Abstract

Infill investments are argued to mitigate environmental footprints, regenerate places and accommodating population growth, but frequently generate local opposition. However, there is a dearth of knowledge around how different types of infill affect different segments of local property markets, how persistent effects are and how far they reach. Using detailed geocoded infill development activity and sales data, we test the price level and trajectory impacts of five infill types, distinguished by the net scale of additional dwellings, on property prices within five concentric 100-meter rings. Using an adjusted interrupted time-series estimation strategy with locality, property and neighborhood characteristic controls we find that developments that generate a net increase in dwellings of four or less, typically result in an appreciation in the average sales prices of proximate dwellings. Moderate and large-scale developments generate negative price effects, but these effects predominantly affect apartments and townhouses, not the dominant detached house submarket. Over time, amenity effects and local market potential may even have a further positive expectation effect on detached house prices. Infill type differentiation shows that urban densification may result in positive affordability outcome in the apartment submarket, but has the opposite effects in the detached house submarket. Divergent price trajectories also contribute to widening wealth disparities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Urban areas across the world face several daunting, interrelated and sometime conflicting real estate development challenges: aggregate housing quantity and quality, housing affordability, neighborhood regeneration and stabilization, and environmental sustainability. Many urban governments are turning to infill development—residential investment that increases dwelling density in existing neighborhoods—as a key planning strategy to address these challenges (Newton & Glackin, 2014). Infill can involve very different scales of buildings. Some are developed through the demolition of existing low-density residential or non-residential structures, others are building on vestiges of vacant land within the urban area’s footprint. Despite its expanding use, the residential price impacts of these different “flavors” of infill development are subject to considerable debate.

Some have worried that laudable efforts to mitigate environmental impacts via infill may have the unintended consequence of increasing property prices and intensifying affordability problems across the metropolitan area by raising per unit land acquisition and construction costs and reducing the aggregate supply of housing thereby (Evans, 2004; Quigley & Raphael, 2004; Glaeser & Ward, 2009; Kok et al., 2014). Ironically, others argue that infill developments will reduce neighboring property prices because they will create a variety of negative spillovers associated with congestion, inconsistent architecture, or socioeconomic and demographic change (Whittemore & BenDor, 2019; Trounstine, 2021). Still others take a more nuanced view that infill development’s neighborhood externality effects will be contingent on the submarket context in which it occurs (Galster et al., 2003), so that infill can have substantial positive price impacts in disadvantaged neighborhoods (Simons et al., 1998; Ellen et al., 2001).

In this paper we investigate whether different types of residential infill development produce changes in proximate residential property price levels or trajectories, and whether these effects differ by housing submarkets. We consider five types of residential infill investment distinguished by the net addition of dwellings after redevelopment. These range from one-for-one replacements, known as “knock-down and rebuilds,” to large-scale developments with 50 or more net dwelling additions on site. A related question is how far any impacts extend. We therefore analyse the impact of infill developments across five, 100-meter-wide concentric rings.

There are several reasons why infill developments are unlikely to produce a consistent price impact in all circumstances. Firstly, the existing urban footprint is non-malleable so that long-lived housing assets may generate adjustment friction (Rothenberg et al., 1991). Areas, once developed, do not smoothly adjust to changes in demand fundamentals. Longevity of land use may in turn be exacerbated by social interactions and property rights (Meen & Nygaard, 2011), owner preferences (Evans, 2004) and transaction costs of development coordination (Hornbeck & Kenniston, 2017). Local price inefficiencies may arise as a result of these factors playing out over an extended period. Infill residential investment within the existing urban footprint may in such cases be able to capitalise latent price-distance gradients in established neighborhoods and thereby raise local return expectations (Caplin & Leahy, 1998; Ding & Knaap, 2003; Ellen et al., 2001; Schwartz et al., 2006; Ooi & Le, 2013).

Secondly, any price effect is likely to be related to the scale and density of redevelopments (both absolutely and relative to the extant housing stock in the neighborhood) and demand fundamentals. In urban economics, local property prices reflect demand for localities and cost of supply (Glaeser & Gottlieb, 2009), where locality includes spatial (proximity measures) and non-spatial (neighborhood effects) characteristics (Haurin et al., 2002). Where infill development constitutes an effective substitute for the extant stock of dwellings in a neighborhood, infill may result in a price dampening (supply) effect. However, where infill alters the appearance of a neighborhood, provision of local amenities or composition of residents, infill can also affect the demand for extant housing stock via positive or negative spillovers. For instance, replacing dwellings like-for-like or adding small-scale or low-density housing may have a negligible effect on neighborhood average incomes or demographic composition, aggregate housing stock characteristics, perceived amenities, or provision of locality-specific supply. It may of course have a ‘tidying up’ effect through increasing local demand (Ellen et al., 2001). It may also provide a signalling effect by removing, or reducing, the likelihood of subsequent (unwanted) changes to an area’s appearance. Conversely, adding large, multi-dwelling structures potentially alters the neighborhood’s income and demographic profiles, visual characteristics (Dye & McMillen, 2007) and supply fundamentals (Newell, 2010), thereby reducing prices for proximate properties. Both Hornbeck and Kenniston (2017) and Newell (2010) point out that these supply effects may be particularly pronounced in lower-demand areas.

It is thus clear that residential infill investment potentially generates supply and demand effects simultaneously, with the size of these effects varying according to the specific developmental context. To the extent that the increasing supply effect and/or the decreasing demand effect (via net negative spillovers) are relatively large, we would predict local property prices to decline, and vice versa.

Our analysis employs infill development (N = 65,183) and residential property sales (N = 418,273) data for the metropolitan area of Greater Melbourne, Australia. Greater Melbourne comprises 31 Local Government Areas that also are the local planning authorities, the City of Melbourne is one of these 31 Local Government Areas. Our transaction data involve sales of all residential properties (2006, 2008–2015). Our analysis considers the impact of all residential developments in Greater Melbourne except developments categorised as broad hectare developments which typically signify greenfield and dedicated ‘growth area’ developments on the urban fringe. In established neighborhoods new residential development is achieved by removing existing dwellings and/or filling-in empty plots between existing dwellings. Each infill type is defined by the net addition of dwellings after development of a plot, so that development types relate to both scale and densification. Infill developments are classified as: knockdown and rebuild (KDR), one-dwelling, small-scale (2–4 dwellings), moderate-scale (5–49 dwellings) and large-scale (50 + dwellings) developments, reflecting the net increase in dwellings on site after development.

To investigate the local housing price impacts of residential infill investment of various kinds, we use an adjusted interrupted time-series (AITS) estimation strategy that controls for locality, property and neighborhood characteristics. The salient advantage of the AITS estimator is that it overcomes the challenge of non-random selection of where infill development occurs and thus provides a plausible, quasi-experimental estimate of causal effects. As we amplify below, AITS does so by comparing the differences in both levels and trends in housing prices between places where infill development occurred and where it did not, both before and after the development occurred. The impact of different dwelling types and structures is capitalised in extant property prices both before and after developments. By defining infill in terms of net additions our analysis is robust to neighborhood heterogeneity in built form prior to development.

