Abstract

This paper uses a search model with Nash bargaining to identify various channels through which agent gender affects selling price and selling time in the resale market for houses. The theory is used in conjunction with the empirical model to infer agent bargaining power when dealing with the same or opposite sex agents on the other side of the transaction. The results reveal that sellers set higher listing prices when working with male agents, a pattern consistent with sellers’ ex ante beliefs that male agents enjoy greater expected bargaining power. Ex post agent bargaining power varies by sex and their role in the transaction. Female agents assisting buyers have stronger bargaining power when facing male listing agents than when facing female agents in rising or falling markets. The ex post bargaining power of male selling agents assisting buyers appears to be generally weaker than that of female listing agents.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Women play important roles in real estate; the National Association of Realtors member profiles regularly report that a majority of Realtors are female. But for an industry in which women play such an important role, the real estate literature offers only limited evidence concerning whether or how such a large female presence affects market outcomes and no evidence regarding how the sexes interact in real estate transactions.

This paper examines the role of agent gender on housing market transactions. Motivated by the broader business literature, the approach taken here recognizes that the sex of the listing agent or selling agent captures only one part of the picture. If it is true that women and men tend to use different approaches in risky negotiations, then the mix of agents' genders in co-brokered transactions where the property seller and buyer rely on different agents also matters.

This paper provides the first empirical evidence for how the gender and mix of agents' genders influence price and liquidity in the resale housing market. We begin by viewing transactions as a two stage process—the initial search and matching process which affects time on market and the subsequent negotiation process which affects realized prices. Turnbull and Zahirovic-Herbert (2011) incorporate Nash bargaining over price into the canonical housing market search model. We extend that approach to allow the house seller to take into account uncertainty over what type of agent, male or female, their listing agent ultimately will face in the negotiation stage of the transaction process when setting their search strategy. The realized price is a function of the seller's initial reservation price in search equilibrium and the realized mix of agents working with the seller and buyer in the transaction. The property seller is forward-looking and rational, so greater expected listing agent bargaining power (on behalf of the seller) increases the seller's reservation price which in turn puts upward pressure on negotiated prices and reduces expected liquidity (i.e. increases time on the market). Lower realized or ex post bargaining power, however, puts downward pressure on the realized transaction price. Therefore, the theoretical model plays a key role when sorting out observed price and liquidity effects in terms of the relative bargaining power associated with agent gender or the gender mix of agents involved in the transaction.

The housing market is a search market and price and liquidity (time on the market) are co-determined in search markets (Krainer 2001). The empirical analysis therefore applies the simultaneous price-liquidity model developed by Turnbull and Dombrow (2006) and Zahirovic-Herbert and Turnbull (2008), an approach successfully adapted to a wide range of property market applications. More importantly for our purposes, the empirical framework offers the opportunity to identify separate agent gender and agent gender mix effects on selling price while controlling for endogenous liquidity.

The empirical insights offered here add to the broader business literature concerned with gender in business settings. There is a growing body of evidence that women and men behave differently in terms of ethics, negotiation methods, and make different managerial decisions. The existing literature, however, tends to draw largely from groups of coworkers, colleagues, or rivals interacting in situations where it is often difficult to ascertain individual performance—which admittedly describes many general business settings. Just as important, though, are settings that entail one-on-one face-to-face negotiations. This study begins filling this gap in the literature, focusing on how women and men perform in one-on-one negotiations in a market setting—as agents working with property sellers and buyers, respectively, in the resale market for houses.

Housing transactions provide several advantages over other business settings for answering these questions. First, housing transactions data allow us to investigate selling ability of male and female real estate agents in an environment involving relatively high economic benefits and extended experience, efforts, and exchanges of information from both sides of the transaction. Compared with seminal research such as the Ayres (1991) and Ayres and Siegelman (1995) who study automobile sales performance, real estate agents arguably exert more individual efforts in sales and thus expect higher compensation in a complex decision-making process. Second, real estate transactions enable us to measure outcomes of one-on-one negotiations conducted through listing and selling agents working with property sellers and potential buyers, respectively; the agents play a crucial role throughout the entire real estate transaction process (Turnbull and Dombrow 2007). The success of a real estate transaction can be measured by two observable outcomes, realized price and liquidity (time on the market), offering a two-dimension evaluation of agent performance. The direct measurement of the outcomes from market interaction between two agents sheds light on the one-on-one interactions of the sexes that are buried in many finance and management settings which often involve group interaction, while avoiding lab bias and other concerns oftentimes associated with experimental evidence such as design, omission, and response biases.

