Abstract

We analyze the interplay of capital requirements and mandatory deferral of compensation in reducing banks’ risk taking incentives. Two heterogenous banks fund uncorrelated projects with fully diversifiable risk or correlated projects with systematic risk. One of both banks can identify project types and is superior at managing risks. If projects are in abundant supply, full mandatory deferral of compensation is optimal as it allows a larger banking sector without increasing the default risk. With limited supply of projects, deferred compensation may misallocate risky projects to the bank that is inferior at managing risks, so that early compensation may be optimal.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

1.1 Motivation and main results

In the aftermath of the financial crisis, tighter capital requirements (e.g. Admati and Hellwig 2014) and mandatory deferral of bankers’ compensation (e.g. Bebchuk and Fried 2010) are the two most prominent suggestions for mitigating the incentives for excessive risk-taking. The European Parliament has released its Capital Requirements Directive IV in April 2013 which increases capital requirements from 2 to 4.5% for Common Equity Tier 1 capital. Bankers’ bonuses are capped to 100% of the fixum, but are allowed to rise to 200% if approved by shareholders. At least 40–60% of variable payments need to be deferred by no less than three to five years. In a similar vein, the Fed established new calculation methods in 2015 for capital ratios, which result in even stricter requirements for global systematically important banks than those mandated under Basel III.Footnote 1 Moreover, although US banks are obliged to achieve a Common Equity Tier 1 capital ratio of 6% only in 2019, the six largest banks have already taken steps to comply with this requirement earlier.Footnote 2 Discretionary bonus payments during any quarter are prohibited if the bank’s eligible retained income is negative and if its capital conservation buffer in the beginning of the quarter was below 2.5%.Footnote 3 These buffer requirements, however, are mandatory only for those large institutions which are seen as critical to avoid globally relevant systemic risks.

While the literature so far mainly restricts attention to either deferred compensation (Hoffmann et al. 2016) or capital requirements (Harris et al. 2017), we contribute to the ongoing discussion on how the risk appetite of financial institutions can be reduced by analyzing the interplay of both of these prominent regulatory instruments. As we focus on the incentives of shareholders to accommodate risky rather than safe projects, we consider the so-called external agency problem between shareholders and society (see in a similar vein e.g. Bolton et al. 2012; Bebchuk and Spamann 2010; Jarque and Prescott 2010; Besley and Ghatak 2013) rather than the internal principal-agent problem between shareholders and bank managers. We make three points: First, mandatory deferral of compensation and tight capital requirements are in many respects substitutes for reducing the risk appetite of shareholders. Second, deferred compensation may be superior to capital requirements as it allows for a larger banking sector without increasing the risk of default. Third, deferred compensation may backfire by misallocating safe and risky projects in a heterogenous banking sector when there is competition for safe projects.

The main building blocks of our model are as follows: In line with the standard approach on banking regulation (Dewatripont and Tirole 1994), we assume that shareholders can externalize part of the default risk to either depositors who do not fully react by demanding appropriately larger interest rates or, via bail-outs, to society. That this agency cost of debt cannot be completely eliminated by relying exclusively on equity finance is a distinctive feature of banks, whose role as financial intermediaries requires them to raise a large amount of debt in the form of deposits. Furthermore, the regulator cannot (fully) tailor capital requirements to the actual project risk. Without these two assumptions, the shareholders’ and the society’s objective functions would be aligned, so that the external agency problem would disappear. Next, we define mandatory deferral of compensation as the percentage of overall compensation that can only be paid out in case of solvency, i.e. that is junior to all liabilities in case of liquidation.Footnote 4 This ensures that deferred compensation is contingent on success, and this is one of the main purposes of mandatory deferral of compensation (Bebchuk and Spamann (2010)). Finally, we consider a heterogenous banking sector, in which only good banks have screening capabilities to discriminate between safe and risky projects.

With these assumptions in mind, we can now describe our results in greater detail. We first show that, by changing the seniority of compensation claims, mandatory deferral of compensation reduces the shareholders’ incentives for risk-shifting.Footnote 5 By contrast to early compensation, bank managers know that they are (fully) paid only in case of solvency, and thus demand a higher salary in the non-bankruptcy state. This reduces the shareholders’ expected return on equity with risky projects. The point we make is that early compensation allows to transfer wealth from society to the coalition of shareholders and bank managers, and this is prevented by deferred compensation.

Second, while risk shifting incentives can also be curbed by capital requirements, this comes at the disadvantage of imposing an upper bound on the size of banks. Being strict on the timing of compensation allows the regulator to be softer on capital regulations without inducing risk-shifting (see also Thanassoulis (2014)). Thus, the potential downside of tight capital requirements that even projects with positive net present value will remain unfunded (credit crunch) can be mitigated by mandatory deferral of compensation. In this sense, our basic model makes a point in favor of payment regulation.

Third, however, we show that deferred compensation may backfire in a heterogenous banking sector when assuming that the number of safe projects is limited. As deferred compensation reduces the shareholders’ risk appetite, the good bank (which can distinguish between safe and risky projects) may prefer safe instead of risky projects. As this deteriorates the remaining project mix in the economy, the bad bank (which cannot distinguish between project types) funds a larger percentage of risky projects. If the good bank has a comparative advantage in managing risky projects, deferred compensation leads to an inefficient allocation of safe and risky projects within the banking sector. It may then be better to accommodate risk-shifting in the good bank by allowing for early compensation, rather than by allowing for many projects by relaxing the capital equity ratio. We will get back to this from a regulatory point of view in the concluding section.Footnote 6

Arguing that the legally required timing of compensation affects the shareholders’ incentives for risk-shifting ultimately requires that the effect size is sufficiently large. It is thus important to note that regulations on bonuses an deferred compensation are not limited to CEOs, but extend to e.g. trading and investment banking. One of the main issues in the stockholders’ meeting of Deutsche Bank in May 2015 was the fact that the bonuses paid to managers are five times higher than the dividends paid to shareholders, so that the question which part of remuneration is early or deferred seems clearly relevant not only from the managers’, but also from the shareholders’ point of view. Bell and Reenen (2014) find that two thirds of the large increase in the one percent highest salaries in the UK after 1999 can be attributed to the increase in banker’s bonuses, and that this didn’t even change after the financial crisis. Overall, it is no exception that remuneration exceeds 30% of shareholder equity, and the ratio sometimes exceeds even 80% of shareholder equity; something rarely observed in non-financial firms (Thanassoulis 2014).

1.2 Relation to the literature

Our paper is most directly related to literature on the impacts of deferred compensation and capital requirements on risk-shifting incentives, but also to the impact of bank managers’ salaries on the incentives for risk-shifting, and to literature on interdependencies of banks’ decisions in credit markets. As we do, most papers on deferred compensation consider the external agency problem between debtholders or the society on the one hand and shareholders on the other hand. Bolton et al. (2012) show that, while performance-based pay maximizes shareholder value, it is likely to induce excessive risk-taking from the debtholders’ point of view. For mitigating these inefficiencies, they suggest tying bank managers’ compensation not only to performance measures, but also to measures of default risk (see in a similar vein Bebchuk and Spamann 2010 and Edmans and Liu 2011).Footnote 7 Many papers provide detailed suggestions for regulating bankers’ pay, including the timing of deferred compensation schemes (Bebchuk and Fried 2010), tying CEO compensation to the CDS spread to account for the risk perceived by the market (Bolton et al. 2015), and charging deposit insurance premiums depending on the compensation structure (Phelan and Clement 2010). In Hakenes and Schnabel (2014), variable payments are beneficial since they induce effort of bank managers, but may also lead to risk-shifting. In case of potential public bail-outs, they find that a system of capped bonuses optimizes the trade-off between effort incentives and excessive risk-taking.

Another string of the literature on deferred compensation emphasizes that useful information may emerge over time, and that postponing payments allows to induce decisions contingent on this information. In Acharya et al. (2016) managers learn their types over time, so that the focus is on uncertainty rather than on asymmetric information. By contrast, deferring compensation allows to infer the agent’s type in Inderst and Pfeil (2013). Learning comes at a cost as bank managers have a higher time preference than shareholders.

Also assuming that valuable information may emerge over time and that bank managers are impatient, Hoffmann et al. (2016) find that deferred compensation may even increase risk-shifting. There are mainly two reasons why their findings differ from ours: First, when confronted with a mandated minimum-deferral requirement, shareholders in their model may respond by using other instruments such as higher bonuses, while we consider exclusively early and late compensation. Second, they assume that shareholders need to pay rents to induce managers to exert risk-reducing effort. And as compensation regulation reduces the contract space, implementing high effort becomes more expensive. From a general perspective, Hoffmann et al. (2016) analyze the impact of compensation regulation on the second-best incentive contract in the principal-agent relationship between shareholders and managers (see also Hakenes and Schnabel (2014)). By contrast, our paper focuses on the impact of regulation on the external agency problem. While moral hazard models are appropriate for analyzing the conflict between shareholders and managers, models in the tradition of Aghion and Bolton (1987) are commonly used for investigating situations where two parties (here: shareholders and managers) have incentives to sign contracts that maximize their joint payoff at the expense of third parties (here: creditors or taxpayers). Following this tradition, it is instructive to neglect information problems between managers and shareholders, so that our approach is complementary to papers focusing on internal agency problems.Footnote 8

In line with our findings, most papers on capital requirements argue that tighter standards reduce the risk appetite of financial institutions, but come at the cost of reduced lending (Thanassoulis 2014; Harris et al. 2017). In a rich model with a heterogeneous banking sector, Harris et al. (2017) show in addition that, by reducing banks’ profits from socially valuable projects, fiercer competition from investors in public markets may increase risk-shifting by banks. In our model, increased competition with good banks increases the risk of the bad bank’s lending portfolio.

