Abstract

I investigate the effect of competition on quality in the internet service provision industry: I examine both local competition within markets and multimarket contact among firms across markets. This industry offers an ideal setting, as quality is both objective and measurable. I use data from speedtest.net from 2008 to 2014 to estimate a reduced-form model of the effects of local competition and multimarket contact on realized consumer download speeds. I find that increased multimarket contact leads to decreased download speeds, which is consistent with the mutual forbearance hypothesis. I also find that duopolies lead to faster download speeds than do monopolies, but that further increases in the number of competitors decrease speeds.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

“The path from narrowband, to broadband, to high-speed broadband, was forged by competition... The simple lesson of history is that competition drives deployment and network innovation. That was true yesterday and it will be true tomorrow.” - Tom Wheeler, FCC Chairman, 2014

This statement reflects an expectation that is held by many: that when firms face greater competition they respond by increasing the quality of their product. While analyses of market structure often focus on prices, competition is also an important determinant of product quality. This paper investigates the effect of competition on product quality in the internet service provision industry. Specifically, I investigate the effect of local competition and multimarket contact on the download speeds that are offered by internet service providers (ISPs). At the local level, when ISPs make quality decisions, they must respond to the actions of rival firms within the market. This competition may incentivize a firm to increase its quality in order to attract consumers. But, since quality adjustments are costly, such investments may not be profitable when the market is highly competitive and market shares are low. Thus, the marginal effect of local competition on quality is likely to vary with the level of competition. Indeed, work as early as Archibald (1964) remarks on the ambiguity of the effect of increased competition on quality.

Moreover, many ISPs interact repeatedly across markets. The mutual forbearance hypothesis contends that when firms compete against one another in multiple markets, they “may hesitate to fight local wars vigorously because the prospects of local gain are not worth the risk of general warfare (Edwards, 1955)”. Bernheim and Whinston (1990) formalize this intuition: They show that when a pricing game is played in a single market, firms’ incentives to deviate from cooperation may render collusion impossible. But, if these firms instead interact in many markets, rivals can punish a firm for deviating by reducing prices in other (or all) jointly contested markets. Their incentive constraints are pooled across markets, which may generate a cooperative equilibrium in which prices remain high.

This argument translates to the quality dimension of competition as well, where multimarket contact can instead facilitate cooperative quality-setting among firms. In fact, it is plausible that in such settings, cooperative quality-setting may be more feasible than price coordination. Since quality is often ambiguous and subjective, deviations from the cooperative qualities may be more difficult to detect. However, it is theoretically ambiguous as to whether this cooperation will increase or decrease qualities, relative to those chosen in a competitive setting. Under a collusive agreement, firms may choose to offer lower quality in order to decrease costs; or, they may instead find it profitable to increase quality in order to further increase prices.

The internet service provision industry is ideal for the study of product quality, as it offers a rare setting in which quality is plausibly one-dimensional. Consumers’ internet experiences are overwhelmingly determined by their download speed, as this determines their ability to view web pages, emails, stream video and music, and most other typical online activity. Moreover, the actual speeds that consumers enjoy are observable and measurable: the rate at which consumers download data, which is measured in Megabits per second (Mbps). This industry is also especially well-suited for the study of multimarket contact, as it is dominated by a small set of firms that overlap in many markets. Due to the regional nature of ISPs’ territories and the existence of smaller local providers, there is considerable variation in the degree of multimarket contact across markets, as well as across firms within markets. Further, ISPs exercise a very limited degree of price discrimination: They typically charge the same price for a given plan across all of their markets—irrespective of local demographics or competition. Firms therefore compete more intensely through their choice of download speeds, thereby potentially channeling the effect of multimarket contact into the quality dimension.

Understanding the effects of local competition and multimarket contact on internet service quality is important, since access to high-speed internet is critical to full participation in the economy—especially in the wake of the COVID-19 pandemic. From October 2020 through April 2021, 52% of U.S. workers worked remotely at least some of the time, with 33% working exclusively from home.Footnote 1 Among those working remotely, 81% used video conferencing, a service that requires a stable high-speed internet connection.Footnote 2 In 2020, nearly 93% of households with school-age children participated in distance learning, while only 71% of households report that internet access is always available for educational purposes.Footnote 3 Quality internet access also enables: online job searches, which lead to shorter unemployment spells (Kuhn and Mansour 2014); online price comparisons, which reduce prices (Morton et al. 2001; Brown and Goolsbee 2002); and online commerce, music and video streaming, and many other welfare enhancing activities. It is therefore essential to understand the degree to which market forces shape the quality of internet access.

In this paper, I use user-generated download speed data collected through speedtest.net to estimate the effects of local competition and multimarket contact on product quality within a unified reduced-form framework. This approach allows me to capture both of these important channels through which competition may affect quality in a single model. Moreover, since greater local competition opens up new avenues for multimarket contact, controlling for local competition is critical to identifying the effect of multimarket contact on quality. Local competition enters the empirical model as a set of dummy variables, which allows its effect on product quality to vary with the number of firms that operate within a market. Consistent with the existing literature, an ISP’s multimarket contact within a given market is measured as the average number of markets in which it competes against each of its within-market rivals.

Given the endogenous formation of market structure, I instrument for local competition with the use of the number of ISPs that are present in neighboring cities. Economies of scale and scope incentivize ISPs to locate in many cities within a region, which makes the number of ISPs in a nearby city a good indicator of the market structure in a given market. At the same time, quality is determined by the ISPs’ “last mile” infrastructure within a local market, and thus its determinants are unlikely to be correlated with their entry into other cities within the region.

Multimarket contact, on the other hand, is driven by two sources of variation. First, entry into a local market will increase multimarket contact for incumbent firms if they already compete against the entrant in other markets. Second, a firm’s multimarket contact will increase if a local incumbent rival enters some other market in which the first firm also operates. While the first source of variation is likely endogenous, rivals’ entry into external markets is exogenous to the market at hand. Therefore, I instrument for multimarket contact by constructing a simulated measure that is equal to the multimarket contact that would result if a firm’s local rivals were held fixed for the duration of the sample. Variation in this instrument is then exclusively driven by exogenous entry and exit in external markets.

I find that duopoly markets experience download speeds that are about 2 Mbps greater than those in monopolized markets. However, I find that further increases in the number of local competitors lead to slower download speeds. I also find evidence that greater multimarket contact generates slower download speeds: A one standard deviation increase in multimarket contact is associated with a 2.4 Mbps decrease in download speeds. This result suggests that the mutual forbearance hypothesis indeed extends to quality competition, and that in this industry, the cooperation that is induced by multimarket contact yields lower product quality, as firms aim to increase profits by avoiding costly infrastructure improvements.

The literature on the effect of competition on product quality is relatively sparse, in part because product quality is often difficult to define and measure. For most products, quality is multi-dimensional, as consumers value many aspects of a product. Moreover, these valuations often vary across consumers, with no objective measure of quality. Mazzeo (2003), Prince and Simon (2017), and Chen and Gayle (2019) investigate the effect of competition among airlines on product quality, measured by on-time performance and flight route directness. Matsa (2011) analyzes the effect of competition on quality in the supermarket industry, as measured by the number of out of stock items at competing supermarkets. A number of studies investigate the effect of local competition on product quality in the healthcare sector; these studies use outcomes such as mortality, management quality, and employee patient load (Kessler and McClellan, 2000; Gowrisankaran and Town, 2003; Bloom et al., 2015; Eliason et al., 2020). The effect of local competition on quality in the U.S. internet service provision industry has been studied by Wallsten and Mallahan (2013) and Molnar and Savage (2017), who find that both advertised speeds and actual speeds are faster in more competitive markets. Bourreau et al. (2019) find that in France, competition induced by local loop unbundling leads incumbents to hasten fiber deployment. Landgraf (2020) finds that the threat of future municipal internet service provision leads private ISPs to offer slower speeds.

