Abstract

Ever-increasing data consumption and evolving technologies make cooperation on investments and network sharing crucial issues in mobile telecommunications markets. In this paper, we analyze incentives for cooperation and investment in product quality. Generalizing quality investment in a Hotelling duopoly model, we allow investment to have heterogeneous effects on consumers’ changing demand responsiveness to prices. If the effect of investment on demand elasticity is weak, consumer surplus and total welfare are higher when firms are prevented from cooperating on quality investment. Otherwise, firms should be allowed to jointly decide on quality improvements and share these improvements as long as they compete in the downstream markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Mobile telecommunications markets have seen important changes in recent years with data taking over for voice. This development has significantly increased the importance of network infrastructure quality, while the cost of improving quality has increased substantially. This remains an important issue for operators today with investments in 5 G spectrum and networks.Footnote 1

During the recent consolidation wave among mobile operators,Footnote 2 market players argued that, while reducing the number of competing operators in the downstream market, mergers would nevertheless increase consumer surplus and total welfare as they would allow for important investments in network quality. These mergers revived the debate among economists on the relationship between competition and innovation. While (Motta & Tarantino, 2021) find no support for such claims as long as there are no significant merger-specific R &D efficiency gains, Bourreau and Jullien (2018) and Bourreau et al. (2018) show that the outcome is ambiguous when firms may undertake demand-enhancing investments.Footnote 3 Using a large panel of prices of mobile baskets as well as information on firms’ investments and profitability, Genakos et al. (2018) show that, in markets where mergers occurred, end-user prices increased (relative to other markets) but investments (i.e., capital expenditure) also increased globally as well as per-operator. There thus seems to exist a trade-off between market power effects on prices and on investments.

An alternative to mergers is network sharing where, ideally, operators can exploit economies of scale at the investment stage without sacrificing the intensity of price competition in the downstream market.Footnote 4 Competition authorities and sector-specific regulators have taken a more friendly approach towards cooperation with respect to network sharing agreements than to complete mergers. Motta and Tarantino (2021) for instance argue that network sharing is always preferable to a full merger. However, in recent decision by the (European, 2022), regarding the mobile market in Czechia, the operators had to make a set of commitments to address concerns that the specific network sharing arrangement could hamper investments.Footnote 5

Although the focus of this paper will be on network sharing in mobile telecommunications markets, the idea that firms can cooperate on product development or product quality investment potentially applies to many markets. It has not been given much attention among economists, or even in the policy debate, although R &D agreements between competitors have been included in the European Commission’s guidelines regarding horizontal agreements.

In this paper, we develop a duopoly setting where firms invest in product quality (think, for instance, of network capacity) before price competition takes place on the product market. Like (Motta & Tarantino, 2021), who also analyze investment incentives in mobile markets, we use elements from the strategic R &D literature (see, e.g., d’Aspremont and Jacquemin (1988) and subsequent papers) but with important differences. Rather than assuming that firms simultaneously decide on network investments and prices, we consider sequential decisions.

More importantly, we adopt a setting similar to (Waterman, 1990) and (Anderson et al., 2017) in which quality investment affects the price elasticity of demand even when firms’ investments are symmetric. Although it may be complex to evaluate how quality investments affect price elasticity of demand, joint investment in quality by competitors may have important effects on firms’ pricing incentives (i.e., on product market competition) and therefore on economic welfare.

Like a large number of papers analyzing competition in mature telecommunications markets (see, e.g., (Laffont et al., 1998a, b) and subsequent papers), we adopt a spatial model à la (Hotelling, 1929). In mature markets, every consumer has a mobile contract and the motivation for investments, for instance upgrading networks to 5 G, is not to increase total demand but rather to steal consumers from rivals as well as to increase consumer’s willingness to pay for services.

