Abstract

This paper studies the gender gap in net wealth. We use administrative data on wealth that are linked to the Estonian Household Finance and Consumption Survey, which provides individual-level wealth data for all household types. The unconditional gender gap in mean wealth is 45%, but this sizeable gap in means originates mainly from the top tail of the distribution, where men have much more wealth than women, while the gender differences in wealth are statistically insignificant in most of the lower wealth quintiles. At the top of the distribution the differences in wealth can be explained by larger self-employment activity of men. Men have more business wealth than women do, and the gender wealth gap is the largest for this asset class. The gender wealth gaps across different household types are very heterogeneous. The unconditional gaps in wealth are strongly in favour of men throughout most of the wealth distribution for married couples. For single-member households, on the other hand, the raw gaps are in favour of women in the lower half of the wealth distribution. These raw gaps in opposite directions can mostly be explained by differences in the observed characteristics of men and women among married couples vs single people.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The gender gaps in various forms of income, such as wages or pensions, have been extensively studied in the academic literature, but there have been substantially fewer studies that have focused on the gender differences in wealth. The aim of this paper is to help filling this research gap. Wealth is an important indicator of welfare and measuring wealth inequalities is relevant both at the level of the population as a whole and within households. While income gaps show current inequality, wealth gaps depict inequality that has accumulated over a longer time span.

The main reason why only a few existing papers have studied gender wealth gaps is that individual-level wealth data are rarely available. Wealth surveys usually collect data at the household level, with only a few exceptions. Consequently, many studies on this topic are based on household-level data, which means that they either analyse the gender wealth gap only among households with one member (e.g. Schmidt and Sevak 2006; Schneebaum et al. 2018, and Ravazzini and Chesters 2018) or impute the allocation of wealth within larger households using data from single-member households (for an overview of the methods for this see Bonthieux and Meurs 2015). Both of these approaches have disadvantages because the unconditional gender wealth gaps vary over different household types. They are larger for couple-headed households and smaller and often statistically insignificant for single-member households (Sierminska et al. 2010; Bonnet et al. 2013). This means that the gender gaps that are estimated on the basis of single-member households are not generalisable to the whole population.

Relatively few papers on the gender wealth gap use individual-level wealth data and cover all types of households.Footnote 1 All of these studies use survey data collected by household interviews. The present paper differs from the earlier studies by employing a different data source. We use a novel dataset from Estonia that derives individual-level wealth data from various administrative sources and links them with the Estonian Household Finance and Consumption Survey (HFCS) from 2013. The main advantage of this combined dataset is that it covers register-based wealth items at the individual level together with other household characteristics from the survey. The administrative data are superior in quality to the survey data, but administrative datafiles often give no information on household structure. The combined dataset used in this article overcomes this problem.

This paper aims to contribute to the literature in several ways. First, we decompose the gender wealth gaps into explained and unexplained parts and explore the distribution of unconditional and conditional gender wealth gaps for different components of net wealth. This lets us evaluate which of the different types of assets and liabilities contribute more to the gender gap in net wealth. Differences in the wealth composition of men and women have not been explored at such a detailed level as we can do with the current dataset. None of the earlier studies estimated conditional gender wealth gaps for various wealth items, i.e. there is no information on whether the differences in the structure of assets for men and for women can be explained by observable characteristics such as differences in income.

Second, we conduct a comprehensive analysis of gender gaps in net wealth over different household types. We compare the distributions of unconditional and conditional wealth gaps between men and women in single-member households, couple-headed households and other types of household. Earlier studies using individual-level wealth data have assessed the raw gaps for single people and couple-headed households but have not conducted the decomposition and estimated the unconditional and conditional gaps separately for different household types (Sierminska et al. 2010; Bonnet et al. 2013).

Third, we base our analysis on data from a different source. While earlier studies have been based on survey data, we use data from administrative files. It can be expected that administrative data are much less prone to measurement error than survey data are. Various sources of measurement error in survey data have been discussed e.g. by Riphahn and Serfling (2005). When measurement errors are caused by systemic under- or overreporting of different components of net wealth they may lead to biased estimates of gender wealth gap. There is evidence that women tend to underestimate the value of the assets they own and men to overestimate it (Zagorsky 2003). This implies that the survey-based assessments of the gender gaps in net wealth may be overestimated. Using administrative data lets us avoid the possible gender biases that are embedded in the wealth surveys. In addition, there is evidence that wealth surveys typically do not cover the very top of the wealth distribution (Vermeulen 2016; Meriküll and Rõõm 2019). As we will show in the current study, the gender wealth gap mostly originates from this part of the distribution. If the richest individuals are not covered by a survey then the disparities in wealth between men and women are undermeasured. The existing evidence therefore implies that using survey data may result in either over or underestimation of the gender wealth gap. Either way, the use of administrative data is free of these biases and so results in a more exact measurement of the gap.

Finally, the current paper provides novel information on the gender wealth gap in Estonia, which is the country that has the largest gender wage gap in the EU (see e.g. Eurostat series sdg_05_020). If the wealth accumulation functions of men and women are similar, then disparities in income are transferred to disparities in wealth. This also provides a good background for exploring how much married couples pool their assets.

Many potential sources of the gender gap in wealth have been identified in the literature. The reasons why wealth accumulation may be different for men and women are discussed more thoroughly in the next section and we mention them here only briefly. First and foremost, the gender gap in wealth may arise because of income differences between the genders. It is well established that men earn more and have higher labour market participation rates than women do (e.g. Blau and Kahn 2000). This lets men accumulate more wealth. Besides income differences, the gender gap can be caused by differences in consumption and saving patterns (e.g. Fisher 2010; Sunden and Surrette 1998) or because women and men invest differently (e.g. Hinz et al. 1997; Grable 2000). Finally, men and women could inherit differently and this could contribute to wealth inequality, but studies mostly do not find that inheritances differ by gender (e.g. Edlund and Kopczuk 2009).

The various assets that a household owns are often used by all the members of the household and provide utility for the members who are not the owners of the particular items. Even so, the distribution of wealth within a household is relevant for two main reasons. First, it affects the bargaining power of individual household members over the allocation of resources within the household. Second, the joint use of wealth is not guaranteed for the full life of both partners but only until the end of their relationship. This makes it important for both men and women to accumulate savings for possible separations. Both men and women receive wealth premiums from marriage (Lersch 2017), while divorcees create wealth losses for both former partners (Ulker 2009; Grabka et al. 2015).

Wealth inequality is typically much greater than income inequality (e.g. HFCN 2013). This implies that wealth differences between the genders may also be more substantial than income differences. Equally though, assets acquired during a marriage are usually split evenly, unless a couple has a prenuptial agreement that stipulates otherwise, and this reduces gender wealth inequality within households with married couples. The key findings on the magnitude of the gender wealth gap are summarised by Bonthieux and Meurs 2015. Men’s mean level of wealth is 45% higher than that of women in Germany (Sierminska et al. 2010), 15% higher in France (Bonnet et al. 2013) and 18% higher in Italy (D’Allessio 2018). Findings for some developing countries indicate that the gender gap in wealth is more substantial there. Men have two to four times more gross assets than women do in Ghana and India (Doss et al. 2014).

