Abstract

The paper analyzes gross upward pricing pressure indices—\(\texttt {iGUPPI}\)—to assess the anti-competitive effects of mergers between vertically integrated firms where independent rivals are active in the downstream market. Such indices could be used, for example, to screen mergers between mobile network operators that compete with mobile virtual network operators in the downstream retail market. It is shown that the \(\texttt {iGUPPI}\) for the downstream divisions of the merging firms corresponds to the sum of two well-known upward pricing pressure indices: the \(\texttt {GUPPI}\) concept of Salop and Moresi (Georget Law J, 2009), and the \(\texttt {vGUPPI}\) concept of Moresi and Salop (Antitrust Law J 79(1):185–214, 2013). However, this simple decomposition does not hold for their upstream divisions a priori. Here, additional effects that are not included in the two concepts arise. Further assumptions with respect to the price reactions of the downstream divisions to increases in the input prices are imposed so that the \(\texttt {iGUPPI}\) for the upstream divisions is decomposable into an upstream market version of the \(\texttt {GUPPI}\) and the \(\texttt {vGUPPI}\).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last decade, upward pricing pressure indices have been used by several competition authorities—such as the Federal Trade Commission and the EU Commission—as an additional tool for screening mergers. These indices have been strongly advocated by Salop and Moresi (2009) as well as by Farrell and Shapiro (2010). They regard them as an easily manageable tool that accurately indicates the potential anti-competitive price effects of mergers: in particular, in markets for differentiated products for which traditional screening tools that are based on market definition often fail.

Upward pricing pressure indices directly focus on the incentive of a merging firm to raise the prices of its products post-merger due to the recapture of lost sales by the other merging partner. The construction of these indices is based on an idea of Werden (1996). They measure the intensity of this incentive by the amount of the reduction in the marginal costs that are required to cause the merged firm to refrain from raising the prices of its products post-merger.

The first type of gross upward pricing pressure index—\(\texttt {GUPPI}\)—was introduced by Salop and Moresi (2009) and is applicable for horizontal mergers in markets with differentiated products.Footnote 1 Meanwhile, there exist several variants of this index that take account of alternative market conditions or types of mergers.Footnote 2

However, to the best of our knowledge, there is one type of merger that has not yet been covered in the upward pricing pressure literature although several of such mergers have been extensively scrutinized by competition authorities in recent years. In this paper, we aim to fill this gap. Our objective is to derive gross upward pricing pressure indices—\(\texttt {iGUPPI}\)—for mergers of vertically integrated firms.

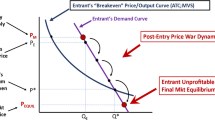

Recently, this type of merger occurred in several national mobile telecommunication markets where two mobile network operators (MNO) merged. Such operators have their own network infrastructure and are active at two stages of the supply chain: the provisions of network services upstream, and telecommunication services downstream. In the upstream stage, they offer network access to independent mobile virtual network operators (MVNOs), which have no network infrastructure of their own and are thus dependent on network access to supply telecommunication services. Moreover, MVNOs compete with the MNOs, which also offer retail services.

Prominent cases of mergers of MNOs in Europe are: Hutchison 3G Austria/Orange Austria in 2012; Hutchsion 3G UK/Telefónica Ireland in 2014; Telefónica Deutschland/E-Plus in 2014; and Hutchison 3G UK/Telefónica UK in 2016.Footnote 3 Interestingly, the European Commission applied the \(\texttt {GUPPI}\) concept of Salop and Moresi (2009) to gauge the price effects of these merger in the retail market.Footnote 4 The question arises whether the \(\texttt {GUPPI}\) concept is still an appropriate measure of the pricing pressure when both merging firms operate at both stages of the supply chain.

This paper provides an answer to this question: Such an approach might lead to an (possibly substantial) underestimation of the actual pricing pressure. This underestimation is attributed to the fact that there are additional pricing pressure effects that are not captured by the standard \(\texttt {GUPPI}\) for this kind of merger.

The paper is organized as follows: In the next section, we provide a brief summary of our model-based approach to measuring the pricing pressure that is induced by a merger of two vertically integrated firms. The game-theoretic setting of our pricing pressure analysis is detailed in Sect. 3. In the fourth section, the situation pre-merger is characterized. The upward pricing pressure methodology and the data requirements for our indices are discussed in Sect. 5. Sections 6 and 7 are the core part of the paper. The \(\mathtt{iGUPPI}\)s for the products that are offered by the merging firms and by their downstream rivals are specified here. Section 8 concludes.

2 Overview of Our Model-Based Approach

Our objective is to analyze the upward pricing pressure that is caused by a merger of two vertically integrated firms. For this purpose, we adopt the framework in Moresi and Salop (2013) and consider a two-stage differentiated Bertrand competition game with imperfect information.

This game-theoretic model describes a supply chain with two value-creation stages: the upstream stage, and the downstream stage. The upstream firms (also called suppliers) produce intermediate goods that are employed by the downstream firms (also called manufacturers) for producing final goods. There are at least two vertically integrated firms—which produce both intermediate goods and final goods—and at least one non-integrated firm in the downstream market. It is assumed that the vertically integrated firms are self-sufficient and do not source intermediate goods from other suppliers.

The price setting proceeds in a sequential way: the suppliers set the prices of the intermediate goods before the manufacturers set the prices of the final goods. However, the manufacturers have only imperfect information about the prices of the intermediate goods. While any non-integrated manufacturer knows only the prices of the intermediate goods that it employs, the manufacturer of any vertically integrated firm is informed only about the prices of the intermediate goods that are offered by its integrated supplier.

The current (pre-merger) market situation is assumed to be a perfect Bayesian equilibrium of this two-stage competition game. This pre-merger equilibrium serves as the reference point of our analysis of the potential anti-competitive effects of a merger between two vertically integrated firms. To quantify these effects, we construct the upward pricing pressure indices \(\texttt {iGUPPI}\). These indices measure the intensity of the incentive that the two vertically integrated firms have post-merger to increase the prices of their products.

The fundamental principle that underlies their construction has already been set forth by Werden (1996). He suggests calculating the magnitude of the reduction in the marginal costs that is needed to offset the incentive of the merged firm to increase the current prices of its products and taking these hypothetical gains in cost efficiency as the measure of the intensity of this incentive.

To reach a comprehensive picture of the anti-competitive effects of the merger, we derive several upward pricing pressure indices: with regard to the intermediate goods that are offered by the merging firms (\(\texttt {iGUPPI} ^\mathtt{u}\)); with regard to the final goods that are offered by the merging firms (\(\texttt {iGUPPI} _\mathtt{d}\)); and with regard to the final goods that are offered by the competitors of the merging firms (\(\texttt {iGUPPI} _\mathtt{r}\)). Moreover, we discuss how these indices are related to the \(\texttt {GUPPI}\) concept of Salop and Moresi (2009) and the \(\texttt {vGUPPI}\) concept of Moresi and Salop (2013). The former measures the upward pricing pressure that is induced by a horizontal merger, while the latter measures the upward pricing pressure that is induced by a vertical merger.

Indeed, as will be shown later in detail, our upward pricing pressure indices \(\texttt {iGUPPI} _\mathtt{d}\) prove to be the sum of the indices \(\texttt {GUPPI}\) and \(\texttt {vGUPPI} _\mathtt{d}\). However, we cannot establish such simple decomposition for our upward price indices \(\texttt {iGUPPI} ^\mathtt{u}\). The reason is that these indices take into account the price reactions of the merging firms’ downstream divisions—which are captured neither in the \(\texttt {GUPPI}\) nor in the \(\texttt {vGUPPI}\) concept.

3 The Economic Setting

As outlined above, we consider a supply chain with two value creation stages: the upstream market, and the downstream market. The former is the place where suppliers sell intermediate goods to manufacturers, while the latter is the place where manufacturers sell final goods to the consumers. The intermediate goods are needed by the manufacturers for producing their final goods. Henceforth, intermediate goods are referred to as inputs, and final goods are referred to as outputs of the manufacturing process. For the sake of simplicity, we assume that both the suppliers and the manufactures are single-product firms.

There are three types of firms: firms that produce only inputs; firms that produce only outputs; and firms that produce both inputs and outputs. The first firms are non-integrated suppliers; the second firms are non-integrated manufacturers; and the third firms are vertically integrated firms. The latter consist of a upstream and a downstream division. While a non-integrated manufacturer might combine inputs from different suppliers, the downstream division of a vertically integrated firm sources all its inputs from its upstream division.

