Abstract

By applying the Bresnahan-Reiss empirical entry threshold model on Census data for the waves 1981 to 2011, we study the evolution of entry conditions in Italian local banking markets under a long-run perspective in order to capture the consequences of the removal of branching restrictions that occurred in the early 1990s. We do not find evidence of collusive behavior among local banks; instead, competition seems to have increased with respect to the number of banks and through the years—even if banks’ variable profits have risen over time. Overall, banks appear to have responded to the growing competition through the adoption of non-price strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The relationship between banking market structure and competitive forces has been an intriguing and persistent topic in the economic literature—especially with respect to highly concentrated markets (for example, local areas). In contestable markets, entry and exit are costless because of low or absent barriers; hence, there are no sunk entry costs, and potential competition may make the market perfectly competitive regardless of its concentration. More often, concentration results from the presence of entry barriers for new banks, with important implications in terms of antitrust and policy debates on the need and importance of competition among banks.

In this study, we apply the empirical entry threshold model of Bresnahan and Reiss (1991) to the Italian banking sector in four different years—1981, 1991, 2001, 2011—that cover a wide period of noteworthy structural and regulatory changes. This model is a consolidated tool for analyzing industries with several geographically independent local markets, so we employ it for analyzing the behavior of all categories of Italian banks, which normally compete at the local level across Italy. The model allows the estimation of entry thresholds—the minimum number of customers that are needed to open a new bank or branch—without needing any information about banks’ prices and costs.

We regard our investigation as a valuable contribution for assessing the impact of deregulation on banks’ behavior in Italy. We provide evidence on the changes in their conduct in a long-run perspective—30 years—through the use of a different econometric technique than those that have been employed in the existing studies. Moreover, we focus on the lowest possible level of geographic aggregation—municipalities (which are the smallest administrative division in Italy with own government), that represent our unit of observation—so as to capture meaningful specific—and otherwise neglected—characteristics of local markets. As background, in Italy local banking markets are mostly monopolies or oligopolies: In 2011, 33.6% of banked municipalities had just one bank (53.4% in 1981), and 22.2% of them had just two banks (20.3% in 1981).Footnote 1

Focusing on the Italian case is also important because we can obtain evidence on how the changes in regulation—which occurred in the past few decades—have affected the competitive forces and behavior in local banking markets; we thus shed light on banks’ reactions to changing environments. The determinants of the number of banks that operate in local markets—as well as the relationship between the number and conduct of banks in a market—are crucial questions also for other European countries that share with Italy the structural transformations that followed the European Directives for the creation of a single European banking market. Hence, our approach might be applied to those countries’ banking industries as well.

The estimation results reject any evidence of collusive behavior among banks for all years, since the per bank entry thresholds gradually increase with the number of operating banks. This means that an additional bank needs a larger clientele in order to achieve long-run profitability. However, such thresholds fall with time, which implies that deregulation has made entry in local markets easier. Besides, banks’ variable profits are higher in monopolistic markets, decreasing in the number of banks but increasing with time, while fixed costs rise with the number of competitors. The latter trends are compatible with the presence of endogenous sunk costs (Sutton, 1991): Banks raise their provision of quality in order to increase consumers’ willingness to purchase, despite the banks’ higher fixed costs.

The analysis is structured as follows: Sect. 2 sketches the evolution of the Italian banking sector, while Sect. 3 illustrates the Bresnahan-Reiss approach to the analysis of entry and competition in local concentrated markets; we also review some empirical studies that have made use of this methodology. Section 4 describes our empirical model; the data and estimation technique are presented in Sect. 5. Section 6 discusses the econometric results, and Sect. 7 provides some conclusions and policy recommendations.

2 The Evolution of the Italian Banking Industry

Since the end of the 1980s, the Italian banking industry has undergone major transformations. On the one side, the structural changes were attributable to factors that were common to most European countries: the deregulation that occurred at the European level, such as the elimination of national barriers and the creation of a common market where banks could open branches without any restraint; the introduction of the Euro currency, which facilitated banks’ establishment and business outside their own countries; and technological progress, which helped to reduce costs, increase productivity, and lessen geographical barriers.

On the other side, the restructuring of the Italian banking sector has been greatly influenced by historical peculiarities that still affect market structure. Particularly, until the beginning of the 1990s, Italian banks operated in a low competitive environment because of strict regulation from the Bank of Italy with respect to the birth of new banks and also the opening of new branches by the existing banks. These rules went back to the 1936 Banking Law, which was an aftermath of the Great Depression of 1929–1933, and were aimed at guaranteeing the soundness and stability of credit intermediaries.

The spirit of the reform of 1936 was to create geographically limited credit markets where operating banks had a sort of exclusive competence. It also introduced the principle of ‘banking specialization’—according to the maturity of their liabilities, credit institutions were distinguished in terms of short-term banks (less than 18 months) and medium- and long-term banks (over 18 months)—as well as a strong separation between banks and industrial firms. As a result, competition among banks, at that time regarded as a source of instability, was limited (Siclari, 2015, p. 9).

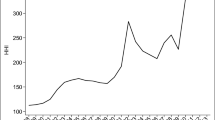

Between the 1930s and the 1980s the main characteristics of the Italian banking system remained on the whole unchanged (the metaphor “petrified forest” was often used for drawing a quick sketch of the banking sector). In 1979 there were 1066 banks and 13,297 branches; on average, each bank managed 12 branch offices. More than a half of branches (56.1%) were located in the Northern area; 21% were in the Central regions; and 22.9% were in the South and Islands.

Compared to international standards, in Italy there were many banks and few branches. The system was dominated by local oligopolies, and it was quite difficult for any bank to penetrate where its competitors were traditionally established. State-owned banks—which were born as a result of government rescue operations during the Great Depression—held about 70 per cent of total credit system assets; this was a market share that stayed generally stable up to the 1990s (De Bonis et al., 2012).

In the 1980s, the Bank of Italy introduced some deregulation by authorizing the opening of new branches throughout the country, although these followed a ‘regulated’ plan of expansion. The main reason for relaxing control of banks’ behavior was the release of European Directives that aimed at creating a single market in which banks were free to open branches across States once they had obtained a license in their home country.

Eliminating its longstanding discretionary power, the Bank of Italy issued three ‘branch plans’ (‘Piani sportelli’) in 1978, 1982, and 1986; these were the first examples of transparent rules with regard to the opening of new offices (De Bonis et al., 2018). They induced the entry of many banks in local markets, which forced incumbents to improve their efficiency. In 1985 there was the liberalization of bank creation, which increased bank turnover; and in 1990 the state-owned banks were transformed into joint-stock companies, while the prohibition of providing long-term loans by commercial banks was relaxed.

Branching restrictions in Italy were totally removed in 1990, and in 1993 a new Banking Law was approved, which incorporated the EU’s Second Coordination Banking Directive and completely reorganized the whole sector. As a result, the number of branches quickly expanded: Between 1989 and 1994 the average yearly growth rate of banks was + 7.6%, while in the period 1994–1999 it slowed somewhat to + 3.9%. This increase allowed Italy to reach about the median in European rankings of indicators of banking capacity (Ciari & De Bonis, 2011).