This paper uses the unconditional quantile regressions suggested by Firpo et al. (2009) to estimate the size of the gender gap over the distribution of net wealth. We decompose the raw gap into explained and unexplained components using an Oaxaca–Blinder decomposition. The gender wealth gaps are estimated for various assets and liabilities and for different household types. We find that the mean unconditional gender wealth gap is as large as 45% in Estonia. However, the gap in means originates mostly from the top tail of the wealth distribution, where men have much more wealth than women, while the gaps are statistically insignificant in lower parts of the wealth distribution. Men have more business wealth than women do, and the gender wealth gap is the largest for this asset class, which is the main source of the large gender wealth gap in means.

It is also found that the raw gender wealth gap is largest among partner-headed households, while it is negative (i.e. in favour of women) or statistically insignificant in single-member households. This highlights how important it is to use individual-level data that cover all household types for analysing the gender wealth gap, since assessments based purely on single-member households can provide results that are not valid for other household types. Conditioning on observed characteristics renders the gaps for different household types mostly statistically insignificant. Men have more vehicles, business assets and private pension assets and women have more deposits even after controlling for observable characteristics. Surprisingly, these differences do not disappear when the gender differences in risk aversion are accounted forFootnote 2. The estimated results point to large heterogeneity in the gender wealth gap over various net wealth components and household types, confirming the need to go beyond the means and aggregates.

The paper is structured as follows. The next section discusses the wealth accumulation function and possible reasons for the gender wealth gap. Section 3 provides an overview of the institutional settings for family finances in Estonia. Section 4 covers the data and methods. Section 5 presents the results of the empirical estimations. Section 6 discusses the results in the context of the wealth accumulation function. Finally, the last section summarises.

2 The wealth accumulation function

The total wealth W of an individual in period t depends on their accumulated wealth, their additional savings S in period t, gifts or inheritances H received in period t, and the returns r on the previously accumulated resources in period t. Resources can be held in different asset types with different risk and return, meaning that \(W_{t - 1} = \mathop {\sum}\nolimits_{a = 1}^n {w_{\alpha ,t - 1}}\) where α denotes a particular type of asset. Wealth accumulation over periods can be described as:

and the total savings S of an individual in the current period, regardless of asset types, depend on the total after-tax income Y and total consumption spending C in that period:

The accumulation of wealth can be different for men and for women for several reasons. First, disparities in wealth accumulation can result from men and women holding different portfolios of assets. The wealth composition for individuals varies widely as it depends on their risk preferences. Several studies have shown that women make more conservative investments and are in general more risk averse (e.g. Jianakopolos and Bernasek 1998; Grable 2000; Hallahan et al. 2004).Footnote 3 They also have lower stock market participation rates than men do (e.g. Bajtelsmit and Bernasek 1996, Hinz et al. 1997, Embrey and Fox 1997). Additionally, investment choices depend on financial literacy (Van Rooij et al. 2011). Empirical evidence suggests that men are more financially literate than women are (e.g. Chen and Volpe 2002; Lusardi and Mitchell 2008), which could be one reason why men have higher stock market participation rates. As a general rule, holding riskier assets results in higher long-term returns, implying that even with the same level of initial wealth and savings men are able to accumulate more wealth over time.

Differences in income are an important source of wealth inequality between men and women. Total after-tax income and spending are endogenous and depend on the individual’s choices, and so saving can also vary across genders. The after-tax income of women is affected because they are more likely to have career breaks to have children, leaving them fewer years of work experience and lower wages than those of men with the same characteristics. Women are more likely to work part-time than men, which also results in them having smaller incomes. Women are generally paid less than men and so their ability to save is lower, and consequently the gender pay gap spills directly into the wealth gap.

In addition, income differences between men and women can result from the different occupational choices they make. Male-dominated professions tend to be better paid than female-dominated professions are and occupational segregation is one of the sources of the existing gender wage gap (e.g. Dolado et al. 2002). Men are also more likely to become entrepreneurs and to have self-employment income than women are (Koellinger et al. 2013). As being an entrepreneur is a riskier occupational choice, it is generally also better rewarded (e.g. HFCN 2013).

Differences in earnings may have additional implications for the wealth composition. As credit constraints are higher for lower levels of income (HFCN 2016), women may be denied mortgage loans more often than men are. A study by Alesina et al. (2013) shows that women also face more stringent conditions for obtaining business credit than men do. Consequently, women are less able to benefit by building wealth from owning businesses or from the long-term rises in house prices that accrue from home ownership.

Additionally, the gender wealth gap in favour of men may be caused by men inheriting more than women. Empirical evidence shows that inheritances have a role in explaining the net wealth of households in a number of western European countries (Fessler and Schürz 2018). However, the existing studies mostly show for developed countries that the probability of inheriting is not dependent on gender (e.g. Edlund and Kopczuk 2009).

There are different approaches to how individual wealth functions are linked to the household-level wealth function. Studies that focus on the within-household allocation of resources distinguish between two different household models, depending on the decision-making structure. According to this literature, a household can act either as a unitary unit or as a collective one. Standard microeconomic theory assumes the unitary model, where household resources are pooled and there is a single utility function and budget constraint (see e.g. Doss 1996). The alternative, the collective model, would imply that household members have different preferences and the observed consumption, savings and investment patterns are the result of bargaining.

The unitary model has frequently been rejected in empirical studies as it has been shown that households do not exhibit full pooling of resources and that they are moving towards more individualised systems, such as partial pooling (Vogler et al. 2006; Pahl 2008). Ashby and Burgoyne (2009) show that partial pooling is also found for savings. Studies show that the consumption of household members depends on their income shares (Bonke 2015), as women spend more on children (Lundberg et al. 1997; Phipps and Burton 1998) and tend to save less than men (Phipps and Woolley 2008). There is empirical evidence showing that the bargaining power of women within the family is linked to their education, income and assets (Doss 2013). If there is a systematic difference in how men and women accumulate individual savings and if families are not pooling all their savings, it would contribute to household members having different levels of wealth.

The upshot is that any systematic differences in wealth accumulation between men and women, and also any within a household, lead to a gender wealth gap. If there is a wealth gap, it is important to understand the role of each component of the wealth function in explaining the gap.

3 Institutional background: financial arrangements of couples in Estonia

The extent of pooling of the property within couple-headed families depends on the institutional settings for the arrangement of household finances. This section provides an overview of the property regimes used by married couples and cohabiting partners to shed light on how common it is in Estonia to have joint property.