We denote the set of vertically integrated firms by I where \(|I| \ge 2\).Footnote 5 There are two vertically integrated firms called firm 1 and firm 2 that intend to merge into a new company: z. Let S be the finite set of suppliers and M be the finite set of manufacturers. The subsets of non-integrated suppliers and non-integrated manufacturers are denoted by \(S^n:=S\setminus I\) and \(M^n:=M \setminus I\), respectively. Throughout our analysis, we take for granted that at least set \(M^n\) is non-empty.

The prices for the inputs and outputs are set in a sequential way: in the first stage of our competition game, the suppliers fix the prices of the inputs that they offer to the manufacturers. In doing so, the suppliers are able to price discriminate among the manufacturers. However, the pricing for each manufacturer is linear: Each manufacturer pays a constant price for each input unit.

We denote the input price that is charged by supplier s to non-integrated manufacturer k by \(w^s_k\). The input prices that are set by supplier s are listed by vector \(w^{s}:=(w^{s}_m)_{m \in M^n}\), and the input prices that are faced by non-integrated manufacturer k are listed by vector \(w_{k}:=(w^s_k)_{s \in S}\). Input price vector \(w:=(w^{s})_{s \in S}\) summarizes all of the prices that prevail in the upstream market. As is customary, \(w^{-s}:=(w^{t})_{t \in S\setminus \{s\}}\) summarizes the input prices that are charged by the suppliers except for supplier s.

In the second stage of our competition game, the manufacturers set the prices of the outputs. This price-setting takes place under imperfect information. While any non-integrated manufacturer is informed only about the prices of the inputs that it employs, the manufacturer of any vertically integrated firm knows only the input prices that are charged by its integrated supplier.Footnote 6 In game-theoretic models such as our competition game, the players’ knowledge is described by information sets. Our assumptions on the manufactures’ knowledge entail that the information sets of a non-integrated manufacturer k are identifiable by the input price vectors \(w_k\) and the information sets of the vertically integrated firm i by the input price vectors \(w^i\).

We denote the output price that is set by manufacturer k by \(p_k\) so that vector \(p:=(p_m)_{m \in M}\) summarizes the prices that prevail in the downstream market. As is customary, vector \(p_{-k}:=(p_{m})_{m \in M\setminus \{k\}}\) lists the prices that are set by the manufacturers except for manufacturer k.

Concerning the costs, we assume that supplier’s marginal costs might differ among the manufacturers: for example, because the delivery of the inputs to the manufacturers causes different transportation or service costs. However, the supplier’s marginal costs are assumed to be constant with respect to any quantity that is delivered to the manufacturers. We denote the constant marginal cost of the input that is produced by supplier s and is delivered to non-integrated manufacturer k by \(c^s_k\).

While each non-integrated manufacturer might combine inputs from different suppliers, the downstream division of a vertically integrated firm i sources all its inputs from its upstream division at transfer price \(c_i\) per input unit. The transfer price is assumed to be equal to the constant marginal cost of this input. We summarize the marginal costs of the input that is offered by supplier s to the non-integrated manufacturers by vector \(c^s:=(c^s_m)_{m \in M^n}\) and the marginal costs of all inputs by vector \(c:=\left( (c^i,c^{}_i)_{i \in I},(c^s_{})_{s \in S^n}\right)\).Footnote 7 The latter vector is henceforth referred to as the cost structure of the supply chain.

The technologies of all manufacturers exhibit constant returns to scale so that the input coefficients of the cost-minimizing manufacturers are independent of the quantity produced.Footnote 8 We denote non-integrated manufacturer k’s production coefficient with respect to the input that is offered by supplier s by \(S^s_k(w_k)\). This input coefficient gives the quantity of the input that manufacturer k sources from supplier s per unit of output at input prices \(w_k\). Henceforth, we take for granted that input coefficient function \(S^s_k(\cdot )\) is differentiable. Cost minimization implies that this function is also non-increasing in the input price \(w^s_k\) that is charged by supplier s and non-decreasing in the input price \(w^t_k\) that is charged by any other supplier \(t \ne s\).Footnote 9

Notice that the input coefficient functions of a non-integrated manufacturer might vary in the input prices that this manufacturer faces. In this case, the manufacturer is said to operate with a variable input ratio. Whenever all input coefficient functions of a non-integrated manufacturer are constant, the manufacturer is said to operate with a fixed input ratio (or to employ the inputs in a perfectly complementary way). We do not rule out that some input coefficient functions are zero functions; in symbols, \(S^s_k(w_k)=0\) for any input price vector \(w_k\). This means that the non-integrated manufacturer k never uses the input that is offered by supplier s.

The demand for the product that is offered by manufacturer k at output price vector p is denoted by \(D_k(p)\). We assume that demand function \(D_k(\cdot )\) for product k is differentiable, decreasing in its own price \(p_k\), and increasing in the price \(p_m\) of any other product \(m \ne k\). The latter assumption states that the other products are (imperfect) substitutes for the product that is offered by manufacturer k. In mathematical terms, these assumptions require \(\frac{\partial D_k}{\partial p_k}(p)<0\) and \(\frac{\partial D_k}{\partial p_m}(p)>0\) for any (relevant) output price vector p and any products \(m \ne k\).

4 The Situation Pre-merger

To specify the upward pricing pressure that results from the merger between the vertically integrated firms 1 and 2, it is necessary to characterize their economic situation pre-merger. It is assumed that the situation pre-merger constitutes a perfect Bayesian equilibrium of our two-stage competition game. In the subsequent paragraphs, we impose several assumptions on the pre-merger equilibrium. These assumptions apply throughout the paper and are needed to infer qualitative statements about our indices.Footnote 10

The perfect Bayesian equilibria of our two-stage competition game depend on the numerical specification of our economic setting. One parameter of this setting is the cost structure c for the inputs. Holding fixed the other economic parameters such as the input coefficient and demand functions, we can construct a correspondence \({\mathrm {PBE}}(\cdot )\) that assigns to each cost structure c the set of all price vectors (w, p) that are realized in some perfect Bayesian equilibrium with this cost structure.

Let \({\hat{c}}\) be the pre-merger cost structure and \(({\hat{w}},{\hat{p}})\) be the pre-merger price vector. Since the per-merger situation is assumed to be a perfect Bayesian equilibrium, \(({\hat{w}},{\hat{p}}) \in {\mathrm {PBE}}({\hat{c}})\). Moreover, we assume that there is a differentiable mapping \(w(\cdot )\) that selects an equilibrium input price vector w for each cost structure c—there exists an output price vector p that satisfies \((w,p) \in {\mathrm {PBE}}(c)\)—where \(w({\hat{c}})={\hat{w}}\) holds. Without any concerns, we suppose

for any vertically integrated firm \(i \in I\) and non-integrated manufacturer \(k \in M^n\). This assumption states that if the production of input i employed by non-integrated manufacturer k becomes more expensive, then integrated supplier i at least partially passes on this cost increase to this manufacturer.

Consider the pre-merger equilibrium: We denote the equilibrium price strategy of manufacturer k by \({\hat{p}}_{k}(.)\). It discloses the prices that are charged by manufacturer k at any of its information sets. The equilibrium price strategies of the manufacturers are summarized by the strategy profile \({\hat{p}}(.)\), where \({\hat{p}}(w):=({\hat{p}}_{m}(w))_{m \in M}\) holds for any input price vector w.Footnote 11 This strategy profile lists the output prices that are charged by the manufacturers for any input price vector w. As is customary, \({\hat{p}}_{-k}(.):=\left( {\hat{p}}_{m}(.)\right) _{m \in M \setminus \{k\}}\) denotes the equilibrium price strategies that are chosen by the manufacturers except for manufacturer k.

A further premise with respect to the pre-merger equilibrium is that the vertically integrated firms do not cross-subsidize: Any business relationship that is undertaken by these firms is profitable at the equilibrium prices.Footnote 12 The equilibrium output price \({\hat{p}}_i\) that is charged by a vertically integrated firm i exceeds the marginal cost \({\hat{c}}_i\) and any equilibrium input price \({\hat{w}}^i_k\) that is charged by this firm exceeds the marginal cost \({\hat{c}}^i_k\) if its upstream division delivers inputs to manufacturer k; in symbols,

Moreover, we assume that the price strategies of all manufacturers are differentiable at the equilibrium input prices. According to our assumptions on the manufacturers’ knowledge, an increase in input price \(w^i_k\) that is charged by the upstream division of vertically integrated firm i to non-integrated manufacturer k is observed only by two manufacturers: the non-integrated manufacturer k, and the downstream division of firm i.

