Abstract

This paper analyzes the effect of network externalities on firms’ timing of new technology adoption in a network industry. In a pre-commitment game under Cournot competition, network effects tend to accelerate the timing of the leader and the follower regarding their adoption dates: under the rational expectations hypothesis and also under the firms’ output commitment. However, while an increase in network effects tends to reduce the discrepancy between the optimal social timing of the new technology adoption and the market-driven time of adoption in the rational expectations model, the opposite occurs under the output commitment game.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is a general consensus among academics and policymakers about the relationship between innovation and economic development. In particular, technological innovation contributes to the productivity of labour and capital, and this in turn has a positive effect on long-run economic growth.

New technology adoptions have a flywheel effect for technological progress. In recent years, an increasing focus is on digital innovations such as 3-D printing, robotic automation, artificial intelligence, the industrial internet of things, and big data analysis (Forbes, 2018), whose effect is to reduce operating (production) costs and improve processes, as consulting groups report (Deloitte, 2018; McKinsey & Company, 2018).

However, it has been widely observed that both the adoption and diffusion rates of new technologies are considerably different across industries. Remarkably, in the European Union (EU), network industries – such as telecommunications and computer programming – and ICT manufacturing are top-ranked sectors with regard to the percentage of firms (above 50%) that have a high “digital intensity index” (a measure of the degree of enterprises’ new technology adoption) – in contrast to, for example, construction and food manufacturing (below 10%) (see, e.g., European Commission, 2004, 2005, 2006, 2018).

Similar findings have been found for the average adoption rates of core digital technologies in the period 2010–2016 for the OECD countries. For example, with regard to cloud computing, adoption rates range from 16.56% in food and beverage service to 55.51% in computer programming; with regard to enterprise resource planning, adoption rates range from 11.19% in food and beverage service to 55.61% in computer, electronic and optical products manufacturing; and adoption rates of customer relation management range from 16.21% in food and beverage services to 65.95% in telecommunications (Nicoletti et al., 2020).

Network industries are expanding in advanced contemporary economics. In general, network industries produce goods whose utility for a consumer/user increases with the number of other consumers/users of those goods: Network goods generate positive consumption externalities, and the total sales of the goods improve the welfare of each consumer (Amir & Lazzati, 2011; Katz & Shapiro, 1985).

To implement a new technology successfully might usually require time. When consumers adopt a new technology, the network externalities can be considered to be one of the reasons for consumers to wait for or for firms to accelerate the introduction of the technology. From this standpoint, introducing the network effects into the timing of the technology adoption is a timely investigation. The present paper focuses on this subject.

The remainder of the paper is organized as follows: Sect. 2 surveys the related literature and briefly describes the key findings. Section 3 describes the model and extensively discusses the results. Section 4 briefly discusses two extensions of the basic model to check its robustness. Section 5 presents some concluding remarks and outlines future lines of research.

2 Literature Review and Main Results

The economics literature has mainly investigated the link between the competitive pressure in the industry, measured by different competition modes (Cournot versus Bertrand) in the presence of differentiated products, and the timing of adoption in an industry with standard goods: without network externalities (Alipranti et al., 2015; Dastidar, 2015; Ma et al., 2015; Milliou & Petrakis, 2011).

In particular, Milliou and Petrakis (2011) analyze how product market competition affects firms’ timing of the adoption of a new technology. In an infinite continuous time horizon model, two competing firms initially employ an identical production technology and consider adopting a new cost-reducing technology. The firm that adopts the new technology earlier than the rival experiences a competitive advantage. If a firm waits, it incurs lower technology adoption costs because of either economies of learning or new results from basic research that smooth the innovation adoption process.Footnote 1 The authors investigate both when firms can pre-commit to their adoption dates — the pre-commitment game — and when firms are flexible in altering their adoption plans: the preemption game; the authors show that adoption dates differ depending on the competition toughness and product differentiation, and that harsh competition does not always generate additional incentives to adopt new technologies.

Alipranti et al. (2015) extend the above-mentioned contribution to markets with vertical relations (input outsourcing) and find that this aspect may accelerate the introduction of new cost-reducing technology innovation; however, the speed is affected by the relative bargaining power of the parties and the type of contract between the upstream firm and the downstream firm. Dastidar (2015) introduces scoring auctions as a mechanism to buy technology for which the cost and the quality are not given.

Ma et al. (2015) analyze the endogenous choice of technology adoption in a two-stage differentiated duopoly game and find that Cournot competition gives firms more incentive to innovate. An exception is represented by the work of Choi and Thum (1998). In a simple two-period model in which consumers may choose among two different technologies – the conventional and the emerging technologies – those authors show that, in the presence of network externalities, consumers adopt conventional technologies too early; the waiting option for a newly emerging technology is not sufficiently exercised.

Making use of Milliou and Petrakis’ (2011) framework, the present paper contributes to this line of research by introducing network externalities – in essence, demand-side economies of scale (see Shapiro & Varian, 1999) – into the study of the timing of technology adoption.

The key results are as follows: In a pre-commitment game under Cournot competition, network effects accelerate the timing of the firms’ technology adoption under both the consumers’ rational expectations hypothesis and the firms’ output commitment. A lower degree of product differentiation unambiguously delays the dates of the new technology adoption. With respect to the first adoption, the socially optimal time is always earlier than the market-driven time. With rational expectations, network effects reduce the discrepancy between the socially optimal and the market-driven timing of the first adoption; the opposite holds with respect to output commitment. As to the second (follower) adoption, the socially optimal adoption would occur earlier (respectively, later) than the market-driven adoption if products are adequately differentiated (respectively, close substitutes).

3 The Model and Results

The role of network effects is initially studied under the rational expectations hypothesis – when consumers, because of rationality, form their expectations on the overall network size, and in equilibrium the expected network size equals the actual size (Katz & Shapiro, 1985); we subsequently study the effect of network effect under the firms’ output commitment hypothesis: One firm can credibly commit to announced output levels before consumers make their purchase decisions, which therefore directly influences the consumers’ expectations as to the size of its network. The latter hypothesis implies that each firm’s output choice is made taking as given the rival’s output, which leads to a standard Cournot model with demand-side economies of scale (Katz & Shapiro, 1985, Appendix A; Amir & Lazzati, 2011).

Under Cournot competition, the analysis focuses on the pre-commitment technology adoption game (Milliou & Petrakis, 2011; Reinganum, 1981a, 1981b): At \(t = 0\), each firm \(i\) pre-commits to adopt the new technology at date \(T_{i}\).