Looking ahead, the next section provides a succinct overview of the literature interested in the role of gender in both broader business settings and in real estate agency in particular. The third section develops a theoretical search and bargaining model in which agent gender mix is uncertain during the search phase but known during the negotiation phase of the transaction. The fourth section explains the data and empirical model and reports the results. The final section concludes.

Gender Differences in Business Settings

The impact of gender on real estate transactions outcomes can be related to three strands of the gender difference literature: gender behavior differences, gender negotiation differences, and the impact of women’s presence. Looking first at gender behavior differences in various business settings, Dawson (1997) shows that there are significant ethical differences between salesmen and saleswomen in relational situations. Looking at the broader workplace, Onemu (2014) shows that different incentive schemes (individual incentives, group incentives, and a combination of the two) create different reactions or adaptations from male and female workers. In particular, group incentives (without individual incentives) improve co-worker relationships for women but deteriorate co-worker relationship for men. Barber and Odean (2001) examine gender differences in stock trading behavior and find that men trade more aggressively than women due to the fact that males exhibit greater overconfidence than females. Huang and Kisgen (2013) document differences in corporate decisions between male and female CEOs and CFOs and also attribute the gender differences to the relative overconfidence of male CEOs and CFOs.

On the other hand, many researchers find no significant or systematic differences between men and women after controlling for abilities, knowledge, and selection bias. For example, Johnson and Powell (1994) study risk preference of males and females in non-managerial and managerial populations and find no gender differences in the managerial population. Similar results are also reported by Master and Meier (1988) with participants who owned a small business. Atkinson et al. (2003) compare performance and investment behavior between male and female mutual fund managers and find no differences. Their results suggest that differences in investment behavior often attributed to gender may be related to investment knowledge and wealth constraints.

Another strand of the gender difference literature focuses on variations in negotiation skills across the sexes. The literature offers compelling evidence that men and women behave differently in negotiations. A majority of the research finds that men tend to outperform women in negotiations and attempt to explain the gender gap in negotiation performance. One string of the literature attributes the gender gap in negotiation performance to gender per se, while the other takes into account the impact of gender pairing.

For example, Niederle and Vesterlund (2007) and Vandergrift and Yavas (2009) conclude that women are less competitive than men, and women tend to be more reluctant to compete than men do. When facing a choice between tournament compensation and piece rate compensation, men choose the tournament at a much higher rate than women even though there is no difference in task performance between the two sexes. Women also seem to be more cooperative in negotiation than men. Eckel et al. (2008) report that women tend to be more egalitarian than men and often ask for less in negotiation. They also find that women are more sensitive to the context of the negotiation and are less likely to fail to reach an agreement than men. The literature provide supports that behavioral differences at least partially explain why men outperform women in negotiations.

Other research studies how negotiation partners influence final outcomes and find that women perform better if they are competing with other women (Gneezy et al. 2003). This suggests that the sex of the competing party is an important factor determining final outcomes in competitive environments. Consistent with Gneezy et al. (2003), Holm (2000) also finds that both males and females behave more competitively and become more "hawkish" when they know their opponent is female. Holm (2000) finds that discrimination with regards to the opponent's sex helps the parties coordinate and increases the average earnings in the subject mixed-sex group when compared to the single-sex group. Sutter et al. (2009) also observe more competition and retaliation and, thus, lower efficiency when the bargaining partners have the same gender than when they have the opposite gender. This line of research thus suggests that we could expect the gender pairing in negotiation to significantly affect final results observed in house sales transactions, and should be accounted for in transaction outcomes.