Recently, the highly influential book by Admati and Hellwig (2014) calls for far higher capital equity ratios and argues that the argument that higher capital equity ratios would ultimately reduce bank lending is flawed. Calibrating a model on the private and social costs and benefit of bank equity, Miles et al. (2013) find that the socially optimal amount of equity is far higher than what is observed, and also far higher than what is required under Basel III.Footnote 9 Current proposals go beyond tighter capital requirements and include mandatory default insurance (Kashyap et al. 2008), reverse convertibles where debt is converted to equity in case the regulator assumes an increased default risk (Squam Lake Group 2009), flexible capital requirements depending on the price of Credit Default Swaps for debt (Hart and Zingales 2011) and so-called “Equity Liability Carriers” which are supposed to guarantee that financial institutions with limited liability can meet their obligations (Admati and Pfleiderer 2010). Bulow and Klemperer (2015) suggest so-called Equity Recourse Notes, which are a kind of debt whose payments are converted into equity in case of a large decrease in share prices. Some papers, however, argue that tight capital ratios may even increase risk-shifting (see the overviews in Bhattacharya et al. 1998 and Allen 2004). In Allen et al. (2011), banks can improve the quality of loans by monitoring and higher equity serves as a commitment device for monitoring.

While all papers mentioned so far restrict attention to either deferred compensation or capital regulation, there are only a few papers that analyze the interplay of compensation regulation and capital equity ratios. As we do, Eufinger and Gill (2016) neglect potential agency conflicts between shareholders and managers and focus on the shareholders’ incentives to trigger risk-shifting via compensation schemes for bank managers. Risk-shifting incentives arise since debtholders are protected by deposit insurance if the debt is below a critical threshold. Payment schemes in Eufinger and Gill (2016) are not directly regulated, i.e. shareholders are free to choose between fixed wages (payments in case the safe project is chosen) and bonuses (payments contingent on the actual return of the risky project). But as shareholders anticipate that capital equity ratios are tighter in the latter case, their incentive to implement excessively high-powered compensation schemes disappears. Our model is less rich in this respect as the regulator in our model decides directly on the percentage of compensation that can only be paid out in case of no default. Eufinger and Gill (2016) do not consider a heterogenous banking sector and the possibility of a misallocation of risky project, which is a focus of our paper. As we do, Kolm et al. (2016) also argue that deferred compensation reduces risk-shifting. However, as it does not increase the inefficiently low incentives to search for risk-reducing investment strategies, tight capital regulations remain beneficial. Gete and Gomez (2016) argue that capital regulation is superior to direct compensation regulation as restricting variable pay does not only reduce risk-shifting incentives but also effort. The argument derived in our model that mandatory deferral of compensation outperforms tight capital ratios if and only if there are sufficiently many safe projects is, to the best of our knowledge, novel.

In our model, the advantage for shareholders when they pay early instead of deferred compensation for risky projects is that part of the (expected) compensation is effectively externalized to debtholders or society. Hence, risk-shifting incentives increase in the manager’s salary. This relates our paper to a growing literature arguing that fiercer competition for bank managers leads to a more risky banking sector (Acharya et al. 2016; Thanassoulis 2012). The detrimental effects of competition are reinforced when the managers’ talent is private information, as excessively high-powered incentive contracts are then offered to reduce the rents of low types (Bannier et al. 2013; Bijlsma et al. 2012).

In our setting with a limited supply of safe projects, the good bank’s portfolio choice influences the portfolio risk of the bad bank. And as the good bank’s behavior depends on the regulation on deferred compensation and capital equity ratios, the regulatory regime leads to an interdependency between the two banks’ portfolio risks. In this sense, our paper extends the literature on the interdependency of default risks from competition among banks (Broecker 1990; Nakamura 1993D; Riordan 1993; Shaffer 1998) and information sharing (Pagano and Jappelli 1993); see Harris et al. (2017) for competition between banks and outside investors.

Finally, our modelling of safe and risky projects draws on Feess and Hege (2012) who also assume that safe projects have higher expected returns, and who show that banks may nevertheless have incentives for risk-shifting if and only if the number of projects banks are allowed to fund via capital requirements exceeds a specific threshold. While they focus on the distinction between internal and external rating, they do not consider managers’ compensation schemes, and hence also not the impact of (mandatory) deferral of compensation.

The remainder of the paper is organized as follows: Sect. 2 presents the model. In Sect. 3, we show that shareholders strictly prefer early compensation in case of positive default risk. Section 4 considers the scenario with an abundant supply of both project types. When extending the model to a limited number of projects in Sect. 5, we point out a potential drawback of deferred compensation. Our assumptions and the robustness of our model is discussed in Sect. 6. We conclude in Sect. 7.

2 The model

Banks and project types.

In our model, there are two heterogenous banks, \(i\in \{G,B\}\), each of which is run by a manager and owned by a shareholder maximizing his expected profits. All participants are assumed to be risk neutral.Footnote 10 As detailed below, the good bank G has two advantages over the bad bank B; one with regards to the identification of project types and one concerning the expected return of risky projects. The two banks have identical and exogenously given equity endowments of E.

In line with standard arguments of the bank regulation literature (Acharya and Yorulmazer 2007; Acharya 2009), we assume that banks can fully diversify their idiosyncratic risk, so that only the contribution of each loan to the systematic risk exposure of the bank matters. We model this in the simplest way by assuming that there are two kinds of projects. One project type contains only idiosyncratic risk, and we refer to them as uncorrelated or safe projects. The other project type is exposed to systematic risk that cannot be diversified, and we refer to them as correlated or risky projects. The fraction of risky and safe projects in the economy is denoted by \(\gamma \) and \(1-\gamma \), respectively.

Costs of all projects are normalized to one, so that funds worth n are needed to finance a portfolio of Lebesgue measure \(n\le 1\). Safe projects (projects “S”) yield a gross return \(X>2\) with probability \(k\ge \frac{1}{2} \), and zero return with probability \(1-k\). As these projects contain only fully diversifiable risk, the return of any measurable portfolio of n safe projects is exactly knX. We assume that the return of safe projects is independent of whether they are funded by the good or by the bad bank. This simplifies the analysis; but all that is required for our results is that the good bank has a comparative advantage in managing risky projects.

Risky projects (projects “R”) have perfectly correlated gross returns, which are equal to X with probability \(\theta ^{G}<k\) when funded by the good bank and with probability \(\theta ^{B}\in \left( \frac{1}{X},\theta ^{G}\right) \) when funded by the bad bank, and zero in the complementary event. Due to the perfect correlation of their returns, either the entire portfolio of risky projects fails or succeeds. Hence, bank i’s gross return of a portfolio of n risky projects will be nX with probability \( \theta ^{i}\), and zero with probability \(1-\theta ^{i}\). Comparing risky and safe projects, both types of banks would prefer safe projects absent any default risk due to \(\theta ^{B}<\theta ^{G}<k\). However, we assume that both banks will find it profitable to shift risks on outside creditors if they are at risk of default, i.e. we assume \(kX-1<\theta ^{B}(X-1)\). Furthermore, we assume that the share of risky projects in the economy is sufficiently large so as to rule out the case in which larger portfolios make the bad bank even less likely to default, i.e. we assume \((1-\gamma )kX<1\).

Assuming that projects are either perfectly correlated or uncorrelated is the simplest way to make our points, but the analysis could be extended to more and less correlation.Footnote 11 For safe projects, examples are then AAA-rated loans or insurance policies for car accidents where risks are moderately correlated. For risky projects, one might think of subprime mortgage loans or start-up companies. On the one hand, default rates are highly correlated as they depend to a large degree on macroeconomic factors (for mortgage loans) and on the success of specific business models in related markets (see the burst of the dot-com bubble in he beginning of the century). On the other hand, however, good banks may be better at developing advisory capacity that reduces the failure risk of projects supported by their loan officers.

In addition to the higher expected return of risky projects, a second advantage of good banks concerns the information structure. While the bad bank cannot distinguish between project types R and S, the good bank can identify them. Thus, the good bank can fund a portfolio with measures \( n_{S}^{G}\) and \(n_{R}^{G}\) of safe and risky portfolios, where the size of the portfolio will be bounded above by the regulator’s capital equity requirement. As the bad bank’s manager cannot distinguish between projects, the frequency of correlated and uncorrelated projects in the pool the bad bank picks from determines its portfolio composition. In Sect. 6, we discuss how our results change when assuming instead that it is the bad bank that can screen project types.