Like other European countries, Estonia has experienced a decline in marriages while cohabiting relationships have become more prevalent. Although Estonia stands out for union formation happening at an earlier age than in other European countries, over recent decades it has become more common for couples to start to live together without marrying. The studies by Katus et al. (2007) and Puur et al. (2012) show that the share of couples in Estonia living together without marrying is one of the highest in European countries. The occurrence of cohabitation not followed by marriage started to increase significantly from the 1980s in Estonia, reaching 50% of cohabitations by the 1990s. This trend is also confirmed by related statistics, as the number of marriages per 1000 inhabitants has declined by 50% in Estonia since the 1960s (Statistics Estonia).Footnote 4 Consequently the share of couples in cohabiting relationships has been increasing. According to the 2011 census around two thirds of couples are married while one third of couples are cohabiting.Footnote 5 In the last two decades the share of children born outside marriage has increased by 23 percentage points from 31% in 1998 to 54% in 2018.Footnote 6

In parallel with the decreasing trend in marriages, the financial arrangements of households have become more and more diverse. Joint property was the default property regime for married couples until 2010 and it has been assessed that only around 5% of married couples chose another property regime.Footnote 7 Since 2010, couples have had to choose a marital property agreement when they marry and no default option is provided. They can choose between three different property agreements. The first option is the joint property regime where all property obtained during the marriage is in joint ownership, but property owned before the marriage is considered separate. The second option is separate property, where the property obtained during the marriage belongs to the spouse who acquires it. The third option is a set-off of property accretion where property is owned separately but each spouse has the right to an equal share of the property accumulated by the other partner. Married couples can also choose a combination of different regimes.

According to Marital Property Register, around two thirds of couples marrying since 2010 have chosen joint property while one quarter chose the separate property regime.Footnote 8 Although the joint property regime is still the most prevalent, the separate property regime is gaining in importance. The reasons for this have not been investigated for Estonian couples but the literature for other countries indicates that separate money management can be linked to the partners aspiring for independence and equality (Sonnenberg 2008; Pahl 2008). Having a separate property regime implies that spouses can accumulate different levels of wealth during the marriage.

Cohabiting couples have separate finances in Estonia unless they enter into a registered partnership that allows them to choose the same property regimes as married couples. The registered partnership was introduced in Estonia quite recently, in 2016, and the public debate has associated the registered partnership mainly with same-sex couples.Footnote 9 It is not known how many of the couples that have registered their partnership have made a property arrangement, but it is apparent that the financial arrangements of cohabiting couples in Estonia are mainly separate unless they are registered as co-owners of the assets. The co-ownership of real estate is registered in the Estonian Land Register with the exact shares of each co-owner. The upshot of all this is that the differences in the wealth of partners may be quite large among cohabiting households as the share of cohabiting relationships where the property is separate in a consensual union has been increasing.

4 Data and methods

4.1 Data

This paper employs a sample of individual-level wealth data collected from administrative registers in Estonia. The administrative data are combined with the Estonian survey data from the Household Finance and Consumption Survey (HFCS) that is run by the euro area central banks. The survey data are publicly available for researchers but the administrative datafiles have restricted access because of data confidentiality. The resulting database has two unique features. First, it covers a comprehensive set of individual-level wealth items, liabilities and income types taken from various administrative registers. Second, it is merged with survey data that provide information on self-reported household structure and a rich set of control variables. Data from interviews have only been used where the information is not available in registers. The survey-based variables cover the characteristics of household structure, individual-level labour market status, tenure, immigration status and education. Since the data that we use contain almost no missing values, they are not imputed.

The advantage of the administrative data over the survey data is that they are free of problems caused by potentially selective survey response. The quality of the administrative data vs the survey data in the Estonian HFCS is analysed in a study by Meriküll and Rõõm (2019) that focuses on unit and item non-response. The study shows that the survey-based estimates for the level of wealth and wealth inequality are downward biased because of selective item non-response, i.e., because richer households are more likely to leave the questions about wealth in the survey unanswered. Imputing the missing values corrects the downward biases for most of the wealth distribution but it cannot recover the missing wealth data at the very top of the distribution and the inequality of wealth is underestimated even in the imputed survey data. This analysis has implications for our study. As we will show in the following sections, the mean gender wealth gap is mainly caused by large disparities in wealth between men and women at the very top of the wealth distribution. If we used the survey data instead of the administrative data then these disparities would be undermeasured and the resulting estimate of the gender wealth gap would be smaller than it actually is.

The information from the survey was combined with register information for all the 2220 households and 4675 household members in the final survey sample. The collection of the survey data was harmonised with the other countries participating in the HFCS. The survey data were collected by Statistics Estonia, the national statistical institution, and the administrative data were collected by the same institution in cooperation with the Statistics Department of the central bank of Estonia. The fieldwork for the survey was done in the second quarter of 2013 and the values of the wealth items were measured at the time of the interview. Wealthy households were oversampled to give better coverage of the richest households. Since register data on wealth were not available in Estonia, the oversampling was based on income, so 20% of the sample was selected from the highest income decile and 80% from the rest of the population. We perform the analysis for adults and exclude children under 16 and dependent children under 25 from the sample. Sampling weights are used throughout the paper to make the sample representative of the whole adult population.

Details about the HFCS survey data can be found in HFCN (2016). The sources of administrative data are given in Table 1. The wealth items covered by the data collected from administrative sources are real estate, household vehicles, business wealthFootnote 10, deposits, mutual funds, bonds, stocks, private pensions, bank loans, bank overdraft debts and credit card debts. The majority of the conventional components of survey-based net wealth are covered by the administrative data. The only conventional items that are not covered are cash at home, valuables, managed accounts and private loans. These items cover only a minor fraction of the total wealth, providing 1% according to the survey data. In addition, the register data do not cover assets and liabilities that are not domestically owned. According to the survey the share of foreign-owned assets in total assets was small and the same applies to liabilities. However, these items may not be sufficiently covered by the survey due to item non-response.

Table 1 shows that the participation in different types of wealth items is well captured by the administrative data, as the data on the ownership of particular items is based on official ownership records in various registers or on administrative data from commercial banks. Most importantly for the purposes of this paper, the ownership of all the wealth items is defined at the individual level. The extensive coverage of wealth items lets us investigate the gender wealth gap at a detailed level for a wide range of asset types, including business assets, and for liabilities. The value of financial assets and liabilities is precisely measured, while the value of real assets is estimated from transaction prices or prices asked for vehicles and real estate and from the value of equity capital in the balance sheets for businesses with non-traded shares (see Table 1 for a description of how each net wealth component is derived). The rates of participation in the various wealth items that are estimated using the administrative records are close to their true rates for all asset types, including financial and real assets, but the same may not apply for the values of various real assets. The transaction prices for vehicles and real estate property reflect accurately their true market value when the markets for particular types of these items are sufficiently liquid. This might be a problem for certain types of property that are seldom traded, such as real estate in scarcely populated areas or rare types of vehicles. Also, the value of equity capital for businesses estimated from register data may depart from the actual market value.

It has been shown that the wealth surveys do not cover the richest households well since data for the top tail of the wealth distribution are often missing, even in surveys that oversample the rich (Vermeulen 2016, 2018). The chance of missing out on very rich households is also a problem for the dataset used in the present paper, since although we use administrative data, the dataset covers the sample of households that participated in the HFCS survey.