In standard variants of the Hotelling model, identical increases in quality by rival firms do not affect individual demand functions. This implies that if firms can “collude” on quality investments, they prefer not to invest. In our model, we allow quality improvements to have heterogeneous effects on consumers, assuming in particular that “loyal” consumers (i.e., located closer to the firm) value quality improvement more. In such a setting, quality improvement increases a firm’s market power over its more loyal customers and thus makes demand less elastic. This affects firms’ incentives to invest in quality even when they can share these quality improvements.

We show that under semi-collusion, i.e., when firms jointly decide on investment levels and degree of network sharing, investment increases when networks are shared and firms optimally prefer to fully share their networks. On the contrary, when firms make separate decisions and maximize individual profit functions, quality is a decreasing function of network sharing. Firms tend to free-ride on each other’s investments when these investments are shared. In equilibrium, their incentives to fully share their networks are lower than under semi-collusion. Moreover, we show that consumer surplus and total welfare are higher when firms can make joint decisions. However, if the impact of investment quality is more homogeneous (i.e., the “loyalty” parameter is close to zero), it may be preferable for both consumers and economic welfare to ban any cooperation, i.e., network sharing should be prohibited altogether.

As with merger analyses, the European Commission pays huge attention to supply side conditions, as the number of operators in the market when assessing network sharing agreements. In a recent clearance of a sharing agreement between Telecom Italia and Vodafone, the Commission accentuates that there are five mobile operators active in the Italian market, and that the sharing agreement only covers approximately one third of the population and data traffic. In contrast, the (European, 2019) states that a main concern in Czechia is that the market is highly concentrated with only three mobile operators. The sharing partners, O2 CZ/CETIN and T-Mobile are the two largest providers, and three quarters of the subscribers are connected to their networks (see further discussion by Geradin and Karanikioti (2020)).Footnote 6

Our findings indicate that demand side conditions, i.e., how quality investment affects the price elasticity of demand, may be crucial when analyzing whether network sharing benefits consumers and leads to increased investments. In our stylized duopoly model, a sharing agreement by its very nature covers the whole market. If quality improvements have heterogeneous effects on consumers, network sharing may lead to increased investments, and benefit consumers also within a duopoly market.

Our paper relates to the literature on strategic R &D investments, where the seminal paper by d’Aspremont and Jacquemin (1988), and the majority of subsequent papers, consider competition a la Cournot in the final stage. Network sharing corresponds to the investment spillover in the strategic R &D literature. d’Aspremont and Jacquemin (1988) show that investments, consumer surplus and welfare are higher with than without investment collusion as long as the exogeneous given spillover is sufficiently high ((Katsoulacos & Ulph, 1998), endogenize the spillover). This contrasts the outcome in a classic Hotelling set up, where business stealing is the only motivation for investments, and investments erode as the spillover becomes large. However, our generalization of the Hotelling model shows that investments, consumer surplus and welfare may be higher with investment collusion if investments have a strong effect on demand elasticity.

2 Quality investment and the Hotelling model

We start out with a generalization of the quality dimension in Hotelling (1929). Two firms (for instance two mobile network operators), \(i\ne j\in \{0,1\}\), competing in prices in the downstream market are located at opposite ends of the unit Hotelling line (firm i at \(x_{i}=i\)). A mass one of consumers is uniformly distributed over this unit line.

The quality of product i depends on its intrinsic quality \(v_{i}\) and on firm i’s additional investment to improve the product’s quality (i.e., the net utility derived by consumers) by \(k_{i}\in \left[ 0,1\right] \). For the sake of simplicity, we assume that firms are ex-ante symmetric in the sense that both the products’ intrinsic values, \(v_{0}=v_{1}=v,\) and the investment technologies are the same, i.e., improving a product’s quality by k costs C(k), where C is strictly increasing and strictly convex. For the sake of exposition, we assume \(C\left( k\right) =\sigma \frac{k^{2}}{2}\) (with \(\sigma >0\) sufficiently large to ensure that \(k_{i}\le 1\)).

