Abstract

This paper proposes a competition theory to explain the role of automobile dealers’ investment in a vertical contract with manufacturers. Dealer contracts specify manufacturer-suggested retail prices and elements of dealer quality. Dealer quality investments require minimum financial capital where manufacturers impose these limits on dealers. The required dealer investment screens for qualified dealers and incentivizes the desired dealer quality. The prediction is that promotional services, prices, and gross returns are greater for high-quality brands than that for standard-quality brands. To test the theory, we collected data on auto dealers in China in June 2015 for an empirical analysis. Our findings support these predictions: Dealer investment (registered capital) is positively correlated with brand average product prices. In addition, the registered capital is higher when the aggregate demand is greater since high demand increases returns, which induces dealers to increase their investment.

Similar content being viewed by others

1 Introduction

Since the early 2000s, the Chinese automobile industry has undergone rapid development. In 2009, auto sales in China surpassed those in the U.S.; China thereby became the largest global auto market. Although declining production costs and increasing competition are important to explain this growth (Li et al., 2015), sales and service levels supplied by automobile dealers play a critical role (e.g. Blair & Lewis, 1994; Klein & Murphy, 1988).

Xiao and Ju (2016) suggest that auto industry policies stipulate that all passenger vehicle manufacturers must provide service systems together with sales, effective April 1, 2005.Footnote 1 As such comprehensive services usually require large intensive investment, auto manufacturers usually delegate such services to independent dealers. Dealership features include the general appearance of the dealership, the display and inventory of the autos, the knowledge of the sales personnel, the post-sale service, the availability of spare parts as needed and all else valued by customers.

Once auto manufacturers have pre-determined the quality segment of the auto market that they wish to enter, manufacturers seek to encourage dealer services that yield success in their target market segment. In particular, auto manufacturers seek to select dealers that are capable of making the required dealership investment and are incentivized to deliver the critical target level of dealer services, which could be explained by a competition theory that features a vertical relationship between auto manufacturers and dealers.

We summarize the theoretical predictions using a reduced-form empirical model and test the claim that auto manufacturers in China apply a minimum requirement on dealers’ equity as an instrument towards these two goals. Unqualified or perhaps even unproven dealers will be unable to raise the commensurate financial capital. Manufacturers of upscale brands enforce higher standards for their retailers consistent with the reputational targets of the brand. Achieving these higher standards requires greater retail investment.

This paper contributes to the literature in the following ways: First, we test the positive correlation between brand quality and dealer investment. In a vertical relationship, the evidence on retailer investment is rare although theoretical research on this issue is abundant (e.g., Macleod, 2007; Klein & Leffler, 1981). This paper seeks to bridge the gap.

Second, this paper adds empirical evidence on retailing channel structure. We collected a unique dataset on auto dealers in China as of June 2015. This dataset captures the key information of the dealers, such as their establishment dates, registered capital (RC), and auto brands of their delegation. Using RC as a proxy for dealer investment, we analyze factors that shift the distribution of dealer investment. This contributes to an understanding of the micro-level structure of the retailing channel (Luttmer, 2007). To our knowledge, this is the first attempt to investigate the investment distribution for auto dealers in China.

Third, understanding the determinants of dealer investment and subsequent market performance is critical to understanding developments in this market. Previous research has tried to explain the take-off of the Chinese vehicle market from the competitive nature of automobile production (Li et al., 2015; Hu et al., 2014), with little attention paid to the role of the dealers. Xiao and Ju (2016) consider the vehicle dealer segment and study how manufacturers set exclusive territories in this market. They explore the match of market experience between vehicle manufacturers and dealers. This paper investigates a more basic question with respect to dealer investment.

We next provide information on the dealer contracts and the nature of the auto retail sector in China. After that is a formulation of the specific hypotheses to be tested. What follows is a description of the Chinese auto market data collected for this paper, the estimated regression and the empirical results including an interpretation of our findings. The final section sets out our conclusions.

2 Industry Background and Descriptive Facts

2.1 Vehicle Sales

Beginning in the late 1990s, Chinese auto manufacturers adopted the vehicle distribution structure that is common to European, North American, and other markets. In China, this retail structure bears the label “4S” stores. 4S refers to four functions: vehicle Sales; Spare parts supply; Service provision; and Survey implementation (for customer feedback). In 2005, this resale model was approved as the Chinese Automobile Trade Policy (ATP)Footnote 2 and became the dominant distribution structure in the Chinese car market.Footnote 3 In this vertical relationship, manufacturers have greater bargaining power over the dealers for two reasons: a manufacturer industrial policy that is supported by statutes (see Appendix 1.1 for details); and a more concentrated auto-manufacturing sector relative to auto dealers (see Appendix 1.2).

2.2 Registered Capital

A key factor that contributes to retail sales is the dealers’ investment, since it is expended on store construction and employee training and hence helps determine dealers’ location, size, and service quality. The detailed information of dealers’ item-based investment is unavailable in China; however, we can use dealers’ registered capital (RC) as a proxy for their service-related investment.

RC refers to the total amount of equity or capital contributions to be paid in full by the shareholders to the enterprises that are registered with the State Administration for Industry & Commerce of China. RC can be contributed in installments. The Company Law of China allows RC to be paid by installment as long as the first installment is no less than 15% of the RC (payable within three months upon the issuance date of the business license), and the balance of the RC is contributed within two years upon the issuance date of the business license.Footnote 4 RC can be paid in cash contribution and/or tangible and intangible assets that can be monetarily valued and legally transferred, such as physical objects, intellectual property right, know-how, or land-use right, etc. The cash contribution cannot be less than 30 percent of the total RC.

The determinants of RC are somewhat complex. Historically, there was a minimum legal requirement for RC.Footnote 5 But beginning in 2014, Company Law in China no longer mandated minimum capital requirements.

Another factor that influences the level of RC turns on the operating cost of the dealership. For example, in a city with high land rents or labor costs, company owners have to contribute additional RC to underwrite the operation of the company.

The RC level is important in determining the credit-worthiness of the company. For example, a company with a low RC level could face difficulty in securing a bank loan or trade credit or entering into commercial contracts with other input suppliers. Foreign direct investors in China face a statutory minimum ratio between their RC and the total foreign direct investment (FDI). This refers to the projected amount of funds that is necessary for the foreign direct investor to attain the production or operational capacity that is set out in its articles of association.

The minimum RC is viewed as the funding to operate the dealership and in most cases cannot be withdrawn. Firms can change their RC; but doing so requires a formal re-registration of the company in accordance with China’s Company Law. When completed, the company registration authorities issue a new business licence, which means that only the updated RC is observed from the business registration at any one time.

All of this means that the level of RC plays a significant role in the day-to-day operations of a company that operates in China. Some observations suggest that minimum requirements with respect to RC could be leveraged to guarantee delivery of the desired services. In its documentation for prospective dealers, for example, Toyota (joint venture of Toyota and the First Auto Works, or FAW) defines its expectations with respect to the customer experience to be “to provide consumers with a complete, satisfactory, and sincere car buying experience and service experience.”Footnote 6 For this purpose, Toyota requires the applicants “to set up an independent legal entity, which is only used for the project operation of FAW Toyota Motor Sales Co., Ltd., with a registered capital of not less than 10 million yuan.”Footnote 7

2.3 Other Dealer Conditions

Chinese dealer contracts are proprietary and confidential. We do not have these contracts. Publicly available information reveals that manufacturers set terms other than RC requirements so as to control dealer behavior. For example, manufacturers set suggested retail prices, or MSRPs.Footnote 8 MSRPs are widely advertised in both manufacturers’ websites and other publications such as leading auto journals (e.g. Car Market Guide). Information on other dealer restrictions is available from manufacturers’ recruitment documents. For example, in its dealer recruitment documentation for selected cities, Ford lists the minimum requirement with respect to land size and frontage for a dealership. As well, Ford lists minimum store size (including second floor offices) and minimum frontage (including the dealer’s service area) for the dealership.Footnote 9 Another example is the aforementioned FAW-Toyota joint venture. According to its dealer recruitment document, successful applicants must meet Toyota’s land and building design requirements.