In the 2000s, advances in information technology contributed to a further transformation and reorganization of the Italian banking industry, with beneficial effects on banks’ efficiency, cost-effectiveness, and innovation (Beccalli & Girardone, 2016). Distribution channels that employ new technologies—such as internet banking and mobile banking—are today increasingly being used: According to Eurostat data, in 2011 the individuals who used internet banking in Italy amounted to 20% of the population aged 16–74; it was 9% in 2006, while in 2019 this figure is estimated to have increased to 36%.

Toward the end of the 2000s, Italy suffered the effects of the global financial crisis and the Eurozone sovereign debt crisis, which were the prime causes of a reduction in the number of banks (especially mutual banks), branches, and banks’ employees; a decrease in banks’ margins; and an increase in non-performing loans. The average size of Italian banks increased, while their performance suffered from low margins, rising regulatory costs, poor loan demand, and the increasing cost of credit (Beccalli & Girardone, 2016).

In 2011, in Italy there were 728 banks (−31.7% compared to 1979) and 33,621 branches (+ 152.8%); the average size (46.2 offices per bank) was almost four times as that of 1979. Banks’ presence was even higher in Northern regions (57.7% of total branches) and lower in the South and Islands (21.1%), meaning that they were focusing to a larger extent on more productive areas. Finally, there was an increase in loans that were provided by cooperative banks (from 2 to 7% of the total, due to their small size coupled with a unique customer proximity, which made them the primary funding providers for many Italian households and SMEs) and foreign banks (5.5% of total loans, whereas they were absent before).

We try to ascertain both the degree and the evolution of competitive conditions in the Italian banking industry through the empirical entry threshold model of Bresnahan and Reiss (1991); we focus on local markets—municipalities—in the years 1981, 1991, 2001, and 2011 (which correspond to the last four Census waves). Our sample period covers two of the three regimes identified by De Bonis et al. (2018) within the Italian banking sector: the ‘highly restrictive regulatory regime’ (introduced by the 1936 Banking Law and mostly unchanged until at least the end of 1970s) and the ‘deregulation and liberalization period’ (starting in the 1980s with the choice of the European Economic Community to achieve a more integrated financial system).Footnote 2

A few papers have investigated the determinants of entry in Italian local markets—usually coinciding with provinces. Through a Poisson regression model for the years 1990–2002, Gobbi and Lotti (2004) show that banks’ entry in such markets was more likely when there were more business opportunities in the provision of financial services that did not require the acquisition of significant proprietary information.

Working with data on 729 individual banks’ lending for the period 1986–1996, Bofondi and Gobbi (2006) find that asymmetric information between incumbents and entrants is able significantly to explain entrants’ loan default rates, since the latter were significantly higher for those banks that entered local markets without opening a branch. This result suggests that such asymmetries can generate barriers to entry into local credit markets.

Felici and Pagnini (2008) employ a fixed effect conditional logit model for estimating the probability of entry of a bank in a new local market in the period 1990–2002. Their evidence is that a bank of larger size, higher profitability, and with a wider geographical scope of operations was more likely to enter new markets, which at the same time needed to be more populated and display a greater availability of funds (in terms of per capita deposits). In addition, banks that were endowed with more ICT capital were able to open branches in more distant markets.

With respect to the above studies, our investigation represents a novel contribution in the analysis of the Italian banking industry, as it offers a different perspective on evaluating the effects of the substantial transformation that followed both the regulatory interventions and the significant consolidation process. For our purposes, an ordered probit model that identifies the probability of observing a given number of banks in each municipality is estimated; the results allow us to calculate entry thresholds. The joint analysis of the results that come from homogeneous cross-sections—which cover both a long period of time and a phase of substantial deregulation within the banking sector—allows inferences that cannot be drawn on the basis of shorter period observations.

We believe that—in spite of the wide time interval under inspection, during which many changes, in terms of clientele characteristics and technology development, have occurred—the main activities of banks have remained the gathering of deposits, the making of loans, and the provision of other financial services (the weight of the latter has notably increased in more recent years), for which the geographical proximity is normally regarded a source of utility, at least for households and small firms (de Juan, 2008, p. 150), as the wide branch networks of some banks clearly indicate.

Therefore, banks can still be considered as firms that sell fundamentally homogeneous products that they seek to differentiate while competing in the various (local) sub-markets with the hope of reducing price rivalry (interest rates, service fees). At the local level, large banks rely on their size (and the related scale economies) as well as on a solid brand recognition, while small banks may be perceived as institutions that are deeply rooted in the local economic life, and hence with particular knowledge of resident individual and small businesses and special attention to their needs. All the above justifies the application of the Bresnahan and Reiss model of entry to the banking sector.

3 The Bresnahan and Reiss Model: Theoretical Background and Empirical Applications

In their seminal paper, Bresnahan and Reiss (1991) propose a model of entry into small isolated markets that assesses how quickly entry reduces firms’ profits. They consider five retail and professional service industries (doctors, dentists, druggists, plumbers, and tire dealers) and use cross-section data on the number of firms in 202 distinct US geographic markets.

They assume that the profits π of each of the N firms that operate in a given market are

the product between market size S (assumed as a linear function of population variables) and the per-customer variable profits VN (revenues minus variable costs) less fixed costs FN.

The impact of competition is incorporated by allowing variable profits VN to be a function of the number of firms. Such profits should be lower where more firms operate because of a stronger price competition. This is done by assuming that

where the α2,…,αN parameters describe how variable profits drop as the number of entrants increases from 2 to N (and X is a vector of control variables that affect either revenues or variable costs). For example, α2 quantifies the change of a monopolist’s variable profits when another firm enters the market. For the VN function to make economic sense, α2,…,αN should all be higher than or equal to zero, meaning that variable profits do not increase with entry, while their absolute values should decline with more entry (Berry & Reiss, 2007, p. 1857).

Fixed costs FN—which include both fixed production costs and fixed entry costs—are specified in a similar way:

In (3), the γn terms capture the increase in fixed costs that later entrants should incur, while W is again a vector of variables that might affect FN. For instance, if we observe a positive and significant value of γ2, we infer that a firm that enters a monopoly market has higher fixed costs than the existing firm.

Relying on the above framework, Bresnahan and Reiss (1991) are able to estimate the “entry thresholds” SN, that represent the smallest market size S that is able to accommodate N potential entrants, or the level of overall local demand that allows variable profits just to cover the fixed costs of N firms in the market. Under a discrete choice perspective, even if we do not have any information on firms’ profits, we can make use of qualitative evidence about their profitability. It is straightforward that a market will be able to support N firms when πN ≥ 0 and πN+1 < 0. By imposing the breakeven condition πN = 0, from (1) we get that SN = FN/VN.

Since larger markets are expected to support more firms, we can calculate the per-firm thresholds sN = SN/N that measure the fraction of the overall market that allows the N-th firm to stay in the market—how much population is needed to support each incumbent firm—and its value decreases as variable profits grow and as fixed costs decrease.