The (net) utility \(u_{i}\) derived by a consumer located at x and buying from firm i at price \(p_{i}\) is thus given by:

We assume that both the basic willingness to pay v and the unit transportation cost t are high enough to ensure that the market is fully covered and that both firms are active in equilibrium (even without investment). The basic Hotelling model corresponds to \(\lambda =0\), where an increase in quality uniformly increases consumers’ willingness to pay. In contrast, as soon as \(\lambda >0\), consumers who have a strong preference for firm i (i.e., located close to \(x_{i}\)) benefit more from an increase in quality \(k_{i}\) than consumers located further away from firm i. We assume \(0\le \lambda <1\).Footnote 7 The restriction \(\lambda t<(4/5)\) ensures that all consumers benefit from an investment.Footnote 8

Deriving the demand functions (assuming full market coverage) for any vector of prices \({\textbf{p}}=\left( p_{0},p_{1}\right) \) and investment levels \( {\textbf{k}}=\left( k_{0},k_{1}\right) \) yields:

where \(\kappa \equiv \frac{k_{0}+k_{1}}{2}\) is the average quality investment level and \(\Omega \left( k\right) \equiv 1-\lambda +\lambda \kappa \). We then have:

Proposition 1

If \(\lambda >0\), demand becomes more inelastic following identical increases of \(k_0\) and \(k_1\).

In the standard Hotelling model (i.e., \(\lambda =0\)), \(\Omega (k)=1\), and an identical increase in quality by both firms does not affect individual demands, the quality improvement is cancelled out when comparing the net utilities derived by consuming the different products. Business stealing is the only motivation for investments, since prices and profits are not affected by an identical increase in quality. As emphasized above, when instead \(\lambda >0\), the willingness to pay for firm i’s product increases more for consumers located close to firm i. An identical increase in investment levels thus increases a firm’s market power over the “loyal” consumers and price competition is therefore less intense. We now show that this generalization of the standard Hotelling setup provides firms with generic incentives to invest in quality even if they share the benefit of the increased quality (i.e., share their networks).

3 A model with quality investment and sharing

3.1 Setup and timing

Network sharing is a frequent feature of mobile telecommunications markets, so we now allow the firms to partially or totally share their networks, i.e., to share their product quality investments. Let us denote by \(\theta \in \left[ 0,1\right] \), the degree of network sharing. Alternatively, one may interpret \(\theta \) as a spillover effect of quality improvement, an effect that may be directly adjusted by the firms.

We assume that before choosing which product to buy (or which network to join), consumers observe the levels of investment as well as the degree of network sharing. Sharing networks (or quality investment) now means that consumers buying from firm \(i\ne j\) obtain a net utility equal to \( u(x;x_{i},k_{i}+\theta k_{j},p_{i})\) rather than \(u\left( x;x_{i},k_{i},p_{i}\right) \). In this modified setting, demand for product i is therefore:

In what follows, we look for the subgame perfect Nash-equilibrium of the following three-stage game. At stage 1, the firms decide on the degree of network-sharing. At stage 2, they invest in quality. Finally, at stage 3, they compete in prices.

We investigate two alternative decision processes at stages 1 and 2. The firms can either jointly or separately decide on the degree of network sharing and quality investment. In the semi-collusive regime, the firms jointly decide on \(\theta \) as well as on \(k_{i}\) and \(k_{j}\) so as to maximize their joint profit.Footnote 9 In the no-collusion regime, it is not obvious how the reciprocal level of network sharing is determined. We assume that each firm i at stage 1 proposes \(\theta _{i}\) and the realized degree of reciprocal network sharing is the lowest of the two values, i.e., \(\theta =\min \left\{ \theta _{i},\theta _{j}\right\} \). Put differently, the firm with the lowest offer has a veto.Footnote 10 At stage 2 they choose \(k_{i}\) and \(k_{j}\) to maximize own profit.