The paper makes four contributions to the state of knowledge. First, unlike the majority of studies in this area, our study examines the impact of private sector investment rather than publicly subsidised housing; it thus adds to the underdeveloped literature on private sector residential spillovers. Secondly, we test for differential impacts of different infill types, or scales of development, which are closely related to contemporary urban densification strategies. To our knowledge, this is the first attempt to differentiate infill developments by types and simultaneously test for their spillover effects.Footnote 1 This differentiation allows to identify potential submarket effects and consider distributional as well as affordability related outcomes. Thirdly, we employ a vector of 100-meter distance rings to test for spatially tapering price effects, rather than a singular, fixed-distance ring. We argue that identification of potential distance decay is critical to understanding different sources of spillovers. Fourthly, where most studies employ OLS regressions to test for spillovers, we model the variance as an exponential function of distance, density and age of properties to deal with issues of heteroscedasticity.

The paper consists of six sections. Second section reviews the empirical literature and sets out our empirical modelling approach. Third section gives a brief overview of Melbourne metropolitan planning constraints and outcomes. Fourth section provides data and variable descriptive statistics. Fifth section presents estimation results. Sixth section concludes.

Residential Infill Investment in Existing Neighborhoods: Previous Studies and Our Analytical Strategy

Prior Research

There is a considerable literature analysing the external effects (measured by property value changes) of publicly subsidized residential investment in established neighborhoods. The existence, magnitude and spatial reach of potential externalities could generate a public policy rationale for intervention in housing markets and underpin the development tax increment finance and other schemes for urban renewal programmes. The results of these studies, reviewed in Galster et al. (2003), Schwartz et al. (2006) and Galster (2019: Ch. 9), paint an inconclusive picture. There is considerable evidence of positive effects of newly developed public or assisted housing, but also negative effects associated with some types of publicly supported residential investment, especially in weak housing submarkets.

In Melbourne as in many other cities, however, the vast majority of housing investment is private-sector led without any public subsidy. The spatial distribution and scale of such investment can, a priori, be expected to differ from the publicly subsidised investment examined in the above literature and thus its property value impacts are also likely to be different. Unfortunately, the literature focusing on private sector residential investment in existing neighborhoods is extremely limited and inconsistent in results. Ding and Knaap (2003) examine new single-family infill dwellings constructed on vacant plots in Cleveland and observe substantial positive spillovers for nearby single-family home values. These average 8% per home within 150 feet of the new construction; within 151 to 300 feet, the figure is 2%. By contrast, Zahirovich-Herbert and Gibler (2014) estimate the effect of new single-family home construction on nearby single-family attached and detached property prices in Baton Rouge. They find no general statistically significant spillover effect. There is, however, evidence of a supply effect that lowers prices of similar-sized houses where demand is unchanged, and a positive externality where newly constructed dwellings are large relative to the area average and located within a quarter of a mile. There appears to be a scale effect, suggesting that more concentrated redevelopments will have larger positive effects than smaller developments. Finally, they find that the newly constructed dwellings typically trade at a price premium, even for otherwise small or lower-priced properties.

The last result suggests that new construction in existing neighborhoods is able to capitalise on latent price-distance gradients. Infill and residential investment may thus increase average area prices, without generating spillover effects on individual properties, by raising rate-of-return expectations and benchmarks set by market intermediaries. That infill developers are indeed able to act as price leaders is supported by Ooi and Le (2013), who investigate price effects from new high-rise developments in Singapore. They find that time between property sale and launch of a new development nearby is directly related to prices, indicating a positive expectation effect that strengthens as developments come to completion. Kurvinen and Vihola (2016) similarly find that multi-story developments in Helsinki have a positive impact on the price level of nearby apartments built in the 1960s/70s. New developments do not, however, change the negative price trend prior to development within a 300-meter radius of developments.

As suggestive as these studies are, questions must be raised about how successfully they met the fundamental challenge faced by all investigations of the proximate property value impacts generated by some new investment: spatial selection based on unobserved spatial heterogeneity. New investments in housing are clearly not made on a geographically random basis. Public sector decision-makers may select areas with the greatest “need” or “potential for leveraging private investments” as targets for their subsidized housing developments. Analogously, private housing developers are likely to choose locations where the underlying market fundamentals offer the prospects of superior rates of return on their investments. The empirical challenge is controlling for these difficult-to-quantify aspects of local real estate markets that both affect where new developments will occur and the housing price trajectories manifested independently of these developments.

The most common estimation strategy pursued in the aforementioned literature to deal with this identification challenge is a difference-in-difference (DiD) hedonic specification. Sales price of an individual dwelling is regressed on a vector of property characteristics,Footnote 2 an overall market time trend, and local area (investment and non-investment control) fixed effects measured both before and after the investment(s) in question. Any observed differences between the pre- and post-investment periods in the mean price differences between the treatment and control areas is the measure of impact. Unfortunately, the internal validity of this identification strategy is badly eroded if there are systematic differences in the pre-existing price trends in neighborhoods where new investments will occur and those where they will not, which is entirely predictable based on how both public and private decision-makers target their investments.Footnote 3 For example, for-profit developers will likely be drawn to lower-valued local areas where nascent revitalization efforts have already started or where other public and private investments are anticipated.Footnote 4 The counterfactual in such areas would be growing property values, thus the measured impact of a new infill development in a DiD specification will be biased upward.

This issue of time-varying heterogeneity in small-area price trajectories holds special salience in Melbourne. Melbourne has over the past two decades experienced employment re-centralisation and economic restructuring that has altered the economic geography of the city and region. More generally, the wide variety of local zoning policies and unobserved housing and neighborhood characteristics may generate spatial interdependencies or omitted variable bias that systematically affect the capitalisation rate that infill residential investment generates for surrounding properties. For instance, Brueckner and Rosenthal (2009) argue that cities exhibit cyclical re-construction trends that also result in cyclical neighborhood status trends. Meen and Nygaard (2011) argue that local supply elasticities are conditioned by degree and type of existing land use so that price effects are expected to be locally correlated and heterogeneous. By implication, changing economic determinants would not be expected to have uniform impacts across different areas. Meen et al. (2016), for example, argue that social interactions may generate persistence in local neighborhood dynamics.

Our Analytic Strategy

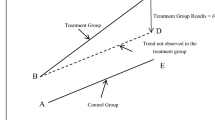

Our solution to this vexing identification problem is to extend the logic of the DiD model to include not only local area pre-/post-development comparisons of levels in prices but also trends in prices.Footnote 5 This is the Adjusted Interrupted Time Series (AITS) model. DiD assumes that selection is made only on basis of pre-existing property price levels before development activity (compared to levels in other locations where development activity did not occur), with trends in development and non-development locations otherwise moving in parallel. Impact is measured by comparing the differences in post- and pre-development activity price levels in development and non-development locales. AITS relaxes the parallel trend assumption, and assumes that selection is made on basis of both pre-existing property price trends and levels before development activity and in comparison to trends and levels in non-development locales. Impact is measured by comparing the differences in post- and pre-development activity price trends and levels in development and non-development locales. AITS thus has more robust internal validity in making causal inferences in complex property markets.

AITS was developed by Galster et al. (1999) to assess the impacts of tenants receiving housing subsidies on nearby property values. It has since been widely employed in price impact and spillover analyses of subsidized housing developments and area-based urban revitalization programs (Santiago et al., 2001; Galster et al., 2004a, b, 2006; Koschinsky, 2009; Woo et al., 2016).

Our AITS specification is set out symbolically in Eq. (1):

In (1), the log of real price (base $2006 prices) for the ith house is regressed on hedonic and AITS elements, respectively. The hedonic element contains a vector (X’) of property and neighborhood characteristics that drive systematic differences in property prices, plus several types of fixed effects: σ for 30 local authorities, φ for 7 main zoning codes delineating planning schemes and 2 zoning overlays (heritage and flooding), ξ for 254 postcodes, and 𝜃 for year and quarter. Local Authorities σ are further interacted with τ years to allow for heterogeneous rates of price appreciation across sectors within metropolitan Melbourne.