My work adds to this literature by utilizing a rich panel of data with observations at the city-ISP-day level from 2008 to 2014, which allows for the inclusion of firm, market, and time fixed effects. While Wallsten and Mallahan (2013) and Molnar and Savage (2017) generally agree in their finding that speeds are faster in more competitive markets, the cross-sectional nature of their data prevents the use of market-level fixed effects. These fixed effects play an important role in my analysis, which control for market characteristics (e.g., ruralness) that may affect both ISPs’ entry behavior and quality choices, which may in turn otherwise bias the estimated effect of local competition.

Along with other analyses of the broadband industry, I add to the literature that investigates the effect of competition on product quality through the use of download speed as an objective, scalar measure of product quality. In contrast, much of the previous literature has focused on products for which quality is subjective and multi-dimensional, which may lead to an underestimate of the effect of competition if quality changes manifest in product attributes not studied, or if the focal attribute is measured with error.

The empirical literature on the effect of multimarket contact has almost exclusively focused on firms’ pricing decisions. Evans and Kessides (1994) provide some of the first empirical evidence in support of the mutual forbearance hypothesis. They find that airlines that experience high levels of multimarket contact follow the “golden rule”: They do not initiate aggressive pricing actions on a given route for fear of facing backlash from competitors on other jointly contested routes. Ciliberto and Williams (2015) confirm this finding in the airline industry, and further show that the effect of multimarket contact depends on the cross-price elasticities between airlines. Jans and Rosenbaum (1997) find that multimarket contact increases prices in the U.S. cement industry; Parker and Roller (1997) and Fernandez and Marin (1998) find similar results in the mobile phone and hotel industries, respectively.

Prince and Simon (2009) were the first to analyze the impact of multimarket contact on product quality. They find that in the airline industry, higher contact is associated with increased delays. Further, they find that less competitive markets are more negatively affected by multimarket contact than are highly competitive markets. Similarly, Lin and McCarthy (2023) examine the effect of multimarket contact on health insurance prices and quality; they find that greater multimarket contact causes prices to rise and quality to fall.

My work also adds to this literature through the use of an objective, one-dimensional measure of product quality. Moreover, in most industries, products’ qualities and prices are set jointly, which may generate an ambiguous effect of multimarket contact on quality. In the broadband industry, price competition is negligible, which induces firms to compete on quality; this allows us to observe more directly the effect of multimarket contact.

2 Data and Industry Background

The primary source of data is the Net Index source data, provided by Ookla. Ookla owns and operates speedtest.net: This is a website that allows users to check the actual internet speeds that they receive by downloading and uploading a file to a nearby server. Ookla records these tests and aggregates the results by ISP, city, and day. At this level, Ookla reports the average download and upload speed, the total number of tests conducted, and the average distance from users to their local server for 986 United States cities. Ookla has operated speedtest.net since 2006 and made this data publicly available from January 2008 through January 2014, charging a fee for access thereafter.

This aggregation aligns well with geographic market boundaries in this industry. Since consumers can purchase internet service only from a provider that offers service at their address, and an ISP typically serves the majority of a city,Footnote 4 city boundaries segment the industry into mutually exclusive geographic markets. Therefore, in what follows, I define a market to be a U.S. city. Since some ISPs do serve only a portion of a city, this measure will overstate the degree of competition in some instances. In order to mitigate this potential measurement error, I drop all ISP-market observations that never reach 10% of the total daily tests conducted in a particular market. Table 1 shows that the markets in the data consist of medium to large U.S. cities. When compared against the set of all Census Places in the United States, the sample markets are much larger in population, younger, and with higher median household income and educational attainment. However, the sample markets are very similar to the set of U.S. Census Places with a population of 40,000 or greater. There is no statistically significant difference between their population, income, college education or age, while high school graduation rates are marginally higher in the Ookla sample.

I define an ISP’s local quality to be its download speed, measured in Megabits per second (Mbps). The quality of the typical internet user’s online experience is overwhelmingly driven by her download speed, as this speed determines the rate at which she can download and view content, including web pages, emails, and audio and video streaming. As such, download speeds are by far the most salient product attribute to consumers, and are typically the highlight of firms’ advertising.Footnote 5 Moreover, downloads comprise approximately 85% of users’ internet traffic (Malone et al., 2021).Footnote 6

Under the modern internet architecture, data travels long distances along the backbone: a network of long-distance fiber-optic cables that is operated by tier-1 internet service providers. Then, local (tier-2 and tier-3) ISPs operate the so-called “last-mile” infrastructure: a network that connects subscribers’ homes and businesses with the use of a combination of fiber-optic cables, telephone lines, and coaxial cable. These last-mile ISPs connect their subscribers to internet users around the globe by interconnecting with the backbone at Network Access Points, or nodes, for a negotiated fee (Economides, 2005). In the United States, the vast majority of last-mile internet service is provided by firms that historically provided either wireline telephone service or cable television service. Over time, these firms have upgraded their lines to allow for the bilateral transfer of data, and today provide internet service using digital subscriber line (DSL) and cable technology, respectively. Since fiber-optic cables offer greater bandwidth and faster data transmission speeds, ISPs can increase the speeds that they deliver to consumers by increasing the proportion of fiber in their last-mile network. This requires a significant capital investment, as ISPs must run new wires to each address at which it offers service.

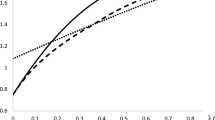

The industry’s transition towards greater fiber usage and faster download speeds can be seen in Fig. 1. Average download speed across all firms and markets increased from 6 Mbps in January 2008 to 20 Mbps in January 2014. There is also considerable variation across providers—and particularly across technologies. Average download speed among the five largest DSL providers increased from 4 Mbps in January 2008 to 15 Mbps in January 2014, while average download speed among the five largest cable providers increased from 8 Mbps to 25 Mbps. Together, these ten firms make up 86% of the observations in the data; they thereby provide a representative picture of the relative capabilities of the two technologies.

Since increasing download speeds requires substantial time and capital, the daily variation in speeds that is measured in the data does not necessarily reflect investments made by firms. In order to represent better the scale at which firms make decisions, I aggregate the data to the ISP-city-month level. I drop all observations from May and June 2010, as they report less than half the number of speed tests than any other month during that year—presumably due to data recording error. I drop all business-only, wireless, and non-infrastructure ISPs in order to focus on the residential wireline broadband industry. Finally, I drop one market and three ISPs that appear only once in the data. This results in a sample of 146,079 observations.

After aggregating the data to the month level, actions undertaken by firms become apparent in the data. By way of a simple example, a press release from CenturyLink dated October 09, 2013 states “CenturyLink launched its first 1 Gbps fiber network in Omaha, Neb. in May 2013. The company expects to have the targeted homes and businesses in Omaha connected with its fiber-to-the-premises (FTTP) technology by the end of October.” Fig. 2 clearly illustrates the impact of this investment on average download speeds, with the months during the upgrade highlighted by the shaded area. Between May and October 2013, the average download speed of CenturyLink customers increased from 7 Mbps to 23 Mbps.

