Abstract

In this paper we provide a novel explanation of the relationship between product quality and variety. We develop a simple theoretical model with nearly rational consumers, who randomize among all alternatives that yield the same utility for them but could make a mistake of choosing a slightly worse alternative. We show that it is optimal for a firm to offer more varieties of its higher quality, more profitable, products, in order to price discriminate more effectively. When the market is thin at the very top quality level, the number of varieties first increases and then decreases, which results in the overall hump-shaped relationship between the number of varieties and quality. We find empirical support for our qualitative predictions in the Australian car market.

Similar content being viewed by others

Notes

See Prentice and Yin (2004) for an example and further applications to cars.

If a consumer requests an alteration of a car, for example, pays extra to have a towbar installed, this will not be treated as a separate variety.

Evidence to support this is provided in Sect. A.1 of a separate Online Appendix that is available at https://sites.google.com/site/dprenticeresearch/cv-and-links-to-work/filecabinet.

In the Glass’s data minivans are referred to by the British and Australian term “people movers”.

We draw on their work to argue in Sect. A.2 of the Online Appendix that, under reasonable conditions, one can move freely between these interpretations.

Mattsson and Weibull interpret \(\lambda\) as capturing deliberation costs and representing the relative weight that the decision-maker attaches to the disutility of choosing probability assignment across outcomes other than q.

Note that we are not considering the effects of evaluation costs, as is highlighted in Kuksov and Villas-Boas (2010) who assume that greater variety may prevent consumers from participating in the market. In our model, unlike Villas-Boas (2009), adding a horizontal dimension (varieties) adds depth to the product line without affecting its length. The reason for this, again, is the absence of evaluation costs.

Luce probabilities, as in Eq. (3), satisfy these properties.

Exponentially small in a Luce model.

Note that \(P_{i}<1\) for \(i<N\) and \(P_{N}=1\); therefore, type \(\theta _{N}\) is served efficiently, and the quality consumed by all the other types is downward biased. This observation was first made by Mussa and Rosen (1978).

For \(i=1\) option \(i-1\) is interpreted as the outside option: not buying.

This outcome can be justified as a Bayes-Nash equilibrium.

Basov (2009) shows that the required change in prices in an optimal contract is of the order of \(\lambda \ln \lambda\), which corresponds to the proportion of consumers who make a mistake as being of order \(\lambda .\)

This is the incremental set-up costs of getting a new variety into production. The costs of the production process itself are accounted for in Eq. (10).

It is not optimal to adjust qualities for nearly rational consumers, since that adjustment will disrupt the trade-off between information rent extraction and efficient provision of low types. Therefore, one has to choose between adding new varieties and adjusting prices. Results in Basov (2009) and condition (23) imply that the former is more profitable.

But not too small. See the proof for more details.

The technical reason for this is the failure of lower hemicontinuity of the choice correspondence in the parameter that captures the degree of irrationality \(\lambda\) (see Basov (2009)). This situation is quite general and is not restricted to the Luce model.

Even in this case proliferation will be wasteful as long as \(\lambda<<F_{i}<<\lambda \ln \lambda\) for all i.

Section A.3 of the Online Appendix analyzes two other arguments that we find less convincing.

Section A.4 of the Online Appendix includes further robustness analysis of the dip test and the estimates of the beta densities.

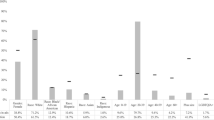

Similar figures for all other makes are reported in the Online Appendix.

But also not too big, so condition (23) still holds.

References

Anderson, S. P., de Palma, A., & Thisse, J.-F. (1992). Discrete choice theory of product differentiation. Cambridge, MA: MIT Press.

Basov, S. (2009). Monopolistic screening with boundedly rational consumers. Economic Record, 85(S1), S29–S34.

Ben-Akiva, M., & Lerman, S. R. (1985). Discrete choice analysis: Theory and application to travel demand. Cambridge, MA: MIT Press.

Berger, J., Draganska, M., & Simonson, I. (2007). The influence of product variety on brand perception and choice. Marketing Science, 26(4), 460–472.

Berry, S., Levinsohn, J., & Pakes, A. (1995). Automobile prices in market equilibrium. Econometrica, 63(4), 841–890.

Champsaur, P., & Rochet, J.-C. (1989). Multiproduct duopolists. Econometrica, 57(3), 533–557.

Cheng, M.-Y., & Hall, P. (1998). Calibrating the excess mass and dip tests of modality. Journal of the Royal Statistical Society, Series B, 60(3), 579–589.

Donnenfeld, S., & White, L. J. (1990). Quality distortion by a discriminating monopolist: Comment. The American Economic Review, 80(4), 941–945.

Draganska, M., & Jain, D. C. (2006). Consumer preferences and product-line pricing strategies: An empirical analysis. Marketing Science, 25(2), 164–174.

Hartigan, J. A., & Hartigan, P. M. (1985). The dip test of unimodality. The Annals of Statistics, 13(1), 70–84.

Henderson, D. J., Parmeter, C. F., & Russell, R. R. (2008). Modes, weighted modes, and calibrated modes: Evidence of clustering using modality tests. Journal of Applied Econometrics, 23(5), 607–638.

Huber, J., & Puto, C. (1983). Market boundaries and product choice: Illustrating attraction and substitution effects. Journal of Consumer Research, 10(1), 31–44.

Kuksov, D., & Villas-Boas, J. M. (2010). When more alternatives lead to less choice. Marketing Science, 29(3), 507–524.