Ideally we would have liked to control for key neighborhood (built form and social) characteristics at the same micro-neighborhood scale as used in the AITS analysis.Footnote 6 This level of data granularity is unfortunately not available. However, our specification indirectly captures variations in build form through the inclusion of heritage overlays (these also limits the extent to which new construction visually can deviate from the existing built form) and proximity to different activity centres. Activity centres concentrate employment and non-residential construction and buildings and thus also, indirectly, provide a control for proximity to non-residential construction taking place. Differences in neighborhood income and social status is captured through the 2006 Socio-Economic Indexes for Area (SEIFA), where we utilize the Index of Relative Socio-economic Advantage and Disadvantage. This is measured at the census collection district level and thus somewhat larger than our micro-neighborhoods. The neighborhood characteristic variables also include proximity to a number of local amenities (such as parks, schools, public transport, major roads). Descriptive statistics for all variables in the hedonic element is shown in Table 4 ("Transaction Data" section). For the purpose of the 10-year analysis here the neighbourhood variables are treated as fixed (time-invariant). Finally, in Eq. (1) 𝜃 and σ * τ are time-variant components capturing overall property price changes in Melbourne and local government specific price changes, respectively.

The AITS element consists of level and trend elements where infill development is defined in terms of at least one actual development activity of type k, as opposed to type k planning permits. For the level element, Dꞌ is vector of dummy variables indicating whether or not an infill development of type k took place at any time during the analysis period within each of five, 100-meter-wide concentric rings (j) centred on each individual property transaction. The five k infill development types are: knockdown and rebuild (KDR), one-dwelling, small-scale (2–4 dwelling net increase), moderate-scale (5–49 net dwellings) and large-scale (50 + dwellings) developments. ADꞌ is a vector of dummy variables for whether the sale took place after commencement of the first infill development of type k occurred within distance ring j. For the trend element, BDnꞌ is a vector giving for observations where D = 1 the number of years between the sale and the start of our data period (2006), distinguished by each of k development types and j distance rings. ADnꞌ and ACDnꞌ are analogous vectors for observations where AD = 1 giving the number of years between the sale and the commencement of construction activity of the first and the completion of construction activity of the last, respectively, infill development of type k within distance j.Footnote 7

In (1), sales exhibiting infill developments within any of the concentric distance rings (j) are compared to sales with no infill developments within 500 m, but located in the same postcode area, local government area and zoning allocation. These comparisons are made both before and after a development occurs. The level elements D and AD control for systematic variation in area mean property prices before and after nearby residential development. Specifically, coefficient \(\vartheta\)measures the degree to which mean prices in the areas near where new infill developments will eventually occur differ from others; it is one control for selection. Systematic variation in property price level (and trend) can reflect a number of unobserved factors, including differences in the type of dwellings that existed in a neighborhood prior to any development activity. Coefficient \(\gamma\) measures the degree to which the initial difference changes after development, and is one measure of impact as in a standard DiD.

The inclusion of the trend elements BDn, ADn, and ACDn allows for the underlying price trajectory in areas with and without proximate residential infill development to differ before, during and after development occurs, controlling for the price trend in the encompassing local authority (i.e., \(\sigma *\tau\)). The coefficient \(\nu\)measures the degree to which price trends in the areas near where new infill developments will eventually occur differ from others; it is the other control for selection unique to the AITS model. Coefficient \(\mu\) measures the degree to which the initial difference in trends changes after development is completed, and is one measure of impact unique to AITS. Coefficient \(\rho\)measures the degree to which price trends might be affected as soon as developments commence; it is another measure of impact unique to AITS.Footnote 8

In sum, we believe that this AITS approach embodied in (1) offers a much more convincing identification strategy than has previously been employed in the investigation of the housing price impacts of infill development. We use this model to address the following research questions in the context of the metropolitan Melbourne housing market:

-

1.

To what extent does new infill development affect either the mean level and/or the trajectory of proximate residential property prices?

-

2.

How far do such effects extend spatially?

-

3.

How are the answers to (1) and (2) affected by different types (scales) of infill development?

-

4.

How are the answers to (1), (2) and (3) affected by whether measured prices appertain to homes or apartments?

A priori, from the existing literature on residential development within existing neighborhoods, we can formulate a number of estimation expectations:

-

1.

A statistically significant reduction in the post-infill level \(\left(\gamma \right)\) of extant property prices across multiple distance rings is consistent with a supply effect, provided extant housing stock is in the same housing sub-market (homes or apartments).

-

2.

A statistically significant reduction in the post-infill level \(\left(\gamma \right)\)of extant property prices, but one that decays with distance from the development, is consistent with a demand effect arising from a long-term net disamenity arising from change to neighborhood characteristics, overshadowing, increased traffic, inflow of lower-income households relative to existing residents, etc.

-

3.

Conversely, a long-term net amenity from tidying-up effects, superior quality housing, inflow of higher-income residents relative to existing residents, etc., should generate a statistically significant increase in the post-infill level \(\left(\gamma \right)\) of extant property prices that decays with distance from the development.

-

4.

A statistically significant decrease in the post-infill price trends \(\left(\rho \right)\) and/or \(\left(\mu \right)\) of extant property prices is consistent with a persistent demand effect arising from expectation/signalling effects such as might arise from pessimism about the future of a neighborhood.

-

5.

Conversely, a statistically significant increase in the post-infill price trends \(\left(\rho \right)\) and/or \(\left(\mu \right)\) of extant property prices is consistent with a persistent demand effect arising from expectation/signalling effects such as might arise from optimism about the future of a neighborhood.

The combined effect of these impacts may mean that what a property owner might think of as a positive or negative impact on their property can change over time. For instance, initial negative impacts, such as a change in the level of property prices, may over time be offset by an increase in the price appreciation trend. The balance of positive and negative impact can thus have a distinct temporal profile determined for each development type k by the magnitude of \(\gamma ,\) \(\rho\)and \(\mu\). To foreshadow our results, we indeed often find such patterns of offsetting initial level and temporal trend effects of infill development, which we will portray graphically.

Land Use Regulation and Densification in Melbourne

Over the past 50 years, there has been an inherent tension between Melbourne’s physical development and metropolitan planners’ attempt to govern the process (Tsutsumi & Wyatt, 2006). Metropolitan planners’ efforts to contain urban sprawl was introduced in 1971 with the introduction of urban green wedges that sought to concentrate development in seven growth corridors. In 2003, legislative protection and parliamentary oversight of the urban growth boundary was intended to firm up containment of urban sprawl and increase density by redirecting new development from growth corridors to activity centres built around access to public transport (Buxton & Taylor, 2011).

Throughout the 2000s, specific targets for infill development, ranging from 50 to 70% of all new construction, were adopted as components of planning strategies in several Australian cities (Newton et al., 2017). While achieving some reduction in the average new plot size, the policy did not prevent an increase in the average new dwelling size or significantly increase the rate of development around activity centres and transport hubs (Goodman et al., 2010).

