Abstract

This paper surveys the monopoly regulation literature with the Bayesian approach. The literature builds on Baron and Myerson’s seminal 1982 paper, entitled “Regulating a Monopolist with Unknown Costs.” After presenting their contributions to the regulation literature, the paper discusses the main criticisms of their model, relating to either informational or commitment assumptions about the Bayesian regulator. The paper also briefly reviews some non-Bayesian incentive schemes, price-cap regulation, and several extensions and applications of Baron and Myerson’s regulatory model to highlight the evolution and scope of the new economics of regulation after 40 years.

Similar content being viewed by others

Availability of data and materials

Not applicable.

Notes

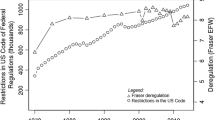

Vogelsang (2002) reports that twenty years after the emergence of the Bayesian approach the most popular regulatory mechanism in the U.S. telecommunication sector is price cap regulation which is a hybrid between Bayesian and non-Bayesian mechanisms. In Sect. 5, we will briefly review some non-Bayesian mechanisms and price-cap regulation.

Littlechild (2009, p. 96) reports that “the mean value of a rate reduction was eight times larger with a stipulation than without; the median value was more than 50 times larger”.

See Armstrong and Sappington (2007, pp. 1583–1586) for a brief review and discussion.

In related works, Cantner and Kuhn (1999) and Saglam (2019) consider a simpler setup, a one-period extension of the B–M model, to understand R &D incentives of a regulated monopolist. Whereas Cantner and Kuhn (1999) consider, like Baron and Besanko (1984a, 1984b), both the case of unobservable and non-contractible R &D investment and the case of observable and contractible R &D investment, Saglam (2019) studies the remaining possibility, namely observable but non-contractible investment. Differing from earlier studies, Lewis and Yildirim (2002) consider a regulated multi-period industry where the cost-reducing innovation occurs not due to research and development investment of the monopolist but because of its ability of learning by doing.

References

Aguirre, I., & Beitia, A. (2008). Regulating a multiproduct monopolist with unknown demand: Cross-subsidization and countervailing incentives. Journal of Institutional and Theoretical Economics, 164(4), 652–675.

Armstrong, M., & Rochet, J. C. (1999). Multi-dimensional screening: A user’s guide. European Economic Review, 43, 959–979.

Armstrong, M., & Sappington, D. (2007). Recent developments in the theory of regulation. In M. Armstrong & R. Porter (Eds.), Handbook of industrial organization (Vol. 3, pp. 1557–1700). Elsevier.

Armstrong, M., & Vickers, J. (2000). Multiproduct price regulation under asymmetric information. Journal of Industrial Economics, 48(2), 137–160.

Baron, D. P. (1981). Price regulation, product quality, and asymmetric information. American Economic Review, 71(1), 212–220.

Baron, D. P. (1985). Regulation of prices and pollution under incomplete information. Journal of Public Economics, 28, 211–231.

Baron, D. P., & Besanko, D. (1984). Regulation, asymmetric information, and auditing. RAND Journal of Economics, 15, 447–470.

Baron, D. P., & Besanko, D. (1984). Regulation and information in a continuing relationship. Information Economics and Policy, 1(3), 267–302.

Baron, D., & Myerson, R. (1982). Regulating a monopolist with unknown costs. Econometrica, 50, 911–930.

Baumol, W. J. (1982). Productivity adjustment clauses and rate adjustment for inflation. Public Utilities Fortnightly, 22, 11–18.

Beaudry, P. (1994). Why an informed principal may leave rents to an agent. International Economic Review, 35(4), 821–832.

Bedard, N. C. (2017). The strategically ignorant principal. Games and Economic Behavior, 102, 548–561.

Bernstein, J. I., & Sappington, D. E. M. (1999). Setting the X factor in price-cap regulation plans. Journal of Regulatory Economics, 16, 5–26.

Besanko, D., Donnenfeld, S., & White, L. J. (1987). Monopoly and quality distortion: Effects and remedies. The Quarterly Journal of Economics, 102(4), 743–768.