Another body of research offers evidence that the mere presence of women can significantly alter outcomes. For example, Adams and Ferreira (2009) find that the presence of females on the board of directors has significant positive impacts on corporate governance, improving attendance and monitoring power. Krishnan and Park (2005) similarly find a positive relationship between the proportion of women on top management teams and organizational performance. Karremans et al. (2009) offer evidence that men's cognitive performance is impaired after an interaction with a woman, at least to some extent due to men's attempts to make good impression on their opposite sex counterparts. Their experiments also reveal that the more attractive the woman in a mixed-sex interaction, the more cognitive function is reduced for male subjects. Along the same lines, Nauts et al. (2012) find that even the mere anticipation of an interaction with a woman can impair men's cognitive ability; men experience cognitive impairment when informed of such an encounter.

The impact of agent sex has been studied in real estate as well. One strand of the literature examines how agent gender (an indicator variable) affects real estate agent compensation. Abelson et al. (1990) find that female sales associates earn significantly higher compensation than their male counterparts. They use a human capital model and do not control for property characteristics. Besides, they only study sales associates rather than real estate agents in general and do not address self-selection by female sales staff. Abelson et al. (1990) results nonetheless refine Chinloy’s (1988) by examining only residential brokerage rather than pooling residential with commercial brokers.

Follain et al. (1987), on the other hand, find no significant sex impact on agent compensation. They do not take into account any relationship between property type and agent income; the study only examines agent characteristics, work effort, and general firm and market factors. Their sample includes agents from both urban (83% of the sample) and rural areas (17% of the sample), as well as both residential (95% of the sample) and commercial real estate agents (5% of the sample). Their results are somewhat surprising given commercial real estate is dominated by male agents and is often associated with higher commission rates than the female dominated residential real estate field.

Crellin et al. (1988) find a negative female impact on real estate commissions, but they also do not distinguish between commercial and residential real estate. Sirmans and Swicegood (1997) differentiate between commercial and residential brokerage using indicator variables and find that selling primarily residential real estate reduces income. They also find that female agents have lower compensation.

Closest to our research is the strand of the real estate literature that examines the impact of agent gender on the outcomes of individual transactions, generally by introducing an indicator of agent sex into the hedonic price framework. Consider a few key examples that illustrate the mix of empirical results, Hsieh and Moretti (2003) report a positive correlation between home prices and the proportion of female agents in a market. In contrast, Turnbull and Dombrow (2007) find no significant gender impact on pricing outcomes after controlling for agent specialization (i.e. primarily working as listing or selling agent). Salter et al. (2012) examine how the physical attractiveness of the real estate agent affects sales price and include listing and selling agent sex indicators in the pricing model; they find male agents are associated with lower selling prices.

More recently and closely related to our research, Seagraves and Gallimore (2013) conclude that the higher price and shorter time on market enjoyed by women agents are not attributable to superior skills. Instead, they are due to the choices made by their clients; the price differential for properties sold by male and female agents disappears after controlling for agent selection by clients. Similar to our study, Seagraves and Gallimore (2013) briefly examine the dyads of agent pairings by gender. Their approach, however, uses only the hedonic price equation after accounting for time on market and spatial autocorrelation using two-stage or three-stage least squares and does not allow for an investigation of agent bargaining power. In contrast, our paper uses the theoretical search-bargaining model with the empirical simultaneous price-liquidity model derived from the theory and uses the empirical estimates coupled with the theoretical search model to compare bargaining power of the agents on each side of the real estate transaction.

Another recent study by Andersen et al. (2020) also uses real estate transactions to investigate negotiation differences between men and women. Andersen et al. (2020), however, use Danish data and focus on the gender of the buyers and sellers rather than the agents’. The role of real estate agent is more limited while buyers and sellers engage more directly in the Danish real estate market, compared to the U.S. market. In addition, Andersen et al. (2020) do not consider or explicitly control for negotiations between gender pairs but examine final transaction outcomes (price) ex post to determine whether men and women fare better in their own negotiations. Unlike Andersen et al. (2020), our study centers on real estate agents’ bargaining power revealed by transactions outcomes, allowing bargaining power to vary with their roles as listing or selling agents as well as the sex of the counterparty agent.