A crucial indicator that is suggested by Bresnahan and Reiss (1991) to measure the rate at which variable profits fall with entry—hence, to assess how local competition changes when the number of firms increases—is the ratio between per-firm entry thresholds sN+1/sN.

When firms have the same costs—and if entry does not change competitive conduct—this ratio equals 1, which is the case of both competitive and collusive markets. For example, if 2000 customers are needed to support a single firm in a market with homogeneous products and 4000 customers are needed to support two firms, the per-firm entry thresholds are 2000 and the entry-threshold ratio is 1. This outcome is compatible with either the competition case (actually, firms’ entry does not change competitive conduct) and the collusion case (since a cartel with N firms requires N times a single monopolist’s breakeven level of demand).

Instead, if 2000 customers are needed to support a single firm but 10,000 customers are needed to support a second firm—which means that the per-firm entry thresholds are 2000 and 5000, respectively, while the entry threshold ratio is 2.5—we might suppose that the first firm is able to hinder the entry of the second competitor, hence it exerts market power, and competition is then low. This also means that, if entry threshold ratios fall as the number of incumbents increases, the competitive conditions are improving (which is what we would normally expect).Footnote 3

From the above discussion, it should be evident that this statistic does not measure the level of competition, but how the level of competition changes with the number of firms. It is important to check what happens after several firms have entered: When the entry threshold ratio converges to one for large values of N, the market can be regarded as competitive (Bresnahan & Reiss, 1991, pp. 982–983).

The likelihood to observe N firms in a market is estimated by means of an ordered probit model (assuming that the error term has a normal distribution), where the categorical dependent variable is the number of firms that operate in each market and the likelihood function is maximized.

Essentially, the structural model by Bresnahan and Reiss (henceforth BR) builds on the strategic representation of a static, perfect information entry game, whose econometric version postulates that we observe the players’ equilibrium actions in each sample market (“enter” vs. “stay out”) but do not observe firms’ economic profits.

The logic is to use a specific equilibrium solution concept to work backward from the observed equilibrium actions to statements about unobserved profits (Reiss & Wolak, 2007, p. 4404). This also implies another advantageous characteristic of the BR model: It does not need data on firms’ margin and output—which are often not available—since fixed costs can be inferred by the breakeven condition that is imposed for the calculation of the entry thresholds, while the latter can be used to derive information on the extent of competition and firms’ technologies (Bresnahan & Reiss, 1991, p. 983).

The economics literature has also highlighted some limits of the BR approach: First, it is a static model; hence it is unable fully to reveal the patterns of firms’ entry from the data and requires that market structure be in long-run equilibrium. Second, the analysis relies on cross-sectional data without considering time series or examining actual new entries.

Third, the baseline framework does not take into account firm heterogeneity and assumes that firms produce homogeneous products. In the latter case, this means that an additional entrant leads only to business stealing and does not create market expansion (Schaumans & Verboven, 2015, p. 195). Fourth, sellers are supposed to be nearly identical, apart from potential differences in fixed costs.

Lastly, both per capita variable profit and fixed cost functions are assumed to be linear in their variables and constants. The reason for this assumption is twofold: The estimation is easier, and the separation between cost and demand variables is not easily achieved (Reiss & Wolak, 2007, pp. 4409–4410). Nonetheless, such linearity is not crucial to interpreting the entry thresholds (de Juan, 2008, p. 149).

On the whole, since the BR model draws economic inferences from qualitative data on entry and exit, it inevitably needs to impose a considerable economic structure and sacrifice realism in order to obtain empirically tractable specifications (Reiss & Wolak, 2007, p. 4411).

The BR paper has represented a significant contribution within the empirical literature on static entry models, especially for its ability to infer competition effects. Studies on the relationship between market size and market structure that have applied this approach (or its variants) include: Asplund and Sandin (1999) on Swedish driving schools; Manuszak (2002) on the American brewing industry in the nineteenth century; Mazzeo (2002) on US local motels; Dranove et al. (2003) on US Health Maintenance Organizations; Cleeren et al. (2006) on the Belgian video-rental market; Abraham et al. (2007) on the US hospital industry; Schaumans and Verboven (2008) on Belgian pharmacies and physicians; Nishida and Gil (2014) on the Spanish local TV industry; Schaumans and Verboven (2015) on different local service sectors in Belgium; Labaj et al. (2017) on a group of retail and professional service industries in Slovakia; Gil and Marion (2018) on US movie theaters serving African-American customers in the 1950s; Labaj et al. (2018) on three occupations in the Slovak healthcare industry (pharmacies, physicians, dentists); and Grant et al. (2021) on non-profit and for-profit nursing homes in the German long-term care market.

However, the BR approach has not been frequently used in the banking literature, and the existing applications refer mainly to the US: Cetorelli (2002) employs the BR framework to estimate entry thresholds for a cross-section of 2257 US local banking markets (particularly, rural counties) with reference to the year 1999. He finds no evidence of collusive behavior even in markets with only two or three banks in operation, and he shows substantial increases in the intensity of competition as the number of banks rises. The conclusion is that, by eliminating important barriers to entry, the process of deregulation in US banking during the 1990s has enhanced the conditions for market competition.

Cohen and Mazzeo (2007) use a variant of the BR methodology in order to assess competition among retail depository institutions in 1,884 US rural banking markets for the years 2000 and 2003. Particularly, they endogenize the operating decisions of three types of depository institutions—multimarket banks, single-market banks, and thrift institutions—and find robust evidence that product differentiation is able to deliver additional profits to retail depository institutions. Such gains allow markets to support many more depository institutions—including smaller banks and thrifts, even as larger banks expand their operations—than in a scenario with homogenous competitors.

Feinberg (2008) considers a cross-section of 115 geographically dispersed US rural markets (non-metropolitan labor market areas) for the year 2005 and tries to explain the impact that credit union entry has had on performance in local financial services markets by means of the BR methodology. The results suggest that credit unions possess little market power: There is a modest pro-competitive impact of adding credit unions beyond the first in a market; and the credit unions can be considered a competitive fringe sub-category of the broader local financial services market.

Feinberg and Reynolds (2010) study the change in the level of competition in 278 US rural banking markets after the deregulation that followed the Riegle-Neal Act of 1994. By employing the extension of the BR model that was suggested by Abraham et al. (2007)—incorporating information on the quantity of deposits—they decompose the impact of the entry of new banks into resulting changes in per capita demand and the costs/profits of local banks in 1994 and 2004. They discover that local banking markets have become more competitive.

Outside the US, we can find three studies: de Juan (2008) concentrates on the Spanish retail banking sector in 2003 and employs the BR methodology to examine how competitive conditions vary in 1572 independent local banking markets when the number of depository branches grows. Her empirical evidence shows that the entry of a new branch increases competition, even if local branches seem to have some scope for changing prices that are fixed at the national and regional levels.

