Abstract

In this paper, we propose the use of an extended well-being approach to assess economic insecurity. Our main purpose is to study its dimension and identify its main drivers in the United States by overcoming the dichotomy between income and wealth. To this end, we approximate an extended well-being measure that includes monetary resources from income and the potential stream from wealth, which can be understood as an emergency reserve to cope with future economic difficulties but could also be a source of financial distress due to fluctuations in asset holdings and prices. We find that economic insecurity levels are larger when considering our extended well-being variable than income alone. Household income and non-liquid assets appear to be the main drivers of economic insecurity, although part of the US population was able to obtain higher returns on non-liquid assets and maintain their income levels.

Similar content being viewed by others

1 Introduction

There is a general feeling that good times are over and economic progress for low and middle classes is almost depleted. Recent trends in globalization, technological advances and changes in work organization have improved the living conditions of some population groups but have also brought to light the fragile situation of the vast majority, who face increasing risk and uncertainty (Hacker, 2019).

It is only in recent years that social and economic researchers have become aware of the importance of economic insecurity, especially in the wake of the Great Recession. Many households suffered negative financial shocks (huge income losses, an increase in unemployment risk and a rise in household debt among other economic distresses), which led to a deterioration of future economic prospects. In other words, people worried more about financial shocks in later periods and the impossibility to overcome their negative consequences, that is, they became more economically insecure (Hacker, 2018). These high levels of insecurity do not seem to have improved much with the recovery of the economic activity but have been maintained due to growing labour precariousness and the transfer of risk from public institutions and corporations to individuals (Hacker, 2019). More recently, the COVID-19 pandemic has led to a larger unpredictability of future states and growing feelings of fear (Clyne and Smith, 2022).

Economic insecurity reveals itself as one of the greatest challenges of modern societies together with poverty and inequality. A larger exposure to economic risks will increase the anxiety that people feel about future financial situation, reducing their quality of life in the present and influencing their economic behaviour. Individuals will be less prone to engage in risk-taking activities and the negative effects of their decisions could also transcend to the macroeconomic level. Among its multiple effects, economic insecurity may impact consumption and housing investment (Benito, 2006); human capital acquisition (Stiglitz et al., 2009); job mobility (McGuinness & Wooden, 2009; Swaen et al., 2002); fertility (Fiori et al., 2013; Mansour, 2018; Modena et al., 2014); physical and mental health (Rohde et al., 2017; Rohde et al., 2016; Smith et al., 2009; Staudigel, 2016; Watson, 2018), and even political participation and voting decisions (Bossert et al., 2023).

In this context, an ideal measure of economic insecurity should capture three fundamental elements: the probability of an unfortunate future event, a negative economic consequence in case this event takes place and the absence of protection to cope with distress (Hacker, 2018). This reference to future economic hazards poses serious difficulties in designing indicators to assess this phenomenon. Even though some attempts have been made, the literature has not yet agreed on a standard method to compute insecurity and further effort is required to understand this phenomenon in order to guide public policy. Thus, if policy makers are able to anticipate households’ future economic risks, they could more effectively design targeted ex-ante interventions to prevent declines in household well-being. This strategy represents an advantage over ex-post action against inequality and poverty when well-being losses have already materialised.

One of the main issues when designing an insecurity indicator is the selection of variables or dimensions. There have been several proposals to assess the exposure to objective economic risk with standard variables traditionally used in the measurement of poverty and inequality, such as income or wealth. The consideration of these variables allows for the comparison of insecurity with other low well-being phenomena in a more homogeneous manner. For instance, Rohde et al. (2014) approximate insecurity as downward income instability, whereas Watson (2018) uses the predicted individual probability of experiencing a large income loss. Conversely, Bossert and D’Ambrosio (2013) believe that wealth is a more adequate variable to assess economic insecurity as it can be understood as an emergency buffer stock: in case an adverse event materialises, current wealth can be turned to an income flow to mitigate the negative consequences of distress. With an integrated approach, Hacker et al. (2010, 2014) measure economic insecurity as the percentage of individuals who experience a large drop in their household income from one year to the next and lack enough liquid financial wealth to cope with that loss.

While income and wealth may be equally valid to measure economic insecurity from a theoretical perspective, empirical analyses reveal that results are highly conditioned to the dimension selected. Using information on changes in household wealth, D’Ambrosio and Rohde (2014) find that US households have more economic security than those in Italy due to a larger accumulation of financial assets. On the contrary, Rohde et al. (2014) find that economic insecurity (measured as downward income instability) is higher in the United States (US) than in the United Kingdom (UK) and Germany when considering post-government incomes. These results evince that the use of a single dimension limits the correct measurement of economic insecurity and cannot fully capture the diverse aspects in which this phenomenon is manifested (Rohde et al. 2017; Romaguera-de-la-Cruz, 2020). On the one hand, income can be used as an indicator of living standards and represents the monetary flow of resources obtained by an individual or household at a given time and which are readily available. Wealth, on the other hand, corresponds to the accumulation of resources over a person’s lifetime and captures the permanent component of well-being: households could transform wealth into a flow of resources if needed (acting as a buffer stock), but it could also be a source of financial distress due to fluctuations in asset holdings and prices. Hence, the consideration of an extended well-being approach brings us closer to assessing economic insecurity to its full extent: it combines the liquidity scope of income with the future realization of wealth, providing the best predictor of all annual consumption possibilities to cope with unfortunate events.

The purpose of this paper is twofold. First, we aim to disentangle the dichotomy between income and wealth when assessing economic insecurity. Therefore, we follow Weisbrod and Hansen (1968) to generate a measure of extended well-being (hereafter EW) by converting current wealth stock into a flow which is added to pre-tax income in a given period. We then approximate economic insecurity as the probability of experiencing short-term losses in this EW and analyse whether the evolution and distribution of this phenomenon in the US over the last two decades are robust to the selection of different variables. Thus, we are able to produce a forward-looking measure of insecurity that reflects the objective risk of individuals within the household and captures the probability of future large decreases in all their available resources. To the best of our knowledge this is the first attempt to assess economic insecurity with an EW measure that combines income and wealth. Secondly, we study the possible drivers of economic insecurity by comparing the evolution of various components of EW for those individuals above and below the average level of insecurity in our period of analysis. To this end, we estimate changes in the probability of owning a given type of asset (composition effect) as well as changes in the value of this EW components (price effect) through fixed effects estimates for each group which allow us to control for unobserved heterogeneity.

Our results show that levels of economic insecurity are not robust to the dimension selected for its calculation. Thus, from 2001 to 2019, the average probability of suffering EW losses in the US was 33%, whereas this percentage reduces to 22% when income is considered and increases to 43% when we take into account only wealth. The lower income-based insecurity for the average US population can be explained by more stable labour market conditions compared to large variations in asset prices, which most likely lead to greater economic insecurity in wealth. Hence, the inclusion of the flow from wealth to household income increases the probability of EW losses compared to the income-based results. Trends in economic insecurity using our EW measure do not reveal significant changes in insecurity during the expansionary period preceding the 2008 financial crisis, while the consequences of the Great Recession led to a general increase in economic insecurity. The turn in the economic cycle after 2011 led to an overall decrease in insecurity until 2019, although the EW measure showed a more volatile evolution. Furthermore, we find that the sharp decline in household incomes and the fall in the flow of non-liquid assets (real estate, business assets, and pension assets) following the Great Recession were the main drivers of the higher probability of well-being losses for part of the US population, while those theoretically less exposed to risk were able to obtain higher returns on non-liquid assets and did not suffer household income losses.