Broad trends in the change and structure-type composition of greater Melbourne’s occupied dwelling stock is illustrated in Table 1. While the overall share of detached houses declined between 2006 and 2016, the combined share of lower-density living, detached/semi-detached houses and townhouses, remained largely unchanged and constituted some 84% of the overall increase in occupied dwellings. Townhouses, while often representing an increase in the capital-land ratio that allows preservation of gardens, as would be expected from increasing land values, do not necessarily lead to an increase in dwelling density. Throughout the middle suburbs, townhouses have frequently appeared as infill developments and teardown redevelopments. There has also been a marked increase in higher-density living, but much of this is geographically limited to the inner parts of the metropolitan area. While most dwelling categories increased numerically, the number (and share) of 1–2 storey flats, units (see note to Table 1) and apartments fell significantly – a potentially important development with respect to the availability of affordable housing for lower-income households.

More detailed analysis can be conducted based on Housing Development Data (HDD) published by the Department for Environment, Land, Water and Planning (DELWP). The HDD contains geocoded cadastral and development project data (2005–2014) that enable identification of residential developments within the existing built-up area, the existing number of dwellings prior to development, net dwelling additions for each project and dwellings under construction. Developments can be classified into infill, urban renewal and broad hectare uses based on the Victorian Department of Environment, Land, Water and Planning’s annual Urban Development Program (DELWP, 2016a). In our analysis we exclude broad hectare developments that typically signify urban fringe or dedicated growth area developments. The HDD data only identifies projects where there is actual development activity, either construction or demolition in any given year.

By OECD standards, Melbourne (like all Australian cities) is low density and sprawling (OECD, 2018). Only some 5% of Melbourne is zoned to support higher-density developments (DELWP, 2016b). Some two-thirds of the metropolitan area is covered by land use regulation restricting height-related densification. Nevertheless, zoning enabling higher-density development is scattered across the metropolitan area in a number of commercial zones, activity centers, transport nodes and urban renewal sites. Thus, while spatially separate, many low-density residential areas will nevertheless be within the vicinity of higher-density developments. Table 2 shows the distribution of residential infill projects by development type and the net addition of dwellings (2005–2014). Infill projects are classified by their net increase in dwellings on a plot after development: knockdown and rebuild (net increase = 0), one-dwelling (1), small- (2–4), moderate- (5–49), and large-scale (50+).

Notwithstanding the small proportion of developments that are higher density (50 or more dwellings), these constituted just over a third of new infill dwelling supply in existing neighborhoods during the 2005 to 2014 period. By contrast, lower-scale supply constituted some 44% of total infill dwellings. Medium-density development constituted nearly a fifth dwellings through infill.

While classified here according to their net dwelling addition, our infill types in practice contain a variety of dwelling structures. KDRs tend to replace older or qualitatively lower-quality housing with larger, single-dwelling structures. Many one-dwelling developments take place on empty plots (43%), resulting in dwellings that are visually comparable to KDR developments. Small-scale development often involves the removal of a single double-fronted property, or small number of smaller properties, with infill apartment-style or townhouse-style developments arranged in a two-story block or arranged horizontally. Moderate- and large-scale developments span a greater variation. Moderate-scale developments can be arranged as a collection of townhouses around one or more common drive-ways, but also as a low-rise (6–7 storey) block of apartments. Large-scale developments often consist of multiple townhouses, a combination (of townhouses and apartment blocks (6–7 storey), but also high-rise (10+) storey apartment blocks. The latter are more frequently found in the CBD, designated activity centers across Melbourne, and key arterial routes. In Melbourne, different dwelling types are closely associated with different tenure types. At the last Census (2016), 80% of detached houses, 50% of townhouses, and just under a third of apartments were owner-occupied.

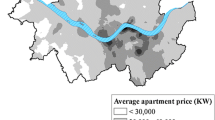

Figure 1 summarizes the spatial distribution of each of the development types in relation to the CBD. Historically, it has been Melbourne’s fringe that has housed a growing population and, notwithstanding consolidation objectives, the outer suburbs remain the growth centers for new housing. A key focus for housing Melbourne’s expected population growth is, however, the middle ring suburbs (5–15 kms from the CBD) (DELWP, 2017). Figure 1 gives rise to three general observations. Firstly, it shows that high-density development primarily takes place in the inner city. This is consistent with the higher land values and capital-land ratio intensification arising from the monocentric city (e.g. Alonso, 1964, Muth, 1969, Duranton & Puga, 2015). Indeed, parts of inner Melbourne have been developed at density levels exceeding maximum levels allowed in Hong Kong, Tokyo and New York, but frequently with low-quality private and public space (Hodyl, 2015).

Secondly, it is notable that infill development more generally is concentrated in the inner and middle suburbs. This too is consistent with predictions arising from monocentric city models, but also construction and building cycles (e.g., Brueckner & Rosenthal, 2009). Finally, the spatial distribution of knockdown and rebuild, one-dwelling, small - and moderate-scale development is largely taking place at similar distance to the CBD. A priori this finding is less consistent with the monocentric city model or with capital-land ratio intensification arising from a space premium (note that the peak of developments do exhibit some alignment with monocentric expectations, however). Based on Melbourne’s price-distance gradient, lower-density development would be expected at a greater distance to the CBD than medium-density development. Their significant spatial overlap therefore raises the prospect that land utilisation in the middle suburbs is inefficient and that infill development and replacement may generate significant positive spillover effects.

Transaction Data

The empirical work in "Estimation Results" section estimates the price effect of residential infill investment on existing residential properties in Melbourne. To identify this impact we use sale transaction prices of properties that are not part of a new residential development, as recorded by the Valuer General, Victoria, for the years 2006 and 2008–2015.Footnote 9 We use the above-described HDD to identify infill developments and sales that are part of a new residential development.

For the years 2006 and 2008–2015 we were able to geocode 589,740 out of 808,556 transactions to their street address based on recorded street number, name, suburb and postcode. Some 135,937 transactions relate to sale that are part of new property developments. These are excluded from the main analysis as they represent the infill developments themselves, although we include these ‘new builds’ as tests of price-pushing dynamics. Transaction data are available with an actual date of sale. The HDD, however, only records the calendar years when a new development started and ended.

Sales prices were deflated to 2006 values using the general consumer price index. We further exclude properties that sold for less than $100,000(AU) or more than $3,000,000(AU) and any observations where cadastral or contextual information was incomplete. This left a total estimation sample of 418,273 properties involving different sorts of dwelling types that sold over the period and were not themselves an infill development.

Five concentric ring-shaped, mutually exclusive buffers were drawn around the centroid of each property transaction with radii in 100-meter increments (0-100 m., > 100–200 m., etc.). Buffers containing the centroids of infill activity captured proximity to such development. To avoid capturing the same development across multiple buffers (e.g., where a development was close to a border) the centroids of developments were used. Table 3 shows the percentage of property transactions taking place in proximity to where infill will take place (A), and the percentage of property transactions taking place after infill has commenced (B), by distance buffer and infill development type.

Approximately half the property transactions are within 100 m of where a one-dwelling net increase will take place. The percentage of sales proximate to KDRs, small-, moderate- and large-scale developments is successively lower, with only some 4% of property transactions within the a 100 m vicinity of a large-scale development. The proportion of property transactions with infill development taking place within the 200-500 m bands gradually increases for each of the infill types. The percentage of property transactions taking place after an infill has taken place is approximately a third for a one-dwelling increase infills within 100 m, declining successively to 2% for large-scale infills within 100 m. It is thus clear that most property transactions in Melbourne are within a 500 m vicinity of a KDR or one-dwelling infill development, whereas only a small percentage of property transactions are close to large-scale developments.