In sum, prospective auto dealers face well-defined attributes for success in Chinese auto retailing. The observations from Ford’s and Toyota’s dealer requirements offer support for the claim that initial dealer investment requirements on dealers are in place.

2.4 Descriptive Facts

As outlined above, investment in dealer quality requires dealer financial capital. On the dealer’s balance sheet, physical capital and firm goodwill together with other assets appear on the asset side of the balance sheet, and the registered financial capital to underwrite the physical capital and goodwill investments and other assets appears with other liabilities on the liability side of the balance sheet.

To better understand the distribution of dealer investment, we collect the data of dealers’ RC and key features, such as their brand values (measured by their average product prices) and their contractual structure with manufacturers, and demand shifters such as market size (see Sect. 4.1 for details), and conduct kernel density estimation (KDE) with the use of the RC of the auto retailers in our data. We use Gaussian basis functions for the kernel.

2.4.1 Dealer Size Distribution

Figure 1 shows the distribution of dealers’ RC for the full sample. Inspection reveals that the fitted density differs from a normal distributionFootnote 10: The estimated density has a fatter left tail than the normal distribution and is more concentrated to the right side of the mean value, which suggests that the log RC distribution is negatively skewed (skewness = − 0.76). This distribution of the Chinese auto retailers’ investment differs from that of the other industries in both the US and elsewhere (Cabral and Mata 2003 for Portugal and Angelini and Generale 2008 for Italy and non-OECD countries), which suggests that the firms’ asset distribution has positive skewness. This distribution suggests that the RC sizes of the Chinese car dealers are more concentrated in the middle level and the number of small dealers is fewer than found in other industries documented by previous studies.

2.4.2 Product Values

Table 1 reports quantiles in the distribution of dealer investments measured by RC by brand values, which are reported as well by quantiles in the distribution of brand average product prices. This table displays a salient feature: The distribution of upscale-brand dealer investment lies to the right of that of downscale-brand dealers. This feature suggests that the optimal dealer investment could be greater for up-scale than for down-scale brands, and so the brand price levels and dealer investments are positively correlated. Previous analysis of this feature is rare.

2.4.3 Market Size

Table 2 presents the RC distribution by market sizes. As shown in Table 9 in the Appendix, we categorize the cities into five groups according to their population. Table 2 suggests that the RC distribution shifts towards the high end of the RC with increases in city size. For dealers in smaller cities, we observe a fat left tail (with a lower RC at the 10% quantile), compared with those in larger cities. One possible explanation for this finding is that a larger city generates higher demand and higher returns for all brands, and so manufacturers set higher requirements on entry in such markets. In small markets, however, demand is lower, and so manufacturers set lower requirements on dealer investment, which leads to the fat left tail in the size distribution. This implies that both increasing numbers and the size of retail outlets are strong signals of the evolution of the Chinese auto market.

2.4.4 Common Agency and Non-exclusive Territory

A dealer may set up dealerships with different manufacturers, which leads to a common agency arrangement. A manufacturer may set up dealerships with multiple agents in a market, which results in a non-exclusive territorial arrangement.Footnote 11 Table 3 shows the RC distribution by types of vertical relations between manufacturers and dealers: The first two rows show the summary statistics of RC for a dealer that sells a single brand (and so is defined as a single-brand dealer) or outlets that are common agency and sell multiple brands; and the last two rows show the summary statistics of RC for outlets with observed status of exclusive territory or not.Footnote 12 The RC distribution is independent of the exclusive-territory status. However, a remarkable feature of the summary statistics is that the RC distribution of common agency dealers stochastically dominates that of the single-branding dealers: The RC distribution of common agency dealers lies to the right of that of single-branding dealers (as the RC values are higher at all quantiles in the table), and has smaller variance.

Two factors could be the source of this distributional variation: the cross-sectional heterogeneity of dealers’ capital access capability, or the temporal evolution of dealers’ capital constraints. Previous literature (e.g., Lucas, 1978; Cabral & Mata, 2003) explains the temporal changes in size of the same firms with the use of a dynamic selection theory. Firms start with small sizes because of financial or managerial capacity constraints. Over time, they evolve into large firms when these constraints are no longer binding. However, this theory cannot explain the temporal changes in dealers’ RC in our sample: Our data show 2541 city-specific dealersFootnote 13 who set up multiple dealerships for different brands in the same city. Within this group, about 80% have invested less on average after accumulating experience from their first retailing outlet. This calls for a different theory to explain the observed facts.

3 Discussion and Research Hypotheses

To sum up and move toward defining testable hypotheses, we propose the following claims to explain the stylized facts of dealers’ RC distribution: The distribution of dealers’ RC is the consequence of incentives that are designed by the car manufacturers in their vertical relations with the car dealers. Different auto manufacturers require different retail physical capital, different retail sales capabilities, and different post-sale auto service. The latter includes auto warranty services that are underwritten by the manufacturer. Potential dealers are ex ante heterogeneous in terms of their unknown skills and abilities to meet the targets that are set by the different manufacturers. These targets vary by the location of the manufacturer in the auto quality spectrum.

Required financial capital investment serves two goals: signaling, and commitment to the manufacturer. (i) Signaling: It offers a signal to the manufacturer that a prospective dealer has sufficient reputational capital to assemble the financial capital that is required to meet the manufacturer’s retail and service targets; and (ii) Commitment: As the retail investment is strongly manufacturer specific, it provides dealer commitment to the manufacturer. We further explain and test this theory below.

As we note above, the 4S dealership in China resembles the typical auto dealership elsewhere in the world. The features of these dealerships are well known: Kessler (1957, pp. 1138–1139) analyzes dealership contracts in the U.S. as vertical integration by contract; he points out “the master dealership contract is frequently accompanied by printed addenda concerning such matters as capital requirements and succession.”Kessler (1957, p. 1140) maintains that while a dealer has the option to accept or reject the dealer contract, once the dealer has committed capital and entered the business, the power of the manufacturer dominates. Citing examples of U.S. dealer contracts, Kessler (1957, p. 1144) claims that the most important feature of the dealer contract is “the power to determine the dealer’s minimum capital requirements.” Langlois and Robertson (1989) suggest that auto firms have to secure investments, such as investments in distribution services that are complementary to production quality. If the dealers are to provide such services, the dealer contracts will set corresponding requirements.

As well, Kessler (1957, p. 1149) maintains that dealers lack brand mobility, as their capital investment is highly specialized. As a result, once a dealer has committed capital to a franchise, other possible legal sanctions to protect the manufacturer’s interest are redundant (p. 1150).

Other literature (e.g., MacLeod, 2007; Klein & Leffler, 1981; Djankov et al., 2003) suggests that typically the enforcement costs of such manufacturer/dealer contracts are significant so that transacting parties typically use informal enforcement mechanisms to guarantee the delivery of desired efforts or quality inputs. Empirically, for instance, Bouwens et al. (2015) find that European car manufacturers use a stair-step price-discount mechanism to incentivize their dealers to achieve sales target.

The general franchising literature also recognizes the role of financial capital in selecting and incentivizing franchisees. For example, Fan et al. (2017) point out that small franchisees typically finance their investment through collateralized loans. The claim is that the size of the franchisees’ collateral plays a significant role in determining the franchisees’ input efforts and therefore retailer quality as the default costs that are faced by the franchisees increase with the size of their collateral. In turn, if the franchisees and retailers acquire RC through leverage—perhaps with a collateral requirement—the RC size can also incentivize retailer quality. Thus, in a competitive environment, only retailers who can credibly signal their capacity to deliver quality and produce successful sales and margins can raise the required capital.