Assuncao (2013) considers the expansion of banking correspondents—non-banking firms that work as bank branches and provide financial and payment services—in Brazilian municipalities in the period 2002–2007 and finds that they have been able to eliminate the entry barriers for the provision of financial services; they thus improve the outreach of the banking network—especially in less populated and more isolated regions.

Marin and Schwabe (2019) study a cross-section of 2165 Mexican local banking markets for the year 2010 and estimate a structural model of banks’ presence based on Bresnahan and Reiss (1991). They then use its residuals as a proxy for the effect of unobservables on market structure in a second-stage regression that aims to explain the penetration of bank accounts at the municipality level; the authors also control for bank infrastructure and sociodemographic factors. Their main evidence is that people are less likely to use basic financial services in markets in which the provision of bank services is more concentrated, whereas fostering competition is likely to drive an increase in the use of basic financial services.

4 Model Specification

In our framework, the profits πi of the N-th entrant are assumed to be the following:

where: \(S = TPOP + {{\mathbf{\lambda}}}^{\prime}{\mathbf{Y}}\) is the municipality’s market size; \(V_{N} = \alpha_{1} + {{\mathbf{\beta}}}^{\prime}{\mathbf{X}} - \sum\limits_{n = 2}^{N} {\alpha_{n} }\) represents banks’ per capita variable profits; and \(F_{N} = \gamma_{1} + \gamma_{L} POPKMQ + \sum\limits_{n = 2}^{N} {\gamma_{n} }\) denotes banks’ fixed costs.

In the function S, in addition to the variable that measures the number of inhabitants (TPOP), the following explanatory variables (vector Y) are considered:

-

the negative growth rate of town population during the last ten years (NGRW);

-

the positive growth rate of town population during the last ten years (PGRW);

-

the number of people that commute to work outside the municipality (OCTY); and

-

the population of the nearby municipalities (NPOP).

These variables enable us to measure possible effects on the number of banks from variations in the demographic characteristics of the town. NGRW and PGRW capture entrants’ asymmetric expectations about future market growth, as well as lags in responses to past growth (Bresnahan & Reiss, 1991, p. 990): They measure how the banks that enter the town expect the population to evolve and the effects of the lags produced in response to the population reduction. Given their characteristics, we are not able to predict the sign of their coefficient for the various years.

The commuters who travel out of the municipality for work (OCTY) help to take into account the possibility that a portion of local population’s demand is addressed to other towns; the nearby population (NPOP)—the sum of the population of all of the municipalities that are located within 10 km from the considered town—should capture the possible increase in demand from surrounding towns. We therefore expect a negative impact of OCTY and a positive impact of NPOP on the probability of establishing a new bank. We set the coefficient of TPOP to one because VN contains a constant term; this normalization allows for translating the units of market demand into units of current town population (Bresnahan & Reiss, 1991, p. 990).

In the function that measures banks’ per capita variable profits (VN), we include a number of control variables (vector X) so as to capture possible differences across markets. Since we do not have municipality-specific economic information for all the years under investigation, we employ Census data for building the following regressors:

-

the municipality share of employment in agriculture (AGR);

-

the number of families per 100 inhabitants (FAM);

-

the local employment rate (EMPL); and

-

the number of industrial local establishments per square kilometer (LOCUN).

It is likely that territories with relatively higher agricultural employment attract fewer banks because of the lower sectoral value added, while municipalities with more families, more employment, and more firms should be characterized by a higher level of demand and thus have a positive impact on the number of local operating banks.

Since the performance of financial institutions is influenced also by their strategic conduct—both at the local level and as a whole—we try to capture its effect on the profitability of locally operating banks by means of two additional variables: the average growth in the number of their branches over the last year at the country level (BGRW), and a measure of multimarket contact among them (MMC), here computed as the average number of contacts in other municipalities for each contact in the given municipality, with regard to the banks that operate in this town.

The first variable should help to catch the influence of an aggressive expansion policy on variable profits, while the second variable is added to assess the extent to which banks’ performance is affected by their strategic interaction as multimarket organizations (occurring chiefly by means of their geographical branch network).Footnote 4 We expect that both regressors are positively linked to variable profits.

So as to limit the omitted variable bias, in the VN function we also include finer spatial controls in the form of NUTS 2 regional dummy variables.

Finally, variable profits per customer VN include a constant, α1, plus a set of coefficients αn (n = 2,…,N) whose expected positive sign represents the fall of variable profits due to the entry of the n-th bank; however, we do not impose any constraint on the sign of the various αn’s. In our specification it is assumed that they do not vary across markets. In essence, in VN the expression \(\alpha_{1} + {{\mathbf{\beta}}}^{\prime}{\mathbf{X}} = V_{1}\) represents the per capita variable profits of a monopolist.

Banks’ fixed costs are modelled as a function of the population density of the municipality (POPKMQ), measured in thousands of people per square kilometer. We expect that the coefficient of this variable is positive given that, all else equal, the cost of buying or renting brick-and-mortar spaces for establishing branches should be higher in more densely populated areas. Fixed costs FN again include a constant, γ1, as well as a set of coefficients γn (n = 2,…,N) for which we expect a positive sign as long as they are higher for later entrants, because of either a lower level of efficiency or the presence of entry barriers; as before, no constraint is nonetheless imposed on the sign of γn’s. This also means that in FN the expression \(\gamma_{1} + \gamma_{L} POPKMQ = F_{1}\) equals a monopolist’s fixed costs.

Table 1 reports our variables and some descriptive statistics on our four samples. Data on banks and their territorial distribution come from the Bank of Italy, while all of the information on population and local economic activity are drawn from the 1981, 1991, 2001, and 2011 editions of both the Population and Housing Census and the Industry and Services Census by Istat (the National Statistical Institute).

5 Empirical Methodology and Data Description

As was mentioned above, in our empirical comparative statics analysis we use four cross-sections of Italian geographically focused banking markets—one for each Census wave from 1981 to 2011—where banks face different levels of demand for their products/services. We need to select our samples carefully so as to identify markets that are geographically independent; hence we focus on municipalities that are confidently separated from other towns.

In our opinion, a suitable selection criterion is to consider only municipalities that are at least 20 km from the nearest municipalities of over 10,000 people, because it allows us to capture adequately ‘isolated’ markets without excluding too many sizeable towns.Footnote 5 We then classify such municipalities according to whether they have zero, one, two, three, or four or more banks.

We are left with four samples that contain 9677 towns, overall: 2,440 for the year 1981, 2,446 for 1991, 2,401 for 2001, and 2,390 for 2011. However, 2,258 municipalities appear in all years, which ensures a high degree of homogeneity among the samples.Footnote 6 Table 2 shows the town distributions by year and number of banks. It emerges that across time—because of the deregulation—there has been a tendency for banks to enter new markets, so that, for example, the number of isolated municipalities without banks dropped by 27.7%, while those with four banks or more increased by 189.6%. Table 3 portrays the geographical distribution of towns within the country; this indicates that there is a satisfactory balance across NUTS 1 macro-regions.

