Abstract

We present a new conceptual framework to estimate office supply elasticity, where net business survival, physical and economic mismatch are used to identify frictional and structural vacancy. Alongside regulatory and geographical constraints, we also find an unobserved feature of supply elasticity linked to natural vacancy. Our results confirm that US Metropolitan Statistical Areas are generally supply inelastic and the search and matching process plays a key role in supply dynamics. In the least inelastic markets, investors tend to be more flexible to respond to negative demand shocks. As a result, we observe a reduction in structural vacancy and a subsequent increase in cyclical vacancy given the slow short-term movement in absorption. These findings also shed light upon office market dynamics during the COVID-19 period.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A revolutionary shift in the nature of office space demand from individual offices to collaborative space happened over the last two decades. On one hand, all major corporations have been advocating for open and shared workspace and have adopted work-from-home policies that have prevailed since the pandemic crisis. On the other hand, smaller companies (especially ventures and sole traders) have been using shared office facilities to efficiently maximise networking opportunities offered by new providers of workspace. Moreover, less demand in office space is foreseen when more on-site tasks are assigned and more tedious work is superseded by automation. Facing all these changes, the ability of supply to adjust to new requirements freely from constraints, and the existence of a temporary mismatch can be used to predict the impact of a negative demand shock on property prices.

Supply constraints are generally classified into two main categories: regulatory and physical. The former is measured by the tightness of the development approval process, which is usually identified through surveys (Gyourko et al., 2008, 2021; Saks, 2008). For the latter, Saiz (2010) introduces a new empirical strategy where land unavailability is measured to solve the endogeneity problem, identifying the tightness of both regulatory and physical constraints of housing supply. Overall constraints are quantified by supply elasticity, which is mostly estimated using an urban growth-based econometric model.

According to this classification, constraints on housing markets may also help to determine supply elasticities of office markets, but rare empirical evidence for non-residential markets motivates the focus of our study on office supply elasticity in US metropolitan statistical areas (hereafter MSAs), where we observe different dynamics of market competition and divergent incentives to control the restrictiveness of supply constraints, with a “strategically managed” supply of office space and a high proportion of informed investors. In equilibrium, their approach and the existence of longer-term tenancy agreements with fixed rents affect the responsiveness of supply to demand shocks and therefore vacancy because landlords maximise profits by strategically holding predefined amounts of vacant space for high-profile tenants who will afford higher rents in the future—see search and match theory, Wheaton (1990). This phenomenon mainly occurs when investors reject their tenants to sublet—Harvard Business Review (1988)—their strategy will also vary over boom and bust cycles. Moreover, how investors manage space with worn-out design affects the responsiveness of supply to market shocks.

In this study, we contribute to the field of real estate and urban economics in three aspects. Firstly, we build a conceptual framework rooted in the search and matching theory (Wheaton, 1990), which associates economic and physical mismatch with supply elasticity and equilibrium vacancy. We define economic mismatch as a situation where the current rent level does not satisfy investors and physical mismatch as the worn-out designed space that cannot be used. In this setup, two types of mismatch drive structural vacancy, while frictional vacancy is normally driven by new firm startups and failures. Moreover, in addition to regulatory and geographical constraints, supply elasticity is also determined by MSA specific unobserved features linked to natural vacancy.

Secondly in terms of an empirical strategy, a novel dataset helps to identify economic mismatch (i.e. space in use which is available for re-letting to new tenants instead of existing tenants), to quantify the search effort (i.e. relative size of available letting space listed) and the prime vs non-prime rental gap associated with physical mismatch. We confirm that the search and matching process plays a pivotal role in determining supply elasticities and 36 MSAs (covering 44% of the US population and more than 60% of office employment) are supply inelastic.

The third contribution is to offer an insight on how investors react by adjusting structural vacancy since the pandemic has started. In general, investors reduce space in economic and physical mismatch causing a decrease in structural vacancy. In the least supply inelastic markets, investors are more flexible to adjust their strategies in managing space, but the larger decrements in equilibrium vacancy convert to a larger increase in cyclical vacancy instead of property absorption. In the short-term, this dynamic is amplified. As we have witnessed with a demand shock caused by COVID-19, a speedy recovery will happen in the least supply inelastic markets only if physical characteristics and asking rent levels adjust to demand quickly enough.

Finally, during the pandemic, the new "Work From Home" economy has been identified by the Stanford Institute for Economic Policy Research. In the US, 42% of the labor force has been working full time from home during the pandemic and they account for more than two-thirds of economic activities in terms of the income measured GDP. The Survey of Business UncertaintyFootnote 1 indicates that around 20% of workforce keeps on working from home even after the pandemic ends. The new economy may persist if office investors do not change their strategies. Social distancing is the crucial criterion of space management that is related to matching in our study, for example, individual ventilated cubicles and stopover arrangement of elevators in skyscrapers, and divisions of working space and regular sterilization in offices. If office space is unused and city centers are eroded, spillover effects on other economic activities such as retail and conferences, and agglomeration effects will fade out. Dark cities may eventually lose capital attraction. The social impacts can be significant as long-term isolation adversely affects mental health. Therefore, office investors can work as a hindrance to new economic transformation and our study offers implicit recommendations on economic recovery for the pandemic crisis.

The paper is organised as follows: the next section provides a literature review, while Sect. 3 presents our conceptual model. In Sect. 4, we explain our empirical strategy and describe data. Sections 5 and 6 include the main results, robustness tests, and a discussion of investors’ strategies to face the coronavirus pandemic. Finally, we draw our conclusions in Sect. 7.

Literature Review

As supply is a key factor to determine the responsiveness of property markets to demand shocks, a growing number of studies focus on supply constraints and policy implications. However, even if the supply elasticity of office markets is heterogeneous and worth investigating, a data shortage for commercial real estate led to a focus on housing markets. Green et al. (2005) argue that the variation of supply elasticity can be explained by the difference in local regulation. Saiz (2010) solves the endogeneity issue and confirms Green et al. (2005) results by quantifying land unavailability through Geographical Information System (GIS) and referring to the Wharton Residential Land Use Regulatory Index(WRLURI). Wheaton et al. (2014) provides a unique approach, merging the stock-flow framework and urban growth theory to separate the short-run disequilibrium from the long-term trend of house prices and to estimate both long- and short-run supply elasticities for 68 MSAs.

Furthermore, large-scale surveys on the planning approval process measure the stringency of regulatory supply constraints using intensive resources and well-designed questionnaires to mitigate the "selection bias" in information disclosure by interviewees. So far, the WRLURI compiled by Gyourko et al. (2008) and the Saks’s composite index (2008) are frequently cited as the most influential measures. Moreover, Gyourko et al. (2021) conducted a new survey in 2018 and re-compiled WRLURI. The WRLURI is the most reliable index to date (high response rate from 2,600 municipalities interviewed in 2006) and consists of 11 sub-indices regarding political pressure, ease of zoning approval, supply, and density restrictions in 293 different MSAs. The Sak’s index, instead, was computed for 83 MSAs between 1975 and 1990, based on the average of six independent surveys related to the processing time of zoning approval, the severity of population growth controls, protection of historic sites, and environmental regulation.

Compared to housing markets, regulatory constraints in commercial real estate curtail fiscal revenues to a greater extent, but they also reduce negative externalities such as congestion and pollution. As a result, the restrictiveness of supply constraints is even more driven by local circumstances, when local governments attempt to reconcile their fiscal need with concerns for the living environment (Fischel, 1973). Since commercial data are difficult to access, empirical studies on supply elasticity in this market are rare. Moreover, as longer production lags and lease terms in commercial markets add complexity to the structure found in housing, a short-run disequilibrium should not be ignored to prevent a biased estimation of supply constraints. Therefore, a stock-flow model offers an adequate tool to jointly study short- and long-run dynamics.