All of these previous studies suggest that car manufacturers could set MSRPs and minimum requirements on dealers’ investment so as to screen for qualified dealers and guarantee the delivery of the desired service quality. Manufacturers set MSRPs for dealers’ reference and give the dealers bounds on the price discounts. Setting MSRPs avoids a double mark-up. At the same time, however, this may limit the dealer’s service margin, which would discourage service inputs. Potential dealers may choose to shirk, so as to lower their costs ex post entry. Consequently, as a second instrument, manufacturers set a minimum on dealers’ investment to guarantee the delivery of desired services.

By setting the minimum requirement on investment equal to the equilibrium returns that correspond to the desired quality, manufacturers screen out the dealers that are incapable of delivering the desired quality: Any lower quality would leave negative net returns for the dealer. Only dealers that are capable of delivering the desired service choose to enter. Post entry, they realize the desired sales by providing the appropriate level of quality services. Enhanced sales not only increase the extensive margin, but also increase the intensive margin by reducing the dealers’ average costs as a consequence of likely dealership economies of scale. In turn, this works to offset the higher costs of quality services. All of this increases variable returns to cover fixed dealer costs.

The claim is that MSRPs and minimum dealership investment are two instruments that promote a vertically integrated level of price and dealer quality. This theory generates some testable hypotheses, as will be discussed below.

3.1 Brand quality

Previous literature suggests that luxury brands require higher dealer quality than do standard brands. Chu and Chu (1994) suggest that manufacturers “rent” retailers’ reputation to signal quality to their consumers, and so manufacturers of higher-quality products distribute through retailers with stronger reputations, while manufacturers of lower-quality products distribute through retailers with lower reputations. Similarly, Bruce et al. (2005) suggest that automobile manufacturers of higher-quality products invest more on promotion to incentivize the service input of their retailers. That retailers’ reputation constitutes their sunk capital for market entry also appears in Rao et al. (1999).

Another brand feature that is related to quality that commands dealers’ service input is the product variety, including the number of products and the extent of vertical differentiation. Previous literature suggests that as firms expand their product lines, forecasting demand for each product becomes more difficult (Moreno & Terwiesch, 2017). The increased demand uncertainty that is associated with product proliferation calls for more dealer inputs, such as more inventories (Kekre & Srinivasan, 1990; Moreno & Terwiesch, 2017). In addition, the increased complexity of the brand products calls for more on-site services. To guarantee the delivery of such enhanced sale services, manufacturers could also demand higher RC to screen out unqualified dealers. This yields the following hypothesis:

Hypothesis 1

(H1) Manufacturers use the minimum requirement on dealers’ investment as an instrument to screen dealer quality. Accordingly, the optimal dealer investment is higher for luxury auto brands than for standard auto brands, since luxury brands demand higher quality inputs by dealers. Also, the RC requirement is higher for brands with more products or higher quality differentiation.

This hypothesis implies that everything else equal, brands of the same quality require the same investment from dealers, which can explain the mass points in the distribution of RC that we found in Sect. 2.4.1, which suggests that the stylized facts offer some support for this prediction.

An important explanation of H1 is that this hypothesis predicts only the minimum requirement on RC. Therefore, our theory mainly predicts the RC distribution for dealers where the minimum requirement is binding. As suggested by Cabral and Mata (2003) and Lucas (1978), firms are more likely to be constrained by their financial capacity at entry and evolve into a larger size once they cease to be financially constrained. So, we expect that those senior firms that survive the competitive process may well increase their RC, although as we noted above, in China, these firms would have to go through a legal process for such a change. Therefore, our analysis controls for firm age.

3.2 Aggregate demand

The preceding discussion on the role of dealer investment as a screening mechanism suggests that the dealer investment depends on aggregate demand, since aggregate demand determines the equilibrium returns to the dealers. This echoes previous research (e.g., Min et al., 2017). What happens as the auto market expands? Suppose that, for some exogenous reasons such as population growth or increased income, the number of consumers who enter any specific auto market expands. Whatever the intensity of preference for autos from this expanded consumer base, these consumers are potential auto purchasers.

Any enhancement of market size would increase net auto revenues and would lead to an increase in aggregate investment: This enhanced fixed quality investment could be achieved through a greater investment by a single retailer or an increased retailer network with more dealers that make the appropriate fixed-quality investment. What matters is that measures of market size—such as the size of the consumer base or of income—affect the auto retail investment decisions. Larger cities have enhanced demand with stronger preferences for luxury brands to support the presence of higher-quality products. In short, all of this results in greater investment in promotional/quality services in larger urban centers. This yields the following hypothesis:

Hypothesis 2

(H2) Dealer investment increases in aggregate auto demand.

3.3 Common agency

Above we labeled a common agency as a dealer group that set up multiple exclusive-dealing outlets with multiple auto brands in a market (that is, a city). As the dealer group can serve only one brand at each outlet, the common agency is actually a chain of stores of multiple brands. If retail capital is brand-specific, then the investment capital for common agency should be greater than the sum of investment capital for single-brand retailers with the same number of outlets because of balancing targets across manufacturers and common retail agents.

On the one hand, when a dealer makes an investment that is specific to a manufacturer’s brand, the dealer seeks assurance against hold-up by the manufacturer. Multiple brand investment by a dealer offers diversification insurance against this possibility (Williamson, 1983; Fein & Anderson, 1997), which makes dealers willing to increase their investment. On the other hand, upstream manufacturers are unwilling to make dealer-specific investment with respect to common-agency dealerships, since the manufacturers are concerned about their competitors’ potential to free-ride on their investment (Marvel, 1982). In turn, this may increase the investment that is required from the dealer. For common-agency dealers, compared with single-brand dealers, the manufacturers’ demand for higher investment is also affordable due to likely economies of scope: The fixed investment could spread over multiple outlets for different brands. Overall, the RC of retailing outlets that are operated by common-agency dealers should be higher than that operated by single-brand dealers.

3.4 Non-exclusive territory

If a brand uses multiple dealers in a retail territory, the investment requirement for each dealer could be reduced. The literature on vertical restraints (e.g., Mathewson & Winter, 1994) suggests that assigning retail territories limits the extent of dealer investment externalities and promotes dealer investments. Franchisees receive exclusive territories when franchisee efforts are critical to the venture. Therefore, exclusivity could be an indicator of the important role of dealers in a vertical relationship. Accordingly, non-exclusive territory implies that the requirement on dealer quality service could be lower than for the exclusive cases.

Kessler (1957, p. 1159) suggests that exclusivity is an initial restriction in the dealer contract that is complementary to the RC requirement. Restricting dealers to focus solely on the auto manufacturer’s products requires an exclusive focus by the dealer not only on the manufacturer’s products but on other services such as consumer financing of an auto purchase, replacement parts, and advertising. Enforcement of these exclusivity restrictions plausibly comes through the threat of cancellation of the dealer contract (Kessler 1957, p. 1161). These factors yield the following hypothesis:

Hypothesis 3

(H3) Dealer investment is higher for common-agency dealers than for single-brand dealers, while it is lower for non-exclusive dealers than for the sole dealers of any single brand.

4 Empirical analysis

4.1 Data and empirical methodology

The main part of our dataset consists of observations at the level of the auto dealer: the 4S stores in China. During the sample period, 4S outlets at each retail site are exclusive to one brand (See Appendix 1.1 for details). These retailers can be part of different dealer groups. Each group can establish separate dealerships for different brands that may even compete in the same retail market (a city). For example, manufacturers such as GM-Shanghai have multiple brands, such as Chevrolet, Buick, and Cadillac. Decisions on dealer choices are made independently at the brand level. This means that Chevrolet, Buick, and Cadillac use independent dealers for their respective brands and establish different requirements on dealer size and RC. As a result, we analyze the dealer size distribution at the brand level and not at the manufacturer level.