This example also highlights a limitation of the data. Despite the fact that CenturyLink now offers 1 GbpsFootnote 7 download speed, their average speed only reaches 23 Mbps. This occurs because not all customers choose to purchase this tier of service. The data cannot distinguish between customers who purchase different tiers of service from an ISP, as only the average speed among all customers of an ISP within each city is reported. Therefore, all results in this paper represent changes in the average download speed among all customers. Nevertheless, average speeds do provide a useful benchmark, as any improvement in the speeds offered by an ISP will be reflected in their average speed. An additional limitation of the data is that the data do not contain details on ISPs’ bundling practices. ISPs often bundle broadband services with phone service and cable television. It is therefore possible that ISPs respond to changes in competition by modulating the price or quality of these related services, which may dampen their broadband quality response.

A surprising feature of the broadband industry is that firms exercise a very limited degree of price discrimination. The overwhelming majority of ISPs charge identical prices for a given plan in all markets in the United States. While prices are not collected in the Ookla data, in 2014, the Federal Communications Commission (FCC) began collecting its Urban Rate Survey, in which the FCC surveys ISPs in randomly drawn Census tracts throughout the U.S. In analyzing these data, I calculate that for 88% of the plans in the survey, the standard deviation of price across Census tracts is exactly 0. For each plan with a positive standard deviation, I calculate the ratio of the standard deviation to the mean price of the plan. The average value of this statistic across all such plans is 0.046, and the maximum value of this statistic is 0.12. Taken together, these statistics indicate that there is very little price discrimination across markets in this industry. This lack of price discrimination makes the broadband industry an attractive setting for the study of competition and quality, as firms are more likely to compete on quality when prices do not vary.

2.1 Multimarket Contact

I follow Prince and Simon (2009) and Gimeno and Woo (1996, 1999) in measuring multimarket contact as the average number of markets in which a firm encounters its within-market rivals. Specifically, for any two firms, j and k, their total nationwide pairwise contact in period t is defined as

where: m indexes markets; and M is the set of all markets. Firm j’s average multimarket contact within market m in period t is then defined to be

where: k indexes firms; \(J_{mt}\) represents the set (and number) of firms in market m in period t; and \(Contact_{jkt}\) is as defined in Eq. (1). This measure is best illustrated through a simple example: There were three ISPs that operated in Chattanooga, Tennessee in January 2014: AT &T, Comcast, and the Electric Power Board (EPB) of Chattanooga. At that time, there were 227 markets in which AT &T and Comcast competed against one another, and one market (Chattanooga) in which each competed against EPB. Therefore, in this market and month, AT &T’s and Comcast’s MMC are each equal to 114, while EPB’s MMC is equal to 1.

Ultimately, any measure of multimarket contact is somewhat arbitrary, and alternative measures could be considered. For instance, one could simply sum a firm’s degree of contact over its within-market rivals, rather than averaging them. However, such a measure is highly correlated with the number of local competitors, which thereby makes separate identification of the MMC and local competition effects difficult. A further advantage of the average measure that is used in this paper is that the entry of a low-MMC rival decreases the firm’s average MMC, which aligns with the notion that such entry renders collusion more difficult. Instead, one could consider a measure of MMC which averages over all firms in a market and therefore yields a market-level measure of MMC, as in Evans and Kessides (1994). However, this measure sacrifices useful firm-level variation in MMC. In the example of the previous paragraph, we would expect AT &T and Comcast to be influenced by their multimarket contact, but that EPB should have no first-order multimarket contact effect. Finally, we could imagine scaling a firm’s local level of MMC according to the size of its nationwide territory. Such a measure allows a firm to consider the proportion of its markets in which it overlaps with within-market rivals, rather than the raw number of overlap markets. I consider this alternative measure in Sect. 4.3 and find qualitatively similar results.

2.2 Summary Statistics

Table 2 reports summary statistics for each of the variables that enter the empirical model that will be described in Sect. 3.2. The average download speed in the sample was 12.049, with considerable variation across both geography, providers, and time, as is illustrated in Fig. 1. The level of local competition ranges from monopolized markets to hyper-competitive markets with six ISPs, with an average of 2.27 ISPs per market. Figure 3 illustrates that local competition increased during the sample period. While a duopoly was the modal market structure throughout the sample, in 2008, an average of 23% of markets were monopolized and just 10% of markets were served by three or more firms. In contrast, by 2014, just 5% of markets were monopolized and 25% of markets were served by three or more firms. Multimarket contact averaged 92.179 with a standard deviation of 80.403. Since the units of MMC are arbitrary, this standard deviation provides a useful scaling for interpreting the estimates of the empirical model. Finally, the average speedtest.net user was about 73 miles from an Ookla server, a distance that mechanically affects the download speed.

3 Model

3.1 Theoretical Predictions

Within a local geographic market, firms must respond to their rivals in the choices that the firms make, including: prices; investment decisions; product variety; and product quality. One might reasonably hypothesize that when facing a greater number of competitors, firms are induced to offer (on average) a higher-quality product in an effort to poach consumers from their rivals. Similarly, we might expect to observe greater quality dispersion in markets with a greater number of competitors if firms’ costs are increasing in quality. Several empirical studies have found that greater competition in the broadband industry is associated with higher product quality, including Wallsten and Mallahan (2013) and Molnar and Savage (2017). In the internet service provision industry, a firm must invest in laying additional fiber optic cable in order to bring this high bandwidth technology closer to consumers’ homes, which incurs a substantial sunk cost.Footnote 8 When facing a large number of competitors, such an investment may not be profitable for the firm, as its return on investment may be limited by its market share. This would be an especially important consideration for firms if consumers face significant switching costs.

Appendix A develops a simple model of local market competition that is used to characterize the conditions under which optimal quality increases with competition. The model predicts that when the cross-partial derivative of profit with respect to price and quality is positive (or sufficiently close to zero), product quality increases with competition when the market is monopolized, but decreases with competition once the number of firms in the market is sufficiently high. The key intuition that underlies this result is that under these conditions, a marginal increase in quality has a greater impact on revenue when prices are high and competition is low, which thereby incentivizes the firm to increase its quality. The number of firms that constitutes “sufficiently high” is context-specific and depends most closely on the responsiveness of a firm’s demand to its rivals’ prices and qualities. The empirical model I will propose in Sect. 3.2 offers a means of identifying the number of firms required for quality to decrease with competition, if at all.

While local market competition is likely to be an important driver of product quality, these firms also engage with one another in many markets around the United States. The mutual forbearance hypothesis contends that when a firm competes in a local market against a rival that it also faces in other markets, it is less likely to compete aggressively for fear of facing backlash in all of their jointly contested markets. This offers a clear prediction for prices: multimarket contact will increase cooperation between the firms, which allows them to set higher prices. Empirical evidence of this effect has been provided by Evans and Kessides (1994) and others.

In the product quality dimension, however, the outcome is less clear. Theory again predicts that multimarket market contact can facilitate cooperation between firms, but this cooperation has a theoretically ambiguous effect on product quality. On the one hand, cooperation may allow firms to invest less in product quality, which thereby economizes on their fixed costs. On the other hand, cooperation may induce firms to invest more in quality, in the expectation that they can increase their prices enough to offset their additional costs. Ultimately, the sign of the multimarket contact effect depends on consumers’ willingness to pay for higher quality.

In Appendix B, I develop a simple model that illustrates conditions under which a firm will set a higher quality under collusion than under competition. I show that a necessary condition for this outcome to obtain is that the cross-partial derivative of profit with respect to price and quality is positive and sufficiently large. This condition can be met when consumers’ price sensitivity decreases as quality increases, which thereby allows the firm to increase quality in order to increases prices commensurately. By extension, a negative sign on this cross-partial derivative is sufficient to ensure that quality will decrease when firms set qualities cooperatively.