3.1 The Model with Rational Expectations

This section considers Cournot competition in a network industry in the presence of rational expectations (Katz & Shapiro, 1985). There are two firms – firm 1 and firm 2 – that face inverse linear demands that have this form, as described in Hoernig (2012), Bhattacharjee and Pal (2014), Pal (2015), Song and Wang (2017), and Fanti and Buccella (2018):

where: \(p_{i}\) is the price of goods; \(q_{i}\) and \(q_{j}\) are the output levels; and \(y_{i}\) and \(y_{j}\) are the consumers’ expectations with regard to firms’ total sales. The parameter \(\gamma \in (0,1)\) represents the degree of product substitutability (which is the reverse of product differentiation); this is a measure of the intensity of market competition: product market substitutability measures how “tough” or “soft” the competition between the two firms is. When products are more substitutable (less differentiated), the degree of competition between the two firms is greater: The equilibrium prices decrease and reduce the firms’ oligopoly rents. In the current context, the competitive pressure measured in terms of the number of firms active in the market is not considered. Finally, the parameter \(n \in [0,1)\) represents the strength of the consumption externality/network effects.Footnote 2

Firm i’s general specification of the profit function is \(\pi_{i} = (p_{i} - c_{i} )q_{i}\), where \(c_{i} < a\) is the constant marginal cost. The equilibrium outputs that maximize the per-period gross (from the adoption cost) profits and their level under Cournot competition are:

where \({\rm M} = (2 - n)^{2} - \gamma^{2} (1 - n)^{2}\). As is commonly considered in the literature, time – \(t \ge 0\)– is continuous, with an infinite time horizon. Strictly following Milliou and Petrakis (2011), at \(t = 0\) the two firms use the same technology; therefore, the marginal cost of production is identical: \(c_{i} = c\). However, firms can gain access to a cost-reducing technology.

If firms do not adopt the technology simultaneously, then the first adopter is defined as firm 1 and the second adopter as firm 2. In those periods in which only firm 1 has adopted the new technology, firm 1 is the “technology leader” (hereafter, the leader), while firm 2 is the “technology follower” (hereafter, the follower).

The firm that first adopts the new technology experiences a competitive advantage vis-à-vis its rival. However, if a firm delays technology adoption, it will sustain lower costs of technology adoption because of either economies of learning or new results from basic research that facilitate the adoption process of the innovation. Therefore, if firm \(i\) adopts the new technology at \(t \ge 0\), then the marginal cost of production reduces by an amount \(\Delta > 0\), so that \(c_{i} = c - \Delta\), with \(\Delta < c\).Footnote 3

To guarantee that in equilibrium all solutions are real numbers, the following parametric restriction is assumed, \(a - c \ge (1 + \sqrt 3 )\Delta\). As is standard in the literature, it is assumed that no further technical advances are anticipated in the market. Moreover, the next assumptions hold.

First, the discounted cost of the new technology adoption at \(t\) is \(k(t)\), which is the sum of the present value of the purchasing and the fine-tuning costs: the costs of adjusting precisely so as to bring on line to the highest level of effectiveness the new technology at date \(t\), and whose current cost is \(k(t)e^{rt}\), with \(r \in (0,1)\) the interest rate. Second, as in Fudenberg and Tirole (1985) and subsequent contributions, the technology adoption’s current cost declines over time at a decreasing rate: \((k(t)e^{rt} )^{\prime} < 0\) and \((k(t)e^{rt} )^{\prime\prime} > 0\). To ensure that instantaneous technology adoption is extremely expensive and that each technology adoption realizes in finite time for each parameter structure, the following technical conditions – \(\mathop {\lim }\limits_{t \to 0} k(t) = - \mathop {\lim }\limits_{t \to 0} k^{\prime}(t) = \infty\) and \(\mathop {\lim }\limits_{t \to \infty } k^{\prime}(t)e^{rt} = 0\) – apply.

The two firms then compete in the product market during each period \(t\) over an infinite time horizon. Given the outlined framework, at \(t = 0\), firm 1 and firm 2 choose their optimal adoption timing (in pure strategies), denoted as \(T_{1}\) and \(T_{2}\), respectively, obtained from the maximization of their discounted sum of profits:

where: \(\pi_{0} (c,c)\) are the profits when both firms do not adopt the technology (the first position in \(\pi ( \cdot , \cdot )\) indicates the firm’s own cost, the second the rival’s cost); \(\pi_{l} (c - \Delta ,c)\) are the leader’s profits when adopting the technology while the follower does not; \(\pi_{f} (c,c - \Delta )\) are the follower’s profits when the follower does not adopt the new technology while the leader does; and \(\pi_{b} (c - \Delta ,c - \Delta )\) are the profits when both companies adopt the new technology.

The first-order conditions of (3) and (4) lead to

where: \(I_{1} = \pi_{l} - \pi_{0}\), and \(I_{2} = \pi_{b} - \pi_{f}\): The optimal adoption date equalizes a firm’s incremental benefits from adoption to the marginal cost of waiting (Milliou & Petrakis, 2011). The larger are the incremental benefits that a firm obtains due to innovation introduction, the earlier that the innovation occurs: The smaller is the value of \(T_{i}\).

The incremental benefits can be expressed as

For industries that produce non-network goods, and in line with the literature on technology adoption in one-tier industries (e.g., Alipranti et al., 2015; Milliou & Petrakis, 2011; Quirmbach, 1986; Reinganum, 1981a, 1981b), the following results hold: (1) \(I_{i} > 0\): firms have always incentives to adopt the new technology; and (2) \(I_{1} > I_{2}\): the incremental benefits of the first adoption are larger than the incremental benefits of the second adoption. Together with the assumptions with regard to the adoption cost, this implies that \(T_{1} < T_{2}\): A technology diffusion equilibrium characterizes the industry, which emerges not from the firms’ strategic behavior but due to the diminishing incremental benefits of adoption and the decreasing adoption cost (Quirmbach, 1986).

In an industry that produces standard goods (see Figs. 1 and 2, solid line), the incremental benefits for the leader are non-monotonic in the degree of product substitutability for both small and large cost reductions, while those of the follower are non-monotonic for small cost reductions but monotonically decreasing for large cost reductions. Milliou and Petrakis (2011) clearly explain the rationale for a U-shaped form of the incremental benefits as a function of the degree of product differentiation, which measures the competitive pressure.

New technology adoption produces two effects: a strategic effect, and an output effect (Milliou & Petrakis, 2011). The strategic effect refers to the firm’s output expansion that is due to the cost reduction from the new technology adoption. The output effect refers to the fact that the larger is the firm's output expansion, the more sizable are the gains (in terms of saved costs) from adopting a cost-reducing technology.

With regard to the leader, the adoption of a new technology is incentivized in the presence of sufficiently close substitute goods. The competitive pressure that is due to greater product substitutability – as \(\gamma \to 1\) – exerts two opposite effects: Close-substitute goods tend to increase firms’ production. On the one hand, this has a positive direct effect on revenues due to output expansion, and a negative indirect price-effect on revenues. The latter effect dominates the former, which reduces margins and profits. Therefore, the overall negative effect on revenues reduces the leader’s adoption incentives. On the other hand, the adoption of the new technology reduces the marginal cost of production, which further expands the leader’s output: The reaction function shifts outward. Consequently, the follower shrinks its production. This is the strategic effect. The cost-cutting applies to increased quantities, which leads to a reduction in total costs: This is the output effect. The overall favorable effect on total costs increases the adoption incentives of the leader. Because the positive effects of total cost reduction more than offset the negative effects on decreased total revenues, the leader’s incremental benefits – and thus its incentives of technology adoption – increase.

In addition, when goods are more differentiated – \(\gamma \to 0\) – the negative effect of margin reduction overcomes the positive effect of cost reduction on the leader’s profits: The timing of technology adoption is delayed. However, when the goods are almost independent, each firm is nearly in a monopoly position. On the one hand, the leader’s cost advantage due to the technology adoption does not hamper the rival’s output choice: The strategic and output effects on cost reduction are minimal. On the other hand, at an almost monopoly price, the impact on revenues is dominant: The incremental benefits increase, and technology innovation occurs earlier.