The data are cross-sectional, collected from a leading auto news website (www.autohome.com.cn) for June 2015. This data set has information on 97 auto brands of 82 car manufacturers and 11,760 dealers, each identified by their respective legal name. In particular, there are 20,446 auto-retailing outlets in 327 Chinese cities, including major cities such as Beijing, Shanghai, and Tianjin.

We define the geographic market at the city level. The State Council published The Notice of the State Council on Adjusting the Standards for Categorizing City Sizes on October 29, 2014. From this notice, their population categorizes Chinese cities into different levels. We use the same population intervals as used for city categorization to summarize the city information in Table 9. The population data comes from the Sixth National Population Census of 2010 in China.Footnote 14 We measure population using the number of permanent residents, including individuals who reside in the local township or street and have their household registration in the same township or street, or have a pending household registration; individuals who reside in the local township or street and have been away from their registered residence for more than six months; individuals who have their household registration in the local township or street and have been away for less than six months or are working or studying abroad. The 2011 statistical yearbook for each province yields the data on per capita disposable income. The data display a positive relationship between city population and per capita income. As expected, larger cities have greater numbers of auto retailers. This suggests that the number of car retailers per city increases with city size. Not surprisingly, both population size and income levels could be critical to the entry decisions by auto manufacturers and their retailers.

Data include the RC of the dealership, the identity of the dealer, and the registration date of the dealership. These data come from The National Enterprise Credit Information Publicity System. The State Administration of Industry and Commerce (SAIC) issued the Provisional Regulations on Public Notice of Corporate Information (approved by the State Council, on August 23, 2014). Following this regulation, 31 Chinese provinces (prefectures, municipalities) launched a public notice system of corporate credit information on March 1, 2014. All are interconnected and available online.

The RC in our study are as of the data collection date and may be different from that on the firm’s establishment date. Even though the RC may be different from its original level, it is synchronized with information such as brand-level product quality. Given that the optimal investment is an equilibrium that is conditional on the physical quality of the product and on the target dealer service, the updated RC is the valid measure for optimal investment that aligns with the up-to-date product quality and dealer service.

Most RC data are recorded in Renminbi (RMB) 10,000 at collection and are converted to RMB millions for data analyses; others are in respective foreign currencies, for example US Dollars (US$) and Hong Kong Dollars (HK$). The historical monthly exchange rates from the Board of Governors of the Federal Reserve System ( http://www.federalreserve.gov )Footnote 15 permit a transfer of assets measured in US$ or HK$ to assets measured in RMB millions.

The registration provides dealer identity. We collect the names of the persons who have legal rights and are responsible for the obligations of the dealership. This is important as these data permit an identification of different retail outlets that are owned by the same individuals or investment groups. This ownership is used to define a dealer group, which may consist of multiple retail outlets in each market.

Using the registration time, we generate the other set of variables for manufacturers and dealers market structure. Binary variables measure market structure: \(Y_{ijm}^{d}\) is a binary variable that indicates whether the dealer group that owns retail outlet j is a common agency after establishing a dealership for brand i in the specific local market m (= 1 if yes; 0, otherwise). \(Y_{ijm}^{b}\) is a binary variable that indicates whether dealer j is a non-exclusive territory dealer of brand i in market m (= 1 if yes; 0 otherwise). The coefficients on \(Y_{ijm}^{b}\) and \(Y_{ijm}^{d}\) measure a potential structural break in minimum requirements on dealer investment because of a change in the brand’s or dealer’s vertical relations.Footnote 16

Information on registration time dates from the late 1970s, before (as noted above) the emergence of a private vehicle market. Figure 2 displays the frequency of observed establishment dates for dealers in our data. Most dealers began operation around 2004: the time of the emergence of the modern Chinese auto market.

We use the registration time to generate a variable that represents the firm age for dealer j of brand i in market m—\(age_{ijm}\)—in terms of years since the establishment of the dealership until the data collection date in 2015. This variable captures the expected survival duration of the dealership under a rational expectation assumption. A longer survival duration will generate larger future revenue flows to the dealer and so promote more investment; consequently, this variable should be a control variable in our analysis. This variable could also capture the potential impact of capital or managerial capability constraints as suggested by Cabral and Mata (2003) and Lucas (1978).

One possible locational control conjecture is that the distance between a target market and a brand’s headquarters generates monitoring and local information asymmetry problems, which could affect retailer performance (Kalnins & Lafontaine, 2013), and, in turn, lead to variation in investment incentives. Therefore, this distance should be included in the regressions. To obtain the distance data, we checked the distance between a manufacturer’s headquartersFootnote 17 and the location of the dealer’s municipal government with the use of the leading web mapping service (maps.baidu.com), which is the Chinese version of Google Maps. The technology of this website, which is provided by Baidu,Footnote 18 offers route selection for travelling by car and provides three different types of paths and associated distances for each pair of departure and destination locations: the recommended, shortest, and no-highway paths. For each type of path, three different plans are available. We choose the distance of the first plan in the recommended paths. This gives \(distance _{im}\) between the city of brand i’s headquarters and market m. For imported brands, we use the address of their general distributor in China as the headquarter location. Most of the imported brands were located in either Beijing or Shanghai.

Brand characteristics are the key factors that affect a dealer’s investment; therefore, we also collected data on brand characteristics from autohome.com. We first collect the key vehicle features, including brand, model name, MSRP, cylinder size, transmission type (auto or manual transmission), wheel drive, domestic or imported, body type, and model year. A car model with an unique set of features in these dimensions is defined as a nameplate.

Using the nameplate-level MSRP of products that was available at the time of data collection (June 2015),Footnote 19 we calculate: the brand-specific average product prices (\(AVGP _{i}\), for brand i)Footnote 20; the normalized standard deviation of product prices (\(STDP _{i}\), which is defined as the ratio of standard deviation of a brand’s product MSRPs to the brand’s \(AVGP\)); and the product assortment of a brand (\(PA_{i}\), which is defined as the number of automobile nameplates of brand i). As suggested by hedonic price theory, \(AVGP _{i}\) measures the brand quality level, and so it should be positively correlated with brand quality. \(STDP _{i}\) and \(PA_{i}\) measure the variety of products. The difference between these two variables is as follows: \(STDP _{i}\) primarily measures the vertical product differentiation of a brand, while \(PA_{i}\) measures the horizontal product differentiation after controlling for \(STDP_{i}\). A brand of higher quality or greater product variety will require more service quality.

Table 4 reports the summary statistics of our data. After dropping those observations with any missing values, we have 20,446 dealer-brand-market relationships (market level retailer) in the data base. The RC of these observations ranges from RMB 0.03 million to about RMB 6.5 billion. Over all the observations, 61.0% of the outlets are set up with a non-exclusive territory, and 37.0% of the outlets are set up as common-agency dealer groups. Brand quality variation is substantial. Also, the market characteristics vary across local markets. For example, the population ranges from 0.08 million to 28.85 million.

We analyze the determinants of the dealer investment summarized in our hypotheses (H1–H3) through a linear empirical model.Footnote 21 Our analysis focuses on the determination of the dealer service and, as noted above, assumes that manufacturers have already pre-determined the quality of their physical product and a suggested retail price. Given that we lack information on dealer service from either the experience of customers or the monitoring of dealers by manufacturers, we test the theory by investigating the relationship between RC and product quality, aggregate demand, and market structure. According to the descriptive features that we presented above, the distribution of dealer investment approximates a lognormal distribution; therefore, we take the natural logarithm of RC and regress it on measures of product quality.

Specifically, the estimated RC equation is given by,

where all variables other than \(AD_m\) are defined above. Aggregate demand (\(AD_{m}\)) specifies the key economic indicators that drive returns to the dealers. We measure \(AD_{m}\) in two ways: First, we use continuous demand shifters such as income and population at the city level and then control for the province-level market fixed effect. Second, we control for the city-level fixed effect directly. We also control for other fixed effects at various levels in different model specifications. Finally, \(\epsilon _{ijm}\) is an i.i.d. error term that follows a mean zero distribution.