The administrative data share a limitation with the survey data because some households may be hiding their wealth and the true wealth cannot be computed from official sources either. The existing literature suggests that the wealthiest part of the population keeps a share of their wealth offshore and so the register data underestimate the wealth of the richest (e.g. Zucman 2014; Roine and Waldenström 2009). This is also a problem for the survey data if individuals are consistent in their reporting to surveys and tax authorities. Roine and Waldenström (2009) demonstrate with a Swedish example that the foreign wealth not captured by administrative data can affect the top 1% of wealth shares by as much as 50%. Sweden had high wealth taxes and foreign wealth has increased substantially since capital controls were removed in the 1980s. However, this limitation is not expected to be prevalent in Estonia, where wealth is not heavily taxed. The only taxed asset is land, which is to a large extent tax-exempt and the tax rates on land are small, so there are no strong incentives to hide assets because of taxes.Footnote 11

Another limitation of the dataset is that we cannot disentangle inherited wealth from self-obtained wealth for individual household members as this information is not available in registers and is collected in the survey at the household level. Empirical evidence shows that inheritances have a role in explaining the net wealth of households in a number of western European countries (Fessler and Schürz 2018). However, it has been shown that intergenerational transfers play only a marginal role in explaining the gender wealth gap (Sierminska et al. 2010 and Bonnet et al. 2013). The share of inherited wealth in total wealth was also modest in Estonia according to the HFCS survey, as the average share of wealth that was inherited was 3.2%.

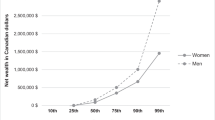

Table 2 presents the descriptive statistics on wealth for men and women across various net wealth components. The unconditional gender gap in mean net wealth is in favour of men in Estonia. Men have on average 45% more net wealth than women, and the respective mean values are 51.3 thousand euros and 35.3 thousand euros. The gender gap in mean net wealth originates from the strong concentration of wealth among men, as women have more net wealth than men in the lower quantiles and men have more net wealth than women at the top of the distribution. The Gini coefficient of net wealth is 0.81 for men and 0.71 for women. Individual-level wealth inequality is wider than household-level inequality, as the Gini coefficient of net wealth is 0.76 in the individual-level data and 0.70 in the household-level data. Earlier studies have also shown that wealth inequality is wider at the individual level than at the household level (e.g. Frick et al. 2007).

The gender wealth gap in the mean level of gross total assets is similar in magnitude to that in net wealth, but the wealth gaps differ substantially across various asset types. Men and women have quite similar mean levels of real estate and deposits, while men have more vehicles, business assets, stocks and bonds. These unconditional regularities are similar to the ones found by the related literature (Sierminska et al. 2010; Bonnet et al. 2013; D’Allessio 2018). As the household main residence contributes most to total wealth, it seems to be an important equaliser of wealth between men and women.Footnote 12

The difference in the ownership of business wealth between men and women is striking, as men have nine times as much business wealth as women. Earlier findings from German data have shown this difference to be 5.5 times (Sierminska et al. 2010). There is also evidence that women mostly get to the top of the rich list through inheritance, while men mostly get there through self-made business wealth (Edlund and Kopczuk 2009). In the Estonian sample, the difference stems mainly from the gap in the value of this item and less from differences in item participation. About 14% of men and 6% of women have business wealth, but conditional on having this item, the average value of the business is 99 thousand euros for men and 25 thousand euros for women. The gender gap in liabilities is smaller than the gender gap in net wealth, as women have 29% less in liabilities than men.

Table 3 shows the descriptive statistics for net wealth for different household types. The share of individuals living in each type of household and the share of households across different types are given in Appendix 1. The mean gender wealth gap for the whole population originates from couple-headed households, while there is no statistically significant mean gender wealth gap for single-member households or for other types of household (with two adults not forming a couple or with more than two adults). The gap is substantial in the households headed by married couples, as men have on average 89% more wealth than women in this subgroup. Among cohabiting couple-headed households the gap is also significant and large at 61%.

Wealth is more equally distributed across household types for women than for men. Married men have substantially more wealth than men belonging to other family types, as they are on average more than two times wealthier than the rest. The mean level of net wealth is the highest for married men with children.

Overall, the gap in net wealth is evident for couples and it is largest for married couples with children. These regularities point to the different penalties and gains that marriage and having children imply for men and women or to the endogenous decision to marry. It has been found that marriage creates positive wealth premiums for both men and women, but women tend to gain lower premiums in financial assets than men do (Lersch 2017).

4.2 Methods

This paper studies the factors behind the gender wealth gap and uses regression analysis and decomposition methods for this purpose. The distribution of net wealth is strongly positively skewed as a large share of assets are owned by a few wealthy households. Because of the skewness the net wealth data violate the standard assumptions of OLS estimation. The usual logarithmic transformation cannot be applied to solve this problem because the net wealth data contain many non-positive values. In the Estonian dataset used in this paper 12% of individuals have negative and 4% have zero net wealth.

One solution for such data, which we also apply in this paper, is to use an inverse hyperbolic sine (IHS) transformation. How suitable this transformation is for regression analysis with wealth data is thoroughly discussed by Pence (2006). The net wealth wi is transformed as follows:

Applying this formula transforms all the negative values to positive and results in a distribution that is close to normal.Footnote 13 The transformation resembles a linear function around zero values and a logarithmic function for larger values (see more discussion in Pence 2006). As the net wealth quickly grows to very high values (medians are typically in the tens of thousands of euros) the coefficients of the regression analysis can be interpreted as being based on logarithmic transformation for most of the net wealth distribution, starting from the 20th quantile.

Given these properties of the wealth data, this paper uses quantile regressions to analyse how the explanatory variables affect net wealth. The advantage of quantile regressions is that they are less sensitive than mean-based estimates to outlier values of the dependent variable. The unconditional quantile regression suggested by Firpo et al. (2009) is applied to estimate the size of the conditional gender wealth gap over the distribution of wealth and to decompose the raw gap into explained and unexplained parts. Like with conditional quantile regressions, the regression coefficients can have different effects across the distribution, but unlike the conditional quantile regression, the unconditional quantile regression allows straightforward interpretation in terms of the unconditional distribution of the dependent variable. Earlier studies on the gender wealth gap that use individual-level data used the inverse probability weighting proposed by DiNardo et al. (1996) for the decomposition. This approach was used by Sierminska et al. (2010) and Bonnet et al. (2013) among others.

The unconditional quantile regression is based on a recentered influence function, where a distributional statistic such as a quantile is expressed in terms of an influence function that shows how much influence or weight each observation has for that particular statistic. The influence function is weighted so that its average value equals the value of the distributional statistic and an OLS with a recentered influence function as a dependent variable can be estimated to get the effect of explanatory variables on the particular quantile. Equation (4) illustrates the specification:

where RIF(wi; Qτ) denotes the recentered influence function of the net wealth of individual i wi at the τth quantile Qτ; xk denotes an explanatory variable; α0,τ and αk,τ denote the effects of the explanatory variables on the τth quantile of net wealth; and εi,τ is an error term. The estimates are performed for nine wealth quantiles from the 10th quantile to the 90th.