As a result, two studies—Benjamin et al. (1998) and Wheaton et al. (2014)—implicitly involve imbalances between supply and demand by using a stock-flow model, where vacancy is captured in the estimation of supply elasticity. Cheshire et al. (2018) enrich this stream of literature and show that tightening regulatory constraints in UK housing markets significantly increase vacancy rates, because inflexible planning hinders the matching process. Furthermore, they argue that an increase of price volatility in office markets motivates landlords to keep properties empty as the value of real options increases. Fluctuations in vacancy rates driven by mismatch hinge on supply constraints, and may function as an alternative test of the plausibility of supply elasticity estimates. Therefore, we argue that equilibrium vacancy has to be considered in this estimation process. (See the appendix for the supplementary note on natural vacancy.)

Investors’ behaviour is exhibited in the search and matching process. Search frictions inevitably derail competitive price formation in property markets and cause vacancy. This requires studies to assume the existence of imperfect property markets, where clearance is not instantaneous or without cost. The search and matching theory developed by Diamond (1971) (Diamond, 1971) suggests that even small search costs drive equilibrium from a competitive to a monopoly price. Although Diamond’s equilibrium model, covering an aggregate matching function, was originated from labour markets,Footnote 2 Wheaton (1990) extends the theory to housing markets and assumes structural vacancy as being equivalent to natural vacancy—computed as (1—number of households/housing units)—upon the condition that expected house prices equal marginal supply costs. To smooth the matching process, vacant houses are necessary in the long run, and structural vacancy can be explained by market activities. Mayer (1995, 1998) also extends the search model to capture the effects of auctions on housing markets.

The existing literature in real estate markets recognises an economic mismatch when landlords hold vacant space deliberately until they reach ideal tenants who can afford to pay higher rents. They therefore create temporary inventories to maximise future net rental receipts during periods of strong demand, according to Rosen et al. (1983), Shilling et al. (1987), Gabriel et al. (1988), and Wheaton et al. (1988). On the other hand, a physical mismatch generates temporary vacant space, when refurbishment is required to align the physical characteristics of obsolete buildings to the newly formed demand. So far in the literature, these two features reflecting investors’ behaviour have not been jointly studied. We believe that their combination in a model is insightful to investigate the determination of equilibrium vacancy and market disequilibrium, as well as the unexplored component of supply elasticity.

Conceptual Framework

We structure the conceptual model to determine the relationship between natural vacancy and supply elasticity in commercial real estate rental markets following Wheaton (1990)’s model for housing markets. We classify the mismatch between landlords and tenants in two categories: economic and physical.

Economic mismatch is defined as the point at which the current rent level paid by a tenant cannot reach the desired level of a landlord (\({r}^{D}\)), and in the meantime other bid offers from potential tenants (\({r}^{B}\)) are also lower than the desired level.

For physical characteristics, instead, we distinguish property space \(S\) as defined by \(N\) heterogeneous characteristics (i.e. building facilities such as ventilators, lifts, car parks, panoramic views, size, etc.), with \(i\) referring to the element of the set (I = 1, \(\cdots\), N). Tenants’ required property characteristics \(j\) can be either (1) matched or (2) unmatched with space characteristics provided by landlords.Footnote 3J denotes the set of tenants’ required characteristics, and its major part is the overlapping subset with I. Physical mismatch is identified by the second group of \(J\) and redundant space characteristics offered. Suppose that some \(i\) match with \(j\) belonging to the first group of \(J\). We denote \(i\) as \({i}_{m}\), indicating with the subscript \(m\) that characteristics are matched. Conversely, bundles of characteristics \(i\) not matching \(j\) are defined as \({i}_{n}\), where the subscript \(n\) stands for non-matched (i.e. mismatched) characteristics. If we consider the time-varying feature of property space in the long run, the supply of space can be categorised as follows: \({S}_{{i}_{m},l,t}\) and \({S}_{{i}_{n},l,t}\), where \(t\) represents time. This kind of mismatch is associated with the disposition effect.

By combining physical and economic matching, space supply is divided into four main groups:

-

Both economic and physical match:\({S}_{{i}_{m}\parallel {r}_{t}^{B}\ge {r}_{t}^{D},l,t}\)

-

Economic mismatch and physical match:\({S}_{{i}_{m}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}\)

-

Economic match and physical mismatch:\({S}_{{i}_{n}\parallel {r}_{t}^{B}\ge {r}_{t}^{D},l,t}\)

-

Both economic and physical mismatch:\({S}_{{i}_{n}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}\)

Vacancy Type

If both economic and physical characteristics are matched, the available space is occupied by tenants. Therefore, vacancy depends on both economic and physical matching conditions as well as frictions. At time 0 (i.e. when a rental contract is signed), all deals are made upon the condition that both economic and physical requirements are satisfied. Long-term leases lead to changes in the mismatch status of occupied space because of immediate rental adjustments by landlords, and/or tenants moving to suitable office space based on their latest requirements. This short- vs long-run dynamic implies that the mismatch status of occupied space may switch among the four aforementioned groups, with a minor role played by the last group. On the other hand, new tenants may introduce new requirements of space characteristics, and bid/asking rents may change as a consequence. In particular, new business startups have a relatively frequent turnover that leads to frequent changes in space status. Clearly, the status of vacant space may vary over time among the other three types (excluding joint economic and physical match). We further classify space supply according to its tenancy (occupied vs vacant) and the mismatch status (matched vs non-matched and economic vs physical) in the following equation:

When the search and matching process is completed, a long-run stable equilibrium is reached, where physically mismatched space would not be occupied any longer.Footnote 4 Therefore, Eq. 1 collapses into Eq. 2 in the long-run:

Following a three-way decomposition of the vacancy rate taken from the labour literature, we then identify the three types of vacancies as follows:

Structural Vacancy

Landlords deliberately hold vacant (maybe unlisted) space until reaching out to their ideal tenants who can afford rents exceeding an equilibrium level, i.e. a rent floor is set above the equilibrium level. Assuming that the space characteristics match tenants’ requirements but bid rents are lower than asking rents, structural vacancy (\({V}_{l,t}^{s}\)) is a percentage rate of \({S}_{{i}_{m}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}(vacant)/{S}_{i,l,t}\), which we classify as economically mismatched and physically matched. On the other hand, the process of matching physical characteristics of buildings may lead to the formation of a vacancy. A certain amount of space may not match tenants’ requirements, and therefore it may not be occupied until it is renovated. We qualify this type of vacant space as physically mismatched. According to Eq. 2, another portion of structural vacancy (\({V}_{l,t}^{s}\)) is obtained as\({S}_{{i}_{n},l,t}(vacant)/{S}_{i,l,t}\).Footnote 5

Frictional Vacancy

Frictions come from a potential frequent turnover of new business startups and failures. New firms may need time to find the most suitable office location for their business and they can therefore decide to move more frequently than well established companies. This phenomenon is even more significant if new startups are represented by growing companies which may see bigger changes in the office space need over time. Frictions also account for a portion of \({S}_{{i}_{m}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}(vacant)/{S}_{i,l,t}\) and\({S}_{{i}_{n},l,t}(vacant)/{S}_{i,l,t}\).Footnote 6

Cyclical Vacancy

Excess property supply results from short-term fluctuations in the general economy or the specific business sector that requires office space. However, responses of tenants and landlords to short-term shocks are delayed because of fixed-term leases and construction lags. This type of vacant space (\({V}_{l,t}^{c}\)) is supposed to match with tenants’ requirements, and we classify it as economically mismatched and physically matched.

To summarise, a natural vacancy rate (\({V}_{l,t}^{n}\)) exists in the long run, and the sum of structural and frictional vacancy represents its measure. Particularly, structural vacancy represents the non-cyclical component of \({S}_{{i}_{m}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}(vacant)/{S}_{i,l,t}\).

