Abstract

In this paper, we explore an alternative explanation of the exposure puzzle, the missing variable bias in previous studies. We propose to correct the bias with the quantile regression technique invented by Koenker and Bassett (Econometrica 46:33–51, 1978). Empirically, as soon as we take into account the missing variable bias as well as time variation in currency exposure, we find that 26 out of 30 or 87 % of the US industry portfolios exhibit significant currency exposure to the Major Currencies Index, and 23 out of 30 or 77 % show significant exposure to the Other Important Trading Partners Index. Our results have important theoretical and practical implications. In terms of theoretical significance, our results strengthen the findings in Francis et al. (J Financ Econ 90:169–196, 2008), and suggest that methodological weakness, not hedging, may explain the insignificance of currency risk in previous studies. In terms of practical significance, our results suggest a simple yet efficient approach for managers to estimate currency exposure of their firms.

Similar content being viewed by others

Notes

See Taylor and Taylor (2004) for a review.

Major currency index includes the Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden.

Countries whose currencies are included in the other important trading partners index are Mexico, China, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Thailand, Philippines, Indonesia, India, Israel, Saudi Arabia, Russia, Argentina, Venezuela, Chile and Colombia.

The data are available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/.

For service industries, we do not have relevant data from the US International Trade Commission to compute their trade balances.

We also experimented with the lag parameter set to 4, 8, 16 and the results are qualitatively similar.

They are Games (Recreation), Hshld (Consumer Goods), Clths (Apparel), Txtls (Textile), Autos (Automobiles and Trucks), Mines (Precious Metals, Non-Metallic, and Industrial Metal Mining), and Bus Eq (Business Equipment).

They are Smoke (Tobacco Products) and Steel (Steel Works Etc).

They are Food (Food Products), Games (Recreation), Hshld (Consumer Goods), Clths (Apparel), Txtls (Textile), EleEq (Electrical Equipment), Autos (Automobiles and Trucks), Mines (Precious Metals, Non-Metallic, and Industrial Metal Mining), and BusEq (Business Equipment).

They are Food (Food Products), Smoke (Tobacco Products), Chems (Chemicals), Steel (Steel Works Etc), FebPr (Fabricated Products and Machinery), EleEq (Electrical Equipment), Autos (Automobiles and Trucks), and Coal (Coal).

An alternative explanation for our findings is that quantile regression may capture the long-horizon exposure suggested by Chow et al. (1997), Bodnar and Wong (2003) and Bartram (2007). As Bartram (2007) point out: “Estimating exposures over longer horizons may be useful since it is possible that they can be estimated more accurately given the complexities of the factors determining exposure and the noise in high-frequency exchange rates relative to the persistence of movements with low frequency” (p. 987). If monthly exchange rate changes are noisy proxy for persistent exchange rate changes, additional instrument variables may be necessary to estimate persistent exchange rate movements (for instance, FHH use imports, exports, and the federal funds rate to forecast future exchange rate changes). As a result, the standard specification of Eqn. (1) may again suffer missing variable biases, since additional instrument variables that help predict persistent movements in exchange rates are not included. Consequently, quantile regression may help take into account the effects of missing variables and capture the long-horizon exposure.

Hedging costs should also be taken into account.

References

Adler M, Dumas B (1983) International portfolio choice and corporate finance: a synthesis. J Financ 38:925–984

Adler M, Dumas B (1984) Exposure to currency risk: definition and measurement. Financ Manage 13:41–50

Aggarwal R, Harper JT (2010) Foreign exchange exposure of “domestic” corporations. J Int Money Financ 29:1619–1636

Allayannis G ((1997)) The time-variation of the exchange rate exposure An industry analysis, working paper. University of Virginia, Charlottesville

Bartov E, Bodnar GM (1994) Firm valuation, earnings expectations, and the exchange rate exposure effect. J Financ 44:1755–1785

Bartram SM (2004) Linear and nonlinear foreign exchange rate exposures of German nonfinancial corporations. J Int Money Financ 23:673–699

