Abstract

This paper examines the role of patent policy in a spatial model of sequential innovation. Initial entrepreneurs develop a new product market and anticipate that subsequent innovation may lead to a product line that consumers value more highly. The likelihood of sequential innovation increases with the number of initial early entrants in the market. Patent protection that encourages early entry can therefore raise the probability of both initial and subsequent innovation. We determine the optimal patent breadth as a function of key industry characteristics of both consumer taste and the new technology.

Similar content being viewed by others

Notes

Well-known examples include: (a) Proctor & Gamble’s “Pampers”, which was marketed more than a decade after the first disposable diapers, yet reached a 90 % market share in 4 years; and (b) Microsoft’s Excel, which built on early spreadsheet programs such as Visi-calc and Lotus and developed into the ultimate market winner.

Bessen and Maskin (2009) also note how subsequent innovations build upon the designs of earlier innovations.

Cohen et al. (2000) observe that there are other, non-patent means of protecting intellectual property, and w could reflect these as well. We focus on w as a patent policy measure as that is the most obvious policy intervention.

We are grateful to the Editor for this interpretation of t.

As profit is homogeneous of degree one in density d, we could instead consider sunk costs per capita: \( \hat{f} = f/d. \)

The assumption r ≤ 1 permits monopoly as a possible market outcome under sequential innovation.

We could equivalently treat both r and t as transport costs and assume as above that firms have lower transport costs than consumers. Note that Baumol’s (2010) innovation model also requires discriminatory prices.

As noted, our approach echoes Klemperer (1990). Key differences are that Klemperer’s consumers agree on the most preferred product, while ours have heterogeneous rankings, and Klemperer’s consumers have different costs t while t is identical across our consumers. Our analysis also echoes that in Norbäck and Persson (2012).

We are grateful to an anonymous referee for this suggested interpretation.

We limit consideration to the case in which just one patent-holding startup is bought. This is more tractable and roughly consistent with evidence in Cummings and Macintosh (2003) and Cochrane (2005) that while many firms may enter with an eye toward eventually being acquired, relatively few venture-backed firms actually exit this way.

This treatment loses no generality since n as a continuous variable is either odd or even. See the Appendix for a more complete description of the condition under which F’s jth nearest neighbors will exit.

The upper and lower bounds are clear. Precise solutions for k(α) are complex and often hard to express concisely.

It should be clear that, all else equal, an increase in f will lead to less initial entry.

References

Astebro, T. (2003). The return to independent invention: Evidence of unrealistic optimism, risk-seeking, or skewness loving? The Economic Journal, 113(484), 226–239.

Barringer, B., & Ireland, D. (2012). Entrepreneurship: Successfully launching new ventures (4th ed.). Upper Saddle River, NJ.: Prentice-Hall.

Baumol, W. J. (2010). The microtheory of innovative entrepreneurship. Princeton: Princeton University Press.

Bessen, J., & Maskin, E. (2009). Sequential innovation, patents, and imitation. Rand Journal of Economics, 40(4), 611–635.

Boldrin, M., Allamand, J. C., Levine, D. K., & Ornaghi, C. (2011). Competition and innovation. In J. A. Miron (Ed.), Cato papers on public policy (Vol. 1, pp. 109–272). Washington, DC: Cato Institute.

Boldrin, M., Allamand, J. C., Levine, D. K., Ornaghi, C., & Levine, D. K. (2013). The case against patents. Journal of Economic Perspectives, 27(1), 3–22.

Cochrane, J. (2005). The risk and return of venture capital. Journal of Financial Economics, 75(1), 3–52.

Cohen, W., Nelson, R., & Walsh, J. P. (2000). Protecting their intellectual assets: Appropriability conditions and why U.S. manufacturing firms patent (or not). NBER Working Paper No. 7552.

Cummings, D., & MacIntosh, J. G. (2003). Venture capital exits in Canada and the United States. University of Toronto Law Journal, 53(2), 101–200.

Dunne, T., Roberts, M. J., & Samuelson, L. (1988). Patterns of entry and exit in U.S. manufacturing industries. Rand Journal of Economics, 19(4), 495–515.

Eaton, B. C., & Schmitt, N. (1994). Flexible manufacturing and market structure. American Economic Review, 84(4), 875–888.