In Table 4, we present the distribution of our sample municipalities by ranges of the local population, which can be seen as a reasonable first approximation of the size of local markets. As is evident, all samples include a wide variety of market sizes, which is reassuring with respect to the possibility of estimating the population that is required to support one, two, and more banks. Finally, Table 5 reports the yearly distribution of the types of credit institutions that operate in the sample towns: commercial, savings, popular, and cooperative banks. Again, we note a satisfactory assortment in all samples, which should rule out any effect that might be due to local credit preferences or peculiarities on market structure.

In the sample towns, commercial banks represent the prevailing type of credit institutions (41.2%). However, in municipalities with just one bank we observe also a noteworthy presence of both popular and cooperative banks. Over time, there is a progressively lesser presence of savings banks, while the share of the remaining categories has moderately increased.

The consolidation that occurred in the years under inspection is evident when we examine the size of operating banks (as measured by their number of branches). The number of municipalities with single-branch banks remarkably fall with time, amounting to just a few units in 2011. On the contrary, there is an increase of towns with large-sized banks. For example, in 2011 in 62.4% of the municipalities with one bank, that bank was a part of a network of credit institutions that managed over 100 branches (in 1981 this figure was 31%); and for towns with four banks or more, this percentage goes up to 69.8% (it was 55.1% in 1981).

Following Bresnahan and Reiss (1991), we assume that all banks within a market have the same unobserved profits, which allows us to make use of an ordered probit model to estimate Eq. (4). The dependent variable is the number of banks in the market. The likelihood functions for the ordered probits are built by calculating probability statements for each type of market structure.

The probability of observing markets where no banks operate is

where: Φ(·) is the cumulative normal distribution function, and π1 represents the monopolist’s profits. If we assume that \(\overline{\pi }_{1} \ge \overline{\pi }_{2} \ge \overline{\pi }_{3} \ge \overline{\pi }_{4}\), the probability that in equilibrium we observe N = 1,2,3 banks in the market is

while the residual probability of observing four or more banks in the market is.

\(\Pr (\pi_{4} \ge 0) = \Pr (\overline{\pi }_{4} + \varepsilon \ge 0) = \Pr (\varepsilon \ge - \overline{\pi }_{4} ) = \Phi (\overline{\pi }_{4} )\).

Hence the log-likelihood function (to be maximized) is the following:

where: M is the number of market observations; and 1(·) is the indicator function.

6 Econometric Results and Discussion

In a first step, we have estimated our probit regression on a pooled sample across all years (N = 9,677); we allow for different αn and γn coefficients each year. For both groups of αn’s and γn’s (n = 1,…,4) we have then tested the hypothesis that they are equal, which is rejected at the 5% significance level for five over eight groups (i.e.: α1, α2, α4, γ1, and γ4).Footnote 7 Hence, there is substantial evidence that the separate years are the appropriate level of analysis.

The estimation results of our ordered probit regression for each year are shown in Table 6. With regard to the market size variables: NGRW exhibits a significant (at least at the 5% level) coefficient in 1981 and 2001 but with opposite signs. Particularly, in 1981 (in 2001) the more (the less) negative is NGRW, the higher is the probability that a bank operates in a municipality. PGRW is never significantly different from zero. The variable OCTY is negative and significant in all regressions, proving that people moving out of towns for work reduce local market size. Nearby population (NPOP) is never significant, hence there is no evidence that the inhabitants of neighboring towns are part of municipalities’ markets.

When we examine the regressors that affect banks’ variable profits, it emerges that (as expected) bank profitability is higher—therefore, banks’ presence is more likely—in municipalities with fewer agricultural workers (AGR), more families (FAM), and higher employment rates (EMPL). Besides, the positive coefficients of the LOCUN variable indicate that markets with more industrial local establishments are also more attractive for banks, except in 1981.

Since BGRW is always positive and significant (at the 10% level only in 2011), we deduce that variable profits per inhabitant are higher in municipalities where operating banks are generally more aggressive in their expansion (as measured by the growth of managed branches all over the country).

The coefficient of MMC is also positive and significantly different form zero in all regressions, suggesting that variable profits increase with multimarket contact among banks. This result supports the conjecture that banks which meet in more markets are able to earn higher profits, and is therefore in line with the evidence of Coccorese and Pellecchia (2013) with regard to the Italian banking industry: Multimarket banks appear to be less willing to behave aggressively towards their rivals and prefer to forbear from aggressive conduct in a municipality as long as their competitors do the same in the other municipalities.Footnote 8

Fixed costs always increase with the population density (POPKMQ), which implies likely higher rent or buy prices for land and buildings, but this evidence is never statistically significant.

Although we did not impose any constraint on the signs of both αn’s and γn’s, they are generally positive and significant. Therefore, the estimated variable profits of each subsequent entrant bank gradually decline, while their fixed costs progressively increase. Moreover, the magnitude of α2 is higher in 1991, 2001, and 2011 than in 1981: In these later years the marginal impact of an entry on variable profits in monopolistic markets was stronger. Similarly, as the magnitude of both γ2 and γ3 is quite higher in 2001 and 2011 than in 1981 and 1991, we infer that in those years the entrants in monopoly and duopoly markets had to face higher fixed costs.

Overall, we deduce that, after deregulation, competitive forces have notably decreased profits in less concentrated local markets, and at the same time encouraged incumbent banks to implement non-price competition strategies that have inevitably increased rivals’ entry costs. Examples of banks’ non-price instruments may include advertising, service charges, personalized loans, extra opening hours, ATM availability, branch size, branch network, development of new products, and technological innovations (Dick & Hannan, 2010; Heffernan, 1992; Kim & Vale, 2001; Pinho, 2000; Scott, 1978).

Considering that the generic entry threshold for N banks—the minimum market size that can allow the presence of N banks—is equal to SN = FN/VN, where \(F_{N} = \gamma_{1} + \gamma_{L} POPKMQ + \sum\limits_{n = 2}^{N} {\gamma_{n} }\), \(V_{N} = \alpha_{1} + {{{\mathbf{\beta}}}}^{\prime}{\mathbf{X}} - \sum\limits_{n = 2}^{N} {\alpha_{n} }\) and N = 1,2,3,4, we can now calculate our SN’s (at the mean value of each regressor) by simply replacing the estimated coefficients of Eq. (4).

As panel (a) of Table 7 displays, for all years there is a steadily increasing path in the minimum number of inhabitants required in order to establish an additional bank in local markets, but the same figures notably drop from 1981 to 1991 and 2001, while in 2011 they still decline but at a much lower rate than earlier years (or slightly increase, as for S1). For example, in 1981 a monopoly bank required 1699 people in town to set up business, while in 2001 the same monopoly bank needed just 542 people (and in 2011 a bit more than 600).

Hence, in 20 years the required market size that allowed monopolistic banks to break even has fallen by more than two-thirds, and a similar trend has characterized duopolies, triopolies, and quadropolies. In the latter case, in 1981 four banks could operate in the same municipality on condition that its inhabitants numbered over 15,600, while in 2001 this figure had dropped to about 4900 (and it further decreased to approximately 4300 in 2011). On the whole, the continuing slump of thresholds from 1981 to 2001 indicates that entry has been increasingly attractive as banking deregulation has progressively spread its effects.