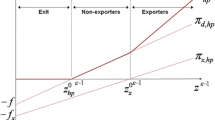

Short- and Long-Run Supply Curve

Following Helsley and Strange (2008), we construct the increasing and convex construction function with respect to building height and the concave profit function of a developer. To benefit from economies of scale, a developer decides how many floors should be built to maximise the profit. This convex construction function implies a convex kinked long-run supply curve:

where \(\pi\) is the developer’s profit, \({h}_{l,t}\) refers to the building height of a developed property which is located in city l at time t, \({r}_{l,t}\) is rent per floor, and \(c\) represents the construction function.

When \({r}_{l,t}\) = \(c\mathrm{^{\prime}}({h}_{l,t})\), the profit is maximised. New supply is assumed to match tenants’ needs, as developers thoroughly study tenants’ demand and their preferences for property characteristics before building. In addition, we assume that developers also base their investment decision on expected rental growth, with demand shocks in property markets leading to changes in expectations regarding future rents. The short-run supply is extremely inelastic, as weak responsiveness to rental changes is the result of construction lags.

Short- and Long-Run Equilibrium Rent

The demand function (\({D}_{l,t}\)) of commercial properties is driven by factors linked to industry-related revenues and expectations about the future business environment as a city grows (i.e. population (\(PO{P}_{l,t}\))). The income growth for residents may reflect the prosperity of the business environment, as more bonuses would be shared with employees in a robust economy. A demand shock is normally triggered by a business environment change, such as a shock in employment for sectors requiring office space. At the same time, we assume that corporations can execute an immediate plan to adjust the workforce after anticipating the future business outlook. In other words, current employment (\(E{M}_{l,t}\)) in city \(l\) at time \(t\) indicates the expectation regarding the future business environment, which drives demand for space. Along with aggregate income for residents (\(R{I}_{l,t}\)) and rents (\({r}_{l,t}\)), Eq. 4 describes the long-run demand.

Figure 1 shows the effect of a positive shock to the aggregate demand (from \(AD1\) to \(AD2\)) due to a sudden increase in employment caused by a company’s relocation to the city. Rents increase and, as a consequence, the amount of supply slightly increases; however, the growth is curtailed by an inelastic short-run supply.

At the point of long-run equilibrium, the demand (\({D}_{l,t}\)) for office space should exactly equal the amount of supply (\({S}_{l,t}\)) after some adjustments. However, a small component of supply remains unoccupied because of market frictions. In other words, a costly search and matching process generates frictional vacancy (\({V}_{l,t}^{f}\)), and the landlords’ strategy of holding vacant space for future gains gives rise to structural vacancy (\({V}_{l,t}^{s}\)). Therefore, we expect that in equilibrium demand equals supply only after deducting vacant space due to frictional and structural vacancy as follows:

In the short run, changes in demand are not completely met by changes in supply. The satisfaction, quantified by space absorption, depends on the matching rates (\({\omega }_{l,t}\)) of tenants in market \(l\). As suggested in Cheshire et al. (2018), a matching rate is determined by the required level of search effort (\({\varepsilon }_{l,t}\)) and the ratio of vacant property to mismatched tenants (\({\theta }_{l,t}\) = \({S}_{l,t}\)(vacant) / \({S}_{{i}_{m}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}\)(occupied)), through a constant return-to-scale Cobb–Douglas matching function:

where \(\alpha\) is a constant and \(\beta\) represents the weighting. Therefore, space absorption can be described by the following equation:

If demand is fully met, the distance “ab” in Fig. 1 indicates the net absorption in the short run. Simultaneously, a construction lag hinders immediate supply responses and, as a result, changes in supply are not fully realized. To reflect a delayed effect in our empirical investigation, a lagged change in supply is singled out to determine a change in vacancy in short-run disequilibrium, with \(z\) in the following equation representing the number of construction lags:

Assuming that one unit of demand shock in the market stimulates a one per cent increase in rents, Eq. 8 suggests that a change in vacancy can be estimated by subtracting the matching rate from the responsiveness of supply. A matching rate model is used to identify structural and frictional vacancy, the change in vacancy can be decomposed into supply elasticity and change in structural and frictional vacancy.

Taking the derivative on Eq. 5 with respect to rents, the limit of supply elasticity is determined by structural and frictional vacancy. Given that structural and frictional vacancy decreases with rents, if the demand is elastic, an increase in structural and frictional vacancy reduces the lower limit of supply elasticity. In case of inelastic demand, a rise in structural and frictional vacancy shifts down the lower and upper limits of supply elasticity (See proof in the Appendix).

Empirical Strategy

Empirical Model

To incorporate the search and matching process into the office market dynamics, our empirical model captures the mismatch between landlords and tenants and the search effort required to find the search equilibrium. In addition to rents (\(ln(RR{I}_{l,t})\)) and supply (\(ln({S}_{l,t})\)), economic mismatch (\(EM{M}_{l,t}\)) and search effort level (\(SE{L}_{l,t}\)) are also endogenous. Four endogenous variables are stationary at the first difference (i.e. I(1)) and the panel cointegration tests confirm the presence of three co-integrating equations.

As there are two types of supply constraints, namely regulatory and geographical, we include corresponding interaction terms with the log of real rent index in the office supply co-integrating equation. Moreover, as we assume an MSA specific component of supply elasticities that are driven by landlords, we also include an MSA interaction term with the log of real rent index. We then define the setup of error correction models. The regulatory one is measured by the Wharton regulatory index (\(WR{I}_{l}\)) and the geographical one refers to the undevelopable land area (\(UD{A}_{l}\)). These time-invariant exogenous variables are stationary. Unlike the conventional vector error correction model, we do not estimate cointegrating equations individually using Stock and Watson’s approach (1993), but we define a simultaneous equation system instead. In addition to three interaction terms, we include sufficient exogenous variables with stationary residuals, to keep the simultaneous system well identified and address a potential endogeneity issue. Moreover, demand and supply shifters should still hold in the long-run state. This motivates us to capture exogenous variables in long-run models. Our empirical model is justified by Rahbek and Mosconi (1999) and Pesaran et al. (2000), who show that the inclusion of stationary regressors in cointegrating equations is feasible.

Equation 9 is the first long-run equation, composed of cointegrated endogenous variables and demand shifters, including the changes in ratio of employment in office-related sectors to population (\(\Delta ln(EM{P}_{l,t})\)), real income per capita (\(\Delta ln(RIP{C}_{l,t})\)) and population index (\(ln(POP{I}_{l,t})\)). The Atlantic hurricane occurrence dummy (\(AH{O}_{t}\)), the Atlantic dummy for MSAs facing the Atlantic Ocean (\(A{T}_{l}\)) and their interaction term are also included to capture a temporary change in overall sentiment. As hurricane related issues may be linked to port cities (\(POR{T}_{l}\)) and reflect a lack of transportation (\(TTW{D}_{l}\)). Equation 10 includes cost shifters, such as changes in operating expenses charged by property management firms (\(\Delta ln(ROPE{X}_{l,t})\)) and the difference between capitalization and risk free rates (\(\Delta C{T}_{l,t}\)). To consider hurricane effects, we also include two related variables and their interaction term to estimate the actual incidence in the long-run supply equation. The economic mismatch represents the third long-run equation (Eq. 11). The same demand shifters reflecting the business outlook are also used to determine the economic mismatch, because the tenants’ plan for expansion and the landlords’ strategy to seek "targeted" tenants may be altered based on movements in the business outlook. To be consistent in our approach, since we capture an MSA interaction term with the real rent index in the long-run supply equation, we also include MSA interaction terms with the real rent index, office supply and economic mismatch in all three co-integrating equations. MSA and time fixed effects are chosen in all long-run equations.

Estimations of Supply Elasticities, Structural and Frictional Vacancy

Our aim is to estimate the long-run supply elasticity for each MSA. After obtaining the results of the above long-run models, we post-estimate marginal effects as \(\frac{d(ln({S}_{l,t}))}{d(ln(RR{I}_{l,t}))}\) in Eq. 10 to compute overall supply elasticities by MSA where original MSA-levels of UDA and WRI are set.