In the conventional monocentric city model, locality represents access to (central) employment markets (Alonso, 1964; Muth, 1969; Rosenthal & Ross, 2015; Duranton & Puga, 2015), but the more extended literature also considers access to a range of amenities (Brueckner et al., 1999; Kahn & Walsh, 2014). In Eq. (1) these are measured by the vector of location, property and neighborhood characteristics (X’). Table 4 provides descriptive statistics for the X’ vector for the main estimation sample.

The average sales price was just over $500,000 ($2006 AU). The average distance to Flinders Street Station (CBD) was approximately 22.6 km, with average distances to other major or smaller activity centers ranging from 6.4 to 8.2 km. Activity centers are a planning-denominated land use indicator and capture concentrations of employment and development. Proximity to different types of activity centres thus also capture proximity to unrelated non-residential construction activity that may be taking place at the same time as infill developments. Activity centres aim to concentrate urban development, thus at greater distance to an activity centre the probability that unrelated non-residential construction activity is taking place declines. While polycentricity has been a planning objective in a number of Australian cities, including Melbourne, the CBD remains the largest center of employment – increasing its share since the early 2000s.

Property characteristics include property type; due to incomplete records some sales can only be classified as detached or non-detached. Approximately three-quarters of sales were detached dwellings. The average construction year of properties was 1974. Plot area measure the footprint of the property and any additional land, e.g., for garden, driveway, etc., respectively.

Neighborhood characteristics typically correlate with property prices and are a source of time-invariant heterogeneity in property prices. Our hedonic component in Eq. (1) includes a 2006 Socio-Economic Index for Areas that captures relative area advantage/disadvantage, and correlates with social status, income and a series of housing market indicators (prices, types and size of housing).Footnote 10 The average standardised score is 1018, marginally greater than the national average standardised score (1000). Equation (1) also includes proximity to transport infrastructure, schools, medical centers and green infrastructure as additional sources of time-invariant heterogeneity. Finally, some 8% of sales are located in heritage-designated planning areas and 9% in flooding zones. Heritage designation reduces the probability of other residential and non-residential construction activity taking place.

Finally, we control for land-use characteristics as determined by planning zones. Some 93% of sales are located in one of the residential planning zones, with the remaining sales divided across mixed-use, commercial, industrial, institutional, open space and other use zones.

Estimation Results

The model fit of Eq. (1) when estimated by OLS is 0.754. There is, however, also evidence of heteroscedasticity. Consequently our estimations are based on Stata’s hetregress command, with the variance of (1) modelled as an exponential function of distance to the CBD, dwelling density in the locality, SEIFA and plot area. A Wald test (p < .05) confirms an improvement in modelling of the variance. In our reported results the ACDnꞌ vector for KDRs, one-dwelling and small-scale infill developments are dropped due to high correlation (r > .9) with the ADnꞌ vector. A likely explanation for this high correlation is the short development time of these types of infill developments, compared to moderate- and large-scale developments.

The control variables estimated in Eq. (1) (not shown) behave as expected. Distance to CBD is negatively associated with property prices, separate houses are more expensive than apartments and townhouses. The index measuring higher-status socioeconomic characteristics of the area is positively related to prices, as is proximity to parks, and newer buildings. The average sales price of houses is typically some 18% more expensive than that of apartments/townhouses. Properties within heritage areas typically are also more expensive. Proximity to the tram network has a positive association with property prices, whereas proximity to major roads does not. Properties within zones classified as industrial and mixed use have a significant price premium that may reflect the potential for developers to build at higher densities in these zones.

Core Results

Our primary results concerning the sales price impacts of residential infill investment (of various types) on other properties whose proximity is measured by a sequence of concentric rings whose radii differ by 100 m are reported in Table 5. The dependent variable is the log of sales price (adjusted for CPI), thus the coefficients can be interpreted as the proportional change in price associated with a unit change in the independent variable (here: one for a price level dummy and one year for a price trend). Recall that the infill development effect measures for the mean level and trend in prices for homes in the given distance ring are given by the “after, level” and “after, trend” coefficients, respectively, in Table 5. Results are shown for all property sales combined (columns 2–6) for each of the infill types. Our core results are based on the level and trend impacts following the commencement of the first infill development of type k, and the trend impact following completion of the last infill development of type k. "Robustness Tests" section discusses variations to this specification.

Because the combined effects of levels and trends potentially display distinct temporal profiles, we find it convenient to graph the price profiles for standardized homes in each distance ring both before and after the infill development; see Fig. 2. Note that for infill KDR, one-dwelling and small-scale developments the ‘After last infill end, price trend at distance’ is simply a continuation of the ‘After first infill start, price trend at distance’ because, as noted above, the intervening period was too short to reliably estimate a price trajectory. For moderate- and large-scale developments the two trend components are identified and graphed separately. Figure 2 shows level and trend for the five years preceding an infill development, the five years following the first infill development, and the five years after completion of the last infill development. From the discussion in the "Introduction" and "Residential Infill Investment in Existing Neighborhoods: Previous Studies and Our Analytical Strategy" section, it is clear that infill development can generate a number of outcomes depending on type of development and local market context. We therefore consider the price level and trend effects separately by type of development.

Geographic Selection of Infill Development

Before turning to the impact results, it is revealing to examine the distinct geographic selection processes at work for different types of Melbourne infill developers, as revealed by the “before infill” variables shown in Table 5, panel 1. Across each of the infill types, apart from one-dwelling infills, developments are more likely to occur within 100 m of somewhat higher-value environments. The ‘before infill, level’ coefficients indicates mean sales prices were consistently 1 to 2% higher within 100 m of where infill developments would eventually occur, compared to properties with identical zoning designations in the same postal code and local authority, but not within proximity of an infill development. For KDRs and moderate-scale developments this higher value environments extends to some 300 m of where infill will take place. One-dwelling infills differ from this generalization. Typically there is no difference in the price level within 300 m of where these developments will take place, although beyond this (300–500 m) average prices are typically 1 to 1.5% lower.

By contrast, the “before infill, trend” coefficient for KDRs, one-dwelling, small-, and large-scale developments indicates that sales prices were declining by 0.13 to 0.30% annually within a 100 m radius vs. comparable properties outside them. This type of development thus tends to concentrate in niches where average sales prices where 1–2% higher, but appreciating at a lower rate than properties elsewhere in the neighborhood. This geographic pattern contrasts with that for moderate-scale developments where there is no similar significant negative trend before the infill developments. Moderate-scale developments thus concentrate in niches were prices were 1.5% higher and appreciating in line with prices elsewhere in the neighborhood.

Differences in before-infill trends also hold important implications about the comparative advantage of our AITS identification strategy. Above we argued that even if pre-/post-development differences in the area’s average price levels were controlled in a DiD framework, biased measures of impact would ensue if pre-development trends in prices were systematically related to locales where development eventually occurred. The cases of knock-down and replace, one-dwelling, small-scale, and large-scale developments bring this worry from the hypothetical to the real.

Impact of Large-scale Developments (50 + Net Increase in Dwellings)

We predicted that the supply-adjustment effect may dominate and reduce price levels across a considerable distance where residential investment in existing neighborhoods substantially increased the stock of location-equivalent properties and different property types constituted effective substitutes for each other.Footnote 11 Alternatively, where large-scale infill alters the neighborhood’s perceived amenity value and architectural character it could reduce the value of older buildings having a different, historical character (i.e., a negative spillover effect), especially when they are proximate.

