermore, a manual search of the targeted firms confirmed that no targeted firm was first targeted by SEC litigation which preempted the AAER.

Other ‘trigger events’ documented by KLM include ‘investigations by other federal agencies…, delayed SEC filings, management departures, whistleblower charges, and routine reviews by the SEC.’ (Karpoff et al. 2008, p. 587).

Murphy et al. (2009) define corporate misconduct as “the subject keywords adopted by The Wall Street Journal Index such as, antitrust, breach of contract, bribery, business ethics, conflict of interest, copyright/patent infringement, fraud, kickbacks, price-fixing, securities fraud, and white-collar crime” (Murphy et al. 2009, p. 5).

Initiation by the company or auditor increases the cost of equity capital beyond increases associated with SEC initiation or an unidentified initiator.

Because my sample employs AAER issuances to identify firms, my study does not capture information related to firms investigated by the SEC that do not receive a subsequent AAER.

A deferred prosecution agreement includes a form of settlement without court proceedings, similar to the agreement reached between KPMG, the Department of Justice, and the IRS in 2005. KPMG admitted to creating phony tax shelters and agreed to pay $456 million in restitution (IRS 2005). Thanks to Professor Lance Cole for indicating deferred prosecution agreements as an alternative to AAERs as an investigation resolution.

The 156 firms exist in both Compustat and CRSP, I check for the exact required data at a later stage.

For example, Sunbeam contains the necessary forecasts and accounting data when the SEC investigation is announced. However, the SEC investigation and related restatements cause Sunbeam to enter bankruptcy and subsequent delisting (Atlas and Tanner 2001) before the SEC issues its AAER. Sunbeam is included in the investigation announcement date sample, but not in the subsequent issue date sample.

Nine of the firms in the investigation announcement sample eventually declared bankruptcy (identified via CRSP delisting codes 552, 560, 561, 570, 574 and 584), four of which declared bankruptcy before the AAER issue date. The remaining five bankrupt firms are included in both samples.

No observations were dropped as a result of there being available information in the month prior to the event, but missing data in the month directly subsequent the event. Observations dropped due to missing information subsequent to the event could introduce a survivorship bias to the results.

Firms’ cost of capital is not restricted to equity capital. Modern finance theory often employs the Weighted Average Cost of Capital (WACC) when considering the cost of capital for a firm. WACC is calculated as Cost of Equity × (Equity/(Debt + Equity)) + Cost of Debt × (1 − Tax rate) × (Debt/(Debt + Equity) (Ogier et al. 2004, p. 8). Because the cost of equity is a core component in calculating WACC, any change in WACC will impact the firm’s Cost of Equity. Therefore, a change in cost of equity is sufficient in signifying a change in a firm’s WACC.

This paper is not intended to evaluate criticisms surrounding the various cost of equity capital measures.

As outlined in the conclusion to this paper, once the impact of SEC AAERs on cost of equity capital is established, future research could use this setting to evaluate the four measures of cost of equity capital, or subsequently proposed measures from future studies.

Cost of equity capital is often associated with more explanatory measures that utilize historic information to forecast future cost of equity capital (e.g., CAPM or APT). Accounting research is often concerned with measuring the current cost of equity capital being applied by the market, which is the main objective of the models described in this paper. This measure is often referred to as the ‘implied cost of equity capital applied by the market’.

See Ehrhardt (1994) for information on the origin and derivation of the dividend growth model. The model is also referred to throughout this section as the dividend discount model.

See Gode and Mohanram (2008) for a discussion of the assumptions and mathematical transformations necessary to derive the economy-wide growth model.

GAO database information is provided, with permission, from Andy Leone’s website: (http://sbaleone.bus.miami.edu/), including the ‘irregularity versus error’ classification outlined in Hennes et al. (2008).

I assume that any restatement issued in close proximity to the SEC investigation announcement or AAER is an associated restatement. It is possible that a restatement in this period is unrelated. My assumption is based on the reverse argument in Hennes et al. (2008) that a restating firm with an AAER has engaged in ‘irregular’ reporting.

References

Ackerman A (2009) Schapiro aims to broaden SEC’s responsibilities, boost funding. Bond Buy 367(33048):4

Atlas RD, Tanner J (2001) Despite recovery efforts, Sunbeam files for chapter 11. The N.Y. Times. http://www.nytimes.com/2001/02/07/business/despite-recovery-efforts-sunbeam-files-for-chapter-11.html. Accessed 8 Aug 2014

Barau A, Smith AL (2013) SEC enforcement releases and audit fees. Managerial Audit J 28(2):161–177

Beneish MD (1997) Detecting GAAP violation: implications for assessing earnings management among firms with extreme financial performance. J Acc Public Policy 16(3):271–309

Beneish MD (1999) Incentives and penalties related to earnings overstatements that violate GAAP. Acc Rev 74(4):425–457

Bonner SE, Palmrose Z, Young SM (1998) Fraud type and auditor litigation: an analysis of SEC accounting and auditing enforcement releases. Acc Rev 73(4):503–532

Botosan CA, Plumlee MA (2005) Assessing alternative proxies for the expected risk premium. Acc Rev 80(1):21–53

Cao Z, Leng F, Feroz E, Davalos VS (2013) Corporate governance and default risk of firms cited in the SEC’s accounting and auditing enforcement releases. Rev Quant Financ Acc. doi:10.1007/s11156-013-0401-9

