Abstract

We investigate whether increased competition among inspection firms leads to an increase in the inspection pass rate in the Swedish car inspection market, which is heavily regulated and consciously designed to mitigate incentives to violate government regulations. We use a panel dataset that represent 22.5 million car roadworthiness tests that were conducted during the period 2010–2015. Fixed effects and instrumental variable estimations, which are used to account for the endogeneity of competition, show that inspection stations that operate in highly competitive markets are more lenient toward their customers than are stations that operate in less competitive markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Under intense competition, firms’ risk of losing customers to rivals will increase. When car owners have greater choice among inspection stations for state-mandated inspections, the car owners may prefer the station that provides the most leniency. Due to the potential to steal market share from rivals, a competitive inspection service provider has stronger incentives to provide leniency to attract customers than would a monopoly provider. Increased competition thus incentivizes an inspection station to deviate from what is socially desirable.

In this paper, we examine the impact of competition among inspection providers on the incidence of leniency toward customers in the Swedish car inspection market.

The Swedish car inspection market is particularly interesting to analyze since it has intentionally been designed with concern about the distorted incentives that competition could create. For instance, if the inspecting firm sells other services (such as car repairs), it can “trade” a passing result (regardless of actual car condition) for the side payment of a valuable future stream of other services (e.g., repairs). To remove such obvious distorting incentives, Swedish car inspection firms are not permitted to engage in other businesses. Firms are also free to set their own prices based on market conditions.

The Swedish car inspection market is also interesting since Sweden belongs to the set of countries with the strongest adherence to the rule of law.Footnote 1 Hence, it may be that in countries where laws and regulations are expected to be followed, the implementation of regulations can avoid side-effects that are present in countries where the adherence to the rule of law is lower. This also means that if side-effects are present in countries where the institutional structure that surrounds the inspections are designed to remove distorting incentives, then it is an indication that more regulatory efforts are required to avoid the side-effects.

The car inspection market in Sweden also provides us with a unique and high-quality panel dataset at the station level, which allows us to study carefully the effect of competition on inspection pass rates. The data represent all car inspections (22.5 million) that were conducted in Sweden from July 2010 to August 2015. Furthermore, we use individual-level data that contain the addresses of car owners and the respective station that each owner chose, so as to measure travel distances, which are used to approximate geographic markets and, thus, the number of competitors of each station.

To examine the connection between competition and inspection pass rates, we start with a simple correlation analysis and find a positive association between local competition and pass rate. To address the possibility that this positive correlation is confounded by omitted factors, we first control for station-specific factors that affect both competition and pass rate. After controlling for station fixed effects, we find that competition has a positive and significant effect on the probability for a given car to pass mandatory inspection. We also use instrumental variables regressions with population size at a municipality level as the instrument for competition. Our results show that local competition has a significant positive effect on the inspection pass rate and is robust to different specifications.

The rest of the paper is organized as follows: Section 2 presents a literature review of the research area. We then (in Sect. 3) introduce a simple theoretical model to illustrate the mechanism through which competition affects pass rates. Section 4 describes the data; it defines geographic markets; and it also provides an overview of the car inspection market in Sweden. Section 5 presents the specification of the model and estimation strategies. Section 6 shows our main results. Section 7 provides a sensitivity analysis. Section 8 presents the conclusion.

2 Literature Review

2.1 Incentives for Leniency

Individuals and firms often pay another party to be monitored in some way. For example, individuals pay accredited institutions to do tests to obtain driving licenses and firms buy accounting services to inspect their financial activity and so on. In many cases, these inspection agencies are owned and funded by the public sector and the inspection activities are carried out by civil servants. The obvious advantage of such an organization is that if the inspectors are not corrupt, then they have no obvious incentive but to do correct and unbiased inspections. In contrast, these organizations face no competition and may, therefore, become inefficient and insensitive to the customers’ demand (Stiglitz, 1986). These drawbacks have motivated some governments to have competing private firms to do inspections in some markets.

However, such institutional arrangement is not unproblematic, since it may give the inspection firm incentives to do inspections in a way that is biased and not socially desirable. It also often requires that such private firms are regulated and monitored. Scandals such as the Enron case and the loan ratings by the big credit rating firms (e.g., Standard and Poor and Moody’s) in the sub-prime loan crisis suggest that private inspecting agencies may give their customers a too-lenient treatment and that the regulation was insufficient. Some studies have shown that credit rating agencies were too lax in the ratings of some structured products in the period leading up to the subprime crisis (see e.g., Mathis et al., 2009; Griffn & Tang, 2012).

Competition is one of the key ingredients to improve the quality and efficiency in markets in general. A standard result in oligopoly theory states that competition in terms of the number of firms increases consumer surplus (see e.g., Tirole, 1988; Bresnahan & Reiss, 1991) and there is also evidence that competition in terms of demand substitutability has a positive effect on productivity (Syverson, 2004). In addition, it has been shown that competition increases quality (e.g., Mazzeo, 2003).

At the same time there are mechanisms where increased competition may push the inspection agency to deviate from what is socially desirable. One mechanism considered by Branco and Villas-Boas (2015) is that firms that face intense competition have less to lose when they deviate from regulations and will, therefore, have a higher probability to do so. Bolton et al. (2012) demonstrate in their model of the credit ratings process that competition allows for “ratings shopping”, which results in inflated ratings.

2.2 Empirical Evidence

A number of empirical studies support the view that competition may lead firms that monitor their customers according to some regulation to become too lenient. For instance, Snyder (2010) provides evidence that liver transplant centers put their relatively healthy patients in the intensive care unit to improve those patients’ position on the liver transplant waiting list and that this behavior was most prominent in areas where there were many transplant centers. Furthermore, Bennett et al. (2013) show that inspection facilities that face greater local competition are more likely to let their customers pass emission tests compared to facilities that face less severe competition.