3.2 Empirical Framework

To estimate the effect of both local competition and multimarket contact on download speeds, I estimate the following model:

where: \(s_{jmt}\) represents the average recorded download speed for customers of ISP j in market m in month t; \(MMC_{jmt}\) indicates the degree of multimarket contact that is faced by ISP j in market m in month t; and local competition is captured by a set of dummy variables. This allows the marginal effect of local competition to vary with the number of firms in the market, and thereby captures any non-monotonicity. I truncate this measure such that \(\#ISP_{mt} = 4\) for all markets with at least four firms, since less than 4% of markets were served by four or more firms. Moreover, it is reasonable to expect that the magnitude of the marginal local competition effect diminishes once the number of firms is sufficiently high. Indeed, Xiao and Orazem (2011) find that once a local broadband market has between one and three firms, the fourth entrant has little effect on competitive conduct. \(Distance_{jmt}\) is the average distance of users from the local server that is used to conduct their speed test. This control is included in the model because download speed varies mechanically with the physical distance between the user and the local server. I also include fixed effects to account for unobserved heterogeneity in firms, markets, and time.

3.3 Identification

With the inclusion of these fixed effects, the MMC and local competition effects are identified by variation in an ISP’s deviation from its average speed, the market’s average speed, and the contemporaneous national average speed, across markets and months with differing levels of competition and MMC. Consistency of the OLS estimators requires shocks at the firm-market-month level to be uncorrelated with both the number of firms that serve the market and the degree of multimarket contact. The former condition is likely to be violated, as local market structure arises endogenously. Firms are attracted to a market on the basis of its current conditions—both observed and unobserved; these conditions likely also influence their choice of download speed. For instance, rising incomes in a particular market may induce a firm to enter the market and offer faster speeds, which generates a positive bias in the ordinary least squares estimates.

To address this concern, I instrument for the number of ISPs in a given market with the number of ISPs that operate in its nearest neighboring market. Specifically, since local competition enters the model as a set of three dummy variables, the instruments are a corresponding set of dummy variables that indicate whether the neighboring market has two ISPs, three ISPs, or four or more ISPs. This instrument is similar to the instruments that are used by Fan (2013) and Wilson et al. (2021), who instrument for local competition with the use of neighboring markets’ attributes. The identifying assumption of this instrument is that a market’s number of ISPs is positively correlated with the level of competition in its neighboring market, but that neighboring competition is otherwise uncorrelated with an ISP’s quality choice in the market at hand.

This assumption is well-supported by the history and physical architecture of the broadband industry, which incentivizes ISPs to make regional entry decisions but localized quality choices. ISPs typically have regional territories, which stem from their historical presence as regional telephone and cable television providers. Moreover, as was described in Sect. 2, entry into a new market requires interconnection with the backbone, which also occurs on a regional basis.Footnote 9 Thus, ISPs face a lower cost of entering markets near their existing territory, where an interconnection agreement is already in place. Indeed, this regional presence of ISPs is borne out in the data. On average, each of the ten largest ISPs—which account for 86% of the observations in the sample—serves only 18% of the sample markets. However, conditional on serving at least one market within a U.S. state, each of these ISPs serves 47% of the markets within that state, on average. The first stage estimates that are presented in Table 4 further confirm the relevance of these instruments.

While market entry is typically determined regionally, the validity of this instrument also requires that quality is determined by market-level characteristics, rather than in response to regional shocks. This, too, is supported by the architecture of the broadband industry: ISPs’ local quality is determined by their “last mile” infrastructure, which is largely determined by their choice of fiber-optic, copper, or coaxial cables to connect to subscribers’ homes. ISPs can make this quality decision on a local level, and the data suggest that they do. For each of the ten largest ISPs and each time period in the data, I decompose the variation in download speeds into within-state variation and between-state variation according to the formula for total variance:

where g indexes U.S. states. The first term represents the average within-state variance in download speeds, and the second term represents the variation across states in average download speeds. If ISPs were setting download speeds on a regional basis rather than on a market-specific basis, the unconditional variance in download speeds would be disproportionately driven by variation across states, with little within-state variation in download speeds. Instead, the data reveal that on average, within-state variance accounts for 51% of the unconditional variance in download speeds. This suggests approximately equal variation within and between states; this is a pattern that is inconsistent with ISPs systematically setting quality at a regional level.

A firm’s exposure to multimarket contact may be endogenous as well. Variation in MMC comes from two sources: entry into the local market; and entry into external markets. First, firm j’s MMC in market m will increase if a new firm enters market m and the two firms already compete against one another in other markets. Second, firm j’s MMC in market m will increase if an incumbent of market m enters an external market in which firm j already operates. The first source of variation is likely to be endogenous for the same reason that local competition is endogenous: Local shocks may induce entry into market m, which in turn affects both MMC and the ISPs’ quality decisions. The latter source of variation, however, is exogenous, as any idiosyncratic shocks that affect firm j’s speed decision in market m will be uncorrelated with the factors that drive entry into external markets around the U.S.—most of which are geographically distant from market m.

Therefore, I generate an instrument by calculating a simulated version of MMC: This measure takes on the value that firm j’s MMC would equal if the local market structure of market m were held fixed at its state during the period that firm j first operated in the market. Specifically,

where: \(J_{mt_{0j}}\) is the set (and number) of firms that operated in market m during the initial period that firm j operated in market m; and \(Contact_{jkt}\) is as defined in Eq. (1). By construction, a firm’s \(MMC\_simulated\) is unaffected by entry into market m after the initial period and varies only when an incumbent firm of market m enters an external market, and therefore exclusively captures the exogenous portion of the variation in MMC. This instrument is similar in nature to the instrument that is used by Lin and McCarthy (2023), who use merger-induced changes in firms’ overlap to instrument for local MMC.

The primary threat to the validity of the exclusion restriction of the instruments is that shocks may be correlated across markets. This may arise, for instance, as a result of state-level policies that aim simultaneously to expand broadband availability and increase download speeds. Such spatially-correlated shocks pose a greater threat to the local competition instrument, as variation in \(MMC\_simulated\) is driven by entry into any market in the U.S., while variation in the local competition instruments are driven by entry into neighboring markets.

I address this concern with two alternative specifications. First, I modify the local competition instrument: I exclude neighboring markets that are located within five miles of the focal market. Second, I add a set of state-year fixed effects to the model in order to control for potential state-level broadband initiatives and other state-wide shocks. I will further discuss these alternative specifications and present their results in Sect. 4.3.

4 Results

4.1 OLS Results

The results of estimating Eq. (3) with the use of ordinary least squares are reported in Table 3. Column 1 uses no fixed effects; column 2 uses only market fixed effects; column 3 adds year-month fixed effects; and column 4 adds ISP fixed effects. The \(R^2\) values of the four specifications suggest that the primary driving factor that underlies the differences in observed speeds is systematic differences across ISPs. This is perhaps unsurprising, as Fig. 1 highlights the substantial differences between cable and DSL ISPs. While still important, the market and time fixed effects explain comparatively little of the variation in download speeds. Nonetheless, column 3 highlights the importance of the year-month fixed effects. In the data, both local competition and multimarket contact increased over time, while download speeds continued to increase due to advances in technology. This pattern generates a clear positive bias in the absence of year-month fixed effects.