A Model of Search and Bargaining

This section introduces Nash bargaining into the canonical model of search in the resale housing market. Before proceeding to the framework, it is useful to note that we are not interested in modeling the actual bargaining process comprising specific offer-counteroffer strategy sequences. The venerable Nash bargaining model instead depicts the outcome of transaction interactions as reflecting the relative ability of each participant to push the outcome farther from their respective threat points (Binmore et al. 1986; Nash 1950). As in most economic applications, bargaining power is not a precisely defined concept in the Nash bargaining framework. In the setting considered here, sellers and buyers ultimately make transaction decisions and the Nash bargaining model defines bargaining power as the agent’s effectiveness in promoting the interests of the seller (in the case of listing agents) or buyer (in the case of selling agents), through information, advice or whatever channels of influence the agent can employ. As such, the Nash bargaining model provides a simple yet general framework that even allows for principal/agent issues where agents do not fully promote the interests of their clients (in which case the principle/agent effects are reflected in weaker relative bargaining power).Footnote 1

The model extends the Turnbull and Zahirovic-Herbert (2011) search and bargaining framework to allow male and female agents working with buyers to differ with respect to negotiation approach or bargaining power, however defined. This section explains the general structure of the setting, focusing on the properties of a solution rather than a formal presentation of the game format. In the first stage, the property seller observes the type of listing agent with whom he or she will be working and then sets the reservation price in order to determine the stopping rule. The seller’s stopping rule takes the familiar form: bargain with the potential buyer if the expected negotiated price exceeds the reservation price or else wait (i.e., search) for another potential buyer. The solution requires that the forward-looking property seller understands that buyers and the agents bringing the buyers to the transaction in the next stage of the game each create ex ante uncertainty that is itself dependent upon the seller’s reservation price. The seller’s anticipation of possible outcomes reflects their beliefs about the distribution of buyers in terms of their willingness-to-pay and the bargaining power of the (selling) agents working with them.

In the second stage of the game, the price is determined with the assistance of the listing agent (representing the seller) and the selling agent (working with the buyer) and the transaction subsequently consummated. From the perspective of a representative seller, the seller is engaged in a game against nature, the latter summarized in the distribution of buyer types (where type is indexed by buyer idiosyncratic valuation of the property, b) mediated by the influence of selling agents assisting buyers, where the probability of facing a particular type of agent working with the buyer is summarized in the distribution of agent types by their relative bargaining power or negotiating ability. Thus, the existence of agents with different relative bargaining powers provides another layer of uncertainty facing the property seller when setting the reservation price in the first stage of the setting.

To examine the properties implied by an equilibrium, begin with the final stage of the game in which the seller and buyer are in contact with each other in order to negotiate a price for the house. Under Nash bargaining the relative bargaining power of the buyer and seller determines their net benefits from the house transaction. Denoting the seller's reservation price r and the buyer's maximum willingness-to-pay for this particular house b, the selling price P of the house under Nash bargaining is

where the parameter β summarizes the seller's bargaining power or negotiating skill relative to the buyer. The seller's and buyer's relative bargaining power is determined, in part, by their respective agent's bargaining abilities or strategies. Performing the above optimization and solving the optimality condition for P yields the selling price under bargaining as

A larger β corresponds to a listing agent with (relatively) greater negotiating ability assisting the property seller, which increases the seller's bargaining power and pushes the ultimate selling price closer to the buyer's reservation price, b. A smaller β corresponds to a listing agent with weaker negotiating ability, which decreases the property seller's bargaining power and results in an ultimate selling price that is closer to the seller's reservation price, r. Since both the buyer and seller must be better off with the transaction for them to voluntarily engage, they each enjoy positive net benefits from the transaction so thatβ ∈ (0, 1).

If agent bargaining power varies by sex, then each seller faces two possible selling price outcomes for each buyer type b. For example, if the listing agent working with the property owner is female then the bargaining solution yields selling price

when the selling agent bringing the buyer to the table is also a female and

when the selling agent is male. Since the property owner sets the reservation price before the type of buyer or selling agent associated with the buyer is known, the reservation price rF does not vary across possible bargaining outcomes.

If the listing agent is male, then the resultant prices are

when the selling agent bringing the buyer to the table is female or male, respectively. Once again, the property owner determines their reservation price before the selling agent sex is known so that the reservation price rM remains the same regardless of the sex of the agent working with the buyer.