Bartram SM (2007) Corporate cash flow and stock price exposures to foreign exchange rate risk. J Corp Financ 13:981–994

Bartram SM (2008) What lies beneath: foreign exchange rate exposure, hedging and cash flows. J Bank Financ 32:1508–1521

Bartram SM, Bodnar GM ((2005)) The foreign exchange exposure puzzle, working paper. John Hopkins University and Lancaster University, Lancaster

Bartram SM, Brown GW, Minton B (2010) Resolving the exposure puzzle: the many facets of exchange rate exposure. J Financ Econ 95:148–173

Bodnar GM, Bartram SM (2007) The exchange rate exposure puzzle. Manage Financ 33:642–666

Bodnar GM, Wong MHF (2003) Estimating exchange rate exposures: issues in model structure. Financ Manage 32:35–67

Cade BS, Noon BR (2003) A gentle introduction to quantile regression for ecologists. Front Ecol Environ 1:412–420

Chen NF, Roll R, Ross S (1986) Economic forces and the stock market. J Bus 59:383–403

Cheung CS, Kwan CCY, Lee J (1995) The pricing of exchange rate risk and stock market segmentation: the Canadian case. Rev Quant Financ Acc 5:393–402

Chiao C, Hung K (2000) Exchange-rate exposure of Taiwanese exporting firms. Rev Pac Basin Finan Mark Pol 3:201–233

Chow EH, Lee WY, Solt ME (1997) The exchange-rate risk exposure of asset returns. J Bus 70:105–123

Du D, Hu O (2012a) Exchange rate risk in the US stock market. J Int Financ Mark Inst Money 22:137–150

Du D, Hu O (2012b) Foreign exchange volatility and stock returns. J Int Financ Mark Inst Money 22:1202–1216

Elyasiani E, Mansur I (2005) The association between market and exchange rate risks and accounting variables: a garch model of the Japanese banking institutions. Rev Quant Financ Account 25:183–206

Fama EF, MacBeth JD (1973) Risk, return and equilibrium: empirical tests. J Polit Econ 81:607–636

Ferson WE, Harvey CR (1993) The risk and predictability of international equity returns. Rev Financ Stud 6:527–566

Francis B, Hasan I, Hunter D (2008) Can hedging tell the full story? Reconciling differences in U.S. aggregate- and industry-level exchange rate risk premium. J Financ Econ 90:169–196

Jorion P (1990) The exchange-rate exposure of U.S. multinationals. J Bus 63:331–345

Khoo A (1994) Estimation of foreign exchange rate exposure: an application to mining companies in Australia. J Int Money Financ 13:342–363

Koenker R (2005) Quantile regression. Cambridge University Press, Cambridge

Koenker R (2012) Quantreg: quantile Regression. R package version 4.81. http://CRAN.R-project.org/package=quantreg

Koenker R, Bassett G (1978) Quantile regression. Econometrica 46:33–51

Koenker R, Hallock K (2001) Quantile regression: an introduction. J Econ Perspect 15:143–156

Koenker R, Ng P (2003) SparseM: a sparse matrix package for R. J Stat Softw 8

Koenker R, Ng P (2005) Frisch-Newton algorithm for sparse quantile regression. Acta Math Appl Sin Engl Ser 21:225–236

Nucci F, Pozzolo AF (2010) The exchange rate, employment and hours: what firm-level data say. J Int Econ 82:112–123

Patro DK, Wald JK, Wu Y (2002) Explaining exchange rate risk in world stock markets: a panel approach. J Bank Financ 26:1951–1972

Portnoy S, Koenker R (1997) The Gaussian hare and the Laplacian tortoise: computability of squared-error vs. absolute-error estimators, with discussion. Stat Sci 12:279–300

Rachev ST, Mitnik S (2000) Stable paretian models in finance. Wiley, London

Rachev ST, Menn C, Fabozzi FJ (2005) Fat-tailed and skewed asset return distributions: implications, for risk management, portfolio selection and option pricing. Wiley, London

