Abstract

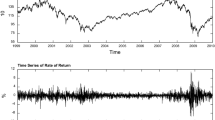

In the S&P500 futures options, we identify three factors, corresponding to movements in the underlying, parallel movements, and tilting of the cross section of implied volatilities (the “smirk factor”). We relate these factors non-linearly to movements in the option prices. They seem to be diffusive in nature, have significant associated risk premia, and can account for an overwhelming part of the option price movements. We interpret the options smirk, which is the notion that out-of-the-money (OTM) puts seem expensive relative to OTM calls, in terms of the prices of these risk factors. Going short OTM puts and long OTM calls, corresponding to the third factor, makes a profit on average, but this corresponds to its risk premium, and does not represent a market inefficiency. Our smirk factor is useful for hedging option portfolios, but seems unrelated to movements in the underlying, and does not fit into the framework of the jump-diffusion models.

Similar content being viewed by others

References

Amin K., Ng V.K. (1997) Inferring future volatility from the information in implied volatility in eurodollar options: A new Approach. Review of Financial Studies 10(2): 333–367

Bakshi G., Cao C., Chen Z. (1997) Empirical performance of alternative option pricing models. Journal of Finance 52(5): 2003–2049

Bakshi G., Kapadia N. (2003) Delta-hedged gains and the negative market volatility risk premium. Review of Financial Studies 16: 527–566

Bates D. (1991) The crash of ’87: was it expected? The evidence from options markets. Journal of Finance 46: 1009–1044

Bates D. (2000) Post-’87 crash fears in the S&P500 futures options market. Journal of Econometrics 94: 181–238

Bollen N.P.B., Whaley R.E. (2004) Does net buying pressure affect the shape of implied volatility functions?. Journal of Finance 59: 711–753

Bondarenko, O. (2002). Why are put options so expensive? Working paper, University of Illinois at Chicago, USA.

Branger, N., & Schlag, C. Can tests based on option hedging errors correctly identify volatility risk premia? Working paper, Goethe University.

Buraschi A., Jackwerth J. (2001) The price of a smile: Hedging and spanning in options markets. Review of Financial Studies 14(2): 495–527

Coval J.D., Shumway T. (2001) Expected option returns. Journal of Finance 56(3): 983–1009

Duffie, D. (1989) Futures markets. Prentice Hall.

Duffie, D. (2001). Dynamic asset pricing theory (3rd ed.). Princeton University Press.

Eraker B. (2004) Do stock prices and volatility jump? Reconciling evidence from spot and option prices. Journal of Finance 59: 1367–1403

Eraker B., Johannes M., Polson N. (2003) The impact of jumps in volatility and returns. Journal of Finance 58: 1269–1300

Heston S. (1993) A closed form solution for options with stochastic volatility with applications to bond and currency options. Review of Financial Studies 6: 327–343

Jones C.S. (2006) A nonlinear factor analysis of S&P500 index options returns. Journal of Finance 61: 2325–2363

Jorion P. (1995) Predicting volatility in the foreign exchange market. Journal of Finance L: 507–528

Liu J., Pan J. (2003) Dynamic derivatives strategies. Journal of Financial Economics 69: 401–430

Pan J. (2002) The jump-risk premium implicit in option prices: Evidence from an integrated times-series study. Journal of Financial Economics 68: 3–50

Skiadopoulos G., Hodges S., Clewlow L. (2000) The dynamics of the S&P 500 implied volatility surface. Review of Derivatives Research 3(3): 263–282

Zhang, J. E., & Xiang, Y. (2006). Implied volatility smirk, working paper, University of Hong Kong.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Carverhill, A., Cheuk, T.H.F. & Dyrting, S. The smirk in the S&P500 futures options prices: a linearized factor analysis. Rev Deriv Res 12, 109–139 (2009). https://doi.org/10.1007/s11147-009-9037-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-009-9037-2