4.2 Empirical results

Table 5 reports the regression results for four specifications. Specifications (1) and (2) use the normalized standard deviation of product prices and product assortment to measure the product variety of brands respectively, without any control for market fixed effects. Instead, these specifications capture the market aggregate demand with the use of city-level income and population. As the results are not sensitive to the choice of the measurement of product variety, we continue with the normalized standard deviation of product prices for the subsequent analysis.Footnote 22 Specification (3) controls for the provincial fixed effect on the capital requirement, while capturing the city level effects with continuous variables of income and population. Specification (4) uses city-fixed effects to control for market impact on RC.

From the adjusted \(R^{2}\), we find that the model’s fit is better when we have city fixed effects—compared to specification (3) that combines city-level continuous variables with provincial fixed effects—to control for the market effect. This implies that some unobservable city-level factors—such as land rents—may also have significance in explaining the capital requirement. Given that specification (4) yields the best fit, we use results from this specification to interpret our findings, except when we need the estimates of population and income effects to test specific hypotheses.

There are two sets of variables that pertain to brand quality in our empirical model: \(AVGP _{i}\) measures the brand’s average quality, while either \(STDP _{i}\) or \(PA_{i}\) measures the product variety of a brand. \(STDP _{i}\) can also indicate the vertical product differentiation of a brand.

One potential concern with the variable of brand quality is an endogeneity issue. The endogeneity issue with product prices could arise because of two reasons:

First, the dealers’ investment determines their retailing capacity and so their operation costs, which in turn determine their resale prices. Second, dealer investment imposes a competition barrier, which affects the market structure and consequently the brand prices. The first reason will result in variation in resale prices across dealers of the same brand, while the second reason will result in variation in resale prices of the same brand across markets. Since we use MSRP, which is brand specific and invariant across dealers of the same brand and markets, to measure quality, this mitigates the concerns with the endogeneity issues that arise for this reason. We further address this potential endogeneity issue in Sect. 4.3.

Our empirical findings suggest that for brands with higher quality (high \(AVGP _{i}\)) or more variety (large \(STDP _{i}\) or \(PA_{i}\)), the required capital is higher. Specifically, when the average or normalized standard deviation of brand prices increases by one standard deviation from their respective mean level (0.31 for \(AVGP _{i}\) or 0.13 for \(STDP _{i}\)), the RC increases by 18.91% or 12.09%, respectively. This finds support through the positive coefficients of both \(STDP _{i}\) and \(PA_{i}\) (specification 2). Intuitively, a brand with higher quality (\(AVGP _{i}\)) and more product variety (\(STDP _{i}\) or \(PA_{i}\)) should require enhanced service efforts to cover the enhanced product quality and variety. All of these results are consistent with our theory: RC underwrites promotional services and retailer quality. This supports H1.

Measuring the impact of \(AD_{m}\) on dealer investment, the coefficients of \(\log(income_{m})\) and \(\log(pop_{m})\) in specifications (1)–(3) are positive and significant: A dealer’s RC is higher when potential demand is higher, which in turn generates higher returns. These results support H2.

The coefficient of \(Y_{ijm}^{b}\) is negative and significant: A brand requires less capital for its non-exclusive dealers in a market. As was discussed above, a non-exclusive territory arrangement indicates a less important role for dealer service in the vertical relationship, which explains a lower requirement on dealer investment. The coefficient of \(Y_{ijm}^{d}\) is positive and significant. As was discussed above, such a result could be explained by either the higher RC requirement from the manufacturer or dealer group self-selection (or both): On the one hand, the manufacturers would set up higher RC requirements on common-agency dealers to incentivize more dealer inputs so that they can avoid the potential free-rider problem if the manufacturers have to make an investment in dealerships. On the other hand, the dealers who serve a single brand face hold-up problems and so have less incentive to make a large investment; the common-agency dealers that can diversify their dealership investment, however, will invest more than do the single-brand dealers. Thus, our results support H3.

Table 6 provides statistical evidence that supports the dealer-focused explanation above. We can categorize all retailing outlets into three types: the single outlet (or the sole outlet of a dealer in a city); the entry outlet (the first outlet of a dealer in a city); and the expansion outlet (the outlets that are additional to the first dealer in a city). The sample average RC size is RMB 11.93 million. The RC size for the single outlet is RMB 10.02 million, while for multiple-outlet dealers it is RMB 16.32 million for their entry outlets and RMB 13.80 million for their expansion outlets.Footnote 23 The claim is that multiple-outlet dealers typically have larger RC than the single-outlet dealers with a corresponding self-selection by dealers along the lines of their access to capital.Footnote 24 This self-selection behavior is consistent with the previous literature on enhanced reputational capital (e.g., Cabral and Mata, 2003; Lucas, 1978).

However, the previous studies could not explain the difference in RC size between the entry and expansion outlets. If the dealers could accumulate sufficient investment capital and managerial ability as their dealership ages, they could invest more capital in brands with higher capital requirement; but our observations show that the average RC is lower, rather than higher, when dealers expand their retailing channels. Our competition hypothesis, however, suggests that these observations may be driven by dealers’ optimal choices for diversification across auto brands once the dealers have established initial reputational capital.

The coefficient of \(log( distance _{im})\) is insignificant: The distance between the target market and the manufacturer’s location has no impact on dealers’ investment decisions: Agent-principal problems that might be related to distance do not appear to be present for Chinese automobile retailing—at least as represented by the dealers’ RC.

Finally, the positive and significant coefficient of \(age_{ijm}\) suggests that, in Chinese auto retailing, RC is larger for longer-lived firms.Footnote 25 This result is also consistent with our screening theory. The claim is that investment is greater when the expected returns are higher. If the firms have rational expectations, a longer lifetime generates a higher present value of total lifetime returns, which justifies higher investment. Hence, RC also indicates the investors’ beliefs in their survival in this industry, and the positive coefficient of \(age_{ijm}\) reveals these beliefs.

4.3 Robustness checks

Table 7 presents results for various robustness checks. We deal first with potential endogeneity concerns with respect to \(AVGP _{i}\) and \(STDP _{i}\). As noted, in a two-stage model, when manufacturers make decisions on MSRP, they factor in their dealers’ service quality to guarantee that dealers can survive when they supply the desired services. In this case, \(AVGP _{i}\) and \(STDP _{i}\) could be correlated with omitted variables in the RC regression (Eq. 1), such as the product markups.

To tease out this potential correlation, we construct a quality index with the use of a hedonic price model.Footnote 26 In this way, the predicted quality index \(\widehat{ AVGP _{i}}\) and \(\widehat{ STDP _{i}}\) depend only on the key features of products, but are independent of factors other than quality. Column (1) reports the results for a model specification that replaces \(AVGP _{i}\) and \(STDP _{i}\) with their respective fitted values \(\widehat{ AVGP _{i}}\) and \(\widehat{ STDP _{i}}\). The estimation results that use such a quality index are very close to those that are reported in Table 5 that use price as a quality index.

Brand-specific factors other than quality level may also differentiate brands’ requirements with respect to RC; therefore, we control brands’ heterogeneity using brand fixed effects in addition to the city fixed effects in column (2). The brand fixed-effect analysis also addresses the potential concerns with regard to the endogeneity of \(AVGP _{i}\) that arises from the potential correlation between product quality and the requirement of dealer investment at the brand level that could be due to brand unobservable features. The results directly support H3.

In addition, the estimated coefficients of the other variables are similar to those in column (1) in both direction and significance level, except for the distance coefficient. Without controlling for the brand fixed effects, the coefficient on distance is insignificant, while it becomes positive and significant after controlling for the brand fixed effects. This could be the consequence of brands’ endogenous location choices: High-quality brands choose to enter large cities and impose the appropriate RC requirement regardless of the distance; in constrast, low-quality brands enter cities of various distances and impose higher RC requirement on dealers in remote cities so as to encourage the delivery of the desired services. Therefore, the impact of distance on RC becomes salient only when the brand effects are controlled.