The paper is structured as follows: the next section reviews the preceding literature on economic insecurity indices. Section 3 sets out the methodology of the paper: how to transform income and wealth into a single variable, the calculation of the economic insecurity measures, the econometric strategy chosen to analyse economic insecurity drivers and which data are used for the empirical illustration. Section 4 presents our main results, while Section 5 gathers our main conclusions.

2 Literature review

Despite the interest in the study of economic insecurity and its impact on several well-being dimensions, no general agreement has yet been reached on its definition and calculation. Each article in the literature starts from an ad-hoc definition of insecurity, even though most of them include the following key elements: (1) an exposure to financial distress which could have not yet materialised; (2) future economic losses, and (3) difficulties to mitigate the negative consequences of the unfortunate event (Berloffa and Modena, 2014; D’Ambrosio and Rohde, 2014; Hacker et al., 2010; Osberg, 1998; Osberg & Sharpe, 2005; Rohde et al., 2014; Rohde & Tang, 2018; Romaguera-de-la-Cruz, 2020). Most researchers have focussed on measuring objective economic insecurity aiming to capture the exposure to downside risk. This kind of measures reflect the likelihood of an economic hazard in a near future with negative consequences should the risk materialise, and individuals lack sufficient protection mechanisms (Hacker, 2018; Osberg, 2018). This approach offers many advantages, as the use of objective indicators provides reliable information on individual risks, simplifying the design and implementation of public policies. Moreover, economic insecurity indices can be based on living conditions surveys which are broadly available and regularly produced. Additionally, the use of objective indicators avoids the potential bias and high heterogeneity more frequently associated with subjective measures.

We can find several proposals to measure objective economic insecurity with both unidimensional and integrated approaches. Within the indices based on a single indicator, many researchers use standard variables in welfare analysis. Income is the most used dimension since it is a well-established indicator of living standards and represents the most liquid monetary resource to turn to in the event of financial difficulties or unexpected expenses. Furthermore, data on income is widely available and regularly produced, and there are some harmonised databases which allow for the comparison of well-being phenomena in several countries. Rohde et al. (2014) identify economic insecurity with downward income instability (estimated as descending deviations from the trend in household incomes), while Nichols and Rehm (2014) estimate a measure of income risk as the aggregate income variability across individuals and time. Watson (2018) assesses economic insecurity with a forward-looking approach based on the individual propensity to experience a large income drop from one period to the next. Bossert et al. (2023) estimate insecurity through income streams (as they believe individuals’ prospects are shaped by past variations of resources rather than their levels), while Rohde et al. (2020) measure individual economic insecurity as unforeseeable volatility in future monetary resources using prospect theory.

Conversely, Bossert and D’Ambrosio (2013) approximate economic insecurity with wealth, considering net wealth levels (assets minus liabilities) as an emergency reserve that individuals could convert to income in the event of an adverse financial shock, while past variations in net wealth shape individuals’ economic prospects. Nonetheless, this measure does not consider the entire wealth stock but only private stocks, leaving out most liquid assets as well as public and private entitlements (Cantó et al., 2021; Osberg, 2018).

Both income and wealth have a theoretical basis that justifies their use when measuring economic security. Nevertheless, unidimensional insecurity indices show contradictory results when used in empirical analysis depending on the key variable considered. Regarding measures based on income, Rohde et al. (2014) find that the US is the most insecure country (compared to the UK and Germany) when using post-government income, in the same vein as Nichols and Rehm (2014). When comparing economic insecurity in Germany and the US, Rohde et al. (2020) also point out to the US as the country with the highest levels of exposure to income risk. On the contrary, the wealth-based index of Bossert and D’Ambrosio (2013) reveals lower levels of insecurity in the US when compared to Italy because of greater financial assets’ accumulation but also a larger negative impact of the Great Recession on the former because of the decline in asset prices (D’Ambrosio & Rohde, 2014).

Previous proposals highlight that the use of domain-specific measures to approximate economic insecurity are highly conditioned to the selected variable, as using either income or wealth can capture one undesirable facet of risk but not the phenomenon to its full extent, leading us to opposite conclusions for the same country or population (Rohde et al. 2017; Romaguera-de-la-Cruz, 2020). In this context, Hacker et al. (2010, 2014) come up with an integrated measure (Economic Security Index, ESI) that identifies economic insecurity with the share of individuals at a given society who experience a large income drop (equal or higher to 25%) as long as they lack sufficient liquid financial wealth to deal with economic loss and subtracting medical out-of-pocket expenditure (especially relevant in the US). The existence of precautionary savings offers households an additional protection against economic distress beyond income, leaving those people with low and volatile incomes who lack accessible savings much more exposed to objective risk than those owning some liquid wealth. Despite the advantage of taking into account both income and wealth, the ESI measure only considers wealth as a buffer stock but does not capture variations in wealth as a consequence of asset accumulation, dissaving or changes in their rates of return, which could be an additional source of financial distress beyond income losses. Furthermore, this measure does not include other less liquid assets as housing or real estate and is not able to reflect the individual exposure to risk since the use of retrospective data only enables the researchers to infer the risk of a given subpopulation through actually realised hazards (Hacker et al., 2014). Moreover, voluntary reductions in household income cannot be distinguished from involuntary losses, the latter being the only ones relevant to insecurity (Osberg, 2018).

There have been other efforts to measure economic insecurity with composite indicators and a variety of dimensions (Bucks, 2011; Cantó et al., 2020; Osberg & Sharpe, 2005, 2014; Rohde et al., 2015, 2016; Rohde et al., 2017; Romaguera-de-la-Cruz, 2020). It is true that multidimensional measures of economic insecurity may be useful when trying to capture diverse aspects of the phenomenon. However, the analysis of separate dimensions may lead to inconclusive results while the construction of a synthetic index is not straightforward and implies several normative decisions regarding the selection of indicators, aggregation, and weighting procedures. Moreover, data requirements are highly increased, especially when computing insecurity indices at the individual level.

As far as we know, this is the first paper to assess objective economic insecurity by considering both income and wealth together in a single variable. Even though our approach can be framed into the prospective unidimensional proposals to measure economic insecurity, we benefit from the advantages of an integrated measure that captures all the potential resources that households can draw on in case they suffer a forthcoming economic loss.