Another advantage of this method is that unlike the method of inverse probability weighting developed by DiNardo et al. (1996), the RIF approach allows path-independent detailed decomposition of the contribution of each explanatory variable to the gender wealth gap (Fortin et al. 2011). We use the Oaxaca-Blinder decomposition based on the RIF regressions for men and women at a particular quantile.Footnote 14 The standard decomposition is:

where \(\overline W _{M,\tau }\) and \(\overline W _{F,\tau }\) represent the net wealth of men and women, \(\overline X _M\) and \(\overline X _F\) denote the average values of explanatory variables for men and women, and aM,τ and aF,τ are the coefficients from separate regressions for men and women. The decomposition is run for quantiles τ based on the RIF regression for the quantile so that the left-hand-side is the difference between the wealth of men and the wealth of women at a particular quantile of the wealth distribution (measured as the average value of the recentered influence function for the quantile) and the right-hand-side is derived from the coefficients for this quantile and the average values of the explanatory variables.

The decomposition analysis allows the unconditional gender wealth gap to be disentangled into two components, the explained part and the unexplained part, which are shown as the first and second terms on the right-hand-side of Eq. (5). The explained part captures the part of the gender wealth gap caused by differences in the characteristics of men and women, such as their employment status, work experience, income or education. The unexplained part captures the part of the gender wealth gap that cannot be explained by observable characteristics, and it originates from different returns on variables, e.g. self-employed men accumulating more wealth than self-employed women, etc. This part is often attributed to discrimination in wage regressions and is interpreted as differences in the wealth function of men and women in studies on wealth.

The results of the decomposition depend on the set of coefficients used as the base in the decomposition. The coefficients for men have been used as the base in this paper, which implies that the explained part is interpreted as though women had the same returns as men but different characteristics, and the unexplained part as though men had the same characteristics as women but different returns. The base coefficients for men have been used as this provides the most straightforward interpretation of how large the unexplained gender wealth gap would be if women were similar to men in their returns to characteristics.

Five groups of explanatory variables are used in the decomposition: (1) labour market experience, (2) income, (3) education, (4) demographics, and (5) geographical region. The set of explanatory variables is similar to what has been used in the related papers on the gender wealth gap. Unlike some earlier studies we do not have individual-level data on inheritance or on parents’ education, but these variables have had very little explanatory power for the gender wealth gap in earlier studies (Sierminska et al. 2010; Bonnet et al. 2013). Unlike other studies we also control for the field of education and geographical region. The field of education can be used as a proxy for financial literacy, which is not available in the dataset. It has been shown that financial knowledge affects individuals’ long-term financial planning (e.g. Lusardi 2008). Regional dummies capture regional disparities in asset accumulation because of regional differences in house prices, the availability of financial services, and other aspects.

The group of variables related to labour market experience contains the following variables: labour market status, work experience, and work experience squared. The variable describing labour market status has seven categories: worker, self-employed, unemployed, student, retired, disabled, doing domestic work, and other non-active. Work experience is measured as years worked for most of the year since the age of 16. The set of variables related to income contains the total income of the last calendar year and total income squared. Total income is gross annual income from employment, self-employment and public and private transfers in thousands of euros.

The set of explanatory variables on education covers the level of education and the field of education. The level of education is measured in three categories: primary (ISCED-97 0-2), secondary (ISCED-97 3-4) and tertiary (ISCED-97 5-6). The field of education is measured in nine broad fields of education taken from ISCED-97: 0 – General programmes, 1—Education, 2—Humanities and arts, 3—Social sciences, business and law, 4—Science, 5—Engineering, manufacturing and construction, 6—Agriculture, 7—Health and welfare, 8—Services. The demographic variables are age, age squared, immigration status, number of children (one, two and three or more), a dummy for at least one child younger than three, and marital status (single, never married; widowed; divorced; married; and cohabiting). The regional variables capture five major regions of the country at the NUTS-3 level and the degree of urbanisation (capital, other town and countryside).

5 Empirical analysis

5.1 Baseline results

First, we estimate the unconditional quantile regressions where the dependent variable is the recentered influence function (RIF) of net wealth. The net wealth is transformed by inverse hyperbolic sine applying Eq. (3). Table 4 shows the regression results for the median, estimated for the total sample and separately for men and women. Appendix 3 presents the regression results for the 10th, 20th, 30th, etc. quantiles.

The coefficient on the male dummy in column (1) of Table 4 is statistically insignificant, showing that when observable characteristics are controlled for there is no gender wealth gap among individuals at the median level of net wealth. As shown in Appendix 3, the coefficients for the male dummy variable are positive and significant for the 10th quantile and for the 80th and 90th quantiles. This implies that the conditional gender wealth gap has a U-shaped pattern over the net wealth distribution.

The estimates of the RIF regressions provided in Table 4 imply that most of the explanatory variables are either insignificantly related with the level of net wealth or have similar effects for both genders. There is only one exception to that. Men tend to have lower wealth when their labour market status is given as inactive but the same does not hold for women. This is the only variable for which the estimated coefficients for men and women are significantly different.

Several variables are strongly associated with net wealth and have similar effects for men and women. Examples of such variables include education, age, income and self-employment. Net wealth is positively related with the level of education and the estimated coefficients for secondary and tertiary education are not significantly different between men and women. Self-employed individuals have more net wealth than wage earners do and although the point estimate of the coefficient is larger for men than for women, this difference is not statistically significant. Variables that also have the same pattern for men and women are age and income. Their relationship with net wealth is concave and the estimated effects for the linear and squared terms are similar across genders.Footnote 15

Some variables are significantly associated with net wealth for one gender only. Having young children aged below three is positively related with the net wealth of women, but not men. Married men have more wealth than single men do, while women’s wealth does not differ with their marital status. There are also some differences across regions as women tend to gain more from living in richer regions like the north and west and in towns, while men tend to have more equal wealth across regions, but have a strong penalty from living in the industrial eastern region. Although the point estimates for all these variables differ across genders, these differences are not statistically significant.

We go further in studying the conditional gender wealth gap by using the decomposition method described in Eq. (5). The results of the Oaxaca-Blinder decomposition based on the RIF regressions for the subsamples of men and women are shown in Appendix 4. These estimates are presented over the net wealth quantiles.

The first row of the table in Appendix 4 depicts the values of the raw or unconditional gender wealth gaps across net wealth quantiles. The estimated raw gaps have a pattern similar to the descriptive statistics presented in Tables 2 and 3 indicating that women have more wealth than men in the lower part of the wealth distribution, while men have more wealth than women at the top values of wealth. As the standard errors are large, the raw gap is only statistically significant at the 20th and 90th quantiles and remains insignificant across most of the net wealth distribution. The explained part of the gender wealth gap is statistically significant only at the 90th quantile. Like the raw gap, the unexplained gap is estimated with large uncertainty so it is marginally significant at the 10% level only for the 30th quantile.

The gender wealth gap can be explained by the following variables: self-employment, retirement (upper part of the wealth distribution), secondary education (upper part of the wealth distribution), training in engineering (lower part of the wealth distribution) and marriage (middle part of the distribution). Men are more likely to be self-employed than women and are therefore wealthier. In the upper part of the wealth distribution, women are more likely to be retired than men. As being retired is associated with lower wealth, taking this into account helps to explain the gender wealth gap. Men are more likely to have training in engineering, which helps to explain the wealth gap in the lower part of the distribution.