Lancaster, K. (1990). The economics of product variety: A survey. Marketing Science, 9(3), 189–206.

Luce, R. D. (1959). Individual choice behavior: A theoretical analysis. New York: Wiley.

Mattsson, L.-G., & Weibull, J. W. (2002). Probabilistic choice and procedurally bounded rationality. Games and Economic Behavior, 41(1), 61–78.

Mussa, M., & Rosen, S. (1978). Monopoly and product quality. Journal of Economic Theory, 18(2), 301–317.

Neven, D. J., & Thisse, J.-F. (1990). On quality and variety in competition. In J. J. Gabszewicz, J. F. Richard, & L. A. Wolsey (Eds.), Economic decision-making: Games, econometrics, and optimisation: Contributions in honour of Jacques H. Dreze (pp. 175–199). Oxford: North-Holland.

Prentice, D., & Yin, X. (2004). Constructing a quality-adjusted price index for a heterogeneous oligopoly. The Manchester School, 72(4), 423–442.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Srinagesh, P., & Bradburd, R. M. (1989). Quality distortion by a discriminating monopolist. The American Economic Review, 79(1), 96–105.

Stole, L. (1999). Lectures on the theory of contracts. Retrieved April 22, 2019 from https://cpb-us-w2.wpmucdn.com/campuspress.yale.edu/dist/3/352/files/2011/01/lectures.pdf.

Thomadsen, R. (2012). Seeking an expanding competitor: How product line expansion can increase all firms’ profits. Journal of Marketing Research, 49(3), 349–360.

Villas-Boas, J. M. (2009). Product variety and endogenous pricing with evaluation costs. Management Science, 55(8), 1338–1346.

Acknowledgements

We would like to thank the anonymous referees and especially the editor, Lawrence J. White, for their helpful and thorough comments. We would also like to thank Damien Eldridge, Catherine de Fontenay, Tue Gørgens, Phillip Leslie, Phillip McCalman, Lawrence Uren and Tom Wilkening for helpful comments. The first author acknowledges the support of ARC Discovery Grant DP0881381 “Mechanism design under bounded rationality: The optimal contracts in the complex world”. The second author acknowledges the support of the Australian Government Research Training Program Scholarship.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix A

Appendix A

1.1 Appendix A1: Background on the Dataset

Price, characteristics and sales data for cars are compiled for the 17 makes that offer 30 or more varieties in the Australian market. These makes range from the low-price Daewoo and Daihatsu to the premium-priced BMW and Mercedes-Benz. We exclude all varieties with prices of A$200,000 or more, because we believe that such cars are not generally sold as off-the-shelf varieties and, thus, their numbers of varieties are not informative.

The issue with the data that we have is that while price and characteristics are available for each variety of a model, the sales data are available only for the whole model and, in a few cases, only for the groups of models. For example, in the price and characteristics data, a distinction is made between the GMH Commodore and what could be considered as two higher-quality models of the Commodore: the Berlina and Calais; but in the sales data all three models are aggregated as the Commodore.

As a result, in order to perform the tests in Sect. 6.3 we calculate an estimate of sales for each variety, by assuming that all varieties of a model have equal shares of sales. This may underestimate (and is unlikely systematically to overestimate) sales for cheaper varieties within a model and, therefore, will bias against finding support for our model.

1.2 Appendix A2: Proofs for the Two Propositions

Proof of Proposition 1

Using (19), it is straightforward to verify that as \(\varepsilon _{i}\rightarrow +0\) for all i (as marginal cost \(c\rightarrow +0\) ), the number of varieties is given by

where coefficients \(a_{i}\) satisfy the second-order difference equation

subject to the following initial and terminal conditions:

Therefore, the ratio of numbers of varieties in the limit goes to zero:

\(\square\)

Proof of Proposition 2

For \(i>j\), for small marginal cost and small \(p_i\), we have \(\varepsilon _{i}\sim 1\). (Note that if marginal cost is so small such that \(\varepsilon _{i}\) is much smaller than \(k_i\), then Proposition 1 applies.) Given that \(k_i<<1\) and \(\varepsilon _{i}\sim 1\), we can drop the second term on the left-hand side of Eq. (19) and easily verify that \(n_{i+1}<n_{i}\) as long as \(4n_{i}\varepsilon _{i+1}>1\). Since \(n_{i}\ge 1,\) a sufficient condition is \(\varepsilon _{i+1}>1/4\): If the cost of proliferation is not too smallFootnote 25 and there are very few high-type consumers, the number of varieties will eventually fall.

For \(i \le j\), the same type of argument as in Proposition 1 applies; thus, the number of varieties is increasing in quality.

Therefore, this case results in an overall hump-shaped set of varieties. \(\square\)

1.3 Appendix A3: Data Transformation for Estimating the Beta Density Function

To generate the number of varieties at 50 points suitable for estimation of the beta density function, we first construct a kernel estimate of the density for each make using the actual data. Second, we select values of the density function at the Stata default option of 50 points. To ease estimation, we convert these values to integers by multiplying them by 10 million and rounding. This yields numbers of varieties at the 50 points. Descriptive statistics of the new densities reveal they are similar to the descriptive statistics for the original prices.

Rights and permissions

About this article

Cite this article

Basov, S., Danilkina, S. & Prentice, D. When Does Variety Increase with Quality?. Rev Ind Organ 56, 463–487 (2020). https://doi.org/10.1007/s11151-019-09704-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-019-09704-7