Sean and Ghent (2017) examine the entry of new credit rating agencies into structured finance products. The findings suggest that new entrants use higher ratings as part of a strategy to win business from the incumbents. Hubbard (1998) examines the California vehicle emission inspection market and shows that failure rates are higher for vehicles that are inspected by state officials than for vehicles that are inspected at private firms. Hubbard (2002) shows that consumers are less likely to return to an inspection station at which they previously failed than the one at which they previously passed. In a related literature, Gino and Pierce (2010) examine if envy and empathy may lead inspectors to discriminate in illicitly helping customers based on customer wealth in the vehicle emission testing market. They showed that customers with standard cars obtain much greater leniency from inspectors than do customers with luxury cars.

One important explanation as to why liver transplant centers favored their own patients was that they were able to perform more transplants, and thus gain more revenue (see Snyder, 2010). Similarly, the explanation for too- lenient emission tests in Bennett et al. (2013) is that these facilities also provide other profitable services in addition to emission testing, such as repairs. Hence, the authorized facilities “trade the “high-quality”service of a passing result (regardless of actual emissions) for the side payment of a valuable future stream of service and repair business worth thousands of dollars per year” (Bennett et al., 2013, P. 2). The authors also outlined that the regulation of prices in the New York emission test market eliminates an important competition instrument for service providers. In the Swedish car inspection market firms are free to set their own prices.

2.3 The Effectiveness of Motor Vehicle Inspection Programs

Most advanced economies have regulations about motor vehicle inspections. For instance, according to EU regulations, all member states are obliged to carry out periodic safety and emission inspections for most types of motor vehicles. In 2018, the EU adopted new rules on vehicle testing that toughens the testing regime and widens its scope. In the United States, it is up to an individual state whether to run a vehicle inspection program or not. These regulations provide the basis for a multi-billion dollar industry that involves hundreds of millions of car-owners around the globe.

Mandatory vehicle inspection programs are mainly motivated by air pollution and road traffic safety concerns. A recent study by Alexander and Schwandt (2022) provides the evidence that the cheating-induced increase in car emissions has harmful effects on infant and child births. However, there has been a debate, especially in the United States about whether vehicle inspections can be motivated on safety grounds. Some studies find no evidence that mandatory inspections significantly reduce fatality or injury rates (see e.g., Merrell et al., 1999; Sutter & Poitras, 2002). On the other hand, Keall and Newstead (2013) find evidence of an association between periodic vehicle inspections and reduced risk of car crash injury. Peck et al. (2015) find evidence that periodic inspections improve the technical condition of inspected cars.

The inconclusive evidence about the effect of vehicle inspection program on crash rates and the challenge of overseeing the program have led many states to abolish safety inspection programs (see United States, 2015). One crucial condition to motivate inspection programs is that they are carried out efficiently and in a fair way. Despite the ongoing debate, the size of this market, and the substantial costs that are imposed on car owners in terms of money and time, there are few studies on this market. This paper partly fills this gap by analyzing a rich dataset from a recently deregulated car inspection market in Sweden.

3 Illustration of the Mechanism in a Simple Theory

To see how the passing rate may be affected by the degree of competition, we present a “toy” model to illustrate a potential mechanism, that may apply to the Swedish car inspection market.Footnote 2 In this market, it is assumed that each consumer demands one unit of inspection; and if the owner’s car does not pass, then one re-inspection is needed. The price of the inspection is p, and the price of re-inspection is r. The probability that a car does not pass the inspection (hence fails) is given by \(\sigma\). The unit costs that are associated with each inspection and re-inspection are c and w, respectively. The overall profit function in this case can, therefore, be described as \(\pi = (p-c + \sigma (r-w))D(.)\), where D(.) is the demand function (which will be described below).Footnote 3

To specify the demand, we will use a modified version of the (price) competition stage in a circular city model (see Salop, 1979; Tirole, 1988). Let there be n identical firms that only differ with respect to their location. They are distributed equidistant 1/n from one another on a circle that has a perimeter of 1. Consumers are uniformly distributed along the circle, and their number is normalized to one. We now assume that firms have access to the same technology, so that there are no differences in costs: \(c_i = c\) and \(w_i = w\) for all \(i= 1,2,.....n\).

Furthermore, it is assumed that market prices are determined centrally and are outside of the control of the local stations. This is close to the reality in the car inspection market in Sweden, since price variation across stations within a chain appears to be very limited, which suggests that prices are decided centrally at a firm (chain) level, and thus not at a station level; see Table 9 in the Appendix.

Hence, the only thing that the local firm can affect is the failure rate – \(\sigma \in (0,1)\) – which is the probability that a car does not pass. Now, a consumer will buy the service from the firm that offers the service with lowest total expected price. Hence, a consumer who is located between i and \(i's\) closest competitor at distance x is indifferent between buying at i and the competitor if \(p + \sigma {_i}r + tx = p + \sigma r + (1/n-x)t\), where t is the (marginal) transport cost and \(\sigma\) is the failing rate of the competitor. To avoid boundary complications, we consider markets for which \(p-c< \frac{t(r-w)}{nr} < (p-c)+ (r-w)\). Solving for x, we get:

Noting that each firm has customers on both sides, we have that \(D_i(\sigma _i,\sigma ) = 2x\). The profit function can, therefore, be specified as:

The first order condition is given by:

This gives the best-response function:

From (4) we see that, since we assume that there is a positive margin in the re-inspection market – \(r-w>0\) – and that \(\sigma \in (0,1)\) – the failing rate – is a strategic complement in this model. Finally, to get a tractable model we assume symmetric equilibrium so that \(\sigma _i= \sigma\) gives:

Note that given the previous assumption that we consider only markets for which \(p-c< \frac{t(r-w)}{nr} < (p-c)+ (r-w)\), the equilibrium failing rate will be between 0 and 1. It should be clear that the equilibrium failing rate in a local market will be decreasing in the number of firms in the market.Footnote 4

To understand the relationship between n and \(\sigma\), note that a decrease in the failure rate – \(\sigma\) – will give rise to two opposing effects on profits. The positive effect is new customers, which results in more inspections and more expected re-inspections.Footnote 5 This marginal effect – which is given by the \(2^{nd}\) term in equation (3) – is independent of the station’s market share (1/n) but is increasing in its failure rate. The negative effect – which is given by the first term in equation 3 – is that the station will re-inspect fewer of its existing customers; and this negative effect will get weaker as n grows and concomitantly its market share gets smaller. Balancing these two effects in equilibrium will push the station to reduce its failure rates as n grows.

4 Vehicle Inspection Market, Data, and Measures of Competition

4.1 Overview of the Motor Vehicle Inspection Market in Sweden

A periodic car roadworthiness test has been mandatory in Sweden since its introduction in 1965.Footnote 6 By law, vehicles are required to pass a mandatory periodic inspection to operate legally on the road.Footnote 7 The mandatory inspection includes both emissions and other safety inspections such as wheels and control system, drive system, brake system, communication and other. Vehicle inspection firms are not allowed by law to engage in any other business but inspection services, which means that their primary revenue comes only from the inspection business. Prices are not restricted by the regulator which allows inspection firms to set their prices based on market conditions.Footnote 8

A state controlled company, Bilprovning AB,Footnote 9 had a monopoly right to provide car inspection services until the government deregulated the market in July 2010. The reform opened the door for accredited private firms to provide inspection services alongside Bilprovning AB. The primary goals of the reform were to introduce competition to the market and, thereby, improve consumer welfare through increased geographical accessibility to the service, reduced prices, better service quality and longer opening hours.

The first private firm, Abesiktning AB, entered the market at the end of 2010. Another two private firms entered the market in 2011. Two more private firms entered the market in 2012.

To enhance competition further, the government decided to sell part of Bilprovning AB to a private firm. Accordingly, during 2012 a private firm, Opus Bilprovning AB, entered the market by buying 70 inspection stations from the government. During 2012 and after the sale of part of Bilprovning AB, the state and the other co-owners of Bilprovning AB agreed to split the remaining 144 stations between themselves.Footnote 10 As a result, the state continues to provide inspection services with 89 stations under the old company name, Bilprovning AB, and the other co-owners operated 55 stations under a new inspection company: Besikta Bilprovning AB.

All of the companies that operate in the market need to obtain accreditation from a government agency: the Swedish Board for Accreditation and Conformity Assessment (SWEDAC). The regulator of the market, Swedish Transport Agency, provides the rules and regulations that inspection companies should follow – such as which equipment and methods to use – and controls the competence of the inspection technicians. The Swedish Transport Agency has the responsibility to make sure that the regulations are not violated by inspection companies. The agency supervises the market by visiting the inspection stations and conducting statistical analysis on the information that is provided by the inspection firms.

4.2 Data

Our article uses station-level monthly panel data over the period July 2010 to August 2015. The Swedish Transport Agency – the regulator of the market – provided us with the data that represent 22.5 million inspections of cars that weigh less than 3,500 kg. The data represent all inspections that were conducted between July 2010 and August 2015 by all licensed stations in Sweden.Footnote 11

The data include detailed information on the number of inspected vehicles and the percentage of vehicles that pass the inspection at the station level. The data also include information about each station’s date of entry and exact geographic address.

Using the data from the Swedish statistics bureau, we construct annual mean income at the municipality level. We also construct median car owner age and car age at the municipality level for each year. We also have data on the population size of each municipality.Footnote 12

Table 1 contains summary statistics for the main variables. Our dependent variable – Passrate – measures the fraction of total inspected cars that pass the inspection at a given station. Our main variable of interest – \(\#Stations\) – is the count of competitors that a station faces within its geographic market. The summary statistics table shows different versions of \(\#Stations\), which depends on the geographic market definitions. In the following section, we discuss the different approaches that we use to define geographic markets. We also discuss the benefits and concerns that are associated with each approach.

4.3 Measures of Competition

Estimating the effect of increased competition on pass rate requires an accurate measure of competition. In this paper, we measure competition for a given station by the number of competing providers within the station’s geographic market. An important element of this approach is to identify a station’s geographic market. In principle, the geographic market for a station should include all other competing providers to which the station reacts competitively.

In the main analyses, we use customer-level data to identify circular geographic markets. As a robustness test, we also identify geographic markets that are based on administrative boundaries (municipalities). The definition of circular geographic markets has two alternatives. Each of them is discussed below.

Graphical illustration of the measure of competition.Notes The figure shows the 14 km catchment area for station A. Station A will have an overlapping catchment area (at least to some extent) with the catchment area of any station within the dashed circle in the figure: any station within 28km radius of station A. Therefore, the measure of competition that is based on a 14 km radius catchment area for Station A includes all stations within a 28 km radius.

In the first approach, a fixed radius is chosen that represents the catchment area of customers for each station. Competition for a station is, then, measured by the number of competing providers within the area that has twice the radius of the catchment area. In this approach, all stations will have equal size circular geographic areas. For example, Bloom et al. (2015) define the catchment area for England’s hospital market with the use of 15-km fixed radius to all hospitals.Footnote 13 Bennett et al. (2013) use 0.2-mile radius around a facility to define a circular geographic market in the New York State vehicle emission test market.