The results from Table 5 (panel 3, column 6), and portrayed in Fig. 2 (column 5), demonstrate that, as predicted, large-scale residential developments have significant negative effects on nearby properties. Dwellings within 100 m of large-scale developments see their average price decline by some 4.6%. Notably, this negative effect disappears beyond 100 m and turns positive beyond 200 m. Following commencement of large-scale infill developments, properties within 200 m appear to benefit from an improvement in their price trajectory. Beyond this, properties experience a negative price trajectory. The positive commencement effect is, however, reversed following completion of the last large-scale infill development. Overall, the core results of large-scale infill developments generate an inconclusive outcome that is difficult to generalize. One explanation for this may be that our core results mask heterogeneity in impacts across housing types; we explore this in "Heterogeneity Tests Across Housing Types" section below.

Impacts of Moderate-scale Infill Development (5–49 Net Increase in Dwellings)

Medium-density development as operationalised here covers a variety of building outcomes. Across Melbourne the quality of moderate-scale infill varies quiet considerably, from developments with comparatively cramped and poorly designed layouts to properties specifically marketed for green and/or living purposes (as opposed to investment). Perhaps due to this, Fig. 2 (column 4) and Table 5 (column 5) shows that the impact of moderate-scale development on prices of surrounding properties is muted when considering all property sales combined. Typically, there is no statistically significant effect on properties within 100 m of these developments (panel 3), whereas the average sales price of properties within 100–300 m experience a small decline (approx. 0.7% annually).

Similarly, there is no clear impact on price trends within 300 m of moderate-scale developments. The absence of a clear trend across the following (300–500 m) distance rings also makes it difficult to generalize the small, but positive and statistically significant effects beyond 300 m. An explanation for the muted and inconclusive outcomes may be the aforementioned substantial variation in building outcomes associated with moderate-scale developments.

Impacts of Small-scale Infill Developments (2–4 Net Increase in Dwellings)

Small-scale infill developments in Melbourne typically constitute townhouses or small terraced apartments/townhouses. The price effect of such developments is consistently positive across all distance rings, with both level and trend effects significant in all rings save one. From Fig. 2 (column 3) it is clear that properties near forthcoming small-scale infill developments experienced a negative price trend. Following commencement of small-scale developments there is an increase in the average sales price of nearby properties and a positive change to the price trend that reduces, but does not eliminate, the pre-development negative trend. Level and trend effects are stronger within 200 m, than beyond.

The results again suggest a positive amenity effect, such as might arise from removal of low-quality/derelict housing, but otherwise a resumption of pre-infill price trends. The exception is the 101–200 m ring where there is a consistent positive price trajectory following beginning of the first small-scale developments in our database and the last.

Impact of One-dwelling Developments

One-dwelling developments frequently take place on empty plots, thus the effects of such infills implicitly test the neighborhood’s evaluation of them compared to empty plots. Following one-dwelling infills the average sales price typically rises by some 0.7% within 100 m of one-dwelling developments. The remaining proximity rings also experience a positive increase in average sales price, marginally lower than the effect within 100 m. The negative price trend experienced prior to infill is typically reversed within 100 m following the commencement of the first one-dwelling development. In the remaining rings there is also a positive trend effect that in the 100–300 m rings ameliorates the negative price trend, and beyond 300 m leads to an appreciation.

Overall, the impact of one-dwelling infill developments appears to be one of a persistent improvement in the long-term amenity from tidying-up effects—a new house of superior quality replacing a vacant plot—as per the findings of Ellen et al. (2001) and Newell (2010). Given that we observe that these new dwellings typically trade at a premium, the implicit inflow of a few higher-income residents also might be viewed as a local amenity. Finally, the low scale of development may generate optimistic expectations about preservation of neighborhood’s character.

Impacts of Knock-down and Rebuilds (Typically One-for-one Replacement Dwellings)

Knock-down and rebuilds typically take place in areas with above-average sales prices. After controlling for location, property and neighborhood characteristics, the average sales price of properties close to KDRs typically increases further after infill. This effect size is largely consistent across the distance rings at 1%. Moreover, the annual appreciation rate also increases by some 0.3% within 100 m, declining to 0.20–0.2.9% at 101–500 m. The results suggest that the market reacts positively to the rebuilding of sites with existing homes. While new homes are likely to be larger than prior ones, and perhaps architecturally different, KDRs also represent a preservation of the overall neighborhood character that in turn may have important, optimistic signalling effects about future neighborhood developments.

Heterogeneity Tests Across Housing Types

The results in Table 5 are based on the sale of all properties. One observation when analysing the outcomes across the different infill development types is that the results are less generalizable as the scale of development increases. A reason for this may be that our core results mask important heterogeneity in impacts across different housing types. That is, as scale of infill development increases the substitutability of new construction (infill developments) and existing housing stock may decline.

Supplementary Table 1 therefore compares the results of Eq. (1) when estimated separately for detached houses and apartments/townhouses.

Heterogeneity in Impact of Large-scale Developments (50 + Net Increase in Dwellings)

Detached houses within 100 m see their average price decline some 5%. This effect is halved within 101–200 m, before disappearing beyond 300 m. However, houses within 100 m subsequently experience a 0.6% per annum higher rate of price appreciation than comparable properties not within proximity of a large-scale development. There is also a positive trend (0.28%) following commencement of the first large-scale development between 101 and 200 m, but this effect is only significant at the 10% level. These opposing effects may reflect a negative spillover from altered socioeconomic, demographic and environmental characteristics or overshadowing effects, but also a positive expectation effect as new developments bring more residents to a neighborhood who, over time, may be expected to transition out of apartments/townhouses and into detached (local) housing. Although attitudes toward housing typologies are changing, the majority of households still aspire to detached living, with numerous instances of organized neighborhood opposition to further/over-development and scale (Newton et al., 2017; Whittemore & BenDor, 2019; Trounstine, 2021).

The impact of large-scale developments on nearby apartments/townhouses is comparable in terms of the decline in average sales prices (5.4%) within 100 m, again suggesting a localized negative spillover. However, there is no subsequent improvement in the price trend. Unlike the impact on houses, the impact of large-scale developments on apartments/townhouses suggests that these are locationally and property-type wise substitutes for each other.

Heterogeneity in Impacts of Moderate-scale Infill Development (5–49 Net Increase in Dwellings)

As with large-scale developments, these results here too suggest moderate-scale developments may not constitute a location-equivalent substitute for the existing detached housing stock. Moderate-scale developments have no statistically significant impact on the average sales price of nearby detached houses. That is, these developments to not appear to generate significant amenity, disamenity or supply effects on nearby detached houses. However, moderate-scale developments do appear to generate a positive increase in the price trajectory within 100 m, as well as smaller price-trend appreciation impacts beyond 300 m. Though this pattern is ambiguous, it is consistent with more optimistic expectations about home prices in the vicinity.

The impact of moderate-scale developments does, however, differ markedly on nearby apartments/townhouses. Typically the average sales price of nearby apartments/townhouses declines by some 1.2–1.6% within 101–300 m of a moderate-scale development, with no distance decay within that range. There is a similar-sized negative level effect within 100 m, but this is only significant at the 10% level. The neighborhood price trend of apartments/townhouses is, however, left unaffected by new moderate-scale developments. Overall, the results in this submarket suggest that moderate-scale developments do have a supply effect. It is possible that this effect also captures some disamenity impact, but given the greater similarity of the building types between and infill and existing stock any disamenity effect is less likely to include a general change to neighborhood appearance.

