Abstract

Auctions have become popular as means of allocating emissions permits in the emissions trading schemes developed around the world. Mostly, only a subset of the regulated polluters participate in these auctions along with speculators, creating a market with relatively few participants and, thus, incentive for strategic bidding. I characterize the bidding behavior of the polluters and the speculators, examining the effect of the latter on the profits of the former and on the auction outcome. It turns out that in addition to bidding for compliance, polluters also bid for speculation in the aftermarket. While the presence of the speculators forces the polluters to bid closer to their true valuations, it also creates a trade-off between increasing the revenue accrued to the regulator and reducing the profits of the auction-participating polluters. Nevertheless, the profits of the latter increase in the speculators’ risk aversion.

Similar content being viewed by others

Notes

For details see Article 18 in the Commission’s Regulation (EU) No 1031/2010 of 12 November 2010.

The EC has designated the EEX platform in Leipzig, Germany as the transitional common auction platform.

The auction limit was set to 5 and 10 % in the two phases, respectively.

The RGGI States are: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island and Vermont. At the start of the scheme, New Jersey was also part of the program, but the state withdrew effective January 1, 2012.

The experience from both the EU ETS and the California ETS shows that not all regulated firms participate in the initial auction. Details on this are provided in Sect. 2.

This is the auction format used by the EU, California, RGGI and Quebec.

In reality the emissions cap is established based on meteorological targets. For example, the EU ETS cap for 2013 was just slightly below 2.04 billion permits and it decreases until 2020, such that ”[...] the overall global annual mean surface temperature increase should not exceed 2 degrees Celsius above preindustrial levels” (Directive 2009/29/EC of the European Parliament).

These are the emissions the firm would release if there were no environmental regulations.

Setting the variance of the shock to one does not reduce the generality of the problem. Variances other than one can be thought of as being absorbed in \(\alpha _f ,\forall f\).

It could be argued that some of the largest polluters, i.e. the electricity producers, are acting in monopoly rather than in competitive markets. However, as these are typically natural monopolies, their prices are regulated and, therefore, they can be considered price takers. The price-taking assumption means that I can focus on the permits market.

Modeling grandfathered permits explicitly would only affect the secondary market price by a constant.

In cases in which some grandfathering exists, \(\bar{{E}}\) denotes the supply of permits net of grandfathered permits.

In practice, the emissions cap is decided based on geological and meteorological forecasts related to the global temperature. A polluter’s participation in the auction may depend on participation costs, cash constraints or the acceptance as a member of the auction platform or other participation costs.

It is worth noting that the theoretical literature does not give any clear revenue ranking or equivalence result for the multi-unit, multi-demand auctions (Klemperer 1999; Ausubel et al. 2014). In fact, Maskin and Riley (1989) conclude that for the multi-demand case, the standard auctions are not optimal and, instead, a nonlinear pricing scheme is the optimal selling procedure. This indicates that, indeed, the uniform-price auction format is not optimal in the revenue-maximization sense. There are, nevertheless, other considerations that make it popular for distributing emissions permits: it has a price mechanism that is easy to understand and perceived as fair, since everyone pays the same price, it encourages more participation than the discriminatory auction (Ausubel et al. 2014), it provides a good price discovery and protection against disruptions of the output market (for details see Holt et al. 2007).

Based on EEX Exchange market data: www.eex.com.

In fact, even if the secondary market was thin, thus creating a bilateral oligopoly market, Malueg and Yates (2009), Haita (2014) show that, as long as firms do not differ in the slopes of their marginal abatement costs, the strategies of the buyers and sellers cancel out, leaving the price unchanged relative to the competitive one. This is, however, only a special case in the current model, which leaves the thickness of the market as the main argument for price-taking behavior in the secondary market.

Penalties for non-compliance are excluded from the model. Most ETSs have prohibitively high penalties such that non-compliance is deterred.

For brevity, constant terms have been discarded.