The variables that widen the unexplained gender wealth gap (i.e. for which the estimated effects for the explained part are negative) are tertiary education, age, and the labour market status of being disabled (lower part of the wealth distribution). Women are more likely to have tertiary education and are in general older than men because their life expectancy is higher. Taking account of these factors increases the unexplained part of the wealth gap. Men in the lower part of the wealth distribution are more likely to be inactive in the labour market because of disability. As this labour market status is associated with lower wealth, taking this into account increases the unexplained part of the gender wealth gap.

The variables that contribute positively to the unexplained part of the wealth gap are self-employment status (upper part of the wealth distribution) and training in science, engineering or agriculture (lower part of the distribution). The variables that contribute negatively to the unexplained part of the wealth gap are time in employment (upper part of the wealth distribution) and age (lower part). The effects for regions are also occasionally significant, but with opposite signs.

The results of the decomposition based on the IHS-transformed net wealth are summarised in Fig. 1, which presents the estimated raw and unexplained gaps across quantiles of the net wealth distribution. The unexplained gender wealth gaps are mostly close to the raw gaps, resembling a U-shape, like the raw gap. That the unexplained gaps follow the pattern of the raw gaps shows the limited and often offsetting explanatory power of the observed explanatory variables. The point estimates of the gaps tend to be negative in the lower quantiles and turn positive in the upper part of the distribution, but they are mostly insignificant. The raw gaps are statistically significant only at the 20th quantile and from the 90th quantile upwards.

Raw and unexplained gender wealth gaps across quantiles of net wealth distribution, RIF based decomposition (n = 4120). The horizontal axis depicts the quantiles of net wealth. The vertical axis shows the estimated values of the raw gap and the unexplained gap. The raw gap is the difference between men and women in IHS-transformed net wealth at each quantile, estimated separately from the net wealth distributions of men and women. The unexplained gap is estimated using the Oaxaca-Blinder decomposition. Confidence bounds refer to statistical significance at 10%. The vertical scale has been trimmed at −2.5 and at 2, so some confidence bounds are not shown in their full extension

Women have about 180% more wealth than men at the 20th quantile, but this large gap in relative terms corresponds to a small difference in euros.Footnote 16 Men have significantly more wealth than women at the upper end of the net wealth distribution. Since the differences at the top tail have a strong impact on the estimated gap at the mean level, we give a more detailed view of the gaps at this end of the distribution, presenting the 95th and 99th quantile estimates in addition to the 90th quantile. Men have about 19% more wealth than women at the 90th quantile and the gap increases towards the upper end of the distribution, reaching 44% at the 99th quantile.Footnote 17 The unexplained gender gap is never statistically significant at the 95% confidence level and is only marginally significant at the 90% level at the 30th quantile, where it is in favour of women.

At the top of the net wealth distribution the raw gap is statistically significant, while the unexplained gap is insignificant. This implies that the gap can be explained by control variables. The detailed results of the decomposition (see Appendix 4) show that the only variable that has a significant positive effect on the explained part of the wealth gap at the upper end of the distribution is the indicator of self-employment. Men are more likely to be self-employed than women, especially among wealthier quantiles. The regression results presented in Table 4 showed that self-employed workers are generally wealthier than wage earners or inactive people are. Therefore accounting for self-employment diminishes the unexplained part of the gender wealth gap.

As a robustness test, we performed the RIF-based decomposition of the gender wealth gap for a subsample that did not include the self-employed. The results of this estimation are presented in Appendix 6. When the self-employed are left out of the sample, the estimated raw gaps at the top tail of the distribution become smaller and the unexplained gaps are insignificant. This confirms the implications from the analysis above that self-employment is an important reason for differences in wealth between genders at the upper end of the wealth distribution.

We confirm the finding of the earlier papers by Sierminska et al. (2010) and Bonnet et al. (2013) that the most relevant determinants of the gender wealth gap are related to the labour market. Additionally, we find that an important reason why men have more wealth is that they are more likely to be entrepreneurs or self-employed. Unlike the earlier studies we find that education also has explanatory power for the wealth gap. Men are more likely to have secondary education than women and women are more likely to have tertiary education than men. The net effect of time spent in education is in favour of women and reduces the gender gap in the upper part of the wage distribution. Like Sierminska et al. (2010) we find that there are parts of the wealth distribution where women have more wealth than men, conditional on the observed characteristics.

5.2 Results by different components of net wealth

As shown in Table 2 in the previous section, the allocation of resources within households can differ substantially for different wealth items. Real estate is mostly owned in equal shares by married couples for example, while men own much more in business assets than women do. Chang (2010) points out that men and women have different compositions of wealth, resulting in different wealth building rates.

Figure 2 illustrates the composition of assets over deciles of gross assets, showing that the asset structure for men is more diversified than that for women. The level of net wealth is negative at the first decile and only about 100 EUR at the second decile. Given this, it is not surprising that bank deposits make up most of the assets for individuals in the first two deciles of the gross asset distribution and this holds for both genders. The asset structures for men and women start to diverge from the third decile. The differences in the composition of assets are largest in the third and fourth deciles and in the tenth decile.

Vehicles make up a substantially larger share of assets for men than for women in the lower half of the distribution, while business wealth comprises a larger share of the assets of men than of those of women in the upper two deciles of the distribution. The difference in holdings of business assets between genders is especially large for the richest decile. It is also apparent that the wealth of men is more diversified, while women hold their wealth mostly in the form of two assets—real estate and deposits. Men are also more likely to own stocks, while women hold a larger share of their wealth as private pensions, but these differences are not large, since the holdings of stocks and private pension funds are small compared to the holdings of other asset classes.

Next we look at whether gender wealth gaps are different for various components of net wealth. We estimate the raw and unexplained gender wealth gaps for various net wealth components. Net wealth was negative for part of the sample, but the values of different wealth items are always non-negative. Therefore we take logarithms of the values of different wealth items instead of using IHS transformation to tackle the problems associated with non-normal distributions of those items.

The participation in individual wealth components is quite heterogeneous. Relatively few people have stocks, bonds and mutual fund holdings, while most people have real estate and deposits. The RIF based decomposition can only be run for observations with non-zero values for a particular asset, so we perform the analysis for wealth items conditional on participation in the item. The differences in the values of the assets are much larger than the differences in the participation, so we focus on comparing the values of the asset components.

Figure 3 presents the findings. The patterns of the raw and unexplained gaps are similar for vehicles, business assets, private pensions, loans, and bank overdrafts and credit card debt, indicating that the observed characteristics do not explain the wealth difference between men and women for these net wealth items. There are also cases where the explanatory variables can explain the difference better. The raw gaps are significantly different from zero but the unexplained gaps are insignificant for real estate in the upper part of the distribution and for deposits and loans in the middle of the distribution. Differences in characteristics explain why women’s deposits and men’s real estate holdings and loans are larger in those cases. The unexplained gap is significant for stocks and bonds in the middle part of the distribution, implying that women with the same characteristics hold less risky financial assets than men do.