Heterogeneity in Other Infill Developments (KDRs, One-dwelling and 2–4 Net Increase in Dwellings)

When estimating the impact of small-scale developments separately on detached houses and apartments/townhouses the results suggests that the negative housing market context before infill largely pertains to detached houses, rather than apartments/townhouses. Similarly, the positive average price and price trajectories after commencement of the first infill in Table 5 is an effect on nearby detached houses, rather than nearby apartments/townhouses. In the disaggregated estimations the positive level effect after nearby small-scale development disappears; instead the positive price trajectories for nearby houses is nearly twice as large. The trend effect decays with distance.

As with small-scale developments, the disaggregated results for KDRs and one-dwelling developments suggests that before and after infill effects arising from these types of infill relate to the detached housing submarket. Unlike small-scale development, there is no change in the structure of level and trend impacts. As in Table 5, there remains evidence of a distance decay in the after commencement of infill price trajectories. Positive effects may arise from a general tidying up and replacement of existing dwellings with superior dwellings.

Overall, the disaggregated results suggests that small-scale infill developments generate a positive effect on the value of the extant detached housing stock, but leave extant apartment/townhouse prices largely unaffected. This strengthens our conclusion that apartments/townhouses and detached houses do not constitute location-specific substitutes. As discussed in "Land Use Regulation and Densification in Melbourne" section, our infill types tend to reflect distinctive housing type / tenure profiles. In particular, KDRs and one-dwelling developments are more likely to resemble the existing dominant detached housing stock and be inhabited by owner occupiers. The moderate- and large-scale developments are more likely to differ significantly from the dominant detached housing stock and to be privately rented. As such, the lack of impact of KDRs and one-dwelling developments on apartments/townhouses and the supply effect of moderate- and large-scale developments on this submarket, jointly comports with a lack of location-specific substitutability between detached houses and apartments/townhouses.

Robustness Tests

To assess the sensitivity of our core findings to variable specification, we conduct a variety of robustness tests. In our core specification we defined ADnꞌ and ACDnꞌ as vectors for observations where AD = 1 giving the number of years between the sale and the commencement of the first and the completion of the last, respectively, infill development of type k within distance j. We re-estimated (1) redefining the periods for these two trend variables in two alternative ways: (a) start of the first infill (of type k) and completion of the same; (b) start of the last infill (of type k) and completion of the same. The results are quite consistent across the core specification and these alternatives, although there are one or two differences of little consequence; see Supplemental Table 2.

Although we control for a large selection of spatial and planning related variables, it is conceivable that unobserved commercial, employment and industrial activities bias our results. We therefore re-estimate Eq. (1) for transactions taking place where the land use regulation is classified as ‘residential’. The results in Supplemental Table 3 show very little difference to our core results.

Probing a Potential Causal Mechanism for Infill Price Effects

The literature suggests that one way in which infill development may affect the neighborhood is through an higher socioeconomic status occupancy pattern that raises the potential return on proximate properties through average income effects (Ellen et al., 2001) or price setting (Ooi & Le, 2013). To test this preposition we add a dummy variable to Eq. (1) that is equal to 1 if the recorded sale itself was part of an infill development between 2006 and 2015 and include these previously excluded sales as part of our estimation. This modification increases the sample size substantially (n = + 73,821).

The coefficient for self-infill shows a highly significant price premium of approximately 11.9% relative to all other properties (β = 0.110, p < .01); see Supplemental Table 4. These estimations already control for year of construction – the elasticity of property price to year of construction is positive and significant (p < .01) – so that the 11.9% premium is evidence that infill developments push prices further within their vicinity. A spillover effect may thus be generated through higher local return expectations and price setting by estate agents/vendors, and/or the in-migration of households able to purchase higher-cost dwellings. The ‘and/or’ statement reflects that we cannot identify separately which effect is occurring, but also that both effects may take place simultaneously. A price premium on new housing was also found by Zahirovich-Herbert and Gibler (2014). Overall, the self-infill coefficient provides further evidence that some forms of infill residential investment push local prices up.

Conclusions

Densification and smart growth policies are employed by many city governments in response to the challenges of containing the environmental footprint of cities and addressing housing access and affordability concerns of growing urban populations. While urban containment policies frequently are argued to increase property prices and exacerbate affordability challenges, containment per se does not need to be deterministic. Land is horizontally limited, but the effective provision of dwelling space is also a function of intensity of land use. Infill development and higher-density development provide a means of utilising land more intensively.

In this paper we estimate the average price level and trajectory impacts, and their spatial extent, arising from knock-down and rebuild, one-dwelling, small-, moderate-, and large-scale developments on existing properties – houses and apartments/townhouses – within consecutive 100 m distance rings in greater Melbourne. Each infill type is defined by the net increase in dwellings resulting on site. Using an adjusted interrupted time-series estimation strategy we can control for geographic heterogeneity in pre- and post-infill development areas’ average sales prices and trends. In particular, controlling for variation in the pre-infill price appreciation trends around different types of infill developments makes the AITS particularly suited to identifying development impacts in a plausibly causal manner.

Our results broadly fall into two categories that are distinguished by scale of infill development taking place and the degree to which the development plausibly represents a location-equivalent substitute for all other properties or only a subset of existing properties in the neighborhood.

First consider smaller-scale infills—KDRs, one-dwelling and 2–4 dwelling developments—where larger dwellings replace smaller or derelict ones, houses replace empty plots, or there is a small net addition of location-equivalent dwellings. Typically these developments result in an increase in the average price level of nearby properties, as well as a steeper trajectory of house price appreciation following commencement of the first infill in this category in our dataset. The average sales price effect is larger within 100 m of this type of infill effect and declining with distance. Notably, the positive impact on extant properties is particularly evident on detached houses. There is little impact on extant apartments/townhouses. The absence of cross-submarket impacts underlines, possibly more so for apartments than townhouses, the likely separate submarket nature of these dwelling segments. These developments likely provide a positive amenity effect arising from tidying up empty plots, adding superior-quality housing, and spurring an inflow of higher-income residents. Moreover, these developments may also foster optimistic price expectations by locking-in the existing neighborhood’s appearance or character.

Second, consider the moderate (5–49 net dwelling additions) and large-scale (50 + net additions) infill developments that are more likely to represent substantial changes to the appearance and population profiles of neighborhoods. These developments provide location-equivalent substitutes at scale, but only for a subset of properties in the neighborhood. Moderate-scale developments therefore typically have little supply effect on detached houses in a neighborhood, although there is some evidence of a positive expectations effect within 100 m following moderate-scale developments. Large scale developments, on the other hand, appear to generate an initial negative amenity effect that reduces the average sales price of detached houses within 200 m, but disappears over 5–7 years as a result of an acceleration in the neighborhood price trajectory. Large-scale developments may very well generate shading effects or privacy/over-looking effects that negatively affects nearby houses. However, the inflow of new people may over time negate this effect as households seek to vacate apartments/townhouses for houses, and as local retail services expand or receive quality boosts due to the increased aggregate local purchasing power. Overall, the results thus suggest that moderate and large-scale developments do not represent location-equivalent substitute for existing detached houses.