Summing up, our setting has the following implications: First, the default risk of banks is exclusively driven by risky projects, while safe projects effectively bolster a bank’s equity, and hence reduce the default risk. Second, the good bank’s advantage is twofold; it can distinguish between project types and it is superior at handling correlated projects. Assuming that both banks perform equally well for safe projects simplifies the analysis, but all we need is the reasonable feature that the good bank has a comparative advantage for risky projects. As a consequence, if risky projects are funded at all, this should be done by the good bank.Footnote 12 The latter point will become important in Sect. 5 when we discuss potential advantages of allowing for (partially) early compensation.

Note that our assumptions imply that risky projects bear larger risk and have lower expected return, and would hence be strictly dominated by safe projects from the perspective of weakly risk-averse individual investors who are not (partially) protected by limited liability. This, however, is different when we consider the owners of banks with positive default risk: If safe projects had lower return, then shareholders would always prefer risky projects to benefit from the limited liability effect. Our assumptions are hence standard in models on banking regulation focusing on incentives for risk-shifting.

Regulation.

The regulator has two instruments to influence the portfolio size and its composition, capital requirements and mandatory deferral of (part of) the bank manager’s compensation. For capital requirements, note first that, if the regulator was able to perfectly observe the banks’ portfolios, it would be easy to implement the socially optimal choices by differentiating the capital equity ratios for risky and safe projects appropriately. To avoid this trivial solution, we consider the more realistic case in which the regulator cannot observe the projects chosen by banks. Thus, banks have the possibility to misreport risky projects as safe ones, so that differentiating the capital equity ratios is meaningless. We denote the single capital equity ratio by b. The banks’ portfolio size is thus restricted by \(n\le {\overline{n}}=\frac{E}{b}\). Our assumption that the regulator does not differentiate the capital ratios between safe and risky projects is not only theoretically motivated by asymmetric information, but also resembles a clear-cut tendency in the current regulation. The financial crisis has shown that regulators can hardly assess the riskiness of banks’ assets, and that banks will always be one step ahead in their creativity of camouflaging the risk of their portfolios. As a consequence, regulators define ratios more and more with respect to the banks’ market capitalization (Core Tier-1 capital in Basel III) rather than by trying to make capital requirements dependent on the riskiness of the bank’s assets.Footnote 13

In addition to capital requirements, the regulator defines a minimum percentage \(\lambda \) of the manager’s compensation which can be paid out only after the return of projects has been realized, and if the bank is solvent (deferred compensation). Thus, we do not distinguish between fixed compensation and variable payments which are made contingent on new information; all that matters in our model is that early compensation allows to pay managers before it turns out whether risk-shifting leads to default. This implies that we define deferred compensation as a legal system where compensation is junior to all other claims in case of liquidation as the distinction between early and deferred compensation would otherwise be meaningless in our model.Footnote 14 The question we are then most interested in is the interplay between capital equity ratios and deferred compensation, that is, the link between the socially optimal values of b and \(\lambda \).

Social Costs of Default Risk.

With regards to the expected social costs from bank failure, we adopt a simple and rather general concept. Specifically, we define \(B^{i}(n^{i})\) as expected social cost when bank i with a portfolio of size \(n^{i}\) defaults with probability \(1-\theta ^{i}\), and if it is the only bank with positive bankruptcy risk. If both banks face positive default risk, expected social costs are denoted by \(B^{GB}(n^{G},n^{B})\). We then impose as little structure as possible: First, we assume that \(B^{G}(n)\), \(B^{B}(n)\) and \( B^{2}(n):=B^{GB}(n,n)\) are all convex in n. Second, recall that, whenever there is a positive bankruptcy risk at all, then the bad bank’s risk exposure is higher due to \(\theta ^{B}<\theta ^{G}\). Thus, we assume that, for every n, \(B^{G}(n)<B^{B}(n)<B^{GB}(n,n)\). This includes the (natural) case where, for identical portfolios, the actual bankruptcy costs in case of default are the same in both banks. If the difference between \( \theta ^{G}\) and \(\theta ^{B}\) is sufficiently large, it is also compatible with the case where the actual bankruptcy costs are higher in the good bank (for instance due to a higher loss in human capital).

Compensation schemes for managers.

Recall that each bank is run by a single manager who decides on the bank’s portfolio. We assume that managers are risk neutral and demand an expected compensation of e to sign a contract in a bank.Footnote 15 Most naturally, e can be interpreted as the bank manager’s exit option or opportunity cost. For the reasons discussed in the introduction, we assume that the good bank’s shareholders can observe their banks’ portfolios, so that there is no internal agency problem in our model.Footnote 16 Each bank’s shareholders can suggest a compensation scheme to a manager as a take-it-or-leave-it-offer.

As shareholders can observe the banks’ portfolios, they can make payments contingent on those. Compensation contracts will thus specify (i) the compensation to be paid to the manager, potentially based on the portfolio observed by shareholders,Footnote 17 and (ii) the percentages \(\alpha \ge \lambda \) of this compensation that is paid out only after the project return has been realized and if the bank is not bankrupt. We will refer to this part as deferred compensation, and to the part \(1-\alpha \) as early compensation. We assume \(e<E\) as equity E would otherwise not be sufficient to compensate the manager for his exit option e with early payments only.

In our model, shareholders make the manager’s compensation contingent on the bank’s actual portfolio, while the regulator sets only b and \(\lambda \), but does not directly control the banks’ portfolio choices. This might be challenged as salaries based on the manager’s portfolio choice can only be legally enforced if the actual portfolio is verifiable; i.e. observability to shareholders is not sufficient for enforcement. Verifiability, however, theoretically enables the regulator to design mechanisms contingent on the actual portfolio, a possibility we exclude by assumption. To account for potential objections against this restriction, we have also considered an extended version of our model, in which we consider an information structure that makes it impossible for the regulator to directly control the banks’ portfolio choices. In this extension, we still assume that the portfolio is observable, but can carry excessive risk for two reasons, poor behavior or bad luck. While shareholders are free to react on excessive risk levels whatever the reason, sanctions levied by the regulator will generally be upheld in court only if the regulator can provide enough substance that there was negligence or bad intention. In other words, while the level of observation might be the same for shareholders and the regulator, the basis on which they can take action will typically differ. All of our results are qualitatively unchanged. The advantage of this extended model is that the restrictions on the regulator’s contract space emerge endogenously, but as this comes at the expense of a far more convoluted analysis, we only briefly summarize it in Sect. 6, and provide the model itself in an “Appendix” that is available on request.

Limited number of projects.

We will consider two settings, one with an abundant supply of projects (Sect. 4), and one where the number of both project types is bounded (Sect. 5). In the first case, for any level of equity E given, the only restriction on the banks’ portfolios is the capital equity ratio b. This implies that the two banks’ portfolio choices are independent from each other. In particular, due to the abundant supply of projects, the portfolio choice of the good bank does not affect the bad bank’s portfolio which cannot distinguish between project types.

When projects are in limited supply, we assume that the good bank can use its informational advantage over the bad bank to attract its preferred project type. In our model, this is a natural assumption for two reasons: First, recall that the bad bank cannot distinguish among project types. Second, it will turn out that banks strictly prefer portfolios that consist of either only safe or risky projects to mixed portfolios. And as only the good bank can distinguish among projects, it can always slightly undercut the bad bank’s offer to project owners.

Timing

Summing up, the timing of the game is as follows:

-

1.

The regulator announces b and \(\lambda \).

-

2.

Shareholders offer contracts to managers who decide on acceptance.

-

3.

The manager of the good bank chooses her portfolio.

-

4.

The manager of the bad bank chooses her portfolio.

-

5.

Shareholders observe the actual portfolios.

-

6.

Early compensation is paid out according to the contracts designed in stage 2.

-

7.

Nature determines the success or failure of risky projects.

-

8.

Deferred compensation is paid out if the bank is solvent.

3 Optimal compensation contracts

Each bank i’s shareholders simultaneously choose the project portfolio \( n_{S}^{i},n_{R}^{i}\) that it will ask the manager to fund, the manager’s contractual compensation \(C_{i}\) and the share \(\alpha _{i}\ge \lambda \) of that compensation to be deferred so as to maximize its ex-ante expected value. By assumption, managers in the good bank can distinguish between safe and risky projects. As the shareholder can observe the bank’s actual portfolio, he can easily induce the manager to fund a specific portfolio by specifying zero compensation whenever the manager’s project choice differs from the portfolio fixed in the contract. As managers in the bad bank cannot distinguish between project types, this bank’s portfolio will be automatically determined by the composition of the project pool remaining after the good bank’s lending decisions.