If we examine the per bank entry thresholds sN’s in markets with two, three, or four banks (panel (b) of Table 7), we note that in 1981, 1991, and 2001 each bank served a growing number of residents, while in 2011 this number was nearly the same (around 1000 inhabitants). However, in markets with two banks, each of them has served at least 25% more consumers than those established in local monopolistic markets: This is consistent with the absence of any cartel arrangements, since the presence of a new bank has always required substantial increases in per-bank market size to achieve positive profits.

Turning to per-bank entry thresholds ratios (i.e., sN+1/sN), from panel (c) of Table 7 we note that the values s4/s3 in 2001 and 2011 are quite close to one, while they amount to 1.26 in 1981 and to 1.45 in 1991. In addition, the ratio s3/s2 is also close to unity in 2001 (1.17) and 2011 (1.15). Ratios far from 1 are likely to indicate that the level of competition in a municipality changes when another bank enters the market and/or that this additional bank faces higher barriers to entry.

In order to disentangle the above effects, from the regression results we have derived the estimated values of banks’ per capita variable profits VN and fixed costs FN in each local market structure and for each year: \(V_{N} = \hat{\alpha }_{1} + {\hat{\mathbf{\beta }}}^{\prime}\overline{{\mathbf{X}}} - \sum\limits_{n = 2}^{N} {\hat{\alpha }_{n} }\) and \(F_{N} = \hat{\gamma }_{1} + \hat{\gamma }_{L} \overline{POPKMQ} + \sum\limits_{n = 2}^{N} {\hat{\gamma }_{n} }\), where the overbarred terms are the sample means of variables and the hats denote estimated coefficients. These values are reported in Table 8.

We observe that variable profits—panel (a) of Table 8—are higher in monopolistic markets (especially in 2001 and 2011) and increasing with time but decreasing in the number of banks, whereas fixed costs—panel (b) of Table 8—are increasing (and are broadly comparable across the years) as the numbers of incumbent banks rise.

The decrease in variable profits seems to be a clear signal of stronger competition at the local level as a consequence of the growth in the number of competitors, which are not therefore able to exploit substantial market power. However, they show a steady increasing trend for all types of market structure over the years, which can be ascribed to the use by banks of instruments other than price—such as advertising or product differentiation—that could have been capable of softening competition.Footnote 9

On the other hand, the fixed costs that entrants face might be due to sunk costs of entry, which determine an asymmetry between established and entrant banks. In this case, our results do not support the hypothesis of market contestability: A contestable market is characterized by low or absent barriers to entry and exit, which means that there should not be sunk costs, so that potential competition is able to make a market perfectly competitive regardless of the level of concentration.

The overall picture that we draw from our analysis of the Italian banking industry is consistent with the presence of endogenous sunk costs (Sutton, 1991) that add to typical exogenous fixed costs of entry and setup. Actually, in some industries firms invest resources on fixed items—such as R&D, product quality, advertising, and other characteristics—that are able to increase the demand for their own products and services. As the market grows, firms proportionately boost those fixed outlays so as to meet consumers’ willingness to spend, but this also causes a decrease in their profits, which therefore reduces the incentive for the entry of new firms. Sutton’s intuition applies especially to sectors in which firms compete along non-price dimensions, such as banking (Cohen & Mazzeo, 2010; Dell’Ariccia, 2001; Dick, 2007).Footnote 10

In order to inspect possible changes that are due to banking deregulation, we perform chi-squared tests in which the null hypothesis is that the estimated levels of Vi and Fi (i = 1,2,3,4) are the same across years. Since we estimate a single model for each year, we simply test whether the value of Vi and Fi for one year is equal to the estimated value for the following years. Table 9 reports the results of these tests.

Regarding the per capita variable profits (panel (a) of Table 9), for all Vi’s we detect a significant increase between periods (excluding the year intervals 1981–1991—but not for V1—and 2001–2011), which seems to confirm that monopolistic banks have remarkably succeeded in responding to enhanced competition through other non-price instruments. As to fixed costs (panel (b) of Table 9), all Fi’s1 are significantly different among years, even if—as noted before—there is not a clear path with regard to their progress over time.Footnote 11

7 Conclusions and Policy Implications

In this paper, we have investigated the evolution of the conditions of entry in Italian local banking markets under a long-run perspective (1981–2011) and at the most disaggregated level that is available from official sources in order to capture changes that are associated with the removal of branching restrictions. Focusing on the Italian case is useful because, due to the regulatory framework that was introduced in the 1930s, Italian local markets were remarkably segmented and insulated, hence competitive forces could have significantly operated after the deregulation that took place at the beginning of 1990s with the adoption of the First and the Second European Coordination Banking Directives.

In Italy, the elimination of administrative barriers to branching allowed banks to increase their networks through an expansion in their own markets and through entry into new markets. In the latter case, entry was likely induced by the positive profit margins of incumbent banks that operated therein, but the relevant (and long-lasting) market power of incumbents might have translated into significant entry barriers—especially those linked to informational asymmetries, which normally give rise to adverse selection and moral hazard.

Studying Italian banks’ growth strategies may therefore help to shed light on the identification and quantification of barriers to entry that could have survived after deregulation, and that are pervasive in the banking industry (Ciari & De Bonis, 2011; Vives, 2001).

For this purpose, we have applied the empirical entry threshold model of Bresnahan and Reiss (1991) to four cross-sections of data for local markets—municipalities—for the years 1981, 1991, 2001, and 2011. We have estimated demand entry thresholds—a measure of the market size that is required to support a given number of firms—by simply relating shifts in market demand to changes in the equilibrium number of firms (Bresnahan & Reiss, 1991, pp. 978–979).

We have then focused on the ratio between entry thresholds in order to evaluate whether the level of competition has changed with the number of operating banks. When this ratio approaches one as the number of competitor increases, an entrant bank needs to serve just the same number of consumers as the incumbents, meaning that we are close to a nearly competitive market.

Our results do not indicate any collusive behavior among local banks, since municipalities with two banks seem already adequately competitive. For 1981 (still characterized by a tight banking regulation), we discovered that the per-bank entry threshold that was needed to accommodate a fourth bank was about twice as large as that needed for a duopoly, while in the remaining years it was substantially lower. This indicates that, after deregulation, the increasing number of competing banks has rapidly turned Italian local banking markets into more competitive environments—different from the years before full liberalization.

Another finding is that variable profits have decreased with the number of incumbent banks but increased with time. Accordingly, the new competitive forces have succeeded in lowering banks’ market power, but at the same time credit institutions have tried to soften competition by means of non-price strategies—such as product differentiation or advertising—which therefore represent an important attribute of banks’ conduct. We have finally demonstrated that more banks in the market implies higher fixed costs, which rules out that local banking markets in Italy are contestable. Summing up, the Italian banking sector looks to be characterized by the presence of endogenous sunk costs (Sutton, 1991).