Throughout this paper, we postulate that manufacturer k’s equilibrium price strategy \({\hat{p}}_k(\cdot )\) is increasing in input price \(w^i_k\) at equilibrium input prices \({\hat{w}}\) as long as manufacturer k employs the input that is offered by supplier i; thus, a manufacturer that employs the input that is offered by the upstream division of some vertically integrated firm at least partially passes on an increase in the price of this input to its customers. However, in the case that manufacturer k does not employ this input, no price reactions occur, neither from manufacturer k nor from the downstream division of vertically integrated firm i. Mathematically, these assumptions on the price reactions of the two firms are summarized by

Since the other manufacturers do not observe the increase in input price \(w^i_k\), their price setting is unaffected by this price increase. For this reason, \(\frac{\partial {\hat{p}}_m}{\partial w^i_k}({\hat{w}})=0\) holds for any manufacturer m that is different from i and k.

In consequence, an increase in input price \(w^i_k\) affects the demand \(D_m(\cdot )\) for the output that is produced by some manufacturer m in only two ways: by a change in output price \(p_k\), and by a change in output price \(p_i\). The first transmission channel is henceforth called the direct price channel, while the second one is called the indirect price channel. For any output m that is different from i, it is taken for granted that whenever the effect of the indirect price channel counteracts the effect of the direct price channel, the latter outweighs the former.

We support this claim by imposing two additional assumptions: First, we suppose that the absolute size of the effect on the demand for product k through the direct transmission channel exceeds the size of the effect on the demand for product k through the indirect transmission channel; in symbols,

Second, we suppose that the absolute size of the effect on the demand for any product that is different from k and i through the direct transmission channel exceeds the absolute size of the effect on the demand for this product through the indirect transmission if the latter effect turns out to be negative; in symbols,

for any product m that is different from k and i.Footnote 13

As can be easily checked, our assumptions (3) to (5) ensure that whenever the non-integrated manufacturer k employs the input that is offered by the upstream division of vertically integrated firm i at the equilibrium input prices \({\hat{w}}\), an increase in the price of this input leads to a decrease in the demand for product k, but to an increase in the demand for any product that is different from i and k.

A perfect Bayesian equilibrium requires that the beliefs at the information sets that crosses the equilibrium path be consistent with the factual price decisions. This postulate implies the following conjectures in our competition game: First, each downstream division of a vertically integrated firm i believes at information set \({\hat{w}}^i\) that the other suppliers charge their equilibrium input prices \({\hat{w}}^{-i}\). Second, each non-integrated manufacturer k believes at information set \({\hat{w}}_k\) that its non-integrated competitors pay the equilibrium input prices \({\hat{w}}_{-k}\).

The other requirement that is imposed by the perfect Bayesian equilibrium concept is that all players act sequentially rational at each of their information sets. This entails for our competition game that each firm maximizes its expected profits at each of its information sets. In what follows, we identify the conditions for the equilibrium input and output prices that result from sequential rationality and the above conjectures.

As a first step, we examine the price setting in the downstream market. We begin with the equilibrium price strategies of the non-integrated manufacturers. The profit function of non-integrated manufacturer k is given by

Non-integrated manufacturers have only one source of revenue: the downstream market.

According to our assumptions on the manufacturers’ knowledge, non-integrated manufacturers observe only the prices of their inputs, but not the input prices that the suppliers arrange with the other non-integrated downstream firms. As argued above, a non-integrated manufacturer k conjectures at its information set \({\hat{w}}_k\) that the other non-integrated manufacturers pay the equilibrium input prices \({\hat{w}}_{-k}\). Consequently, manufacturer k expects at this information set that its competitors set the equilibrium output prices \({\hat{p}}_{-k}={\hat{p}}_{-k}({\hat{w}})\).

Sequential rationality at information set \({\hat{w}}_k\) thus implies that the price \({\hat{p}}_{k}\) that is charged by non-integrated manufacturer k at the equilibrium satisfies the first-order condition

As can be easily checked, condition (6) is equivalent to

where \(\epsilon _k:=-\frac{\partial D_k}{\partial p_k}({\hat{p}})\frac{{\hat{p}}_k}{D_k({\hat{p}})}\) denotes the (own-)price elasticity of the demand for the product that is offered by non-integrated manufacturer k at equilibrium output prices \({\hat{p}}\). Equation (7) is the well-known markup rule: The profit margin of manufacturer k corresponds to the inverted value of the price elasticity of the demand for manufacturer k’s product.

Next, we examine the equilibrium price strategies of the vertically integrated firms in the downstream market. The profit function of vertically integrated firm i is given by

The first term on the right-hand side of this equation is the profit that the vertically integrated firm i realizes in the downstream market, while the second term adds up the profits that the firm realizes by selling inputs to the non-integrated downstream competitors \(m \in M^n\).

As mentioned above, vertically integrated firm i believes at information set \({\hat{w}}^i\) that the other suppliers choose the equilibrium input price vector \({\hat{w}}^{-i}\). Such conjecture implies that firm i expects at this information set that its competitors in the downstream market choose the equilibrium output prices \({\hat{p}}_{-i}={\hat{p}}_{-i}({\hat{w}})\). Because firm i acts sequentially rational, the first-order condition

for a profit maximum with respect to output price \(p_i\) is satisfied at information set \({\hat{w}}^i\).

Having solved the pre-merger equilibrium conditions in the downstream market, we are able to solve the pre-merger equilibrium conditions in the upstream market. For this purpose, consider a vertically integrated firm i that delivers inputs to non-integrated manufacturer k; in symbols, \(S^i_k({\hat{w}}_k)> 0\). Plugging equilibrium price strategy profile \({\hat{p}}(\cdot )\) into the profit functions \(\pi _i\) of firm i, we obtain the indirect profit function \({\hat{\pi }}_i(w):=\pi _i(w,{\hat{p}}(w))\). The optimality conditions on the input prices that are charged by firm i are derived from this function.

Maximizing its indirect profit function implies that vertically integrated firm i takes into account the impact of its input prices on the output prices. The envelope theorem indicates that the first-order condition with respect to the input price that is charged by firm i to non-integrated downstream firm k is given by

In sum, the pre-merger input and output prices \(({\hat{w}},{\hat{p}})\) have to satisfy the optimality conditions (6) to (9).Footnote 14 These equilibrium prices constitute the reference point of the pricing pressure analysis that we will conduct in the subsequent sections. To evaluate the anti-competitive effects of a merger between two vertically integrated firms, the upward pricing pressure that is induced by the merger is measured from these prices.

In this regard, it is worth pointing out that, according to the optimality conditions (8) and (9), each vertically integrated firm chooses prices at the pre-merger equilibrium so that the additional profits that are earned by its upstream and downstream division due to a (marginal) price increase are equal to zero. For this reason, the upward pricing pressure that is induced by a merger of two such firms originates only from the additional profits that the upstream and downstream divisions of the other merging partner earn due to a price increase by the partner firm.

5 The \(\texttt {iGUPPI}\) Methodology and Its Data Requirements

Suppose that the vertically integrated firms 1 and 2 merge into a new firm z. The merged firm would comprise four divisions: two upstream divisions that produce inputs 1 and 2, and two downstream divisions that produce outputs 1 and 2. Whenever the merger does not induce cost synergies, the profit function of the new firm z is equal to

Superscript 0 of the above profit function points to the assumption that this merger does not generate any efficiency gains in the form of cost reductions.

The current market environment that confronts the merged firm is the pre-merger equilibrium. As was argued in the previous section, this environment is characterized by input and output prices \(({\hat{w}},{\hat{p}}\)) that satisfy the optimality conditions (6) to (9). Additionally, we suppose that the information management of the merged firm is at the pre-merger level. This means that the downstream division of a merging partner is still uninformed about the input prices that are set by the upstream division of the other partner.

Our objective is to provide meaningful indices that quantify the intensity of the incentive that the merged firm has to increase its input and output prices at the pre-merger equilibrium \(({\hat{w}},{\hat{p}})\). We resort to an idea of Werden (1996) and take the efficiency gains that are required to keep the prices unchanged post-merger as the measure for this intensity. In doing so, we proceed like Farrell and Shapiro (2010), who evaluate the intensity of the incentive to increase the prices separately for each price that is set by the merged firm.Footnote 15

The reduction in marginal cost that is needed to prevent a division of the merged firm from increasing the price is calculated by holding fixed the prices that are set by the divisions and non-integrated firms that would not observe such price increase. In particular, the prices that are set by the other divisions and non-integrated firms that operate at the same or upper stage of the supply chain are kept at the pre-merger level. Only the price reactions of the divisions and non-integrated firms that operate at the lower stage of the supply chain and that observe such price increase are taken into account in the derivation. It is hereto assumed that these divisions and firms react as they would have pre-merger.

With this in mind, it becomes apparent that the calculations of the upward pricing pressure indices are not comparative statics exercises, which contrast the equilibrium prices pre-merger with the ones post-merger. Rather, starting from the pre-merger equilibrium, these indices assess the intensity with which the merged firm aims at increasing its prices by specifying the gains in cost efficiency that is needed to offset this incentive.