Chasan E (2013) CFO journal: new fraud crackdown looms-CFOs can’t afford complacency as SEC beefs up scrutiny of financial reporting. Wall St J (East Ed). ProQuest. Accessed 19 Dec 2014

Chen LH (2013) Income smoothing, information uncertainty, stock returns, and cost of equity. Rev Pac Basin Financ Mark Polic 16(3):1–34

Chu T, Haw IM, Lee BB, Wu W (2014) Cost of equity capital, control divergence, and institutions: the international evidence. Rev Quant Financ Acc 43:483–527

Dechow PM, Sloan RG, Sweeney AP (1996) Causes and consequences of earnings manipulation: an analysis of firms subject to enforcement actions by the SEC. Contemp Acc Res 13(1):1–36

Dechow PM, Ge W, Larson CR, Sloan RG (2011) Predicting material accounting misstatements. Contemp Acc Res 28(1):17–82

Dhaliwal D, Krull L, Li OZ (2007) Did the 2003 tax act reduce the cost of equity capital? J Acc Econ 43(1):121–150

Eaglesham E (2013) Accounting fraud targeted-with crisis-related enforcement ebbing, SEC is turning back to main street. Wall St J (East Ed). ProQuest. Accessed 19 Dec 2014

Easley D, O’Hara M (2004) Information and the cost of capital. J Financ 59(4):1553–1583

Easton PD, Monahan SJ (2005) An evaluation of accounting-based measures of expected returns. Acc Rev 80(2):501–538

Ehrhardt M (1994) The search for value: measuring the company’s cost of capital. Harvard Business School Press, Boston, MA

Feldmann DA, Read WJ, Abdolmohammadi MJ (2009) Financial restatements, audit fees, and the moderating effect of CFO turnover. Audit: J Pract Theory 28(1):205–223

Feroz EH, Park K, Pastena VS (1991) The financial and market effects of the SEC’s accounting and auditing enforcement releases. J Acc Res 29(3):107–142

Gebhardt WR, Lee CMC, Swaminathan B (2001) Toward an implied cost of capital. J Acc Res 39(1):135–176

Geiger M, Lennox C, North D (2008) The hiring of accounting and finance officers from audit firms: how did the market react? Rev Acc Stud 13(1):55–86

Gode DK, Mohanram P (2008) What effects the implied cost of equity capital? Working Paper, Stern School of Business

Gordon JR, Gordon MJ (1997) The finite horizon expected return model. Financ Anal J 53(3):52–61

Hail L, Leuz C (2006) International differences in the cost of equity capital: do legal institutions and securities regulation matter? J Acc Res 44(3):485–531

Hennes KM, Leone AJ, Miller BP (2008) The importance of distinguishing errors from irregularities in restatement research: the case of restatements and CEO/CFO turnover. Acc Rev 83(6):1487–1519

Hribar P, Jenkins NT (2004) The effect of accounting restatements on earnings revisions and the estimated cost of capital. Rev Acc Stud 9(2):337–356

Hume L (2006) SEC chairman: 2006 a ‘banner year’ for enforcement. Bond Buy 358(32501):4

IRS (2005) KPMG to pay $456 million for criminal violations. IR-2005-83

Karpoff JM, Lee DS, Martin GS (2008) The cost to firms of cooking the books. J Financ Quant Anal 43(3):581–611

Kasznik R (2004) Discussion of “the effect of accounting restatements on earnings revisions and the estimated cost of capital”. Rev Acc Stud 9(2–3):357

Kim J, Shi H, Zhou J (2014) International financial reporting standards, institutional infrastructures, and implied cost of equity capital around the world. Rev Quant Financ Acc 42:469–507

Kravet T, Shevlin T (2010) Accounting restatements and information risk. Rev Acc Stud 15(2):264–294

Leng F, Feroz EH, Cao Z, Davalos SV (2011) The long-term performance and failure risk of firms cited in the US SEC’s accounting and auditing enforcement releases. J Bus Financ Acc 38(7):813–841

Li S (2010) Does mandatory adoption of international financial reporting standards in the European Union reduce the cost of equity capital. Acc Rev 85(2):607–636

Murphy DL, Shrieves RE, Tibbs SL (2009) Understanding the penalties associated with corporate misconduct: an empirical examination of earnings and risk. J Financ Quant Anal 44(1):55–83

Nguyen D, Puri TN (2014) Information asymmetry and accounting restatement: NYSE-AMEX and NASDAQ evidence. Rev Acc Stud 43(2):211–244

Ogier T, Rugman J, Spicer L (2004) The real cost of capital. Pearson Education Limited, Edinburgh Gate

Ohlson JA (1995) Earnings, book values, and dividends in equity valuation. Contemp Acc Res 11(2):661–687

Ohlson J, Juettner-Nauroth B (2005) Expected EPS and EPS growth as determinants of value. Rev Acc Stud 10(2):349–365

Scannell K (2009) SEC plans fraud fight with teams of specialists. Wall St J (East Ed). ProQuest. Accessed 19 Dec 2014

Securities and Exchange Commission, Office of the Chief Accountant (2003) Application of the January 2003 rules on auditor independence: frequently asked questions

Securties and Exchange Commission (2008) Eighty-fourth annual report of the SEC

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nicholls, C. The impact of SEC investigations and accounting and auditing enforcement releases on firms’ cost of equity capital. Rev Quant Finan Acc 47, 57–82 (2016). https://doi.org/10.1007/s11156-014-0494-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-014-0494-9