3 Methodology

3.1 Construction of an extended well-being measure

We follow the Weisbrod and Hansen (1968) approach to approximate households’ potential resources by combining income and wealth into a single variable through the following formula in a similar manner as Wolff and Zacharias (2009):

where \({Y}_{i}\) represents the level of well-being for household \(i\). \({L}_{i}\) denotes labour income and includes both wages and self-employment income. The net flow of income generated by housing is then added, where \({H}_{i}\) represents the imputed rent to owner-occupied housing and \({M}_{i}\) represents mortgage debt. Moreover, we take into consideration the net income flow from non-liquid assets, \({{NLQ}}_{i}\) (such as other real estate, business assets and pension assets). \({{LQ}}_{i}\) represents the flow from financial assets and the reported values from savings and current accounts, while \({D}_{i}\) is the annuitized value of other debt, and \({P}_{i}\) refers to public transfers. The household well-being level \({Y}_{i}\) is then adjusted for inflation (expressed in 2015 dollars) and equivalised using the OECD-modified scale.

Household current wealth stock needs therefore to be converted into a flow of income so both variables are measured in the same unit of analysis. Thus, one unit of wealth is transformed into one unit of income as follows (Brandolini et al., 2010; Weisbrod & Hansen, 1968):

where \({W}_{{ij}}\) refers to annuitised income of asset \(j\) for household \(i\); \({\rho }_{j}\) is the annual rate of return for asset \(j\) from 1999 until 2019Footnote 1; \({A}_{{ij}}\) is the reported value of asset \(j\) for household \(i\); and \(n\) represents the length of the annuity.Footnote 2 As households do not report the rate of return for each asset type, we use the information from the System of National Accounts (SNA) to be consistent with the macroeconomic trend of wealth and its importance for the household sector (Wolff et al. 2012). The annuity length is approximated as the expected remaining years of life of the oldest person in the household, which is measured by the years of life expectancy regarding age and gender obtained from the National Centre for Health Statistics (NCHS). Furthermore, we modulate this annuity length according to the civil status of individuals: \(n=T\) for unmarried individuals, and \(n={T}_{1}+\left(T-{T}_{1}\right)b\) for those married; where \({T}_{1}\) refers to the remaining years of life for the person who is expected to die first, T are the remaining years of life of the survivor and b is the reduction in the equivalence scale after the death of the first person.

In this paper, we annuitize four asset and debt classes by applying the formula in Eq. (2): real estate other than the main residence, financial assets (stocks and other assets such as life insurance), business assets, and other debt (see Table A1 in the Online Appendix). On the other hand, the value of the main residence is transformed into an annual income stream to approximate the imputed rents of owner-occupied households (Wolff & Zacharias, 2009). We compute the value of imputed rents to show higher well-being of homeowners compared to those who are renting. The main residence can be used as collateral or converted directly into cash, providing more mechanisms to face an unexpected shock. However, owning your main residence could also be a burden when mortgage payments increase dramatically or if the value of the property plummets. Mortgage debt (\({M}_{i}\)) is obtained through the reported value of monthly mortgage payments, which we convert into an annual amount by multiplying by 12. Only for those households that do not report monthly mortgage payments but declare the amount of the outstanding mortgage (approximately 2% of households that have a mortgage debt in each year), we annuitize the value of total mortgage by taking into account the years remaining to repay. We do not annuitize current accounts, cash and savings, and instead we use their reported value directly, as in the event of an economic downturn households would use these first before selling other assets.

This procedure enables us to estimate all potential economic resources that households could use to smooth their consumption, either to save or to face unexpected negative shocks, which leads us to a more precise measurement of economic insecurity. The consideration of income and wealth together may imply that households are more (or less) vulnerable to insecurity than their income level would suggest. Moreover, our approach allows for the variation of wealth over the lifetime of the holder, while we use different rates of return for each type of assets. Therefore, we are able to compute households’ possibilities to smooth out consumption depending on their income level, wealth composition and age, which is crucial for our analysis: those households that may offset a loss in income with annuitized wealth will not be considered economically insecure.

Note that the same wealth level will translate into a larger income flow for older individuals as their expected remaining years of life are lower than those of younger people, resulting in a higher concentration of annuitized wealth. We want to capture that the protection offered by wealth against forthcoming economic distress is greater for senior individuals, who have fewer expected years of life ahead of them and could draw on all their available resources to cope with the negative consequences of an economic hardship. Also, we consider bequests equal to zero as we assume that the wealth component is totally consumed by the end of the expected lifetime. Bequests are not likely to influence much on economic insecurity as, in a context of hard financial difficulties, individuals would resort to all their available resources to overcome distress.

3.2 How do we measure objective economic insecurity?

Economic insecurity is a forward-looking concept, as it involves future economic states. Therefore, analysing short-term well-being drops directly do not enable us to estimate economic insecurity on an individual level: these falls in well-being are the realization of a given economic risk but do not identify the exposure to the risk itself as we are using retrospective data. Therefore, an individual cannot be classified as insecure or secure, and we can only assume that individuals belonging to a specific subpopulation suffer from the average level of insecurity (Hacker et al., 2014).

As we need to anticipate the individuals’ degree of risk in later periods, we chose to calculate economic insecurity as the individual predicted propensity to suffer well-being losses through pooled probit estimations following Watson (2018):

where \({{EI}}_{{it}}\) is a dummy indicator of large short-term well-being reductions, \(\varnothing\) is the cumulative distribution function of the standard normal distribution, \({X}_{{it}-1}\) represents a variety of sociodemographic characteristics of the household head in the previous period and \(t\) are year dummies. We may note that the household is our unit of measure even if the individual is considered as the unit of analysis: to estimate economic insecurity we make use of household data as we believe negative financial shocks are usually smoothed by the pooling of monetary resources of all household members.

To obtain our dependent variable \({{EI}}_{{it}}\), we classify individuals between those who have suffered a sizable well-being loss from one period to the next and those who have not as follows:

where \({{wb}}_{{it}}\) is an equivalised real measure of well-being for individual \(i\) at moment \(t\), \({{wb}}_{{it}-1}\) is that of the preceding period, and \(k\) is the minimum amount of loss in order to consider a reduction in well-being as sizable. We identify this well-being with the EW measure defined in the previous section, although we also consider income and wealth separately as benchmarks.

To define the threshold \(k\) used to determine well-being losses, we rely on the ESI indicator (Hacker et al., 2014), which sets a threshold of 25 percent of household income loss from one period to the next. This threshold represents the three months that the US population could maintain their welfare levels without their current income before experiencing hardship, as suggested by the American National Election Study (Hacker et al., 2013). In this context, we propose a threshold of 15 percent of EW loss to estimate our insecurity index, which is the amount equivalent to 25 percent of annual income in our EW measure. In addition, we apply the same logic to net wealth, setting a threshold of 7 percent.Footnote 3

As explanatory variables, we include several sociodemographic characteristics related to the head of the household in the previous period, as we assume complete pooling of the monetary resources of all members. As demographic variables we include gender, age, race, years of completed education and region of residence. We also include the civil status as well as his/her overall health status to account for two of the main possible causes of future distress: family breakup and illness (Osberg and Sharpe, 2005, 2014). To capture the insecurity stemming from the labour market, we consider the employment status of the household head, whether he/she is self-employed, whether he/she works for the government, and the occupation and industry of his/her main job. Long-term average EW is introduced to capture the permanent socioeconomic status of households. Additionally, we take into account household composition by including the number of household members as well as the number of children. Finally, we introduce yearly dummies to capture the effects of the business cycle.