In the subsequent sections, we construct upward pricing pressure indices for the merged firm and its downstream rivals. In line with the standard terminology, we term our indices the gross upward pricing pressure indices with regard to a merger of two vertically integrated firms. We henceforth use the abbreviation \(\texttt {iGUPPI}\) for these indices.

Overall, the merged firm sets \(2(|M^n|+1)\) prices: the two output prices that are set by its downstream divisions, and the \(2|M^n|\) input prices that are set by its upstream divisions. In the next section, we specify gross upward pricing pressure indices—\(\texttt {iGUPPI} _\mathtt{d}\)—for the two output prices. Gross upward pricing pressure indices—\(\texttt {iGUPPI} ^\mathtt{u}\)—for the \(2|M^n|\) input prices are the topic of the section after next. Moreover, to provide a comprehensive picture of the harm that is inflicted by the merger on consumers, we also specify pricing pressure indices for the downstream rivals. These indices are referred to as \(\texttt {iGUPPI} _\mathtt{r}\) and measure the pressure caused by the merger on the prices that are set by the downstream rivals of the merging firms. Their construction relies on \(\texttt {iGUPPI} ^\mathtt{u}\).

Our upward pricing pressure indices will be stated in a way so that they can be calculated from observable market data. More precisely, we trace back our indices to the following economic variables:

-

Diversion ratios \(DR_{km}\);

-

Profit margins \(M_k\) and \(M^s_k\);

-

Input coefficient elasticities \(\sigma ^{st}_k\);

-

Cost pass-through elasticities \(\delta ^s_k\) and \(\eta ^s_{k}\); and

-

Price transmission ratios \(\tau ^i_{km}\).

These variables are detailed in the subsequent paragraphs.

If manufacturer k increases the price of its product, some of its customers might switch to other products. In particular, some former customers of manufacturer k become customers of manufacturer \(m \ne k\). The diversion ratio \(DR_{km}:= - \frac{\partial D_m}{\partial p_k}({\hat{p}})/\frac{\partial D_k}{\partial p_k}({\hat{p}})\) from manufacturer k to manufacturer m gives the share of k’s lost sales that are captured by m due to an increase in the price of the product supplied by k.Footnote 16 Diversion ratios were introduced by Shapiro (1996) and Werden (1996) in merger analysis and have become one of the key concepts of the upward pricing pressure approach.

The profit margin \(M_k\) denotes the profit that manufacturer k earns per sold unit as a percentage of the pre-merger equilibrium price \({\hat{p}}_k\). More precisely, the profit margin of the downstream division of a vertically integrated firm i is given by \(M_i:=({\hat{p}}_i-{\hat{c}}_i)/{\hat{p}}_i\), while the profit margin of a non-integrated manufacturer k is given by \(M_k:=({\hat{p}}_k-\sum _{s \in S} {\hat{w}}_k^s S_k^s({\hat{w}}_k))/{\hat{p}}_k\). Recall that the markup rule (7) establishes the relationship \(M_k=1/\epsilon _k\) for any non-integrated manufacturer k. The profit margin \(M^s_k := ({\hat{w}}_k^s-{\hat{c}}^s_k)/{\hat{w}}_k^s\) denotes the profit that a supplier s earns per unit of input sold to manufacturer k as percentage of the pre-merger equilibrium input price \({\hat{w}}^s_k\).

A change in input price \(w^s_k\) might affect not only the output price of manufacturer k, but also its production process. If the input that is offered by supplier s becomes more expensive, the manufacturer might modify its employed input combination: partially substituting other inputs for the input of supplier s. The relative change in the contribution of supplier t’s input for manufacturer k’s production due to a relative change in input price \(w^s_k\) is measured by the input coefficient elasticity \(\sigma ^{st}_k:=-\frac{\partial S^t_k}{\partial w^s_k}({\hat{w}}_k) \frac{{\hat{w}}^s_k}{S^t_k({\hat{w}}_k)}\). To simplify our notation, we denote the input coefficient elasticity with respect to the own price by \(\sigma ^{s}_k\) instead of \(\sigma ^{ss}_k\).

If supplier s is faced with higher marginal costs \(c^s_k\) in producing the input that is offered to manufacturer k, then the supplier might partially pass on this increase in cost to the manufacturer by means of a higher input price. The relative size of this effect is measured by elasticity \(\delta ^s_k:=\frac{\partial w^s_k}{\partial c^s_k}({\hat{c}}) \frac{{\hat{c}}^s_k}{{\hat{w}}^s_k}\). It is called the cost pass-through elasticity of the price of the input s that is employed by manufacturer k with respect to the marginal cost of this input.

Likewise, an increase in the price \(w^s_k\) of the input that manufacturer k sources from supplier s might be partially passed through to manufacturer k’s customers by means of a higher product price. The relative size of this effect is measured by elasticity \(\eta ^{s}_{k}:=\frac{\partial {\hat{p}}_k}{\partial w^s_k}({\hat{w}}) \frac{{\hat{w}}^s_k}{{\hat{p}}_k}\): the cost pass-through elasticity of the price of product k with respect to the price of the input that is offered by supplier s to manufacturer k.

As was argued above, a change in the price \(w^i_k\) of the input that is delivered by the upstream division of vertically integrated firm i to non-integrated manufacturer k affects the demand \(D_m(\cdot )\) for the output of manufacturer m in two ways: by the output price adjustment of the non-integrated manufacturer k, and by the output price adjustment of the downstream division of vertically integrated firm i. The first one is referred to as the direct price channel, while the second one is referred to as the indirect price channel.

The relative significance of these price channels on the demand for manufacturer m’s product is indicated by ratio \(\tau ^{i}_{km}:=\frac{\partial D_m}{\partial p_i}({\hat{p}})\frac{\partial {\hat{p}}_i}{\partial w^{i}_k}({\hat{w}}) / \frac{\partial D_m}{\partial p_k}({\hat{p}})\frac{\partial {\hat{p}}_k}{\partial w^{i}_k}({\hat{w}})\). This ratio is termed the price transmission ratio of the demand for product m with respect to an increase in input price \(w^i_k\). Its numerator captures the change in the demand for product m that is caused through the indirect price channel. Its denominator captures the change in the demand for product m that is caused through the direct price channel.Footnote 17

We remark that our assumptions (3) to (5) imply \(\tau ^{i}_{km} > -1\) for any product m that is different from i. If \(\frac{\partial {\hat{p}}_i}{\partial w^{i}_k}({\hat{w}}) \ge 0\) is additionally assumed, then we have \(\tau ^{i}_{km} \ge 0\) for any product m that is different from i and k as well as \(\tau ^{i}_{kk} \le 0\). For the sake of simplicity, we henceforth denote the price transmission ratio of the demand for product k with respect to input price \(w^i_k\) by \(\tau ^{i}_k\) instead of \(\tau ^{i}_{kk}\).

6 Specification of \({\mathtt{iGUPPI_d}}\)

Following the methodology in Farrell and Shapiro (2010), the upward pricing pressure index \(\texttt {iGUPPI} ^i_\mathtt{d}\) gives the reduction in the marginal cost of the downstream division i that is needed to offset the incentive of this division to increase output price \(p_i\). To derive this index, we thus assume that the merger of the two vertically integrated firms generates gains in cost efficiency for downstream division i in the amount of \(\gamma _i\). In this case, the profit function of the merged firm takes the form of

where j denotes the other merging partner. Superscript i of the above profit function relates to our assumption that the merger generates gains in cost efficiency only for the downstream division of merging partner i.

By taking into account first-order condition (8), we observe that an increase in output price \(p_i\) at pre-merger equilibrium prices \(({\hat{w}},{\hat{p}})\) changes the profit of the merged firm by the amount of

Analogous to Farrell and Shapiro (2010), we aim to figure out the magnitude of the reduction in the marginal costs of downstream division i that would prevent the merged firm from increasing output price \(p_i\). Putting it differently, we specify the size of the cost efficiency parameter \(\gamma _i\) for which the above equation vanishes, i.e., \(\frac{\partial \pi ^i_z}{\partial p_i}({\hat{w}},{\hat{p}})=0\) holds. This critical value is henceforth denoted by \({\hat{\gamma }}_i\). Solving the last equation for \({\hat{\gamma }}_i\) and then dividing both sides by the pre-merger output price \({\hat{p}}_i\), we obtain

The expression on the left-hand side of Eq. (10) states the required gains in cost efficiency for downstream division i as percentage of the pre-merger equilibrium price of i’s product. The ratio on the right-hand side defines our gross upward pricing pressure index for output price \(p_i\): \(\texttt {iGUPPI} _\mathtt{d}^i\). It relates the additional profits that accrue to merging partner j to the value of the lost sales of downstream division i that are due to an increase in price \(p_i\).