A similar line of reasoning applies for the follower, except for the large cost reductions and close substitutes: In that case, the leader’s strategic effect is substantial, which yields a significant contraction of the follower’s output. The output effect on cost reduction applies to a relatively limited production of the follower: the effect on total cost reduction is not strong enough to counterbalance the negative effect on prices – and therefore revenues – due to the expanded output of the leader. As a consequence, the timing of technology adoption is unambiguously delayed.

Let us see the role of network externalities: The presence of network effects increases the magnitude of the incremental benefits for both the leader and the follower: The higher is the intensity of the network effects, the higher are the demand-side effects on revenues and profits: The positive direct effect on quantity increases while the negative indirect effect on prices is softened.Footnote 4 As a consequence, the presence of network externalities unequivocally tends to accelerate the timing of technological innovation in an industry: \(T_{1}\) and \(T_{2}\) decrease.

However, if the network effects are sufficiently intense – though at different threshold levels – the leader and the follower’s incremental benefits become monotonically decreasing for \(\gamma \to 1\), regardless of the magnitude of the cost reduction, as Figs. 1 and 2 depict. These observations can be formally stated in the next Proposition:

Proposition 1.

In a network industry, if the strength of the consumers’ externality is \(n \ge n_{1} \equiv \frac{{(a - c) + 2\Delta - 2\sqrt {(a - c)^{2} + 4(a - c)\Delta + \Delta^{2} } }}{{\Delta - \sqrt {(a - c)^{2} + 4(a - c)\Delta + \Delta^{2} } - (a - c)}}\) for the leader and \(n \ge n_{2} \equiv \frac{{\Delta + 2\sqrt {(a - c)^{2} - 2(a - c)\Delta - 2\Delta^{2} } - (a - c)}}{{(a - c) + 2\Delta + \sqrt {(a - c)^{2} - 2(a - c)\Delta - 2\Delta^{2} } }}\) for the follower, with \(n_{2} < n_{1}\) , then a decrease in the degree of product differentiation unambiguously delays the timing of technology adoption.

Proof:

See the Appendix.

Proposition 1 states that in an industry with adequately intense network effects, when goods become close substitutes the timing of the technology adoption is unambiguously delayed: The values of \(n_{1}\) and \(n_{2}\) define the thresholds of the network externalities such that \(I_{1}\) and \(I_{2}\) are decreasing all over the range \(\gamma \in (0,1)\): For \(n \ge n_{1}\), it follows that \(\frac{{\partial I_{1} }}{\partial \gamma } \le 0\); and for \(n \ge n_{2}\), \(\frac{{\partial I_{2} }}{\partial \gamma } \le 0\).

The economic intuition behind Proposition 1 is as follows: The mechanisms at work are those described earlier. However, with respect to the leader, network externalities soften the strategic effect of the cost advantage on the follower’s production level, which falls less than with standard goods. When the network effects are adequately intense – at the level \(n_{1}\) – their impact on revenues is negative (because the indirect price-effect is dominant) and more than offsets the positive impact on total cost reduction due to technology adoption. Thus, the leader’s incremental benefits decrease: Its timing of technology adoption is delayed.

However, when the network effects are not excessively strong – at the level \(n_{2}\) – the leader gains an already relatively large market share because output expands due to the combined effect of externalities and cost-reducing innovation. Therefore, when the follower introduces the innovation at \(n_{2}\), its output expansion due to the cost reduction is of a relatively small-scale, and the positive cost-saving effect on overall production disappears: The follower’s incremental benefits decrease, which allows the follower to delay its timing of technology adoption.

Let us now consider the impact of network externalities on the optimal technology adoption pattern from a welfare perspective: As in Milliou and Petrakis (2011), the sum of consumers’ and producers’ surpluses gives the per-period gross welfare: \(V\). The social planner cannot influence the firm’s output decision; however, it may consider fixing the adoption dates of the technology to maximize social welfare (\(SW\)):

where \(V_{0} \equiv V(c,c)\),\(V_{1} \equiv V(c - \Delta ,c)\), and \(V_{b} (c - \Delta ,c - \Delta )\) are the welfare outcomes when no firms, only the leader, and both firms adopt the new technology, respectively, and \(V(c_{1} ,c_{2} ) \equiv U(q_{1} (c_{1} ,c_{2} ),q_{2} (c_{1} ,c_{2} )) - c_{1} q_{1} (c_{1} ,c_{2} ) - c_{2} q_{2} (c_{1} ,c_{2} )\). The first-order conditions of (7) lead to

where the upper script \(S\) defines the social planner’s choice. The expressions \(I_{1S} = V_{1} - V_{0}\) and \(I_{2S} = V_{b} - V_{1}\) are the social planner’s incremental benefits of the new technology adoption. To compare the socially optimal timing adoption with the market-driven one, it is possible to construct the following measures

which define the differential between the optimal timing for society and the market-driven timing with regard to the first and the second adoption, respectively.

When the value of these differentials is positive, the optimal social timing of the new technology adoption would take place earlier than the market-driven timing; further, a decrease in their values indicates that the discrepancy between the two timings decreases as well. Figures 3 and 4 graphically depict Eqs. (9), for selected parameters value, and their analytical inspection reveals the following results:

Differential between the socially optimal timing and the market-driven timing with regard to the first (left) and the second (right) technology adoption as functions of product substitutability \( (\gamma ) \) in a pre-commitment game for a given level of \(n\) and a small cost reduction (\(\Delta = .05\)). The graphs are drawn for \(a = 2\), \(c = 1\)

Differential between the socially optimal timing and the market-driven timing with regard to the first (left) and the second (right) technology adoption as functions of product substitutability \( (\gamma ) \) in a pre-commitment game for a given level of \(n\) and a large cost reduction (\(\Delta = .35\)). The graphs are drawn for \(a = 2\), \(c = 1\)

Proposition 2.

In a network industry, in the pre-commitment game with rational expectations, the optimal social timing of the first adoption would always take place earlier than the market-driven timing, while the optimal social timing of the second adoption would take place earlier (later) than the market-driven timing if goods are sufficiently differentiated (close substitutes). Increasing product substitutability unambiguously delays the timing of adoption. In addition, network effects delay the timing of the first adoption while they contribute to delay further (accelerate) the timing of the second adoption if goods are sufficiently differentiated (close substitutes).

Proof

See the Appendix.

Milliou and Petrakis (2011) explain the rationale for the leader’s market technology adoption’s taking place later than the social optimal. The leader cannot take over the entire social surplus that the adoption generates in the market (the non-appropriability effect), and therefore it prefers to wait when the fine-tuning costs decrease.

Likewise, this result applies to the follower when the goods are differentiated. In that case, the follower has an almost monopoly position in the market, and it cannot appropriate the entire social surplus that the technology innovation generates. Consequently, to counterbalance the share of social surplus that cannot be taken over, the follower delays the timing of the technology adoption until the fine-tuning costs become adequately low.

