Abstract

We document how online lenders exploit a flawed, new pricing mechanism in a peer-to-peer lending platform: Prosper.com. Switching from auctions to a posted-price mechanism in December 2010, Prosper assigned loan listings with different estimated loss rates into seven distinctive rating grades and adopted a single price for all listings with the same rating grade. We show that lenders adjusted their investment portfolios towards listings at the low end of the risk spectrum of each Prosper rating grade. We find heterogeneity in the speed of adjustment by lender experience, investment size, and diversification strategies. It took about 16–17 months for an average lender to take full advantage of the “cherry-picking” opportunity under the single-price regime, which is roughly when Prosper switched to a more flexible pricing mechanism.

Similar content being viewed by others

Notes

In contrast, Prosper’s main competitor and the largest peer-to-peer lending platform in the U.S.—Lending Club—adopted a posted-price pricing policy from day one and has since kept this pricing policy.

Lending Club categorizes its loan listings into 7 credit grades (A through G) and further classifies loan listings within each category into five (1–5) subcategories, thus leading to \(7 \times 5 = 35\) (A1–G5) different interest rates.

For example, eBay has tried simple auctions, auctions with buy-it-now (BIN) options, and pure posted prices in various time periods. Figure 1 in Einav et al. (2018) shows the relative popularity of auctions versus posted prices on eBay over time.

Firm learning is the other side of the coin that relates to the consumer learning literature. DellaVigna (2009) provides a comprehensive survey of behavioral anomalies on both the consumer and the firm sides. Ching (2010) investigates consumer learning under a similar situation as ours where the market conditions experienced a sudden change (patent expiration in his case).

Aguirregabiria and Jeon (2019) provide a comprehensive review about how firms learn about demand, costs, or the strategic behavior of other firms in the market. In particular, Hitsch (2006) investigates firms’ dynamic product launch and exit decisions with demand uncertainty. Jeon (2017) estimates firms’ investment decisions with firm learning and demand shocks. Huang et al. (2018) study how firms set prices by learning product demand over time.

eBay even allows NFL ticket sellers on the platform to choose from a menu of four different mechanisms: ascending-like auctions; hybrid auctions with a buy-it-now option; posted prices; and posted prices with an option for buyers to make offers to sellers, who can then engage in bargaining (Waisman 2018).

Backus et al. (2017) find that inexperienced bidders suffer disproportionately more from such behavioral biases as compared with experienced bidders, which agrees with our findings that inexperienced lenders are slower to adjust their investment strategy in response to a platform rule change.

A lender was outbid for a listing if within a predefined period (usually 14 days), the funding requirement was fulfilled by other lenders, all of which accepted a lower interest rate than this lender. It was possible for a lender to be “partially outbid.” For example, if lender A bid for 50% of a loan listing at 8% but lender B bid for 100% at 10% while the borrower’s maximum interest was 15%, then after 14 days (assuming no other lenders bid for the same loan with a rate less than 10%) the loan originated, and each of the two lenders funded 50% of the loan at the rate of 10% as 50% of lender B’s bid was outbid by lender A. In addition, if none of the bidders are outbid or all losing bidders bid at the maximum interest rate that was set by the borrower, the contract interest rate would be the borrower’s maximum interest rate.

The similarity is defined over the delinquency history and default/prepayment tendency of borrowers.

After February 2013, Prosper significantly changed its data accessing policy. All historical bids and investments are hidden and new investment data are no longer available (source: https://web.archive.org/web/20130512072342/http://blog.prosper.com:80/2013/03/30/a-note-from-our-president-aaron-vermut-as-prosper-looks-to-the-future).

The monthly portfolio consists only of investments in loan listings that eventually originated as loans.

The largest lender—not surprisingly, an institutional investor—invested $38.4 million on Prosper during our sample period.

The number of loan projects that a lender funded is roughly the same as the number of bids that the lender made: we consider only bids for listings that eventually originate as loans and that it is of negligible probability that a lender bid for the same listing for multiple times.

Some of the fastest lenders, most likely institutional lenders, use the application program interface (API)—a set of web-based tools Prosper provides for building software—to interact programmatically with Prosper’s loan database and place bids in real time.

We define “Plus loans” as loans with less than the median estimated loss within each Prosper rating, which are less risky given the Prosper rating (see Sect. 4.2).

We will use this definition of “plus” (or “minus”) loans throughout the paper. Our formal empirical tests that are reported in Sect. 5 are based on these definitions.

Specifically, the \({\text {HHI of investment}}_j\) for lender j is defined as: \({\text {HHI of investment}} = \sum _{n=1}^{N_j} \left( {\text {investment in loan }} n/{\text {total investment of lender}} \,j\right) ^2\), where n denotes lender j’s nth loan invested and \(N_j\) is the total number of such loans.

