Abstract

This paper studies the problem of trading in information in two seemingly unrelated settings: inventive activity; and blackmail. In the former, a discoverer of some new information wishes to profit from it but may be deterred because the act of disclosure effectively makes the information public. Thus, legal protection of the information in the form of a patent is usually needed to allow the inventive process to proceed. Blackmail also involves trading in information; but because the transaction is between two parties who already know its content—the discoverer, and someone who wishes to keep it hidden—the appropriability problem is absent. The paradox of blackmail is why the blackmailer prefers to sell the information to the informed party rather than to the uninformed party (who actually values it more); this latter transaction would be legal. The resolution of the paradox provides the link to patent law, because the latter transaction does involve the appropriability problem.

Similar content being viewed by others

Notes

There is some debate, however, about the need for patents as a way to promote innovation. See, for example, Boldrin and Levine (2008).

Nevertheless, Hirshleifer and Riley (1992, p. 274) note that “[e]ven in the most favorable circumstance, where fully effective legal protection means that the seller is in no way inhibited from disclosure, it may still remain difficult to convince buyers of the market value of the idea.” Thus, patents are not a perfect solution to the problem of selling information. Anton and Yao (1994), however, show that an inventor may be able to capture a substantial portion of the value of his invention, even in the absence of enforceable property rights, by revealing the invention to a firm and then negotiating an appropriately-structured contingent contract with the latter. In particular, the contract would have to penalize the inventor from also revealing the invention to a competing firm. However, assuming that the inventor has limited assets with which to pay such a penalty, the payment for exclusive rights to the invention must be sufficiently generous that loss of it deters the inventor from further revelation.

As noted, a possible contractual solution would involve a contingent contract that obligates the recipient of the information to pay a royalty to the inventor if the recipient subsequently makes use of the information. Patent law eliminates the need to create and enforce such contracts by awarding exclusive rights to inventors as the default rule. While this saves on contracting costs, it precludes claims of independent discovery, which are not a defense to a patent infringement claim. See the discussion of this point in Blair and Cotter (2005, pp. 106–113).

The discussion that follows is based on Miceli (2011).

This distribution reflects differences across sellers in terms of their opportunity costs (next best options), which we will assume is not systematically related to their “types.” There is no loss in generality in this assumption.

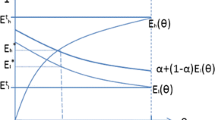

As Hirshleifer and Riley (1992, p. 308) note, it is only in “severe” cases of adverse selection that the market completely collapses to the point where only low-quality types remain. Wilson (1980), for example, shows that the nature of the equilibrium depends crucially on exactly how the price is set, while Grossman (1979) derives a “dissembling” (non-Nash) equilibrium in which low types succeed in masquerading as high types to receive favorable prices. This latter model would seem to be particularly relevant to the blackmail context.

This situation is distinct from a threat by a third party to sell false information that would be damaging to the victim. Such actions are covered by libel laws (see, for example, Cooter (2000, pp. 324–331)).

This sort of private law enforcement is not generally efficient, however, because it could result in either under- or over-enforcement from a social perspective (Ginsburg and Schechtman 1993, p. 1869). Also see Landes and Posner (1975, p. 42), who first developed the argument about the inefficiency of private as opposed to public law enforcement, and then applied the logic to the blackmail paradox.

An interesting question is why non-disclosure agreements (NDAs) are legal, even though, like blackmail, they involve a transaction whose express purpose is to keep certain information private. A complete answer to this question is beyond the scope of this paper; but one possible explanation is the following: In the blackmail case, the blackmailer had no relationship with the victim before he discovered the compromising information; whereas in the NDA case, the parties to the agreement were in a pre-existing productive relationship, which potentially could result in disclosure of the information in question. Thus, in the absence of the NDA, that relationship may never have formed in the first place; the NDA thereby facilitates an otherwise unattainable benefit.

We will also assume that blackmailers gain no pleasure from the act of blackmailing per se.

As noted above, there is a corresponding welfare loss in Fig. 1 from the fact that there are also too few high-quality sellers in the market under the adverse selection outcome (area B). Hypothetically, eliminating this inefficiency by an information transfer would require a third-party to gather information about high-quality sellers who are not currently in the market and pointing them out to would-be buyers. Clearly, this would be a much harder job because it would be harder to identify who such buyers might be. Insurance companies are increasingly trying to attract low-risk drivers through the use of monitoring devices that track their driving habits. Likewise, companies try to use their brand names to signal high quality for new or different product lines. In a non-market context, matchmakers could be seen as performing this sort of function in marriage markets (see the further discussion in Sect. 5 below).

If the third party is a “repeat” blackmailer, he may also be able to establish a reputation for not returning to the well (Shavell, 1993).

Isenbergh (1993, p. 1907), similarly concludes “…that the prohibition of blackmail leads to a relatively greater disclosure of a smaller body of information, because…[the blackmailer] is more likely to disclose information about A [the informed party] to C [the uninformed party] when prevented from bargaining with A” [emphasis in original].