Once we obtain the association between last period sociodemographic characteristics and realised large well-being losses, we can predict the probability of experiencing these losses in the following period by multiplying the obtained coefficients by the present value of the explanatory variables. This strategy allows us to predict the propensity of economic insecurity in a near future through present characteristics of the household, thus generating a forward-looking insecurity measure which ranges from 0 to 1. Unlike large short-term drops in well-being, this probability enables us to analyse economic insecurity with a prospective approach: we can study which part of insecurity can be predicted due to individual and household characteristics beyond risks already realised. Nonetheless, this method also has some limitations as we are not able to capture unpredictable economic shocks that are independent of household characteristics.

3.3 Sources of economic insecurity

Once we have estimated our economic insecurity index, we apply an econometric strategy to understand the role of each component of our EW measure in shaping this phenomenon. To that extent, we divide the population into two groups: individuals who are more likely to experience short-term well-being losses than the population average for the entire period of analysis (high-risk individuals or HR) and those who are less likely (low-risk individuals or LR).Footnote 4 Then, we examine changes in the values and composition of EW components for these two groups to disentangle the main factors influencing their degree of economic insecurity.

We analyse the changes in the tenure of different sources of well-being as well as the changes in asset values for each group by estimating a series of ordinary least square (OLS) regressions with individual fixed effects (Amuedo-Dorantes & Borra, 2018):

where \({y}_{{it}}\) is the likelihood of owning a given type of well-being component or the logarithm of the value of each EW component for individual \(i\) in year \(t\). The main variable of interest in our analysis is \(\delta t\). When the dependent variable is the likelihood of ownership, \(\delta t\) captures the variation in the holding of each well-being source with respect to 1999 (composition effect).Footnote 5 In contrast, when we analyse the logarithm of the amounts of EW components, \(\delta t\) captures the changes in their values with respect to 1999 (price effect).

As explanatory variables, we include time year dummies (\(t\)) and control for a series of time-varying household characteristics (\({X}_{{it}}\)) such as age, marital status, health status, race, and years of education of its head, region of residence, type of household, household size, and the number of children. The variable \({\alpha }_{i}\) captures all unobserved, time-invariant individual level characteristics that have an influence on \({y}_{{it}}\), whereas \({u}_{{it}}\) is the idiosyncratic error term.

The regression analysis described previously allows us to analyse all the multiple effects that each source of our EW measure has on economic insecurity by comparing the coefficients of year dummies for individuals with high risk of well-being losses and those with low risk. Therefore, we expect decreases in both the tenure and value of any well-being component to be associated with a greater likelihood of experiencing economic hardship in the near future, and we expect this relationship to be stronger for individuals with high levels of economic insecurity.

We study the following well-being components: household incomes, imputed rents for the main residence, mortgage payments, non-liquid assets, and liquid assets. With respect to household income, we expect that any variation caused by unemployment, reduced working hours or lower benefit amounts will increase the probability of future well-being losses, while higher labour income or public transfers will provide additional coping capacities to deal with a negative shock.Footnote 6

Regarding the main residence, we expect a reduction in economic insecurity when the value of imputed rents increases, either due to higher house prices or lower mortgage payments. An increase in the value of the main residence reflects that homeowners will have more potential resources to cope with an economic shock, while an increase in the probability of owning the main residence suggests that households have sufficient resources to acquire a first residence and that housing market conditions are adequate for this purpose. We also analyse changes in mortgage payments to capture the influence of this type of debt on economic insecurity, as higher mortgage payments reduce households’ resources. However, a higher probability of having a mortgage could be associated with increased well-being for homeowners, in the same vein as for imputed rents. A lower probability of having a mortgage could imply that households have paid off their mortgage debts, which reduces their exposure to an objective risk.

On the other hand, non-liquid assets cannot be easily converted into cash and have additional long-term effects on well-being. We calculate the probability of holding such assets to evaluate whether households have sufficient savings to invest in long-term resources. Furthermore, falling rates of return would deplete past savings invested in these assets, diminishing the ability of households to weather an economic downturn. Estimates of the changes in the value of non-liquid assets capture the volatility in the rates of return during this turbulent period and their role in shaping economic insecurity.

Households have easy access to liquid assets and therefore use them first to offset an economic shock. Thus, a higher probability of having positive liquid assets indicates whether households were able to increase their protection mechanisms by disposing of savings or investing larger amounts in stock markets. Nevertheless, changes in the value of liquid assets capture the extent to which households’ savings increased or whether they have already made use of these resources, in addition to capturing stock market volatility.

3.4 Data

Our data come from the Panel Study of Income Dynamics (PSID), which is a household longitudinal survey conducted in the US by the University of Michigan since 1968. This database contains household information on employment, income, wealth, expenditures, health, marital status and education among other topics. Since 1997, data have been collected on a biennial basis. In this paper, we use data from 1999 to 2019 to analyse economic insecurity over the last two decades, studying the impact of the Great Recession on this phenomenon and the subsequent economic recovery. Data are collected in the survey year, income is reported for the previous year, and wealth for the survey year (time of the interview).

To estimate our EW measure, we assume that income is reported in year t and wealth at the beginning of that same year. This could lead to double counting of some resources, especially those related to asset income or rental income. Therefore, we exclude all items related to capital income. EW is then the sum of all non-capital income concepts and the flow obtained from the wealth components.

4 Results

4.1 How are income and wealth distributed in the US?

Figure 1 shows the evolution of our EW measure from 1999 to 2019. Prior to the Great Recession, we can observe a clear upward trend in family income that sustained the growth in economic well-being while offsetting the stock market crash in 2001 due to the dotcom crisis, as well as the first signs of deteriorating real estate and business asset values in the run-up to the economic crisis in 2007. In addition, the increase in family income in 2009 cushioned the collapse of the real estate bubble and thus the lower amount of non-liquid assets. The financial crisis hit hardest in 2011, when EW reached its lowest value (approximately 68,000 equivalized dollars). This result is due to a decline in all components of EW, except for imputed rents of the main residence. During the economic recovery, EW experienced uneven growth driven by the evolution of liquid assets and household income levels. Family income rose in 2013 and remained stable until 2019, while liquid assets fell in 2015 following the uncertainty in stock markets.Footnote 7

It is important to note that the EW measure adds from 50 to 80% of income flow to standard gross family income.Footnote 8 Family income is the largest source of our extended measure, with an average share of 60%, that decreases during expansionary periods despite the increase in absolute values (Fig. A5 in the Online Appendix). In terms of the flow we derive from wealth concepts, liquid assets (current and saving accounts and the flow from equities and other assets) account for around 27% of total well-being, with a higher share when favourable macroeconomic conditions lead to higher stock market rates of return and higher savings. It is also observed that during periods of recession, especially in 2001 and 2011, the value of these assets decreases as people tend to use their savings to smooth out consumption and due to the volatility of stock markets. Non-liquid assets (real estate other than the main residence, business assets and private pensions) represent 9% of well-being on average, following a similar trend to liquid assets, but even more dependent on the business cycle. Finally, the average share of imputed rents has been constant in the period of analysis (6%). However, the absolute value of these imputed rents has grown steadily since 2007 despite the collapse in the value of home equity between 2009 and 2013. This result is partly explained by a lower aggregate value of annual mortgage payments (see Fig. A6 in the Online Appendix).

