Abstract

We consider competing mobile marketers that complement geo-targeting with behavior-based pricing and send personalized offers to customers. Firms observe consumers’ locations and can infer their (heterogeneous) responsiveness to discounts from purchase histories. The overall profit effect of behavioral targeting is driven by firms’ discount factor and consumers’ transport cost and can be neutral, positive, or negative. We are the first to show that the profitability of behavioral data may depend on firms’ time preferences. We derive conditions for when firms prefer more rather than less behavioral targeting.

Similar content being viewed by others

1 Introduction

The widespread use of smartphones revolutionized marketing by providing an advertising means that allows delivering personalized commercial messages depending on a wide range of customer characteristics. One of the most profitable and novel marketing opportunities opened up by mobile devices is geo-targeting. Apps that are installed on a device read users’ GPS signals and share these with affiliated advertisers and retailers who can in turn send messages with commercial offers to the users.Footnote 1 Mobile app developers have easy access to smartphone users’ locations by the appropriate commands in the device’s operating system.Footnote 2

Clearly, mobile phone users differ also in characteristics other than location. Age, demographics, income, profession, and many other factors influence how users respond to commercial offers and discounts. Mobile marketers routinely complement geo-location data with behavioral information on customers that can signal their responsiveness to discounts (Thumbvista, 2015).

An example that uses geo-location and behavioral data is the mobile marketing campaign of Dunkin’ Donuts. In 2014 the firm rolled out discounts that were sent to phone users around competitors’ locations coupled with behavioral targeting to deliver coupons on mobile devices (Tode, 2014).Footnote 3 Similarly, ride-hailing services Uber and Lyft are widely rumored to engage in personalized pricing based on the user’s physical location as well as her earlier behavior (Mahdawi, 2018).Footnote 4 These are precisely the main building blocks of our model. While marketing agencies often celebrate data-driven campaigns, a profitability assessment must take into account rivals’ reactions.

We focus on four important features of mobile targeting: First, consumers’ real-time locations are known to sellers. Second, beyond location, other factors such as age, income, and occupation affect how responsive consumers are to discounts. Third, sellers infer with a certain degree of precision consumers’ responsiveness to discounts from previous purchase behavior.Footnote 5 Finally, firms deliver personalized offers through mobile devices to consumers.

We investigate how adding behavioral targeting to location-based marketing affects profits and welfare in a setup that matches today’s mobile marketing landscape. We are the first to show how the profitability and precision of data depend on the discount factor.

Contrary to conventional wisdom, behavioral data collection does not always benefit firms. However, under certain conditions, which we derive, adding behavioral data to geo-information is profitable. When consumers are very similar in transport cost, it is costly to generate informative data on past purchases, which requires giving up market share. There is also little to be gained from targeted discounts when consumers are too similar. However, if some consumers have very low transport cost, firms will compete fiercely for those consumers—even at locations that are close to the rival. Such business-stealing reduces profit compared to a situation without behavioral data.

The paper is organized as follows: The related literature and our contribution are summarized in Sect. 2. Section 3 contains an illustrative example that provides intuition for our main results. We introduce the full model in Sect. 4. In Sect. 5, we provide the full equilibrium analysis. Section 6 concludes.

2 Related Literature

Our paper contributes to the strand of literature on behavior-based price discrimination.Footnote 6 Corts (1998) proposes a unifying approach to predict the price and profit effects of firms’ ability to discriminate among two consumer groups. He shows that with best-response asymmetry the targeted prices to both consumer groups change in the same direction relative to the uniform price.Footnote 7 This change may be either positive or negative, which leads respectively to higher or lower discrimination profits.Footnote 8

Most articles on behavior-based price discrimination consider markets that are characterized by best-response asymmetry and—in line with the predictions of Corts (1998)—attribute unambiguous profit effects of behavioral data. This effect is negative in Fudenberg and Tirole (2000) and Esteves (2010), whereas it is positive in Chen and Zhang (2009).Footnote 9 In our model all of these scenarios are possible. Which effect eventually emerges depends on the distribution of “transport cost”—how strongly consumers differ in their responsiveness to discounts—and in some cases additionally on the discount factor when profits rise or fall with behavioral targeting.

We contribute to the literature by demonstrating that the distribution of transport cost can serve as a reliable tool for predicting the effect of behavioral pricing on profit: The effect is more likely to be negative when transport cost is more heterogeneous.Footnote 10

Closely related to our paper is Colombo (2018), who also investigates how the profit effects of behavioral targeting depend on consumer heterogeneity. He shows that behavioral targeting is more likely to boost profits when consumers are more heterogeneous and firms obtain (specific) asymmetric customer data. In our model, where firms are symmetric in their access to customer data, profits are more likely to increase with behavioral targeting when consumers are less differentiated.

We also contribute to the rapidly growing literature on oligopolistic mobile geo-targeting. Chen et al. (2017) show that mobile targeting can increase profits compared to uniform pricing, even in the case where traditional targeting—where consumers do not seek the best mobile offer—does not. Dubé et al. (2017) show in a field experiment that firms choose to discriminate based only on consumer behavior, in which case profits increase above the level with uniform prices. However, profits would be even higher if firms also used location data. In contrast to Dubé et al. (2017) and Chen et al. (2017) we show that the distribution of transport cost is crucial for predicting the profit and welfare effects of combining behavior-based pricing with mobile geo-targeting.Footnote 11 Compared to using only location data, using also behavioral data for targeted prices does not necessarily increase profits and can harm firms if the difference between the highest and lowest value of transport cost is sufficiently high.

To our knowledge our paper is the first to show that the profit effect of behavioral targeting may depend on the time preferences of the firms. Intuitively, the more weight that firms put on later periods when the data are actually used to discriminate among customers, the more likely it is that behavior-based price discrimination is profitable. Surprisingly, related models so far found without exemption that the discount factor plays no role. Our modeling setup is tractable but just rich enough to accommodate the intuition that the discount factor matters for firms’ incentives to engage in behavior-based price discrimination.

A further contribution relates to the analysis of the precision of targeted prices that behavioral data allow. We argue that whether firms strategically enhance or obfuscate the behavioral information depends on the distribution of transport cost. Related articles found that firms either distort data quality downwards (Esteves, 2010) or no additional data are gained in equilibrium (Chen & Zhang, 2009). We are (to our knowledge) the first to argue that firms may choose first-period prices so as to obtain more precise information. This is the case when the ratio of the highest to the lowest transport cost is moderate.

3 An illustrative example

We introduce the main ideas in a simple way: Consider the following stylized version of the model: There are two competing coffee shops—Ace Donuts (A) and BuckStar (B)—that are located one block away from each other. Each coffee shop has customers who live closer to one of the shops than the other. There are two types of customers: students, and managers. Managers find it relatively inconvenient to walk to the coffee shop further away, while students care much less about the walk.

There are an equal number of managers and students who live close to each of the coffee shops. All customers have mobile phones that broadcast their GPS locations, which both coffee shops observe. However, the firms do not observe which customers are students and managers. The two firms launch mobile marketing campaigns: The firms target discount coupons for the same breakfast menu to the client base of the rival. Initially, firms have no way of distinguishing between customers except for their location, so they send the same targeted discount to every consumer at a given location, regardless of whether that consumer is a manager or student.

Subsequently, the shops learn whether a specific consumer previously bought from them—but they still do not directly observe consumers’ types.Footnote 12 Given that managers have higher transport costs than do students and that companies can reveal some information about customers through their purchasing behavior,Footnote 13 what offers will the firms send in this campaign?

We focus on the consumers who are located near Ace Donut (A). BuckStar (B) is a fierce competitor: It sends to all of these customers a mobile coupon for a cheap breakfast at marginal cost.Footnote 14 If a manager who is close to Ace Donut redeems this coupon at BuckStar, she realizes a low surplus at B due to her high transport cost. A student in turn has lower transport costs, so her surplus at BuckStar from redeeming the same offer is higher.