As discussed, structural vacancy is classified as economic mismatch and physical mismatch, and frictional vacancy is driven by new firm startups and failures. The economic mismatch and search effort level describe the search and matching process. Therefore, we estimate structural vacancy due to economic mismatch with the exponential of \([{e}_{3}SE{L}_{l,t}+{e}_{4}EM{M}_{l,t}+{e}_{5}MSA*EM{M}_{l,t}]\) divided by office supply in Eq. 10. The prime vs non-prime rental gap indicates the motivation of renovation that implies physical mismatch. Based on industry information, we set the threshold of the rental gap at 40%, and NRG40 is a dummy showing a gap greater than this threshold. The exponential of \([{e}_{13}NRG4{0}_{l,t}]\) divided by office supply is suggested as another portion of structural vacancy. As aforementioned, our model captures new firm births (\(NF{B}_{l,t}\)) and deaths (\(NF{D}_{l,t}\)) to identify frictions. Therefore, frictional vacancy is computed as the exponential of \([{e}_{18}NF{B}_{l,t}+{e}_{19}NF{D}_{l,t}]\) divided by office supply.

The short-run model consists of four equations which capture changes in variables and three error correction terms. Four quarter lags are selected. Following the long-run models, short-run equations also include the same interactions with changes in log of real rent index, log of office supply and economic mismatch. MSA and time fixed effects are also chosen (short-run models are reported in the appendix). As landlords adjust the number of listed properties based on the market situation and their own financial capability, the short-run search effort equation contains two exogenous variables: real income per capita (reflecting business outlook) and the difference between capitalization and risk free rates (indicating the riskiness of office real estate markets).

Data Description and Sources

We obtained property data with a quarterly frequency from CBRE Econometric Advisors (CBRE EA hereafter)Footnote 7. The 10-year U.S. Treasury yield (used as risk-free rate) is obtained from the Federal Reserve Board, hurricane information from the National Hurricane Center, structure cost dataFootnote 8 from the Lincoln Institute of Land Policy, and port cities and travel time to work are acquired from the Census. New firm births and deaths in office related sectors at MSA level are sourced from the Business Dynamics Statistics of the Census. Other demographic and economic data on population, aggregate personal income, and employment base in the office sector are estimated by Moody’s Analytics (formerly economy.com)Footnote 9 and included in the CBRE EA database. Undevelopable land areaFootnote 10 and the Wharton land regulation index are obtained from Saiz (2010) and Gyourko et al. (2008, 2021).

To estimate the long-run supply elasticity of office markets using the mismatch model, we capture economic mismatch situations that are identified by available (i.e. listed for rental) but occupied space. Physically mismatched offices require a major refurbishment to avoid holding vacant space for long time periods. We assume this situation is limited to non-prime offices (i.e. Grade B or C). Along with an extension to the economic life of a building, a major refurbishment also raises rents to the level asked for prime quality buildings (i.e. Grade A). Therefore, a gross asking-rent gap between prime and non-prime offices can be used as a proxy for the likelihood of exercising a refurbishment option. After refurbishment, the previous physical mismatch turns into an economic match (if space is occupied) or mismatch (if still vacant). The rental gap signals the likelihood of changes in physical mismatch (the higher the gap, the higher the incentive to refurbish). As the data of available but occupied space are accessible only from the first quarter of 2005 for 38 MSAs (44% of the US population), a balanced panel dataset from the first quarter of 2005 to the fourth quarter of 2019 is used for this study.

If we exclude dummies, nine main variables are used in our model: four endogenous—i.e. real rent index (\(RR{I}_{l,t}\)), office stock (\({S}_{l,t}\)), economic mismatch rate (\(EM{M}_{l,t}\)) and search effort level (\(SE{L}_{l,t}\)), and five exogenous—i.e. real operating expense (\(ROPE{X}_{l,t}\)), real personal income per capita (\(RIP{C}_{l,t}\)), difference between capitalization and Treasury yield (\(C{T}_{l,t}\)), ratio of employment in office-related sectors to population (\(EM{P}_{l,t}\)), and population index (\(POP{I}_{l,t}\)). To obtain data series in real terms, we deflate the nominal series using the Consumer Price Index (CPI) at the MSA level. Mismatch rate and search effort level are important variables to describe the search and matching process, and we explain their computation in the footnote of Table 1. Furthermore, the difference between capitalization and Treasury yield, as an indicator of the riskiness of office markets, can be considered exogenous because of credit markets’ mis-pricing risk, as shown in Wachter (2016).

We collect all tropical cyclone reports for hurricanes occurred in the Atlantic Ocean from 2005 to 2019. Hurricane occurrence, as a time dummy, covers hurricanes, which affected the US territory at a maximum wind speed exceeding 65 kt. Because hurricanes from the Eastern Pacific Ocean less frequently occur than the Atlantic ones and rarely affect the MSAs covered in this study, we omit Eastern Pacific hurricanes. We also include Atlantic dummies to distinguish MSAs which face the Atlantic Ocean from others. These data help us to capture the long-term climate effects on real estate dynamics.

As a preliminary test for the presence of multicollinearity and to confirm the existence of short-run dynamics, we compile VIF and conduct the Im-Pearson-Shin panel unit root tests and the Pedroni panel cointegration test. Except for population index and dummy variables that are stationary, other panel variables in our customised error correction models are I(1). We also confirm that multicollinearity problems do not exist. Based on the data characteristics, we transform exogenous I(1) variables into I(0) by differencing. Only endogenous variables remain as I(1).

Estimation Results

Significant Roles of Search and Matching Process in Office Markets

We treat the search and matching process as a key determinant of rent and supply in office market dynamics. In the preliminary tests, we confirm that economic mismatch, search effort level, natural log of real rent index and office stocks are endogenous. We construct panel error correction models, that disentangle long-run state and short-run disequilibrium by estimating simultaneous systems in a three-stage least squares (3SLS) procedure, to investigate the significance of economic mismatch and search effort level in office market dynamics. Three versions—M1 (without dummies of port cities or lack of transportation), M2 (a dummy of port cities included), and M3 (both dummies included)—are provided.

Long-Run Relationship of Real Rents

The first three columns in Table 2 summarise the results of the long-run relationship of real rents derived from the demand function, where we find that supply, economic mismatch rate, search effort level and demand factors are significant in setting real rents, with economic mismatch rate being the dominant factor.Footnote 11 The negative relationship between economic mismatch rate and rent is consistent with the simulation conducted by Wheaton (1990). The landlords’ behaviour to seek opportunities of earning rents above market rates is a crucial determinant of long-run rents rather than total supply. Once investors can reach deals with rents above market levels, the economically mismatched space then becomes matched, and market rents consequently rise. Showing concave functions and a positive relationship with demand factors, our results are in line with the underlying economic intuition. Furthermore, the inclusion of dummies of port cities and lack of transportation (measured by travel time to work in models M2 and M3) may affect the magnitude of relationships of hurricane issues with real rents. The hurricane occurrence period has significant negative effects on real rents, but only for MSAs facing the Atlantic OceanFootnote 12 lead to an increase in real rent. Moreover, the addition of port cities reveals that this dummy may actually proxy for the greater exposure of MSAs with coastal borders to hurricanes (which then reduce rents). Travel time to work (\(TTW{D}_{l}\)) proves to reduce rents as expected.

Conventionally, there are two types of supply constraints—geographical and regulatory. We capture these types in the office supply equation by inserting interaction terms of real rents with undevelopable land area and the Wharton regulatory index. Due to the simultaneous features, we also report the results of the long-run relationship of real rents in columns 4 to 6 and test for statistical differences. We confirm a small variation in the effects of office supply, economic mismatch and search effort level, with Atlantic Hurricane Occurrence showing a negative relationship with real rents weaker in M4 and M5 and stronger in M6. This may imply that the responsiveness of the environment and the regulations may be related to the hurricane occurrence.