In our paper, each station’s catchment area is defined by a 14 km radius.Footnote 14 Since stations with overlapping catchment areas can be considered as substitutes in the eyes of the car owners, we count each station’s number of competitors within 28 km. Figure 1 presents a graphical illustration of how the geographic market is defined based on a fixed-radius catchment area. Henceforth, we refer to this approach as fixed radius.

The fixed-radius definition, however, has its own limitation. It is reasonable to believe that the length of the radius that defines catchment area could be different across stations depending on local market characteristics. For example, one could expect that stations in urban areas would likely have smaller catchment areas than would stations in rural areas because of differences in population density.

The second approach tries to solve the limitations of the fixed-radius approach. This method uses the customers’ origin information to define station-specific catchment areas (Garnick et al., 1987). The Swedish Transport Agency provided us with data that contain detailed information about car owners’ registered addresses and the respective station that each owner chose to get an inspection service. For our purpose, we identified the latitudes and longitudes of the addresses of 458,405 car owners and the station that each owner chose.

We then calculated the road distance that each owner traveled for inspection service. By utilizing the distribution of these distances at the municipality level, we define the catchment area for each station.Footnote 15 The catchment area for each station is defined by the travel distance of the median customer to stations that were located in the focal station’s municipality.Footnote 16 Competition is, then, measured with the use of use the number of providers within the area that is double the radius of the stations’ respective catchment areas. Henceforth, we refer to this approach as variable radius.

Our main analyses are based on the fixed-radius approach. We, however, present robustness analyses that use both the variable-radius and administrative-boundary approaches. Administrative boundaries (municipal boundaries) and fixed-radius approaches offer a convenient way for defining the market because there is less demand for consumer-level data. Furthermore, political boundaries and the size of the catchment area are exogenous to factors that could influence pass rate. One limitation of the administrative boundaries approach is that a consumer’s choice of a station is not restricted by administrative region.

A major concern about using variable radius approach is that the size of the catchment area may not be exogenous to uncontrolled factors that could influence pass rate. A firm that promises higher pass rates (cet. par.) will attract more customers from farther away and thus have more competitors within its catchment area. For this reason and the other mentioned advantages, we choose the fixed radius approach as our preferred method in the main analyses.

4.4 Preliminary Data Analysis

The number of stations in Sweden increased over the sample period. Table 2 presents the evolution of the number of stations during the sample period. As of August 2015, there were eight companies with a total of 422 stations for light vehicles inspection. At the time of the deregulation, there were only the 190 state-owned stations.

Table 2 also presents the change in the number of competitors that the average station faces within its geographic market over time. At the end of 2010 and based on the fixed-radius approach (column 3), on average, each station competes with 2.5 other service providers within its geographic market. By August 2015 the average station competed with 8.7 other providers within its geographic market. The variable-radius approach in column 5 similarly indicates that stations faced increased competition over the years. In both approaches (columns 4 and 6), the number of competitors that the median station faced increased from 1 to 4 between 2010 and 2015, which is a threefold increase.

Table 3 presents the average and percentile breakdowns of the percentage of vehicles that passed inspections over time. While there was an increase in the number of inspection stations over the sample period, there was also an upward trend in the percentage of cars that pass inspections. The percentile breakdowns also show that the pass rates for the year 2015 (in the 50th, 75th, and 90th percentiles) exceed the pass rates of previous years for the corresponding percentiles.

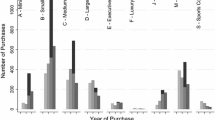

Figure 2 presents early evidence on the relationship between pass rate and the number of competitors that a focal station faced over the period July 2010 to August 2015. In Fig. 2, the fixed-radius approach is used to define geographic market. The number of competitors that stations face is divided into five categories, from local monopolies to stations that face at least nine rival stations. The figure suggests that there is a positive relationship between the intensity of competition and the average pass rate. This relationship is also evident when the geographic market is defined using the variable-radius approach; see Figure 4 in the Appendix.

4.5 Pass Rate and Entry Pattern of New Entrants

One clear pattern of entry that we observe is that new stations enter municipalities where there are large populations. The stations that entered after the reform are located in municipalities where the mean (median) population size is 113,419 (60,422); whereas the incumbent (pre-2010) stations are located in municipalities where the mean (median) population size is 70,085 (27,297).

We also observe that those state-owned stations that later transferred to private owners are also located in municipalities where the average population size is larger than the population size of the municipalities where the stations that continue to be owned by the state are located. This may be an indication that the state-owned stations contribute more to ensuring accessibility in areas where private actors could be less interested.

To check on the pattern of the pass rates of the new entrants, we divided the ages of the new entrants (those that entered after the reform) into five categories: stations that had been conducting inspections during their first year, second year, third year, fourth year and finally during their fifth year after entry. The results show that the new entrants’pass rates do not show any noticeable trend over time, although it increases slightly (see Fig. 5 in the Appendix). We also compared the pass rates of the new entrants and incumbents. The unconditional mean comparison shows that the incumbents’ pass rate is 0.84 percentage points higher than the new entrants over the sample period (see Figure 6 in the Appendix).

5 Empirical Strategy and Specification

We investigate the relationship between pass rate and competition with the following reduced-form regression model:Footnote 17

where \(Passrate_{imyt}\) is the fraction of total inspected cars that pass the inspection at station i located in municipality m for month t in year y. The main variable of interest is \(\#Stations_{iyt}\), which measures the number of competitors that station \(\textit{i}\) faces within its geographic market for the month t in year y. Because the measure of competition appears in logarithmic form, a diminishing effect of competition is built into the specification. All other covariates at a municipality level (car owner age, car age and income) are included in the vector \(\varvec{x}_{my}\). The level of care that people give to their cars may differ across the owner’s age. Older people may be more attached to their cars and, therefore, may be more inclined to maintain and service their cars than are their younger counterparts.