In order to put the upward pricing pressure index \(\texttt {iGUPPI} _\mathtt{d}^i\) in terms of the economic concepts that were presented in the previous section, both the numerator and the denominator of the above fraction are divided by \(-\frac{\partial D_i}{\partial p_i}({\hat{p}})\). Carrying out this mathematical operation, we obtain formula

where j denotes the merging partner of firm i and \(S^j_m:=S^j_m({\hat{w}}_m)\) denotes manufacturer m’s production coefficient with regard to the input that is offered by supplier j at pre-merger equilibrium input prices \({\hat{w}}_m\).Footnote 18

The numerator of \(\texttt {iGUPPI} _\mathtt{d}^i\) decomposes the total effect of an increase in price \(p_i\) on the profit of merging partner j into two effects. Its first summand describes the effect on the profit that is earned by the downstream division of merging partner j. Since the product of downstream division j is a substitute for the product that is offered by downstream division i, the sales of j’s product increases as the price of i’s product goes up.

Its second summand is the effect on the profit that is earned by the upstream division of merging partner j. If the downstream division of merging partner i raises the price of its product, then some of its customers might switch to the products that are offered by the non-integrated manufacturers. These additional sales of the non-integrated manufacturers in turn trigger increased sales of the inputs offered by the upstream division of merging partner j.

Our assumptions as to the demand functions and the no-cross-subsidization assumption (2) imply that the two effects that are described in the numerator of \(\texttt {iGUPPI} _\mathtt{d}^i\) are positive so that merging partner j unambiguously profits from the merger. Moreover, the denominator—which measures the value of the lost sales of merging partner i—is also positive. Consequently, our index \(\texttt {iGUPPI} _\mathtt{d}^i\) is positive, which implies that any merger of vertical integrated firms induces an upward pressure on the prices that are set by their downstream divisions.

Interestingly, our upward pricing pressure index for output price \(p_i\) is the sum of two well-known upward pricing pressure indices: The ratio \(({{ DR}}_{ij} {\hat{p}}_j M_j)/ {\hat{p}}_i\) is the gross upward pricing pressure index for horizontal mergers \(\texttt {GUPPI} _i\) as derived by Salop and Moresi (2009). It summarizes the upward pricing pressure that results from the merger of the downstream divisions of the firms 1 and 2. The ratio \((\sum _{m \in M^n} { DR}_{im} S_m^j {\hat{w}}_m^j M_m^j) / {\hat{p}}_i\) is the gross upward pricing pressure index for vertical mergers \(\texttt {vGUPPI} ^{i}_\mathtt{d}\) with respect to output price \(p_i\) as suggested by Moresi and Salop (2013) in their Equation (A14).Footnote 19 It summarizes the upward pressure resulting from the merger between the downstream division of i and the upstream division of j on this price.

We conclude from the composition of our \(\texttt {iGUPPI} _\mathtt{d}\) that if either the \(\texttt {GUPPI}\) concept of Salop and Moresi (2009) or the \(\texttt {vGUPPI} _\mathtt{d}\) concept of Moresi and Salop (2013) is alone applied to evaluate the merger of two vertically integrated firms, then the upward pressure on the output prices is underestimated.

7 Specification of \({\mathtt{iGUPPI^u}}\) and \({\mathtt{iGUPPI_r}}\)

In this section, we specify two further kinds of upward pricing pressure indices: First, we construct indices that measure the upward pressure that is induced by the merger on the input prices that are charged by the upstream divisions of the merged firm. After that, we design indices that measure the upward pressure on the output prices that are set by the downstream rivals of the merged firm. The construction of the latter indices follows the methodology in Moresi and Salop (2013). It relies on the former indices and uses linear approximations.

To specify the upward pricing pressure index for the input that is offered by the upstream division of merging partner i to non-integrated manufacturer k, we take for granted that manufacturer k has employed this input pre-merger; in symbols, \(S^i_k({\hat{w}}_k)>0\). If this inequality is not satisfied, no upward pricing pressure on the input occurs.

Analogous to Sect. 6, we proceed as suggested by Farrell and Shapiro (2010): We assume that the merger generates a reduction in the marginal costs of i’s production for manufacturer k in the amount of \(\gamma ^i_k\). Given such gains in cost efficiency, the profit function of the merged firm takes the form of

where j denotes the other merging partner. Superscript k of the above profit function points to our assumption that the merger brings about efficiency gains only with regard to the production of the inputs that supplier i offers to manufacturer k.

To capture the effect of an increase in input price \(w_k^{i}\) on the profit of the merged firm, we resort to the pre-merger equilibrium price strategies that were specified in the previous section. Plugging these price strategies into the profit function of the merged firm gives the indirect profit function \({\hat{\pi }}^k_{z}(w) := \pi ^k_{z}(w,{\hat{p}}(w))\). Partially differentiating this function with respect to input price \(w^{i}_{k}\) at the pre-merger equilibrium \(({\hat{w}},{\hat{p}})\), we obtain the initial effect of an increase in input price \(w^i_k\) on the profit of the merged firm. By taking into account the first-order conditions (8) and (9) as well as \({\hat{p}}={\hat{p}}({\hat{w}})\), this partial derivative is equal to

We seek the magnitude of the efficiency gain \(\gamma ^i_k\) that is needed to compensate the incentive of the upstream division i to increase its input price to manufacturer k. In mathematical terms, we have to specify the size of the efficiency gain \(\gamma ^i_k\) that implies \(\frac{\partial {\hat{\pi }}^k_{z}}{\partial w^i_k}({\hat{w}})=0\). The required efficiency gain is henceforth denoted by \({\hat{\gamma }}^i_k\). Solving the last equation for \({\hat{\gamma }}^i_k\) and then dividing both sides by the pre-merger input price \({\hat{w}}^{i}_k\) yields

The expression on the left-hand side of Eq. (12) states the required gains in cost efficiency as percentage of the pre-merger equilibrium input price that is paid by manufacturer k to upstream division i. The term on the right-hand side defines our gross upward pricing pressure index for input price \(w^{i}_k\)—\(\texttt {iGUPPI} ^\mathtt{u}_{i,k}\). This ratio relates the additional profits that are earned by merging partner j to the value of the lost sales of merging partner i that are due to an increase in input price \(w^{i}_k\).

In order to put the upward pricing pressure index \(\texttt {iGUPPI} ^\mathtt{u}_{i,k}\) in terms of the economic concepts that were presented in Sect. 5, we divide both the numerator and the denominator of Eq. (12) by \(-\frac{\partial D_k}{\partial p_k}({\hat{p}}) \frac{\partial {\hat{p}}_k}{\partial w_k^i}({\hat{w}})\) and apply the mark-up rule (7). As a result of this mathematical manipulation, we obtain index formula

where j denotes the merging partner of i and \(S^i_m:=S^i_m({\hat{w}}_m)\) denotes manufacturer m’s production coefficient with respect to the input that is offered by supplier i at pre-merger equilibrium input prices \({\hat{w}}_m\).Footnote 20

The numerator of \(\texttt {iGUPPI} ^\mathtt{u}_{i,k}\) decomposes the total impact of the increase in input price \(w^{i}_k\) on the profit of the merging partner j into three effects:

-

(i)

The effect on the profit that is earned by the downstream division of merging partner j;

-

(ii)

The effect on the profit that is earned by the upstream division of merging partner j from the business relationship with non-integrated manufacturer k; and

-

(iii)

The effect on the profit that is earned by the upstream division of merging partner j from the business relationship with non-integrated manufacturers that are different from k.

Effect (i) is captured by the first summand of the numerator. As was argued in Sect. 4, an increase in input price \(w^i_k\) affects the prices of the products that are supplied by the downstream division of merging partner i and by non-integrated manufacturer k. Since both products are imperfect substitutes for the product that is offered by the downstream division of merging partner j, the demand for this product might change. Indeed, our assumptions (3) and (5) imply that the increase in input price \(w^i_k\) induces an increase in the demand for product j. Consequently, the profit of the downstream division of merging partner j increases.

Effect (ii) is described by the second summand of the numerator. This effect can in turn be decomposed into two effects: an output substitution effect, and an input substitution effect.

The output substitution effect is captured by term \(-(1+\tau ^{i}_{k})S^j_k{\hat{w}}^j_kM^j_k\). It refers to the impact of an increase in input price \(w^i_k\) on the demand for the product that is offered by non-integrated manufacturer k. As noted above, an increase in input price \(w^i_k\) affects the prices of the products that are supplied by the downstream division of merging partner i and by non-integrated manufacturer k. The demand for manufacturer k’s product is therefore subject to both an own-price effect and a cross-price effect.