The seller sets the reservation price in the first stage, before contacting buyers and their agents. The seller, however, knows whether their listing agent is type M or F. Consider a particular house listed for sale. The probability of a potential buyer with type M or F agent arriving to visit this house during a unit of time is πM or πF,respectively. The population of buyers is ordered by their willingness-to-pay, b, summarized in the distribution function Φ(b; x),where the distribution of buyers is in general a function of property characteristics, x. We suppress property characteristics to simplify notation without loss of generality since we are focusing on a given subject house for the time being.

Now consider the house seller who has engaged listing agent type i ∈ {F, M} and has set a reservation price of ri. The probability of a visit by a potential buyer working with a selling agent type i at a given time is πi so that the probability of a transaction in any given period is the sum across i-types πi multiplied by the probability that an arriving buyer is of the type whose willingness-to-pay, b, is greater than the seller's reservation price r, or

It is sufficient for our purposes to consider the simplest search model with no time discounting and a stationary distribution of buyer types. Lippman and McCall (1976) show that the seller's optimal reservation price, \( {r}_i^{\ast }, \) satisfies the marginal waiting time condition

where c is the seller's search cost or single period cost of waiting for another buyer to arrive. This is the familiar condition that the optimal reservation price equates the marginal cost of turning down a current offer (the waiting or search cost on the right hand side) with the marginal benefit (the expected gain from an offer possibly forthcoming in the next period on the left hand side). For our case, this condition becomes

Substitute (2) - (5) for selling price into this condition and simplify to restate the seller's reservation price condition as

The seller working with listing agent type i has a weighted ex ante relative bargaining power of ω = (πMβiM + πFβiF). Solve (7) implicitly for the seller’s optimal reservation price

where Φ in this function denotes a vector of parameters describing the buyer distribution function in equilibrium. Implicitly differentiating (7) yields the comparative static properties of the equilibrium reservation price as

so that

These results are intuitively appealing in light of standard search theory results. As expected, higher seller search cost or lower probability of buyer arrival prompts the seller to set a lower reservation price. In light of (2)-(5), higher search cost or lower probability of buyer arrival each leads to lower selling price in all cases. The new comparative static results pertain to bargaining power. Greater seller ex ante expected bargaining power, ω, leads to a higher reservation price, as does greater realized bargaining power relative to any one type of buyer agent ex post. This is an intuitive outcome: rational sellers who believe they are working with agents with stronger bargaining power on average take this expected performance advantage into account by setting higher expectations for possible outcomes. In light of (2)-(5), greater expected seller bargaining power ω leads to a higher reservation price hence expected ex ante selling price on average; the effects on realized selling price also depend upon the ex post bargaining power relative to the counterparty type, i.e., βij, as derived below.

The seller’s solution to the multi-stage search and bargaining process is given by (7) and (2) - (5). The results (9) and (2)-(5) turn out to be important for interpreting estimated coefficients in the empirical price model. Looking first at liquidity, substitute the equilibrium reservation price r into (6) and differentiate to find the comparative statics on the probability of sale at a given point in time (given that the property remains unsold to that point) q(ω, c; Φ) as

The equilibrium liquidity or expected selling time E[T]* is proportional to 1/q so the expected selling time effects take the opposite signs as the above comparative static effects. The seller's expected time on the market is

which has the following derivative properties

Clearly, greater seller expected weighted bargaining power leads to longer expected selling time. The liquidity comparative static results provide an additional tie between the expected relative bargaining power and expected time-on-market, identifying another dimension of bargaining power effects on transaction outcomes.

The search and bargaining framework impose parametric constraints on the empirical model. Substituting (8) into (2)–(5) yields realized price as a function of the usual property characteristics and market conditions, X, and the vector of ex post bargaining power β = [βMM βMF βFM βFF]

where aij takes a value of one for listing agent type i and selling agent type j and zero otherwise. The hedonic price function can be expressed as

where A = [aij]and εP is the stochastic error term. The liquidity equation follows immediately from (10), making explicit the presence of X suppressed earlier for notation convenience,

where εL is a stochastic term jointly distributed with εp. Thus far the theory requires that the hedonic price and selling time equations are functions of the same property characteristics variables X and agent type variables A. The stochastic errors may be correlated across the equations because realized price and selling time are co-determined. The empirical approach takes these complications into account.