Note that although bidders have heterogeneous valuations, in a uniform price auction each bidder pays the same price.

Although linear strategies may appear restrictive, they can be interpreted as linear approximations of demand around the equilibrium price. Moreover, it can be shown that if the \(n-1\) firms other than i plays a linear strategy, then the best response of firm i is also linear.

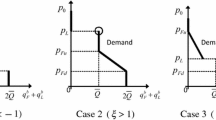

One could also generalize to an equilibrium in discontinuous piecewise linear functions in which each firm would take into account the active firms in the market for each price range, according to the marginal valuations for the first permit. This approach is illustrated in Baldick et al. (2004) for the case of two firms bidding for electricity supply (see also Rudkevich 2005). However, such a procedure would complicate the analysis and shift the focus of the paper. Therefore, it is worth thinking of (17) and (18) as smooth approximations of piecewise linear functions.

The case of all bidders being risk neutral and submitting competitive bids would amount to all bidders submitting bid functions equal to the expected secondary market price. For the case of strategic bidding with risk neutrality and no speculators, see Haita (2014).

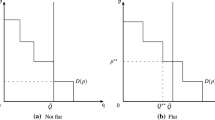

Decreasing marginal valuation functions are crucial for obtaining meaningful SFE in linear strategies.

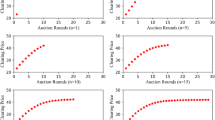

For convenience, I represent the valuations of the auction non-participating polluters (indexed from 11 to 50) as being equal to zero.

For illustrative convenience I assume that the most sensitive polluters participate in the auction.

Recall that with more than two risk neutral speculators the auction cancels.

References

Aatola, P., Ollikainen, M., & Toppinen, A. (2013). Price determination in the EU ETS market: Theory and econometric analysis with market fundamentals. Energy Economics, 36(1), 380–395.

Ausubel, L. M., Cramton, P., Pycia, M., Rostek, M., & Weretka, M. (2014). Demand Reduction and Ineffciency in multi-unit auctions. Review of Economic Studies, 81(4), 1366–1400.

Baldick, R., Grant, R., & Kahn, E. (2004). Theory and application of linear supply function equilibrium in electricity markets. Journal of Regulatory Economics, 25(2), 143–167.

Baldursson, F. M., & von der Fehr, N.-H. M. (2004). Price volatility and risk exposure: On market-based environmental policy instruments. Journal of Environmental Economics and Management, 48(1), 682–704.

Benz, E., Loschel, A., & Sturm, B. (2010). Auctioning of CO\(_{2}\) emission allowances in phase 3 of the EU emissions trading scheme. Climate Policy, 10, 705–718.

Betz, R., Seifert, S., Cramton, P., & Kerr, S. (2010). Auctioning greenhouse gas emissions permits in Australia. Australian Journal of Agricultural and Resource Economics, 54(2), 219–238.

Bikhchandani, S., & Huang, C. (1989). Auctions with resale markets: An exploratory model of Treasury bill markets. The Review of Financial Studies, 2(3), 311–339.

Burtraw, D., Goeree, J., Holt, C. A., Myers, E., Palmer, K., & Shobe, W. (2009). Collusion in auctions for emissions permits: An experimental analysis. Journal of Policy Analysis and Management, 28(4), 672–691.

Chevallier, J., Ielpo, F., & Mercier, L. (2009). Risk aversion and institutional information disclosure on the European carbon market: A case-study of the 2006 compliance event. Energy Policy, 37(1), 15–28.

Colla, P., Germain, M., & van Steenberghe, V. (2012). Environmental policy and speculation on markets for emission permits. Economica, 79, 152–182.

Demailly, D., & Quirion, P. (2006). CO2 abatement, competitiveness and leakage in the European cement industry under the EU ETS: Grandfathering vs. output-based allocation. Climate Policy, 6(1), 93–113.