Our assumptions (3) and (4) imply that the own-price effect exceeds the cross-price effect so that the demand for manufacturer k’s product falls. This, in turn, might cause a drop in the demand of manufacturer k for the input that is supplied by the upstream division of merging partner j. Hence, the output substitution that is triggered by an increase in input price \(w^i_k\) might negatively affect the profit of this division.

The input substitution effect is captured by the term \(-\frac{M_k \sigma _k^{ij}}{\eta ^{i}_k} S^j_k{\hat{w}}^j_kM^j_k\) and works as follows: Due to the increase in input price \(w^i_k\), non-integrated manufacturer k is prompted to revise its production process. It might partly substitute inputs from other suppliers for the input that is offered by the upstream division of merging partner i. In particular, it might partially replace this input with the input offered by the upstream division of the other merging partner j. Consequently, a positive effect on the profit of this division might result from this substitution of inputs.

The output substitution effect and the input substitution effect act against each other. While the former negatively influences the profits of merging partner j, the latter has a positive impact on j’s profits. For this reason, the sign of effect (ii) is not determinable a priori.

Effect (iii) is captured by the third summand of the numerator. As mentioned above, an increase in input price \(w^i_k\) affects the prices of the products that are supplied by the downstream division of merging partner i and by non-integrated manufacturer k. These products are assumed to be imperfect substitutes for the products offered by the other non-integrated manufacturers \(m \ne k\). The demand for the products offered by those manufacturers is thus affected by an increase in input price \(w^i_k\).

Indeed, our premises (3) and (5) imply that the demand for their products goes up due to an increase in input price \(w^i_k\). This boost in their sales, in turn, might trigger an increase in their demand for the input that is supplied by the upstream division of merging partner j. In consequence, the profit that is earned by this upstream division from its business relationships with non-integrated manufacturers \(m \ne k\) might be positively influenced by an increase in input price \(w^i_k\).

The denominator of \(\texttt {iGUPPI} ^\mathtt{u}_{i,k}\) summarizes the total impact of the increase in price \(w^i_k\) on the revenues that the upstream division of merging partner i earns from sales to non-integrated manufacturer k. Again, this impact can be decomposed into two effects: an output substitution effect, and an input substitution effect.

The first effect is captured by term \((1+\tau ^{i}_{k})S^i_k{\hat{w}}^i_k\). It refers to the impact of an increase in input price \(w^i_k\) on the demand for the product that is offered by non-integrated manufacturer k. Recall that an increase in input price \(w^i_k\) alters the prices of the products that are offered by the downstream division of merging partner i and by non-integrated manufacturer k. The demand for manufacturer k’s product is thus affected by a change in its own price and a change in the price of one of its substitutes. Due to our premises (3) and (4), the resulting change in the demand for manufacturer k’s product is negative. This, in turn, affects negatively the demand of manufacturer k for the input that is supplied by the upstream division of merging partner i.

The second effect on the revenues that the upstream division of merging partner i earns from sales to non-integrated manufacturer k is captured by term \(\frac{M_k \sigma _k^{i}}{\eta ^{i}_k} S^i_k{\hat{w}}^i_k\). It operates in the following manner: Non-integrated manufacturer k might respond to an increase in input price \(w^i_k\) by adjusting its production process. In particular, it might partially substitute other inputs for the input that is offered by the upstream division of merging partner i. Such input substitution implies that a lower quantity of input i is employed by manufacturer k per unit of output. As a consequence, the substitution effect might reduce the sales of the upstream division of merging partner i to manufacturer k.

We observe that the input substitution effect and the output substitution effect on the revenues that the upstream division of merging partner i earns from the sales to non-integrated manufacturer k go in the same direction. For this reason, it is unambiguous that these revenues decrease due to an increase in input price \(w^i_k\).

Summing up: The sign of the pricing pressure indices \(\texttt {iGUPPI} ^\mathtt{u}\) is indeterminate given the assumptions that we have imposed on our two-stage competition game; consequently, it is not a priori established that the merged firm has an incentive to increase its input prices. This ambiguity results from the output substitution contained in effect (ii). Since an increase of input price \(w^i_k\) leads to a decrease in the demand for product k, the output substitution effect is negative whenever manufacturer k sources inputs from supplier j. The output substitution effect counteracts all of the other effects on the profit of merging partner j: the input substitution effect that is contained in effect (ii), and the two effects (i) and (iii).

The above index formula for the upward pressure on the input prices that are set by the merging firms is quite complex and might be difficult to implement. In the following, we impose additional assumptions with regard to the price reactions of the manufacturers and the substitutability of the inputs so that this formula can be handled more easily.

If we assume that the downstream division of merging partner i does not react to the price change of its upstream division—\(\frac{\partial {\hat{p}}_i}{\partial w^{i}_k}({\hat{w}})=0\) and thus \(\tau ^{i}_{km}=0\) for any manufacturer m that is different from i—, then our index \(\texttt {iGUPPI} ^\mathtt{u}_{i,k}\) is simplified to

The first summand of the above formula exactly corresponds to the \(\texttt {vGUPPI} ^\mathtt{u}_{i,k}\) formula that is derived by Moresi and Salop (2013) in their Equation (5) for the case of input substitution.Footnote 21 It captures the upward pricing pressure that results from the merger of the upstream division of firm i and the downstream division of firm j on the input price \(w^i_k\). Moreover, the sum of the second and third summand is the \(\texttt {GUPPI}\) formula for the merger of two upstream multi-product firms.Footnote 22 It summarizes the upward pricing pressure that results from the merger between the upstream divisions of the firms i and j on input price \(w^i_k\).

In practice, the price transmission ratios \(\tau ^{i}_{km}\) might be difficult to estimate. For this reason, our \(\mathtt{iGUPPI}^\mathtt{u}_{i,k}\) formula might be of less practical value. However, if it is considered very likely that cross pass-through \(\frac{\partial {\hat{p}}_i}{\partial w^i_k}({\hat{w}})\) is non-negative, \(\mathtt{iGUPPI1}^\mathtt{u}_{i,k}\) becomes a “cautious” estimate of \(\mathtt{iGUPPI}^\mathtt{u}_{i,k}\). In order to see this, recall that \(\frac{\partial {\hat{p}}_i}{\partial w^i_k}({\hat{w}}) \ge 0\) implies \(\tau ^{i}_{km} \ge 0\) for any product m that is different from i and k as well as \(\tau ^{i}_k \le 0\). Consequently, \(\mathtt{iGUPPI1}^\mathtt{u}_{i,k} \le \mathtt{iGUPPI}^\mathtt{u}_{i,k}\) results whenever \(\frac{\partial {\hat{p}}_i}{\partial w^i_k}({\hat{w}}) \ge 0\). That is, \(\mathtt{iGUPPI1}^\mathtt{u}_{i,k}\) proves to be a lower bound of \(\mathtt{iGUPPI}^\mathtt{u}_{i,k}\) in this case.

If we additionally assume that there is no input substitution—\(\sigma ^{i}_{k}=0\) and \(\sigma _{k}^{ij} =0\)—, our index \(\texttt {iGUPPI} ^\mathtt{u}_{i,k}\) is further simplified to

Unlike the more general index \(\texttt {iGUPPI1} ^\mathtt{u}_{i,k}\), the sign of the second summand in the numerator of \(\texttt {iGUPPI2} ^\mathtt{u}_{i,k}\) is unambiguously negative. It indicates that the profit that the upstream division of merging partner j earns with its business relationship with manufacturer k decreases whenever the upstream division of merging partner i charges a higher price for the inputs that are employed by manufacturer k.

The downward pricing pressure that is displayed by this summand is caused by the elimination of double marginalization. Before their merger, the vertically integrated firms 1 and 2 charged excessively high input prices to manufacturer k. However, their pre-merger price-setting was harmful for both firms since each of them did no take into account that any increase in the price of the input that is offered to manufacturer k reduces the sales of the complementary input that is offered by the other firm. This negative pecuniary externality is internalized by the merger. The merging firms are thus incentivized to decrease the prices of the inputs that are offered to manufacturer k.