Hence, when shareholders make take-it-or-leave-it contract offers to managers, they only need to ensure that the manager accepts the contract (participation constraint), and the regulatory constraint for the percentage \(\alpha _{i}\) of deferred compensation needs to be observed, i.e. \(\alpha _{i}\ge \lambda \). The participation constraint requires in both banks that the manager’s expected compensation is at least as large as their opportunity cost, and there will be a unique contractual compensation level \( C_{i}\) for each choice of \(n_{S}^{i}\), \(n_{R}^{i}\) and \(\alpha _{i}\) such that the participation constraint is binding. Note that specifying actual compensation to be equal to e is only sufficient if the manager can be sure to receive the whole payment, that is, when all compensation is early or when there is no default risk. With positive default risk and partly deferred compensation, the compensation in the no-default state needs to be above e in order to give the manager e in expectation.

The following Lemma shows that, for a given portfolio \(n_{S}^{i},n_{R}^{i}\), either deferral of compensation does not matter or the bank strictly prefers early over deferred compensation, in which case \(\alpha _{i}=\lambda \) is optimal. The Lemma presents conditions for each of these cases to arise.

Lemma 1

Suppose bank i wants to fund \(n_{S}^{i}\) safe and \(n_{R}^{i}\) risky projects. Then:

-

(i)

If \(E+\left( kX-1\right) n_{S}^{i}-n_{R}^{i}\ge \frac{1-\lambda }{1-(1-\theta ^{i})\lambda }e\), then the bank’s expected value is, independently of \(\alpha _i\), given by

$$\begin{aligned} \pi _{i}\left( n_{S}^{i},n_{R}^{i}\right) =E+\left( kX-1\right) n_{S}^{i}+\left( \theta ^{i}X-1\right) n_{R}^{i}-e. \end{aligned}$$(1) -

(ii)

If \(E+\left( kX-1\right) n_{S}^{i}-n_{R}^{i}<\frac{1-\lambda }{ 1-(1-\theta _{i})\lambda }e\), then deferred compensation is as low as possible, \(\alpha _i=\lambda \). The bank’s expected value is

$$\begin{aligned} \pi _{i}\left( n_{S}^{i},n_{R}^{i}\right) =\theta ^{i}\left[ E+\left( kX-1\right) n_{S}^{i}+\left( X-1\right) n_{R}^{i}\right] -\frac{\theta ^{i}e }{1-(1-\theta ^{i})\lambda }. \end{aligned}$$(2)

Proof

All proofs are relegated to the “Appendix”. \(\square \)

In Case (i), the number of risky projects is so low that there is either no default risk at all or that, even in case of bankruptcy, the bank can satisfy all claims except (part of) the manager’s deferred compensation. In other words, there is no risk for outsiders, and it is then impossible to externalize part of the risk to those outsiders. Then, the timing of compensation is irrelevant for banks: Paying the manager expected compensation e imposes expected cost e on the bank irrespective of \( \lambda \).

In Case (ii), by contrast, the number \(n_{R}^{i}\) of risky projects is so large and the part of the compensation paid out early so small that the bank defaults if the risky projects fail, and the bankruptcy assets are not sufficient to meet its obligations to outsiders.Footnote 18 Then, shareholders maximize bank value by deferring only the legally binding part of the compensation. The reason is that early compensation protects the manager from the default risk, who hence weighs each Dollar of early compensation with one Dollar. Shareholders, by contrast, care about the payment only in the non-bankruptcy case, and thus benefit from deferring as little compensation as possible. In the extreme case where the manager is paid in full up front, paying the manager an amount of e only imposes expected costs \(\theta ^{i}e\) on the bank. As the fraction \(\lambda \) the bank needs to defer increases, the manager must be compensated for the foregone salary in case of default. This is reflected by the bank’s expected costs of compensating the manager, \(\frac{\theta ^{i}e}{1-(1-\theta ^{i})\lambda }\), which is strictly increasing in \(\lambda \). The intuition is that early compensation effectively externalizes part of the manager’s compensation as the salary is no longer available for the bankruptcy assets. In this sense, the expression \(e-\frac{\theta ^{i}e}{1-(1-\theta ^{i})\lambda }=\frac{(1-\theta ^{i})(1-\lambda )}{1-(1-\theta ^{i})\lambda } e \) may be interpreted as the expected amount of money a bank saves in manager compensation by switching from a safe to a risky portfolio. Since this expression is strictly decreasing in \(\lambda \), the bank can save less and less in manager compensation by introducing default risk as the regulation of manager compensation gets stricter.

Lemma 1 shows how the shareholders’ preferences for early compensation depend on the portfolio, and this is independent on whether such a portfolio is chosen by a manager who can discriminate between project types (good bank) or not (bad bank). Thus, we do need to distinguish between the two bank types in Lemma 1.

Over all, the insight of Lemma 1 is that mandatory deferral of compensation reduces a bank’s expected profit (2) if it is exposed to default risk due to the large number of risky projects in its portfolio, but leaves profit (1) unchanged if the bank relies mainly on safe projects. In other words, mandatory deferral of compensation makes risky projects less attractive and, thus, reduces banks’ risk-taking incentives ceteris paribus.

In the following, we consider two settings: First, we assume that there is an abundance of both project types, which means that the two banks’ shareholders’ portfolio decisions are unlinked. The focus is thus completely on the relationship between mandatory deferral of compensation and capital requirements, whereas the heterogeneity of banks and potential scarcity of projects plays no role. In Sect. 4, we proceed to a model with limited supply of projects.

4 Abundant supply of projects

In this section, we assume that projects are in abundant supply, so that there is no interdependency between the two banks’ portfolio decisions. We will see later that this case emerges as the limit of the case with a restricted number of projects where total supply of projects grows infinitely large. Considering the case with an abundant supply of projects first, however, sharpens the intuition on how the optimal regulation is influenced by bank competition for safe projects.

Equilibrium Project Choices.

If projects are supplied in abundance, all that restricts banks’ portfolios is capital-equity regulation. Capital requirements b imply

that is, the maximum number of projects a bank can fund is \({\overline{n}}= \frac{E}{b}\). Let us first consider the good bank. As the manager can discriminate between project types, the problem is to choose \(n_{S}^{G}\) and \(n_{R}^{G}\) so as to maximize expected value given by (2) and (1) subject to (3). Straightforwardly, the capital requirement is always binding: Adding a marginal safe project to a given portfolio increases the value of a solvent bank by \((kX-1)\) and leaves a defaulting bank’s value unchanged at zero, thus strictly increasing a bank’s expected value.

Consider next the choice between risky and safe projects. Without default risk, shareholders always prefer safe projects due to their higher expected return, \(k>\theta ^{G}\). With default risk, however, shareholders face a trade-off between the higher return of safe projects and the fact that, in case of bankruptcy, the bank does not have enough equity to cover its liabilities. This means that, whenever the bank funds risky projects at all, it is profitable to replace even more safe projects with risky projects. This is the well-known risk-shifting problem: If equity is wiped out anyway in the case of failure, then increasing the risk even further keeps shareholders’ downside risk constant, while improving gains on the upper tail of the distribution. As a consequence, shareholders will strictly prefer either risky or safe projects.

The choice between the two project types then depends on the number of projects \({\overline{n}}=\frac{E}{b}\) the bank is allowed to fund and the percentage of compensation that needs to be deferred, \(\lambda \). The lower the number of projects the bank can fund, the lower is the benefit from the limited liability effect. Similarly, the higher \(\lambda \), the less capital can indirectly be protected from bankruptcy by transferring it to the manager. Part (a) of the following Proposition thus shows that shareholders of the good bank prefer safe projects if and only if \({\overline{n}}\) is sufficiently low and \(\lambda \) sufficiently large, thereby confirming the intuition that tight capital equity ratios and mandatory deferral of compensation have comparable impacts on the incentives for excessive risk-taking. Besides, taking the partial derivative of the right hand side of the condition in Part (a (i)) of Proposition 1 with respect to e shows that the maximum number of projects the regulator can allow without triggering risk-shifting by the good bank decreases in the manager’s expected compensation e - the higher the manager’s compensation, the higher is the incentive to externalize part of the compensation to creditors via risk-shifting.