Graham, S. J. H., Merges, R., Samuelson, P., & Sichelman, T. (2009). High technology entrepreneurs and the patent system: Results of the 2008 Berkeley patent survey. Berkeley Technology Law Journal, 24(4), 255–327.

Hall, B., & Ziedonis, R. (2001). The patent paradox revisited: An empirical study of patenting in the U.S. semiconductor industry, 1979–95. Rand Journal of Economics, 32(1), 101–128.

Hunt, R. M. (2004). Patentability, industry structure, and innovation. Journal of Industrial Economics, 52(3), 401–425.

Jarmin, R. S., Klimek, S. D., & Miranda, J. (2004). Firm entry and exit in the U.S. retail sector: 1977–1997. Working Paper 04–17, Center for Economic Studies, Bureau of the Census.

Jovanovic, B., & MacDonald, G. (1994). The life cycle of a competitive economy. Journal of Political Economy, 102(2), 322–347.

Klemperer, P. (1990). How broad should the scope of patent protection be? RAND Journal of Economics, 21, 113–130.

Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. Rand Journal of Economics., 31(4), 674–692.

Markides, C. C., & Geroski, P. A. (2005). Fast second: How smart companies bypass radical innovation to enter and dominate new markets. London: Jossey-Bass.

Norbäck, P.-J., & Persson, L. (2012). Entrepreneurial innovations, competition, and competition policy. European Economic Review, 56(3), 488–506.

Nordhaus, W. G. (2004). Schumpeterian profits in the American economy: theory and measurement. National Bureau of Economic Research, Working Paper 10433.

Norman, G., Pepall, L. & Richards, D. (2008). Entrepreneurial first movers, brand-name fast seconds, and the evolution of market structure. The B.E. Journal of Economic Analysis & Policy (Contributions), 8(1), Article 45. http://www.bepress.com/bejeap/vol8/iss1/art45

Norman, G., & Thisse, J.-F. (1999). Technology choice and market structure: Strategic aspects of flexible manufacturing. Journal of Industrial Economics, 47(3), 345–372.

O’Donoghue, T., Scotchmer, S., & Thisse, J.-F. (1998). Patent breadth, patent life, and the pace of technological progress. Journal of Economics and Management Science, 7(1), 1–32.

Pepall, L., & Richards, D. (2002). The simple economics of brand-stretching. Journal of Business, 75(3), 535–552.

Salop, S. (1979). Monopolistic competition with outside goods. Bell Journal of Economics, 10(1), 141–156.

Schnars, S. P. (1994). Managing imitation strategies. New York: The Free Press.

Acknowledgments

This research benefited from a Tilburg Law and Economics Center (TILEC) IIPC grant. We thank Chris Schneider, Dan Spulber, Sheryl Winston Smith, members of the Tilburg Law and Economics Center seminar, two anonymous referees, and the editor of this journal for comments on earlier drafts.

Author information

Authors and Affiliations

Corresponding author

Appendix: Conditions Under Which Early Entrants Near F Exit After F Enters

Appendix: Conditions Under Which Early Entrants Near F Exit After F Enters

Consider Fig. 5 below. For illustrative purposes only and without loss of generality we take the case of n = 8 initial entrants. The results in the text are derived for any value of n ≥ 2. In the figure, Firm F has acquired one of the initial entrants, and we present the market positions of each firm relative to F’s. What is the probability of survival for each of these remaining firms?

Start with firms 1 and −1 and focus on firm 1 as symmetry implies that the necessary condition for F to drive out firm 1 are the same as those needed to induce firm −1 to exit.

To induce firm 1’s exit, F must be able to offer every customer that firm 1 serves a product at a sufficiently low total cost (firm + consumer versioning) such that, given F’s product value advantage, firm 1 cannot profitably win any consumers. We need therefore to identify the consumer for whom F will have the highest total cost in serving. If F can win this consumer, then F can win all of firm 1’s customers. Of course, by symmetry, this means it can also win all of firm −1’s customers, too. Foreseeing this, firms 1 and −1 will exit.

The consumer at s 0 is this critical consumer. To see this consider Fig. 6. In this diagram, we have “flattened” the circle in the region around firms F and 1, and focused on the competition between them.

