Abstract

Endogenous access pricing (ENAP) is an alternative to the traditional procedure of setting a fixed access price that reflects the regulator’s estimate of the supplier’s average cost of providing access. Under ENAP, the access price reflects the supplier’s actual average cost of providing access, which varies with realized industry output. We show that in addition to eliminating the need to estimate industry output accurately and avoiding a divergence between upstream revenues and costs, ENAP can enhance the incentive of a vertically integrated producer to minimize its upstream operating cost. However, ENAP can sometimes discourage surplus-enhancing investment.

Similar content being viewed by others

Notes

The efficient component pricing rule for setting access prices (e.g., Baumol et al. 1997) might be viewed as a revenue neutral policy in the sense that it sets the price of access equal to VIP’s unit cost of supplying access, including relevant opportunity costs. The total element long run incremental cost (TELRIC) methodology employed to set prices for wholesale services in the U.S. telecommunications industry might be viewed as a variant of a revenue neutral access pricing methodology. Under the TELRIC methodology, the unit price set for a relevant wholesale service can be viewed as an approximation of the estimated minimum feasible average cost of supplying the service. See Tardiff (2002), for example.

\(w_{0}\) might reflect the regulator’s estimate of the VIP’s unit cost of supplying access, for instance.

The settlement payment, \(\left[ w_{1}-w_{0} \right] A_{0}\), can be negative, in which case the VIP would compensate the supplier for the “excess” access payments it made during the period in question. If there is a concern that an industry participant might not deliver the monies it owes at the end of a period, the participant can be required to post a financial bond at the start of the period.

As Valletti and Estache (1999, p. 19) observe, if a regulator has limited knowledge of the minimum possible cost of supplying access, the regulated supplier of access may find it profitable to exaggerate these costs or “engage in wasteful practices” that allow these costs to rise above the minimum feasible level.

The concluding discussion considers positive and asymmetric retail production costs.

Section 5 extends the analysis to consider settings in which increases in \(F\) reduce the VIP’s unit variable cost of supplying access.

Klumpp and Su (2010) analyze a setting in which the VIP can increase the quality of the input it supplies by incurring a higher fixed cost of production. The increased quality enhances the demand for the homogeneous product sold by the retail suppliers. The authors show that the VIP may provide excessive quality under EXAP in part because retail rivals pay a large share of the costs of enhanced quality.

Alternatively, the VIP might face expected penalty \(\Phi (F-\underline{F})\) when it chooses \(F\ge \underline{F}\), where \(\Phi (\cdot )\) is an increasing, convex function of \(F\). This formulation would provide similar qualitative conclusions, but with additional computational complexity.

To illustrate, when industry demand is linear so that the market-clearing price for industry output \(Q\) is \(P(Q)=a-b Q\) (where \(a>0\) and \(b>0\) are constants), the profit-maximizing retail output for a monopolist is \(\frac{a}{2b}\), and the corresponding price is \(\frac{a}{2}\). Therefore, the maximum variable profit of the monopolist in this setting is \(\frac{a^{2} }{4b}\).

Thus, \(P(Q)\) represents the inverse demand curve for the retail product.

Klumpp and Su (2010) also analyze a setting in which the demand for the retail product is linear and access costs are the only costs of retail production.

Here and throughout the ensuing analysis, we will employ a “\(\hat{}\)” above a variable to denote an outcome under EXAP.

The concluding discussion considers alternative possibilities.

As Lemma 1 in the “Appendix” reports, the VIP’s retail output increases whereas the output of each retail rival declines as \(\widehat{w}\) increases under EXAP.

\( \underline{F}=0 \) in this setting because higher values of \(F\) always reduce the VIP’s unit variable cost of production.

As Klumpp and Su (2010) demonstrate, EXAP can sometimes induce a VIP to undertake more than the efficient level of quality-enhancing investment. In such cases, ENAP can sometimes limit such over-investment because it provides weaker incentives than EXAP for the VIP to increase \(F\).

This is the case, for example, if market demand is linear and the VIP’s marginal cost of retail production (\(c_{0}\)) is no less than the marginal cost of the retail rivals (\(c\)). If \(c_{0}<c\), the possibility arises that an increase in the equilibrium access charge caused by an increase in \(F\) under ENAP might benefit the VIP by particularly disadvantaging its less efficient retail rivals. Of course, the relatively strong incentive for upstream cost inflation persists under EXAP even when \(c_{0}<c\).

For simplicity, we have abstracted from financial penalties that the regulator might impose on the VIP if she determines that \(F\) exceeds \( \underline{F}\). In many settings, the VIP will continue to raise \(F\) above \( \underline{F}\) under EXAP as long as such penalties are not too pronounced.

Of course, even when increases in \(F\) do not enhance industry surplus, a VIP may increase \(F\) above \( \underline{F}\) under ENAP if doing so provides direct benefits to the VIP (e.g., perquisites for company officials). The incentives for cost inflation remain more pronounced under EXAP than under ENAP in this case, though, for the reasons identified above.