Note that the horizontal differentiation reflects attributes outside the model, i.e., brand preference due to different features in the subscriptions offered (e.g., customer service, terminal subsidies and terminal insurance, access to various types of content etc.). Vertical differentiation is due to quality investments. A concrete interpretation of quality investments is an upgrade from 4 G to 5 G. At the outset, firms have identical (“national”) 4 G coverage. By investing in 5 G the firms can offer higher quality (higher download speeds and various 5 G specific tailored features). If a mobile operator offers partial 5 G coverage, the customers will only have access to the high quality for the proportion of time they are inside the 5 G coverage. As a mobile operator expands 5 G coverage, consumers experience higher “average” quality (see also footnote 1 above). If the firms choose to initiate network sharing, the 5 G investments by one of the firms will benefit consumers of the rival. The decision to share may be a discrete decision (no sharing, or full sharing) or it may be a continuous decision (5 G is shared only in some areas). In the present paper, we model sharing as a continuous variable.

3.2 Price competition

Taking \(\theta \) and \({\textbf{k}}=\left( k_{0},k_{1}\right) \) as given, we now consider the pricing equilibrium (i.e., stage 3). Firm i sets its price \( p_{i}\) so as to maximize its profit \(p_{i}Q_{i}\left( \theta , {\textbf{k}}, {\textbf{p}}\right) \). By solving the (necessary and sufficient) first-order conditions, we derive the equilibrium price and operating profit for firm \( i\ne j \in \{0,1\}\):

An increase in quality \(k_{i}\) allows firm i to raise its price for two reasons: it increases the firm’s market power over loyal customers through the higher willingness to pay (at least as long as \(\lambda >0\)) but it also makes firm i relatively more attractive and thus increases demand for firm i as long as the firms do not fully share their networks (i.e., \(\theta <1\) ). Even with full network sharing (\(\theta =1\)), the firms directly benefit from a unilateral increase in quality, as long as \(\lambda >0\), as in this case, we have \(\pi _{i}^{e}\left( 1,{\textbf{k}}\right) =\frac{t}{2}\Omega \left( k_{0}+k_{1}\right) \).

4 Joint decisions (semi-collusion)

In the semi-collusion case, there are no strategic interactions between the firms before pricing decisions are made, and stages 1 and 2 thus collapse into a single stage. The firms jointly choose the degree of network sharing and the investment levels so as to maximize their joint profitFootnote 11

Rather than choosing the investment levels \(k_{0}\) and \(k_{1}\), it turns out to be more convenient to let the firms choose the average investment level, \( \kappa \in [0,1]\), as well as the “average” degree of asymmetry, \(\Delta =\frac{k_{0}-k_{1}}{2 }\in [-\frac{\kappa }{2},\frac{\kappa }{2}]\). Using the simplifying notation, \(\tau (\theta )=\frac{(2-\lambda t)(1-\theta )}{3}\), we can then rewrite the firms’ joint-profit as:

Generating asymmetry between the two firms (keeping average quality \(\kappa \) constant) has conflicting effects on the joint profit. On the one hand, it increases total revenue by generating a price discrimination effect (i.e., the high quality firm sets a higher price than the low quality one). On the other hand, it increases investment costs. If the cost function is sufficiently convex, i.e., if \(\sigma \) is sufficiently high, the joint profit \(\Pi \) is a strictly concave function of \(\Delta \), as we have:Footnote 12

We can then easily check that it is optimal for the firms to minimize the cost by eliminating any asymmetry between them:

This partial derivative is thus equal to 0 for \(\Delta =0\), and therefore, \( k_{0}=k_{1}=\kappa \). The firms’ joint-profit can now be rewritten as:

Given that \(\Omega \) is a linear function of \(\kappa \), \({\widetilde{\Pi }}\) is a strictly concave function of \(\kappa \). The optimal (per-firm) investment level thus satisfies (sc superscript for semi-collusion):

Firms therefore invest more when they increase the degree of network sharing. We can then rewrite the firms’ joint-profit as a function of \( \theta \) and we find that this profit is an increasing function of the degree of network sharing:

The above analysis leads to the following result:

Proposition 2

When firms jointly decide on the degree of network sharing and on investment levels, they fully share their investments, \( \theta ^{sc}=1\) and each firm’s level of investment is \(k^{sc}=\frac{\lambda t}{\sigma }\).