Previous results are average values for the whole population, but these patterns change depending on the position of individuals in the EW distribution. Figure 2 shows the relative importance of each source by decile of EW. In the bottom 50% of the population, well-being is mainly determined by family income. The weight of annuitized wealth is higher for individuals between the fourth and ninth decile, although family income remains the most important source of EW. Conversely, the flow from wealth components is the most relevant source for the well-being of those at the top.

4.2 Economic insecurity results

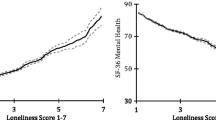

We analyse the degree of economic insecurity in the US by considering the predicted propensity of suffering large short-term declines in our measure of EW. We also show the results considering income and wealth separately to analyse whether this phenomenon is robust to the use of different welfare indicators (Fig. 3). Overall, the average probability of suffering well-being losses in the future over the whole period of analysis is 33% when calculated with EW, while it is approximately 22% when considering income alone and 43% when using wealth. These differences could be explained by the higher volatility of wealth, driven by large variations in the market value of real estate assets (Menta et al. 2021) compared to the more stable conditions of the labour market, which is the main source of family income.

The EW-based insecurity follows a similar trend to that of EW in absolute values. Economic insecurity remained stable during the pre-crisis period. Notably, economic insecurity increased slightly in 2005, possibly driven by rising mortgage payments in a context of lax credit conditions during the real estate boom, and also by short-term debts (refer to Fig. A6 in the Online Appendix). Similarly, there was a modest increase in insecurity in 2007 that can be attributed to negative rates of return on real estate and business assets in the initial phase of the collapse of the real estate bubble (see Table A8 in the Online Appendix). These results suggest that US households are not only exposed to economic risks during recessions, but also in expansionary periods (Hacker, 2019) and that one of the main factors is uncertainty in asset prices. Moreover, the slight increase in family income in 2009 together with the constant value of imputed rents of the main residence offset the fall in the value of real estate and business assets. The value of imputed rents remained similar due to the reduction in the aggregate value of the mortgage payments. The decline in the overall value of mortgages can be explained by the decrease in the homeownership rate after the collapse of the real estate bubble, due to the tightening of financial conditions for granting a mortgage (Wolff, 2022).

Thus, economic insecurity reached its peak in 2011, when the effects of the Great Recession had a significant impact on the economic well-being of households, as a result of falling household income and negative rates of return on real estate assets and stocks. The post-crisis period was characterized by an overall decrease in economic insecurity, although not exempt from financial market uncertainties, as indicated by the slight increase in insecurity in 2015 and changes in household income, especially in 2019.

Figure 4 presents average economic insecurity by EW deciles for the entire period of analysis. As expected, a general negative trend is observed: the individual propensity of well-being losses becomes lower as one moves up the EW ladder, although the difference between the lowest and the highest decile is approximately 5 percentage points (p.p.). The estimation of an EW measure together with the inclusion of a variety of sociodemographic characteristics when estimating probabilities leads to a reordering process that compresses differences in insecurity between deciles. Nonetheless, while it is clear that households at the bottom of the distribution are the most insecure, this phenomenon is also relevant for the middle and upper classes. Therefore, in designing policies to reduce economic insecurity, policy makers should not only target poor households, as this problem affects the entire population.

The income-based distribution of insecurity describes a similar shape to that of EW, partly because household income remains the main source of well-being throughout the distribution except for those at the top. This reduction is more pronounced when we analyse the probability of wealth losses, probably because the greater accumulation of assets of different types at the top of the EW distribution allows those individuals to diversify risk.

Table 1 displays economic insecurity by diverse socioeconomic groups. In general, the results are robust whatever variable we consider, although the levels of insecurity are higher when wealth is used. In terms of age, households headed by young individuals (aged 16–34) are more exposed to risk. Households headed by 35–54-year-olds face lower levels of insecurity when it is measured by income and EW, probably due to more stable and less precarious labour market conditions than the youth. Elderly-headed households (all aged 55+) are the most secure if we focus on the probability of wealth losses, but those aged 65+ are the second most vulnerable group if we consider EW. This result highlights the larger asset accumulation at the end of the life cycle, which may act as a consumption smoothing mechanism. Nonetheless, by transforming this wealth stock into a flow of income, insecurity in old age is mainly due to large short-term drops in income. Older individuals may be affected by fluctuations in the value of their private pension plans (IRAs). Furthermore, we find that female-headed households are always more insecure than those headed by men, regardless of the dimension used.

On the other hand, black and American Indian households are more exposed to objective risk. White individuals are the least likely to suffer drops in wealth, but they are more likely to suffer income losses than Asian households, which are the most secure in terms of income and wealth. However, differences in economic insecurity between racial groups are somewhat small and this phenomenon seems to be more determined by other characteristics such as age or employment status.

Economic insecurity decreases as years of completed education grow and its reduction is larger when individuals have at least 16 years of education. Regarding labour market status, the unemployed are the most insecure whatever method we use, followed by inactive households. This result evinces the lack of public benefits that prevent people from experiencing large drops in well-being when they are unable to work or suffer the loss of employment. The self-employed are the most protected group when measuring the probability of wealth losses, suggesting that they possess wealth to be protected from income volatility. In line with the degree of insecurity by age group, retired individuals would suffer less from wealth falls as they hold a larger stock of wealth.

When analysing insecurity by household type, we find that single-parent families suffer the highest levels of insecurity followed by individuals living alone. This may be due to the pooling of the monetary resources of all household members: single individuals only rely on their income and accumulated wealth, which will probably be lower than households with more adults.

4.3 Drivers of economic insecurity

Thus far, we have analysed the evolution and distribution of economic insecurity approximated by the predicted probability of short-term losses in EW greater than 15%. But which are the main drivers of this phenomenon? Which EW components are related to higher levels of risk? To answer these questions, we examine if the evolution of diverse well-being sources has been different for individuals with a higher risk of future economic distress than the population average (HR group) compared to those with an exposure to risk lower than the general mean (LR group).Footnote 9 We therefore apply the fixed effects estimation described in Eq. (5) for each group, studying to what extent changes in the ownership (composition effect) and value (price effect) of several resources may be associated with the propensity of future drops in well-being.