Part (a) of Proposition 1 summarizes the behavior of the good bank:Footnote 19

Proposition 1

Suppose that both project types are in abundant supply. Then, depending on the capital regulation \({\overline{n}}=\frac{E}{b}\) and the minimum fraction \(\lambda \) of deferred compensation, banks’ portfolios and default probabilities (\(d^{i}\)) are:

-

(a)

Good Bank G:

$$\begin{aligned} \begin{array}{ll} \text {(i) }n_{S}^{G}={\overline{n}}\text {, }n_{R}^{G}=0\text { and }d^{G}=0, &{} \hbox {if }{\overline{n}}\le {\hat{n}}^G(\lambda ):=\dfrac{E-\frac{1-\lambda }{1-(1-\theta _G)\lambda }e}{1-\frac{k-\theta _G}{1-\theta _G}X}; \\ \text {(ii) }n_{S}^{G}=0\text {, }n_{R}^{G}={\overline{n}}\text { and } d^{G}=1-\theta ^{G}, &{} \hbox {otherwise.} \end{array} \end{aligned}$$ -

(b)

Bad Bank B: \(n_{S}^{B}=(1-\gamma ){\overline{n}}\), \( n_{R}^{B}=\gamma {\overline{n}}\) and

$$\begin{aligned} d^{b}=\left\{ \begin{array}{ll} 0, &{} \hbox {if}{\overline{n}}\le {\hat{n}}^B:=\frac{E-e}{1-(1-\gamma )kX}; \\ 1-\theta ^{B}, &{} \hbox {otherwise.} \end{array} \right. \end{aligned}$$ -

(c)

Comparison of Banks: For every \(\lambda \in [0,1]\) there exists a \({\hat{\gamma }}(\lambda )\in (0,1)\) such that \({\hat{n}}^{G}(\lambda )< {\hat{n}}^{B}\) if and only if \(\gamma <{\hat{\gamma }}(\lambda )\).

Turning next to the bad bank in part (b) of the Proposition, recall that managers cannot discriminate between the two project types, so that risk-shifting is no issue. As the good bank does, the bad bank will always fund as many projects as possible, i.e. \(n^{B}={\overline{n}}=\dfrac{E}{b}\). To see this, just note that the expected return of both project types is positive, and that the shareholder in addition benefits from the limited liability effect in case of bankruptcy. Due to the law of large numbers, the fractions of risky and safe projects in the bad bank’s portfolio are thus always \(\gamma \) and \(1-\gamma \), respectively.

To see the reason for part (c), recall first that the bad bank cannot identify projects, so that their default risk is purely driven by the portfolio size and the exogenously given fraction \(\gamma \) of risky projects. If most projects are safe (\(\gamma \) low), the bad bank will never default even if it funds a large portfolio. But if most projects are risky (\( \gamma \) close to 1), the bad bank will be at risk of default whenever their portfolio is larger than \(E-e\), the difference between its equity and the manager’s compensation. By contrast, the good bank’s default risk is driven by its choice between all-safe and all-risky portfolios, which in turn depends on the maximum portfolio size permitted by capital regulation. Irrespective of \(\lambda \), the good bank prefers safe projects for very small portfolios, but risky projects even for permitted portfolio sizes below \(E-e\) due to the externality it imposes on creditors. Hence, irrespective of \(\lambda \), it is always possible to find pairs of \(\gamma \) and \({\overline{n}}\) such that the good bank is at risk of default but the bad bank is not, and vice versa.

Optimal Regulation.

Recall that social welfare in our model is just the sum of net returns of all projects, reduced by social costs of default. With the equilibrium project choices derived in Proposition 1, we get:Footnote 20

The first line captures the case without default risk, i.e. where shareholders of the good bank prefer safe projects, and where \({\overline{n}}= \frac{E}{b}\) is so low that the bad bank is not driven into bankruptcy even when risky projects fail. In the second line, the good bank’s shareholder still prefers safe projects, but the capital equity ratio is not tight enough to avoid the default of the bad bank in case risky projects fail. The third line deals with the opposite case: While the good bank’s shareholder now prefers risky projects, the capital equity ratio is tight enough to certainly avoid the default of the bad bank. Note that a switch from the second to the third line requires that \(\lambda \) decreases, since the good bank’s shareholder’s incentive for risk-shifting decreases in \(\lambda \), while the bad bank’s bankruptcy risk only depends on \({\overline{n}}\), i.e. on the capital equity ratio. The fourth line, finally, represents the case where both banks default if risky projects fail.

For a given capital regulation \({\overline{n}}\), it is easy to check that \(SW_{i}^{A}({\overline{n}})>\max \{SW_{ii}^{A}({\overline{n}}),\) \( SW_{iii}^{A}({\overline{n}})\} \ge \min \{SW_{ii}^{A}({\overline{n}} ),SW_{iii}^{A}({\overline{n}})\}>SW_{iv}^{A}({\overline{n}})\) holds: As safe projects have higher expected return and avoid any bankruptcy risk, it is better that the good bank has an all-safe portfolio. Furthermore, social welfare in cases (ii) or (iii) where just one bank is risk-free cannot be ranked without further assumptions as this depends on the portfolio mix in the bad bank (i.e. on \(\gamma \)). Finally, for a given number of funded projects n, welfare is clearly lowest when both banks face positive default risk.

When shareholders implement their profit-maximizing portfolios, however, they impose two kinds of externalities: First, due to limited liability, they don’t take into account their creditors’ losses in case of default. Second, the additional social cost of default \(B_{i}(\cdot )\) are a negative externality. Hence, banks choose their privately optimal project portfolios characterized in Proposition 1, although all-safe portfolios are always socially optimal.

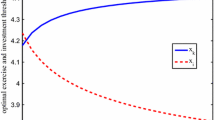

The analysis of the banks’ portfolio choices in Proposition 1 has shown that, when the regulator wants to implement a risk-free banking sector, he needs to impose tight restrictions, so that the banking sector will be small. Thus, there is a trade-off between inducing the good bank to make more efficient project choices and permitting more projects to be carried out in the economy (recall that, neglecting bankruptcy costs, risky projects also provide positive expected net return). This trade-off is illustrated in Fig. 1, which displays social welfare for different numbers of projects banks are permitted to fund when \({\hat{n}} ^{G}(\lambda )<{\hat{n}}^{B}\) (i.e., \(\gamma <{\hat{\gamma }}(\lambda )\)). The linear function represents the case without bankruptcy risk (\(SW_{i}^{A}( {\overline{n}})\)) in which each additional project just adds its expected net return \(kX-1>0\) (in the good bank) and \(\gamma \left( kX-1\right) +\left( 1-\gamma \right) \left( \theta ^{B}X-1\right) \) (in the bad bank) to social welfare. By contrast, the curve representing \(SW_{iii}^{A}({\overline{n}})\) is concave due to the social cost of default.Footnote 21

Figure 1 displays a situation where social welfare is highest when the regulator restricts the number of projects so that the banking sector is risk free (case (i) in equation (4), represented by the solid line), i.e. \({\overline{n}}=\min \left\{ {\hat{n}}^{G}\left( \lambda \right) ,{\hat{n}}^{B}\right\} \), compared to a setting where only the good bank faces positive bankruptcy risk (case (iii) in equation (4), represented by the dotted curve).Footnote 22 Recall that the case where only the good bank faces default risk is the one where \( \gamma \) is low, i.e. where the mixed portfolio in the bad bank contains a large fraction of safe projects. In order to increase the number of projects for which the good bank still prefers safe projects, it is then optimal to demand full deferral of compensation, \(\lambda =1\). In Fig. 1 , this moves the threshold \({\hat{n}}^{G}\left( \lambda \right) \), represented by the dashed vertical line, to the right. Thus, whenever the regulator wants to keep the entire banking sector risk free, mandatory deferral of full compensation is optimal as it allows for a larger banking sector without triggering risk-shifting in the good bank.

Abundant supply of projects: maximum mandatory deferral of compensation in a risk-free banking sector. For \(n\le {\hat{n}}^G(\lambda )\), both banks are free from default risk, and social welfare is given by the solid line. For \(n>{\hat{n}} ^G(\lambda )\), the good bank prefers risky projects, and social welfare is given by the dotted concave curve. The optimal capital regulation is \(n={\hat{n}}^G(\lambda )\). Increasing mandatory deferral of compensation \(\lambda \) shifts the threshold \({\hat{n}}^G(\lambda )\) (vertical dashed line) to the right, which is social welfare enhancing as the regulator can allow the good bank to fund more projects while avoiding risk-shifting incentives

If the capital ratio required to avoid risk-shifting in the good bank is very strict, however, the regulator may accommodate risk-shifting in order to increase the size of the banking sector. In this case, the optimal capital regulation \({\overline{n}}=\frac{E}{b}\) is driven by the trade-off between bank size and social cost of default rather than by the threshold implied by \(\lambda \). In order to discuss this case, it will prove useful to introduce some additional notation. For all \(j\in \{ii,iii,iv\}\), let

denote the unique peaks of each of the concave functions the social welfare function is made up of.

To exclude the uninteresting case, assume that it is never optimal for the regulator that both banks face positive default risk:

Assumption 1

If \(\gamma \le {\hat{\gamma }}(1)\), then \(SW_{iv}^{A}( {\overline{n}}_{iv}^{A})<\max \{SW_{i}^{A}({\hat{n}}_{G}(1)),SW_{iii}^{A}(\min \{ {\overline{n}}_{iii}^{A},{\hat{n}}^{B}\})\}\).If \(\gamma >{\hat{\gamma }}(1)\), then \(SW_{iv}^{A}({\overline{n}}_{iv}^{A})<\max \{SW_{i}^{A}({\hat{n}}^{B}),SW_{ii}^{A}(\min \{ {\overline{n}}_{ii}^{A},{\hat{n}} ^{G}(1)\})\}\).