Long-Run Relationship of Office Supply

Table 3 summarises the long-run relationship of office supply. As indicated by columns 1 to 3, the economic mismatch rate is a key determinant of supply, while the impact of market rents and search effort levels follow at distance.Footnote 13 Combining the findings related to the long-run relationship of rents, the pivotal role of the search and matching process, which reflects the behaviour of landlords in office markets, is evidenced.

Regulatory restrictiveness is estimated through the surveys conducted by Gyourko et al. (2008 and 2021), and undevelopable land area (UDA)—measured by Saiz (2010)—quantifies the degree of geographical constraints. In models M1-M3 we do not include the interaction terms of real rents with geographical and regulatory constraints. An increase in undevelopable land area leads to a reduction of office supply as expected. We also find a negative relationship between regulatory constraintsFootnote 14 and office supply (i.e. looser regulation, more supply). Our findings are consistent with Gyourko and Molloy (2015) for housing markets. Hurricanes do not seem to show a highly significant impact and MSAs exposed to the Atlantic Ocean have a higher supply, which even grows during the hurricane season. We also note that port cities may face stringent geographical constraints, thus lower office supply is seen in models M2 and M3. In model M3, Time Travel to Work (\(TTW{D}_{t}\)) increases the supply as the CBD may need to expand further out.

As discussed in the conceptual framework, a certain amount of vacant space reflects the physical mismatch where the space remains vacant until a major refurbishment. The significant rental gap between prime and non-prime buildings motivates landlords to exercise the option of renovation. As industry experts reveal that landlords are likely to be willing to renovate if the rental gap passes a certain threshold, we use a dummy to capture the marginal effect of rents on supply associated with a situation when the gap is large enough (40% for base case and 50% as a robustness test) to justify an intervention. The need for transformation to usable space should adjust office supply, but changes in supply driven by a rental gap are only found to be marginally significant (at 85% level) in models M1 to M6.

New firm births and deaths identify the existence of frictions in office markets. As reported in columns 1 to 6, new firm births and deaths lead to a reduction of supply. New business startups take much longer time to seek suitable operating space and cause larger frictions in the real estate rental markets. Their frequent turnover does not turn out to be sustainable demand. Landlords are relatively reluctant to make a deal with a frequent mover in lieu of long-term tenants to secure stable income flow. Therefore, markets having more frequent turnover will have less available supply when landlords prefer to market their space to long-term tenants. Our findings are in line with large frictions in the housing market as evidenced by Comes et al. (2019).

Supply elasticities could be classified into two conventional types: geographical and regulatory. We therefore include the corresponding interaction terms of rents with UDA and WRI in models M4 to M6. We find a negative impact of both geographical and regulatory constraints on the responsiveness of supply to rental movements. Particularly, the two interaction terms with UDA and WRI show opposite signs because, while higher values of UDA reflect greater geographical constraints, a higher WRI index level refers to less regulated markets. In other words, less available land hinders the responsiveness to rental shocks, and less restrictive regulations help to improve the timeliness of response to market changes.

Long-Run Relationship of Economic Mismatch

The equilibrium state of the search and matching process is represented by the long-run equation of economic mismatch rate in Table 4. The overall results from models M1-M6 conclude that real rents, office supply, concave functions of real personal income per capita and ratios of office employment to population, and population index well explain economic mismatch.

As shown in columns 4 to 6, when real rents increase, landlords release a small amount of space, and economic mismatch becomes matched.Footnote 15 We also evidence a negative relationship of economic mismatch with supply.Footnote 16 At the same time, the relationship with search effort level is not significant. Economic mismatch rates moderately increase with city size (i.e. a 1% population growth leads to an increase of 3.4%). Even when port cities and cities with a lack of transportation are considered in models M5 and M6, our results remain consistent. Overall, our findings reflect a stable economic mismatch rate, which implies the existence of strategic games played by landlords who may wait for better deals to happen in the future, and thus hold vacant space strategically. A similar argument is made by Mayer (1995) regarding housing markets, where a bigger range of mismatch in terms of property characteristics helps sellers to raise the price. Thus, the study of property market dynamics requires an investigation of landlords’ behaviour and strategies related to mismatch.

Short-run Dynamics

We estimate short-run dynamics in an error correction model by building a four-equation recursive system. The setup is similar to a vector error correction model, but exogenous variables differ across equations. Most of the models maintain stability, which is indicated by a negative sum of coefficients of error correction terms.Footnote 17

Tables 5 and 6 numerically describe short-run disequilibrium in office markets. In columns 1 to 6, the positive autocorrelation and adjustment to equilibrium explain short-run changes in rents and supply. Lagged increases in search effort level and population lead to a subsequent increase in rents, and the effect of population is relatively greater. Lagged increases in new firm deaths lead to a short-term increase in available space. The inclusion of interaction terms of changes in real rents with UDA and WRI in the supply equation does not cause any significant difference in Panel A. We cannot find evidence for a short-term impact of geographical and regulatory constraints on supply and its elasticity by type. Our results remain consistent, even when we include port cities and cities with a lack of transportation in models M2S and M3S. This implies similar features of short-run dynamics wherever the markets are located. Comparing the adjustment to equilibrium, rents and supply take respectively 36 and just above 100 quarters to restore to their equilibrium. The time taken by rents reflects the length of a real estate cycle (normally c.ca 8–10 years), while the slow response of developers leads to a longer adjustment period for supply. In general, landlords’ behaviour has a minimal short-term impact on the markets by controlling the listing of properties.

Tables 7 and 8 summarise the short-term process of search and matching. As with rents and supply, economic mismatch rates exhibit positive autocorrelation in short-run dynamics. Landlords subtly alter their behaviour in the short term, based on the available supply. A lagged 1% increase in supply reduces the search effort level by 2.4%. New supply is ushered to the markets, and hence more properties are listed. This helps to save search effort, but the economic mismatch rate tends to be rigid, in that landlords may not easily change their strategies to cope with short-term market movements. Small deviations from the equilibrium of economic mismatch rates are substantiated by the much shorter adjustment period to equilibrium of economic mismatch rate (i.e. 9 quarters). In conclusion, landlords may adjust their marketing strategies based on the short-term market situation, while remaining prudent in controlling mismatched space in the short run. Our empirical findings are in line with the theoretical framework of a housing-market matching model developed by Wheaton (1990).

Quantifying MSA-Level Variations in Office Market Dynamics

We have shown that investors could significantly affect office market dynamics through the search and matching process. This implies that office supply elasticities could be also driven by investors’ behaviour alongside natural barriers and government regulations. Since their behaviour may be adjusted based on market conditions, we include MSA interaction terms with real rents, supply and economic mismatch in the panel error correction models as the next step. Table 9 summarises the long-run state. A generally stronger relationship (in magnitude) of real rents with independent variables is shown in columns 1 to 3, compared with original models M4 to M6. The absolute effects of economic mismatch and search effort on real rents are respectively at least three-times and double the size shown in the baseline model.

In contrast, the effect of economic mismatch on office supply is weaker by 75%, and search effort shows a negative impact. A rental gap exceeding 40% leads to a 0.3% reduction in supply. When we include MSA interaction terms, we find that office supply increases with new firm deaths. This may imply a possibility that new business failures may be caused by their limited market knowledge. Normally, new business may not understand the trends of bigger and more structured markets easily where greater office supply is provided. Moreover, government regulations (indicated by WRI) turn out to be more significant but the importance of natural barriers (indicated by UDA) varies.Footnote 18 Even land is limited and, if governments relax height restrictions, supply may still rise.