Column 4 displays the most reliable set of OLS results, as all fixed effects are included. I find that increased multimarket contact leads to slower download speeds. This result is consistent with the mutual forbearance hypothesis and suggests that when multimarket contact facilitates cooperation between firms, they choose lower product quality. In order to interpret the magnitude of this estimated effect, note that the standard deviation of MMC is 80.403. Therefore, a one standard deviation increase in MMC leads to a 0.322 Mbps decrease in download speed. Since the average download speed in the sample is 12 Mbps, the practical effect of multimarket contact is fairly small.

However, multimarket contact should be expected to have its largest impact when firms engage repeatedly across many markets. While many of the ISPs in the data overlap in few markets, there is a substantial degree of contact among the nation’s largest ISPs. Entry of one large ISP into the territory of another therefore has the potential to increase MMC considerably. For example, in January 2014, Comcast and AT &T competed against one another in 227 of the 985 markets. Therefore if AT &T were to enter a market that Comcast serves, Comcast’s MMC could increase by as much as 227, which I estimate decreases download speeds by 0.908 Mbps.

I also estimate that increasing competition from a monopoly to a duopoly results in download speeds that are 0.535 Mbps higher. However, increasing competition to three firms has a small negative but statistically insignificant effect on download speeds. Further increasing the number of competitors to four or more firms decreases download speeds by 0.598 Mbps, relative to a monopoly, though it should be noted that less than 4% of observations contain four or more firms. These effects are also quite small in magnitude, given an average download speed of 12 Mbps over the duration of the sample.

The controls for distance take on the expected sign across all specifications. The further a user is from the nearest Ookla server, the slower is their download speed. Column 4 implies that initially, each additional 100 miles of distance slows the download by 0.089 Mbps, and that the magnitude of this marginal effect decays with distance.

4.2 IV Results

In order to address the endogeneity in local competition and multimarket contact, I estimate the same four specifications with the use of instrumental variables. In Sect. 3.3, I argued that the number of firms that operate in a market’s nearest neighboring market is a credible instrument for local competition. In support of this claim, Table 4 displays the results from estimating the first stage of the instrumental variables regression. Column 1 shows that the simulated measure of MMC—which captures only the variation in MMC that is driven by entry into external markets—has a positive and statistically significant effect on the true measure of MMC. The model has a large F statistic, which indicates a strong instrument. Columns 2–4 show that a market’s neighbor’s number of ISPs is positively related to the market’s own number of firms. These models again have large F statistics, which suggest that a market’s number of ISPs is well-explained by competition in its neighboring market.

Table 5 shows the results of estimating the four specifications of the instrumental variables model, again with various levels of fixed effects. The results in column 4 represent the most credible estimates of the effects of multimarket contact and local competition on internet download speeds. Qualitatively, the findings mirror those in the OLS results, but the magnitudes of the estimates are greater under the instrumental variables approach. I find that a one standard deviation increase in multimarket contact decreases download speeds by 2.412 Mbps. This is a large effect in practice, as average download speeds in the sample ranged from 7 Mbps in 2008 to 20 in 2014. On the upper end of this effect, contact between Comcast and AT &T could decrease download speeds by as much as 6.81 (\(0.03 \times 227\)) Mbps.

I find that shifting from a monopoly to a duopoly increases download speeds by 1.915 Mbps, which represents a 27% increase over average 2008 download speeds and a 10% increase over average 2014 speeds. However, I also find that increasing competition to three firms decreases download speeds by 2.097 Mbps, and that increasing competition to four or more firms decreases speeds by 5.183 Mbps, relative to a monopoly. These results are fairly consistent with the findings of Wallsten and Mallahan (2013), who estimate that download speeds are higher in markets with two providers than in monopolized markets. They find that the expected download speeds of cable providers increase with the presence of a third firm, while expected download speeds of DSL and fiber providers fall with the presence of a third competitor. Molnar and Savage (2017) find that download and upload speeds are higher in markets with two or more wireline ISPs. They find that speeds continue increasing with competition, but that the marginal effect of additional competitors beyond the third or fourth incumbent is close to zero.

In line with the theory that was outlined in Sect. 3.1, I find that, ceteris paribus, the entry of the second ISP increases download speeds, and that an increase in MMC decreases download speeds. However, these changes in market structure are not independent of one another. When the second ISP enters a market, it exposes the incumbent monopolist to multimarket contact. The ratio of the estimated duopoly effect to the estimated MMC effect is 1.915 / 0.03 = 63.833. Therefore, if MMC rises to a level greater than 63.833 upon the second ISP’s entry, the MMC effect dominates and the net effect of entry is a reduction in download speeds. In the data, among all observations with exactly two ISPs, 66% of markets have a level of MMC that is greater than 63.833. Thus, these results imply that in the majority of markets, entry cannot be expected to increase download speeds. Therefore, policymakers who aim to increase entry and product quality should consider carefully the identities of potential entrants, as incentivizing the entry of local or regional firms is likely to generate the positive local competition effect without being offset by the multimarket contact effect.

4.3 Alternative Specifications

While many distinct ISPs appear in the data, the industry is highly concentrated among a small set of large ISPs: The ten largest ISPs account for 86% of the observations in the data, and accordingly face the greatest exposure to multimarket contact.

Consequently, I next investigate whether the estimated MMC and local competition effects are disproportionately driven by the quality choices of these large ISPs. I estimate Eq. (3) with the use of two subsamples of the data: observations of the ten largest ISPs; and observations of all smaller ISPs. Column 1 of Table 6 reports results from the subsample of large ISPs and column 2 reports results from the subsample of small ISPs. The estimates that are obtained from the subsample of large ISPs are of the same sign as those in the primary specification that is reported in column 4 of Table 5, but they are generally larger in magnitude. The estimated effect of MMC implies that a one standard deviation increase in MMC decreases download speeds by 4.5 Mbps. The estimates obtained from the subsample of small ISPs vary in sign and are statistically insignificant. Taken together, these results imply that the behavior of large national ISPs is driving the estimated effects of MMC and local competition. In support of this, I conduct a test of the joint hypothesis of equality of all of the estimated coefficients across the two subsamples. I obtain an F statistic of 5.80 and reject this null hypothesis at the 1% level.

Next, as was discussed in Sect. 2.1, there are many plausible ways to measure multimarket contact. I now explore an alternative definition of MMC, in which each firm weights its contact with each rival according to the share of its incumbent markets in which it competes against the rival. This measure captures the idea that a firm may be more heavily influenced by its multimarket contact with a rival if their territorial overlap represents a greater proportion of the firm’s total territory. Specifically, I define

where: \(M_{jt}\) represents the number of markets in which firm j operates in period t; and \(Contact_{jkt}\) is as defined in Eq. (1). I report results from estimating Eq. (3) under this alternative measure of MMC in column 1 of Table 7. These estimates imply that a one standard deviation increase in weighted MMC leads to a 0.617 Mbps decrease in download speeds, a smaller effect than was estimated under my primary specification. Qualitatively, however, the results are unchanged: I find that greater multimarket contact leads to slower download speeds.

Related to this, I also explore the possibility that multimarket contact may have a non-linear effect on firms’ download speeds. I therefore estimate my primary specification using the log of MMC, where MMC is as defined in Eq. (2). I report the results of this specification in column 2 of Table 7. I estimate that a 100% increase in MMC leads to decrease in download speeds of 2.529 Mbps. I again find that firms offer faster download speeds in duopolies than they do in monopolies. But, in this specification, I find that firms continue to increase their download speeds in response to additional entry, though speeds increase by successively smaller amounts.