Ace Donut knows which clients are located close by, but it cannot tell managers and students apart. It can send a mobile coupon with an offer for the breakfast menu to the clients—students and managers alike—that are located close by, which only managers would accept while students would choose the rival.Footnote 15 Ace Donut can, at least sometimes, do better by offering the breakfast menu at a price that both managers and students would accept.Footnote 16

It would be valuable for Ace Donut to identify managers and students, because then it could charge managers and students tailor-made prices that leave them indifferent between choosing its own offer or that of BuckStar; Ace would extract the whole surplus and would gain greater profits than in the absence of identifying the groups.

Assume that Ace Donut runs the marketing campaign in two waves, and that it can identify returning customers in the second wave, which means that Ace is taking advantage of behavioral data. In that case, it may be optimal for the firm to make a first-period offer such that it separates managers and students, and allows the students (who have low transport costs) to purchase from the rival. Doing so generates data about the customers’ transport cost: Ace Donut would know in the second period that all previous (returning) customers must be managers, while first-time customers are students.

The firm could achieve this by setting a price in the first period that leaves managers indifferent. As explained above, managers would buy from Ace Donut at this price, but students would choose BuckStar: At the latter they are better off even after the inconvenient walk around the block. In the first period, Ace Donut’s profit would amount to the revenues from managers. But since in period 2 the firm would know that all returning customers are managers and that unknown customers are students, it could make offers—e.g., a special discount for first-time buyers—that leave both types of consumers indifferent, and could thereby extract all surplus.

Ace Donuts could separate managers and students with high prices in the first period; it would thereby attract only one type of customer: managers. This strategy generates behavioral data and information on customer transport cost, even if that involves losing market share. If instead the firm applied a uniform pricing strategy in both periods—pooling managers and students—it might make less profit. The first strategy is more profitable in the example of footnote 16, but that may change if the firm applied a discount factor to its second-period profits. If the second period had a weight of \(\delta \in [0,1]\) in the profit calculation, the separating strategy would be more profitable than the pooling strategy only if the firm is patient enough.

The example may yield different results if the transport cost of the students was just below that of managers.Footnote 17 Being able to recognize returning customers in the second period and therefore separating managers and students would allow the firm to extract only a small amount of additional profit. The additional profit is the (discounted) difference in transport cost. Generating the necessary behavioral data requires the firm to forgo profit from interacting with the students in period 1, which would be almost half the potential revenue in that period.

Generating behavioral data by a separating strategy is never profitable when transport costs are too similar among customers. So, an important intuition from this simple example is also that the market allocation that gives firms maximum information about consumers is not necessarily the one that maximizes profit. That’s because the costs and benefits of information collection are highly dependent on consumer characteristics.

In the full model with a continuum of locations and types, the rival firm adopts a more nuanced strategy compared to this example. In particular, the rival strategically generates behavioral data.Footnote 18 All of the results flow from the parameters that govern transport cost and the discount factor. Tables 2 and 3 in the Online AppendixFootnote 19 lay out the consequences of the various parameter values for the behavior in the first period—especially the pricing decision and market shares in the first period—and the behavior and outcomes in the second period.

To arrive at these results, after laying out the model in Sect. 4, we first analyze the second period in Lemma 1 and Proposition 1, before defining the subgame-perfect Nash equilibria (over both periods) in Proposition 2. Corollary 1 covers the precision of behavioral targeting. In Propositions 3 and 4 we analyze profits and consumer and social welfare of geo-targeting with and without behavioral data.

4 The Model

There are two firms—A and B—that produce two brands of the same product at zero marginal costs and compete in prices. They are situated at the ends of a unit Hotelling line: Firm A is located at \(x_{A}=0\) and Firm B at \(x_{B}=1\). There is a unit mass of consumers each with an address \(x\in \left[ 0,1\right] \) on the line; the address describes her real physical location, as transmitted by GPS signals to app developers (retailers) in mobile marketing. If a consumer does not buy at her location, she incurs linear transport cost that is proportional to the distance to the firm.

We assume that consumers differ not only in their locations, but also in transport cost per unit distance: \(t\in \left[ \underline{t},\overline{t}\right] \), where \(\overline{t}>\underline{t}>0\).Footnote 20 Transport costs are higher if t is larger. The consumer with the lowest transport cost at each location x therefore has \(t=\underline{t}\), and the one with the highest transport cost has \(t=\overline{t}\). Each consumer is uniquely characterized by a pair of location-transport cost (x, t). We assume that t is uniformly and independently distributed (\(t\sim U[\underline{t},\overline{t}]\)) and that consumers are equally distributed along the line. This yields the following density functions: \(f_{t} =1/(\overline{t}-\underline{t})\); \(f_{x}=1\); and \(f_{t,x}=1/(\overline{t}-\underline{t})\).

Firms know that there are several consumers at each location x: for example, workers in an office building who are waiting for an Uber ride or a lunch delivery. They also know that consumers’ transport costs are distributed at each location uniformly between \(\underline{t}\) and \(\overline{t}\), with the endpoints known and being the same at each location.Footnote 21 Firms, however, do not observe an individual consumer’s transport cost (t). With regard to the rival firm’s behavior, firms assume that the rival will apply Bertrand pricing in period 1, which is symmetric to their own. Both firms’ ability to engage in targeted discounts is common knowledge. We will focus in our analysis on symmetric equilibria.

The utility of a consumer \(\left( x,t\right) \) from buying at Firm \(i=\left\{ A,B\right\} \) is

In Eq. (1), \(\upsilon >0\) denotes the basic utility, which is assumed high enough such that the market is always covered in equilibrium. Consumers buy from the firm whose product yields higher utility.Footnote 22 Without loss of generality, we normalize \(\overline{t}=1\) and measure the ratio of transport cost by dividing the upper by the lower end of the range of the transport cost parameter: \(l:=\overline{t}/\underline{t}=1/\underline{t}\), with \(l\in \left( 1,\infty \right) \).Footnote 23 As we show below, the parameter l (a measure of the range of transport cost) plays a crucial role in our analysis. We refer to locations \(x<1/2\) (\(x>1/2\)) along with the associated consumers who are thereby located closer to Firm A (B) as the turf of Firm A (B).

There are two periods in the game: In the first period, location (x) is the only dimension by which firms can distinguish consumers. Firms issue targeted offers at the same time to all consumers depending on their location. All consumers at the same location—for example in the same apartment block or office building—will receive the same targeted offer, which is independent of their transport cost (t).Footnote 24

In the second period firms again send simultaneously targeted offers to consumers. However, this time they are able to distinguish consumers that visited them in the first period from those that did not.Footnote 25 As a result, in the second period firms can charge (up to) two different prices at each location: one price to their own past customers, and a different price to those who bought from the rival in the first period.

Table 1 summarizes the three types of information that firms can obtain in our model. We analyze how this information translates into pricing decisions in a dynamic competitive environment.

To sum up the information that is available to firms: We assume that they observe with perfect precision the physical locations (x) of all consumers in the market.Footnote 26 They also know \(\underline{t}\), \(\overline{t}\), and the fact that users are uniformly distributed between these endpoints with respect to their transport cost (t). Firms however do not directly observe the transport cost (t) of individual consumers, but infer a range from customers’ first-period purchases. Firms observe the prices of the rival and formulate correct best responses.Footnote 27 In the second period they know customers’ period-1 choice and realize that at any given location (x) the consumers who bought from the farther-away firm have lower transport cost.

We assume that firms are forward-looking while consumers are myopic, which allows us to concentrate on the strategic effects of customer data.Footnote 28 It seems realistic that consumer foresight is limited. A fully rational consumer would need to: (1) realize that firms systematically collect their behavioral data AND (2) foresee that firms use these data in pricing AND (3) anticipate that she may get a better deal in the future by changing her current purchasing behavior AND (4) act upon this knowledge. Our results would not change so long as consumers are not extremely sophisticated: It is sufficient that they violate at least one of these conditions.Footnote 29

We want to clarify the scenarios that we compare to evaluate the effects of behavioral data. Our benchmark scenario is one with location-based targeting only, without added behavioral data. We compare profits, consumer and social welfare to the scenario with behavioral data (from identifying returning and new customers) in addition to location data.Footnote 30 Theoretical research on geo-targeting has been argued typically to foster competition (e.g., Thisse and Vives, 1988). We take geo-targeting as a starting point and show that combining geo-data with behavioral price discrimination can make firms better off. We solve for a subgame-perfect Nash equilibrium and concentrate on equilibria in pure strategies.