When firms jointly decide on the degree of network sharing and investment levels (i.e;, semi-collusion), their joint revenue depends on their average quality (i.e., investment) as well as on the degree of asymmetry. However, if the investment cost is a sufficient convex fonction of quality, it is optimal for the firms to coordinate on symmetric investment levels so as to minimize the cost of investment as this effect dominates any positive effect (through price discrimination) on the joint revenue. Given that investment levels are identical, the joint profit is then simply a function of perceived quality by consumers (i.e., of \(\Omega ((1+\theta )\kappa )\). It is thus optimal to fully share the firms’ network so as to maximize (at no additional cost) the perceived network’s quality.

5 Independent decisions (competition)

5.1 Investment decisions (stage 2)

Suppose now that the firms now take independent decisions at stages 1 and 2, and let \(\theta \) be the selected degree of network sharing after stage 1. At stage 2, firm i chooses its investment level \(k_{i}\) so as to maximize its own profit:

Because \(p_{i}^{e}\) and \(\Omega \) are both linear functions of \(\kappa \) and therefore of \(k_{i}\), there is no guarantee, a priori, that this profit function is strictly concave in \(k_{i}\). However, a relatively mild condition on \(\sigma \) suffices to guarantee concavity for the relevant range of values of \(\theta \) and \(\kappa \). It again suffices to assume that \(\sigma \) is sufficiently large, more specifical that \(9\sigma t>1\). In this case, first-order conditions are necessary and sufficiently, and solving for the equilibrium investment levels yields a unique symmetric solution (nc superscript for no collusion):

Contrary to the semi-collusion regime, the optimal level of (individual) investment is a decreasing function of the degree of network sharing. When the firms keep separate networks, increasing the quality of their product relative to that of the rival has two positive effects: it increases the willingness to pay in general but it also makes the firm more attractive relative to the rival firm and thus relaxes the competitive pressure. However, this second effect is eliminated when investments are fully shared as firms only care about the aggregate investment level. They are then tempted to free-ride on the rival’s investment.

5.2 Network sharing decision

Given that firms are symmetric, the pricing equilibrium is also symmetric and we have

Investment and pricing decisions only depend on the actual degree of network sharing \(\theta \). Therefore, the firms’ individual profit functions are identical and given by

where \(\theta =\min \{\theta _{0},\theta _{1}\}\).

Let us first focus on the degree of network sharing \(\theta ^{*}\) that maximizes the profit function \(\Pi \left( \theta \right) \).

Lemma 1

The degree of network sharing that maximizes the firms’ profit is \(\theta ^{*}=1\) whenever \(\lambda t\in \left[ \frac{4}{11},\frac{4}{5}\right) \) and \(\theta ^{*}={\hat{\theta }}\) otherwise, where

Proof

Because \(\kappa ^{nc}(\theta )\) is a strictly decreasing linear function of \( \theta \), \(\Pi (\theta )\) is a strictly concave function that admits a unique maximum over the interval [0, 1]. Solving for the unconstrained maximum (i.e., solving the first-order condition), yields

Furthermore, over the interval \(\left[ 0,\frac{4}{5}\right) \), \({\hat{\theta }} \le 1\) if and only if \(\lambda t\le \frac{4}{11}\). \(\square \)

For a given choice \(\theta _{j}\) made by its rival, firm i actually selects \(\theta \) rather than chooses a precise value for \(\theta _{i}\). If firm j has chosen \(\theta _{j}>\theta ^{*}\), firm i simply selects the degree of network sharing that maximizes its profit, that is, \(\theta ^{*}\). If firm j has selected \(\theta _{j}\le \theta ^{*}\), firm i is indifferent between all values of \(\theta _{i}\in \left[ \theta _{j},1 \right] \). The game thus has multiple equilibria due to coordination failure, as any \(\theta \le \) \(\theta ^{*}\) can be sustained in equilibrium.