If products have a sufficiently high degree of substitutability among them, the leader has already captured a large market share because it benefits from the positive cost-reduction effect of the earlier technology adoption. On the one hand, the follower’s technology adoption has a small-scale positive impact on social welfare because, though its costs decrease, it experiences only a slight production increment: the non-appropriability effect is insignificant. On the other hand, the follower’s new technology adoption tends to increase its market share. This business-stealing effect overcomes the non-appropriability effect, therefore providing an incentive to adopt the technology earlier than the social optimum.

The above-described mechanisms also apply in network industries. However, the presence of the network effects tends to reduce the discrepancy between the social planner’s objective and the market outcome with regard to the timing of technology adoption. The rationale for this result is as follows: It can be easily checked that the more intense are the network effects, the higher is the share of profits in the overall social welfare, which reduces the gap between the firms’ objectives and the social planner’s objective.

The above discussion reveals that, also in network industries, the market and the social planner do not have consistent incentives with regard to the patterns of new technology adoption: From the social planner’s perspective, the market-led adoption is generally too sluggish.

3.2 The Model with Output Commitment

Let us now consider a model in which firms can commit to an output level before consumers make their purchase decisions: Only the equilibrium output levels are credible announcements (Katz & Shapiro, 1985, Appendix A; Amir & Lazzati, 2011). In such cases, the output choices by each firm can lead to different equilibrium outcomes. Notice that each firm makes output decisions given its expectations with regard to the consumers of the rival firm’s product. This means that each firm knows that its own consumers consider its own output commitment; however, it does not know the consumers’ expectations with regard to the output of the rival firm.

Firm i’s profit function is as in (2). However, if a firm reliably commits to a given output level, it can directly affect the consumers’ expectations about the size of its network. Consequently, firm \(i\)’s reaction curve shifts upwards with respect to the equilibrium reaction correspondence in the presence of rational expectations. This means that, in the presence of output commitment, each firm is much more sensitive to the strategic moves of its rival.

The solution of the system of reaction functions for both firms leads to the equilibrium output that maximizes the per-period gross (from the adoption cost) profits and their level:

where \({\rm N} = (1 - n)(4 - \gamma^{2} )\).

Direct inspection of Eq. (10) reveals that, if \(n \to 1\), then the equilibrium output – \(q_{i}\) – tends to infinity, and profits tend to zero. The rationale for this result is as follows: An increase in the strength of the network effects increases the value of the intercept of each firm’s reaction function: Each firm produces in equilibrium a larger output because network externalities push them to try to capture higher market shares. However, the positive direct impact of increasing quantities due to the network effects on revenues is smaller than the negative indirect impact of decreasing prices which, consequently, tend to zero. As a consequence of decreasing prices, profits also tend to zero.Footnote 5

Following the procedure in the previous subsection, the leader and follower’s optimal adoption timings – \(T_{1}\) and \(T_{2}\) – are obtained from the maximization problem in (3) and (4), respectively, whose first-order conditions lead to (5). The incremental benefits expressions are now

Also, in this case: 1) \(I_{i} > 0\): a firm is incentivized to adopt the new technology; and 2) \(I_{1} > I_{2}\) and, therefore, \(T_{1} < T_{2}\): technology diffusion characterizes the industry.

Notice that when \(n \to 1\), then \(I_{1} ,I_{2} \to \infty\) and, thus, \(T_{1} ,T_{2} \to 0\). The rationale for this result is as follows: Because network effects lead to a harsher competitive environment under output commitment than under rational expectations, the firms’ margins deteriorate faster in the former case. As a consequence, in the presence of strong network effects, the leader has an immediate incentive to adopt the cost-reducing technology to improve its profitability. In order not to lose market share, the follower promptly reacts to the leader’s move and adopts the technology as well.

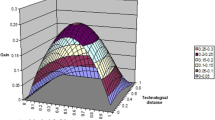

Let us concentrate on the role of the network effects: With regard to the leader, as in the rational expectations model, the incremental benefits are non-monotonic in the degree of product differentiation: for both small and large cost reductions. However, a remarkable difference arises under output commitment: In contrast to the model with rational expectations, intense network effects reinforce the non-monotonicity of the incremental benefits in the degree of product differentiation for the leader – irrespective of the magnitude of the cost reduction (see Fig. 5).

The reason for this finding is that the both firms react more aggressively: Output with advance commitment is larger than with rational expectations. Therefore, the competitive pressure increases. With respect to the leader: On the one hand, output expansion has a stronger indirect negative effect on prices, which reduces margins and revenues, and reduces its adoption incentives. On the other hand, the cost-reducing technology adoption reinforces the strategic effect and the output effect, which is stronger than with rational expectations because it spreads over a larger output, which leads to a more pronounced decrease in total costs. The overall positive effect on costs with output commitment is larger than with rational expectations, and this more than offsets the negative effects on decreased revenues: The leader’s incremental benefits – and therefore its incentives for technology adoption – increase.

When the goods are almost independent, firms act as near-monopolists. Thus, the leader’s cost advantage due to technological innovation does not hinder the rival’s output choice: The strategic and output effects are minimal, and the business-stealing effect does not occur. However, the impact of an almost monopolist price-setting is dominant. Moreover, profits with output commitment are larger than with rational expectations: The incremental benefits increase, and technology innovation occurs earlier.

With regard to the follower, the results under output commitment qualitatively mirror those under the rational expectations model: The impact of network effects on revenues first tend to outweigh (when not too intense), and then to neutralize (when adequately intense) the strategic effect on the follower’s output that is caused by the leader’s cost advantage, which allows the follower to delay its timing of technological innovation (see Fig. 6).

The magnitude of the incremental benefits for both the leader and the follower is larger under the firms’ output commitment than under the rational expectations hypothesis and, therefore, the timing of the technology adoption is accelerated. These observations can be formally stated in the next Proposition:

Proposition 3.

In a network industry with output commitment: (a) for a given level of \(n\), \(I_{1}\) rises if \(\gamma \ge \gamma_{1}^{\tau } \equiv \frac{2}{3}\left[ {\frac{{2(a - c) + \Delta - \sqrt {(a - c)^{2} + 4(a - c)\Delta + \Delta^{2} } }}{a - c}} \right]\), and the timing of technology adoption is accelerated when goods either are almost independent or are close substitutes. For the network effects, an increase in \(n\) yields an increase in \(I_{1}\): More intense network effects lead unambiguously to an earlier timing of the new technology adoption; and (b) an increase in \(n\) generates an increase in \(I_{2}\), which leads unambiguously to an earlier timing of the new technology adoption. However, for a given level of \(n\), if \(\Delta \ge \Delta_{f} \equiv \frac{a - c}{3}\), then the timing of technology adoption is unambiguously delayed as the degree of product differentiation decreases, and network effects have a neutral role in the adoption decision.

Proof:

See the Appendix.

Proposition 3 states that, for given network effects, the degree of product differentiation plays a key role in determining the timing of the leader’s technology adoption: If \(\gamma \ge \gamma_{1}^{\tau }\), then \(\frac{{\partial I_{1} }}{\partial \gamma } \le 0\). However, more intense network effects unambiguously tend to incentivize an earlier adoption of the cost reducing technology: \(\frac{{\partial I_{1} }}{\partial n} > 0\). A similar result holds for the follower: \(\frac{{\partial I_{2} }}{\partial n} > 0\). Moreover, if the industry is characterized by strong network externalities, \(\frac{{\partial I_{2} }}{\partial \gamma } \le 0\): \(I_{2}\) is decreasing all over the range \(\gamma \in (0,1)\).