Empirical Analysis

The Data

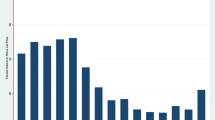

The data are drawn from multiple listing service (MLS) records for the Lynchburg area in central Virginia. The data contain sufficient agent information identifying certain listing and selling agent characteristics, including gender. The initial data includes observations listed for sale between 1999 and 2009. The data are carefully culled for incomplete, missing or illogical data. The final data set includes 16,740 observations listed for sale with a brokerage firm of which 10,332 are sold. The MLS provides data on almost all properties that are listed for sale in the area, regardless of whether the property is ultimately sold or otherwise removed from MLS. Data collected from the MLS include property characteristics such as age, square footage, various amenities such as a garage or fireplace, geographic location information, lot size, listing and selling price of properties and listing and selling agents. Year and month fixed effects are included to control for changing market conditions and seasonality. Table 1 provides variable definitions and Table 2 reports the summary statistics for the full sample. The typical property in the sample of listed properties has a listing price of $188,461 and is 34 years old with roughly 2,033 square feet of living area, 3.3 bedrooms and 2 full bathrooms. The average property that sold has a price of $168,331, is 33 years old and has 1,967 square feet of living area, 3.2 bedrooms and 1.98 full bathrooms. When compared with listed properties, the typical property sold is less likely to be tenant occupied (1.5% vs. 2.3%) and more likely to be vacant (27.2% vs. 25.9%), have hardwood floors (59.2% vs. 58.6%), a fireplace (71.2% vs. 69.6%) and brick exterior (54.8% vs. 52%). Female agents represent 61% of listed properties and 63% of sales. Given that females represent the largest proportion of real estate agents, it is not surprising that largest percentage of non-dual agency sale transactions (34.4%) are listed and sold by female agents (LAFSAF) as compared to only 10.1% of sales being listed and sold by male agents (LAMSAM). Listing agent females and selling agent males (LAFSAM) represent 16.8% of transactions while listing agent male and selling agent females (LAMSAF) account for 20.6% of transactions. Dual agency transactions where the buyer and seller are represented by the same agent represent about 18.1% of sales in the sample data of which 11.6% are represented by female agents (DUAL FEMALE).

Table 3 breaks down the sample by listing agent sex (the first three columns) and selling agent sex (the last three columns). Properties listed or sold by female agents are larger and appear to sell for higher prices. Properties listed by female agents sell more quickly but there is no significant pattern for the sex of the selling agent. There are significant differences observed for several key property characteristics (baths, floors, and fireplace) across agent sex, whether listing or selling. Female agents list significantly fewer tenant occupied and vacant properties and they work with buyers as selling agents on significantly fewer vacant properties as well.

Bargaining Power Effects on Reservation Prices

One of the insights provided by the theoretical model is that the seller’s reservation price is affected by the seller’s ex ante beliefs about the expected bargaining power of their listing agent. While the reservation price is not directly observable, Knight et al. (1994) argue that the listing price, which is observable, is correlated with the underlying reservation price of the seller. We follow the approach of Zahirovic-Herbert et al. (2020) to extract house seller beliefs from listing price information. The listing price, LP, is set by the seller ex ante (with input from the listing agent) and is a function of house characteristics, including location and time fixed effects, summarized in the vector Y. The listing price empirical model also includes a variable for listing agent sex, LAM = 1 for male agent, to pick up the effects of seller perceived agent bargaining power associated with agent sex, the ω term in the theoretical model:

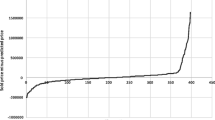

Table 4 reports the listing price function OLS estimates of the LAM coefficient for the full sample (1999-2009), the rising market (1999-2006) and the declining market (2007-2009) phases. The LAM coefficient is significantly positive for the full sample and the rising market phase, indicating significantly higher reservation prices for houses listed with male agents in the rising market. In terms of the theoretical model, the estimates indicate sellers perceive that male agents enjoy stronger expected relative bargaining power ω which translates into higher reservation prices for sellers whose properties are represented by male agents: rM > rF. For what follows it turns out to be convenient to introduce the variational term Δ > 0 to express this relationship as

The insignificant LAM coefficient in the declining market indicates no systematic perception by sellers that male listing agents enjoy relatively stronger bargaining power in that phase of the market.