5 Equilibrium Analysis

We start from the second period, where firms can discriminate based on both consumer locations and past behavior. At this stage, firms recognize their own returning customers from the first period, and are also able to identify new customers: those who purchased from the rival in the first period.

Equilibrium analysis of the second period As firms are symmetric, it is sufficient to analyze a single location: for instance, on Firm A’s turf.

Consider an arbitrary \(x<1/2\) on Firm A’s turf. Here too, as at all locations, consumers are uniformly distributed with respect to their transport cost: \(t\in [\underline{t},\overline{t}]\). There is a critical transport cost parameter \(t_{\alpha }\) such that consumers with \(t\ge t_{\alpha }\) visited Firm A in the previous period, while consumers with \(t<t_{\alpha }\) purchased from Firm B (which is located farther away).

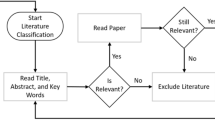

Figure 1 depicts consumers according to their first-period purchase decisions at location x. If the share of consumers at location x who bought from Firm B in the first period is \(\alpha \in \left[ 0,1\right] \), then \(t_{\alpha }:=\alpha +\underline{t}\left( 1-\alpha \right) \), as is shown in Fig. 1. For clarity, we will refer to \(\alpha \) and \(1-\alpha \) as market shares but remind the reader that within these shares, consumers have different transport costs.

The market share \(\alpha \) thus includes consumers with low transport cost who purchased in the first period from the firm that is located farther away. The complement market share \(1-\alpha \) covers consumers who bought from the firm located close by. We denote the second period prices of Firm \(i\in \{A,B\}\) to consumers on \(\alpha \) and \(1-\alpha \) respectively as \(p_{i, \alpha }\left( x\right) \) and \(p_{i, 1-\alpha }\left( x\right) \). Firms choose prices so as to maximize their profits within each group of consumers separately.

Consider market share \(\alpha \), and denote \(t_{c, \alpha }\) as the difference between the prices of Firms A and B (normalized for location by dividing by \(1-2x\)). On its own turf Firm A has a pricing advantage compared to the rival and can therefore attract even consumers with higher transport cost parameters, such that:

Firms choose prices \(p_{A, \alpha }(x)\) and \(p_{B, \alpha }(x)\) to maximize their expected profits:

The mechanism is analogous on \(1-\alpha \).

The following lemma characterizes the equilibria at any location \(x<1/2\) depending on the ratio of transport cost, \(l=1/\underline{t}\), and Firm B’s first-period market share, \(\alpha \).

Lemma 1

(Equilibrium in the second period). Consider an arbitrary x on the turf of Firm A. The equilibrium at this location in the second period depends on first-period market shares \(\alpha \) and \(1-\alpha \) and the ratio of transport cost l.

Proof

The proof is in the Appendix, and numerical threshold values are in the Online Appendix.

Recall that in the second period every firm sets two prices at any location: one price for each of the two consumer groups: its own customers of the first period, and the first-period customers of the rival. A firm can either charge a higher price and allow the rival to attract customers with the lowest transport cost, or charge a lower price and gain more (possibly all) consumers at that location. Thereby for each consumer group a firm solves a trade-off between a higher price or a larger market share.

Firm A’s pricing strategy depends on how different consumers are. This in turn is determined by the ratio of transport cost (l) and the split of market shares (\(\alpha \) and \(1-\alpha \)) from the first period. Market shares matter because Firm A approximates consumers’ true transport cost (t) by an average value that is within its and its rival’s market share at each location. That average transport cost fits consumers better if a market share is small. The cumulative squared distance between true transport cost and inferred average transport cost across all customers is minimized when market shares are \(\alpha = 1-\alpha = 1/2\) (the intuition for this follows from Fudenberg and Tirole (2000) and Fudenberg and Villas-Boas (2006)).

If the ratio of transport cost is sufficiently low, then all consumers are relatively similar in transport cost.Footnote 31 In equilibrium Firm A then serves all consumers at location x for any inherited market shares \(\alpha \) and \(1-\alpha \). The reason is that the potential gain from higher prices to customers of each group (\(\alpha \) and \(1-\alpha \)) is more than offset by losses in market shares (see the example in Sect. 3, where profits are higher when both managers and students are served).

When the ratio of transport cost increases, the optimal strategy of Firm A depends on the first-period market shares \(\alpha \) and \(1-\alpha \). Note that capturing all consumers of a group (\(\alpha \) or \(1-\alpha \)) requires a relatively low price. This is profitable only if the respective market share (\(\alpha \) or \(1-\alpha \)) is relatively small such that consumers are similar in transport cost. Otherwise, some consumers buy at the rival, and the equilibrium market share is a function of \(\alpha \). The equilibrium prices are stated in the proof of Lemma 1 in the Appendix.

We next turn to the question of how profits in the second period change when firms combine behavioral and geo-targeting compared to the case with only geo-targeting. We do this by assuming that each firm served the same share \(\alpha \) of customers at any location on the rival’s turf in the first period. We then demonstrate that in equilibrium indeed the first-period market share of each firm is the same at any location on the rival’s turf.Footnote 32

The following proposition summarizes our resultsFootnote 33:

Proposition 1

(Second-period profits: geo- and behavioral data vs. geo-data only). Assume that in the first period each firm served the share \(\alpha \) of consumers at any location on the rival’s turf. The profit effect of behavioral data is weakly positive (negative) below (above) a threshold value of l and depends on \(\alpha \) for intermediate values of l.

Proof

The proof is in the Appendix and numerical threshold values are in the Online Appendix.

The impact of combining location and behavioral data on second-period profits is driven by two effects: rent-extraction, and competition. Behavioral data allows each firm to recognize its past (first-period) customers among all of the consumers who are located close-by and to distinguish these past customers from the consumers with low transport cost who visited the rival.

A firm would like to charge a higher price to its customers with high transport cost parameters. This is the rent-extraction effect of behavioral data. However, the rival prefers to target exactly these consumers more aggressively, which gives rise to the competition effect.

How accurately firms can target individual users’ transport cost in their prices also depends on the share of consumers that they could attract at each location in the first period (\(\alpha \) and \(1-\alpha \)).

The overall effect of additional data on profits depends on the interplay between these two opposing effects and is driven by the ratio of transport cost (\(l=1/\underline{t}\)) together with first-period market shares (\(\alpha \) and \(1-\alpha \)). In the extreme cases of \(\alpha =0\) or \(\alpha =1\), behavioral data does not provide any additional information on customer preferences, because all consumers at a given location bought from the same firm in the first period.

In contrast, firms can target individual consumers based on their transport cost most precisely when the market shares are equal for both firms: for \(\alpha =1/2\). Figure 2a and b depict firm profits in the second period as a function of the rival’s first-period market share (\(\alpha \)) for all of the three cases that are described in Proposition 1 with \(l=2\), \(l=3\) and \(l=10\), respectively.

We emphasize the point that the most precise behavioral information does not necessarily imply highest profits in the second period. While the rent-extraction effect is maximized, intense competition can be detrimental. Figure 2a and b illustrate this statement: Of the three cases, only for \(l=2\) is profit maximized at \(\alpha =1/2\).

When the ratio of transport cost is low, then in the second period both firms serve all consumers on their own turf independently of first-period market shares.Footnote 34 The rival cannot do better than pricing at marginal cost (zero in our case) both for consumers who did and who did not buy from them in period 1, such that the competition effect of behavioral data is absent.Footnote 35 The remaining rent-extraction effect in the second period is strongest when equal first-period market shares allow the greatest pricing precision: for \(\alpha =1/2 \). That’s because in this case, the average consumer’s distance to the midpoint of transport cost is minimized.