This conclusion differs for the impact on apartments/townhouses where moderate- and large-scale developments provide location-equivalent substitutes at scale. Within 300 m moderate-scale developments results in an average price decline in apartments/townhouses consistent with a supply effect, whereas large-scale developments result in a reduction in the average sales price within 100 m and a reduction in price appreciation within 100–200 m. Beyond 300 m the negative average price effect for moderate-scale developments disappears. For large-scale developments any negative impacts on price level or trajectory disappears beyond 200 m. Overall, the results suggest that moderate- and large-scale developments are location-equivalent substitutes for existing apartments/townhouses in a neighborhood.

The different impacts of large-scale developments on houses and apartments/townhouses has significant implications for housing affordability and wealth inequality. Current planning policy is concerned with increasing the scale of supply to address ongoing affordability concerns. However, while there appears to be an amenity effect within 200 m of large-scale developments, there does not appear to be a supply effect on detached houses, which constitutes some two-thirds of Melbourne’s housing stock. Instead, houses in proximity to large-scale development experience an accelerated price appreciation trend that over the medium- and long-term outweighs the initial disamenity effect. Owners of houses thus stand to benefit, over time, from nearby development. Moderate-scale developments largely leave the detached housing segment unaltered.

By contrast, owners of apartments/townhouses experience a persistent reduction in the value of their properties as a consequence of an increased supply of infilled properties that are considered close substitutes. Moderate- and large-scale developments may thus have beneficial impacts on the affordability (purchase price and deposit requirements) of other apartments/townhouses. However, since the impact of these developments is not homogenous across property types the result may very well also be widening wealth disparities, with the asset holdings of apartment/townhouse owners declining over time relative to that of detached house owners.

Our results also suggest that urban densification strategies employing small- and moderate-scale developments can proceed without generating negative spillover effects that archetypically drive opposition to densification strategies. Moreover, many medium-density developments specifically target life-style preferences and provide densification ‘for living’ rather than investment. As such, they often provide additional local amenities that may work to erode local opposition.

The evidence here then suggests that there is considerable potential for densification of cities without significant negative spillover impacts on surrounding properties, but also without significant affordability gains across the majority of Melbourne’s housing stock. This is in line with expectations from land value increases following population and income growth. However, the gradient of price impacts across infill types also serves as a reminder why most local property owners likely prefer lower-scale densification to more-intensive densification. Thus, for city planners and urban developers there is a challenge in ensuring that densification is appropriate to place and context, rather than simply extracting the highest dwelling yield on available sites.

Notes

Zahirovich-Herbert & Gibler (2014) look at differently sized single –family home constructions.

For instance, McMillen (2008) finds that changes in the coefficients of the hedonic price functions explain most of the change in the distribution of price appreciation, in his case bigger homes appreciating faster than smaller homes.

Ooi & Le (2013) include a measure that controls for time between sale and launch of a new development. The study also controls for general Singapore-wide price dynamics, as well as price dynamics within planning areas. However, it does not control for time-variant price trends within the estimated impact radius of new developments. It is thus conceivable that the price trend observed after the launch of new developments reflects a price trend that also existed prior to the launch.

We control for a number of neighbourhood and property characteristics as well as planning characteristics that indirectly capture a number of time-invariant sources of heterogeneity, but also the probability of time-varying sources of heterogeneity. However, ideally we would have wanted to more directly capture effects such as the extent to which new construction differs from pre-existing dwellings (beyond the sheer net number of dwellings); the presence of actual un-related construction activity within the concentric rings; and, variations in the commercial and industrial make-up of concentrations of such activity.

The HDD data is specified by year and by actual development activity. Commencement and completion of infill activity are thus defined as commencement of construction activity and completion of construction activity. In practice this means that pre is defined as before development activity (construction or demolition), post is defined as after development activity (construction). During has two definitions depending on the exact specification. In the core results during is defined as after the commencement of first infill development activity (demolition or construction) of type k and completion of last development activity (construction) of type k. In the robustness test during is defined as either the commencement of first infill development activity (demolition or construction) of type k and completion of first development activity (construction) of type k. OR the commencement of last infill development activity (demolition or construction) of type k and completion of last development activity (construction) of type k.

Observed differences between when infill commencement and completion can occur in two ways. Over our analysis period multiple, geographically distinct infill developments of type k can occur within the same ring j. Moreover, even one, large-scale development can take years between ground-breaking and occupancy.

Our 2007 transaction data, unfortunately, does not contain sufficient geographic detail for accurate geocoding.

The SEIFA is a summary measure of social and economic indicators collected through the Australian Census. A low score indicates relatively greater disadvantage (e.g. concentration of low-income and low-skilled people) and vice versa. There are a range of available SEIFA indices, we used the Index of Relative Socio-economic Advantage and Disadvantage. Areas with a combination of low- and high-income or low- and high-skilled population fall in the middle of the ranking. In Australia SEIFA indices are not directly comparable overtime. We therefore only use the 2006 SEIFA index.The average Australian SEIFA score for small area census geographies is 1000.

For example, townhouse developments might be part of the same submarket as certain detached dwellings.

References

Alonso, W. (1964). Location and land use: towards a general theory of land rent. Harvard University Press.

Brueckner, J., & Rosenthal, S. (2009). ‘Gentrification and neighbourhood housing cycles: will America’s future downtowns be rich?’ Review of Economics and Statistics, 91(4), 725–743.

Brueckner, J., Thisse, J. F., & Zenou, Y. (1999). Why is central Paris rich and downtown Detroit poor? An amenity-based theory. European Economic Review, 43(1), 91–107.

Buxton, M., & Taylor, E. (2011). Urban land supply, governance and the pricing of land. Urban Policy and Research, 29(1), 5–22.

Caplin, A., & Leahy, J. (1998). Miracle on Sixth Avenue: information externalities and search. The Economic Journal, 108(446), 60–74.

DELWP. (2016a). Housing development data – metropolitan Melbourne. Victorian State Government. Last accessed 17/9/2018: https://www.data.vic.gov.au

DELWP. (2016b). Overarching report: residential zones state of play. Victorian State Government.

DELWP. (2017). Plan Melbourne 2017–2050. Victorian State Government.

Ding, C., & Knaap, G. (2003). Property values in inner-city neighborhoods: The Effects of homeownership, housing investment and economic development. Housing Policy Debate, 13(4), 701–727.

Duranton, G., & Puga, D. (2015). Urban land use. In G. Duranton, V. Henderson, & S. Strange (Eds.), Handbook of regional and urban economics (Vol. 5). North-Holland/Elsevier.

Dye, R., & McMillen, D. (2007). Teardowns and land values in the Chicago metropolitan area. Journal of Urban Economics, 61, 45–63.

Ellen, I., Schill, M., Susin, S., & Schwartz, A. (2001). Building homes, reviving neighbourhoods: spillovers from subsidized construction of owner occupied housing in New York City. Journal of Housing Research, 12(2), 185–216.

Evans, A. (2004). Economics and land use planning. Blackwell Publishing.

Galster, G. (2019). Making our neighborhoods, making our selves. University of Chicago Press.

Galster, G. (1987). Homeowners and neighborhood reinvestment. Duke University Press.

Galster, G., Tatian, P., & Accordino, J. (2006). Targeting investments for neighborhood revitalization. Journal of the American Planning Association, 72(4), 457–474.

Galster, G., Tatian, P., & Pettit, K. (2004). Supportive housing and neighborhood property value externalities. Land Economics, 80(1), 33–53.

Galster, G., Tatian, P., Santiago, A. M., Pettit, K., & Smith, R. (2003). Why NOT in My Back Yard? The neighborhood impacts of assisted housing. Rutgers University, Center for Urban Policy Research / Transaction Press.