Garratt, R., & Troger, T. (2006). Speculation in standard auctions with resale. Econometrica, 74(3), 753–769.

Goeree, J. K., Palmer, K., Holt, C. A., Shobe, W., & Burtraw, D. (2010). An experimental study of auctions versus grandfathering to assign pollution permits. Journal of the European Economic Association, 8(2–3), 514–525.

Green, R. (1996). Increasing competition in the British electricity spot market. The Journal of Industrial Economics, 44(2), 205–216.

Green, R. (1999). The electricity contract market in England and Wales. The Journal of Industrial Economics, 47(1), 107–124.

Haile, P. A. (2000). Partial pooling at the reserve price in auctions with resale opportunities. Games and Economic Behavior, 33, 231–248.

Haile, P. A. (2003). Auctions with private uncertainty and resale opportunities. Journal of Economic Theory, 108, 72–110.

Haita, C. (2014). Endogenous market power in an emissions trading scheme with auctioning. Resource and Energy Economics, 34, 253–278.

Hepburn, C., Grubb, M., Neuhoff, K., Matthes, F., & Tse, M. (2006). Auctioning of EU ETS phase II allowances: How and why? Climate Policy, 6(1), 137–160.

Holt, C., Shobe, W., Burtraw, D., Palmer, K., Goeree, J. (2007). ‘Auction design for selling CO2 emission allowances under the regional greenhouse gas initiative’, Final Report, http://www.rff.org/research/publications/.

Keloharju, M., Nyborg, K. G., & Rydqvist, K. (2005). Strategic behavior and underpricing in uniform price auctions: Evidence from Finnish treasury auctions. The Journal of Finance, 60(4), 1865–1902.

Klemperer, P. (1999). Auction theory: A guide to the literature. Journal of Economic Surveys, 13(3), 227–286.

Klemperer, P. D., & Meyer, M. A. (1989). Supply function equilibria in oligopoly under uncertainty. Econometrica, 57(6), 1243–1277.

Kyle, A. (1989). Informed speculation with imperfect competition. The Review of Economic Studies, 56(3), 317–355.

Leland, E. H. (1972). Theory of the firm facing uncertain demand. The American Economic Review, 62(3), 278–291.

Maeda, A. (2003). The emergence of market power in emission rights markets: The role of initial permit distribution. Journal of Regulatory Economics, 24(3), 293–314.

Malueg, D. A., & Yates, A. J. (2009). Bilateral oligopoly, private information, and pollution permit markets. Environmental and Resource Economics, 43(4), 553–572.

Marin, J. M., & Rahi, R. (1999). Speculative securities. Economic Theory, 14(3), 653–668.

Maskin, E., & Riley, J. (1989). Optimal multi-unit auctions. In F. Hahn (Ed.), The economics of missing markets: Information and games (pp. 312–335). Oxford: oxford University Press.

Milgrom, P. (2004). Putting auction theory to work. Cambridge, UK: Cambridge University Press.

Montero, J.-P. (2009). Market power in pollution permit markets. The Energy Journal, 30, Special Issue #2.

Neuhoff, K. (2007). Auctions for CO2 allowances: A straw man proposal. Electricity Policy Research Group: Climate Strategies. University of Cambridge.

Pagnozzi, M. (2007). Bidding to lose? Auctions with resale. RAND Journal of Economics, 38(4), 1090–1112.

RGGI Inc. (2014). CO2 Auctions, Tracking and Offsets. http://www.rggi.org/market/co2auctions/results.

Rudkevich, A. (2005). On the supply function equilibrium and its applications in the electricity markets. Decision Support Systems, 40, 409–425.

Sandmo, A. (1971). On the theory of competitive firm underprice uncertainty. The American Economic Review, 61(1), 65–73.

Sopher, P., Mansell, A. & Munnings, C. (2014). Regional greenhouse gas initiative. The worlds carbon markets: A case study guide to emissions trading. Environmental Defense Fund and International Emissions Trading Association.