Then, the optimal mix of capital requirement and regulation of managerial compensation can be characterized as follows:

Proposition 2

Suppose that both project types are in abundant supply and that Assumption 1 holds. If \(\gamma \le {\hat{\gamma }}(1)\), then:

-

(1a)

If \(SW_{iii}^{A}\left( \min \left\{ {\overline{n}}_{iii}^{A},\hat{ n}^{B}\right\} \right) <SW_{i}^{A}({\hat{n}}^{G}(1))\), then the unique optimal regulation is \(\lambda =1\) and \({\overline{n}}={\hat{n}}^{G}(1)\).

-

(1b)

If \({\hat{n}}^{B}<{\overline{n}}_{iii}^{A}\) and \(SW_{i}^{A}({\hat{n}} ^{G}(1))\le SW_{iii}^{A}({\hat{n}}_{B})\), then the optimal regulation is \( {\overline{n}}={\hat{n}}^{B}\) and any \(\lambda \).

-

(1c)

Otherwise, the optimal regulation is \({\overline{n}}={\overline{n}} _{iii}^{A}\) and any \(\lambda \).

If \(\gamma >{\hat{\gamma }}(1)\), then:

-

(2a)

If \(SW_{ii}^{A}\left( \min \left\{ {\overline{n}}_{ii}^{A},{\hat{n}} ^{G}(1)\right\} \right) <SW_{i}^{A}({\hat{n}}^{B})\), then optimal regulation is \({\overline{n}}={\hat{n}}^{B}\) and any \(\lambda \).

-

(2b)

If \({\hat{n}}^{G}(1)<{\overline{n}}_{ii}^{A}\) and \(SW_{i}^{A}({\hat{n}} ^{B})\le SW_{ii}^{A}({\hat{n}}^{G}(1))\), then the unique optimal regulation is \(\lambda =1\) and \({\overline{n}}={\hat{n}}^{G}(1)\).

-

(2c)

Otherwise, the optimal regulation is \({\overline{n}}={\overline{n}} _{ii}^{A}\) and any \(\lambda \in \left\{ \lambda :{\overline{n}}_{ii}^{A}\le {\hat{n}}^{G}(\lambda )\right\} \).

Proof

Follows immediately from above.

In cases (1a) to (1c), the critical \({\overline{n}}\) above which the good bank switches to an all-risky portfolio, even for \(\lambda =1\), is lower than that above which the bad bank faces positive bankruptcy risk (i.e. \({\hat{n}} ^{G}\left( 1\right) \le {\hat{n}}^{B}\)). Thus, given our assumption that the regulator will never implement a fully risky banking sector, he is left with three possibilities: In case (1a), it is optimal to keep the banking sector risk-free. As mentioned before, it is then optimal to set \(\lambda =1\) as this minimizes the good bank’s risk-shifting incentives; thereby allowing to increase \({\overline{n}}\) up to \({\hat{n}}^{G}(1)\). In case (1b), the regulator tolerates risk-shifting by the good bank, and \({\overline{n}}\) is thus given by the maximum number of projects the bad bank can fund without risk of default. Mandatory deferral of compensation is then meaningless as the good bank funds an all-risky portfolio anyway, while the bad bank cannot distinguish between project types. However, if \(\gamma \) is so high that the bad bank faces default risk only for a very large number of projects, then the optimal \({\overline{n}}\) is no longer given by \({\overline{n}}={\hat{n}}^{B}\), but depends on the (convex) bankruptcy costs in the good bank, as accounted for in case (1c).

The cases (2a) to (2c) can be interpreted analogously, with the only difference that \({\hat{n}}^{G}\left( 1\right) >{\hat{n}}^{B}\), so that, in case of a risky banking sector, the bad bank faces the risk of default. This is the case if the frequency of safe projects in the economy is low, as this frequency determines directly the risk exposure of the bad bank, but leaves the risk-shifting incentives of the good bank unchanged.Footnote 23

Summing up, the regulator decides between a small banking sector without default risk or a larger, but risky banking sector. Our analysis with an abundant availability of the socially preferable safe projects then yields two main insights: First, mandatory deferral of compensation and tight capital requirements are substitutes with respect to the incentives for risk-shifting. Second, whenever the regulator wants to avoid risk-shifting, mandatory deferral of compensation is superior to tighter capital requirements as it allows banks to fund more socially valuable projects. \(\square \)

5 Limited number of projects

Equilibrium Project Choices.

We now turn to our second setting, in which the numbers of both safe and risky projects in the economy are limited. Let \(N_{S}\) and \(N_{R}\) be the total number of safe and risky projects, respectively, in the economy. To avoid tedious and economically uninteresting case distinctions, let us assume that \({\overline{n}}<\min \left\{ N_{S},N_{R}\right\} \), so that the good bank will still fund an all-safe or all-risky portfolio.

The fact that the number of both project types is limited does not necessarily exclude that both banks can fund all-safe or all-risky portfolios; it just means that the good bank’s portfolio choice influences the pool the bad bank can fish in, and hence its portfolio. To make this point as simple as possible, we assume that the good bank can first pick its portfolio. The fraction of risky projects in the economy after the good bank has made its choice, and hence also the fraction of risky projects in the bad bank’s portfolio, is now affected by the good bank’s behavior. Denote this fraction by \(\gamma _{S}({\overline{n}}):=\frac{N_{R}}{N_{R}+N_{S}- {\overline{n}}}\) when the good bank has picked an all-safe portfolio, and by \( \gamma _{R}({\overline{n}}):=\frac{N_{R}-{\overline{n}}}{N_{R}+N_{S}-{\overline{n}} }\) when the good bank has picked an all-risky portfolio of size \({\overline{n}} \). Note that the bad bank’s portfolio is always affected by the good bank’s portfolio choice except in the implausible sequence where the bad bank chooses its entire portfolio first (in this uninteresting case, nothing changes compared to the case with an abundant supply of projects).

For later reference, note that \(\gamma _{S}(\cdot )\) is increasing and \( \gamma _{R}(\cdot )\) is decreasing in \({\overline{n}}\), and \(\gamma _{S}(0)=\gamma _{R}(0)\). Furthermore, \(\gamma _{S}(\cdot )\) (\(\gamma _{R}(\cdot )\)) approaches the initial share \(\gamma \) of risky projects in the economy from above (below) as the total supply of projects \(N_{R}+N_{S}\) grows large. In other words, the case where projects are in abundant supply discussed in Sect. 4 is the limit case of this analysis where total supply of projects grows infinitely large.

As the fraction of risky projects in the economy when the bad bank makes its choice depends on the good bank’s choice, so does the maximum number \({\hat{n}} ^{B}\) of projects the bad bank can be allowed to fund without incurring any default risk. We denote this maximum number by \({\hat{n}}_{S}^{B}\) or \({\hat{n}} _{R}^{B}\), depending on whether the good bank has picked an all-safe or an all-risky portfolio, respectively. These maximum risk-free portfolio sizes for the bad bank are implicitly given byFootnote 24

Depending on the capital regulation, \({\overline{n}}=\frac{E}{b}\) and the mandatory percentage deferral of compensation, \(\lambda \), the equilibrium allocations of projects and default risks are now given by the following Proposition:

Proposition 3

Suppose both project types are in limited supply. Then, banks’ portfolios \(n_{S}^{i}\), \(n_{R}^{i}\), and default probabilities \( d^{i}\) are:

-

(i)

\(n_{S}^{G}={\overline{n}}\), \(n_{R}^{G}=0\), \(n_{S}^{B}=(1-\gamma _{S}({\overline{n}})){\overline{n}}\), \(n_{R}^{B}=\gamma _{S}({\overline{n}}) {\overline{n}}\) and \(d^{G}=d^{B}=0\) if \({\overline{n}}\le \min \{ {\hat{n}} ^{G}(\lambda ),{\hat{n}}_{S}^{B}\}\).

-

(ii)

\(n_{S}^{G}={\overline{n}}\), \(n_{R}^{G}=0\), \(n_{S}^{B}=(1-\gamma _{S}({\overline{n}})){\overline{n}}\), \(n_{R}^{B}=\gamma _{S}({\overline{n}}) {\overline{n}}\), \(d^{G}=0\) and \(d^{B}=1-\theta ^{B}\) if \({\hat{n}}_{S}^{B}< {\overline{n}}\le {\hat{n}}^{G}(\lambda )\).

-

(iii)

\(n_{S}^{G}=0\), \(n_{R}^{G}={\overline{n}}\), \(n_{S}^{B}=(1-\gamma _{R}({\overline{n}})){\overline{n}}\), \(n_{R}^{B}=\gamma _{R}({\overline{n}}) {\overline{n}}\), \(d^{G}=1-\theta ^{G}\) and \(d^{B}=0\) if \({\hat{n}}^{G}(\lambda )< {\overline{n}}\le {\hat{n}}_{R}^{B}\).