However, only one equilibrium is trembling-hand perfect: suppose that there is an infinitesimal probability that firm j selects (by mistake) a value above \(\theta ^{*}\), for instance \(\theta _j=1\). In this case, firm i is no longer indifferent between all values above \(\theta _{j}\) but strictly prefers \(\theta ^{*}\) to all other values of \(\theta _i\). This guarantees uniqueness of the trembling-hand equilibrium as choosing \(\theta ^{*}\) is now a strictly dominant strategy. As a consequence:

Proposition 3

When firms decide non-cooperatively on the degree of sharing and on investments, there exists a unique trembling-hand perfect equilibrium given by:

-

If \(\lambda t\in [\frac{4}{11},\frac{4}{5})\), the firms fully share their investments, \(\theta ^{nc}=1\), and each firm invests \(\kappa ^{nc}=\frac{\lambda t}{2\sigma }\).

-

If \(\lambda t\in (0,\frac{4}{11})\), the firms partially share their investments, \(\theta ^{nc}={\hat{\theta }}<1\), and each firm invests \(\kappa ^{nc}=\frac{2\lambda t\left( 2-\lambda t\right) }{\sigma \left( 4+7\lambda t\right) }\).

6 Welfare effects of network sharing

Before comparing the two situations, let us discuss the benchmark scenario where regulation prevents firms from sharing their networks. In theory, we could look at joint or independent investment decisions, but in this no-network-sharing scenario it seems natural to look at independent investment decisions (i.e., the regulator does not allow any coordination between firms). In this case, using the analysis from the previous section, we obtain that both firms choose the level of investment \(\kappa ^{nc}(0)= \frac{4+\lambda t}{12\sigma }\). Because the firms do not share their network, this also corresponds to each product’s quality.

Given that the equilibrium is symmetric in all three cases, consumer surplus and total welfare simply write as functions of the degree of network sharing \(\theta \) and (the symmetric) individual investment k:

and

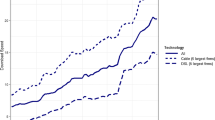

Consumer surplus is an increasing function of each product’s equilibrium quality (i.e., \((1+\theta )k\)). Figure 1 shows how consumer surplus varies with \(\lambda t\) in the three different cases and results are summarized in Proposition 4 below.Footnote 13

Proposition 4

When networks share capacity, consumers are always better off when firms can coordinate their investment decisions. However, network sharing (with joint decisions) is preferable to a ban on network sharing if and only if \(\lambda t\ge \frac{4}{23}\simeq 0.174\).

Comparing total welfare is more involved as consumers benefit directly from increased product quality (i.e., from higher investment and from network sharing) but higher investment also means higher costs. Figure 2 shows how total welfare varies with \(\lambda t\) in the three different cases and results are summarized in Proposition 5 below.

Proposition 5

When networks share capacity, total welfare is higher when firms can coordinate their investment decisions. However, network sharing (with joint decisions) is preferable to a ban on network sharing if and only if \(\lambda t\ge \frac{37-3\sqrt{105}}{53}\simeq 0.118\).

Increased investments and network sharing imply that overall quality increases. This also leads to higher prices and transportation costs but consumers benefit from the better quality product overall as the former effect dominates. If network sharing is allowed, consumer surplus is therefore higher when firms can coordinate their decisions. The reason is that network sharing (\(\theta >0\)) results in an investment spillover. When firms collude at the investment stage this effect is internalized and accordingly investments are higher. This results in higher welfare.

This does indeed lead to full network sharing and, in addition, investment increases with network sharing when firms coordinate investment levels, whereas investments otherwise decreases. Higher quality means higher investment costs but welfare is nevertheless higher when decisions are coordinated as the cost effect is dominated by the increased gross utility derived by the consumers.

Firms making independent decisions invest a lot when network sharing is not feasible. Therefore, there exists thresholds values for \(\lambda t\). Below this threshold, a ban on network sharing is preferable for consumer surplus and total welfare. Hence, if we are close to the standard quality formulation in Hotelling models, i.e., \(\lambda \) approaches to zero, a ban on network sharing maximizes consumer surplus and total welfare.