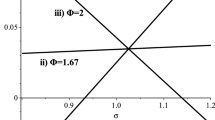

Now, consider the consumer that is s units to the right of firm 1 but still within 1’s patent-protected zone. That zone is indicated by the central triangle in the diagram. F can version a product to either edge of this zone at a cost of r per unit of distance, as is indicated by the upward-sloping line starting at F that is solid until it reaches the near boundary of the zone and then continues as a dashed line to the far boundary.

Now, consider the consumer that is s units to the right of firm 1 but still within 1’s patent-protected zone. That zone is indicated by the central triangle in the diagram. F can version a product to either edge of this zone at a cost of r per unit of distance, as is indicated by the upward-sloping line starting at F that is solid until it reaches the near boundary of the zone and then continues as a dashed line to the far boundary of that zone. The reason for the dashed line is of course that F cannot sell directly within firm 1’s patent-protected “territory”. Instead, consumers within 1’s patent-protected market must incur the higher cost t of traveling (consumer versioning) to one of the two boundaries to which F can legally version its good. Whichever boundary consumer s chooses, the total transport or consumer versioning cost is t times the distance to that point.

Consumer s will choose the boundary that yields the lowest total cost, which is the sum of the cost incurred by F in versioning to that boundary plus the additional transport cost that is incurred by s in further refining the product to s’s location. The rightward boundary saves on consumer transport cost but requires more versioning cost on F’s part. Because this boundary lies [1/n + w/2n ] units away from firm F and [(w/2n) − s] units from s, the total cost that s faces in in this case is: r[(1/n) + (w/2n)] + t[(w/2n) − s].

However, s also has the option of traveling to the leftward boundary. This strategy incurs a lower versioning cost for F because it is only [(1/n) − (w/2n)] from F. However, it incurs a greater transport or versioning cost for the consumer because it lies [(w/2n) + s] units away from the consumer s. This boundary lies w/2n + s units away. Hence, the total cost of s to buy F’s product by traveling to the left is r[(1/n) − (w/2n)] + t[(w/2n) + s]. These expressions correspond exactly to those in Eqs. (6) and (7) when j = 1.

Now, the critical value of s is s = s 0 = rw/2nt. For s = s 0, the total cost to this consumer of buying F’s product is the same whether it travels to the right boundary or the left one. Thus, s 0 is the most expensive of firm 1’s customers for F to serve. If F’s product quality advantage is sufficient that it can capture consumer s 0, then F can capture all of firm 1’s customers because any other customers will live closer to one boundary or the other and therefore have a lower total (firm + customer) versioning cost for F’s good. Of course, if F’s value advantage is sufficiently large that it can win consumer s 0 and therefore take all of firm 1’s customers, F can also capture all of firm −1’s customers by symmetry. Hence, both firms 1 and −1 will exit in the wake of F’s entry if it can capture consumer s 0. This will leave firms 2 and −2 as F’s nearest neighbors. We can then repeat this analysis with j = 2 as the expressions in Eqs. (6) and (7) indicate. If these two firms exit, we go on to j = 3 and so on. Given the distribution of α and hence of F’s value advantage, it is then a somewhat arduous but straightforward task to work out the probability of survival for the n initial entrants.

Because the model is set in product and not literally geographic space, examples of product versioning to the far side of a rival’s patent zone may be difficult to envision. Indeed, even within our model such versioning does not happen in equilibrium as the threat of such versioning and not its actual use is sufficient to induce a neighbor of F to exit.

However, many heuristic examples do exist. For instance, GE began its dominance of the North American CT Scanner market (against 17 incumbents) in the mid-1970s by entering at the 3rd generation stage with a full-body scanner in contrast to the mainly head-image scanners that previously existed and using a fan beam in a continuous rotation that eliminated the need for axis translation. Not all medical practices wanted a full-body scanner; but the superior technology was compelling, and GE quickly gained market share. Off-label drug prescription provides numerous other examples. Antidepressants are often prescribed as both pain medication and sleep aids. Gabapentin that was originally patented as an anti-seizure medicine is now frequently used to treat both bipolar disorder and menopausal hot flashes. Many cancer treatments involve combinations of drugs—only some of which were initially patented to treat the particular cancer type in question.

Rights and permissions

About this article

Cite this article

Norman, G., Pepall, L. & Richards, D. Sequential Product Innovation, Competition and Patent Policy. Rev Ind Organ 48, 289–306 (2016). https://doi.org/10.1007/s11151-015-9484-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-015-9484-x