Before turning to the ex post bargaining power effects on selling price and liquidity, we note that male agents tend to list different types of houses than their female counterparts, raising the possibility of selection bias in the estimated relationship between listing price and agent sex. One way to address this possibility is to estimate the listing price model using a matching sample of houses listed by females that have the same characteristics as houses listed by males. We use the propensity scoring matching (PSM) method to construct the matched sample based on a linear combination of property characteristics. The first stage of the procedure estimates a logit model of male listing agent as a function of house characteristics, including location, year, and monthly fixed effects. We then use the propensity score based on the estimated logit to identify a matching female-listed house for every male-listed house in the sample. The matched sample comprises these pairs of observations. Table 4 reports the second stage of the procedure i.e. the estimates of the original listing price model on the matched sample. Clearly, the LAM coefficient shows the same pattern observed in the full sample estimates, indicating that the full sample result is not being driven by the underlying tendency for male agents to list particular types of properties. Sellers appear to believe that male listing agents enjoy stronger expected relative bargaining power so that (14) holds with Δ > 0 as in the full sample.

Empirical Price-Liquidity Model

Drawing on the above evidence that sellers believe male agents have greater ex ante expected bargaining power on average, we can now consider how the mix of agents affects transaction outcomes. Using female listing agent and female selling agent, LAFSAF, as the basis for comparisons in the empirical models below, (2)-(4) and (14) yield the following ex post outcomes

where (1 − βMM)Δ > 0 and (1 − βMF)Δ > 0 have been established for the full sample and the rising market subsample in the listing price analysis above. These relationships provide the tie between the estimated coefficients on the mix of agents in the empirical model (the left-hand sides of (15)-(17)) and the underlying βij for the mix of agents involved in the transactions and are essential to interpret the empirical results.

Recall that the search model shows that the realized price and selling time are determined simultaneously at the end of the search-and-matching process. This implies that empirical hedonic price analysis should take into account simultaneous selling time or liquidity effects whenever possible. The econometric problem confounding many studies that attempt to deal with the simultaneous nature of both price and liquidity is that both are determined by the same factors. As a consequence, any system of equations describing price and liquidity outcomes is under-identified. Integrating agent bargaining power into the analysis does nothing to resolve the identification issue. Fortunately, the method proposed by Zahirovic-Herbert and Turnbull (2008) for the model without bargaining can be applied to the model with bargaining as well. This method relies on variables capturing neighborhood market conditions to fully identify the system of equations, which allows us to estimate individual price and liquidity equations.

To understand the intuition underlying the empirical model, introduce neighborhood market conditions summarized in the variable C along with the characteristics vector X into both price and liquidity equations, restated here as

The variable C captures the localized or neighborhood competition arising from other nearby houses for sale at the same time as the subject property. The approach taken here follows Turnbull and Dombrow (2006) and Zahirovic-Herbert and Turnbull (2008) (see the latter for a complete explanation of the model implementation and interpretation of parameter estimates). Since localized competition effects are not central to our main question, we focus solely on the role of these variables in econometrically identifying the system of simultaneous equations (18)–(19).

The subject house may be affected by neighborhood competition from nearby houses for sale at the same time. The competition measures the number of other houses on the market with the subject house, inversely weighted by the distance between the houses to reflect the assumption that nearby houses will have stronger effects on the sale of the subject than will competing houses farther away. The days-on-market or selling time is s(i) - l(i) + 1, where l(i) and s(i) are the listing date and sales date for house i. Denoting the listing date and sales date for competing house j by l(j) and s(j), the overlapping time on the market for these two houses is min[s(i), s(j)] - max [l(i), l(j)]. The straight-line distance in miles between houses i and j is D(i, j). The measured competition for house i is defined as

where the summation is taken over all competing houses j, that is, houses for sale within one mile and 20 percent larger or smaller in living area of house i. We also define another variable, listing density, as the measure of competing and overlapping listings per day on the market