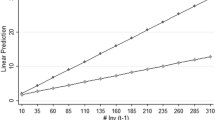

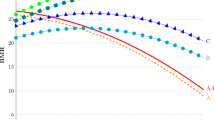

To see this, using the estimates reported in column (4) of Table 4, the marginal effect of time is \(\hat{\beta _1} + 2 \hat{\beta _2} T_t = 0.0105 - 0.00063 T_t\). Setting it equal to zero gives us \(T_t \approx 16.67\). From the estimates in column (8), \(T_t \approx 17.04\). The similarity in these two sets of estimates supports the robustness of our results.

The other characteristics that we consider—the bidding speed (measured by the inverse of time until the first commitment in a funding process), and the frequent-lender status—do not play significant roles in moderating learning patterns.

References

Aguirregabiria, V., & Jeon, J. (2019). Firms’ beliefs and learning: Models, identification, and empirical evidence. Working paper.

Backus, M., Blake, T., Masterov, D., & Tadelis, S. (2017). Expectation, disappointment, and exit: Evidence on reference point formation from an online marketplace. NBER Working Paper No. 23022.

Butler, A. W., Cornaggia, J., & Gurun, U. G. (2016). Do local capital market conditions affect consumers’ borrowing decisions? Management Science, 63(12), 4175–4187.

Camerer, C., & Malmendier, U. (2007). Behavioral economics of organizations. In P. Diamond & H. Vartiainen (Eds.), Behavioral economics and its applications. Princeton: Princeton University Press.

Ching, A. T. (2010). Consumer learning and heterogeneity: Dynamics of demand for prescription drugs after patent expiration. International Journal of Industrial Organization, 28(6), 619–638.

Conley, T. G., & Udry, C. R. (2010). Learning about a new technology: Pineapple in Ghana. American Economic Review, 100(1), 35–69.

DellaVigna, S. (2009). Psychology and economics: Evidence from the field. Journal of Economic Literature, 47(2), 315–72.

Doraszelski, U., Lewis, G., & Pakes, A. (2018). Just starting out: Learning and equilibrium in a new market. American Economic Review, 108(3), 565–615.

Einav, L., Farronato, C., Levin, J., & Sundaresan, N. (2018). Auctions versus posted prices in online markets. Journal of Political Economy, 126(1), 178–215.

Freedman, S. M., & Jin, G. Z. (2018). Learning by doing with asymmetric information: Evidence from Prosper.com. NBER Working Paper No. 16855.

Goldfarb, A., Ho, T.-H., Amaldoss, W., Brown, A. L., Chen, Y., Cui, T. H., et al. (2012). Behavioral models of managerial decision-making. Marketing Letters, 23(2), 405–421.

Goldfarb, A., & Xiao, M. (2011). Who thinks about the competition? Managerial ability and strategic entry in US local telephone markets. American Economic Review, 101(7), 3130–61.

Hammond, R. G. (2010). Comparing revenue from auctions and posted prices. International Journal of Industrial Organization, 28(1), 1–9.

Hammond, R. G. (2013). A structural model of competing sellers: Auctions and posted prices. European Economic Review, 60, 52–68.

Hitsch, G. J. (2006). An empirical model of optimal dynamic product launch and exit under demand uncertainty. Marketing Science, 25(1), 25–50.

Hitsch, G. J., Hortaçsu, A., & Ariely, D. (2010). Matching and sorting in online dating. American Economic Review, 100(1), 130–63.

Huang, Y., Ellickson, P. B., & Lovett, M. J. (2018). Learning to set prices in the Washington State liquor market. Working paper.

Jeon, J. (2017). Learning and investment under demand uncertainty in container shipping. Working paper.

Schmalensee, R., Joskow, P. L., Ellerman, A. D., Montero, J. P., & Bailey, E. M. (1998). An interim evaluation of sulfur dioxide emissions trading. Journal of Economic Perspectives, 12(3), 53–68.

Waisman, C. (2018). Selling mechanisms for perishable goods: An empirical analysis of an online resale market for event tickets. Working paper.

Wang, R. (1993). Auctions versus posted-price selling. American Economic Review, 83(4), 838–851.

Wei, Z., & Lin, M. (2017). Market mechanisms in online peer-to-peer lending. Management Science, 63(12), 4236–4257.

Zhang, J., & Liu, P. (2012). Rational herding in microloan markets. Management Science, 58(5), 892–912.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We deeply appreciate Prof. Victor Tremblay and Prof. Lawrence White’s comments and suggestions on this paper.

Appendix: Alternative Specifications

Appendix: Alternative Specifications

In this appendix, we report the results from several alternative specifications and regression techniques. First, in addition to the quadratic form of the time variable in the main specification, we also estimate the learning model with an alternative functional form of time. Here we report the results obtained using the logarithm of time. Tables 9 and 10 show qualitatively similar results as in the main analysis. In another set of regressions, we run fractional logit regressions and two-sided Tobit regressions. The main coefficients are reported in Tables 11, 12, 13 and 14. Again, the results are not surprisingly consistent with the findings in our main specification.

Rights and permissions

About this article

Cite this article

Liu, X., Wei, Z. & Xiao, M. Platform Mispricing and Lender Learning in Peer-to-Peer Lending. Rev Ind Organ 56, 281–314 (2020). https://doi.org/10.1007/s11151-019-09733-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-019-09733-2