The gender gaps of various net wealth items, RIF-based decomposition. The vertical scale is the difference between the logarithmic values of a given wealth item for men and women. The wealth gaps are presented conditional on participation. Confidence bounds show statistical significance at 10%. Sample sizes: Real estate n = 2698, vehicles n = 1359, businesses n = 441, deposits n = 3720, stocks and bonds n = 157, private pensions n = 655, loans n = 1444, bank overdraft and credit card debt n = 1026

The unexplained gender wealth gaps for different wealth items are quite divergent. The unexplained gap is statistically insignificant for real estate and loans for all net wealth quantiles. For the other real assets (vehicles and business wealth) the unexplained gap is in favour of men throughout most of the distribution, and it is strongly statistically significant and large in magnitude. When significant, the value of the gap ranges from about 15 to 30% for vehicles and from approximately 70 to 125% for business assets. The share of business wealth in total real wealth is larger in Estonia than the euro area average and it is an important source of wealth inequality.Footnote 18 Edlund and Kopczuk (2009) highlight the importance of business wealth in the raw gender wealth gap at the very top of the wealth distribution in the US. We cannot compare the results with those of other countries explicitly as no study has explored the role of business wealth,Footnote 19 but our findings suggest that it is important not to neglect this wealth item when analysing the gender wealth gaps.

The unexplained gaps for financial assets are mostly in favour of women for deposits, but in favour of men for other, more risky financial assets and for private pensions. Men are accumulating more private pension wealth than women with similar characteristics, which implies that men will have more resources in their retirement than women.

The differences between men and women in deposit holdings are large. Women have about 50% more in deposits than men in the lower half of the distribution and the raw gap is significant up to the 70th quantile. Accounting for observable characteristics renders the gap insignificant for the upper quintiles, but it still remains statistically significant and has the same magnitude as the raw gap in the three lowest quintiles.

The raw gap for other financial assets (stocks and bonds) is insignificant, but the unexplained gap is in favour of men in the middle part and upper end of the distribution. When significant, the unexplained gap is large in magnitude, in the range of about 100 to 180%. These findings highlight possible differences in risk aversion between men and women. Given the observable characteristics, it is apparent that women save more in deposits and men more in other financial assets such as stocks and bonds and voluntary pension schemes that are based on riskier instruments. The upshot of the estimations is that the gender wealth gap varies across asset types and the preference of men for riskier assets gives them greater capacity for building wealth.

The differences in the structure of financial assets between men and women indicate that women could be more risk averse and so may make safer investments. We run additional estimations to investigate whether differences in risk preferences help to explain gender gaps in the holdings of various assets. The Estonian HFCS survey contains a variable measuring risk aversion. It is a categorical variable assessing the extent of financial risks people are willing to take when investing or saving on a scale of four options.Footnote 20 We use this measure as an additional control variable in the model and re-estimate the gender wealth gap decompositions across different wealth components. Women are more risk averse than men, as 82% of women are not willing to take any financial risk, while the same applies to 68% of men. The response rate for the related question is low and we lose more than 20% of observations when we include this variable in the model.

The estimates with the risk aversion variable added to the set of observable characteristics in the decomposition are given in Appendix 5. The results do not change substantially for most of the net wealth components from the estimates presented in Fig. 3. The only notable change is that the unexplained gap for business assets becomes insignificant for most of the wealth distribution, but this results from the omission of 20% of the sample from the regression and not from the additional explanatory power of the risk aversion variable. However, men have more stocks and bonds and women more deposits even after risk aversion is controlled for. These findings imply that either the risk aversion measure that we use does not capture differences in risk aversion to the full extentFootnote 21 or there could be other factors that lead men and women to invest and save differently, which could be related to financial literacy (e.g. Lusardi and Mitchell 2008), social norms or gender identity (Akerlof and Kranton 2000 and Bertrand 2010).

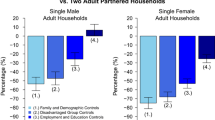

5.3 Results by household type

In this subsection we show the results of the net wealth decomposition for different household types. To the best of our knowledge no previous studies have performed such decomposition. The descriptive statistics in Table 3 showed that there was a large and statistically significant unconditional gender gap in mean net wealth in couple-headed households, but for all other household types the differences in the mean levels of net wealth were insignificant. We assess the extent of the raw and unexplained gaps for different household types across net wealth quantiles and the results are presented in Table 5. These estimates show that, as with the unconditional findings for mean wealth, the raw gaps for different quantiles are significantly positive throughout most of the net wealth distribution for households with married couples, ranging from 19 to 58%. The raw gaps are also positive for cohabiting couples, but significant only for the lower part of the distribution, between the 20th and 40th quintiles. When significant, these differences are large in relative terms, ranging from 160 to 950%, but since they are estimated for the lower part of the distribution the associated gaps in euros are modest.

While the unconditional gender wealth gaps are in favour of men in couple-headed households, they are negative, i.e. in favour of women, for households with one adult member and for other types of household (with two adults who are not a couple or with three or more adults). The raw gaps are significantly negative between the 20th and 40th quintiles of the net wealth distribution for single-member households and between the 30th and 70th quintiles for other types of household.

These diverging findings on unconditional gender wealth gaps for couple-headed households vs single people or other types of household are at least partially caused by the different selection of men and women into marriage (or into a cohabiting relationship). An overview of the various reasons for this is given in Schneebaum et al. (2018). They discuss the factors that contribute to selection into being single, but a similar reasoning can be applied for selection into marriage. First, there are age-related differences. Married men are usually older than women, while women tend to live longer and so are more likely to be widowed. Second, preferences for relationship status may differ between men and women. Third, social norms and customs for household formation and the decision to have children may differ across genders and may vary across different countries as well. This all affects the selection into marriage differently for men and for women (see Schneebaum et al. (2018) for further discussion).

Marriage leads to greater wealth but is also endogenous with respect to wealth. It has been shown that being married leads to faster accumulation of wealth independently of other characteristics (Ruel and Hauser 2013), but at the same time wealthier individuals or people who have better potential for wealth accumulation are more likely to marry. If this form of selection associated with marriage is stronger for men than for women then it will lead to larger wealth differences in favour of men among married couples than among other types of household, causing a pattern that is similar to the evidence presented in Tables 3 and 5.

When the selection into marriage is related to observable characteristics such as higher income, being employed in occupations with greater earning potential, higher age, etc. then controlling for these characteristics in regressions should be able to explain the unconditional wealth gaps, i.e. the unexplained parts of the wealth gaps should become insignificant. As is evident from the figures presented in Table 5, this is indeed mostly the case.

Single-member households are more heterogeneous than partner-headed households as this group consists of single people who have never married and those who are widowed or divorced. This means that the conditional wealth gap is more informative than the unconditional gap. The raw gaps are negative for the 20th, 30th and 40th quintiles, and very sizeable, ranging from about 150 to 500%. After observable characteristics are controlled for, the negative wealth gaps in the lower part of the distribution are mostly rendered insignificant, except at the 20th quantile. In the upper part of the distribution the unexplained gap is significantly positive for the 80th quantile. So when we account for observable characteristics, the unexplained gaps are more in favour of men than the raw gaps are. This implies that single women possess characteristics that help them accumulate wealth better than single men do (e.g. higher education). Taking into account the differences in these characteristics renders the unexplained gaps mostly insignificant.