The intuition behind Proposition 3 has been previously sketched. The channels through which the U-shaped form of the incremental benefits for both the leader and the follower (when the cost-reduction is small) are the same, as was described in the previous section. However, product market competition with output commitment is harsher than with rational expectations, which magnifies the effects of network externalities on the leader’s decision about the adoption of a new technology. When adequately intense, network externalities cause the leader to adopt promptly the cost-reducing technology so as to increase margins; the follower immediately adopts the new technology as well to keep market shares.

When strong network effects are present, product differentiation further intensifies the competitive pressure, with an additional negative effect on the firms’ profitability. As products become close substitutes, when only the leader adopts the new technology, its cost advantage is larger than in the case of rational expectations. This is because of the leader’s more aggressive behavior (the strategic effect of further production) that is due to the output commitment.

However, part b) of Proposition 3 reveals that, if the cost reduction is drastic (larger than \(\Delta_{f}\), which is equivalent to the standard Cournot output value), the cost-disadvantage effect on the follower’s output that is due to the strategic effect of the leader’s cost advantage, depends only on the degree of product differentiation, and it is always decreasing.

This is because less differentiation causes the leader to have a significant strategic effect, which reduces the follower’s production. The output effect of adopting the cost-reducing technology spreads on a limited extra production of the follower, which is smaller than with rational expectations: The effect on total cost reduction is not sufficiently large to offset the indirect negative effect on prices, and therefore revenues, which is caused by the leader’s output expansion. As a consequence, the follower delays its technology adoption when the fine-tuning costs decrease.

This result suggests that network effects exhaust their role in shaping the follower’s technology adoption within standard competition; otherwise, efficiency gains become predominant, though not exhaustive, with regard to the innovation decision.

Let us now analyze the role of the network externalities under output commitment on the optimal technology adoption pattern from a welfare perspective. As in the previous subsection, the social planner may consider to set the adoption dates of the technology to maximize the overall welfare. The maximization problem is given by (7), the first-order conditions of which lead to (8). Under output commitment, the measures of the discrepancy between the socially and the market-driven first and second optimal adoption timing take, respectively, the following form:

Figures 7 and 8 give a graphical representation of (12) for the selected parameter values; an in-depth analytical inspection reveals the following results:

Differential between the socially optimal timing and the market-driven timing with regard to the first (left) and the second (right) technology adoption as functions of product substitutability \( (\gamma ) \) in a pre-commitment game, with output commitment for a given level of \(n\) and a small cost reduction (\(\Delta = .05\)). The graphs are drawn for \(a = 2\), \(c = 1\)

Differential between the socially optimal timing and the market-driven timing with regard to the first (left) and the second (right) technology adoption as functions of product substitutability \( (\gamma ) \) in a pre-commitment game, with output commitment for a given level of \(n\) and a large cost reduction (\(\Delta = .35\)). The graphs are drawn for \(a = 2\), \(c = 1\)

We have the following Proposition 4:

Proposition 4.

In a network industry, in the pre-commitment game with output commitment, the optimal social timing of the first adoption would always take place earlier than the market-driven one, while that of the second adoption would take place earlier (later) than the market-driven one if goods are sufficiently differentiated (close substitutes). A decrease in the degree of product differentiation unambiguously delays the timing. However, in contrast to the rational expectations model, more intense network effects unambiguously accelerate the optimal social timing of the first technology adoption while they tend to accelerate (delay) the timing of the second adoption if goods are sufficiently differentiated (close substitutes).

Proof:

See the Appendix.

In contrast to the rational expectations model, under output commitment the presence of network externalities expands the discrepancy between the social optimal timing and the market-driven timing adoption. The rationale for this result is as follows: Given that the social surplus is directly linked to output levels, and the output commitment pushes firms to increase production more than under the rational expectations, despite an increase in the level of the firms’ profits, their share in the overall social welfare decreases. As a consequence, the gap between the firms’ objectives and the social planner’s objectives widens.

With regard to the leader’s market-led innovation introduction, the takeover of the social surplus that is generated by the new technology adoption is smaller than in the case of the rational expectation model: The non-appropriability effect under output commitment is more pronounced. As a consequence, the leader delays the new technology adoption to a greater extent under output commitment than under rational expectations: The leader waits until the fine-tuning costs decrease sufficiently.

The same logic applies also to the follower when the goods are sufficiently differentiated because, as was described in the previous subsection, the follower is almost in a monopolist position. As has already been seen, when products are close substitutes, the follower has a small share of the market. The adoption of the cost-reducing technology allows the follower to gain market share: This incentivizes an earlier implementation. However, the new technology adoption – though it contributes to expand total output – has a small positive effect on overall social welfare.

Given that output commitment represents an additional source of competition (the follower becomes more aggressive), the firms’ profit margins tend to decrease. When goods are sufficiently close substitutes, the business-stealing effect still overcomes the non-appropriability effect, and the follower adopts the new technology earlier than the social optimum. However, the presence of network externalities leads to a further output expansion, with an additional negative effect on the follower’s profitability: Network externalities represent a force that tends to postpone the adoption of the new technology.

4 Extensions

This section briefly discusses two extensions of the basic model:

First, the pre-emption game (Fudenberg & Tirole, 1985; Milliou & Petrakis, 2011) is analysed, in which firms are unable to commit to their adoption dates at \(t = 0\). Each firm observes the rival’s actions with no information lags and can immediately react – at zero costs – to its adoption decision. As is known (Fudenberg & Tirole, 1985), contrary to the pre-commitment game, in the pre-emption game firms earn, in equilibrium, the same discounted profits.

The key findings of this model’s specification are as followsFootnote 6: As for standard goods, the leader’s incentives in the pre-emption game are increasing in the degree of product differentiation, and are larger than in the pre-commitment game: The new adoption in the pre-emption game occurs at an earlier date than in the pre-commitment game. The role of the network externalities is to expand the incremental benefits of the leader, which are larger when the goods are less differentiated: The more that the goods are close substitutes, the earlier the leader tends to adopt the new technology. These results hold under both the rational expectations and the output commitment hypotheses.

From the societal viewpoint, the social planner commonly delays adoption as the goods become closer substitutes. Milliou and Petrakis (2011) show that, with standard goods, the leader adopts the technology earlier in the technology diffusion equilibrium of the pre-emption game than in the second-best optimum. However, the role of the network externalities is the opposite under the rational expectations and the output commitment hypotheses: Under rational expectations (output commitment), network effects tend to magnify (lessen) this trend, further shrinking (enlarging) the discrepancy between the societal and the market-driven adoption incentives. Consequently, increasing network effects tend to delay farther (accelerate) the social planner adoption timing.

Second, the case of Bertrand competition under the rational expectation hypothesis has been investigated.Footnote 7 From Eq. (1), one derives the following direct linear demands

The expressions of equilibrium outputs that maximize the per-period gross (from the adoption cost) profits and their level under Bertrand competition are:

where \({\rm O} = (1 - \gamma^{2} )[(2 - n)^{2} - \gamma^{2} ]\). The first-order conditions of the firms’ discounted sum of profits maximization problem in (3) and (4) lead to the following expressions of the incremental benefits:

Analytical and graphical inspections (see Fig. 9) reveal the following results: 1) \(I_{1} > 0\): The leader always has incentives to adopt the new technology; however, \(I_{2} \frac{ > }{ < }0\) if \(\gamma \frac{ < }{ > }\gamma^{\iota }\): When the goods are sufficiently close substitutes, the follower can be disincentivized to adopt the cost-reducing technology; and 2) \(I_{1} > I_{2}\), the leader’s incremental benefits are larger than the follower’s. As a consequence, \(T_{1} < T_{2}\): The industry is characterized by technology diffusion in equilibrium also under Bertrand competition.