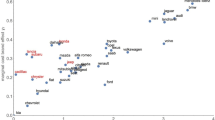

To provide supporting evidence for H1, we first run the regression using variables as specified in column (2) of Table 7 and save the fitted value of the brand fixed effects (\(\widehat{ BF_{i}}\)); then, we produce the scatter plots of brand fixed effects against the logarithm of average product prices ( \(log( AVGP _{i})\)) in Fig. 3a), and the normalized standard deviation of product prices (\(STDP _{i}\)) in Fig. 3b,Footnote 27 respectively.

Correlation among brand fixed effects, logarithm of average product prices [log(AVGP)] and normalized standard deviation of product prices (STDP). Note: All the data that involve normalized standard deviation of product prices (STDP) are restricted to STDP<0.8 so as to eliminate the influence of the outliers

Visually, the slopes of these two diagrams are different: The slope for Fig. 3a is positive, which indicates a positive correlation between the average prices and brand values; the slope for Fig. 3b is almost zero, which suggests that the correlation between the standard deviation of product prices and brand values is weak. More clearly, Fig. 3c shows the 95% confidence intervals of the respective estimated coefficients of \(log( AVGP _{i})\) and \(STDP _{i}\) in the regressions of the brand fixed values. Clearly, the coefficient of \(log( AVGP _{i})\) is statistically positive at the significance level of 5%, while that for \(STDP _{i}\) is not statistically different from zero. In sum, Fig. 3 shows that the brand fitted value is positively correlated with \(log( AVGP _{i})\), but it is uncorrelated with \(STDP _{i}\).Footnote 28

Columns (3) and (4) of Table 7 present results that control for the effects of confounding factors on RC, predicted by alternative theories. As was noted above in Sect. 2.4.4, previous literature suggests that financial constraints (Cabral & Mata, 2003) or managers’ capacity constraints (Lucas, 1978) may determine RC, which implies that dealers that survive a longer time are less subject to a brand’s minimum RC requirement since the financial and managerial constraints usually apply to new firms and loosen as firms age. Therefore, to control for the potential effects of such constraints, we run the regression using subsamples that consist of dealers that have been in the business for over five years and over 10 years and then respectively report the results in columns (3) and (4) of Table 7.

The results are still similar to those in Table 5, although the coefficients of both \(AVGP _{i}\) and \(STDP _{i}\) are of lower magnitude for dealers that had survived over 10 years than those for dealers that had survived over five years. This suggests that financial and managers’ capacity constraints may play a role in RC determination (as the magnitude of RC dependence on quality decreases), but they cannot fully explain the causal relationship between product quality and RC: The RC dependence on quality is still significant even for dealers of over 10 years. In addition, the indicator for non-exclusive territory becomes insignificant for dealers that had survived over 10 years, which suggests that for a retailer that accumulates experience and managerial capacity as it ages, the manufacturers do not have to impose a higher RC requirement on this dealer for being a sole dealer of a brand in a market.

Column (5) presents results that use the data of mass-market brands; we remove brands whose average prices are either below the 1% quantile or above the 99% of the average price distribution. Our main conclusions remain unchanged.

Finally, we aggregate the data at the brand-city level, so as to mitigate the effect of dealer heterogeneities. Correspondingly, we drop the retailer-specific variables \(Y_{ijm}^{b}\) and \(Y_{ijm}^{d}\) and use the brand-city average of the other variables to estimate the model. Column (6) presents the results, which are very similar to those in Table 5. Again, our main conclusions remain unchanged.

4.4 Subgroup analysis

Some driving factors of RC other than brand quality may also mitigate the causal effect of brand quality on RC; therefore, we conduct subgroup analysis along various dimensions of the data so as to examine the heterogeneities in the effects of brand quality on RC and present the results in Table 8. To make the coefficients of subgroups directly comparable, we also present the results from pooled regressions with interactions between the group dummy variable and the independent variables in Table 10.Footnote 29

We first analyze the effects of city size on model coefficients. We categorize all cities into two subgroups, large cities with a population over 5 million,Footnote 30 and small cities that are less populated. The estimation and Chow test results in column (1) show that the model coefficients are different between these two sub-samples. In particular, the positive effect of brand quality on RC is mitigated in large cities, compared to that in small cities. One possible explanation is that because of economies of scale, the marginal service cost is lower in large cities than in small cities, and so retailers have a greater incentive to provide quality services in large cities than they do in small cities. Therefore, the incentive requirement on RC in large cities does not need to increase in brand quality as much as it does in small cities.

Second, we categorize all brands into two subgroups: luxury brands with an average price that is over the 95% quantile of the average price distribution (around RMB 0.45 million) and standard brands with a price that is less than this cutoff.Footnote 31 The results in column (2) suggest that the parameter estimates are quite different between these two subgroups. The coefficient of the luxury dummy variable in Table 10 suggests that the RC for the luxury brand retailers is on average 159.97% higher than that of the standard brand retailers,Footnote 32 everything else equal; however, the RC does not vary in brand quality for luxury brands as it does for standard brands. This finding suggests that there could be a cap on the causal effect of brand quality on RC: Above the cap, the RC ceases to vary in brand quality.Another possible explanation is that the luxury-brand dealers could invest more than the required RC so as to signal that they do not have any financial constraints, while the standard-brand dealers usually just meet the requirement.

The other salient difference between the luxury-brand and standard-brand subgroups lies in the coefficients of non-exclusive territory (\(Y^{b}\)) and firm age (age). The coefficient of \(Y^{b}\) for the standard-brand dealers is of the same sign and magnitude as that in Table 5; however, the same coefficient for the luxury-brand dealers is positive and significant, which is opposite to the previous findings that use the pooled data. The intra-brand competition will generate two effects on the dealers: On the one hand, the competition will incentivize service inputs, which enlarges the return for all dealers; however, on the other hand, the competitors have to share the enhanced demand as they compete with each other. Luxury brands typically have lower demand, which may be less sensitive to promotion efforts; therefore, the business competition effect may dominate; and so the individual dealer sales under intra-brand competition may be lower than that under the exclusive territory. Hence, the manufacturers could demand higher RC to guarantee that the dealers can deliver enough services and survive the competition.

The RC of luxury-brand dealers depends negatively on the dealers’ age, while that of standard-brand dealers increases with their age. For luxury brands, this could be explained by the following theory:

In their life spans, the luxury brands have more consistent RC requirements than do standard brands since their products change less over time. In other words, the RC of luxury brands is more likely to stay at its initial level. At the same time, a greater age means an earlier entry date, when the competition was less intensive and the initial RC requirement was lower. Therefore, we observe lower RC for luxury brands that have entered the market earlier. For standard brands, both product quality and variety are dynamic; therefore, the requirement could change, and so the dealers have to increase their RC accordingly.

Figure 4 presents the normalized standard deviation of brands’ average product prices by brand types over nameplate years. It shows that the variation in luxury brands’ average product prices stays close to 0.5 over years, except for 2014, which is more stable than that of the standard brands. This provides evidence that supports our argument.

Normalized standard deviation of brands’ average product prices over nameplate years (2011–2015). Note: The normalized standard deviation of brands’ average product prices is calculated by \(\frac{\sigma \textit{(AVGP)}_{t}}{\mu \textit{(AVGP)}_{t}}\), where \(\sigma \textit{(AVGP)}_{t}\) is the standard deviation of brands’ average prices of products introduced in nameplate year t, and \(\mu \textit{(AVGP)}_{t}\) is the mean of brands’ average prices of products introduced in nameplate year t. We calculate this measure for both luxury brands, whose average product prices are above the 95% quantile of the distribution of brands’ average product prices, and the standard brands.