Pricing incentives are different when the ratio of transport cost lies in the intermediate range. In this case, unlike with a low ratio of transport cost l, changes in profits depend on first-period market shares (\(\alpha \) and \(1-\alpha \)) and are also driven by the competition effect: Market shares among returning customers are sensitive at the margin to firms’ pricing. It is the interplay of tougher competition and finer rent-extraction that determines how profits turn out with the use of behavioral data.

As the first-period share of a rival on a firm’s turf (\(\alpha \)) increases above zero, behavioral data with consumers’ purchase histories allow price differentiation based on transport cost. Recall that there is no behavioral data generated for consumers at location x when they all purchase from the same firm. Higher precision data boosts competition: The rival reduces its prices both for consumers who did and who did not buy from the rival in period 1, which erodes profits. When more equal first-period market shares allow finer targeting based on transport cost the rent-extraction effect starts to dominate, and profits increase.

For example, for a high ratio of transport cost irrespective of \(\alpha \), Firm A faces very heterogeneous consumers and has to give up some to the rival in equilibrium. Figure 3 provides two examples of the second-period equilibrium at an arbitrary location \(x<1/2\) depending on the ratio of transport cost (l) and the rival’s first-period market share (\(\alpha \)) at this location and shows each firm’s demand regions on \(\alpha \) and \(1-\alpha \).

The balance of market shares implies more precise information in the panel on the right than on the left. With relatively similar transport cost (left), capturing all of its previous consumers is not too costly. When transport cost are less similar (right), capturing all consumers that previously bought from A requires a comparatively lower price. In the left panel, A wins all returning customers at x plus some of the customers that previously bought from B. The exact numeric values follow from the value of l and the precision of information that is implied by \(\alpha \).

Demand regions at some \(x<1/2\) in the second period for \(l=3\), \(\underline{t}=0.33\) and \(\alpha =0.2\) (left) and \(l=10\), \(\underline{t}=0.1\) and \(\alpha =0.4\) (right). “A” and “B” indicate the ranges (over t) of customers at x who are attracted to Firms A and B, respectively, in the second period

In the intermediate case (\(l=3\) in Fig. 2b), profits are the highest when equal first-period market shares allow the highest pricing precision with \(\alpha \) close to 1/2. With a further increase in \(\alpha \), data about the consumers who bought from the rival in the initial period allow progressively less precise targeting, which thus weakens the rent-extraction effect and reduces profits. However, even then profits always remain above the level without transport cost data (at \(\alpha =1\) or \(\alpha =0\)).

When the ratio of transport cost is high (\(l=10\) in Fig. 2a), profits drop rapidly as we move away from a monopoly in the first period (as \(\alpha \) becomes strictly positive). As a result, although profits slowly recover when \(\alpha \) increases above a certain threshold, they never exceed the level without information on transport cost (at \(\alpha =1\) or \(\alpha =0\)). Interestingly, in this case profits are the lowest when first-period market shares allow high-precision targeting (\(\alpha \) takes intermediate values), because that is when competition is most intense.

We now turn to the analysis of the first period.

Equilibrium analysis of the first period In this subsection we analyze competition in the first period where firms can discriminate based only on consumer locations and charge prices to maximize their discounted profits over both periods. Similar to (2006, Fudenberg and Villas-Boas (2006)), we concentrate on equilibria in pure strategies.Footnote 36 The proposition below summarizes our results.Footnote 37

Proposition 2

(Subgame-perfect Nash equilibria) Consider an arbitrary location x on the turf of Firm \(i=A,\) B. In the subgame-perfect Nash equilibrium in pure strategies:

-

(i)

First period. If l is sufficiently low or if l is intermediate but \(\delta \) is below a certain threshold, Firm i serves all consumers at location x. Otherwise, consumers with low transport cost buy at the distant firm.

-

(ii)

Second period. Depending on l and \(\delta \), one of three cases arises: A firm serves either all consumers at location x, it serves all consumers that purchased from it in period 1 and some that purchased from its rival in period 1, or it serves only some of the consumers from either group.

Proof

The proof is in the Appendix and detailed derivations and exact numerical thresholds are in the Online Appendix. In the first period firms set a single price at each location. The main trade-off is between first- and second-period profits, which involves balancing the market shares (\(\alpha \), \(1-\alpha \)) that eventually determine how precise the targeted prices in the second period will be.

Demand in equilibrium is driven by both the ratio of transport cost and firms’ discount factor. Although the relationship is intertwined and also the thresholds for the ratio of transport cost depend on the discount factor, there are parameter ranges that allow unambiguous insightsFootnote 38: When the ratio of transport cost \(l=1/\underline{t}\) is small, then in equilibrium each firm serves all customers at any location on its turf in both periods. In these cases, it is not very costly for a firm to capture the whole nearby demand by setting a price at which all customers prefer the closer firm.

As the ratio of transport cost l increases, both the opportunity cost of serving all customers increases as it now involves setting a lower price to capture all consumers with low transport cost, and the behavioral data in period 2 becomes more valuable because there is more surplus to be extracted from price discrimination when consumers are less similar. As the latter effect involves a trade-off between period-1 and period-2 profits, the discount factor also determines the equilibrium market shares for a sufficiently high ratio of transport cost l.

A contribution of the model lies in describing why behavioral data can be worthless. This is the case when these data are: too costly to acquire either in terms of forgone profit during the learning stage; too costly in terms of the intertemporal trade-off; or of too little value due to limited scope for price discrimination after learning. While these issues are related, and firms will take into account all three effects, any one effect may dominate on its own: E.g., for very low ratios of transport cost \(l=1/\underline{t}\), there is no discount factor \(\delta \) for which firms collect behavioral data.

For sufficiently high values of the ratio of transport cost l, the equilibrium also depends on how strongly firms value future profits. In this case a sufficiently high discount factor leads to the monopoly outcome in the second period for some or all consumers.

There are two reasons for the firm’s capturing all nearby customers when the ratio of transport cost l is low. First, with relatively homogeneous transport cost, forgoing even those customers with the lowest transport cost is relatively costly as the forgone profit on these customers is high—keep in mind that the consumers would visit the nearby firm as long as it offers at least as much utility as the consumer would enjoy from traveling to the rival. The lower is the ratio of transport cost l, the higher is this potential profit even from the consumers with the lowest transport cost.

Second, the value of the behavioral data gained is low if consumers are relatively homogeneous. We may recall the example from Sect. 3. If students are very similar to managers, the gain from price discrimination might be very small compared with simply setting a price at which students and managers are happy to buy. This also holds true in the more complex model with a continuity of types.

Conversely, as the ratio of transport cost l increases, both the cost of generating behavioral information decreases as it would require a firm to offer a very low price in the first period to capture consumers with low transport cost, while losing margin on all consumers with higher costs, and the value of behavioral data in the second period increases. From the profit function, it is clear that the second effect is increasing in \(\delta \): As firms become more patient and put a higher value on second-period profits, it becomes more attractive to forgo market share in the first period so as to improve information (which is greatest in a minimum-variance sense at \(\alpha = 1/2\)).

To understand how dynamic considerations influence pricing decisions, it is useful to consider first the case of \(\delta =0\), where firms fully ignore future profits. Firms then attract all consumers who are located close by if the ratio of transport cost is low and give up some consumers to the rival when the ratio of transport cost is higher.

When future profits carry some weight for firms (\(\delta >0\)), they still ignore dynamic considerations in the first period under low ratio of transport cost and simply monopolize any location on their turfs regardless of the discount factor. In this case no information on transport cost can be inferred from behavioral data. Contrary to the conventional wisdom of data vendors and marketing professionals, behavioral data can be valueless. The reason is that when consumers are similar in transport cost, monopolization of all consumers who are located close-by can be easily achieved.

As differentiation among consumers becomes stronger, discounting starts to play a role. If the discount factor is sufficiently high, firms sacrifice some of the short-run profits so as to be able to extract higher rents in the future: They give up some consumers for the additional behavioral data that allow them more precise targeting of prices to new and returning customers in the second period. Overall, dynamic considerations play a role if the ratio of transport cost is sufficiently high and enough weight is put on second-period profits.