-

(iv)

\(n_{S}^{G}=0\), \(n_{R}^{G}={\overline{n}}\), \(n_{S}^{B}=(1-\gamma _{R}({\overline{n}})){\overline{n}}\), \(n_{R}^{B}=\gamma _{R}({\overline{n}}) {\overline{n}}\), \(d^{G}=1-\theta ^{G}\) and \(d^{B}=1-\theta _{B}\) if \({\overline{n}}\ge \max \{ {\hat{n}}_{G}(\lambda ),{\hat{n}}_{R}^{B}\}\)

where \({\hat{n}}_{S}^{B}\) and \({\hat{n}}_{R}^{B}\) are given by (5) and (6), and \({\hat{n}}_{S}^{B}<{\hat{n}}_{R}^{B}\).

In cases (i) and (ii), the good bank prefers safe projects, so that the critical \({\overline{n}}\) that triggers a positive bankruptcy risk in the bad bank is low (the remaining fraction of safe projects in the economy is below \(1-\gamma \)). Then, case (i) captures the situation where \({\overline{n}}\) is so low that the bad bank faces no default risk, whereas it fails in case (ii) whenever risky projects fail. Note that this case requires also that \( {\overline{n}}\le {\hat{n}}^{G}(\lambda )\), since the good bank would otherwise prefer risky projects.

In cases (iii) and (iv), the good bank funds an all-risky portfolio. In case (iii), only the good bank faces bankruptcy risk, which requires that \({\hat{n}} ^{G}(\lambda )<{\overline{n}}\le {\hat{n}}_{R}^{B}\). Finally, both banks face positive bankruptcy risk in case (iv).

As an illustration, Fig. 2 displays the threshold capital regulations for the cases discussed in Proposition 3 as functions of the share \(\gamma \) of risky projects in the original pool of projects. The solid horizontal lines are \({\hat{n}}^{G}(1)\) (the upper line) and \({\hat{n}}^{G}(0)\) (the lower line). Both \({\hat{n}}^{G}(1)\) and \({\hat{n}} ^{G}(0)\) are independent of \(\gamma \), and the higher the share of compensation that needs to be deferred, the larger is the portfolio size \( {\overline{n}}\) beyond which the good bank wants to engage in risk shifting.

Existence of cases discussed in Proposition 3. Capital regulation above which the bad bank is at risk of default given that good bank funds all-risky (dotted curve, \({\hat{n}}_R^B\)) and all-safe (dashed curve, \({\hat{n}}_S^B\)) portfolio, respectively

The dashed curve represents the threshold portfolio size \({\hat{n}}_{S}^{B}\) beyond which the bad bank has positive default risk when the good bank funds an all-safe portfolio. If \(\gamma \) is low, this threshold is above the good bank’s threshold for risk shifting even if all compensation must be deferred. This means that the bad bank will never be at risk of default for portfolio sizes for which the good bank prefers safe projects. For larger \( \gamma \), however, the dashed curve falls below the upper solid line, and the area above the dashed curve and below the solid line then represents case (ii) in Proposition 3. In this case, the bad bank is at risk of default, while the good bank still does not have incentives for risk shifting if all compensation must be deferred. If \(\gamma \) increases further, then the bad bank may even be at risk of default for portfolio sizes that wouldn’t induce the good bank to fund an all-risky portfolio absent any mandatory deferral of compensation.

Similarly, the dotted curve represents the threshold portfolio size \({\hat{n}} _{R}^{B}\) beyond which the bad bank has positive default risk when the good bank funds an all-risky portfolio. For small \(\gamma \), there are some portfolio sizes above \({\hat{n}}^{G}(\lambda )\) but below the dotted curve such that the good bank will fund an all-risky portfolio whereas the bad bank is free from default risk. For higher \(\gamma \), however, the bad bank will be at risk of default whenever the good bank has incentives for risk shifting. Again, the level of \(\gamma \) beyond which the latter case applies, is decreasing in \(\lambda \).

Furthermore, recall that the fraction of risky projects in the bad bank’s portfolio is higher (lower) than in the economy if the good bank funds safe (risky) projects. Thus, in case the good bank picks risky projects, the capital regulation required to avoid any bankruptcy risk in the bad bank can be less strict, i.e. \({\overline{n}}\) can be larger. This is represented by the dotted line in Fig. 2. This endogeneity of the bad bank’s default risk and its impact on the socially optimal percentage of deferred compensation is the main point we wish to make when we now turn to the optimal regulation.

Optimal Regulation.

From the case distinction describing the banks’ portfolios and default risks, we immediately obtain the following social welfare:

Compared to the case of abundant supply of projects, the limited supply of projects sets higher incentives for the regulator to accommodate risk-shifting by the good bank. To see this, just recall that the percentage of risky projects in the bad bank increases when the good bank funds an all-safe portfolio. Compared to the setting with an abundant supply of projects, this introduces a countervailing social benefit of the good bank’s risk shifting. If this benefit is sufficiently large, risk shifting by the good bank may even be socially superior to keeping the banking sector free from default risk for the same given portfolio size.

Furthermore, this effect reduces the maximum number of projects the bad bank can fund without default risk, and hence requires tougher capital equity ratios if the regulator wants to keep the entire banking sector risk free. By contrast, if the good bank funds an all-risky portfolio, then the percentage of safe projects in the bad bank’s portfolio increases, and the regulator can allow for more projects even when he wants to keep the bad bank risk free. As a consequence, it may now be better to trigger risk-shifting by the good bank even in cases where this was inferior in the setting with an abundant supply of projects. Recalling that the good bank is superior in managing risky projects as expressed by \(\theta ^{G}>\theta ^{B}\) , this case is not far-fetched.

From the previous analysis, we know that, when the regulator wants to induce risk-shifting by the good bank in order to improve the quality of the bad bank’s portfolio, there are two possibilities; he can either increase \( {\overline{n}}\) or reduce \(\lambda \). Which of the two instruments is superior depends on the situation: Suppose first that the regulator wants to induce risk-shifting by the good bank, but without jeopardizing too many projects, for instance because bankruptcy costs are highly convex in n. Then, it is better to trigger risk-shifting in the good bank by reducing \(\lambda \). Thus, by contrast to the case with an abundant supply of projects, full mandatory deferral of compensation is now no longer a weakly dominant choice for the regulator. Second, consider the case where \(\gamma \) is so high that the bad bank has zero default risk even when the number of projects is high. Then, the regulator does not want to reduce the number of projects in the economy. Thus, risk-shifting in the good bank can be triggered by lax capital regulations, and there is no benefit from reducing \(\lambda \).

Let us now move more formally to the welfare comparison of the different cases. Just like in the previous case, let us, for all \(j\in \{i, ii,iii,iv\} \), define

as the unique peaks of each of the concave functions the social welfare function is made up of. Note that, due to the impact of the good bank’s choice on the project pool available to the bad bank, \(SW_i^L(\cdot )\) is also concave.

In order to further streamline the discussion, Assumption 2 rules out some of the less relevant cases:

Assumption 2

-

(a)

\({\hat{n}}^{G}(1)<{\overline{n}}_{i}^{L}\) and \({\hat{n}}^{G}(0)<{\hat{n}} _{R}^{B}\).

-

(b)

\(SW_{ii}^{L}({\overline{n}}_{ii}^{L})<\max \{SW_{i}^{L}({\hat{n}} _{B}^{S}),SW_{iii}^{L}({\hat{n}}_{G}(0))\}\).

-

(c)

\(SW_{iv}^{L}({\overline{n}}_{iv}^{L})<\max \{SW_{i}^{L}(\min \{ {\hat{n}}^{G}(1),{\hat{n}}_{S}^{B}\}),SW_{iii}^{L}(\max \{ {\hat{n}}^{G}(1),{\hat{n}} _{R}^{B}\})\}\).

Part (a) of Assumption 2 ensures that the trade-off between the benefits from funding more projects and protecting society from banks’ default risk exists for any \(\lambda \): If, by contrast, \({\overline{n}} _{i}^{L}\le {\hat{n}}^{G}(1)\), then the social welfare maximizing regulation would simply be \(\lambda =1\) and \({\overline{n}}={\overline{n}}_{i}^{L}\). Similarly, if \({\hat{n}}_{R}^{B}\le {\hat{n}}^{G}(0)\), there wouldn’t exist any regulation such that the good bank has a positive default risk but the bad bank has not.

Parts (b) and (c) of Assumption 2 ensure that it is never efficient that either both or only the bad bank banks face positive bankruptcy risk. Part (c) corresponds to Assumption 1 in the case of abundant supply of projects. Part (b) also excludes a rather uninteresting case as, similar to the case with an abundant supply of projects, the regulator would simply avoid risk-shifting of the good bank by setting \({\overline{n}}\le {\hat{n}}^{G}(1)\),Footnote 25 which would hardly yield new insights. Thus, Assumption 2 allows us to focus on the most interesting difference of unrestricted and limited supply of projects: if the regulator avoids risk-shifting by the good bank by tight capital equity ratios and mandatory deferral of bonuses, this may backfire by allocating more risky projects to the bank that is inferior in handling those risks.