Third, we categorize retailers into two subgroups based on the number of brands that their respective dealer groups carry: common-agency dealers, or solo-brand dealers. Column (3) of Table 8 presents the results of the estimation together with a Chow test. It shows that the quality effects (as measured by \(STDP _{i}\)) on RC are smaller for common agency than for solo-brand dealers. Intuitively, the common agency’s performance on one brand provides reputational reference for the other brands. When the manufacturers are partially informed of the dealers’ performance, they may set lower RC requirement. However, solo-brand dealers have no reputational carryover for manufacturers’ reference; consequently, manufacturers may increase their required RC as a screening mechanism for dealer selection. Similarly, the indicator for non-exclusive territory is insignificant for common agency: Once a dealer handles multiple brands, the manufacturers receive information from the common agency’s performance from these other brands and thus do not have to impose higher RC requirement for exclusivity, which results in a consistent RC requirement between exclusive and non-exclusive territories.

Finally, we categorize retailers into two subgroups based on their vintage: senior retailers with more than 10 years of experience and junior retailers with less experience. Column (4) presents the results. The coefficients on the quality variables \(AVGP _{i}\) and \(STDP _{i}\) are significantly lower in the senior group than in junior group. Other salient differences in the estimation results between these two subgroups lie in the coefficients of age and the indicator of non-exclusive territory: For the senior retailers, their RC increases in age, while for the junior retailers, their RC decreases in age.

Cabral and Mata (2003) and Lucas (1978) both suggest that dealers are more likely subject to financial or managerial constraints at their beginning and evolve into larger sizes over years as the constraints no longer bind. This is a vintage effect. This could apply to the auto dealers in our study: Dealers in the senior group are less likely to be subject to financial or managerial constraints. Their sizes increase over years as their capital accumulates.In contrast, dealers in the junior group are more likely to be subject to financial or managerial constraints. If so, these dealers can meet only the minimum requirement for RC. They may not have enough time to accumulate RC, which implies that their RC is likely to stay at its initial level.

Meanwhile, a greater age also indicates an earlier establishment date. Since the RC requirement could be lower for earlier than for later entrants, as the competition over time becomes more intensive in this dynamic market, the observed RC could decrease in firm age for the junior dealer subgroup. The above discussion implies that Cabral and Mata (2003) and Lucas (1978) can only partially explain the size of RC. Our theory extends their theory and better explains the RC variation in the car retailing industry in China.

As for the insignificance of the indicator of non-exclusive territory for the senior retailers, similar to the scenario discussed in column (4) of Table 7, senior retailers can accumulate experience and managerial capability that can convince manufacturers not to impose a higher RC requirement on a dealer for being a sole dealer of a brand in a market.

5 Conclusion

This paper proposes a competition theory to explain the observed stylized facts about retailer registered capital (RC) in the Chinese automobile industry. Three research hypotheses summarize our market analysis. Our empirical analysis supports these hypotheses and suggests that registered dealer capital serves manufacturers as a screening device, an instrument, and an incentive mechanism in selecting dealers and motivating retail performance by dealers.

The importance of dealer investment lies in its relationship with a firm’s performance in the market, although debates about the relationship persist. Both theory (e.g., Iyer and Kuksov, 2010) and empirical evidence (e.g., Hall & Weiss, 1967; Agarwal & Audretsch, 2001; Luttmer, 2007) support the claim that entry investment plays a significant role in determining firm performance. Previous research, however, also provides evidence that shows a negative effect of firm size on firm performance. Evans (1987a, 1987b) finds an inverse growth-size relationship, which contradicts the prediction of Gibrat ’s (1931) law. Although these previous studies fail to reach an unambiguous conclusion about the relation between firm size and performance, they suggest that entry investment is important in understanding and predicting firm performance through its link with firm size. As a particular strategy, investment encourages rapid take-off that shortens the risky and resource-intensive market introduction time (Montaguti et al., 2002).

Our analysis of the determinants of dealer investment is consistent and underscores the importance of retailers’ capital investments in promoting vehicle sales and vehicle sales growth in China.

Notes

The “Measures for Implementing the Administration of Brand Sales of Automobiles ” and the “Automobile Trade Policy” are two examples of legislation that requires the connection of sales and service.

Order No. 16 (2005) of the Ministry of Commerce, August 10, 2005.

The Chinese auto market also has auto supermarkets that can sell multiple brands but cannot obtain autos directly from auto manufacturers (see Appendix 1.2). These outlets are not in our sample.

“Registered Capital of Foreign Invested Enterprises in China: Not as Scary as it Seems”, Lehman, Lee and Xu’s Briefing Paper Series, by Lily Han, Kelly Zong and Wei Wei Ye.

Prior to the 2005 revision, the minimum requirement on RC was RMB 3 million for a limited liability company, RMB 10 million for a joint stock limited company, and RMB 50 million for a listed company. In 2005, the minimum requirement was reduced to RMB 0.3 Million for a limited liability company, RMB 5 million for a joint stock limited company, and RMB 30 million for a listed company.

https://www.ftms.com.cn/footernav/dealerrecruit, the fourth paragraph.

See the link in the previous footnote, item 2(2).

In the taxonomy of Kirmani and Rao (2000), these up-front quality investments by the dealer are default-independent signals of unobservable quality.

A Kolmogorov-Smirnov test is done to test the hypothesis that the fitted distribution is identical to a normal distribution with mean and standard deviation equal to the sample counterparts. The test statistics suggest to reject the null hypothesis. The p value of this test is shown in Fig. 1.

As the market is defined at the city level, under an exclusive territory arrangement, an exclusive-territory dealer is the only one who obtains the rights from a manufacturer to market a car brand within the city. By contrast, under a non-exclusive territory arrangement, multiple dealers have the rights to sell the same brand in the city.

As we have no access to the contracts between the manufacturers and dealers, we can only infer the exclusivity status through observing the number of dealers of a brand in a market. At the time of data collection, if a brand had only one dealer in a city, we define the dealer as an exclusive-territory dealer; otherwise, it is defined as non-exclusive-territory dealer.

The same dealer in different cities will be counted as different dealers.

The census was conducted with the standard reference time of 12:00 a.m. on November 1, 2010. The official report indicated that the total population of China at that time was 1,370,536,875 people. The census registration targets refer to individuals who were present within the territory of the People’s Republic of China at the standard census reference time and Chinese citizens who were residing outside the territory of China but were not settled as immigrants. It does not include residents of Hong Kong, Macau, and Taiwan who were temporarily staying within the territory of the People’s Republic of China, as well as foreign nationals.

We do not use the daily exchange rate even although the dealers’ establishment dates are available since the foreign exchange markets in US could be closed on some special establishment dates of China such as weekends and the US holidays.

Specifically, we use the establishment date information to retrieve the market structure at a dealer’s respective entry time. Since we do not observe dealer exits, however, this method may overestimate the scenarios of \(Y_{ijm}^{d}=0\) and \(Y_{ijm}^{b}=0\).

Quite a few manufacturers have several assembly factories in different locations. Since the distance variable is a measure of how well a manufacturers is familiar with the target market, and the managerial decisions are usually made from the brand’s headquarters, we use the location of a brand’s headquarters to measure the distance. For imported brands, no manufacturer headquarters exist in China. We use the address of the imported brand’s general distributor to derive the distance. For those brands without general distributor’s information, we choose the distributors in Beijing or Shanghai—whichever is available in the listed order.

Baidu is a Chinese multinational technology company that specializes in Internet-related services and products.

Our database covers the cars that were introduced to the market from 2007 to 2015.

\(AVGP _{i}\) is computed as the simple unweighted average of national MSRP for nameplates.