How much insight about individual consumers’ transport cost does behavioral data allow and how does this depend on the discount factor? We are mainly interested in whether and how the precision of behavioral targeting depends on the time preferences of the firms. If firms have similar market shares, we conclude that behavioral data allows finer targeted prices as firms become more patient.Footnote 39

It is useful to recall that firms never observe directly any consumer’s transport cost (t). They know only the distribution of consumers’ transport cost. They however infer a range separately for the transport cost of new and returning customers in the second period, by observing where the consumer purchased in the first period.

The observed share of consumers that purchased from the rival in the first period, \(\alpha \), serves as a measure of the precision by which firms can approximate individual users’ transport cost parameters. When \(\alpha \) is near the endpoints of the market share interval (\(\alpha =0\) or \(\alpha =1\)), knowing whether the consumer is new or returning allows less precise targeting in the second period. Since the firm can use in its pricing only an average transport cost parameter for customers that frequented it in the first period and again for those that did not, the average transport cost will be overall closest to the consumers’ true transport cost if the market shares are of equal size: \(\alpha =1/2\).Footnote 40

A higher \(\alpha \) implies more precise targeted prices if it includes less than half of consumers at a given location.Footnote 41 If a higher discount factor results in more equal market shares, then adding behavioral data to geo-targeting allows more fine-tuned targeted prices.

The following corollary summarizes our results on how the equilibrium first-period market shares depend on the discount factor.

Corollary 1

(Precision of behavioral targeting) Behavioral information is more precise when the first-period market shares are closer to \(\alpha = 1/2\). The correlation between \(\delta \) and the precision of behavioral targeting is: strictly positive for low l, strictly negative for high l, and ambiguous for intermediate l.

Proof

The proof is in the Appendix, and numerical thresholds are in the Online Appendix.

Corollary 1 shows that the effect of firms’ being more patient (the discount factor’s being larger) has a threefold effect on the first-period market shares (\(\alpha \) and \(1-\alpha \)) and resulting precision of behavioral targeting in the second period: For a low ratio of transport cost and/or discount factor,Footnote 42 firms charge uniform prices in the first period as if there were no second period and attract all consumers who are close by. Discounting is irrelevant in this case, and behavioral data are useless. When the ratio of transport cost is higher and/or firms value future profits more, dynamic considerations start to matter.

As we show in Proposition 1, the effect of more precise targeting that is due to more equal first-period market shares (\(\alpha \) and \(1-\alpha \)) on second-period profits tends to be positive when the ratio of transport cost is lower and negative otherwise. With a lower ratio of transport cost firms prefer more accurate customer data when the discount factor is higher. This is because with more precise targeting higher rent-extraction profits accrue in the future. When the ratio of transport cost is higher, firms prefer less precise information because the rival can successfully compete for the customers with the lowest transport cost.Footnote 43

However, in both cases firms gain from having at least some behavioral data to accompany the geo-information even if this reduces their second-period profits. This is because with sufficient heterogeneity in transport cost (\(l>h_{1}\left( \delta \right) \)), serving all consumers on a firm’s turf in the first period would require setting excessively low prices.

Note that \(\alpha = 1\) is never optimal. A firm may choose to forgo some profits in period 1 so as to gain more profits in period 2 due to better customer information. But if \(\alpha = 1\), then a firm completely forgoes profits in period 1 and does not gain any customer data, so that it loses in both periods. \(\alpha = 1\) can never be a profit-maximizing strategy: It is sufficient for a firm to decrease its price slightly in period 1 so as to serve some consumers in that period and gain some profits and additionally gain customer data for competition in the second period. In this case profits in both periods would increase. Indeed, in equilibrium it always holds that \(\alpha (\delta ) <1/2\), so that the majority of consumers buy at the closer firm.

An important result of Esteves (2010) is that firms may avoid learning consumer preferences so as to prevent intense competition in the subsequent period. We find an analogous result when the ratio of transport cost is high enough and the weight on future profits is also high: Firms distort first-period market shares so as to make sure that behavioral targeting becomes less precise. However, our model generates also the opposite result for some values of the ratio of transport cost l above \(h_{1}\left( \delta \right) \), when more accurate behavior-based targeting is likely to increase profits.

Thus, by influencing first-period market shares and the resulting precision of behavioral targeting, firms are able to strengthen the positive and dampen the negative effect of this information on second-period profits.

We now turn to the question of how overall profits change when firms use both behavioral data and geo-data compared to the case when only geo-data are available. We compare the discounted sum of profits in the subgame-perfect Nash equilibrium (in pure strategies) in both scenarios.

The following proposition summarizes our results:

Proposition 3

(Comparison of profits: geo- and behavioral data vs. geo-data only) Adding behavioral targeting to geo-targeting increases profits only for intermediate l and a sufficiently high discount factor.

Proof

The proof is in the Appendix and exact numerical thresholds are in the Online Appendix.

Only in some cases does the discount factor play a role for the profitability of behavioral data. For sufficiently low values of the ratio of transport cost \(l=1/\underline{t}\), the ability of firms to engage in behavioral targeting is neutral for their discounted profits. Behavioral data are not worth collecting in this case. In the example of Sect. 3, this was the case when managers and students are so similar that price discrimination in period 2 never compensates for giving up market share in period 1.

If the ratio of transport cost l takes intermediate values, then the sign of the profit effect of enriching geo-data with behavioral targeting depends on the discount factor. A higher weight on future profits makes this form of price discrimination profitable.

Within this intermediate range, the presence of behavioral data leads to higher profits at lower values of l. In that case price competition is intensive even without behavioral data, so that additional customer data has mainly a positive rent-extraction effect as competition cannot increase much. Profits with behavioral data as a function of l are non-linear; and in special cases, firms may even gain from additional customer data when consumers are not very different.

For high values of the ratio of transport cost l behavioral data never increases profits. If l is high, then competition without customer data is relatively weak: Consumers are so different that each firm concentrates on its own market segment (consumers on its own turf with high transport costs and those with low on the rival’s turf) without creating competition for its rival. Since competition is weak initially, there is a big potential for it to intensify. This happens when firms gain customer data: Competition intensifies, and the competition effect dominates the rent-extraction effects so that the profits of both firms decrease.

The result that incentives to engage in behavioral targeting depend on the discount factor appears intuitive: Firms compete and generate data in the first period and use those data to extract rents in the second period. We would then expect that the relative weight that is put on the profits in the two periods matters for the overall profitability of obtaining data. Yet, to our knowledge our article is the first to provide a modeling setup that actually generates this intuitive result.Footnote 44

We qualify the strict profit effects in the existing literature by allowing for different levels of consumer differentiation, which in turn influences the interplay between the rent-extraction and competition effects. In some cases, when neither of these two effects dominates the discount factor may turn the balance.

We now turn to the analysis of how firms’ ability to combine behavior-based price discrimination with geo-targeting influences consumer surplus and social welfareFootnote 45:

Proposition 4

(Comparison of consumer and social welfare: geo- and behavioral data vs. geo-data only) Adding behavioral targeting to geo-targeting compared to geo-targeting alone increases social welfare for high l or intermediate l and low \(\delta \). In all other cases, adding behavioral data weakly decreases social welfare. Consumer surplus is not always aligned with social welfare and is more likely to be negatively affected irrespective of \(\delta \).

Proof

The proof and exact numerical thresholds are in the Online Appendix.

When the ratio of transport cost is low, firms serve all customers close by in the first period; hence, there is no behavioral targeting later, and both consumer welfare and social welfare do not change compared to the case with only geo-data. Note that due to the covered market assumption, social welfare is maximal when transport costs are minimal, which is the case when firms serve all consumers on their turf. Our calculations of social and consumer welfare use firms’ discount factor.

Social welfare can decrease for intermediate values of the ratio of transport cost \(l = 1/\underline{t}\) when firms find it profitable to collect behavioral data. Additional customer data render the second-period distribution of consumers less efficient, because of increased total transport cost. When firms distort first-period prices in order to obtain more precise transport cost data we have a higher misalignment of consumers between the firms in that period, which reduces social welfare.Footnote 46

This result is reversed when the ratio of transport cost is higher: Behavioral data harms firms in that case. Firms prefer to obfuscate transport cost information and achieve a distribution of consumers in the first period so that fewer customers buy from the firm that is located far away, which reduces total transport cost.