References

Australian Competition and Consumer Commission. (2003). Assessment of Telstra’s core services undertakings—preliminary view, December 12. www.accc.gov.au/content/item.phtml?itemId=423316&nodeId=5fb13c72df9d0d962af0adb8ac76a583&fn=Preliminary+view+paper.doc.

Baumol, W., Ordover, J., & Willig, R. (1997). Parity pricing and its critics: A necessary condition for efficiency in the provision of bottleneck services to competitors. Yale Journal on Regulation, 14(1), 145–164.

Boffa, F., & Panzar, J. (2012). Bottleneck co-ownership as a regulatory alternative. Journal of Regulatory Economics, 41(2), 201–215.

Fjell, K., Foros, O., & Pal, D. (2010). Endogenous average cost based access pricing. Review of Industrial Organization, 36(2), 149–162.

Fjell, K., Pal, D., & Sappington, D. (2013). Technical appendix to accompany “On the Performance of Endogenous Access Pricing”. www.warrington.ufl.edu/sappington.

Gale, P., & Weisman, D. (2007). Are input prices irrelevant for make-or-buy decision? Journal of Regulatory Economics, 32(2), 195–207.

Klumpp, T., & Su, X. (2010). Open access and dynamic efficiency. American Economic Journal: Microeconomics, 2(2), 64–96.

Mandy, D. (2009). Pricing inputs to induce efficient make-or-buy decisions. Journal of Regulatory Economics, 36(1), 29–43.

Sappington, D. (2005). On the irrelevance of input prices for make-or-buy decisions. American Economic Review, 95(5), 1631–1638.

Sidak, J. G., & Spulber, D. (1998). Deregulatory takings and the regulatory contract. New York: Cambridge University Press.

Tardiff, T. (2002). Pricing unbundled network elements and the FCC’s TELRIC rule: Economic and modeling issues. Review of Network Economics, 1(2), doi:10.2202/1446-9022.1010.

Valletti, T. & Estache, A. (1999). The theory of access pricing: An overview for infrastructure regulators. World Bank Policy research working Paper No. 2097, April. www.google.no/books?id=BCtRX-OHE4C&printsec=frontcover&hl=no&q&f=false.

Vareda, J. (2010). Access regulation and the incumbent investment in quality-upgrades and in cost-reduction. Telecommunications Policy, 34(11), 697–710.

Vareda, J. (2011). Quality upgrades and bypass under mandatory access. Journal of Regulatory Economics, 40(2), 77–197.

Acknowledgments

We thank the editor, Michael Crew, two anonymous referees, and Carlo Cambini for very helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

From (1) and (5), the VIP’s equilibrium profit under ENAP is:

From (3) and (5), equilibrium industry output under ENAP is given by:

(11) implies that if \(P^{\prime \prime }(Q^{*})\le 0\) and \(\frac{\partial Q^{*}}{\partial F}\le 0\), then \( \frac{d\pi _{0}^{*}}{dF}<0\), and so the VIP will set \(F= \underline{F} \) under ENAP. To determine when \(\frac{\partial Q^{*} }{\partial F}\le 0\), let \(h\left( Q^{*}\right) \equiv Q^{*}\left[ N+1\right] P\left( Q^{*}\right) +\left( Q^{*}\right) ^{2}P^{\prime }\left( Q^{*}\right) \). It is readily verified that \( h^{\prime \prime }\left( \cdot \right) <0\), and so \(h\left( \cdot \right) \) is a concave function of \(Q^{*}\), under the maintained conditions. From (9), \(Q^{*}\) is determined by \( h(Q^{*})=NF\), and so (9) will have at least one real root when \(F\) is sufficiently small. Furthermore, when (9) has two real roots, the larger root of (9) decreases as \(F\) increases, and so \(\frac{\partial Q^{*}}{\partial F}<0\), when \( h\left( \cdot \right) \) is a concave function of \(Q^{*}\). Fjell et al. (2013) prove that the larger root of (9) is the relevant root in cases where (9) has two roots. \(\square \)

The following Lemmas are instrumental in the proof of Proposition 2.

Lemma 1

Suppose Assumption 1 holds. Then given access price \(\widehat{w}\), the equilibrium output of the VIP under EXAP is \( \widehat{q}_{0}^{ *}= \frac{{a}+ \widehat{w} N}{b \left[ N+2\right] }\). The equilibrium output of each of the \(N\) rivals under EXAP is \( \widehat{q}_{i}^{ *}= \frac{a - 2 \widehat{w}}{{b}\left[ N+2\right] }\, { for} \,\,i = 1,\ldots ,N\).