The finding that accounting for observable characteristics for single-headed households renders the unexplained gap more in favour of men is similar to the finding of the study by Schmidt and Sevak (2006) focusing on single-member households only. They find that the observed wealth of single men and women is similar, but when observable characteristics are controlled for, women’s wealth drops well below that of men.

The unexplained gaps for partner-headed households are mostly statistically insignificant, indicating that differences in characteristics can explain the wealth gap between male and female partners. The wealth gap remains unexplained and large for some less wealthy cohabiting partners, but it is well explained for the wealthiest married couples, for whom the gap is the largest in monetary terms. The characteristics that help to explain the gap for married couples are self-employment status and age. Married men are more frequently self-employed and are older than married women, both of which contribute to their greater wealth. The factor that contributes negatively to the gender wealth gap is tertiary education. Women are highly educated more frequently than men are, which makes their wealth larger. Accounting for this widens the unexplained part of the gender wealth gap.Footnote 22 The total contribution of characteristics is positive and statistically significant, indicating that among married couples women have characteristics that are associated with lower wealth accumulation, and this helps to explain a large part of their unconditional gender gap in wealth.

The same characteristics help to explain the gender gap for cohabiting partners and for married couples. Additional factors that contribute positively to explaining the gap are income and having training in health. Men have higher incomes and are less frequently trained in health, and these both contribute positively to men having more wealth. Accounting for tenure widens the unexplained gap in the lower part of the wealth distribution.

Among households that have two adult members who are not partners or three or more adult members, the unexplained gender wealth gaps are negative and statistically significant for most of the middle part of the distribution (from the 30th quantile to the 70th quantile), and are large in magnitude, ranging from about 60–340%. The unconditional and conditional wealth gaps are quite similar for these households. Although there are differences in characteristics between men and women, some of them contribute positively and others negatively to explaining the gap. These positive and negative effects cancel each other out, so in total the explained part of the gap is never statistically significant.

The large gender wealth gap in partner-headed households has been identified by Sierminska et al. (2010) on the basis of German data. They find the raw gap to be larger for cohabiting couples than for married couples but they do not decompose the wealth gaps for different household types. Our results imply that although the raw gap is significantly in favour of men in married couples, this difference disappears when the observable characteristics such as age and being self-employed are accounted for.

Additionally, our findings point to problems with 50–50 splits in the imputation of individual-level wealth for married couples. Further investigation of the distribution of assets within a household reveals that men own more than 75% of within-household assets in 15% of married couples and women own more than 75% of within-household assets in only 8% of married couples. In order to capture wealth differences within a household, it is crucial to use individual-level wealth data.

To summarise, the raw gender gap for couple-headed households is in favour of men, and more strongly so for married couples. For other types of household the raw gap is to a large extent in favour of women. Accounting for observable characteristics renders the unexplained parts of the gaps mostly or entirely insignificant. It appears that women in partner-headed households have characteristics that are worse for wealth accumulation than those of men, and accounting for this eliminates the gender wealth gap. In other types of household it is the other way around, as women generally possess the characteristics that are associated with faster wealth accumulation and taking this into account reduces the gaps in favour of women.

It is important to highlight that even when there is no unexplained gap for couples, the raw gap suggests that households do not pool their resources fully, as was also indicated by the earlier literature (Ashby and Burgoyne 2009). If households were pooling all their resources, we would observe similar wealth structures for men and women despite their differences in income.

6 Discussion: what is causing the differences in wealth accumulation between men and women?

Earlier literature has shown that there are large explained and unexplained gender wage gaps in Estonia that are in favour of men throughout the wage distribution (see e.g. Christofides et al. 2013). This raises the question of why this substantial gender gap in wages does not transfer into the gender gap in wealth. This section considers this question and analyses the differences between men and women in some factors that contribute to wealth accumulation, such as income and consumption.

As shown in Section 2, the differences between the wealth functions of men and women may be caused by differences in inheritance or gifts received, in the composition of wealth, in income, or in consumption. In what follows, we discuss the relevance of each of these factors. The limitation of this analysis is that we have cross-sectional data, so we cannot observe income and consumption patterns in the past. Even so, if the differences in income and consumption habits between men and women are persistent in time, the current income and consumption gaps will be correlated with their past values and can shed light on the possible origins of the wealth gaps.

First, we look at the role of gifts and inheritances. These estimations are based on the data from the Estonian HFCS. See Appendix 7 for an overview of the related block of questions. The data for these items are backward-looking in the HFCS, so we can learn about gifts and inheritances received in the past.Footnote 23 There is no practice in Estonia of discriminating between heirs by their gender. The Estonian HFCS collects data about inheritances and gifts at the household level, and the estimates show that there are no statistically significant differences in single-member households between men and women in inheriting the household main residence or receiving it as a gift, or in getting any other valuable gifts or inheritances (the estimations are available upon request).

Second, the composition of wealth in Estonia varies across genders, as was shown in Subsection 4.2. Men hold more of their wealth in the form of risky assets such as business assets, stocks and pension funds, whereas women’s asset holdings mostly consist of deposits and real estate. Since men hold riskier assets, they tend to accumulate more wealth, because return is positively related with risk in the long term. Risk tolerance has proven to be one of the factors that determine the different investment strategies of men and women (see e.g. Almenberg and Dreber 2015). We showed in Subsection 4.2 that the differences in financial asset holdings cannot be explained by differences in the observed risk aversion of men and women. So either our risk aversion variable is a poor proxy of actual risk aversion or there may be other factors such as financial literacy (see e.g. Lusardi and Mitchell 2008) that lead men to invest more in stocks and women to accumulate more deposits.

Next we analyse the gender-based differences in income. Figure 4 presents the gender gap in gross income over its distribution and includes all the components of income: wage income, self-employment income, capital gains, pensions, and transfers. The gender pay gap is usually estimated for wages but we estimate the gap for total income, including for those who have no wage income.

The gender gap in quantiles of gross income, RIF based decomposition (n = 4120). Notes: The results for the 10th quantile have not been calculated as men have zero income at that quantile. The gap is strongly in favour of women there, although the level of income is very low. The confidence bounds indicate statistical significance at 10%

The pattern of the raw gender income gap over the distribution is similar to that for the gender gap in net wealth, as it is in favour of women in the lower part of the distribution where social transfers are the most important part of income and in favour of men in the upper part of the distribution where wages contribute the most to disposable income. Comparing Figs. 4 and 1 indicates that the raw gaps are much more often statistically significant and more persistently in favour of men for income than for net wealth. In the 90th quantile the raw gender income gap is close to 50% while the gender wealth gap is about 20%. The difference between unexplained gaps is even more pronounced. While the unexplained gaps for net wealth are never significant at the 95% level, the unexplained gaps for income are positive and large in magnitude throughout the upper half of the income distribution. This suggests that while there is a tendency for the gender gap in income to be transferred to the gender gap in wealth, women seem to accumulate wealth better than men do, given their level of income. This finding suggests that women either save more relative to their income or benefit from the intra-household division of assets. To understand the differences in saving patterns, we next investigate differences in the propensity to consume across income deciles.