The main conclusion of our analysis is that—by removing significant barriers to entry—banking deregulation in Italy has been effective in favoring enhanced competition among banks. Nowadays, antitrust intervention in local markets with more than three operating banks may well be unnecessary.

Given the crucial role of endogenous sunk costs, Italian local banking markets can be regarded as “natural oligopolies”, which implies that antitrust analysis does not need to focus excessively on industry local concentration. For example, one important sunk cost originates from the information content that characterizes lending relationships: It is mostly private and therefore provides an advantage to the banks already in the market. Thus, in order to enter new geographical markets, the less costly way is the acquisition of existing banks or branches.

Bank quality—which is generally measured through non-price competition variables such as advertising intensity, branch density, and geographic diversification of the bank network—is another sunk cost to be considered when evaluating the impact of changes in banking market structure on consumer welfare. As Dick (2007, p. 77) notes, if consumers are receiving higher quality and are benefiting as a result, they are not necessarily hurt by the higher prices that they have to pay.

Hence, if a bank merger also boosts the fixed costs that are associated with the provision of better products, both prices and consumer welfare could rise; therefore, a more concentrated market could deliver also higher-quality banking products and improvements in consumer welfare (VanHoose, 2017, p. 135), and regulators have to consider those potential mitigating factors for the potential anticompetitive effects of the merger.

Change history

27 July 2022

Missing Open Access funding information has been added in the Funding Note.

Notes

The words ‘municipality’ and ‘town’ are commonly used as synonyms, so we will do the same here.

We omit the first regime that De Bonis et al. (2018) identify: the so-called ‘free-banking era’. It characterized Italy’s banking environment from 1890 through the 1920s, up to the post-World War I financial instability, that brought a new banking law; hence it falls outside the period on which we focus.

Kesternich et al. (2020) demonstrate that in a one-shot Cournot oligopoly the entry threshold ratio may not fall monotonically for additional entrants, but can display a hump-shaped pattern, first rising with the number of active firms, then declining monotonically up to one.

Our multimarket contact measure is built following a procedure similar to Evans and Kessides (1994), Jans and Rosenbaum (1996) and Coccorese and Pellecchia (2013). We omit the passages for sake of brevity, but the interested reader can refer to the above references or contact the authors for any detail.

So as to check the sensitivity of our results to this choice, we have also tested other plausible selection criteria: We combined three different distances (15, 20, and 25 km) and three different sizes of the nearest town (7500, 10,000, and 12,500 people). However, the overall empirical evidence remains substantially unchanged.

This is confirmed by the fact that estimating our model on the balanced sample of 2258 municipalities for each year provides absolutely comparable results.

The estimation results of this model and the related tests on coefficients are available upon request.

It has been widely recognized that an important factor that influences the behavior of banks is risk. It is often proxied by the Z-score, a widely used global measure of individual firms’ stability (e.g.: Fang et al., 2014; Hannan and Hanweck, 1988; Laeven and Levine, 2009) that is calculated as the sum of the return on assets (ROA) and the equity-to-assets ratio, divided by the standard deviation of ROA (hence, it can be regarded as an index of insolvency risk). Unfortunately, we do not have balance sheet data for its calculation in 1981 and 1991. Regarding 2001 and 2011, we have added Z-score in the variable profits equation and re-estimated our model. In both regressions we get a positive and significant coefficient, while nothing else (including the various thresholds) substantially changes. Therefore, profits are higher in towns with banks that are characterized by higher Z-scores (hence, higher stability). The results of these additional regressions are available from the authors upon request.

This conjecture is supported by an ad-hoc estimation of price elasticities of demand on a sample of 1,370 Italian banks for the period 1977–2013 (21,952 observations). Particularly, we have estimated the equation lnQit = lnPit + t + i (with Q = total loans and P = ratio between interest revenues and loans, while t and i are time and bank fixed effects, respectively). The parameter represents the price elasticity of demand, whose absolute value drops from 0.68 in the period 1977–1986 (i.e., around the year 1981) to 0.56 in the period 1987–1996 and to 0.32 in the years 1997–2006. We interpret this pattern as a signal of reduced price competition. However, in the period 2007–2013 the absolute value of the price elasticity of demand rises to 0.53; this last result fits with the generalized decrease of VN that we observe in 2011.

Hubbard and Mazzeo (2019) investigate the 1960s-1980s hotel and motel industry in the US, and find that, since quality competition in this sector involves fixed investments (particularly in the form of swimming pools), demand increases that are associated with highway openings have led to fewer, not more firms, thus confirming Sutton’s (1991) theory.

We have also estimated a pooled model (including all years) for each of the NUTS 1 macro-regions that are listed in Table 3. The previous evidence and patterns are generally confirmed, but some differences in the magnitude of the effects emerge. Noticeably, Northern regions—which have been characterized by a better macroeconomic performance for an extended period of time—exhibit higher profits and lower thresholds, which indicate that they are more competitive (the results are available from the authors upon request).

References

Abraham, J. M., Gaynor, M., & Vogt, W. B. (2007). Entry and competition in local hospital markets. Journal of Industrial Economics, 60(2), 265–288.

Asplund, M., & Sandin, R. (1999). The number of firms and production capacity in relation to market size. Journal of Industrial Economics, 47(1), 69–85.

Assuncao, J. (2013). Eliminating entry barriers for the provision of banking services: Evidence from ‘banking correspondents’ in Brazil. Journal of Banking and Finance, 37(8), 2806–2811.

Beccalli, E., & Girardone, C. (2016). Banking in Italy. In T. Beck & B. Casu (Eds.), The Palgrave Handbook of European Banking (pp. 521–540). Palgrave Macmillan.

Berry, S., & Reiss, P.C. (2007). Empirical models of entry and market structure. In M. Armstrong, & R.H. Porter (Eds.), Handbook of Industrial Organization (pp. 1845–1886), Volume 3, Amsterdam: North-Holland/Elsevier.

Bofondi, M., & Gobbi, G. (2006). Informational barriers to entry into credit markets. Review of Finance, 10(1), 39–67.

Bresnahan, T. F., & Reiss, P. C. (1991). Entry and competition in concentrated markets. Journal of Political Economy, 99(5), 977–1009.

Cetorelli, N. (2002). Entry and competition in highly concentrated banking markets. Economic Perspectives, 26(4), 18–27.

Ciari, L., & De Bonis, R. (2011). Entry decisions after deregulation: The role of incumbents’ market power. Mo.Fi.R. Working Papers, 50, Money and Finance Research group, Univ. Politecnica Marche, Department of Economic and Social Sciences.

Cleeren, K., Dekimpe, M. G., & Verboven, F. (2006). Competition in local-service sectors. International Journal of Research in Marketing, 23(4), 357–367.

Coccorese, P., & Pellecchia, A. (2013). Multimarket contact, competition and pricing in banking. Journal of International Money and Finance, 37, 187–214.