We include \(Year_{y}\), which is a full set of year dummy variables to capture common shocks to (common trends in) the pass rates of all stations. For example, aggregate time effects can capture changes in the inspection guidelines by the regulator that stations are required to follow or the average quality of cars in the country might be improving over time. \(S_{i}\) denotes a full set of station fixed effects that capture time-invariant unobserved heterogeneity across stations; \(Season_{t}\) denotes a full set of monthly seasonal dummy variables that capture unobserved heterogeneity that is invariant over stations. \(\epsilon _{iyt}\) is an error term that captures the remaining time-varying unobserved factors for station i in month t of year y.

Identification of the parameter of the competition variable by ordinary least squares (OLS) may be confounded by omitted variables. For example, our measure of competition may systematically be correlated to the conditions of cars in an area. Markets with poor-running cars are more attractive to providers than are markets with well-running cars because there will be more inspections per car in the market due to higher failure rate. It follows that areas where cars are in poor condition will attract more firms, because the markets are effectively larger. This can be a source of downward bias in the hypothesized positive relationship between pass rate and competition.

Since we have a panel dataset, our first strategy to address omitted variables concern is to control for time-invariant station-specific factors. An important factor that explains the difference in pass rates between stations is the variation in the quality of inspected cars. If these variations between stations are time-invariant (or change slowly over time), then the inclusion of station fixed effects removes the bias from unobserved heterogeneity.

Our second strategy is to use instrumental variable regression. We propose the size and density of population at a municipality level as instrumental variables for the number of competitors that stations face within their relevant geographic market.Footnote 18 Given that the inspection regulations in Sweden prohibit car inspection stations from providing any other services but vehicle inspections, the location decisions of stations are highly likely to depend on population size and/or the number of registered vehicles. Empirically, population size and the number of competing stations are strongly correlated.

The first stage equation in the 2SLS estimation is modeled as follows:

where \(POP_{my}\) and \(Density_{my}\) are population size and population density, respectively, and \(\eta _{iyt}\) is the error term. The rest of the variables are as defined for equation 6.

6 Main Results

6.1 Fixed-Effects Estimates

Table 4 presents OLS and fixed-effects results. The variable-radius approach is used to identify geographic markets. For an accurate statistical inference, we allow for error clustering at a municipality level in all estimations of the paper: The standard errors are robust against arbitrary heteroskedasticity and error correlation at the municipality level.Footnote 19 Columns (1) and (2) of Table 4 provide OLS estimates that use a varying set of control variables. The last column presents fixed-effects OLS results.

The first column presents the OLS regression of pass rate on the number of rivals with no control variables. The results show that when the number of competing stations increases by around 33% (which corresponds to one additional station at the median), the pass rate increases by 0.3 percent.

Column (2) includes car owners’ age, car age and income at a municipality level and year and monthly seasonal dummy variables. The estimates suggest that the effect of competition on pass rate is positive and statistically significant at the 5% level. The OLS estimates indicate that when the number of competing stations increases by around 33% (which corresponds to one additional station at the median), the pass rate increases by 0.4 percent.

To minimize the potential bias from unobserved factors, column (3) reports our results with fixed effects estimation. The competition parameter is positive and statistically significant at the 1% level. The fixed effects estimate of the competition parameter is almost double the magnitude of the OLS estimate. The result suggests that a failure to account for unobserved heterogeneity biases the true effect of competition downward. Increasing the number of competing stations by around 33% (which corresponds to one additional station at the median) now increases the pass rate by 0.8 percent.

The most likely reason why the fixed effects estimates are larger than OLS is simply omitted variable bias. The key unobserved variable here is the condition of the vehicles that stations inspect. There will be more stations in areas where demand is expected to be higher. All else being equal, areas with poor-quality cars will have more stations than do areas with good-quality cars, because a higher failure rate is more profitable for a firm. It follows that one should see more competitors in the areas where failure rates are high – which thus biases the simple OLS estimates of the competition parameter downwards.

The control variables provide some interesting results: The coefficients on the monthly seasonal dummy variables indicate that there is a variation in pass rates on a seasonal basis. August has the highest pass rate, followed by September and May, respectively. The average pass rate during August is 2.1 and 2.7 percentage points higher than the pass rates during September and May, respectively. March has the lowest pass rate, followed by February and January, respectively.

We have also checked if there is a difference in pass rate between the cold and warm parts of Sweden. In the southern part of Sweden winter is generally mild, while in the northern part winter is extremely cold. The results show that the pass rate in the north (the cold part of Sweden) is higher than the pass rate in the south (the warm part of Sweden). This result could be due to the fact that people in the north part of Sweden are much more dependent on their cars for their day-to-day activity and as a result would maintain and service their cars more properly.

In all of the regressions above, the measure of competition – \(\#Stations\) – is taken to be exogenous after controlling for observed variables and time-invariant unobserved heterogeneity. In the next section, we present the results that use the instrumental variables method to account for any potential correlation between measures of competition and remaining unobserved factors in the error term.

6.2 Instrumental Variables Estimates

Table 5 presents the results from the first-stage regressions of the corresponding 2SLS estimation results in Table 6. It can be seen in the table that population size has a positive and highly significant effect on the number of competitors that a station faces (\(\#Stations\)). We report the Kleibergen-Paap Wald statisticFootnote 20 at the bottom of Table 5 to test for a weak instrument. Because the statistics exceed the critical values, the models satisfy the weak-identification test.

Table 6 presents the fixed-effects 2SLS estimates of the impact of competition on the pass rate. The models satisfy the Sargan test for over-identification. Columns (1), (2), and (3) show fixed-effects 2SLS estimates with different sets of control variables. Our preferred specification is the one presented under column (3). The results in all estimations suggest that competition has a positive and statistically significant effect on pass rate.