Bhattacharjea, A. (1998). Optimal trade policy when a foreign monopolist has unknown costs: An incentive-compatible approach. Indian Economic Review, New Series, 33(1), 97–104.

Blackmon, B. G. (1992). The incremental surplus subsidy and rate of return regulation. Journal of Regulatory Economics, 4, 187–196.

Bolton, P., & Dewatripont, M. (2005). Contract theory. MIT Press.

Bower, A. (1993). Procurement policy and contracting efficiency. International Economic Review, 34(4), 873–901.

Brainard, S. L., & Martimort, D. (1996). Strategic trade policy design with asymmetric information and public contracts. The Review of Economic Studies, 63(1), 81–105.

Brennan, T. (1989). Regulating by ‘capping prices’. Journal of Regulatory Economics, 1(2), 133–147.

Cantner, U., & Kuhn, T. (1999). Optimal regulation of technical progress in natural monopolies with asymmetric information. Review of Economic Design, 4, 191–204.

Chade, H., & Silvers, R. (2002). Informed principal, moral hazard, and the value of a more informative technology. Economics Letters, 74, 291–300.

Chu, L., & Sappington, D. (2007). Simple cost-sharing contracts. American Economic Review, 97(1), 419–428.

Crémer, J. (1995). Arm’s length relationships. Quarterly Journal of Economics, 8(2–3), 377–387.

Crémer, J. (2010). Arm’s length relationships without moral hazard. Journal of the European Economic Association, 110(2), 275–296.

Crew, M. A., & Kleindorfer, P. R. (1986). The economics of public utility regulation. MIT Press.

Crew, M. A., & Kleindorfer, P. R. (2002). Regulatory economics: Twenty years of progress? Journal of Regulatory Economics, 21, 5–22.

Dana, J. D. (1993). The organization and scope of agents: Regulating multi-product industries. Journal of Economic Theory, 59, 288–310.

Dasgupta, P. S., Hammond, P. J., & Maskin, E. S. (1979). The implementation of social choice rules: Some results on incentive compatibility. Review of Economic Studies, 46, 185–216.

Dewatripont, M., Jewitt, I., & Tirole, J. (1999). The economics of career concerns, part I: Comparing information structures. Review of Economic Studies, 66(1), 183–198.

Dupuit, J. (1952). On the measurement of the utility of public works. International Economics Papers, 2, 83–110 (translated by R. H. Barback from “de la mesure de l’utilite des travaux publics,” Annales des Ponts et Chaussees, 2nd Series, Vol. 8, 1844).

Ellis, G. M. (1992). Incentive compatible environmental regulations. Natural Resource Modeling, 6(3), 225–256.

Finsinger, J., & Vogelsang, I. (1981). Alternative institutional frameworks for price incentive mechanisms. Kyklos, 34(3), 338–404.

Finsinger, J., & Vogelsang, I. (1982). Performance indices for public enterprises. In L. Jones (Ed.), Public enterprise in less developed countries. Cambridge University Press.

Giannakis, D., Jasmsb, T., & Pollitt, M. (2004). Benchmarking and incentive regulation of quality service: An application to the UK distribution utilities. Energy Policy, 33(17), 2256–2271.

Gresik, T. A., & Nelson, D. R. (1994). Incentive compatible regulation of a foreign-owned subsidiary. Journal of International Economics, 36, 309–331.

Guesnerie, R., & Laffont, J. J. (1984). A complete solution to a class of principal-agent problems with an application to the control of a self-managed firm. Journal of Public Economics, 25, 329–369.

Harris, M., & Townsend, R. M. (1981). Resource allocation under asymmetric Information. Econometrica, 49, 33–64.

Hotelling, H. (1938). The general welfare in relation to problems of taxation and of railway and utility rates. Econometrica, 6, 242–269.

Işık, M. (2007). Three essays in industrial organization. Ph.D. thesis, Economics Department, Bogazici University.

Jasmsb, T., & Pollitt, M. (2001). Benchmarking and regulation: International electricity experience. Utilities Policy, 9, 107–130.

Jasmsb, T., & Pollitt, M. (2003). International benchmarking and regulation: An application to European electricity distribution utilities. Energy Policy, 31(15), 1609–1622.