Taylor AM, Taylor MP (2004) The purchasing power parity debate. J Econ Perspect 18:135–158

R Core Team (2012) R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. http://www.R-project.org/

Wei LT, Starks KD (2005) Foreign exchange exposure and short-term cash flow sensitivity, working paper. University of Texas, Austin

Yu K, Lu Z, Stander J (2003) Quantile regression: applications and current research area. J Roy Stat Soc D-Sta 52:331–350

Acknowledgments

The authors thank the editor Cheng-Few Lee and two anonymous referees for their valuable and insightful comments and Ken Lorek for his editorial help. The responsibility of any remaining errors is ours.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The quantile regression coefficients can pick up the effects of missing variables. To illustrate the idea, consider a simple case in which only leverage affects currency exposure and takes value of one when leverage is high and zero otherwise. Then we can express the true model in Eq. (2) as.

When leverage is high, the conditional mean of r it on FX t given a specific value of M in Eq. (6b) will be higher or lower than the conditional mean of r it on FX t in Eq. (6a) when leverage is low depending on the signs of FX and β i,leverage. When the least-squares regression is applied to the misspecified model in Eq. (1), however, the regression attempts to estimate the conditional mean of the misspecified model, which will obviously yield biased estimate for either of the two true conditional mean relationships depicted in either Eqs. (6a) or Eq. (6b). However, if Eq. (1) is estimated with the quantile regression instead, the effects of leverage will be captured by the quantile regression coefficients \( \beta_{i,FX}^{\tau } \) near the tails.

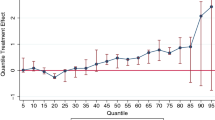

Figure 1 is a simple simulation of a scenario depicted above where M t in the true model specified by Eqs. (6a) and (6b) is generated as a normal random variable with a mean of 0 and a standard deviation of 5, FX t is a uniform random variable between 0 and 5, u it is a standardized normal, the leverage dummy variable is generated as a binomial random variable with a 0.5 probability of being in either state, α = β i,FX = 1, β i,M = 0, β i,leverage = 3 and the sample size is 1,000. In the figure, the solid dark line is the conditional mean of r it on FX t when the leverage is low, while the dash-dot dark line depicts the conditional mean of r it on FX t when the leverage is high. The dark dotted line is the least-squares regression applied to the misspecified model in Eq. (1). It is obvious in the figure that the least-squares regression line results in a biased estimate of both conditional mean relationships. The grey solid lines are the quantile regressions for the misspecified model in Eq. (1) for τ ∈ [0.1, 0.9] in increments of 0.1. The nine quantile regression lines manage to capture the heteroskedastic effect caused by the missing interaction effect between the leverage dummy and FX t when the misspecified model in Eq. (1) is used. The different slopes, \( \beta_{i,FX}^{\tau } \), of the quantile regression lines also reveal the effect of the omitted variable.

A Simulation of the least-squares regression bias caused by missing variables The two conditional means of the true model specified in Eqs. (6a) and (6b) are represented by the solid dark line for low leverage and the dash-dot dark line for high leverage. The dark dotted line is the least-squares regression based on the misspecified model in Eq. (1). The least-squares regression applied to the model with missing variable yields a biased estimate of both conditional mean relationships. The grey solid lines are the quantile regressions for the misspecified model in Eq. (1) for τ ∈ [0.1, 0.9] in increments of 0.1. The nine quantile regression lines for the misspecified model in Eq. (1) capture the heteroskedastic effect caused by the omitted interaction effect between the leverage dummy and FX t . The different slopes, \( \beta_{i,FX}^{\tau } \), of the quantile regression lines also reveal the effect of the omitted variable

Rights and permissions

About this article

Cite this article

Du, D., Ng, P. & Zhao, X. Measuring currency exposure with quantile regression. Rev Quant Finan Acc 41, 549–566 (2013). https://doi.org/10.1007/s11156-012-0322-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-012-0322-z