The point estimates in column (3) suggest that increasing the number of competing stations by around 33% (which corresponds to one additional station at the median) increases the pass rate by 1.92 percent, which is more than double the magnitude of the estimate from fixed effects in Table 4.

Although our analyses suggest that it is competition that leads to the higher pass rate, one could argue that other potential mechanism may provide an explanation. Suppose that all of the stations are doing their best to be accurate. But stations make errors and there is variation among stations in the probability of passing an inspection. Car owners can communicate and identify which stations have higher pass rates. This is more likely to occur when the car owners have more choices. The results that we find thus could be due not to leniency but primarily to car owner choices. This mechanism has been explained in the context of the market for credit ratings for bonds (see Skreta & Veldkamp, 2009).

We argue that this potential mechanism is less likely to hold in our case. First, compared to credit ratings for bonds, car inspection is much less complex, and complexity is thought to be a primary cause for unintentional errors in the credit ratings market. Second, in the credit ratings case asset issuers can choose between different ratings and reveal only those that are favorable to them. This feature of the credit rating markets makes it much easier for asset issuers to choose agencies that provide inflated ratings. For the Swedish motor vehicle inspection market, however, once a car owner gets a fail result she needs to address the problem that causes the failure. There is, therefore, much less opportunity to disclose only the most favorable results. We, therefore, argue that it is less likely for this mechanism to hold in our case.

7 Robustness Analyses

7.1 Using the Variable-Radius Approach to Identify Geographic Markets

In our main analyses the fixed-radius approach is used to identify geographic markets. With the fixed-radius approach all stations have same size catchment area (14 km radius). In this section, we now repeat our analyses based on a variable-radius approach. The method allows stations in different municipalities to have different radii for catchment areas.

Table 10 in the Appendix reports OLS, fixed effects and fixed effects 2SLS results based on our preferred specification, where all of the control variables are included. The fixed effects and 2SLS results show that competition has a statistically significant and positive effect on pass rates. The fixed effects estimates show that increasing the number of competing stations by around 33% (which corresponds to one additional station at the median) now increases the pass rate by 0.92 percent; this compares to the 0.8 percent for the fixed-radius approach in the main analyses.

The fixed effects 2SLS estimates suggest that increasing the number of competing stations by around 33% (which corresponds to one additional station at the median) increases the pass rate by 1.93 percent. This result can be compared with the 1.92 percent increase that we find in the main analyses. The results with the variable-radius method once again support our hypothesis that competition increases the probability for a given car to pass mandatory inspection.

7.2 Using Administrative Boundaries to Identify Geographic Markets

In the main analyses, we use the locations of stations and their respective customers to create a circular geographic market for each station. An alternative approach is to use administrative boundaries to identify geographic markets. In this section, a station’s relevant geographic market is its municipality. There are a total of 229 geographic markets (municipalities). Table 7 reports the results. The 2SLS estimation satisfies the weak-identification and over-identification tests.

The fixed effects and 2SLS results support our main findings that the probability of passing mandatory inspection increases with local competition. The fixed effects estimates in column 2 of Table 7 show that a shift from a market with three providers to one with four providers (about a 33% increase in the count of stations), increases the pass rate by 0.77 percent, which was 0.8 percent with a fixed-radius approach in the main analyses. Based on the 2SLS results in column 3 of Table 7, a shift from a market with three providers to one with four providers (about a 33% increase in the count of stations) increases the pass rate by 2.39 percent. This result can be compared with the 1.92 percent increase that we find in the main analyses.

7.3 Other Robustness Analyses

In this section, we report a range of other sensitivity analyses: Table 8 reports the results of the sensitivity analyses that are based on our preferred specification, where all of the control variables are included. For comparison purpose, the first row of the table presents the OLS, fixed effects, and fixed effects 2SLS results of our preferred specification results, which correspond to columns 2 and 3 of Table 4 and column 3 of Table 6. We report the coefficient of the competition variable. We focus the discussion only on the fixed effects and fixed effects 2SLS estimates.

Another potential concern that may affect our results relates to the theory of supplier-induced demand. Vehicle inspection stations may use their information advantage over car owners to increase their revenue from reinspection by deliberately failing cars. For example, stations with local monopoly power may intentionally fail cars to increase their revenue from the mandatory re-inspection that failed cars should undergo. If local monopolies practice such behavior, then our estimates of the effect of competition on pass rate could be biased upward. We address this concern by controlling for monopoly stations with an indicator variable. Competition still has a positive and significant effect on the pass rate. The fixed effects point estimate now becomes larger than the estimate of the main analyses.

After the deregulation in July 2010, private firms start to enter the market in the year 2011 and entered more actively in 2012. We re-estimate the model by excluding the observations from the early periods of the deregulation. Excluding the data for the years 2010 and 2011, the estimates from both the fixed effects and fixed effects 2SLS are statistically significant and become larger than the estimates from the main analyses.

The summary statistics in Table 1 shows that there are pass rates in the data that are as low as 0.25 and as high as 0.97. We checked if these outliers affect the main results. We estimate the model by excluding them from the data. The estimate from fixed effects become larger than the results in the main analyses, and the fixed effects 2SLS results remain almost the same.

8 Conclusion

This paper examines whether increased competition motivates firms to relax the inspection standards in the motor vehicle inspection market. We hypothesized that increased competition induces inspection stations to be lenient to their customers because of the risk of losing them to their rivals if they strictly follow the inspection rules.

We employ both fixed effects and fixed effects 2SLS analyses to identify the relationship between competition and the probability of passing mandatory car inspection. We find that inspection stations become more lenient to their customers when they face greater competition from rival stations. Our results are robust to the different approaches that we follow to identify geographic markets, and different model specifications and estimation methods.