In Sect. 6, we constructed upward pricing pressure indices for the products that are offered by the downstream divisions of the merging firms. However, in order to obtain a comprehensive picture of the upward pricing pressure that is induced by the merger in the downstream market, it is also necessary to examine the upward pressure on the output prices that are set by the downstream rivals of the merging firms. For this purpose, we next put forward pricing pressure indices for the products that are offered by these manufacturers. The construction of these indices resembles that of indices \(\mathtt{vGUPPI}_\mathtt{r}\) by Moresi and Salop (2013) and is based on our upward pricing pressure indices \(\mathtt{iGUPPI}^\mathtt{u}\).Footnote 23

Consider a non-integrated manufacturer k that sources inputs from at least one of the merging firms. Due to their merger, the vertically integrated firms 1 and 2 might be prompted to change the prices of the inputs that are offered to rival k. Our index \(\mathtt{iGUPPI}^k_\mathtt{r}\) measures the pricing pressure on manufacturer k’s product that results from these merger-related input price changes. In line with the approach of Farrell and Shapiro (2010), we keep fixed the other input prices in the derivation of this index. Like our indices \(\mathtt{iGUPPI}^\mathtt{u}\) and \(\mathtt{iGUPPI}_\mathtt{d}\), it quantifies the pricing pressure in terms of a compensating relative marginal cost decrease.

As was detailed above, the merger provides an incentive for each merging partner \(i \in \{1,2\}\) to increase the price of the input that is offered to non-integrated manufacturer k since the lost sales due to this price increase are partially recaptured by the other merging partner. This incentive is measured by our index \(\mathtt{iGUPPI}^\mathtt{u}_{i,k}\). It indicates the reduction in the marginal costs (relative to the pre-merger input price) that is needed to offset the merging firm i’s incentive to raise the price of the input that is used by manufacturer k. Equivalently, the merger creates an incentive for merging firm i to increase the price of this input as if firm i undergoes an increase in the marginal costs of producing this input by \({\hat{w}}^i_k \cdot \mathtt{iGUPPI}^\mathtt{u}_{i,k}\).

Similar to Moresi and Salop (2013), we apply the technique of linear approximation to estimate how this pressure on the input prices is passed through to manufacturer k. The starting point of our derivation is the pre-merger cost structure \({\hat{c}}\) where merging partner i is undergoing an increase in the marginal cost of producing the input for manufacturer k by \(\Delta c^i_k:={\hat{w}}^i_k \cdot \mathtt{iGUPPI}^\mathtt{u}_{i,k}\).

To estimate the effect of this increase in marginal cost on input price \(w^i_k\), we linearize the input price function \(w^i_k(\cdot )\) around pre-merger cost structure \({\hat{c}}\). Based on this linear approximation, it is predicted that the price of the input that is offered by merging firm i to manufacturer k increases by the amount of

due to the merger.Footnote 24

Consider now non-integrated manufacturer k. Its marginal cost function is given by

Due to the merger, the prices of the inputs that are offered by the merging firms 1 and 2 to manufacturer k increases by \(\Delta w^1_k\) and \(\Delta w^2_k\), respectively. To estimate the effect of these changes in the input prices on the marginal production cost of manufacturer k, we again apply the technique of linear approximation. By linearizing around pre-merger input prices \({\hat{w}}_k\), we obtain

Hence, we predict that the marginal cost of producing output k increases by amount \(\Delta c_k\) due to the merger between the vertically integrated firms 1 and 2.

Our upward pricing pressure index \(\mathtt{iGUPPI}^{k}_\mathtt{r}\) for the product of manufacturer k is defined as the ratio of the change in the marginal cost of producing output k due to the merger to the pre-merger price of output k. Dividing \(\Delta c_k\) by \({\hat{p}}_k\) yields

where \(S^s_k:=S^s_k({\hat{w}}_k)\) denotes manufacturer k’s production coefficient with respect to the input that is delivered from supplier s at pre-merger equilibrium input prices \({\hat{w}}_k\). Our index \(\mathtt{iGUPPI}^k_\mathtt{r}\) is a weighted sum of the indices \(\mathtt{iGUPPI}^\mathtt{u}_{1,k}\) and \(\mathtt{iGUPPI}^\mathtt{u}_{2,k}\). By our premise (1), the index is positive if there is gross upward pricing pressure on the two inputs that are offered by the merging firms to manufacturer k.

If one additionally assumes that the downstream divisions of the merging firms do not react to the changes in the input prices that are set by their upstream divisions—\(\tau ^{i}_{km}=0\) for any \(m \in M \setminus \{i\}\) and any \(i \in \{1,2\}\)—and that manufacturer k produces with a fixed input ratio—\(\sigma ^{is}_k=0\) for any \(s \in S\) and any \(i \in \{1,2\}\)—, this index reduces toFootnote 25

Given these assumptions, the rate with which the merger-induced pricing pressure on the input that is offered by merging partner i to manufacturer k impacts the production costs of manufacturer k corresponds to \({\hat{w}}^i_k S^i_k/c_k({\hat{w}}_k)\): the share of the pre-merger costs per unit of product k that is attributed to input i.

8 Conclusion

This paper has extended the pricing pressure methodology to the case of a merger between two vertically integrated firms. Such mergers have been recently observed especially in the telecommunication sector, e.g., the Telefónica Deutschland/E-Plus merger in 2014. To the author’s best knowledge this paper is the first one that derives gross upward pricing pressure indices for this important type of merger.

Our upward pricing pressure indices \(\texttt {iGUPPI}\) quantify the intensity of the incentive that the vertically integrated firms have after their merger to increase the prices of their products. We identify two forces that underlie the upward pricing pressure: a horizontal pricing pressure, and a vertical pricing pressure. If a division of a merging partner increases the price of its product, then the losses that are induced by this price increase are partly recaptured by the divisions of the other merging partner. While the horizontal pricing pressure results from the recapture by the other merging partner’s corresponding division, the vertical pricing pressure results from the recapture by the other merging partner’s lower-level or upper-level division.

Interestingly, our upward pricing pressure indices \(\texttt {iGUPPI} _\mathtt{d}\) for the outputs that are offered by the downstream divisions of the merging firms are the sum of the \(\texttt {GUPPI}\) of Salop and Moresi (2009) and the \(\texttt {vGUPPI} _\mathtt{d}\) of Moresi and Salop (2013). The first measure describes the horizontal upward pressure, while the second measure describes the vertical upward pressure on the output price. An important conclusion of this decomposition is that whenever a merger of vertically integrated firms is scrutinized only by either the \(\texttt {GUPPI}\) concept or the \(\texttt {vGUPPI} _\mathtt{d}\) concept, the upward pressure on the output prices would be underestimated.

Unlike \(\texttt {iGUPPI} _\mathtt{d}\), our upward pricing pressure indices \(\texttt {iGUPPI} ^\mathtt{u}\) for the input prices are not decomposable in such a simple way a priori. In this case, it is justifiable to say that the whole is greater than the sum of its parts. The reason is that an increase in an input price brings about two price reactions in the downstream market: a price reaction by the non-integrated manufacturer whose input has become more costly, and a price reaction by the downstream division of the merging partner whose upstream division has increased the input price. The latter price reaction is incorporated neither in the \(\texttt {GUPPI}\) concept of Salop and Moresi (2009) nor in the \(\texttt {vGUPPI} ^\mathtt{u}\) concept of Moresi and Salop (2013).

While the signs of our indices \(\texttt {iGUPPI} _\mathtt{d}\) for the output prices are definitely positive, the signs of our indices \(\texttt {iGUPPI} ^\mathtt{u}\) for the input prices are ambiguous. This ambiguity is due to the possibility that some manufacturers employ their inputs in a complementary way. In the situation pre-merger, such production processes give rise to the problem of double marginalization. The competing upstream divisions of the vertically integrated firms charge excessively high input prices, which is unfavorable for both of them. A merger eliminates this problem, which creates a downward pressure on the input prices. In some instances, this downward pricing pressure might outweigh the opposite pricing pressures that are induced by the merger.

An interesting question that we leave for future research is to find out how robust our upward pricing pressure indices are with respect to the assumptions that we have imposed on our competition model. For example, one might examine how changes in the information structure or in the timing of the price-setting alter our index formulas. In this context, one could also abandon our assumption that the downstream division of a vertically integrated firm sources all inputs from its upstream division.

Another controversial assumption of our model is that the pricing of the firms is linear. In real life, non-linear contracts such as two-part tariffs are often in place between vertically integrated firms and their non-integrated downstream competitors. Therefore, it might be a worthwhile project to construct upward pricing pressure indices also for such kinds of contracts.

A further issue that future research might tackle is how our indices are related to the prices that prevail post-merger. Shapiro (1996) addressed this issue for the case of horizontal mergers. It turns out that the merged firm increases each of its prices by factor \(\frac{1}{2(1-D)}\texttt {GUPPI}\) whenever the merging partners i and j are confronted with the same market conditions: the same constant marginal costs and linear demand functions so that the diversion ratios \(D:=DR_{ij}=DR_{ji}\) between them are equal.Footnote 26 It might be interesting to find out whether there exists an analogous relationship between the values of our \(\texttt {iGUPPI}\) and the size of the price changes that are induced by a merger of vertically integrated firms.