Behavior-based price discrimination does not result only in a rent-shift between consumers and firms, because transport costs are also affected. When adding behavioral targeting to geo-data reduces the misalignment of consumers, both profits and consumer surplus may increase.Footnote 47

As in the case of the profit effect of behavior-based price discrimination, the way that the latter influences social welfare and consumer surplus also depends on firms’ discount factor when consumers differ moderately in their preferences. Consumer welfare and social welfare are more likely to improve by adding behavioral pricing to geo-targeting when firms discount future profits more.

6 Conclusion

We present a model that takes into account four important features of a modern mobile targeting environment:

First, sellers can observe consumers’ real-time locations. Second, apart from location other factors also influence the responsiveness of a consumer to discounts, such as age, income and occupation; in our modeling we summarize these as “transport cost”. Unlike location, these are imperfectly observable to marketers. Third, sellers may infer consumer transport cost from observing previous purchasing behavior. Fourth, firms can deliver personalized offers through mobile devices in a private manner that is based on both consumer locations and consumers’ transport cost that is inferred from previous purchases.

Our results show that firms benefit from enriching geo-data with behavioral targeting when the range of transport cost (which we represent as a ratio) among consumers is moderate. When transport costs are homogeneous, behavioral data are useless, while with very heterogeneous transport cost the addition of behavioral targeting to geo-targeting intensifies competition and reduces profits. We are also the first to highlight the importance of the discount factor for the profit effect of behavioral targeting. Adding behavioral data to the marketing mix is likely to increase profits when firms put more weight on future profits.

We also find that consumer and firm interests are not necessarily opposed. When the ratio of transport cost is sufficiently low and markets are covered, consumer surplus, profits, and social welfare may increase with behavioral targeting, as overall transport costs can be minimized. Firms strategically influence the precision of the behavioral targeting by managing first-period market shares so as to enable greater rent extraction and reduce competition.

Our results carry relevance for managers and policy alike. The main managerial implication of our analysis is that combining behavioral marketing with geo-targeting needs careful consideration of the market environment. We highlight the ratio of transport cost and the discount factor that firms apply and derive conditions under which adding behavioral targeting to geo-marketing may be profitable in a competitive setting.

The main implication for consumer and privacy policy is that regulatory measures need to be carefully designed, since the combination of behavioral price discrimination with geo-targeting can be either beneficial or harmful for consumers. For example, restricting firms with respect to the collection of types of data that may relate to consumer “transport cost” (such as age and demographics) may improve outcomes for consumers when these do not differ strongly. Similarly, reducing the data retention period—a possible proxy for the discount factor in our model—may also benefit consumers when they are moderately differentiated.

7 Appendix

Proof of lemma 1. As firms are symmetric, we will restrict attention to the turf of Firm A. Consider some \(x<1/2\) and market share \(\alpha \). Maximizing the expected profit of Firm A yields the best-response function, which depends on the ratio \(t_{\alpha }/\underline{t} \). If \(t_{\alpha }/\underline{t}\le 2\) (\(\alpha \le 1/\left( l-1\right) \)), then \(p_{A, \alpha }(x;p_{B, \alpha })=p_{B, \alpha }+\underline{t}\left( 1-2x\right) \), such that Firm A optimally serves all consumers on market share \(\alpha \) irrespective of Firm B’s price. Then in equilibrium Firm B reduces the price to marginal cost (i.e., charges \(p_{B, \alpha }\left( x\right) =0\)) as it could profitably reduce an positive price. Hence, \(p_{A, \alpha }(x)=\underline{t}\left( 1-2x\right) \). If \(t_{\alpha }/\underline{t}>2\), then the best response of Firm A takes the form:

such that Firm A serves all consumers on \(\alpha \) only if the rival’s price is relatively high. Maximization of the expected profit of Firm B yields the best-response function:

Inspecting (2), we conclude that Firm B cannot serve all consumers in equilibrium. It is straightforward to show that there are no such prices, which constitute the equilibrium, where Firm A serves all consumers. Hence, only the equilibrium can exist, where both firms serves consumers. Solving (2) and (3) simultaneously, we get the prices: \(p_{A, \alpha }(x)=\underline{t}\left( 1-2x\right) \left[ 2\alpha \left( l-1\right) +1\right] /3\) and \(p_{B, \alpha }(x)=\underline{t}\left( 1-2x\right) \left[ \alpha \left( l-1\right) -1\right] /3\). For this equilibrium to exist, it must hold that \(t_{\alpha }/\underline{t}>2\). In a similar way one can derive the equilibrium for \(1-\alpha \) consumers. Precisely, if \(1/t_{\alpha }\le 2\) (\(\alpha \ge \left( l-2\right) /\left[ 2\left( l-1\right) \right] \)), then in the monopoly equilibrium Firm A serves all consumers, where firms charge prices: \(p_{A, 1-\alpha }(x)=\underline{t}\left[ 1+\alpha \left( l-1\right) \right] \left( 1-2x\right) \) and \(p_{B, 1-\alpha }(x)=0\). If \(1/t_{\alpha }>2\), then the sharing equilibrium emerges with the prices: \(p_{A, \alpha }(x)=\underline{t}\left( 1-2x\right) \left[ 2\,l-1-\alpha \left( l-1\right) \right] /3\) and \(p_{B, \alpha }(x)=\underline{t}\left( 1-2x\right) \left[ l-2-2\alpha \left( l-1\right) \right] /3\).

The demand regions follow directly from the results obtained in the proof so far: \(1/\left( l-1\right) >\left( l-2\right) /\left[ 2\left( l-1\right) \right] \) if \(l<4\), \(\left( l-2\right) /\left[ 2\left( l-1\right) \right] >0\) if \(l>2\), \(1/\left( l-1\right) >1\) if \(l<2\), with the opposite sign otherwise. Note that \(1/\left( l-1\right) >0\) and \(\left( l-2\right) /\left[ 2\left( l-1\right) \right] <1\) hold for any ratio of transport cost l. Q.E.D.

Proof of Proposition 1 Consider first some x on the turf of Firm A. We start with deriving profits for consumers that did and did not buy from Firm A in period 1. Consider first those that did not. If \(\alpha \le 1/\left( l-1\right) \), then Firm A serves all consumers and profits are

If \(\alpha >1/\left( l-1\right) \), then Firm A serves consumers with \(t\ge \underline{t}\left[ \alpha \left( l-1\right) +2\right] /3\) and profits are

Consider now \(1-\alpha \) consumers that bought from Firm A in period 1. If \(\alpha \ge \left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then Firm A gains all consumers and firms realize profits:

If \(\alpha <\left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then Firm A serves consumers with \(t\ge \underline{t}\left[ l+1+\alpha \left( l-1\right) \right] /3\) and firms realize profits:

The profits at some x on the turf of Firm B can be derived in a similar way. Note now that \( {\textstyle \int \nolimits _{0}^{1/2}} \left( 1-2x\right) dx= {\textstyle \int \nolimits _{1/2}^{1}} \left( 2x-1\right) dx=1/4\). Using the above results, we can write down the total profits (on both turfs) depending on the ratio of transport cost l and \(\alpha \) under the assumption that at any x on its turf in the first period every firm served the share \(1-\alpha \) of consumers (those with \(t\ge t_{\alpha }\)).

Consider first \(l\le 2\). The total profits of Firm \(i=A,B\) on both turfs are

Consider now \(2<l<4\) and \(\alpha \le \left( l-2\right) /\left[ 2\left( l-1\right) \right] \). The total profits of Firm i on both turfs are

If \(\left( l-2\right) /\left[ 2\left( l-1\right) \right]<\alpha <1/\left( l-1\right) \), then the total profits of Firm i on both turfs are

If \(\alpha \ge 1/\left( l-1\right) \), then the total profits of Firm i on both turfs are

Consider finally \(l\ge 4\). If \(\alpha \le 1/\left( l-1\right) \), then the total profits of Firm i on both turfs are

If \(1/\left( l-1\right)<\alpha <\left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then the total profits of Firm i on both turfs are

If \(\alpha \ge \left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then the total profits of Firm i on both turfs are

The analysis of the behavior of the derived above functions yields the results stated in the proposition. All the technical details can be found in (2018, Baye et al. (2018)).