The Swedish car inspection market is carefully designed to reduce the distorting incentives that have been observed in other similar markets. For example, stations are not allowed to provide other services such as repair or car dealership, so as to avoid conflicts of interest. Furthermore, the market is closely monitored by the Swedish Transport Agency. Despite all of the precautions that have been taken, competition still affects inspection firms’ compliance with regulations. If we take our findings as the lower bound of the effect of competition on fraudulent passes, then policymakers must consider how to obtain the benefits of competition while alleviating the risk of illegal passes.

Finally, although our findings indicate the adverse side of competition, they do not necessarily recommend against the private provision of car inspection services. Our findings, however, suggest that the regulators of the market should allocate more of their limited supervision resources in highly competitive areas where there is an incentive not to comply with the government regulations.

Notes

Sweden was ranked third of all of countries in the world in the “rule of law index” 2015 (see the Rule of Law Index report, 2015, by the World Justice Project).

The model does not incorporate the drawback of being caught by the regulator for passing cars fraudulently, which certainly does bring penalties to stations.

The model assumes that for any failed initial inspection the car always passes the re-inspection. This assumption is close to the reality in the Swedish car inspection market. The data indicates that 92% of the cars that had failed their first inspection passed the re-inspection. The model further assumes that for any failed initial inspection: the owner of the car always brings it back to the same inspection station for the re-inspection.

Habte (2018), one of the authors of this paper, estimates car owners’preferences for station characteristics in the Swedish motor vehicle inspection market. The model incorporates broad characteristics of stations - including the pass rate. The estimates of both the multinomial and mixed logit models show that car owners prefer stations with higher pass rates after controlling for other factors.

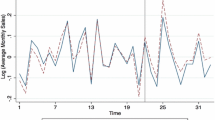

Figure 3 in the Appendix presents early evidence on the relationship between pass rate and volume of inspections over the period July 2010 to August 2015. The figure suggests that the volume of inspections increases with the pass rate, but the relationship is non-linear.

The inspection market can be categorized in terms of the weights of vehicles: light vehicles (\(< 3500kg\)), and heavy vehicles (\(>3500kg\)). Light vehicle inspection accounts for 95% of the total market. This study will focus on the light vehicle inspection market.

During the period of this study, there was a 3-2-1-1 rule: New cars that weigh no more than 3,500 kg should undergo their first mandatory inspection when they are three years old and the second inspection when they are five years old. Afterwards, they must be inspected annually. Cars for commercial use should undergo inspection every year regardless of their age.

The costs of inspection varies between stations and the type of inspections. The price of pre-booked inspection service varies between 330 and 600 kronor. The average station charges 394 kronor. Drop-in inspection services cost a little more than the pre-booked inspection. A car that fails an inspection needs to be re-inspected after the problems get fixed. The price of re-inspection is cheaper than the first inspection.

The state owns 52%, and auto insurance companies and other associations own the remaining 48%.

Bilprovning AB opened 24 new stations during 2010–2012.

The authors received pass rate data monthly from the data provider (Swedish Transport Agency). When we started the study, we agreed with our data provider that we needed five years of data; as a result the data collection stopped in August 2015 when we reached the full five years of data (July 2010 - August 2015).

We use linear interpolation to convert the annual data into monthly data.

They define each hospital’s geographic market as a circular area with 30 km radius since a given hospital with 15 km catchment area will have an overlapping (at least to some extent) area with the catchment areas of any hospitals that are less than 30 km far away.

14 km is the median of the distribution of the road travel distances between the residential addresses of 458,405 car owners and the respective station that each owner chose for inspection service. Using actual travel distances to approximate a station’s catchment area partly solves the main criticism in other studies for using arbitrary radii.

In this approach, stations in the same municipality will have equal size catchment areas, while stations’ catchment areas across municipalities are allowed to vary.

We also present a robustness check by defining the catchment area with the use of the travel distances of the \(75^{th}\) percentile customer.

A full structural model approach would have been an alternative way to examine our research question, which would be more important if the purpose was to simulate the effects of alternative policies and other hypothetical scenarios. Unfortunately, the price data that we have are not adequate for a full structural model. We nevertheless believe that the reduced-form approach that we followed also serves well to examine the hypothesized relationship between pass rate and competition where intuition and prior research among other things are used to specify the reduced-form equation.

Olivares and Cachon (2009) use population size at a market level as an instrument for the number of car dealers in their study of the impact of competition on inventory.

As discussed by Cameron and Miller (2015), the higher is the size of the within-cluster correlation of regressors and errors, the higher is the need to use cluster-robust standard errors. Municipality-level clustering allows not only for within-station correlation across time periods but also for error correlations across stations in the same municipality. If we cluster at the station level, then our test statistics become much larger than the statistics that we obtain at the municipality level.

References

Alexander, D., & Schwandt, H. (2022). The impact of car pollution on infant and child health: Evidence from emissions cheating. Review of Economic Studies, Forthcoming.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2007). ivreg2: Stata module for extended instrumental variables/2sls, gmm and ac/hac, liml, and k-class regression. Boston College Department of Economics, Statistical Software Components (http://ideas.repec.org/c/boc/bocode/s425401.html)

Bennett, V., Pierce, L., Snyder, J., & Toffel, M. (2013). Customer-driven misconduct: How competition corrupts business practices. Management Science, 59(8), 1725–1742.

Bloom, N., Propper, C., Seiler, S., & Van Reenen, J. (2015). The impact of competition on management quality: Evidence from public hospitals. Quarterly Journal of Economics, 82(2), 457–489.

Bolton, P., Freixas, X., & Shapiro, J. (2012). The credit ratings game. Journal of Finance, 67(1), 85–112.

Bound, J., Jaeger, D. A., & Baker, R. M. (1995). Problems with instrumental variables estimation when the correlation between the instruments and the endogenous explanatory variable is weak. Journal of the American Statistical Association, 90(430), 443–450.