Jebjerg, L., & Lando, H. (1997). Regulating a polluting firm under asymmetric information. Environmental and Resource Economics, 10, 267–284.

Joskow, P.L. (2014). Incentive regulation in theory and practice: Electricity distribution and transmission networks. In Economic regulation and its reform: What have we learned? (pp. 291–344). National Bureau of Economic Research, Inc.

Kaya, A. (2010). When does it pay to get informed? International Economic Review, 51(2), 533–551.

Kim, J. C., & Jung, C. Y. (1995). Regulating a multi-product monopolist. Journal of Regulatory Economics, 8, 299–307.

Koray, S., & Saglam, I. (1995). Corruption and learning in regulating a monopolist with unknown costs. Research Paper, Bilkent University, Ankara, Turkey.

Koray, S., & Saglam, I. (1999). Bayesian regulatory mechanisms: Corruption and learning. In M. Kaser & M. R. Sertel (Eds.), Contemporary economic issues, volume 4: Economic behavior and design. MacMillan Press.

Koray, S., & Saglam, I. (2005). The need for regulating a Bayesian regulator. Journal of Regulatory Economics, 28(1), 5–21.

Koray, S., & Saglam, I. (2007). Learning in Bayesian regulation: Desirable or undesirable? Economics Bulletin, 3(12), 1–10.

Koray, S., & Sertel, M. R. (1990). Pretend-but-perform regulation and limit pricing. European Journal of Political Economy, 6, 451–472.

Laffont, J. J. (1994). The new economics of regulation ten years after. Econometrica, 62, 507–538.

Laffont, J. J., & Martimort, D. (2002). The theory of incentives: The principal-agent model. Princeton University Press.

Laffont, J. J., Maskin, E., & Rochet, J. C. (1987). Optimal nonlinear pricing with two-dimensional characteristics. In T. Groves, R. Rander, & S. Reiter (Eds.), Information incentives and economic mechanisms. University of Minnesota Press.

Laffont, J. J., & Rochet, J. C. (1998). Regulation of a risk-averse firm. Games and Economic Behavior, 25, 149–173.

Laffont, J. J., & Tirole, J. (1986). Using cost observation to regulate firms. Journal of Political Economy, 94, 614–641.

Laffont, J. J., & Tirole, J. (1990). Adverse selection and renegotiation in procurement. Review of Economic Studies, 57(4), 597–626.

Laffont, J. J., & Tirole, J. (1991). The politics of government decision-making: A theory of regulatory capture. Quarterly Journal of Economics, 106(4), 1089–1127.

Laffont, J. J., & Tirole, J. (1993). Theory of incentives in procurement and regulation. MIT Press.

Lantz, B. (2007). A non-Bayesian piecewise linear approximation adjustment process for incentive regulation. Information Economics and Policy, 19, 95–101.

Lewis, T. R., & Sappington, D. E. M. (1988). Regulating a monopolist with unknown demand. American Economic Review, 78(5), 986–998.

Lewis, T. R., & Sappington, D. E. M. (1988). Regulating a monopolist with unknown demand and cost functions. Rand Journal of Economics, 18(3), 438–457.

Lewis, T. R., & Sappington, D. E. M. (1989). Countervailing incentives in agency problems. Journal of Economic Theory, 49, 294–313.

Lewis, T. R., & Yildirim, H. (2002). Learning by doing and dynamic regulation. The Rand Journal of Economics, 33(1), 22–36.

Littlechild, S. C. (1983). Regulation of British telecommunication’s profitability. Report to the Secretary of the State, Department of Industry, London: Her Majesty’s Stationery Office.

Littlechild, S. (2009). Stipulated settlements, the consumer advocate and utility regulation in Florida. Journal of Regulatory Economics, 35(1), 96–109.

Loeb, M., & Magat, W. A. (1979). A decentralized method for utility regulation. Journal of Law and Economics, 22, 399–404.

McAfee, R. P., & McMillan, J. (1988). Multidimensional incentive-compatibility and mechanism design. Journal of Economic Theory, 46, 335–354.