Next, I explore a potential threat to the validity of the local competition instrument. In order for the exclusion restriction to be valid, unobservables that affect an ISP’s choice of download speed in one market must not be correlated with unobservables that affect their entry into neighboring markets. While this assumption is generally defensible, given that speeds are largely determined by last-mile infrastructure, if a market’s nearest neighbor is located in very close proximity, there is a potential for their shocks to be correlated.

To address this concern, I consider a related instrument: the number of firms that operated in the market’s nearest neighbor that is at least five miles away. Requiring a minimum distance between the markets mitigates the potential for correlated shocks while retaining the relevance of the instrument. I report results from estimating Eq. (3) using this instrument in column 3 of Table 7. These estimates are qualitatively the same as those produced under the primary specification, though slightly larger in magnitude.

One may still worry that shocks can be correlated more broadly across markets within a state: perhaps in response to state policies that aim to expand broadband availability and increase broadband quality. To address this concern, I estimate the primary specification and add state-year fixed effects. These fixed effects will capture any state level shocks that are specific to a particular point in time, which may influence both entry and download speeds. I report the estimates of this specification in column 4 of Table 7. I again obtain results that are qualitatively the same as those of the primary specification, though larger in magnitude.

Next, given the panel structure of the data, it is likely that there is serial correlation in the errors, covariates, and instruments. While the presence of serial correlation does not threaten the exogeneity of the instruments, it may lead to inconsistent standard errors (Bertrand et al., 2004). To account for this possibility, I estimate the primary specification of the model using heteroskedasticity and auto-correlation robust (HAC) standard errors, and report the results in column 5 of Table 7. Under these standard errors, multimarket contact remains statistically significant at the 1% level, but the entry of a market’s second ISP is no longer statistically significant. However, since the effects of local competition and multimarket contact appear to be driven entirely by the actions of large ISPs, I estimate the model on this subsample of data, as in column 1 of Table 6, this time using HAC standard errors. I report the results in column 6 of Table 7 and find that multimarket contact and the entry of the second ISP remain statistically significant.

Finally, I estimate an alternative specification in which I control for distance using the log of the distance between the user and the nearest speedtest.net server instead of a quadratic specification. I report these results in column 7 of Table 7 and obtain qualitatively similar estimates to those obtained under the primary specification.

5 Conclusion

This paper investigates the effect of competition on product quality in the market for internet service provision. This industry is especially well-suited for this topic, as it offers a rare product for which quality is easily measurable and arguably one-dimensional. It is natural to hypothesize that when facing greater local competition, firms respond by increasing the quality of their product in an effort to attract consumers. Indeed, I estimate that transitioning from a monopoly to a duopoly increases download speeds by 1.9 Mbps: This represents a 27% increase over average 2008 speeds and a 10% increase over average 2014 speeds. However, I also find that further increases in the number of competitors are associated with a decrease in download speeds; this is likely due to firms’ inability to recoup the substantial sunk cost that is required to offer fast speeds when the market is more competitive than a duopoly.

Additionally, this industry offers an opportunity to study the effect of multimarket contact on product quality. While the majority of the literature on multimarket contact focuses on pricing, the underlying theory can be expected to translate into outcomes such as product quality as well. Internet service providers rarely price discriminate across markets, instead modulating their product quality in response to market conditions. It is therefore reasonable to expect any effect of multimarket contact between firms to be channeled into the quality dimension. Empirically, I find that an increase in multimarket contact results in lower download speeds. I estimate that a one standard deviation increase in multimarket contact lowers download speeds by about 2.4 Mbps. This finding offers empirical support for the mutual forbearance hypothesis: When firms engage with one another in multiple markets, they alter their competitive conduct and appear reluctant to compete aggressively against one another. In the setting of internet service provision, this manifests as lower product quality. This outcome can reasonably be expected to materialize in other markets—especially those in which firms’ ability to increase prices is limited.

Data Availibility Statement

The data analyzed during the current study are available in the openICPSR repository, https://www.openicpsr.org/openicpsr/project/192970/version/V1/view.

Notes

Saad, Lydia, and Jeffrey M. Jones. 2021. “Seven in 10 U.S. White-Collar Workers Still Working Remotely.” Gallup, May 17. https://news.gallup.com/poll/348743/seven-u.s.-white-collar-workers-still-working-remotely.aspx.

Parker, Kim, Juliana M. Horowitz, and Rachel Minkin. 2020. “How the Coronavirus Outbreak Has - and Hasn’t - Changed the Way Americans Work.” Pew Research Center, December 9. https://www.pewresearch.org/social-trends/2020/12/09/how-the-coronavirus-outbreak-has-and-hasnt-changed-the-way-americans-work/.

McElrath, Kevin, 2020. “Nearly 93% of Households With School-Age Children Report Some Form of Distance Learning During COVID-19.” U.S. Census Bureau, August 26. https://www.census.gov/library/stories/2020/08/schooling-during-the-covid-19-pandemic.html.

The National Broadband Map (https://www.fcc.gov/BroadbandData) details ISPs’ availability at the Census block level. Aggregating from this level to the Census place level, which corresponds with the “city” identifier in the Ookla data, I use the National Broadband Map data to calculate that the mean coverage area of an ISP within a Census place is 95%.

See, for example, https://broadbandnow.com/California/Claremont?zip=91711.

See figure 4 of Malone et al. (2021).

1 Gbps = 1000 Mbps.

See Brouse (2010) for a network operator’s estimates of the accounting costs of cable and fiber technology.

Durairajan et al. (2015) develop a nationwide map of the U.S. backbone, and document just 267 nodes where interconnection can occur.

References

Archibald, G. C. (1964). Profit maximizing and non-price competition. Economica, 31(121), 13–22.

Bernheim, B. D., & Whinston, M. D. (1990). Multimarket contact and collusive behavior. The RAND Journal of Economics, 21(1), 1–26.

Bertrand, M., Duflo, E., & Mullainathan, S. (2004). How much should we trust difference-in-differences estimates. The Quarterly Journal of Economics, 119(1), 249–275.

Bloom, N., Propper, C., Seiler, S., & Van Reenen, J. (2015). The impact of competition on management quality: evidence from public hospitals. The Review of Economic Studies, 82(2), 457–489.

Bourreau, M., Grzybowski L., & Hasbi, M. (2019). Unbundling the incumbent and deployment of high-speed internet: Evidence from France. International Journal of Industrial Organization, 67.

Brouse, J. (2010). Fiber access network: A cable operator’s perspective. International Telecommunication Union: Technical report.

Brown, J. R., & Goolsbee, A. (2002). “Does the internet make markets more competitive? Evidence from the life insurance industry. Journal of Political Economy, 110(3), 481–507.

Chen, Y., & Gayle, P. G. (2019). Mergers and product quality: Evidence from the airline industry. International Journal of Industrial Organization, 62, 96–135.

Ciliberto, F., & Williams, J. W. (2015). Does multimarket contact facilitate tacit collusion? Inference on conduct parameters in the airline industry. The RAND Journal of Economics, 45(4), 764–791.

Durairajan, R., Barford, P., Sommers, J., & Willinger, W. (2015). InterTubes: A study of the US long-haul fiber-optic infrastructure. ACM SIGCOMM Computer Communication Review, 45(4), 565–578.

Economides, N. (2005). The economics of the internet backbone. In M. Cave, S. Majumdar, & I. Vogelsang (Eds.), The handbook of telecommunications economics (Vol. II, pp. 373–412). Elsevier.