Branco, F., & Villas-Boas, J. M. (2015). Competitive vices. Journal of Marketing Research, 52(6), 801–816.

Bresnahan, T. F., & Reiss, P. C. (1991). Entry and competition in concentrated markets. Journal of Political Economy, 99(5), 997–1009.

Cameron, C. A., & Miller, D. L. (2015). A practitioner’s guide to cluster-robust inference. Journal of Human Resources, 50(2), 317–372.

Garnick, D. W., Luft, H. S., Robinson, J. C., & Tetreault, J. (1987). Appropriate measures of hospital market areas. Health Services Research, 22(1), 69–89.

Gino, F., & Pierce, L. (2010). Robin hood under the hood:Wealth-based discrimination in illicit customer help. Organization Science, 21(6), 1176–1194.

Griffn, J. M., & Tang, D. (2012). Did subjectivity play a role in CDO credit ratings? Journal of Finance, 67(4), 1293–1328.

Habte, O. A. (2018). Deregulation, choice and competition in the motor vehicle inspection market. Dissertation, Lund University. (https://lup.lub.lu.se/record/2b3e60c0-b3ad-4575-be9d-1c8f4dfea61f)

Hubbard, T. N. (1998). An empirical examination of moral hazard in the vehicle inspection market. The RAND Journal of Economics, 29(2), 406–426.

Hubbard, T. N. (2002). How do consumers motivate experts? Reputational incentives in an auto repair market. Journal of Law and Economics, 45(2), 437–468.

Keall, M. D., & Newstead, S. (2013). An evaluation of costs and benefits of a vehicle periodic inspection scheme with six-monthly inspections compared to annual inspections. Accident Analysis and Prevention, 58, 81–87.

Mathis, J., McAndrews, J., & Rochet, J.-C. (2009). Rating the raters: Are reputation concerns powerful enough to discipline rating agencies? Journal of Monetary Economics, 56(5), 657–674.

Mazzeo, M. J. (2003). Competition and service quality in the U.S. airline industry. Review of Industrial Organization, 22(4), 275–296.

Merrell, D., Poitras, M., & Sutter, D. (1999). The effectiveness of vehicle safety inspections: An analysis using panel data. Southern Economic Journal, 65(3), 571–583.

Olivares, M., & Cachon, G. P. (2009). Competing retailers and inventory: An empirical investigation of general motors’dealerships in isolated US markets. Management Science, 55(9), 1586–1604.

Peck, D., Matthews, H. S., Fischbeck, P., & Hendrickson, C. T. (2015). Failure rates and data driven policies for vehicle safety inspections in Pennsylvania. Transportation Research Part A, 78, 252–265.

Salop, S. C. (1979). Monopolistic competition with outside goods. Bell Journal of Economics, 10(1), 141–156.

Schaffer, M. E. (2005). Xtivreg2: Stata module to perform extended iv/2sls, gmm and ac/hac, liml and k-class regression for panel data models. Boston College Department of Economics, revised 22 Feb 2015.

Sean, F., & Ghent, A. (2017). Competition and credit ratings after the fall. Management Science, 64(4), 1672–1692.

Skreta, V., & Veldkamp, L. (2009). Ratings shopping and asset complexity: A theory of ratings inflation. Journal of Monetary Economics, 56(5), 678–695.

Snyder, J. (2010). Gaming the liver transplant market. Journal of Law, Economics, and Organization, 26(3), 546–568.

Stiglitz, J. E. (1986). Economics of the public sector. New York: W. W. Norton and Company.

Stock, J., Yogo, M., & Wright, J. A. (2002). Survey of weak instruments and weak identification in generalized method of moments. Journal of Business and Economic Statistics, 20, 518–539.

Sutter, D., & Poitras, M. (2002). The political economy of automobile safety inspections. Public Choice, 133(3–4), 367–387.

Syverson, C. (2004). Market structure and productivity: A concrete example. Journal of Political Economy, 112(6), 1181–1222.

Tirole, J. (1988). The theory of industrial organization. Cambridge, MA: MIT Press.

United States Government Accountability Offce. (2015). Vehicle safety inspections-improved DOT communication could better inform state programs (report no. GAO-15-705). https://www.gao.gov/assets/680/672131.pdf .

Acknowledgements

We thank Florin Maican, David Edgerton, Joacim Tåg, two anonymous referees and Lawrence J. White (the editor) as well as conference participants at the Annual Congress of the European Economic Association 2017, European Association for Research in Industrial Economics 2017, Eurasia Business and Economics Society 2017, the Swedish Workshop on Competition & Public Procurement Research 2016 and Microeconomics Seminar at Lund University for their valuable comments. We would also like to thank the Swedish Transport Agency for providing us with the data. Special thanks to Peter Holmlund (Swedish Transport Agency) for helping us obtain the data and for valuable discussions about the market. We gratefully acknowledge financial support from the Swedish Competition Authority [Grant number 44/2015 Ab 26]. The usual disclaimer applies.

Funding

Open access funding provided by Lund University.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

A Appendices

A Appendices

1.1 A.1 Prices of Chain Firms

1.2 A.2 Robustness checks: Using a variable-radius approach to identify geographic markets

1.3 A.3 Volume of Inspections versus Pass Rate

1.4 A.4 Pass Rate versus Competition

1.5 A.5 Pass Rates of New Entrants Over Time

1.6 A.6 Pass Rates of Incumbents versus New Entrants

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Habte, O.A., Holm, H.J. Competition Makes Inspectors More Lenient: Evidence from the Motor Vehicle Inspection Market. Rev Ind Organ 61, 45–72 (2022). https://doi.org/10.1007/s11151-022-09864-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-022-09864-z