Subramanian, R., Gupta, S., & Talbot, B. (2007). Compliance strategies under permits for emissions. Production and Operations Management, 16(6), 763–779.

Vargas, J. S. (2003). Bidder behavior in uniform price auction: Evidence from Argentina. Universidad Nacional de La Plata, mimeo.

Wilson, R. (1979). Auctions of shares. The Quarterly Journal of Economics, 93(4), 675–689.

Wirl, F. (2009). Oligopoly meets oligopsony: The case of permits. Journal of Environmental Economics and Management, 58, 329–337.

Acknowledgments

I would like to thank the Editor, Michael A. Crew, and two anonymous referees for their helpful comments, suggestions and time dedicated to this paper. I am indebted to Andrzej Baniak and Adam Szeidl for valuable suggestions in early stages of developing the model. I am grateful to Andrea Canidio, Peter Kondor, Nenad Kos and Andreas Lange for fruitful discussions. All errors are mine. This research was partially supported by the European Research Council Starting Grant for Project 636746 (HUCO).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Derivation of the bidding schedules

Each bidder \(j\in \{f,s\}\) chooses her bidding strategy maximizing the utility in (12) if she is a polluter or in (14) if she is a speculator, acting as a monopsonist on the residual supply of permits \(\bar{{E}}-D_{-j} (\nu )\), where \(D_{-j} (\nu )=\sum \nolimits _i {D_i } (\nu ),i=1,\ldots ,j-1,j+1,\ldots ,N_a +M\). The equilibrium concept is the supply function equilibria (Klemperer and Meyer 1989). A strategy for bidder j is a non-increasing schedule \(D_j (\nu )\) which specifies the quantity demanded for every price \(\nu \).

Thus, each bidder solves the following problem:

The first order conditions read:

Focusing on linear strategies, let the demand schedules have the form:

Substituting (23) in (22), grouping around \(\nu \) and identifying the coeffcients yields:

and

Appendix 2: The case of risk-neutral speculators

Instead of maximizing the CARA utility function of profits, a risk-neutral speculator maximizes the expected profit: \(\max _\nu E[\Pi _s ]=E[(\lambda ^{*}-\nu )D_s (\nu )]=(\bar{{\lambda }}^{*}-\nu )D_s (\nu )\) on the residual supply \(D_s (\nu )=\bar{{E}}-D_{-s} (\nu ),\) where \(-s\) represents bidders \(1,\ldots ,N_a \) (i.e. the polluters) plus the \(M-1\) speculators except for s. The FOC reads:

Assuming linear strategies of the form \(D_s (\nu )=x_s -y_s \nu \) and identifying the coefficients in (B.1) it obtains: \(D_s (\nu )=y_s (\bar{{\lambda }}^{*}-\nu ),\) where \(y_s =\sum \nolimits _{j=1,j\ne s}^{N_a +M} {y_j } ,\) which is exactly the counterpart of the second type of equations in (24), for \(\rho _s =0\). The slopes of the polluters will continue to be given by the first type of equations in (24). Note, however, that in this case the system of equations (24) does not have a positive solution for\(M\ge 2\). In fact, the only non-negative solution is \(y_f =y_s =0\) and this amounts to all firms submitting empty bids. The only non-degenerated equilibrium in linear strategies is obtained for \(M=1\). In this case we have \(y_s =\sum \nolimits _{f=1}^{N_a } {y_f } ,\) with \(y_f \) defined by \(y_f =(1-\Omega ^{2}\kappa _f y_f )(y_f +2y_{-f} ),\) where \(y_{-f} =\sum \nolimits _{i=1,i\ne f}^{Na} {y_i } \).

Rights and permissions

About this article

Cite this article

Haita-Falah, C. Uncertainty and speculators in an auction for emissions permits. J Regul Econ 49, 315–343 (2016). https://doi.org/10.1007/s11149-016-9299-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-016-9299-1