Furthermore, in the long-run relationship of economic mismatch (columns 7 to 9), an inclusion of MSA interaction terms helps us to confirm a negative relationship between economic mismatch and search effort level. A rental market boom encourages landlords to raise asking rents and hence it leads to a growth in economic mismatch. Instead, fewer properties listed in a market cause tenants paying greater search effort. If their need is urgent, they will be bound to accept higher rents and hence the economic mismatch will decrease.

Three short-run models (I1S, I2S, I3S) are constructed and results are confirmed. Table 10 summarise the short-run disequilibrium of real rent and supply. A more significant adjustment to equilibrium is yielded in short-run rents and supply (i.e. respectively 11 and 35 quarters). However, we report a weaker short-term impact of search effort and greater effects of population on real rents. Panels C and D summarise the short-run disequilibrium of economic mismatch and search effort. More significant adjustments to equilibrium are also found in economic mismatch. In the short term, a change in search effort is determined by its autocorrelation and office supply (Table 11).

MSA-level Estimates of Overall Supply Elasticities, Structural, Frictional and Natural Vacancy

As aforementioned, we argue that an unobserved feature of MSA specific office supply elasticity could be driven by investors. Alongside geographical (UDA) and regulatory (WRI) constraints, we also include a third interaction term for rents in the long-run supply equation (MSA). We post-estimate marginal effects at the original values of time-invariant UDA and WRI to compute overall supply elasticities for each MSA. The estimates are reported in the first column of Table 12. We find confirmation that all 36 MSAs are supply inelastic and elasticities range from 0 to 0.61. West Palm Beach, Boston and Oakland are the most supply inelastic markets, while Columbus, Chicago and San Jose are the least inelastic.

In our conceptual framework, investors could control structural vacancy and hence the rentable supply responsiveness is adjusted. We argue that cross-sectional differences among MSAs may be explained by different levels of competition among investors. Office investors are primarily real estate investment trusts, listed developers, pension funds and endowment funds, in which the first two are public and the latter two private. We compute the Herfindahl–Hirschman Index of public investors for property ownershipFootnote 19 to estimate market concentration at MSA level, according to the information from S&P Global Intelligence database. A -0.28 correlation between market concentration and overall supply elasticity implies that less competition leads to lower supply elasticity. As markets tend to be competitive, public investors have fewer opportunities for making deals with above-market rents. This reduces the incentives to hold space, which accelerates the supply responsiveness. Boston and Oakland, having the lowest supply elasticity, possess moderately high market concentration (i.e. 0.21 and 0.24); whereas low concentration (i.e. 0.07) is found in Chicago, one of the most elastic MSAs. We also compute the correlation between market concentration among private equity investors and we report a negative value (-0.4).Footnote 20 Overall, we find evidence that investors’ behaviour affects office supply elasticity alongside natural barriers and government regulations.

The structural and frictional vacancy is identified by types of mismatch. Shifts in mismatch mainly depend on landlords’ behaviour. Columns 2 to 8 report our estimated structural, frictional and natural vacancy rates at MSA level. Structural vacancy driven by economic and physical mismatch is extremely highly correlated with frictional vacancy driven by new business startups and failures. This means that landlords execute consistent strategies of controlling different types of mismatch. In addition, the correlation of office supply elasticity with structural vacancy is around -0.1 and the correlation with natural vacancy reaches -0.07, thus partly supporting our suggestion that greater supply responsiveness to rents reduces natural vacancy. Based on our conceptual framework, the ranges of supply elasticity could decrease with structural and frictional vacancy. Intuitively, in a supply elastic market, a greater new supply can respond to a demand shock. New business startups are faster to find suitable office space and frictions can be reduced. Moreover, a lower negotiation power of landlords due to the presence of competitive markets with new supply causes less mismatch and hence reduces structural vacancy.

So far, the existing literature estimating natural vacancy without identifying structural and frictional vacancy separatelyFootnote 21 covers no more than 20 MSAs. In particular, Voith and Crone (1988) and Wheaton and Torto (1994) represent commonly used methods to estimate natural vacancy. We estimate these models with our dataset to evaluate the reliability of our findings. Table D1 in the Appendix reports the comparison of natural vacancy. Our Voith and Crone results show statistically significant time-invariant estimates of natural vacancy which are strongly correlated with actual vacancy. However, as the time variant component of their model is not significant, we prefer our empirical setting to test our conceptual framework. Moreover, the range of the estimates by adopting the Wheaton and Torto model is significantly narrow and they show a negative correlation with actual vacancy rates. Therefore, we overall find support for our model to estimate natural vacancy and identify structural and frictional components.

Robustness Tests

In this section we briefly present a series of further estimations, where we test the robustness of our main results.

Alternative Estimation Method in a Panel VAR Model

Our main error correction models are built with simultaneous systems of equations, which are estimated by 3SLS. To test the appropriateness of our main estimation method, we build a panel VAR model with lagged exogenous variables, which is estimated using GMM.Footnote 22 We note that the panel VAR model applied to stationary series in first differences loses the long-run relationship information and causes a discrepancy of results with those of an error correction model. Thus, the main contribution of an alternative panel VAR model is to confirm the need to treat endogeneity in the search and matching process. Table 13 summarizes the results, combined with Granger causality tests. In first differences, economic mismatch rate and supply Granger cause rents; search effort level and rents Granger-cause supply; and supply Granger-causes economic mismatch rate. Following the Hausman test, we confirm that the four main variables are endogenous. Impulse responses in the panel VAR model show overall consistency with our main error correction models. As cointegration does exist, our main error correction model is the most appropriate approach. Our results do not seem to be driven by model choice.

A Different Threshold of Rental Gap to Identify Physical Mismatch

In our main models, the threshold of rental gap is set at 40%, based on the information from industry experts. In order to test that our results are not driven by this specific threshold, we increase the threshold to 50%. Columns 1, 4, and 7 in Table 14 present results of the long-run state, consistent with our main findings. The short-run results are also confirmed, and we do not report them for parsimonious reasons.

A Different Measure of Economic Mismatch Rate

We use a different mismatch rate measure, defined as the ratio between available but occupied stock and vacant stock. The long-run results that are reported in columns 2, 5, and 8 in Table 14 are consistent with the main findings, with a slightly smaller impact on real rents and office supply.

Sum of New Firm Births and Deaths, and Their Net Difference

Frictions are driven by new startup companies moving in and out of office space. Therefore, we expect that a growing total of both new business startups and failures leads to greater frictions. In this robustness test, we replace the two separate variables used in our main models (new firm births and deaths) with the sum of two and their net difference. The net difference identifies net survival of new business tenants. Table 14 reports our estimates for the demand (Panel A), supply (Panel B) and economic mismatch (Panel C) equations. The third column of each Panel (R3) presents the results which are consistent with our main model I3. Office supply increases with the sum of new firm births and deaths. This may further confirm our explanation in Sect. 5.2, where we showed the possibility that new business failures may be more likely to occur in large markets where greater office supply is provided. The negative relationship of supply with the net difference suggests that relatively robust new business startups lead to more frequent office search, rigid frictions and a reduction of available supply.

Discussion on Investors’ Strategies to Face the COVID Pandemic Crisis

The COVID pandemic has spread across the US since late March 2020. To contain the coronavirus, social distancing rules and "Work From Home" policies have been implemented. A shocking amount of office space in traditional core business districts (CBD) is unused. The unprecedented and dramatic changes in the nature of office demand cause an increase in overall vacancy rates. The space characteristics required by tenants in skyscrapers may transform the facilities to fit individual and fully ventilated cubicles. Moreover, some tenants in the CBD even choose to move out to sub-urban areas for more spacious offices (i.e. to increase space per worker).

We elaborate two main strategies of office investors to manage their space in terms of economic and physical mismatch. For economic mismatch, investors hold a small amount of space for seeking a better rental deal. For physical mismatch, worn-out designed space is not suitable for any tenant and investors may wait for a major refurbishment until a significant rental gap between prime and non-prime is realised. During this pandemic, investors have less negotiation power and have to face a lower likelihood to reach a good deal. They are more willing to lower the asking rents, and hence the economic mismatch decreases. On the other hand, the demand for prime offices wanes and the rental gap narrows. Therefore, there may be no significant changes in physical mismatch.