Myerson, R. B. (1979). Incentive compatibility and the bargaining problem. Econometrica, 47, 61–74.

Neu, W. (1993). Allocative inefficiency properties of price-cap regulation. Journal of Regulatory Economics, 5(2), 159–182.

Nosal, E. (2006). Information gathering by a principal. International Economic Review, 47, 1093–1111.

Posner, R. A. (1974). Theories of economic regulation. Bell Journal of Economics, 5, 335–358.

Prusa, T. (1990). An incentive compatible approach to the transfer pricing problem. Journal of International Economics, 28, 155–172.

Riordan, M. H. (1984). On delegating price authority to a regulated firm. RAND Journal of Economics, 15(1), 108–115.

Riordan, M. H., & Sappington, D. E. M. (1987). Awarding monopoly franchises. American Economic Review, 77(3), 375–387.

Rochet, J. C. (2009). Monopoly regulation without the Spence–Mirrlees assumption. Journal of Mathematical Economics, 45(9–10), 693–700.

Rogerson, W. (2003). Simple menus of contracts in cost-based procurement and regulation. American Economic Review, 93(3), 919–926.

Saglam, I. (2017). Regulating a manager-controlled natural monopoly with unknown costs. Managerial and Decision Economics, 38(6), 792–805.

Saglam, I. (2019). The effect of awareness and observability on the non-contractible investment of a regulated natural monopoly. Journal of Industry, Competition and Trade, 19(4), 617–639.

Saglam, I. (2022). Self-regulation under asymmetric cost information. Economia e Politica Industriale: Journal of Industrial and Business Economics, 49(2), 335–368.

Saglam, I. (2022). Pareto gains of predonation in monopoly regulation. Journal of Public Economic Theory, 24(4), 817–854.

Saglam, I. (2023). Incentives of a monopolist for innovation under regulatory threat. Economics of Governance, 24(1), 41–66.

Sappington, D. (1982). Optimal regulation of research and development under imperfect information The. Bell Journal of Economics, 13(2), 354–368.

Sappington, D. (1983). Optimal regulation of a multiproduct monopoly with unknown technological capabilities. The Bell Journal of Economics, 14(2), 453–463.

Sappington, D., & Sibley, D. (1988). Regulating without cost information: The incremental surplus subsidy scheme. International Economic Review, 29(2), 297–306.

Sibley, D. (1989). Asymmetric information, incentives and price-cap regulation. The RAND Journal of Economics, 20(3), 392–404.

Spulber, D. F. (1988). Optimal environmental regulation under asymmetric information. Journal of Public Economics, 35, 163–181.

Tullock, G. (1967). The welfare costs of tariffs, monopolies, and theft. Western Economic Journal, 5, 224–232.

Vogelsang, I. (2004). Transmission pricing and performance-based regulation, presented at Carnegie Mellon Conference on Electricity Transmission in Deregulated Markets: Challenges, Opportunities, and Necessary R &D Agenda: Pittsburgh, December.

Vogelsang, I. (1988). A little paradox in the design of regulatory mechanisms. International Economic Review, 29, 467–476.

Vogelsang, I. (1989). Price cap regulation of telecommunication services: A long-run approach. In M. Crew (Ed.), Deregulation and diversification of utilities. Kluwer Academic Publishers.

Vogelsang, I. (1990). Optional two-part tariffs constrained by price caps. Economics Letters, 33, 287–292.

Vogelsang, I. (2002). Incentive regulation and competition in public utility markets: A 20-year perspective. Journal of Regulatory Economics, 22, 5–27.

Vogelsang, I., & Finsinger, J. (1979). A regulatory adjustment process for optimal pricing by multiproduct monopoly firms. Bell Journal of Economics, 10(1), 151–171.

Acknowledgements

The author is very grateful to an anonymous reviewer for many suggestions and corrections that have greatly improved this paper. The usual disclaimer applies.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

The single author IS has the full contribution.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Ethical approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Saglam, I. The Bayesian approach to monopoly regulation after 40 years. J Regul Econ 65, 108–136 (2024). https://doi.org/10.1007/s11149-023-09470-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-023-09470-1