Proof

Differentiating (1) and ( 2) provides:

In equilibrium, \(\frac{\partial \pi _{0}}{\partial q_{0}}=\frac{\partial \pi _{i}}{\partial q_{i}}=0\). Therefore, from (12):

Since \(\frac{\partial \pi _{0}}{\partial q_{0}}=0\) in equilibrium, (12) and (13) provide the identified expressions for \( \widehat{q}_{0}^{ *}\) and \( \widehat{q}_{i}^{ *}\). \(\square \)

Lemma 2

Suppose Assumption 1 holds. Then when the VIP’s fixed cost is \(F\), the access price that will be set under EXAP is \( \widehat{w} (F)= \frac{1}{2N}\left[ a\left( N+1\right) -\sqrt{ \widehat{G}(F)} \right] \) where \( \widehat{G}(F) \equiv a^{2}\left[ N+1 \right] ^{2}-4bFN\left[ N+2 \right] \).

Proof

From Lemma 1, \( \widehat{Q}^{ *}=q_{0}^{*}+\sum _{i=1}^{N}\widehat{q}_{i}^{ *}= \frac{a\left[ N+1 \right] -wN}{b\left[ N+2 \right] }\).Therefore, when \(Q^{e}= \widehat{Q}^{ *}, \ w= \frac{F}{\widehat{Q}^{ *}}= \frac{bF\left[ N+2\right] }{a \left[ N+1\right] -wN}\), which ensures that \( \widehat{w}(F)\) is as specified in the lemma. \(\square \)

Lemma 3

Suppose Assumption 1 holds. Then for a given fixed cost, \(F\), the VIP’s equilibrium profit under EXAP is:

Proof

From Lemmas 1 and 2:

where \(H \equiv \left[ a+\widehat{w}N \right] ^{2}+\left[ N+2 \right] \widehat{w}N\left[ a-2 \widehat{w} \right] \). Substituting for \( \widehat{w}(F) \ \)from Lemma 2 provides the identified expression for \( \widehat{\pi }_{0}^{*}(F)\).\(\square \)

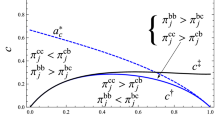

Proof of Proposition 2

Differentiating \(\widehat{\pi }_{0}^{*}(F)\) provides \(\ \widehat{ \pi }_{0}^{*\prime }(F)=\frac{N+4}{N+2}\left[ -\frac{a}{\sqrt{\widehat{G}}}+1\right] -1 \), which implies \(\widehat{\pi }_{0}^{*\prime }(F)\gtreqless 0\) \( \Leftrightarrow \) \(F \lesseqgtr \frac{3a^{2}\left[ N-2 \right] }{16bN}\). Therefore, \(\frac{\partial \pi _{0}^{*}}{ \partial F}<0\) (and so \(\widehat{F}^{*}=\underline{F}\)) if \(N\le 2\). In contrast, if \(N\ge 3\), then \(\widehat{F}^{ *}=\min \left\{ \max \left( \underline{F},\frac{ 3a^{2}\left[ N-2\right] }{16bN}\right) ,\overline{F}\right\} \). Consequently, \(\widehat{F}^{*}> \underline{F}\) if \(\underline{F}<\frac{ 3a^{2}\left[ N-2\right] }{16bN}\). This will be the case if \( \underline{F} <\frac{a^{2}}{16b}\), since \(z(N)\equiv \frac{N-2}{N}\) is an increasing function of \(N\) with \(z(3)= \frac{1}{3}\). \(\square \)

Proof of Proposition 3

The incumbent’s profit in the setting with variable access costs is:

Differentiating (14) provides:

where:

From Proposition 3 in Fjell et al. (2010), the equilibrium value of \(Q\) is the same under EXAP and ENAP for a given \(F\). Therefore, it must be the case that both \(Q\) and the rate at which \(Q\) varies with \(F\) are the same at each \(F\) under EXAP and ENAP. Consequently, (16) implies that for any given \(F, \frac{\partial }{\partial F}\left\{ c(F)Q\right\} \) is the same under exogenous access pricing and endogenous access pricing.

Under the conditions specified in Proposition 2, \( \frac{\partial }{\partial F}\left\{ q_{0}P(Q)+w\sum _{i=1}^{n}q_{i}-F\right\} \) is strictly positive under EXAP for \(F\in [0, \widehat{F}^{*})\) (where \( \widehat{F}^{*}>0\)) and strictly negative under ENAP for all \(F\ge 0 \). Therefore, (15) implies that for each \(F, \frac{ \partial \pi _{0}}{\partial F}\) is larger under EXAP than under ENAP, and so the VIP will implement a larger level of \(F\) under EXAP than under ENAP in the setting with variable access costs. \(\square \)

Rights and permissions

About this article

Cite this article

Fjell, K., Pal, D. & Sappington, D.E.M. On the performance of endogenous access pricing. J Regul Econ 44, 237–250 (2013). https://doi.org/10.1007/s11149-013-9232-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-013-9232-9