7 Concluding remarks

The effects of allowing competing firms to cooperate on product quality investments and network sharing crucially depend on how such investments affect consumers’ willingness to pay. If investments lead to an identical increase in all consumers’ willingness to pay, or just makes demand slightly more inelastic, we show that a ban on network sharing (and coordinated investment decisions) is preferable. Otherwise, some form of semi-collusion is good for both consumers and economic welfare. In this case, firms should be allowed to jointly decide both on the degree of network sharing and also on how much to invest individually in each network.

For policymakers it is (almost) impossible to predict how investments will change demand elasticity. Nevertheless, this may be crucial for firms’ incentive with respect to undertaking investments and sharing their investments, as well as for welfare implications. Furthermore, there is concern by authorities that semi-collusion at the upstream level may be transferred into the downstream market, such that the outcome resembles a complete merger. The latter effect is not analyzed in the present paper.

Notes

Higher spectrum bands are used under 5 G compared to 4 G. Consequently, a cell covers a smaller area, while the speed is higher compared to 4 G. Furthermore, higher spectrum bands have lower capability to pass through walls etc. More base stations are required to deliver coverage, as well as capacity, also in urban areas. This may imply that 5 G network sharing agreements will become important in urban areas as well.

A number of mergers have taken place in Europe in recent years, often reducing the number of competing operators from four to three. While the European Commission approved most of them—often subject to commitments—the mergers between O2 and Three in the UK and between Telia and Telenor in Denmark were both blocked. In the US, the merger between T-Mobile and Sprint was finally approved in April 2020, after having been blocked a few years earlier by the FCC.

See also, e.g., (Federico et al., 2017, 2018) and Jullien and Lefouili (2018a) who look at the effects of horizontal mergers on incentives to invest in R &D and/or new products. Jullien and Lefouili (2018b) provide an extensive review of the literature on the effects of horizontal mergers on innovation.

According to The body of European regulators (BEREC, 2018) there is “active network sharing” with “joint deployment” in 13 of 30 European countries. Furthermore, there are other forms of network sharing in six additional countries.

Maier-Rigaud et al. (2020) undertake a difference-in-differences analysis to estimate the effects of the network sharing agreement in the Czech Republic. They show that sharing has reduced quality-adjusted prices. In a companion paper, Cojoc et al. (2020) set up a structural model that indicates that network sharing benefits consumers through lower prices as well as higher quality (measured by download speed).

In the press release, the (European, 2019) states: “the Czech mobile communications market is highly concentrated with only three mobile network operators,—the sharing parties O2 CZ/CETIN and T-Mobile CZ are the two largest operators, with their networks serving approximately three quarters of subscribers. The Commission, therefore, has reached the preliminary conclusion that the network sharing agreement between the two main mobile operators in Czechia restricts competition and thereby harms innovation in breach of EU antitrust rules. The Commission holds the view that in this instance, instead of leading to greater efficiencies and higher service quality, the network sharing agreement is likely to remove the incentives for the two mobile operators to improve their networks and services to the benefit of users.”

This restriction also ensures that, for relevant values of \(k_{i}\), second order conditions are fulfilled.

Because firms jointly decide and maximize their joint-profit, it does not matter whether decisions on the degree of network sharing and on the investment levels are sequential or simultaneous.

Such a veto resembles the conventional assumption on the determination on reciprocal compatibility between competing networks.

Following the assumption made in the R &D literature (d’Aspremont & Jacquemin, 1988): and Motta and Tarantino (2017), we assume that the firms continue to operate two “plants”, that is, the aggregate investment cost is given by \(C\left( k_{0}\right) +C\left( k_{1}\right) \).

A sufficient condition for \(\Pi \) to be a strictly concave function of \( \Delta \) is to have \(\sigma >\frac{2}{3t}\).