Edwards, C. D. (1955). Conglomerate bigness as a source of power. In Business Concentration and Price Policy (pp. 331–359), Princeton University Press.

Eliason, P. J., Heebsh, B., McDevitt, R. C., & Roberts, J. W. (2020). How acquisitions affect firm behavior and performance: Evidence from the dialysis industry. The Quarterly Journal of Economics, 135(1), 221–267.

Evans, W. N., & Kessides, I. N. (1994). Living by the ‘Golden Rule’: Multimarket contact in the U.S. airline industry. Quarterly Journal of Economics, 109, 341–366.

Fan, Y. (2013). Ownership consolidation and product characteristics: A study of the US daily newspaper market. American Economics Review, 103(5), 1598–1628.

Fernandez, N., & Marin, P. L. (1998). Market power and multimarket contact: Some evidence from the Spanish hotel industry. The Journal of Industrial Economics, 46(3), 301–315.

Gimeno, J., & Woo, C. (1996). Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation. Organization Science, 7(3), 322–341.

Gimeno, J., & Woo, C. (1999). Multimarket contact, economies of scope, and firm performance. Academy Management Journal, 42(3), 239–259.

Gowrisankaran, G., & Town, R. J. (2003). Competition, payers, and hospital quality. Health Services Research, 38(6), 1403–1422.

Jans, I., & Rosenbaum, D. I. (1997). Multimarket contact and pricing: Evidence from the US cement industry. International Journal of Industrial Organization, 15(3), 391–412.

Kessler, D. P., & McClellan, M. B. (2000). Is hospital competition socially wasteful? The Quarterly Journal of Economics, 115(2), 577–615.

Kuhn, P., & Mansour, H. (2014). Is internet job search still ineffective? The Economic Journal, 124(581), 1213–1233.

Landgraf, S. W. (2020). Entry threats from municipal broadband internet and impacts on private provider quality. Information Economics and Policy 52.

Lin, H., & McCarthy, I. M. (2023). Multimarket contact in health insurance: Evidence from Medicare Advantage. The Journal of Industrial Economics, 71(1), 212–255.

Malone, J., Nevo, A., & Williams, J. W. (2021). The tragedy of the last mile: Economic solutions to congestion in broadband networks. Working paper.

Matsa, D. (2011). Competition and product quality in the supermarket industry. Quarterly Journal of Economics, 126(3), 1539–1591.

Mazzeo, M. J. (2003). Competition and service quality in the US airline industry. Review of Industrial Organization, 22(4), 275–296.

Molnar, G., & Savage, S. J. (2017). Market structure and broadband internet quality. Journal of Industrial Economics, 65(1), 73–104.

Morton, F. S., Zettelmeyer, F., & Silva-Risso, J. (2001). Internet car retailing. The Journal of Industrial Economics, 49(4), 501–519.

Ookla. (2014). Net Index source data.

Parker, P. M., & Roller, L. (1997). Collusive conduct in duopolies: Multimarket contact and cross-ownership in the mobile telephone industry. The RAND Journal of Economics, 28(2), 304–322.

Prince, J. T., & Simon, D. H. (2009). Multimarket contact and service quality: Evidence from on-time performance in the U.S. airline industry. Academy of Management Journal, 52(2), 336–354.

Prince, J. T., & Simon, D. H. (2017). The impact of mergers on quality provision: Evidence from the airline industry. The Journal of Industrial Economics, 65(2), 336–362.

Wallsten, S., & Mallahan, C. (2013). Residential broadband competition in the United States. In S. Greenstein, A. Goldfarb, & C. Tucker (Eds.), The Economics of Digitization (pp. 131–156). Elgar Publishing.

Wilson, K., Xiao, M., & Orazem, P. F. (2021). Entry threat, entry delay, and internet speed: The timing of the U.S. broadband rollout. Journal of Economics and Management Strategy, 30(1), 3–44.

Xiao, M., & Orazem, P. F. (2011). Does the fourth entrant make any difference? Entry and competition in the early U.S. broadband market. International Journal of Industrial Organization, 29(5), 547–561.

Funding

Open access funding provided by SCELC, Statewide California Electronic Library Consortium. The author did not receive support from any organization for the submitted work.

Author information

Authors and Affiliations

Contributions

Authors’ contributions is not applicable, as this study has a single author.

Corresponding author

Ethics declarations

Conflict of interest

The author has no competing interests to declare that are relevant to the content of this article.

Ethical approval

Ethical approval is not applicable, as this study did not involve human or animal subjects.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank Mo Xiao, Stan Reynolds, Mauricio Varela, Ashley Langer, Tiemen Woutersen, and numerous seminar and conference participants for comments.

Appendices

Appendix A

This section proposes a simple model of oligopolistic price and quality setting competition, and illustrates conditions under which quality is increasing in the number of rivals that a firm faces.

Consider firm i, which competes in a market under oligopolistic competition against n rival firms. Firm i’s demand is given by

where \(g(p_i,s_i) \ge 0\) \(\forall p_i,s_i\); \(h(p_j,s_j) \ge 0\) \(\forall p_j, s_j\); \(\partial g/\partial p_i< \partial h / \partial p_j < 0\); \(\partial g/\partial s_i> \partial h / \partial s_j > 0\); \(\partial ^2 g / \partial p_i^2 > 0\); and \(\partial ^2\,g / \partial s^2 < 0\). In essence, I assume that a firm’s demand is decreasing (increasing) in own price (speed); increasing (decreasing) in rival price (speed); and that the own price and speed effects are stronger than the rival price and speed effects. I further assume that the own price and speed effects are stronger at low prices and speeds.

Firm i faces a constant (zero) marginal cost but faces a fixed cost that depends on its chosen quality, which is given by \(f(s_i)\) and is assumed to be increasing and strictly convex. Thus, firm i chooses its price and quality (i.e. download speed) in order to maximize its profits, given by

This produces the following first-order conditions:

where the \(*\) superscript denotes optimality.

All n firms solve an analogous set of first-order conditions. For tractability, I focus on the symmetric equilibrium in which \(p_i = p_j = p\) and \(s_i = s_j = s\) \(\forall j\). The above can then be simplified to

These optimal choices—\(p^*\) and \(s^*\)—are themselves functions of n: the number of rival firms.

Next, taking total derivatives with respect to n yields

which can be rewritten as

Then, by Cramer’s Rule,

This expression allows us to characterize the firm’s optimal response to a change in competition. The sign of Eq. (17) depends on the sign of \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\).

-

1.

Case 1: \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i} < 0\)

In this case, the numerator of Eq. (17) is positive and therefore \(\frac{\partial s^*}{\partial n} > 0\) if and only if the denominator of Eq. (17) is positive; if and only if

$$\begin{aligned} \frac{\partial ^2 \pi _i}{\partial s_i^2}\left( \frac{\partial ^2 \pi _i}{\partial p_i^2} - n \frac{\partial h}{\partial p_j}\right) > \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\left( \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i} - n \frac{\partial h}{\partial s_j}\right) . \end{aligned}$$(19)When a firm faces zero competitors—when \(n=0\)—this expression simplifies to

$$\begin{aligned} \frac{\partial ^2 \pi _i}{\partial s_i^2}\left( \frac{\partial ^2 \pi _i}{\partial p_i^2}\right) > \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\left( \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\right) . \end{aligned}$$(20)Since profits are concave in quality and price, both sides of the inequality are positive. It can therefore be satisfied if the magnitude of \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\) is sufficiently small: if consumer price sensitivity does not vary much with the level of product quality. Alternately, the inequality may be satisfied if profits are sufficiently concave in price and/or quality. Profits will be highly concave in quality if increases in quality affect demand much more when quality is low, and if the cost of quality provision is highly convex.