Overall, we do not find a significant variation in EW tenure, as most of the population has positive values of some of its components (Table 2, column 1). In contrast, it seems that the evolution of economic insecurity is due to the price effect (Table 3, column 1): the value of EW for those individuals classified as HR is lower than in 1999 in all years (except for 2003). This group was already experiencing losses in the value of their resources prior to the Great Recession, although it did not change between 2007 and 2009Footnote 10 which, together with the non-significant variation for the LR group, could explain the decrease in economic insecurity in 2009 showed in Fig. 3. Their value of EW plummeted in 2011 due to the Great Recession (−23%) and has suffered some volatility during the recovery, with increases in 2013 and 2017 and decreases in 2015 and 2019 which follow the general trend in overall economic insecurity. Conversely, the value of EW for the LR group did not experience significant variations with respect to our reference year until 2017, when EW worth started to rise. This result suggests that less insecure individuals have benefited more from the economic recovery after the Great Recession than those in the HR group. Because of the diverse evolution of the value of EW, the gap between both groups has been constantly increasing since the financial crisis and up to 33.7% in 2019 (Table 4).

When analysing EW components, we find that neither the holding nor the value of imputed rents corresponding to the main residence have a significant influence on economic insecurity as they have remained steadily constant during the period of analysis.Footnote 11 We may recall that the main residence is not extremely concentrated at the top of the EW distribution, and the flow of imputed rents we obtain is similar for both the HR and LR groups (Figs. A7, A8 in the Online Appendix).

Nevertheless, we do find significant differences between the two groups when we explore the evolution of annual mortgage payments, which could indicate that owning a main residence is not important in shaping economic insecurity but rather having debt related to it and its corresponding amount. In this vein, we observe that the HR group spent less on mortgage than the LR group after the Great Recession, as the gap between them is significant and negative from 2011 to 2019 (Table 4). The HR group experienced steady declines in the probability of having a mortgage since 2009 due to the credit constraints that prevailed after the collapse of financial markets (Table 2, column 2). This decrease in mortgage payments implied therefore an improvement in the financial situation of HR households who owned mortgage, which could be associated with lower levels of economic insecurity.

The flow derived from non-liquid assets is one of the most important components of well-being explaining differences between the HR and LR groups. The HR group had a lower probability of owning non-liquid assets compared to the LR group since 2013 (Table 2, column 3). Although we find evidence of some compositional effect, the price effect is even more important: the gap between groups with respect to 1999 has grown steadily over the whole period of analysis (Table 4). We can observe how LR individuals obtained relative gains from the investment in this kind of assets prior to the financial crisis while the HR group suffered relative losses, widening the gap between the two groups. The difference between the more insecure and the less insecure increased even more with the economic recovery: although the HR group was able to recover some of the suffered losses, the LR group obtained relative gains since 2013 (leading to a gap of 163% in 2019). The LR group was thus able to manage the risk associated with non-liquid assets over this period of high volatility, resulting in lower exposure to objective risk.

Considering the flow of liquid assets, the differences between both groups only become relevant for 2017 and 2019 in terms of the value of its flow, when the HR group lost 63.5% and 56.3% with respect to 1999 compared to the LR group (Table 4, column 4). Nevertheless, it is also relevant that the probability of having positive savings decreased between 2011 and 2015 for the HR group, which contributed to the overall increase in economic insecurity those years, although they experienced a slight recovery in 2017 that helped to reduce average insecurity.

Finally, we analyse the evolution of the value of family income. We may recall that household income accounts for most of our EW measure and thus its variations are the most important source of economic insecurity. We can observe that individuals in the HR group have lower amounts of income than those in the LR group, and this gap has been constantly rising since 2001 (Table 4, column 5) reaching a 44% in 2019. The value of its family income was already falling before the Great Recession, except for a small recovery in 2009 (compared to the previous year) that was insufficient to offset the large drop in non-liquid assets. The fall for this group was even more pronounced in 2011 (average income for the HR group was 31% lower than the amount in 1999) and continued to decrease despite the economic recovery. In contrast, the LR group only experienced a significant decrease of family income of 6% in 2001, while for the rest of the years it remained practically unchanged compared to 1999 values.

In summary, we find that losses in the value of household income and non-liquid assets are the most important well-being components in shaping the phenomenon of economic insecurity, as they mainly affect those individuals with a high risk of hardship in the future. The imputed rents of the HR group remained constant, while the decrease in mortgage payments could generate opposite effects: the fall in the value of mortgage payments could lead to an increase in well-being, but the decrease in the probability of holding this type of debt could reveal that individuals have restricted access to property and therefore fewer protection mechanisms against distress. Liquid assets do not seem to influence insecurity, as their value has remained constant for this group.

On the other hand, the LR group was able to manage the risk associated with non-liquid assets and obtain gains in the flow of these assets, while their household income did not change significantly. In recent years, this group has experienced a rise in liquid assets, thus increasing their protection mechanisms. Their financial situation was only affected by the increase in mortgage payments before the Great Recession and the lower probability of having positive savings in 2011. Thus, the gap between the two groups in terms of household income and non-liquid assets has been widening especially after the shock of the 2008 financial crisis.

5 Conclusions

In this paper, we propose to measure economic insecurity with a measure of extended well-being that combines income and wealth. We therefore account for the liquid scope of income, but also include all the possible effects that wealth could have on objective insecurity: it can be understood as a short-term protection mechanism, but its reduction could become a source of distress as households will have less resources to resort to in case of an economic shock. We construct an EW measure that combines income and wealth using the Weisbord and Hansen (1968) approach to estimate all available economic resources that households own to face unexpected negative shocks. We then evaluate economic insecurity as the predicted propensity to suffering from a sizable well-being loss to capture the individual vulnerability to future hazards. Furthermore, we study the evolution of economic insecurity in the US over the last two decades and disentangle the potential drivers of this phenomenon by looking into changes of each component of EW.

Our results show that economic insecurity levels are conditioned to the dimension selected for its calculation. The average probability of suffering from EW losses in the US was 33%, whereas this percentage decreases to 22% when considering income and increases to 43% when we take into account wealth. The higher levels of economic insecurity obtained for wealth can be explained by the volatility of asset prices. Thus, our extended measure is able to capture the uncertainty emanating from wealth, beyond the propensity of income losses. The average probability of EW losses in the US remained stable prior to the Great Recession, although raised slightly in 2007 due to negative rates of return on real estate and business assets. Economic insecurity reached its maximum level in 2011 as a consequence of the collapse of labour and stock markets during the Great Recession but returned to pre-crisis levels with the subsequent economic recovery. However, our EW measure captures some aspects of economic risk in later periods that income and wealth separately cannot: we find an increase in the probability of EW losses in 2015 due to uncertainty in stock markets, and also in 2019 due to falling household income and declining current accounts and savings. We also find that households in the lower tail of the EW distribution are the most economically insecure, but the level of insecurity of the middle and upper class is not negligible. Therefore, policy makers should not only focus on the poor when designing public policies to reduce economic insecurity, as it is a phenomenon that affects the entire US population. Moreover, when analysing the average propensity of well-being losses by sociodemographic groups, it appears that age and employment status are the characteristics that most influence economic insecurity.