The proposed theory could be constructed into a two-stage game theory model, where manufacturers move first and dealers move subsequently. When this is solved recursively, we assume that the manufacturers know the dealers’ actions and take these into account when defining dealer contracts, while dealers take these manufacturer decisions as pre-determined when they select their quality inputs. The empirical analysis in this paper is focused exclusively on the second stage of dealer decisions. The reduced-form solution to the structural model could be non-linear. In this case, our linear model is the first-order approximation of the RC solution to the structural model.

These two measures of product variety are positively correlated (correlation coefficient = 0.49); however, the correlation between average product price and these two respective measures is in opposite direction: the correlation coefficient of \(AVGP _{i}\) and \(STDP _{i}\) is 0.17, while the correlation coefficient of \(AVGP _{i}\) and \(PA_{i}\) is − 0.14. Our results are insensitive to the choice of variety measures, which suggests that both variables are valid measures for product quality variation when average prices are controlled.

The lower RC for the expansion outlets than the entry outlets could be due to the economies of scope by dealers. Or perhaps the manufacturer of the brand expansion outlet is reassured that the dealer already has some experience (a “track record”), and the manufacturer is consequently comfortable with a lower RC. We thank the editor Lawrence White for these insights. Appendix 1.5 provides more analysis of the heterogeneity among dealers of the entry and expansion outlets.

We acknowledge that there could be an alternative theory that could explain the same observations: For example, another possible explanation for multiple-outlet dealers having larger RC is that these dealers also choose to enter larger cities for their expansion outlets. We found the mean of city population for multiple outlets is larger than that of single outlets by a magnitude of about 1 million.

Our data is cross-sectional, so we do not observe the path of capital changes directly. Our interpretation of the coefficient of \(age_{ijm}\) is based on the comparison across firms with different ages. We do not observe exits, but we assume that only firms with lower profitability will exit from the market.

See Appendix 1.3 for the estimation results of this regression.

All the analysis that involves \(STDP _{i}\) in Fig. 3 is restricted to \(STDP _{i}<\)0.8.

A more rigorous test on H1 and H2 is to regress the estimated brand fixed effects \(\widehat{BF_{i}}\) on \(AVGP _{i}\) and \(STDP _{i}\) with the use of brand-level data and regress the estimated city fixed effects \(\widehat{CF_{m}}\) on population and income with the use of city-level data. Saxonhouse (1976) suggests that the estimation results will be the same as those that substitute the brand- or city-level regressors into the regression of RC directly, as is shown in column (1) of Table 5, when we do not have additional control variables in the brand- and city-level analysis. This is because the variation of quality measures such as \(AVGP _{i}\) and \(STDP _{i}\) are at the brand level, while the demographic characteristics such as income and population are at the city level.

The difference between these two methods lies in the restrictions on the city fixed effects: The separate regression on subgroup data does not have restrictions on city fixed effects, while the pooled regression assumes that the fixed effects are the same for subgroups. When the fixed effects are exclusive, results from both methods are identical as shown in the first subgroup analysis about city size (Saxonhouse, 1976).

This group includes cities in the categories of extra-large or super cities following Notice of the State Council on Adjusting the Standards for Categorizing City Sizes (2014); see Table 2 for detailed categories.

We drop an outlier in the price distribution. The MSRP of this product (a luxury product of brand Redflag) is over RMB 9 million, which is usually not available in the retailing channels.

This difference is estimated by \(\exp((luxury\times \bar{X}^\prime )\beta ) - 1\), where \(\bar{X}\) is the vector of all covariates in the interaction terms evaluated at their means; and \(\beta\) is the vector of coefficients of the interaction terms between luxury and the covariates.

Article 10 and 12, ATP.

Most dealers sell only SUVs (Sports Utility Vehicles), MPVs (Multi-Purpose Vehicles) or sedans, although passenger vehicles also include buses. Hence, these dealers account for a larger share of the distribution of SUVs, MPVs and sedans.

We thank the editor Lawrence White for this insightful advice.

The average wage is for all industries. Ideally, we could use the wage particular to the car retailing sector for analysis. However, we could not obtain the city-level wages for a particular industry, such as “auto mechanic”, “auto salesperson”, or “supermarket checkout clerk”. Such data for retailing sectors are available only at the province level from the China Statistic Bureau. As they show only cross-sectional variation in 2015, the provincial wages would have perfect collinearity with the province fixed effects.

If there are multiple entries of outlets for the same dealer in a city on the same date, we randomly pick one of them and regard it as an entry outlet, although this is rarely observed in our sample.

References

Agarwal, R., & Audretsch, D. B. (2001). Does entry size matter? The impact of the life cycle and technology on firm survival. The Journal of Industrial Economics, 49(1), 21–43.

Angelini, P., & Generale, A. (2008). On the evolution of firm size distributions. The American Economic Review, 98(1), 426–438.

Besanko, D., & Perry, M. K. (1993). Equilibrium incentives for exclusive dealing in a differentiated products oligopoly. The RAND Journal of Economics, 24(4), 646–667.

Blair, B. F., & Lewis, T. R. (1994). Optimal retail contracts with asymmetric information and moral hazard. The RAND Journal of Economics, 25(2), 284–296.

Bouwens, J., Cardinaels, E. & Zhang, J. (2015). Principals and their car dealers: What do targets tell about their relation?. SSRN.

Bruce, N., Desai, P. S., & Staelin, R. (2005). The better they are, the more they give: Trade promotions of consumer durables. Journal of Marketing Research, 42(1), 54–66.

Cabral, L. M. B., & Mata, J. (2003). On the evolution of the firm size distribution: Facts and theory. American Economic Review, 93(4), 1075–1090.

Chu, W., & Chu, W. (1994). Signaling quality by selling through a reputable retailer: An example of renting the reputation of another agent. Marketing Science, 13(2), 177–189.

Djankov, S., La Porta, R., Lopez-de Silanes, F., & Shleifer, A. (2003). Courts. The Quarterly Journal of Economics, 118(2), 453–517.

Evans, D. S. (1987). The relationship between firm growth, size, and age: Estimates for 100 manufacturing industries. The Journal of Industrial Economics, 35(4), 567–581.

Evans, D. S. (1987). Tests of alternative theories of firm growth. Journal of Political Economy, 95(4), 657–674.

Fan, Y., Kuhn, K.-U., & Lafontaine, F. (2017). Financial constraints and moral hazard: The case of franchising. Journal of Political Economy, 125(6), 2082–2125.

Fang, H., Gu, Q., Xiong, W., & Zhou, L.-A. (2016). Demystifying the Chinese housing boom. NBER Macroeconomics Annual, 30(1), 105–166.

Fein, A. J., & Anderson, E. (1997). Patterns of credible commitments: Territory and brand selectivity in industrial distribution channels. Journal of Marketing, 61(2), 19–34.

Gibrat, R. (1931). Les inégalités économiques. Recueil Sirey.

Hall, M., & Weiss, L. (1967). Firm size and profitability. The Review of Economics and Statistics, 49(3), 319–331.

Hu, W.-M., Xiao, J., & Zhou, X. (2014). Collusion or competition? Interfirm relationships in the Chinese auto industry. The Journal of Industrial Economics, 62(1), 1–40.

Iyer, G., & Kuksov, D. (2010). Consumer feelings and equilibrium product quality. Journal of Economics & Management Strategy, 19(1), 137–168.

Kalnins, A., & Lafontaine, F. (2013). Too far away? The effect of distance to headquarters on business establishment performance. American Economic Journal: Microeconomics, 5(3), 157–179.

Kekre, S., & Srinivasan, K. (1990). Broader product line: A necessity to achieve success? Management Science, 36(10), 1216–1232.

Kessler, F. (1957). Automobile dealer franchises: Vertical integration by contract. The Yale Law Journal, 66(8), 1135–1190.

Kirmani, A., & Rao, A. R. (2000). No pain, no gain: A critical review of the literature on signaling unobservable product quality. Journal of Marketing, 64(2), 66–79.