With regard to the latter issue, one could refer to the results of Asphjell et al. (2017) and Bergh et al. (2019), who study the price effects that are caused by horizontal mergers with vertical relations in a market with linear demand functions.Footnote 27 It is an open question as to how their predicted price effects are related to our \(\texttt {iGUPPI}\).

Change history

09 July 2021

A Correction to this paper has been published: https://doi.org/10.1007/s11151-021-09817-y

Notes

The derivation of the \(\texttt {GUPPI}\) from the profit maximization problem of the merged firm is detailed e.g. in Baltzopoulos et al. (2015), Moresi (2010) and Willig (2011). In the academic literature, Sørgard (2012) uses the index to gauge the price effects of an acquisition in the Norwegian grocery market, while Baltzopoulos et al. (2015) apply it to several merger cases in Sweden.

For example, Moresi (2010) extends the upward pricing pressure methodology to situations where firms are engaged in Cournot or bidding competition. The modifications of the standard \(\texttt {GUPPI}\), which are elaborated by Willig (2011), are aimed at screening cases where horizontal mergers cause quality changes in the products or where there are partial acquisitions. The adjusted gross upward pricing pressure index of Neurohr (2016) is implementable for situations where the merging firms are confronted with capacity constraints or kinked demand curves. Affeldt et al. (2013) derive gross upward pricing pressure indices for mergers of platforms. The \(\texttt {vGUPPI}\) concept of Moresi and Salop (2013) is applicable for vertical mergers.

Tyagi (2018) provides a detailed survey about recent mergers of MNOs in European telecommunication markets.

See for example EU merger case no COMP/M.7018-Telefónica Deutschland/E-Plus, available at http://ec.europa.eu/competition/mergers/cases/additional_data/m7018_5501_3.pdf. For a discussion of the competitive effects of this merger, see Maier-Rigaud and Schwalbe (2015).

Following standard notation, we denote the cardinality of a set X by |X|.

This assumption can be motivated as follows: Non-integrated manufacturers might shop around among the suppliers and receive price quotes from them. However, since the quotes might be fictitious, these manufacturers can truly know only the actual prices that they are finally charged by the suppliers and thus can only speculate about the prices that the other non-integrated manufacturers are charged for the inputs. I would like to thank the reviewer from whom I have learned this argument.

Notice that if \(i \in I\), then vector \((c^i,c_i)\) summarizes the marginal costs of the input that is produced by the upstream division of vertically integrated firm i. As defined above, \(c^i:=(c^i_m)_{m \in M^n}\) lists the marginal costs of this input if it is delivered to the non-integrated manufacturers and \(c_i\) denotes the marginal cost of this input if it is delivered to i’s downstream division.

See also Proposition 5.C.2 (viii) in Mas-Colell et al. (1995).

See also Proposition 5.C.2 (vii) in Mas-Colell et al. (1995).

Notice that a full-fledged Bertrand competition model would be required in order to derive these properties of the pre-merger situation instead of simply assuming them. However, we here abstain from this issue because such game-theoretic exercise is beyond the objective of this paper. We note only that our assumptions can be derived from a Bertrand competition model in which (i) the manufacturers are faced with linear and Slutsky symmetric demand functions so that the aggregate diversion ratios are less than one; (ii) the manufacturers produce with fixed input ratios; and (iii) the firms have static beliefs: They believe—even at information sets that are off the equilibrium path—that the competitors charge their equilibrium prices.

Without any loss of precision, we can write the equilibrium price strategies of the manufacturers as functions of input price vector w even if the output price of any non-integrated manufacturers k is unaffected by \(w_{-k}\) and that of the downstream subsidiary of any vertically integrated firm s is unaffected by \(w^{-s}\).

We remark that this property might be violated in two-sided markets: In this case it might be profitable for firms to subsidize one side of consumers due to the indirect network effects. This finding is detailed in the analysis of Rochet and Tirole (2003). Upward pricing pressure indices for mergers in two-sided markets are derived in Affeldt et al. (2013). Cosnita-Langlais et al. (2018) modify these indices to incorporate feedback effects.

If one alternatively assumes \({\partial {\hat{p}}_i}/{\partial w^i_k}({\hat{w}}) \ge 0\), condition (5) follows immediately.

Indeed, the pre-merger prices also satisfy the first-order conditions that result from the profit maximization of the non-integrated suppliers \(s \in S^n\). However, because these conditions are irrelevant to the derivation of our upward pricing pressure indices, we have skipped them without any concerns.

A comprehensive introduction to the various construction approaches for upward pricing pressure indices is provided in Baltzopoulos et al. (2015). They particularly discuss the difference between the two-sided efficiency approach of Werden (1996) and the one-sided efficiency approach of Farrell and Shapiro (2010). As sketched above, the construction of our upward pricing pressure indices follows the latter approach.

By trivial manipulations, the diversion ratio can be rephrased as \(DR_{km}=-(\epsilon _{km}/\epsilon _k)(D_m({\hat{p}})/{D_k({\hat{p}})})\) where \(\epsilon _{km}:= - ({\partial D_m}/{\partial p_k}({\hat{p}}))\,{{\hat{p}}_k}/{D_m({\hat{p}})}\) denotes the cross-price elasticity of the demand for product m with respect to the price of product \(k \ne m\).

By suitable algebraic manipulations, the price transmission ratio can be rephrased as a product of a ratio of price elasticities and a ratio of cost pass-through elasticities. Indeed, we obtain \(\tau ^{i}_{km}=(\epsilon _{im}/{\epsilon _{km}})({\eta ^{i}_{ki}}/{\eta ^{i}_{k}})\) where \(\eta ^{i}_{ki}:={\partial {\hat{p}}_i}/{\partial w^i_k}({\hat{w}})\,{{\hat{w}}^i_k}/{{\hat{p}}_i}\) is the cross-cost pass-through elasticity of the price of the product that is offered by firm i’s downstream division with respect to the price of the input that is offered by firm i’s upstream division to non-integrated manufacturer k.

The above algebraic manipulation has rescaled the reference point of our interpretation of the numerator and the denominator. The right-hand side of Eq. (10) indicates the additional profits and the value of the lost sales due to an increase of output price \(p_i\) by one monetary unit. In contrast, Definition (11) measures the additional profits and the value of lost sales that are due to an increase of output price \(p_i\) by an amount that causes a loss of sales for downstream division i by one physical unit.

Indeed, this index has been termed \(\texttt {GUPPI}\) by Moresi and Salop (2013). To be in line with our notation, we denote the index by \(\texttt {vGUPPId1} _\mathtt{d}\).

Similar to the algebraic manipulation that leads from Eq. (10) to Definition (11), the above manipulation has rescaled the reference point of our interpretation of the numerator and the denominator. In Eq. (12), the numerator indicates the additional profits of merging partner j and the denominator indicates the value of the lost sales of merging partner i that is due to an increase in input price \(w^i_k\) by one monetary unit. In Definition (13), however, the numerator captures the additional profits of merging partner j and the denominator captures the value of the lost sales of merging partner i that is due to an increase in input price \(w^i_k\) by an amount so that the direct price channel induces a decrease in the demand for product k by one physical unit.

Indeed, Moresi and Salop (2013) denote these indices by \(\texttt {vGUPPIu}\).

This variant of index \(\texttt {GUPPI}\) is derived in the standard way. It measures the upward pressure that is induced by a merger of two non-integrated suppliers on the prices of the inputs that they offer to the manufacturers. Because such a supplier s does not operate in the downstream market, its profit function is given by \(\pi _s(w,p) =\sum _{m \in M^n}(w_m^s-{\hat{c}}^s_m)S_m^s(w_m)D_m(p)\).

Indeed, Moresi and Salop (2013) denote the upward pricing pressure indices on the prices that are set by the downstream rivals of the merging firms by \(\mathtt{vGUPPIr}\).

Notice that this prediction is based on the pre-merger pass-through \(\partial w^i_k/\partial c^i_k({\hat{c}})\). This assumption might be problematic if the input price function \(w(\cdot )\) is substantially modified by the merger. The issue whether it is permissible to use pre-merger pass-throughs for predicting merger-related price changes is discussed in Jaffe and Weyl (2013). One finding of their paper is that whenever the price changes that are predicted by linear approximations with the proper pass-throughs (Jaffe and Weyl (2013) call them the merger pass-throughs) are close to the actual price changes, the pre-merger pass-throughs are also close to the proper pass-throughs.

Moreover, as can be easily checked, if one additionally assumes that manufacturer k exclusively sources its inputs from merging firm i, then index \(\mathtt{iGUPPI2}^{k}_\mathtt{r}\) turns into index \(\mathtt{vGUPPI}_\mathtt{r}\) as is stated in Equation (2) of Moresi and Salop (2013).