Given Assumption 2, the optimal regulation can be characterized as follows:

Proposition 4

Suppose that projects are in limited supply and that Assumption 2 holds. Then:

-

(a)

If \(SW_{iii}^L(\min \{ \max \{ {\overline{n}}_{iii}^{L},{\hat{n}} ^{G}(0)\},{\hat{n}}_{R}^{B}\})<SW_{i}^{L}(\min \{ {\hat{n}}^{G}(1),{\hat{n}} _{S}^{B}\})\), then the unique optimal regulation is \(\lambda ^{*}=1\) and \({\overline{n}}^{*}=\min \{ {\hat{n}}^{G}(1),{\hat{n}}_{S}^{B}\} \).

-

(b)

If \({\overline{n}}_{iii}^{L}>{\hat{n}}_{R}^{B}\) and \(SW_{i}^{L}(\min \{ {\hat{n}}^{G}(1),{\hat{n}}_{S}^{B}\})\le SW_{iii}^{L}({\hat{n}}_{R}^{B})\), then the optimal regulation is \({\overline{n}}^{*}={\hat{n}}_{R}^{B}\) and any \(\lambda \).

-

(c)

If \({\hat{n}}^{G}(1)\!>\!{\overline{n}}_{iii}^{L}\) and \(SW_{i}^{L}(\min \{ {\hat{n}}^{G}(1),{\hat{n}}_{S}^{B}\})\!<\!SW_{iii}^{L}(\max \{ \min \{ {\overline{n}} _{iii}^{L},{\hat{n}}_R^B\},{\hat{n}}^{G}(0)\})\), then the optimal regulation is \( {\overline{n}}^{*}=\max \{ \min \{ {\overline{n}}_{iii}^{L},{\hat{n}}_R^B\}, {\hat{n}}^{G}(0)\}\) and \(\lambda ^{*}\in \{ \lambda :\min \{ {\overline{n}} _{iii}^{L},{\hat{n}}_R^B\}>{\hat{n}}^{G}(\lambda )\} \cup \{0\}\).

-

(d)

Otherwise, the optimal regulation is \({\overline{n}}^{*}= {\overline{n}}_{iii}^{L}\) and any \(\lambda \).

Parts (a), (b) and (d) correspond to the respective cases discussed in Proposition 2, but taking into account that the optimal regulation conditional on avoiding any default risk is now \(\min \{ {\hat{n}}^{G}(1),{\hat{n}}_{S}^{B}\}\) instead of \({\hat{n}}^{G}(1)\). The main difference introduced by the limited supply of projects is discussed in Part (c), which is illustrated in Fig. 3 for the case where \(\hat{n }^{G}(1)<{\hat{n}}_{S}^{B}\). The vertical, dashed line represents \({\overline{n}} ={\hat{n}}^{G}(1)\), whereas the solid and the dotted curves represent \(SW_{i}( {\overline{n}})\) and \(SW_{iii}({\overline{n}})\), respectively. Suppose the regulator wants to re-allocate safe projects from the good to the bad bank, because the bad bank is inferior in managing risky projects. To induce risk-shifting by the good bank, the regulator could set \({\overline{n}}>{\hat{n}} ^{G}(1)\), which still keeps the bad bank risk-free due to \({\hat{n}}^{G}(1)< {\hat{n}}_{R}^{B}\), and which is more efficient since, for some capital regulations slightly to the right of the vertical dashed line representing \( {\hat{n}}^{G}(1)\), \(SW_{i}({\overline{n}})<SW_{iii}({\overline{n}})\). Thus, the higher return of risky projects in the good compared to the bad bank overcompensates the expected social costs of the good bank’s potential bankruptcy. However, it can be superior to let the good bank incur default risk, but with less projects at stake due to \({\overline{n}}_{iii}^{L}<{\hat{n}} ^{G}(1)\). The only way of making the good bank fund less projects while still retaining its risk-taking incentives is to reduce \(\lambda \), which would move the vertical dashed line to the left. In the example displayed in Fig. 3, the optimal fraction of mandatory deferral of compensation is such that the vertical dashed line intersects the dotted curve \(SW_{iii}(\cdot )\) at the latter’s peak. If even \({\overline{n}} _{iii}^{L}<{\hat{n}}^{G}(0)\le {\hat{n}}_{S}^{B}\), then the uniquely optimal regulation will even require \(\lambda =0\).

Limited supply of projects: misallocation of projects in a risk-free banking sector. For \(n\le {\hat{n}}^G(1)\), both banks are free from default risk, and social welfare is given by the solid line. For \(n>{\hat{n}}^G(1)\), the good bank prefers risky projects, and social welfare is given by the dotted concave curve. The optimal capital regulation at \(\lambda =1\) is slightly above \({\hat{n}}^G(1)\), as risk-shifting by the good bank improves the pool from which the bad bank’s projects are drawn. Reducing mandatory deferral of compensation \(\lambda \) shifts the threshold \({\hat{n}}^G(\lambda )\) (vertical dashed line) to the left, which is social welfare enhancing as risk-shifting incentives for the good bank are maintained while putting fewer projects at risk of default

This case thus illustrates why a limited supply of projects in a heterogenous banking sector may provide a rationale for early compensation, even from a social welfare perspective: Mandatory deferral of compensation reduces the risk-taking incentives of the good bank, which might prefer safe projects if and only if the part of compensation that needs to be deferred is sufficiently large. As a consequence, more risky projects are misallocated to the bad bank. Thus, allowing for early compensation may enable the bad bank to fund more safe projects without jeopardizing too many risky projects in the good bank.

Limited supply of safe projects: misallocation of projects with default risk . For \(n\le {\hat{n}}_S^B\), both banks are free from default risk, and social welfare is given by the solid line. For \({\hat{n}}_S^B<n\le {\hat{n}}^G(0)\), the bad bank has positive defualt risk after the good bank has selected their all-safe portfolio. For \(n>{\hat{n}}^G(0)\), the good bank prefers risky projects, which removes the bad bank’s default risk, and social welfare is given by the dotted concave curve. Hence, the optimal capital regulation at \(\lambda =0\) is slightly above \({\hat{n}}_G(0)\). Increasing mandatory deferral of compensation \(\lambda \) would shift the threshold \({\hat{n}}_G(\lambda )\) (right vertical dashed line) to the left, which is social welfare reducing as more projects would be at risk of default

Next, consider the case displayed in Fig. 4, in which \({\hat{n}} _{S}^{B}\), represented by the left vertical dashed line, is smaller than \( {\hat{n}}^{G}(0)\), represented by the right vertical dashed line. This means that, for the maximum number of projects that avoids risk shifting by the good bank even with early compensation only (\(\lambda =0\)), the bad bank would face positive default risk. A tight capital regulation may then reduce welfare as too few safe projects are left over in the pool the bad bank draws its projects from. Again, the regulator may wish to trigger risk-shifting by the good bank by allowing for early compensation: The area between the vertical dashed lines in Fig. 4 displays the set \( ({\hat{n}}_{S}^{B},{\hat{n}}^{G}(0)]\) of capital requirements that induce case (ii) of Proposition 3 absent any requirement to defer compensation (\(\lambda =0\)). Due to our Assumption 2, the regulator wants to avoid this case, which is illustrated in our example by the low position of the dash-dot curve \(SW_{ii}(\cdot )\). The optimal capital requirement outside this area is \({\hat{n}}^{G}(0)\), in which case the banking sector would be quite large, with the good bank being at risk of default. Introducing mandatory deferral of compensation will then move the right vertical dashed line even further right, which reduces social welfare for the capital requirement \({\overline{n}}={\hat{n}}^{G}(\lambda )\). At the same time, the optimal default-risk free regulation \({\overline{n}}={\hat{n}} _{S}^{B}\) may still be less attractive. Hence, \(\lambda =0\) is the strictly optimal regulation in this case.

Both examples just discussed have in common that social welfare under the optimal regulation when the banking sector is free from default risk (case (i) of Proposition 3) is below the maximum social welfare when only the good bank has positive default risk (case (iii) of Proposition 3). Recall that this can never occur under abundant supply of projects. In the example discussed in Fig. 3, \(SW_{i}({\overline{n}})<SW_{iii}({\overline{n}})\) for any capital regulation \({\overline{n}}\). The difference between cases (i) and (iii) of Proposition 3 is that the good bank funds an all-safe portfolio in case (i) and an all-risky portfolio in case (iii). If supply of projects was abundant, the bad bank’s portfolio would be identical in both cases, so that, for given portfolio sizes, social welfare in case (i) strictly dominates. However, if supply of projects is limited, the pool of projects from which the bad bank draws randomly contains more safe projects if the bad bank funds an all-risky portfolio, thus introducing a countervailing effect. The fewer projects there are over all, the more pronounced will this effect be, and the more likely will the countervailing effect be to dominate.