Abstract

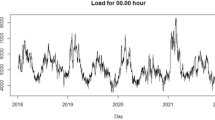

This paper uses hourly data from Ontario (Canada) between 2005 and 2008 to estimate the effects of real time wholesale electricity prices on demand by industrial customers. Nonlinear SUR estimates from Generalized Leontief (GL) specifications reveal elasticities of substitution from 0.02 to 0.07, confirming that industrial customers (connected to the transmission grid) shift consumption across peak and off-peak periods in order to reap benefits of lower prices. Estimates from FGLS and IV models suggest that this reduction in demand by industrial customers results in lower wholesale prices, which benefits all consumers. The policy lesson is that market based schemes that encourage Real Time Pricing (RTP) pricing should result in positive spillovers to all consumers.

Similar content being viewed by others

References

Berndt E. (1991) The practice of econometrics: Classic and contemporary. Addison-Wesley Publishing Co, Reading, MA

Boisvert R., Cappers P., Goldman C., Neenan B., Hopper N. (2007) Customer response to RTP in competitive markets: A study of Niagara Mohawk’s Standard Offer Tariff. Energy Journal 28(1): 53–74

Boisvert, R., Cappers, P., Neenan, B., & Scott, B. (2004). Industrial and commercial customer response to real time electricity price. Unpublished document, Neenan Associates.

Borenstein S. (2005) The long-run efficiency of real-time electricity pricing. Energy Journal 26(3): 93–116

Borenstein S., Holland S. (2005) On the efficiency of competitive electricity markets with time-invariant retail prices. RAND Journal of Economics 36(3): 469–493

Borenstein S., Bushnell J. B., Wolak F. A. (2002) Measuring market inefficiencies in California’s deregulated wholesale electricity market. American Economic Review 92(5): 1376–1405

Braithwait S. (2000) Residential TOU price response in the presence of interactive communication equipment. In: Faruqui A., Eakin K. (eds) Pricing in competitive electricity markets. Kluwer Academic Publishers, Boston, MA

Brattle Group. (2007). Quantifying demand response benefits in PJM. Prepared for PJM Interconnection, LLC and the Mid-Atlantic Distributed Resources Initiative (MADRI), available at http://www.brattle.com/_documents/uploadlibrary/upload367.pdf

Cappers P., Goldman C., Kathan D. (2010) Demand response in U.S. electricity markets: Empirical evidence. Energy 35: 1526–1535

Caves D., Christensen L. (1980a) Residential substitution of off peak for peak electricity usage under time of use prices. Energy Journal 1(2): 85–142

Caves D., Christensen L. (1980b) Econometric analysis of residential time-of-use pricing experiments. Journal of Econometrics 14: 287–306

Caves D., Christensen L. (1984) Consistency of residential response in time-of-use pricing experiments. Journal of Econometrics 26(2): 179–203

Davidson R., MacKinnon J. (2003) Econometric theory and methods. Oxford University Press, Oxford

Faruqui A., Hledik R., Newell S., Pfeifenberger H. (2007) The power of 5 percent. The Electricity Journal 20(8): 68–77

Federal Energy Regulatory Commission (FERC). (2009). A national assessment of demand response potential. Available at http://www.ferc.gov/legal/staff-reports/06-09-demand-response.pdf

Federal Energy Regulatory Commission (FERC). (2011). FERC sees huge potential for demand response. Electricity Currents: A Survey of Trends and Insights in Electricity Restructuring, 23(3), 1–6.

Gallant A. R. (1975) Seemingly unrelated nonlinear regression models. Journal of Econometrics 3: 35–50

Goldman, C., Hopper, N., Sezgen, O., Moezzi, M., Bharvirkar, R., Neenan, B., et al. (2004). Customer response to day-ahead wholesale market electricity prices: Case study of RTP program experience in New York. Report to the California Energy Commission. LBNL-54761. Berkeley, CA: Lawrence Berkeley National Laboratory.

Goncalves S., Kilian L. (2004) Bootstrapping autoregressions with conditional heteroskedasticity of unknown form. Journal of Econometrics 123(1): 89–120

Ham J., Mountain D. C., Chan M. W. L. (1997) Time-of-use prices and electicity demand allowing for selection bias in experimental data. RAND Journal of Economics 28(0): s113–s141

Herriges A., Baladi S. M., Caves D. W., Neenan B. F. (1993) The response of industrial customers to electric rates based upon dynamic marginal costs. Review of Economics and Statistics 75(20): 446–454

Holland S. P., Mansur E. T. (2006) The short-run effects of time-varying prices in competitive electricity markets. Energy Journal 27(4): 127–155

Melino A., Peerbocus N. (2008) High frequency export and price responses in the Ontario electricity market. Energy Journal 29(4): 35–51

Mountain D. C. (1993) An overall assessment of the responsiveness of households to time-of-use electricity rates: The Ontario experiment. Energy Studies Review 5: 190–203

Mountain D. C., Lawson E. L. (1992) A disaggregated non-homothetic modeling of responsiveness to residential time-of-use electricity rates. International Economic Review 33(1): 181–207

Mountain D. C., Lawson E. L. (1995) Some initial evidence of Canadian responsiveness to time-of-use electricity rates: Detailed daily and monthly analysis. Resource and Energy Economics l 7: 189–212

Neenan B., Boisvert R., Cappers P. (2002a) What makes a customer price responsive?. Electricity Journal 15(3): 52–59

Neenan, B., Pratt, D., Capers, P., Boisvert, R., & Deal, K. (2002b). NYISO price-responsive load program evaluation final report. Prepared by Neenan Associates, LLC for New York Independent System Operator, Albany, NY.

Patrick, R., & Wolak, F. (2001). Estimating customer level demand for electricity under real time market conditions. NBER Working Paper 8213.

Schwarz P. M., Taylor T. N., Birmingham M., Dardan S. L. (2002) Industrial response to electricity real-time prices: Short run and long run. Economic Inquiry 40(4): 597–610

Sen A. (2003) Higher prices at Canadian gas pumps: International crude oil prices or local market concentration? An empirical investigation. Energy Economics 25(3): 269–288

Sen A., Townley P. G. C. (2010) Estimating the impacts of outlet rationalization on retail prices, industry concentration, and sales: Empirical evidence from Canadian gasoline markets. Journal of Economics & Management Strategy 19(3): 605–633

Shepard R. (1970) Theory of cost and production functions. Princeton University Press, Princeton

Taylor T., Schwarz P. M., Cochell J. (2005) 24/7 hourly responses to electricity prices: Pricing with up to eight summers’ experience. Journal of Regulatory Economics 27(3): 2235–2262

Trebilcock M. J., Hrab R. (2005) Electricity restructuring in Ontario. Energy Journal 26(1): 123–146

Yatchew A. (2000) Scale economies in electricity distribution: A semiparametric analysis. Journal of Applied Econometrics 15(2): 187–210

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Choi, W.H., Sen, A. & White, A. Response of industrial customers to hourly pricing in Ontario’s deregulated electricity market. J Regul Econ 40, 303–323 (2011). https://doi.org/10.1007/s11149-011-9169-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-011-9169-9

Keywords

- Deregulation

- Elasticities of substitution

- Industrial customers

- Wholesale electricity prices

- Demand response