On the other hand, when n becomes sufficiently large, \(\left( \frac{\partial ^2 \pi _i}{\partial p_i^2} - n \frac{\partial h}{\partial p_j}\right) > 0\) and \(\left( \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i} - n \frac{\partial h}{\partial s_j}\right) < 0\). When this occurs, the left-hand-side of inequality (19) becomes negative and the right-hand-side becomes positive, and thus the inequality cannot be satisfied. Therefore, a firm’s optimal quality will always decrease with competition when the level of competition is sufficiently high.

In sum, in case 1, if inequality (20) is satisfied, quality is increasing in competition when the market is monopolized, and decreasing in competition once the level of competition is sufficiently high. If inequality (20) is not satisfied, then quality is always decreasing in competition.

-

2.

Case 2: \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i} > 0\) In this case, the numerator of Eq. (17) is negative, and therefore \(\frac{\partial s^*}{\partial n} > 0\) if and only if the denominator of Eq. (17) is negative; if and only if

$$\begin{aligned} \frac{\partial ^2 \pi _i}{\partial s_i^2}\left( \frac{\partial ^2 \pi _i}{\partial p_i^2} - n \frac{\partial h}{\partial p_j}\right) < \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\left( \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i} - n \frac{\partial h}{\partial s_j}\right) \end{aligned}$$(21)When a firm faces zero competitors—when \(n=0\)—this expression simplifies to

$$\begin{aligned} \frac{\partial ^2 \pi _i}{\partial s_i^2}\left( \frac{\partial ^2 \pi _i}{\partial p_i^2} \right) < \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\left( \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\right) . \end{aligned}$$(22)Since profits are concave in quality and price, both sides of inequality (21) are positive. It can therefore be satisfied if \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\) sufficiently large: if consumer price sensitivity drops sufficiently as quality increases.

On the other hand, when n becomes sufficiently large, \(\left( \frac{\partial ^2 \pi _i}{\partial p_i^2} - n \frac{\partial h}{\partial p_j}\right) > 0\), and \(\left( \frac{\partial ^2 \pi _i}{\partial s_i \partial p_i} - n \frac{\partial h}{\partial s_j}\right) < 0\). Now, we require \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\) to be sufficiently small in order to satisfy inequality (21).

Thus, if \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\) is sufficiently large, inequality (21) is satisfied when \(n=0\) but not once n grows sufficiently large. Therefore, if \(\frac{\partial ^2 \pi _i}{\partial s_i \partial p_i}\) is sufficiently large, the firm’s optimal quality is increasing in competition when it operates as a monopolist but decreasing in competition once a sufficiently large number of competitors are present.

Appendix B

Bernheim and Whinston (1990) show that multimarket contact between firms can facilitate collusion between them. This section uses a simple model to illustrate that when firms compete by setting both price and quality, the firms’ choice of quality may increase or decrease under collusion, relative to the competitive outcome.

Consider two identical firms that set prices and quality under oligopolistic competition. Each firm maximizes

where: p and s denote price and quality; \(q_i(\cdot )\) is firm i’s demand function; and \(f(s_i)\) represents the fixed cost of providing quality level \(s_i\). It is assumed that \(\frac{\partial q_i}{\partial p_i} < 0\), \(\frac{\partial q_i}{\partial s_i} > 0\), \(\frac{\partial q_i}{\partial p_j} > 0\), \(\frac{\partial q_i}{\partial s_j} <0\), \(\frac{\partial ^2 q_i}{\partial s^2} < 0\), \(\frac{\partial ^2 q_i}{\partial s_i \partial s_j} < 0 \), \(f'(\cdot ) > 0\), and \(f''(s_i) > 0\).

In equilibrium, each firm therefore chooses prices and quality that satisfy

If the firms were instead to set prices and quality cooperatively, their joint profit function becomes

The joint firm now chooses prices and quality—\({\tilde{p}}\) and \({\tilde{s}}\)—that solve

Proposition 1

\(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i \partial p_i} > 0\) is a necessary condition for the optimal quality to increase under collusion. And by extension, \(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i \partial p_i} < 0\) is a sufficient condition for the optimal quality to decrease under collusion.

Proof

Since \(\frac{\partial q_j({\tilde{p}}_1,{\tilde{p}}_2,{\tilde{s}}_1,{\tilde{s}}_2)}{\partial p_i} > 0\) and \(\frac{\partial q_j({\tilde{p}}_1,{\tilde{p}}_2,{\tilde{s}}_1,{\tilde{s}}_2)}{\partial s_i} < 0\) \(\forall \) p and s, this implies that the first-order conditions of the joint firm when evaluated at the prices and qualities that are chosen under competition can be signed as follows:

Therefore, when shifting from competitive prices and qualities \((p_1^*,p_2^*,s_1^*,s_2^*)\) to collusive prices and qualities \(({\tilde{p}}_1,{\tilde{p}}_2,{\tilde{s}}_1,{\tilde{s}}_2)\), \(\frac{\partial {\tilde{\pi }}}{\partial p_i}\) must decrease and \(\frac{\partial {\tilde{\pi }}}{\partial s_i}\) must increase. Thus, the total differentials of these derivatives must satisfy \(d (\frac{\partial {\tilde{\pi }}}{\partial p_i}) <0\) and \(d (\frac{\partial {\tilde{\pi }}}{\partial s_i}) > 0\). These necessary conditions are given by

Now, suppose that these conditions are to be satisfied by increasing quality under collusion, or that \(d s_i > 0\). Since profits are concave in prices, \(\frac{\partial ^2 {\tilde{\pi }}}{\partial p_i^2} < 0\). This implies that \(\frac{\partial ^2 {\tilde{\pi }}}{\partial p_i^2} dp_i < 0\), as price must increase with an increase in quality in order for profits to rise. Thus, \(d (\frac{\partial {\tilde{\pi }}}{\partial p_i}) <0\) can potentially be satisfied with \(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i \partial p_i} > 0\) or \(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i \partial p_i} < 0\).

Next, since profits are concave in quality, \(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i^2} ds_i < 0\). Since \(dp_i\) must be greater than zero when \(d s_i > 0\), \(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i \partial p_i} > 0\) must be positive in order to satisfy \(d (\frac{\partial {\tilde{\pi }}}{\partial s_i}) > 0\). \(\square \)

With this necessary condition established, it is instructive to characterize when \(\frac{\partial ^2 {\tilde{\pi }}}{\partial s_i \partial p_i}\) may be positive:

Since \(\frac{\partial q_i}{\partial s_i} > 0\), this condition can hold when \(\frac{\partial ^2 q_i}{\partial s_i \partial p_i}\) and/or \(\frac{\partial ^2 q_j}{\partial s_i \partial p_i}\) are positive (or at least not too negative). \(\frac{\partial ^2 q_i}{\partial s_i \partial p_i}\) is positive if consumers’ price sensitivity for a given firm’s product decreases as its own quality rises. \(\frac{\partial ^2 q_j}{\partial s_i \partial p_i}\) is positive if the effect of a rival’s price increase on a given firm’s demand is greater when the rival’s quality is higher.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wilson, K. Local Competition, Multimarket Contact, and Product Quality: Evidence From Internet Service Provision. Rev Ind Organ (2023). https://doi.org/10.1007/s11151-023-09928-8

Published:

DOI: https://doi.org/10.1007/s11151-023-09928-8