Cohen, A. M., & Mazzeo, M. J. (2007). Market structure and competition among retail depository institutions. Review of Economics and Statistics, 89(1), 60–74.

Cohen, A. M., & Mazzeo, M. J. (2010). Investment strategies and market structure: An empirical analysis of bank branching. Journal of Financial Services Research, 38(1), 1–21.

De Bonis, R., Pozzolo, A. F., & Stacchini, M. (2012). The Italian banking system: Facts and interpretations. University of Molise, Department of Economics.

De Bonis, R., Marinelli, G., & Vercelli, F. (2018). Playing yo-yo with bank competition: New evidence from 1890 to 2014. Explorations in Economic History, 67, 134–151.

de Juan, R. (2008). Competition in local markets: Some evidence from the Spanish retail banking market. Review of Industrial Organization, 32(2), 145–162.

Dell’Ariccia, G. (2001). Asymmetric information and the structure of the banking industry. European Economic Review, 45(10), 1957–1980.

Dick, A. A. (2007). Market size, service quality, and competition in banking. Journal of Money, Credit and Banking, 39(1), 49–81.

Dick, A. A., & Hannan, T. H. (2010). Competition and antitrust policy in banking. In A. N. Berger, P. Molyneux, & J. O. S. Wilson (Eds.), The Oxford Handbook of Banking (pp. 405–429). Oxford University Press.

Dranove, D., Gron, A., & Mazzeo, M. J. (2003). Differentiation and competition in HMO markets. Journal of Industrial Economics, 51(4), 433–454.

Evans, W.N., & Kessides, I.N. (1994). Living by the ‘Golden Rule’: multimarket contact in the U.S. airline industry. Quarterly Journal of Economics, 109(2), 341–366.

Fang, Y., Hasan, I., & Marton, K. (2014). Institutional development and bank stability: Evidence from transition countries. Journal of Banking and Finance, 39, 160–176.

Feinberg, R. M. (2008). Explaining the credit union entry decision, and implications for performance. Review of Industrial Organization, 33(1), 81–91.

Feinberg, R. M., & Reynolds, K. M. (2010). An examination of entry and competitive performance in rural banking markets. Southern Economic Journal, 76(3), 624–637.

Felici, R., & Pagnini, M. (2008). Distance, bank heterogeneity and entry in local banking markets. Journal of Industrial Economics, 56(3), 500–534.

Gil, R., & Marion, J. (2018). Residential segregation, discrimination, and African-American theater entry during Jim Crow. Journal of Urban Economics, 108, 18–35.

Grant, I., Kesternich, I., & Van Biesebroeck, J. (2021). Entry decisions and asymmetric competition between non-profit and for-profit homes in the long-term care market. International Economic Review (in press). https://doi.org/10.1111/iere.12544

Gobbi, G., & Lotti, F. (2004). Entry decisions and adverse selection: an empirical analysis of local credit markets. Journal of Financial Services Research, 26(3), 225–244.

Hannan, T. H., & Hanweck, G. A. (1988). Bank insolvency risk and the market for large certificates of deposit. Journal of Money Credit and Banking, 20(2), 203–211.

Heffernan, S. A. (1992). A computation of interest equivalences for nonprice characteristics of bank products. Journal of Money, Credit and Banking, 24(2), 162–172.

Hubbard, T. N., & Mazzeo, M. J. (2019). When demand increases cause shakeouts. American Economic Journal: Microeconomics, 11(4), 216–249.

Jans, I., & Rosenbaum, D.I. (1996). Multimarket contact and pricing: evidence from the U.S. cement industry. International Journal of Industrial Organization, 15(3), 391–412.

Kesternich, I., Schumacher, H., Van Biesebroeck, J., & Grant, I. (2020). Market size and competition: A “hump-shaped” result. International Journal of Industrial Organization, 70, Article 102605.

Kim, M., & Vale, B. (2001). Non-price strategic behavior: The case of bank branches. International Journal of Industrial Organization, 19(10), 1583–1602.

Labaj, M., Morvay, K., Silanic, P., Weiss, C., & Yontcheva, B. (2017). Market structure and competition in transition: Results from a spatial analysis. Applied Economics, 50(15), 1694–1715.

Labaj, M., Silanic, P., Weiss, C., & Yontcheva, B. (2018). Market structure and competition in the healthcare industry. European Journal of Health Economics, 19(8), 1087–1110.

Laeven, L., & Levine, R. (2009). Bank governance, regulation and risk taking. Journal of Financial Economics, 93(2), 259–275.

Manuszak, M. D. (2002). Endogenous market structure and competition in the 19th century American brewing industry. International Journal of Industrial Organization, 20(5), 673–692.

Marin, A. G., & Schwabe, R. (2019). Bank competition and financial inclusion: Evidence from Mexico. Review of Industrial Organization, 55(2), 257–285.

Mazzeo, M. J. (2002). Product choice and oligopoly market structure. RAND Journal of Economics, 33(2), 1–22.

Nishida, M., & Gil, R. (2014). Regulation, enforcement, and entry: Evidence from the Spanish local TV industry. International Journal of Industrial Organization, 32, 11–23.

Pinho, P. S. (2000). The impact of deregulation on price and nonprice competition in the Portuguese deposits market. Journal of Banking and Finance, 24(9), 1515–1533.

Reiss, P.C., & Wolak, F.A. (2007). Structural econometric modeling: Rationales and examples from industrial organization. In J.J. Heckman, & E.E. Leamer (Eds.), Handbook of Econometrics (pp. 4277–4415), Volume 6A, Amsterdam: North-Holland/Elsevier.

Schaumans, C., & Verboven, F. (2008). Entry and regulation: Evidence from health care professions. RAND Journal of Economics, 39(4), 949–972.

Schaumans, C., & Verboven, F. (2015). Entry and competition in differentiated products markets. Review of Economics and Statistics, 97(1), 195–209.

Scott, J. T. (1978). Nonprice competition in banking markets. Southern Economic Journal, 44(3), 594–605.

Siclari, D. (2015). Context, specific features and potential evolution of the Italian banking and financial law. In D. Siclari (Ed.), Italian Banking and Financial Law: Supervisory Authorities and Supervision (pp. 3–42). Palgrave Macmillan.

Sutton, J. (1991). Sunk Cost and Market Structure. MIT Press.

VanHoose, D. (2017). The Industrial Organization of Banking. Springer.

Vives, X. (2001). Competition in the changing world of banking. Oxford Review of Economic Policy, 17(4), 535–547.

Acknowledgements

We would like to thank Lawrence J. White (the General Editor), two anonymous referees, Sherrill Shaffer, and the seminar participants at the 60th Annual Conference of the Italian Economic Association (Palermo, Italy, October 2019) for useful comments and stimulating discussions on earlier drafts of the paper.

Funding

Open access funding provided by Università degli Studi di Salerno within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Coccorese, P., Pellecchia, A. Deregulation, Entry, and Competition in Local Banking Markets. Rev Ind Organ 61, 171–197 (2022). https://doi.org/10.1007/s11151-022-09867-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-022-09867-w