When analysing potential drivers of economic insecurity, we find that losses in the value of household income and non-liquid assets are the most important well-being components in shaping the phenomenon of economic insecurity, as they mainly affect those individuals with a high risk of hardship in the future. The gap in the value of these resources between high-risk individuals and those with low risk has steadily grown over the whole period of analysis: in 2019, household income of the HR group was 44% lower than that of the LR group with respect to the gap in 1999, whereas this difference reached a 163.4% in case of non-liquid assets. Mortgage payments may also have played a role in insecurity, as those individuals with high objective risk experience reductions in this kind of debt. On the contrary, liquid assets remained stable for this group and seem to not have a significant impact on insecurity. The LR group was able to manage the risk associated with non-liquid assets and obtained gains on the flow of these assets, while their household income did not change significantly. In recent years, this group has experienced a rise in liquid assets, thus increasing their protection mechanisms.

To our knowledge, this is the first paper that assessed economic insecurity with an EW approach. We are aware that our study has some limitations that we hope to improve in future research. First, the assumptions made to estimate the flow from wealth using the Weisbrod and Hansen (1968) approach may be too strong. Nevertheless, we believe that this is the best approach to estimate a comprehensive measure of well-being including income and wealth, and also that those assumptions do not affect the estimates of economic insecurity, since our purpose is to measure exposure to financial risk and the lack of sufficient protection mechanisms. Second, our procedure cannot capture unpredictable economic shocks that are independent of household characteristics. We would also like to extend the scope of the paper by undertaking a comparative analysis with other countries that also have conducted longitudinal data surveys with information on household income and wealth. However, it is difficult to find surveys with homogeneous variables that can be compared with the PSID data. Finally, further analysis is needed to understand the relationship between economic insecurity and public policies, as the correct measurement of this phenomenon allows policy makers to effectively design targeted ex-ante interventions to prevent future declines in household well-being.

Notes

See Table A8 in Online Appendix for more details on the rates of return for each asset.

Alternatively, we estimate the probability of experiencing EW losses using a threshold of 10% and 20% (see Fig. A1 and A2 in the Online Appendix). The trend in economic insecurity is robust to the selection of the threshold, while its level is slightly higher for the 10% threshold and decreases for the 20%. Therefore, we choose the 15% threshold for the main analysis as it follows exogenous information about future economic losses and insecurity, avoiding potential endogeneity issues.

The average probability of experiencing a well-being loss for the whole period of analysis is 33%. We define the groups by considering the average individual probability for the entire period, so that those individuals who are more (less) economically insecure have an individual propensity to suffer well-being losses higher (lower) than 33%. As a robustness check, we define these groups by considering the average probability of suffering an economic loss in 2001 (the first period for which we have economic insecurity results), in 2009 (when we find the highest propensity to experience well-being losses) and 2019 (the most recent year). The results are consistent whatever strategy we use to define the groups (from Table A2 to A7 in the Online Appendix).

We take 1999 as the reference year as it is the first period in our dataset. We must recall that we cannot calculate the economic insecurity index for that specific year as it is based on a dynamic approach.

We do not estimate Eq. (5) for the case of income tenure, since most of the US population has positive amounts of this component.

The lower rates of return of financial assets during 2015 can be explained by the spillover effects of the Greek debt default in June 2015, the slowdown in GDP growth in China and the effects of the end of quantitative easing in the United States in October 2014.

We add a higher amount of income flow compared with Wolff et al. (2012) mainly because we use the reported values of cash and currents accounts.

The counterfactual analysis is inconclusive on the role of each component in economic insecurity (see Figs. A3, A4 in the Online Appendix). This analysis consists of adding sequentially each component of the EW measure to look into the contribution to economic insecurity of each source.

Coefficients are not included in the tables because we did not find significant results, but are available on request.

References

Amuedo-Dorantes, C., & Borra, C. (2018). Emerging wealth disparities after the storm: Evidence from Spain. Review of Economics of the Household, 16, 1119–1149. https://doi.org/10.1007/s11150-017-9363-3.

Benito, A. (2006). Does job insecurity affect household consumption? Oxford Economic Papers, 58(1), 157–181. https://doi.org/10.1093/oep/gpi041.

Berloffa, G., & Modena, F. (2014). Measuring (in)security in the event of unemployment: Are we forgetting someone? Review of Income and Wealth, 60(S1), S77–S97. https://doi.org/10.1111/roiw.12062.

Bossert, W., & D’Ambrosio, C. (2013). Measuring economic insecurity. International Economic Review, 54(3), 1017–1030. https://doi.org/10.1111/iere.12026.

Bossert, W., Clark, A., D’Ambrosio, C., & Lepinteur, A. (2023). Economic insecurity and political preferences. Oxford Economic Papers, 75(3), 802–825. https://doi.org/10.1093/oep/gpac037.

Brandolini, A., Magri, S., & Smeeding, T. (2010). Asset‐based measurement of poverty. Journal of Policy Analysis and Management, 29(2), 267–284. https://doi.org/10.1002/pam.20491.

Bucks, B. (2011). Economic vulnerability in the United States: Measurement and trends. Paris, France: IARIW-OECD conference on economic insecurity.

Cantó, O., García-Pérez, C., & Romaguera-de-la-Cruz, M. (2020). The dimension, nature and distribution of economic insecurity in European countries: A multidimensional approach. Economic Systems, 44(3). https://doi.org/10.1016/j.ecosys.2020.100807

Cantó, O., García-Pérez, C., & Romaguera-de-la-Cruz, M. (2021). Multidimensional measures of economic insecurity in Spain: The role of aggregation and weighting methods. Hacienda Pública Espanola/Review of Public Economics, 238, 29–60.

Clyne, D. V., & Smith, T. G. (2022). Economic insecurity during the COVID-19 pandemic: insights from the Great Recession. New Zealand Economic Papers, 56(1), 81–89. https://doi.org/10.1080/00779954.2021.2006757.

D’Ambrosio, C., & Rhode, N. (2014). The distribution of economic insecurity: Italy and the U.S. over the Great Recession. Review of Income and Wealth, 60(S1), S33–S52. https://doi.org/10.1111/roiw.12039.

Fiori, F., Rinesi, F., Pinnelli, A., & Prati, S. (2013). Economic insecurity and fertility intentions of Italian women with one child. Population Research and Policy Review, 32, 373–413. https://doi.org/10.1007/s11113-013-9266-9.

Hacker, J. S., Huber, G., Rehm, P., Schlesinger, M., & Valletta, R. (2010). Economic security at risk: Findings from the economic security index. Rockefeller Foundation, Yale University.

Hacker, J. S. In: J. E. Stiglitz, J. P. Fitoussi M. Durand, (eds.) (2018). Economic security. For good measure: Advancing research on well-being metrics beyond GDP. (10.1787/9789264307278-en. 205–242). Paris: OECD Publishing.

Hacker, J. S., Rehm, P., & Schlesinger, M. (2013). The insecure American: Economic experiences, financial worries, and policy attitudes. Perspectives on Politics, 11(1), 23–49. https://doi.org/10.1017/S1537592712003647.

Hacker, J. S. (2019). The great risk shift: The new economic insecurity and the decline of the American Dream. New York: Oxford University Press.

Hacker, J. S., Huber, G., Nichols, A., Rehm, P., Schlesinger, M., Valletta, R., & Craig, S. (2014). The economic security index: A new measure for research and policy analysis. Review of Income and Wealth, 60(S1), S5–S32. https://doi.org/10.1111/roiw.12053.