Firm 1's and Firm’s 2 incremental benefits in a Bertrand market as functions of product substitutability (\(\gamma\)) in a pre-commitment game for a given level of \(n\) and a large cost reduction (\(\Delta = .35\)). The graphs are drawn for \(a = 2\), \(c = 1\). For small cost reductions, the figures are qualitatively unchanged

With regard to the timing of adoption by the leader: The presence of network externalities alters the result of Milliou and Petrakis (2011) in Proposition 1(i): For \(n = 0\), those authors find that the incremental benefits under Bertrand – \(I_{1}^{B}\) – are higher than those under Cournot – \(I_{1}^{C}\) – if the degree of product differentiation is above a given threshold: \(\gamma^{*}\).

The novelty is that a second threshold appears – \(\gamma^{**} < \gamma^{*}\) – that generates three areas in which the ranking order of the incremental benefits is as follows (see Fig. 10, left box): 1) for \(\gamma < \gamma^{**}\), \(I_{1}^{B} > I_{1}^{C}\); 2) for \(\gamma^{**} \le \gamma < \gamma^{*}\), \(I_{1}^{B} \le I_{1}^{C}\); and 3) for \(\gamma^{*} \le \gamma\), \(I_{1}^{B} \ge I_{1}^{C}\). However, numerical simulations (because no closed-form solution exists) lead to the result that, if the network effects are adequately strong (for \(\Delta = .35\), \(n > n^{\iota } \simeq .1471\)), then \(I_{1}^{B} > I_{1}^{C} ,\;\forall \gamma \in (0,1)\).

Firm 1's and Firm 2’s incremental benefits as functions of product substitutability (\(\gamma\)) in a pre-commitment game for \(n = .1\) and a large cost reduction (\(\Delta = .35\)), Cournot versus Bertrand competition. The graphs are drawn for \(a = 2\), \(c = 1\). For small cost reductions, the figures are qualitatively unchanged

The intuition behind this novel result is as follows: With standard goods, the strategic effect of adoption under Cournot competition is positive because it expands the adopter's output, which induces a decrease in the rival’s output; while under Bertrand competition, the strategic effect is negative: Adoption reduces the adopter's price and that of the rival as well, which diminishes adoption incentives. Because market competition is tougher when it is in prices rather than in quantities, the output expansion that is due to the cost-reducing technology adoption is more pronounced; thus, the output effect under Bertrand competition is greater than under Cournot competition.

When goods are highly differentiated (low substitutability), firms are almost monopolists irrespective of the Cournot/Bertrand competition mode: Their demands are barely connected, and their outputs are virtually identical. This implies that the output effect is irrelevant: The strategic effect dominates. However, network externalities alter the latter result because they allow both output expansion and a non-drastic fall in prices, which alleviates the negative strategic effect. Thus, if the degree of product differentiation is not too high, the output effect becomes dominant.

On the other hand, with regard to the timing of adoption of the follower, the presence of network externalities deeply modifies the result of Milliou and Petrakis (2011) in Proposition 1(ii): The authors find that, regardless of the degree of product differentiation, \(I_{2}^{B} \le I_{2}^{C}\): Technology adoption occurs earlier under Cournot than under Bertrand competition.

The presence of network effects reverses the incremental benefits’ ranking order under the different competition modes if the degree of product substitutability is below a threshold level, \(\gamma^{o}\): \(\gamma^{o} < \gamma^{**}\) (see Fig. 10, right box). Moreover, numerical simulations reveal that the greater are the network effects, the higher is the value of \(\gamma^{o}\) such that \(\gamma^{o} \le \gamma \Rightarrow I_{2}^{B} \le I_{2}^{C}\): The strategic effect dominates the output effect only if the network externalities are adequately intense.

With respect to the socially optimal timing, the first-order conditions of the social planner’s maximization problem in (7) allow the derivation of the differential between the optimal timing for society and the market-driven timing with regard to the first and the second adoption, respectively:

Analytical and graphical inspections reveal that the social planner would prefer the first adoption to occur earlier than the market-driven one, regardless of the competition mode (\(\sigma\) is always positive, see Fig. 11). Under Cournot competition, network externalities always reduce the discrepancy between the market and the social planner incentives; this follows the mechanisms described in the previous section.

Differential between the socially optimal timing and the market-driven timing with regard to the first technology adoption under Cournot (left) and Bertrand (right) as functions of product substitutability \( (\gamma ) \) in a pre-commitment game with rational expectations, for a given level of \(n\) and a large cost reduction (\(\Delta = .35\)). The graphs are drawn for \(a = 2\), \(c = 1\). For small cost reductions, the figures are qualitatively unchanged

However, under Bertrand competition, when the goods become close substitutes, network externalities increase this discrepancy because they magnify the negative impact of the strategic effect on the leader’s adoption, while fostering competition and expanding output, and therefore improving overall social welfare.

With regard to the timing of the second adoption (see also Fig. 12), the findings under Bertrand competition qualitatively reflect those under Cournot competition. Moreover, comparing the incremental benefits functions, one obtains that if \(\gamma\) is below a certain threshold, then the social planner would adopt the second technology earlier under Bertrand competition than under Cournot regardless of the network effect intensity: Price competition magnifies the non-appropriability effect.Footnote 8

Differential between the socially optimal timing and the market-driven timing with regard to the second technology adoption under Cournot (left) and Bertrand (right) as functions of product substitutability \( (\gamma ) \) in a pre-commitment game with rational expectations, for a given level of \(n\) and a large cost reduction (\(\Delta = .35\)). The graphs are drawn for \(a = 2\), \(c = 1\). For small cost reductions, the figures are qualitatively unchanged

5 Conclusions

This paper has introduced network externalities into the analysis of the timing of technology adoption à la Milliou and Petrakis (2011). In a pre-commitment game under a Cournot duopoly market competition, the presence of network effects tends to increase the size of the incremental benefits of the new technology adoption for both firms. This result applies both under the rational expectations hypothesis and under the firms’ output commitment conjecture. Consequently, the stronger are the network effects, the earlier the technology innovation occurs.

However, under the rational expectations hypothesis, if the network effects are sufficiently intense, the firms’ incremental benefits are monotonically decreasing for every degree of product differentiation, irrespective of the scale of the cost reduction. The timing of the technology adoption thus tends to be delayed. On the other hand, under the output commitment hypothesis, the firms’ incremental benefits become monotonically decreasing for every degree of product differentiation, but the network effects play a neutral role: The magnitude of the cost reduction is the only force that drives this result.