Parameter values used to construct the figure: \(t=1\), \(v=2\), \(\sigma =1\).

References

Anderson, S. P., Foros, Ø., & Kind, H. J. (2017). Product functionality, competition, and multi-purchasing. International Economic Review, 58(1), 183–210.

BEREC. (2018). BEREC Report on infrastructure sharing. BoR, 18, 116.

Bourreau, M., Jullien, B., & Lefouili, Y. (2018). Mergers and demand-enhancing innovation. TSE Working Paper 18-948.

Bourreau, M., & Jullien, B. (2018). Mergers, investments and demand expansion. Economics Letters, 167, 136–141.

Cojoc, A., Ivaldi, M., Maier-Rigaud, F.P., & März, O. (2020). Horizontal cooperation on investment: Evidence from mobile network sharing. Working paper, https://doi.org/10.2139/ssrn.3593732

d’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R &D in duopoly with spillovers. The American Economic Review, 78(5), 1133–1137.

European Commission. (2019). Antitrust: Commission sends Statement of Objections to O2 CZ, CETIN and TMobile CZ for their network sharing agreement, Press release, Brussels, 7 August 2019.

European Commission. (2022). Antitrust: Commission accepts commitments from T-Mobile CZ, CETIN and O2 CZ on Czech network sharing, Press release, Brussels, 11 July 2022.

Federico, G., Langus, G., & Valletti, T. (2017). A simple model of mergers and innovation. Economics Letters, 157, 136–140.

Federico, G., Langus, G., & Valletti, T. (2018). Horizontal mergers and product innovation. International Journal of Industrial Organization, 59, 1–23.

Jullien, B., & Lefouili, Y. (2018a). Mergers and investments in new products. TSE Working paper 18-949.

Jullien, B., & Lefouili, Y. (2018). Horizontal mergers and innovation. Journal of Competition Law and Economics, 14(3), 364–392.

Genakos, C., Valletti, T., & Verboven, F. (2018). Evaluating market consolidation in mobile communications. Economic Policy, 33(93), 45–100.

Geradin, D., & Karanikioti, T. (2020). Network sharing and EU competition law in the 5G era: A case of policy mismatch, Working Paper, https://doi.org/10.2139/ssrn.3628250

Hotelling, H. (1929). Stability in competition. Economic Journal, 39, 41–57.

Katsoulacos, Y., & Ulph, D. (1998). Endogenous spillovers and the performance of research joint ventures. The Journal of Industrial Economics, 46(3), 333–357.

Laffont, J.-J., Rey, P., & Tirole, J. (1998). Network competition: I. Overview and non-discriminatory pricing. RAND Journal of Economics, 29(1), 1–37.

Laffont, J.-J., Rey, P., & Tirole, J. (1998). Network competition: II. Price discrimination. RAND Journal of Economics, 29(1), 38–58.

Maier-Rigaud, F.P., Ivaldi, M., & Heller C.-P. (2020). Cooperation among competitors: Network sharing can increase consumer welfare. Working paper. https://doi.org/10.2139/ssrn.3571354

Motta, M., & Tarantino, E. (2021). The effect of horizontal mergers, when firms compete in prices and investments. International Journal of Industrial Organization, 78, Article 102774.

Waterman, D. (1990). Diversity and quality of information products in a monopolistically competitive industry. Information Economics and Policy, 4, 291–303.

Funding

Open access funding provided by Norwegian School Of Economics

Author information

Authors and Affiliations

Contributions

All authors have contributed equally both wrt. research idea and the analysis.

Corresponding author

Ethics declarations

Competing interests

All author declares that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Øystein Foros thanks the Norwegian Competition Authority for financial support. Bjørn Hansen was Senior Research Economist at Telenor until June 2019.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Foros, Ø., Hansen, B. & Vergé, T. Co-operative investment by downstream rivals: network sharing in telecom markets. J Regul Econ 64, 34–47 (2023). https://doi.org/10.1007/s11149-023-09462-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-023-09462-1