Larrimore, J., Burkhauser, R., Auten, G., & Armour, P. (2021). Recent trends in US income distributions in tax record data using more comprehensive measures of income including real accrued capital gains. Journal of Political Economy, 129(5), 1319–1360. https://doi.org/10.1086/713098.

Mansour, F. (2018). Economic insecurity and fertility: Does income volatility impact the decision to remain a one-child family? Journal of Family and Economic Issues, 39, 243–257. https://doi.org/10.1007/s10834-017-9559-y.

McGuinness, S., & Wooden, M. (2009). Overskilling, job insecurity, and career mobility. Industrial Relations: A Journal of Economy and Society, 48(2), 265–286. https://doi.org/10.1111/j.1468-232X.2009.00557.x.

Menta, G., Wolff, E. N., & D’Ambrosio, C. (2021). Income and wealth volatility: evidence from Italy and the US in the past two decades. Journal of Economic Inequality, 19(2), 293–313. https://doi.org/10.1007/s10888-020-09473-4.

Modena, F., Rondinelli, C., & Sabatini, F. (2014). Economic insecurity and fertility intentions: The case of Italy. Review of Income and Wealth, 60(S1), S233–S255. https://doi.org/10.1111/roiw.12044.

Nichols, A., & Rehm, P. (2014). Income risk in 30 countries. Review of Income and Wealth, 60(S1), S98–S116. https://doi.org/10.1111/roiw.12111.

Osberg, L. (1998). Economic insecurity. Social Policy Research Centre, University of New South Wales, SPRC Discussion Paper, 88.

Osberg, L. In: C.D’Ambrosio, (eds.) (2018). Economic insecurity: Empirical findings. Handbook of research on economic and social well-being. (316–338). London: Edward Elgar Publishing. https://doi.org/10.4337/9781781953716.00019.

Osberg, L., & Sharpe, A. (2005). How should we measure the “economic” aspects of well-being? Review of Income and Wealth, 51(2), 311–336. https://doi.org/10.1111/j.1475-4991.2005.00156.x.

Osberg, L., & Sharpe, A. (2014). Measuring economic insecurity in rich and poor nations. Review of Income and Wealth, 60(S1), S53–S76. https://doi.org/10.1111/roiw.12114.

Rohde, N. & Tang, K.K. In: C,. D’Ambrosio, (eds.) Economic insecurity: Theoretical approaches. Handbook of research on economic and social well-being. (300–315). London: Edward Elgar Publishing. https://doi.org/10.4337/9781781953716.00018.

Rohde, N., Tang, K. K., & Osberg, L. (2017). The self-reinforcing dynamics of economic insecurity and obesity. Applied Economics, 49(17), 1668–1678. https://doi.org/10.1080/00036846.2016.1223826.

Rohde, N., Tang, K. K., & Rao, P. (2014). Distributional characteristics of income insecurity in the US, Germany and Britain. Review of Income and Wealth, 60(S1), S159–S176. https://doi.org/10.1111/roiw.12089.

Rohde, N., Tang, K. K., D’Ambrosio, C., Osberg, L., & Rao, P. (2020). Welfare-based income insecurity in the US and Germany: Evidence from harmonized panel data. Journal of Economic Behavior & Organization, 176, 226–243. https://doi.org/10.1016/j.jebo.2020.04.023.

Rohde, N., Tang, K. K., Osberg, L., & Rao, P. (2015). Economic insecurity in Australia: Who is feeling the pinch and how? Economic Record, 91(292), 1–15. https://doi.org/10.1111/1475-4932.12141.

Rohde, N., Tang, K. K., Osberg, L., & Rao, P. (2016). The effect of economic insecurity on mental health: Recent evidence from Australian panel data. Social Science & Medicine, 151, 250–258. https://doi.org/10.1016/j.socscimed.2015.12.014.

Romaguera-de-la-Cruz, M. (2020). Measuring economic insecurity using a counting approach: An application to three EU countries. Review of Income and Wealth, 66(3), 558–583. https://doi.org/10.1111/roiw.12428.

Smeeding, T., & Thompson, J. (2011). Recent trends in income inequality. In H. Immervoll, A. Peichl & K. Tatsiramos (Eds.), Who loses in the downturn? Economic crisis, employment and income distribution (Research in Labor Economics, Vol. 32) (pp. 1–50). Leeds: Emerald Group Publishing Limited. https://doi.org/10.1108/S0147-9121(2011)0000032004.

Smith, T.G., Stoddard, C., & Barnes, M.G. (2009). Why the poor get fat: weight gain and economic insecurity. Forum for Health Economics & Policy, 12(2). https://doi.org/10.2202/1558-9544.1151

Staudigel, M. (2016). A soft pillow for hard times: Economic insecurity, food intake and body weight in Russia. Journal of Health Economics, 50, 198–212. https://doi.org/10.1016/j.jhealeco.2016.09.001.

Stiglitz, J.E., Sen, A., & Fitoussi, J.P. (2009). Report by the Commission on the Measurement of Economic Performance and Social Progress.

Swaen, G. M., Kant, I., van Amelsvoort, L. G., & Beurskens, A. J. (2002). Job mobility, its determinants, and its effects: Longitudinal data from the Maastricht cohort study. Journal of Occupational Health Psychology, 7(2), 121–129. https://doi.org/10.1037/1076-8998.7.2.121.

Watson, B. (2018). Does economic insecurity cause weight gain among Canadian labor force participants? Review of Income and Wealth, 64(2), 406–427. https://doi.org/10.1111/roiw.12293.

Weisbrod, B. A., & Hansen, W. L. (1968). An income-net worth approach to measuring economic welfare. American Economic Review, 58(5), 1315–1329.

Wolff, E. N. (2022). The Stock Market and the Evolution of Top Wealth Shares in the United States. Journal of Economic Inequality, 20, 53–66. https://doi.org/10.1007/s10888-022-09535-9.

Wolff, E. N., & Zacharias, A. (2009). Household wealth and the measurement of economic well-being in the United States. Journal of Economic Inequality, 7, 83–115. https://doi.org/10.1007/s10888-007-9068-6.

Wolff, E. N., Zacharias, T., & Masterson, T. (2012). Trends in American living standards and inequality, 1959–2007. Review of Income and Wealth, 58(2), 197–232. https://doi.org/10.1111/j.1475-4991.2012.00503.x.

Acknowledgements

We acknowledge financial support received from Grant PID2022-137352NB-C42 funded by MCIN/AEI/10.13039/501100011033/FEDER, UE.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Contributions

The authors of this paper have made equal and substantial contributions to all aspects of the research, writing, and preparation of this manuscript. Each author has played a significant role in conceiving, designing, and executing the research, as well as in the analysis and interpretation of the data. Additionally, all authors have contributed equally to the drafting and revision of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Petrov, D., Romaguera-de-la-Cruz, M. Measuring economic insecurity by combining income and wealth: an extended well-being approach. Rev Econ Household (2024). https://doi.org/10.1007/s11150-024-09700-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s11150-024-09700-1