Proof of Proposition 2 Consider some x on the turf of Firm A. Using the notation from the proof of Proposition 1, we can write down second-period profits at x depending on l and \(\alpha \). If \(l\le 2\), then Firm A gains all consumers at x independently of \(\alpha \), such that profits of Firm \(i=A,B\) at x, \(\Pi _{i}\left( \left. x\right| x<1/2\right) \), are

Consider now \(2<l<4\), in which case second-period profits at x depend on \(\alpha \). If \(\alpha \le \left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then Firm A gains all consumers on \(\alpha \) and loses some consumers on \(1-\alpha \), such that profits are

If \(\left( l-2\right) /\left[ 2\left( l-1\right) \right] \le \alpha <1/\left( l-1\right) \), then Firm A serves all consumers, and profits are given by (4). If \(\alpha \ge 1/\left( l-1\right) \), then Firm A loses consumers on \(\alpha \), and profits are

Consider finally \(l\ge 4\). If \(\alpha \le 1/\left( l-1\right) \), then Firm A loses consumers on \(1-\alpha \), and profits are given by (5). If \(1/\left( l-1\right)<\alpha <\left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then Firm A loses consumers on both \(\alpha \) and \(1-\alpha \), and firms realize profits:

If \(\alpha \ge \left( l-2\right) /\left[ 2\left( l-1\right) \right] \), then Firm A loses consumers on \(\alpha \), and profits are given by (6).

We introduce now a new notation for the (adjusted) price of Firm \(i=A,B\) at some \(x<1/2\):

At any \(x<1/2\) those consumers buy at Firm A who have relatively high transport cost:

from where we can derive \(\alpha \) as follows

Note next that if \(\underline{t}\le t_{\alpha }\left( \cdot \right) \le 1\), then Firm A’s profit at \(x<1/2\) in the first period is

Similarly, the profit of Firm B at \(x<1/2\) in the first period is

To derive the optimal prices of the first period, we will consider the discounted sum of each firm’s profits over two periods, multiplied by \(\left( l-1\right) \) and divided by \(\underline{t}\left( 1-2x\right) \). The detailed derivations can be found in the Online Appendix.

Proof of Corollary 1 We use the results on the equilibrium market share of Firm B derived in the proof of Proposition 2. If \(l\le h_{1}\left( \delta \right) \), then \(\alpha =0\). If \(h_{1}\left( \delta \right) <l\le h_{2}\left( \delta \right) \), then \(\alpha =\left[ l\left( 1+\delta \right) -2-\delta \right] /\left[ \left( 2\delta +3\right) \left( l-1\right) \right] \). If \(h_{3}\left( \delta \right) \le l\le \min \left\{ h_{4}\left( \delta \right) ,h_{5}\left( \delta \right) \right\} \), then \(\alpha =\left[ l\left( 9-8\delta \right) +19\delta -18\right] /\left[ \left( l-1\right) \left( 27-10\delta \right) \right] \).Footnote 48 Finally, if \(l\ge \max \left\{ h_{4}\left( \delta \right) ,h_{5}\left( \delta \right) \right\} \), then \(\alpha \left( \delta ,l\right) =\left[ l\left( 9-8\delta \right) +6\left( 2\delta -3\right) \right] /\left[ \left( l-1\right) \left( 27-20\delta \right) \right] \). Taking the derivatives of these market shares yields the results stated in the corollary. Q.E.D.

Proof of Proposition 3 To prove the proposition we will use the results stated in the proof of Proposition 2. In that proof we derived the equilibrium adjusted profits (divided by \(\underline{t}\left( 1-2x\right) \) and multiplied by \(\left( l-1\right) \)) of each firm at a given location on Firm A’s turf. Note that these profits do not depend on the location and firms are symmetric. Hence, to analyze how the ability to collect additional transport cost data influences profits it is sufficient to compare the sum of both firms’ adjusted equilibrium profits at some location. Precisely, for the case without additional customer data we evaluate the respective profits at \(\delta =0\) and then multiply them with \(1+\delta \) to get the discounted sum of profits over two periods. In the following we derive first the profits without behavioral data.

Consider \(l\le 2\). Evaluating the sum of (10) and (11) at (16) and \(\delta =0\) and then multiplying by \(1+\delta \) yields \(\left( 1+\delta \right) \left( l-1\right) \).Footnote 49 Consider \(2<l\le 5\). Evaluating the sum of (17) and (18) at (19) and \(\delta =0\) and then multiplying by \(1+\delta \) yields \(\left( 1+\delta \right) \left( 5\,l^{2}-8\,l+5\right) /9\). Consider finally \(l>5\). Evaluating the sum of (27) and (28) at (26) and \(\delta =0\) and then multiplying by \(1+\delta \) yields again \(\left( 1+\delta \right) \left( l-1\right) \).

Comparing the above derived profits with the respective equilibrium profits yields the results stated in the corollary. Precisely, for \(1.5<l<2\) profits are higher with the ability to collect additional data if \(\delta >h_{1} ^{-1}\left( l\right) \). For \(3.07<l\le 4\), profits are higher with the ability to collect additional data if \(\delta >h_{6}^{-1}\left( l\right) \), where

The technical details of the profit comparisons can be found in Baye et al. (2018). Q.E.D.

Proof of Proposition 4 The detailed derivations of the welfare effect of behavioral targeting can be found in the Online Appendix.

Supplementary information. An Online Appendix is available under https://github.com/philiphanspach/Geolocation-and-behavioral-data-online-appendix.

Notes

Widely distributed mobile applications such as Apple Wallet and Android Pay allow retailers to engage with consumers in real time and push targeted offers on their mobile devices based on location. For example, Paez, an Argentinian shoe brand, used mobile coupons targeted at passers-by to attract these consumers into stores (https://passworks.io/case-study/paez).

For Android, see https://developer.android.com/things/sdk/drivers/location. For iOS, see https://developer.apple.com/documentation/corelocation.

Dunkin’ Donuts complemented geo-location data with external data on behavioral profiles, which were obtained from billions of impressions gathered through mobile devices to identify anonymous Android and Apple device IDs. The campaign delivered banner ads to targeted devices that ran in the recipient’s favorite apps or on mobile web sites. These ads featured offers such as a $1 discount on a cup of coffee and a $2 discount on a coffee plus sandwich meal.

Policy makers such as the OECD are increasingly interested in the welfare effects of personalized pricing including the use of discounts and coupons (Gonzaga, 2018).

According to the data categorization suggested by (among others) World Economic Forum (2011), Crémer et al. (2019), and Gonzaga (2018), our model incorporates both observed (real-time and historical) and inferred data. Observed data here are consumers’ real-time locations. Observed historical data are behavioral data with customers’ previous purchases. Inferred data relate to consumers’ transport cost, which firms obtain by analyzing behavioral data.

If—for a given uniform price of the rival—both firms optimally charge a higher price to the same consumer group, then according to Corts this market is characterized by best-response symmetry In all other cases best-response asymmetry applies.

In a static setting, Thisse and Vives (1988) were the first to demonstrate the negative effect of price discrimination on prices and profits, which leads to a prisoners’ dilemma (see, for a similar result, Bester & Petrakis, 1996; Liu & Serfes, 2004; Shaffer & Zhang, 1995). More recent literature showed that firms may be better off with price discrimination under best-response asymmetry: The positive profit effect is demonstrated in articles that start with an asymmetric (more advantageous to one of the firms) situation [see Shaffer and Zhang (2000, 2002), Carroni (2016)] and in articles that assume imperfect customer data (as in Chen et al. 2001; Liu & Shuai, 2016; Baye & Sapi, 2019).

In related articles Villas-Boas (1999) and Colombo (2016) also show that firms are worse off with the ability to recognize consumers. Villas-Boas derives this result in a model with infinitely lived firms and overlapping generations of consumers, while Colombo assumes that firms can recognize only a share of their previous customers.