With regard to the optimal social timing, the socially optimal first adoption would always take place earlier than the market-driven adoption; a decrease in the degree of product differentiation, which leads to harsher market competition, unambiguously delays the innovation introduction. On the other hand, with regard to the second technology adoption, the socially optimal timing would take place earlier (later) than the market-driven one if goods are sufficiently differentiated (close substitutes). Also, for the follower, product differentiation unequivocally delays the innovation introduction. Those findings are valid under both rational expectations and output commitment.

However, the role of network externalities under the two models’ specifications is completely the opposite: Under the rational expectation hypothesis, the network effects shorten the discrepancy between the social optimal and the market-driven innovation introduction; by contrast, under the output commitment, network effects widen this discrepancy.

Moreover, with regard to the second technology adoption, with rational expectations, an increase in the network externalities delays (accelerates) the innovation introduction if products are sufficiently differentiated (close substitutes); on the other hand, with output commitment, increasing network effects accelerates (delays) the innovation introduction if products are sufficiently differentiated (close substitutes). With regard to the timing of the second adoption, the findings under Bertrand competition qualitatively reflect those under Cournot competition. Moreover, comparing the incremental benefits functions, one obtains that if \(\gamma\) is below a certain threshold, then under Bertrand competition the social planner would adopt the second technology earlier than under Cournot regardless of the network effect intensity: Price competition magnifies the non-appropriability effect.

An interesting research direction that should be pursued, is to extend the analysis to the case of the adoption of cost-reducing technologies that abate pollution levels as well: to extend the current framework to an analysis of the timing of adoption of cleaner production processes and green investments. This is left for future research.

Notes

The innovation adoption process is defined as a three-stage sequence: 1) initiation, which integrates the pre-adoption activities; 2) the adoption decision (the process that leads the management to the decision to adopt an innovation); and 3) implementation, which stresses the post-adoption activities (Pichlak, 2016).

As usual in IO models, the demand function derives from a quasi-linear utility function, which rules out income effects (analytical details are available in supplemental material upon request from the authors): The price effect drives the demand changes. In a report on network industries, the European Commission (2007) states that, in the period 1994-2004, the expenditure of telecommunication services by low-income households with respect to that of high-income households in the EU was mainly affected by the direct price effect. Due to “club” (consumption) externalities, the consumers’ reaction to a decrease in prices is amplified, which leads to a large increase in the use of telecommunication services (in particular mobile phones). The data also reveal that, on average, lower-income households increased their consumption of telecommunication services to a larger extent than did high-income households. These findings point to the strong price elasticity of consumption, but also the effect of technological advances and habit changes across user categories and across EU countries.

In their analysis, Milliou and Petrakis (2011) build the parameter \(\delta \equiv \frac{\Delta }{(a - c)}\) to capture how “drastic” is the new technology: the extent to which the new technology is responsible for the reduction of the marginal cost (relative to market size). A higher \(\delta\) means that the new technology is relatively more drastic, and therefore the efficiency improvement/cost reduction from new technology adoption is relatively far-reaching. If the term \((a - c)\) is normalized to one (as is done in our numerical simulations), the parameter \(\Delta\) mirrors the efficiency improvement of the new technology adoption.

Note that, when the scale of the cost reduction (\(\Delta\)) is small, there is virtually no difference in the incremental benefits for the leader and follower: \(I_{1} - I_{2} \simeq 0\)

Analytical details are available upon request in a Supplement.

Analytical details are available upon request from the authors.

Analytical details are available in a Supplement from the authors upon request.

The case of output commitment under Bertrand competition has also been tested. In this case, the model becomes analytically complex, with several results characterized by non-monotonicity. However, our preliminary findings show that: 1) the model requires a specific set of parameter restrictions to guarantee the existence of the analytical results; 2) except for the case of standard goods, the incremental benefit functions of the leader and the follower have a similar behavior: They are increasing in the degree of product differentiation if the goods are sufficiently differentiated while, if close substitutes, they are decreasing (the timing of adoption is delayed); and 3) as expected, the incremental benefits of the leader are larger than those of the follower; however, while in the rational expectations model the discrepancy between the two incremental benefits expands as long as the goods become more substitutable, in the output commitment model the first-mover advantage tends to disappear.

References

Alipranti, M., Milliou, C., & Petrakis, E. (2015). On vertical relations and the timing of technology adoption. Journal of Economic Behavior & Organization, 120, 117–129. https://doi.org/10.1016/j.jebo.2015.10.011

Amir, R., & Lazzati, N. (2011). Network effects, market structure and industry performance. Journal of Economic Theory, 146(6), 2389–2419. https://doi.org/10.1016/j.jet.2011.10.006

Bhattacharjee, T., & Pal, R. (2014). Network externalities and strategic managerial delegation in Cournot duopoly: Is there a prisoner’s dilemma? Review of Network Economics, 12(4), 343–353. https://doi.org/10.1515/rne-2013-0114

Choi, J. P., & Thum, M. (1998). Market structure and the timing of technology adoption with network externalities. European Economic Review, 42(2), 225–244. https://doi.org/10.1016/S0014-2921(97)00065-2

Dastidar, K. G. (2015). Nature of competition and new technology adoption. Pacific Economic Review, 20(5), 696–732. https://doi.org/10.1111/1468-0106.12140

Deloitte (2018). Toward the next horizon of Industry 4.0. Retrieved January 24, 2020 from https://www2.deloitte.com/content/dam/insights/us/articles/IL327_Toward-the-next-horizon/IL327_Toward-the-next-horizon.pdf

European Commission. (2004). A pocketbook of e-business indicators. Office for Official Publications of the European Communities.

European Commission. (2005). A pocketbook of E-business indicators. Office for Official Publications of the European Communities.

European Commission. (2006). A pocketbook of E-business indicators. Office for Official Publications of the European Communities.

European Commission. (2007). Evaluation of the performance of network industries providing services of general economic interest. European Economy (1), Office for Official Publications of the European Communities, Luxembourg.

European Commission. (2018). Digital Transformation Scoreboard 2018. EU businesses go digital: Opportunities, outcomes and uptake. Office for Official Publications of the European Communities

Fanti, L., & Buccella, D. (2018). Profitability of corporate social responsibility in network industries. International Review of Economics, 65, 271–289. https://doi.org/10.1007/s12232-018-0297-8

Forbes (2018). Digital is changing the economics of manufacturing. Retrieved January 23, 2020 from https://www.forbes.com/sites/vickiholt/2018/08/02/digital-is-changing-the-economics-of-manufacturing.

Fudenberg, D., & Tirole, J. (1985). Preemption and rent equalization in the adoption of new technology. Review of Economic Studies, 52(3), 383–401. https://doi.org/10.2307/2297660

Hoernig, S. (2012). Strategic delegation under price competition and network effects. & Economics Letters, 117(2), 487–489. https://doi.org/10.1016/j.econlet.2012.06.045

Katz, M. L., & Shapiro, C. (1985). Network externalities, competition, and compatibility. American Economic Review, 75(3), 424–440.

Ma, H., Wang, X. H., & Zeng, C. (2015). Cournot and bertrand competition in a differentiated duopoly with endogenous technology adoption. Annals of Economics & Finance, 16(1), 231–253.

McKinsey & Company (2018). The next horizon for industrial manufacturing: Adopting disruptive digital technologies in making a delivering. Retrieved January 23, 2020 from https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/McKinsey%20Digital/Our%20Insights/The%20next%20horizon%20for%20industrial%20manufacturing/The-next-horizon-for-industrial-manufacturing.ashx.