As with contractual alternatives to patents for inventions, a contract between D and U is possible which would theoretically make this rationale for blackmail laws unnecessary. Such a contract, however, would be difficult to enforce because D would have to be able to prove that U did not independently discover the information. This would be particularly difficult—probably harder than it would be for an inventor to prove that a user did not independently discover his idea.

I thank Larry White for suggesting this analogy. See, for example, White (2020).

Horner and Skrzypacz (2016) show that an informed third party can overcome this problem if the information can be parceled out gradually, with the uninformed buyer paying little by little with each disclosure. As a concrete example, the informed party could gradually sell the information to a newspaper, thereby providing a conduit to readers who would continue to pay for the daily information disclosure as long as the expected gain exceeds the cost. Such a scheme, however, would seem to be of little practical relevance.

In any case, such evidence, no matter how convincing, often has little effect in matters of the heart.

References

Akerlof, G. (1970). The market for ‘lemons’: Quality uncertainty and the market mechanism. Quarterly Journal of Economics,84, 488–500.

Anton, J., & Yao, D. (1994). Expropriation and inventions: Appropriable rents in the absence of property rights. American Economic Review,84, 190–209.

Bartlett, R. (1981). Property rights and the pricing of real estate brokerage. Journal of Industrial Economics,30, 79–94.

Blair, R., & Cotter, T. (2005). Intellectual property: Economic and legal dimensions of rights and remedies. New York: Cambridge University Press.

Boldrin, M., & Levine, D. (2008). Against intellectual monopoly. New York: Cambridge Univ. Press.

Cass, R., & Hylton, K. (2013). Laws of creation: Property rights in the world of ideas. Cambridge, MA: Harvard University Press.

Cheung, S. (1982). Property rights in trade secrets. Economic Inquiry,20, 40–53.

Coase, R. (1988). The 1987 McCorkle Lecture: Blackmail. Virginia Law Review,74, 655–676.

Cohen, L. (1998). Marriage as contract. In P. Newman (Ed.), The new Palgrave dictionary of economics and the law (Vol. 2, pp. 618–623). New York: Stockton Press.

Cooter, R. (2000). The strategic constitution. Princeton, NJ: Princeton University Press.

Ginsburg, D., & Shechtman, P. (1993). Blackmail: An economic analysis of law. University of Pennsylvania Law Review,141, 1849–1876.

Grossman, H. (1979). Adverse selection, dissembling, and competitive equilibrium. Bell Journal of Economics,10, 336–343.

Hirshleifer, J., & Riley, J. (1992). The analytics of uncertainty and information. Cambridge, UK: Cambridge Univ. Press.

Horner, J., & Skrzypacz, A. (2016). Selling information. Journal of Political Economy,124, 1515–1562.

Isenbergh, J. (1993). Blackmail from A to C. University of Pennsylvania Law Review,141, 1905–1933.

Kitch, E. (1998). Patents. In P. Newman (Ed.), The new Palgrave dictionary of economics and the law (Vol. 3, pp. 13–17). New York: Stockton Press.

Landes, W., & Posner, R. (1975). The private enforcement of law. Journal of Legal Studies,4, 1–46.

Landes, W., & Posner, R. (2003). The economic structure of intellectual property law. Cambridge, MA: Harvard University Press.

Lindgren, J. (1984). Unraveling the paradox of blackmail. Columbia Law Review,84, 670–717.

Miceli, T. (2011). The real puzzle of blackmail: An informational approach. Information Economics and Policy,23, 182–188.

Posner, R. (2003). Economic analysis of law (6th ed.). New York: Aspen Publishers.

Posner, R. (2005). The law and economics movement: From Bentham to Becker. In F. Parisi & C. Rowley (Eds.), The origins of law and economics: Essays by the founding fathers (pp. 328–349). Cheltenham, UK: Edward Elgar.

Shavell, S. (1993). An economic analysis of threats and their illegality. University of Pennsylvania Law Review,141, 1877–1903.

White, L. (2020). A “primarily property” presumption is—still—really needed for the IP/antitrust interface. Review of Industrial Organization (this issue).

Wilson, C. (1980). The nature of equilibrium in markets with adverse selection. Bell Journal of Economics,11, 108–130.

Acknowledgements

I thank the participants in the conference on The Intellectual Property-Antitrust Interface, sponsored by the Robert F. Lanzilotti Public Policy Research Center at the University of Florida, for their insightful comments. I also wish to acknowledge the comments of Larry White, Irina Manta, Hillary Greene, and participants at the faculty workshop at the University of Connecticut School of Law, where I presented an earlier draft of this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Prepared for the conference on The Intellectual Property-Antitrust Interface, sponsored by the Robert F. Lanzilotti Public Policy Research Center at the University of Florida, March 15, 2019.

Rights and permissions

About this article

Cite this article

Miceli, T.J. Trading in Information: On the Unlikely Correspondence Between Patents and Blackmail Law. Rev Ind Organ 56, 637–650 (2020). https://doi.org/10.1007/s11151-020-09749-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-020-09749-z