As defined, structural vacancy is determined by economic and physical mismatch. We apply our main model I3 to forecast the structural vacancy by type for four most supply inelastic and four least inelastic markets to verify our hypotheses. As the overall office demand is shrinking, overall vacancy rates (in particular cyclical vacancy) rise. Based on our estimates of overall supply elasticities at MSA level, West Palm Beach, Oakland, Boston, and Cincinnati are the most inelastic, and Austin, Columbus, Chicago and San Jose are the least inelastic. During the COVID-19 period, the larger increments in vacancy rates are exhibited in the least supply inelastic markets (average growth: 44.5% vs 32% in most inelastic markets). This implies a faster responsiveness of supply, although this time it is bound to be driven by lockdown executed through the government’s emergency policies.

Figure 2 exhibits the forecast of structural and frictional vacancy during this period in four most supply inelastic markets. Structural vacancy generally drops in spite of rising overall vacancy rates. This implies that vacant space driven by economic or physical mismatch is not taken up but it is transformed into another type of vacancy (i.e. cyclical). For instance, an investor releases previously economically mismatched space and lowers the asking rent at market level. However, in a gloomy market situation the space remains vacant. Therefore, a portion of non-cyclical vacancy switches to cyclical. Moreover, structural vacancy due to economic mismatch is relatively more unstable than the one caused by physical mismatch. In other words, investors who are more inclined to have a conservative attitude may not show such firm decisions to manage economic mismatch. The reduction in structural vacancy due to physical mismatch is greater than economic mismatch. This implies that social distancing may change the requirements of space characteristics. It is possible that poorly designed but spacious space may be marketable. Figure 3 presents the corresponding forecast for four least supply inelastic markets. Except Chicago, the reduction in structural vacancy due to economic and physical mismatch in least supply inelastic markets is greater than in most inelastic markets. Therefore, investors who are more responsive to market structural shocks are more flexible to adjust their strategies in managing space.

In general, the pandemic leads to the formation of demand-driven markets and an increase in short-term cyclical vacancy. Our findings may infer that markets will even worsen in the short-term if investors significantly revise their strategies in managing economic and physical mismatch to face a slump in demand.

Conclusion

This work represents the first attempt to link office supply elasticities with equilibrium vacancy, using a proprietary dataset of 38 US MSAs covering 61% of the office workforce (and 44% of the US population). We contribute to the literature in several ways. Firstly, we build a conceptual framework that distinguishes between physical and economic mismatch; we thereby obtain an estimation of frictional and structural vacancy as the main components of the natural vacancy rate. Both mismatches describe landlords’ or investors’ strategies in managing mismatched space. Secondly, we adopt an empirical strategy, which allows us to distinguish between long- and short-run dynamics through a search and matching process, and estimate supply elasticities, structural and frictional vacancy at the MSA level. Thirdly, we also forecast structural vacancy due to economic and physical mismatch during the COVID-19 period, and provide an analysis of space management to face the pandemic.

We find significant effects of investors’ strategies, which are identified through the search and matching process in office markets. This finding reveals the need to incorporate the behaviour of investors into office market dynamics in order to estimate supply elasticity consistently. We conclude that all analysed US office markets are supply inelastic and an unobserved component of MSA specific supply elasticity may be linked to natural vacancy. Cross-sectional differences could be explained by the market concentration of investors (i.e. due to some areas having less competition and tighter supply constraints). The sum of structural and frictional vacancy represents natural vacancy that can be interpreted as the equilibrium one. Greater economic or physical mismatch increases structural vacancy and it also reflects a delay in investors’ responses to market dynamics.

The coronavirus pandemic has significantly changed the nature of office demand. We show that structural vacancy by type has fallen during the pandemic crisis, while the actual overall vacancy has risen. Larger reductions in structural vacancy are projected in the least supply inelastic markets, but more significant increases in actual vacancy are recorded. In other words, in these markets investors are more flexible to adjust space management strategies to release previous economically or physically mismatched space, with space not taken up due to waning demand. As a result, short-term cyclical vacancy may be found. The least supply inelastic markets can recover only if physical characteristics and asking rent levels adjust to movement in demand in the short term.

Social distancing shifts the demand from CBD high rise buildings to suburban low rise space, which was possibly more likely obsolete in the past. Therefore, policymakers may motivate and support investors renovating physically mismatched space based on new requirements due to the pandemic at lower costs. If office investors can offer space and facilities which help containing the virus, the prosperity of city centres will be sustained. Finally, spillover effects can stimulate an economic recovery during or in the aftermath of the pandemic, provided that other sectors also have appropriate measures to deal with the crisis.

Data Availability

We obtained property data with a quarterly frequency from CBRE Econometric Advisors (CBRE EA hereafter). As this is an independent private company, this represents a proprietory database and therefore it cannot be shared. For replication purposes, readers may contact CBRE EA (http://www.cbreea.com) to obtain information on data subscription.

Notes

This survey is conducted by the Atlanta Federal Reserve, the University of Chicago and the Stanford University.

See the appendix for the details.

Some provided space characteristics may also be redundant and no tenant requires them.

The second line of Eq. 1 - \({S}_{{i}_{n}\parallel {r}_{t}^{B}\ge {r}_{t}^{D},l,t}\) (occupied) and \({S}_{{i}_{n}\parallel {r}_{t}^{B}<{r}_{t}^{D},l,t}\) - is equal to zero because occupied and physically mismatched space either becomes vacant or refurbished and then matched in the long-run.

We acknowledge the suggestion of anonymous reviewers to better define frictional vacancy.

CBRE EA (formerly Torto Wheaton Research) is an independent research firm owned by CBRE, which is one of the largest property consultancy firms in the US. They provide a comprehensive property market database to real estate investors. The database covers fundamental market and investment data at MSA level by property sectors, which include apartments (61 MSAs), offices (63), retail (63) and industrial (52) properties. Basic data such as rent, stock, vacancy, completion, net absorption and capitalization rates are provided in every property sector over time. Despite a possible discontinuity in time series for some MSAs, the office sector database is the most comprehensive in terms of time span (starting from the second quarter of 1988) and greater depth of market data compiled by CBRE EA with information provided by property owners (e.g. availability rate, available but occupied space, total return, gross income and net operating income). For replication purposes, readers may contact CBRE EA (http://www.cbre-ea.com) to obtain information on data subscription.

These data are available until the fourth quarter of 2015 for 29 MSAs. We replace operating expense with structure cost, for a robustness check.

Economy.com has been the subsidiary of Moody’s Analytics since 2005. It provides data and analysis on regional economies by country. Particularly in the US, labour markets, demographics, industries and other variables are offered at MSA level.

Saiz (2010) estimated as the area within the cities’ 50-km radii corresponding to wetlands, lakes, rivers or other internal water bodies to quantify land availability.

A 1% increase in supply, economic mismatch rate and search effort level respectively lead to a reduction of 0.02-0.03% and 0.9-1.3% (computed by the exponential of (-0.01*0.902) in M1), and an increase of 0.01-0.02% (computed by the exponential of (0.0031*0.042) in M1).

Some may not be close to the coast.

A 1% increase in rent, search effort level and economic mismatch rate respectively lead to an increase of 0.71-0.75%, and a reduction of 0.02%, and a reduction of 3.9-4.2%.

WRI decreases with regulatory restrictiveness.

A 1% increase in rents slightly reduces the economic mismatch rate by 0.15-0.23% (computed by -0.007*log(101/100)/0.048 in the model M4).

A 1% rise in supply leads to a reduction of 4.6% (computed by -0.225*log(101/100)/0.048 in M4).

Models M2S and M3S may be marginally unstable as a slightly positive sum of coefficients of error correction terms is found.