Milliou, C., & Petrakis, E. (2011). Timing of technology adoption and product market competition. International Journal of Industrial Organization, 29(5), 513–523. https://doi.org/10.1016/j.ijindorg.2010.10.003

Nicoletti, G., von Rueden, C., & Andrews, D. (2020). Digital technology diffusion: A matter of capabilities, incentives or both? European Economic Review, 128, 103513. https://doi.org/10.1016/j.euroecorev.2020.103513

Pal, R. (2014). Price and quantity competition in network goods duopoly: A reversal result. Economics Bulletin, 34(2), 1019–1027.

Pal, R. (2015). Cournot vs. Bertrand under relative performance delegation: Implications of positive and negative network externalities. Mathematical Social Science, 75, 94–101. https://doi.org/10.1016/j.mathsocsci.2015.02.007

Pichlak, M. (2016). The innovation adoption process: A multidimensional approach. Journal of Management & Organization, 22(4), 476–494. https://doi.org/10.1017/jmo.2015.52

Quirmbach, H. C. (1986). The diffusion of new technology and the market for an innovation. The RAND Journal of Economics, 17(1), 33–47. https://doi.org/10.2307/2555626

Reinganum, J. (1981a). On the diffusion of new technology: A game theoretic approach. Review of Economic Studies, 48(3), 395–405. https://doi.org/10.2307/2297153

Reinganum, J. (1981b). Market structure and the diffusion of new technology. The Bell Journal of Economics, 12(2), 618–624. https://doi.org/10.2307/3003576

Shapiro, C., & Varian, H. R. (1998). Information rules: A strategic guide to the network economy. Harvard Business Press.

Song, R., & Wang, L. F. S. (2017). Collusion in a differentiated duopoly with network externalities. Economics Letters, 152, 23–26. https://doi.org/10.1016/j.econlet.2016.12.032

Acknowledgements

We are extremely grateful to the Editor-in-Chief, Professor Lawrence White for constructive criticism and extensive comments, and two anonymous referees for valuable suggestions that have helped us to improve significantly the quality and clarity of this paper. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Proof of Proposition 1

In the range \(\gamma \in (0,1)\), the leader’s incremental benefit function, \(I_{1}\), has a local minimum in \(\frac{{\partial I_{1} }}{\partial \gamma } \le 0 \Rightarrow \gamma \le \frac{{(2 - n)\left[ {2(a - c) + \Delta - \sqrt {(a - c)^{2} + 4(a - c)\Delta + \Delta^{2} } } \right]}}{3(a - c)(1 - n)}\). Solving the equation \(\left. {\frac{{\partial I_{1} }}{\partial \gamma }} \right|_{\gamma = 1} \le 0\) (so that \(I_{1}\) is decreasing \(\forall \gamma \in (0,1)\)) for the network externality, one gets the value of \(n_{1}\). Likewise, with regard to the follower, \(I_{2}\) has a local minimum in the range \(\gamma \in (0,1)\) when \(\frac{{\partial I_{2} }}{\partial \gamma } \le 0 \Rightarrow \gamma \le \frac{{(2 - n)\left[ {2(a - c) + \Delta - \sqrt {(a - c)^{2} - 2(a - c)\Delta - 2\Delta^{2} } } \right]}}{3(a - c + \Delta )(1 - n)}\). Solving \(\left. {\frac{{\partial I_{2} }}{\partial \gamma }} \right|_{\gamma = 1} \le 0\) (so that \(I_{2}\) is decreasing \(\forall \gamma \in (0,1)\)) for the network externality, one gets the value of \(n_{2}\). Direct comparison reveals that \(n_{2} < n_{1}\).

Proof of Proposition 2

Simple inspection of the first equation in (9) reveals that \(\sigma > 0\) for all of the relevant ranges of the model’s parameters. Differentiation shows that both \(\frac{\partial \sigma }{{\partial \gamma }} < 0\) and \(\frac{\partial \sigma }{{\partial n}} < 0\). On the other hand, from the second equation in (9) one gets that \(\varsigma \frac{ > }{ < }0\) if \(\gamma \frac{ < }{ > }\frac{2(a - c) + \Delta }{{2(a - c + \Delta )}}\), and differentiation reveals that \(\frac{\partial \varsigma }{{\partial \gamma }} < 0\) and \(\frac{\partial \varsigma }{{\partial n}}\frac{ > }{ < }0\) if \(\gamma \frac{ > }{ < }\frac{2(a - c) + \Delta }{{2(a - c + \Delta )}}\).

Proof of Proposition 3

With regard to part a), simple differentiation of the first equation in (11) shows that, in the range \(\gamma \in (0,1)\), the incremental benefits function of the leader \(I_{1}\) has a local minimum in \(\frac{{\partial I_{1} }}{\partial \gamma } \le 0 \Rightarrow \gamma \le \frac{2}{3}\left[ {\frac{{2(a - c) + \Delta - \sqrt {(a - c)^{2} + 4(a - c)\Delta + \Delta^{2} } }}{a - c}} \right]\); moreover, \(\frac{{\partial I_{1} }}{\partial n} = \frac{{I_{1} }}{(1 - n)} > 0\).

With regard to part b), differentiation of the second equation in (11) also shows that \(\frac{{\partial I_{2} }}{\partial n} = \frac{{I_{2} }}{(1 - n)} > 0\). Furthermore, in the range \(\gamma \in (0,1)\), the follower’s incremental benefit, \(I_{2}\), has a local minimum in \(\frac{{\partial I_{2} }}{\partial \gamma } \le 0 \Rightarrow \gamma \le \frac{2}{3}\left[ {\frac{{2(a - c) + \Delta - \sqrt {(a - c)^{2} - 2(a - c)\Delta - 2\Delta^{2} } }}{a - c + \Delta }} \right]\); and the solution of the inequality \(\left. {\frac{{\partial I_{2} }}{\partial \gamma }} \right|_{\gamma = 1} \le 0\) (so that \(I_{2}\) is decreasing \(\forall \gamma \in (0,1)\)) for the size of the cost reduction, \(\Delta\), leads to the value of \(\Delta_{f}\).

Proof of Proposition 4

A simple inspection of the first equation in (12) shows that \(\sigma > 0\) in the relevant parameter ranges of the model. Differentiation shows that both \(\frac{\partial \sigma }{{\partial \gamma }} < 0\) and \(\frac{\partial \sigma }{{\partial n}} = \frac{\sigma }{(1 - n)} > 0\). From the second equation in (12) it is obtained that \(\varsigma \frac{ > }{ < }0\) if \(\gamma \frac{ < }{ > }\frac{2(a - c) + \Delta }{{2(a - c + \Delta )}}\). Differentiation reveals that \(\frac{\partial \varsigma }{{\partial \gamma }} < 0\) and \(\frac{\partial \varsigma }{{\partial n}} = \frac{\varsigma }{(1 - n)}\frac{ > }{ < }0\) if \(\gamma \frac{ < }{ > }\frac{2(a - c) + \Delta }{{2(a - c + \Delta )}}\).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wang, L.F.S., Buccella, D. The Timing of Technology Adoption in Network Industries. Rev Ind Organ 62, 367–392 (2023). https://doi.org/10.1007/s11151-023-09902-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-023-09902-4