To keep our analysis tractable, we do not allow consumers to change their locations strategically (so as to get the best mobile offer) and assume that they are targeted at their home locations. Our results would remain the same if the location of all consumers changed randomly in the second period.

In the model, there is a continuum of types, so a past purchase reveals information imperfectly.

In the model, the companies compete in two periods, so that the market outcome in period 1 reveals consumer information that can be used in period 2.

This is only for exposition. In the equilibrium analysis, we focus on symmetric strategies.

In the event of a tie, customers choose the closer shop.

As a numerical example, suppose that: marginal costs are 0; both groups are normalized to unit size; and transport costs are 8 for managers and 5 for students. Then a price of 8 attracts only the managers and yields a profit of 8 for Ace Donut, while a price of 5 attracts (pools) both groups and yields a profit of 10. Accordingly, if Ace Donut charges a price of 8 in the first period and then charges a price of 8 to returning (manager) customers and a price of 5 to new (student) customers, it makes an aggregate profit of 21 across the two periods; whereas if Ace Donut charged a price of 5 in both periods, it makes an aggregate profit of only 20. By contrast (as is discussed below), if transport costs are 7 for students, then a uniform price of 7 in both periods yields higher price than does a price of 8 in the first period and discriminatory prices in the second period.

For example, assume that transport costs are 8 for managers and 7 for students.

Thus, this simplified example can be thought of as the problem of a monopolist Firm A.

The Online Appendix is available under https://github.com/philiphanspach/Geolocation-and-behavioral-data-online-appendix.

Esteves (2009), Liu and Shuai (2013, 2016), Won (2017), and Chen et al. (2017) also consider a market where consumer preferences are differentiated along two dimensions. However, in their analysis the strength thereof is the same among all consumers. In Borenstein (1985) and Armstrong (2006) consumers also differ in their transport cost parameters. Both show that firms may benefit from discrimination along this dimension of consumer preferences.

In reality, firms are likely to know which consumers have the lowest and highest transport cost in the market. For example, car sharing services Lyft and Uber likely know that some students are very responsive to discounts while business people are not.

We follow the tie-breaking rule of Thisse and Vives (1988) and assume that if a consumer is indifferent, she buys from the closer firm. If \(x=1/2\), then in the case of indifference a consumer buys from Firm A.

While it is intuitive to think of the range of transport costs \(\overline{t} - \underline{t}\), we will find it mathematically convenient to define the ratio of the highest to the lowest transport cost which, given the normalization of \(\overline{t}\), carries the same information. We will refer to l as the ratio of transport cost for brevity.

Transport costs in reality correspond to any information that is related to the responsiveness of users to discounts. For example, age (young, old) or professional status (student, manager).

Danaher et al. (2015) conduct a field experiment where all consumers got coupons with the same discount. They show that both the consumer’s distance to the store and her previous behavior (redemption history) determine the probability that a coupon will be redeemed by a customer. It is then consistent with these results that in our model where firms can target consumers with personalized coupons, they use the information on both customer locations and their purchase history to design coupons. Similarly, Luo et al. (2014) show in a field experiment that depending on consumer locations different temporal targeting strategies are needed to maximize consumer responses to mobile promotions. This also indicates a necessity to target consumers individually depending on location.

In reality this may also be the case if firms have access to location data via advertising agencies that routinely offer geo-targeting services for marketing purposes (see, for example, passworks.io or here.com). Geo-fencing and geo-conquesting are typical mobile marketing practices ((Dubé et al., 2017).

This is the standard assumption in the literature on personalized pricing. In reality firms do not need to monitor each other’s prices in real-time. It is sufficient that they are able to verify their assumptions about those prices. Uber, for example, monitors rival Lyft’s operation real-time and in great detail, including the availability of individual drivers (Hern, 2017).

The authors of this article consider themselves rational consumers, yet they do not display the level of foresight that is outlined here.

We do not address the case of uniform pricing, since our benchmark is locational targeting (only). This is realistic for mobile applications, where any software user such as Uber or Dunkin Donuts mentioned in the examples earlier can access the user’s physical location from the smartphone’s GPS chip. Behavioral data need to be gathered in addition.

We compute exact numeric bounds for these regions for all results. These are reported in the Online Appendix for completeness but are not economically interesting in and of themselves.

This can be seen in the proof of Proposition 2 in the Online Appendix: In the subgame perfect Nash equilibrium the share \(\alpha (p_A^x,p_B^x)\) does not depend on x.

The Appendix contains the proof and an extended version of the proposition with more detail on the shape of the second-period profit function depending on \(\alpha \) and the ratio of transport cost l.

Given our formalization, this corresponds to specific ranges of l that are reported in the Online Appendix. Here, while in the case of \(2<l\le 2.38\), any firm loses some consumers at any location on its turf in equilibrium of the second period, total profits over both turfs behave in the same ways as in the case \(l\le 2\).

The rival firm would make a loss if it set a lower price. It would be indifferent to setting a higher price since its demand would be 0 either way.

For some values of the ratio of transport cost (\(2<l<2.89\) or \(5<l<14.13\)), there are values of the discount factor for which in the first period either no equilibrium in pure strategies exists or there are two pure strategies equilibria. Proposition 2 focuses on combinations of parameters l and \(\delta \) that yield a unique equilibrium in pure strategies in the first period. This is more likely when firms are less patient: The dynamic optimization problem of the firms is then closer to the static one.

The proof in the Online Appendix contains the precise parameter ranges of the different subgame-perfect Nash equilibria in Proposition 2.

We provide a graphical illustration in Fig. 4 in the Online Appendix.

Formally, we measure how the discount factor changes the precision of behavioral targeting by the sign of the expression \(\partial \alpha \left( \delta \right) /\partial \delta >0\), with \(0\le \alpha \left( \delta \right) \) \(\le 1/2.\)

Fudenberg and Villas-Boas (2006) also note that when the cut-off parameter for first-period purchasers is “near the endpoints, firms have less precise information in the larger market."

It always holds that \(0\le a(\delta )\le 1/2\), because the majority of consumers buy at the closer firm in equilibrium.

Exact threshold values for \(l\le h_{1}\left( \delta \right) \) are in the Online Appendix.

The equilibrium prices of the first period depend on firms’ time preferences and the ratio of transport cost. With a low transport cost ratio, dynamic considerations play no role. With an intermediate transport cost ratio, firms benefit from a higher precision of behavioral targeting in the second period. They set higher prices on their own turfs if they put more weight on future profits, in order to create more equal market shares in the first period. The relationship is opposite with a high ratio of transport cost. We provide a formal analysis in the Online Appendix.

To keep the exposition simple, we ignore the very special case of \(2.28\lessapprox l<2.29\) (\(2.61\lessapprox l<2.62\)), where social welfare (consumer surplus) increases when the discount factor takes intermediate values and decreases otherwise.

Our model assumes that the market is covered. Lifting the covered market assumption in terms of location would likely increase the profitability of behavior-based price discrimination. Some consumers would belong to the hinterland of one of the firms, out of reach by the rival and able to be exploited by more targeted prices (Gabszewicz and Thisse, 1992). Lifting the covered-market assumption in terms of transport cost is less clear, because in that case firms would not know whether a new customer bought from the rival in the first period (implying low transport cost) or did not buy at all (implying high transport cost).

The formulas for \(h_{n}\left( \delta \right) \), with \(n=\{1,...,5\}\), can be found in the proof of Proposition 2 in the Online Appendix.

These and following equations are in the Online Appendix.

References

Armstrong, M. (2006). Recent developments in the economics of price discrimination. In R. Blundell, W. K. Newey, & T. Persson (Eds.), Advances in Economics and Econometrics: Theory and Applications: Ninth World Congress (Vol. II, pp. 97–141). Cambridge: Cambridge University Press.

Baye, I., Reiz, T., & Sapi, G. (2018). Customer recognition and mobile geo-targeting. https://econpapers.repec.org/paper/zbwdicedp/285.htm.

Baye, I., & Sapi, G. (2019). Should mobile marketers collect data other than geo-location? The Scandinavian Journal of Economics, 121(2), 647–675. https://doi.org/10.1111/sjoe.12275