Because the positive impacts of natural barriers on supply in M4 are unreasonable, we do not compare the results between I1 and M4.

As some data of property area are missing, we cannot compute concentration ratios in terms of area.

We source the data related to the size of asset under management by location of head offices from the Private Equity Real Estate (PERE) News to compute market concentration.

A panel VAR model with contemporaneous exogenous variables is also constructed; its results are consistent with the model including lagged exogenous variables.

References

Benjamin, J. D., Jud, D. G., & Winkler, D. T. (1998). The supply adjustment process in retail space markets. The Journal of Real Estate Research, 15(3), 297–307.

Cheshire, P., Hilber, C. A. L., & Koster, H. R. A. (2018). Empty homes, longer commutes: The unintended consequences of more restrictive local planning. Journal of Public Economics, 158, 126–151.

Combes, P.-P., Duranton, G., & Gobillon, L. (2019). The costs of agglomeration: Housing and land prices in french cities. Review of Economic Studies, 86, 1556–1589.

Diamond, P. A. (1971). A model of price adjustment. Journal of Economic Theory, 3(2), 156–168.

Englund, P., Gunnelin, A., Hendershott, P. H., & Söderberg, B. (2008). Adjustment in property space markets: Taking long-term leases and transaction costs seriously. Real Estate Economics, 36(1), 81–109.

Eubank, A. A., & Sirmans, C. F. (1979). The price adjustment mechanism for rental housing in the US. Quarterly Journal of Economics, 93(1), 163–168.

Fischel, W. A. (1973). Fiscal and environmental considerations in the location of firms in suburban communities. PhD thesis, Princeton University.

Gabriel, S. A., & Nothaft, F. E. (1988). Rental housing markets and the natural vacancy rate. Journal of the American Real Estate and Urban Economics Association, 16(4), 419–429.

Gabriel, S. A., & Nothaft, F. E. (2001). Rental housing markets, the incidence and duration of vacancy, and the natural vacancy rate. Journal of Urban Economics, 49(1), 121–149.

Green, R. K., Malpezzi, S., & Mayo, S. K. (2005). Metropolitan-specific estimates of the price elasticity of supply of housing, and their sources. American Economic Review, 95(2), 334–339.

Grenadier, S. R. (1995). Local and national determinants of office vacancies. Journal of Urban Economics, 37, 57–71.

Gyourko, J., & Molloy, R. (2015). Regulation and housing supply. In G. Duranton, V. Henderson, & W. Strange (Eds.), Handbook of regional and urban economics (1st ed., Vol. 5B, pp. 1289–1337). North-Holland, New York US. Chap 19.

Gyourko, J., Saiz, A., & Summers, A. (2008). A new measure of the local regulatory environment for housing markets: The Wharton residential land use regulatory index. Urban Studies, 45(3), 693–729.

Gyourko, J., Hartley, J. S., & Krimmel, J. (2021). The impact of local residential land use restrictions on land values across and within single family housing markets. Journal of Urban Economics, 126, 103374.

Helsley, R. W., & Strange, W. C. (2008). A game-theoretic analysis of skyscrapers. Journal of Urban Economics, 64(1), 49–64.

Hendershott, P. H., Jennen, M., & MacGregor, B. D. (2013). Modeling space market dynamics: An illustration using panel data for US retail. Journal of Real Estate Finance and Economics, 47(4), 659–687.

Jud, G. D., & Frew, J. (1990). Atypicality and the natural vacancy rate hypothesis. Journal of the American Real Estate and Urban Economics Association, 18(3), 294–301.

Keller, G., & Oldale, A. (2003). Branching bandits: A sequential search process with correlated pay-offs. Journal of Economic Theory, 113(2), 302–315.

Mayer, C. J. (1995). A model of negotiated sales applied to real estate auctions. Journal of Urban Economics, 38(1), 1–22.

Mayer, C. J. (1998). Assessing the performance of real estate auctions. Real Estate Economics, 26(1), 41–66.

Mortensen, D. T., & Pissarides, C. A. (1994). Job creation and job destruction in the theory of unemployment. The Review of Economic Studies, 61(3), 397–415.

Mortensen, D. T., & Pissarides, C. A. (1999). New developments in models of search in the labor market. In O. Ashenfelter, & D. Card D (Eds.), Handbook of labor economics (1st ed., Vol. 3B, pp. 2567–2627). North-Holland, Oxford UK. Chap 39.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2000). Structural analysis of vector error correction models with exogenous I(1) variables. Journal of Econometrics, 97(2), 293–343.

Pissarides, C. A. (1994). Search unemployment with on-the-job search. The Review of Economic Studies, 61(3), 457–475.

Rahbek, A., & Mosconi, R. (1999). Cointegration rank inference with stationary regressors in VAR models. Econometrics Journal, 2, 76–91.

Rosen, K. T., & Smith, L. B. (1983). The price-adjustment process for rental housing and the natural vacancy rate. The American Economic Review, 73(4), 779–786.

Saiz, A. (2010). The geographic determinants of housing supply. The Quarterly Journal of Economics, 125(3), 1253–1296.

Saks, R. E. (2008). Job creation and housing construction: Constraints on metropolitan area employment growth. Journal of Urban Economics, 64(1), 178–195.

Shilling, J. D., Sirmans, C. F., & Corgel, J. B. (1987). Price adjustment process for rental office space. Journal of Urban Economics, 22(1), 90–100.

Sivitanides, P. S. (1997). The rent adjustment process and the structural vacancy rate in the commercial real estate market. Journal of Real Estate Research, 13(2), 195–209.

Stock, J. H., & Watson, M. W. (1993). A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica, 61(4), 783–820.

Van Ommeren, J., & Russo, G. (2014). Firm recruitment behaviour: Sequential or non-sequential search? Oxford Bulletin of Economics and Statistics, 76(3), 432–455.

Voith, R., & Crone, T. (1988). National vacancy rates and the persistence of shocks in US office markets. AREUEA Journal, 16(4), 437–458.

Wachter, S. M. (2016). Credit supply and housing prices in national and local markets. Public Finance Review, 44(1), 6–21.

Wheaton, W. C. (1990). Vacancy, search and prices in a housing market matching model. The Journal of Political Economy, 98(6), 1270–1292.

Wheaton, W. C., & Torto, R. G. (1988). Vacancy rates and the future of office rents. Journal of the American Real Estate and Urban Economics Association, 16(4), 430–436.

Wheaton, W. C., & Torto, R. G. (1994). Office rent indices and their behavior over time. Journal of Urban Economics, 35(2), 121–139.

Wheaton, W. C., Chervachidze, S., & Nechayev, G. (2014). Error correction models of MSA housing supply elasticities: Implications for price recovery. MIT Department of Economics Working Paper Series 14–05.

Acknowledgements

We thank the Editor and two anonymous referees for helpful comments and suggestions. We would also like to thank CBRE Econometric Advisors for providing the data. We appreciated useful feedback received on an earlier version from Daniel Broxterman, John Clapp, Mike Clements, Dean Gatzlaff, Daniel Mariya Letdin, David Ling, Crocker Liu, Tobias Muhlhofer, Andy Naranjo, Albert Saiz, Charles Ward, William Wheaton and discussants / participants at the National AREUEA, International AREUEA and AEA Conferences, as well as research seminars held at CBRE Econometric Advisors, Florida State University, Henley Business School, MIT, UCD Smurfit, University of Aberdeen, University of Durham, University of Florida and University of Plymouth. The views expressed herein are those of the authors and all errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Marcato, G., Tong, L.M.M. Supply Constraints and Search Equilibrium in Office Markets. J Real Estate Finan Econ (2023). https://doi.org/10.1007/s11146-023-09955-y

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-023-09955-y

Keywords

- Supply elasticity and Constraints

- Structural Vacancy

- Frictional Vacancy

- Commercial Real Estate

- Search Equilibrium

- COVID-19