Zahirovic-Herbert and Turnbull (2008) note that regressing sales price on the right-hand-side variables in (18) yields the estimated effect of competition on price as the partial derivative ∂φp/∂Cholding selling time constant. Changing competition while holding selling time constant, however, is simply a change in listing density (21). Therefore, ∂φp/∂C ≡ ∂φp/∂L so that imposing this parametric constraint directly into the price function (18) recognizes that it is a function of the listing density (21) and not competition (20). With this parametric restriction the estimating equations can be expressed as

The separate LD and C variables make it possible to identify both equations in the estimation (Zahirovic-Herbert and Turnbull 2008).Footnote 2 As important, this approach also explicitly introduces empirical controls for the neighborhood market conditions that--when neglected--justify the need to correct spatial correlation in housing price models. This approach models the spatial competition effects directly and therefore obviates the usual rationale for applying spatial estimation methods.

The empirical models assume semilog forms of (22)-(23), with the only differences across models being the set of variables used to capture agent gender and gender mix effects. Denoting selling price P and time on the market T,Footnote 3 the empirical model based on (22)-(23) is

where X is the vector of property characteristics (see Table 1) including the constant term, physical property attributes, location fixed effects and year and month listing time fixed effects; A is the vector of listing and selling agent sex dummy variablesFootnote 4; parameter vectors are α, δ, ψ, and η; scalar parameters are τ, χ, and ρ; and the stochastic errors are εP and εT. The system is identified and estimated using 3SLS to account for possible cross-equation correlation in the errors of the individual equations.

Bargaining Power Effects on Price and Liquidity

We use 3SLS to estimate the price and liquidity equation system (24) – (25) for sales completed during 1999–2009 and during the rising (1999–2006) and declining market (2007–2009). To keep the presentation concise, Table 5 only reports the key 3SLS parameter estimates for the system of price and liquidity equations.

Gneezy et al. (2003), Holm (2000), Sutter et al. (2009), Karremans et al. (2009) and Nauts et al. (2012) argue that the presence of a woman in a transaction environment affects the outcome. This raises the question of whether mixed male-female agents on opposite sides of a house transaction affects the outcome and, if so, how?

Table 5 reports key parameter estimates from the full model (24)-(25). Model (1) in the table includes the variable LAM which equals one when the listing agent is male and SAM which equals one when the selling agent is male. The LAM coefficients in both the price and liquidity equations are insignificant and the SAM coefficient is significantly negative in the price equation and significantly positive in the liquidity equation. These results indicate that the sex of selling agents does affect outcomes; when compared with female selling agents, male agents obtain lower prices for their buyers but also lead to longer marketing times. This approach, however, does not allow the agent sex effect to vary depending on the sex of the agent on the other side of the transaction. The other models in the table relax this constraint.

The data include sales by dual agents, where one agent handles both sides of the transaction. In order to remove the effects of dual agency on the agent effects estimates, model (2) in Table 5 includes variables controlling for dual agent sex, DUAL MALE and DUAL FEMALE, indicating a male or female dual agent, respectively. For all other transactions the relationships (15)-(17) are captured by the set of variables LAFSAM (listing agent female, selling agent male), LAMSAF (listing agent male, selling agent female) and LAMSAM (listing agent male, selling agent male) which pertain to non-dual agent transactions only. LAFSAF (listing agent female, selling agent female) represents the omitted category.

The full sample period results reported as model (2) in the table show that houses listed and sold by males as dual agents sell at a price discount and with a longer marketing time than the female listing and selling nondual agents case. The other agent sex pairings are not significantly different from each other. The male dual agent discount and liquidity premium indicates that these agents take longer to find lower value buyers. The sex mix coefficients for nondual agency transactions are not significantly different. But drawing on (15)-(17) and using Δ > 0 from the listing price analysis, the insignificant agent mix estimates do yield meaningful bargaining power implications. The insignificant LAFSAM coefficient implies that the relative bargaining power of female listing agents does not vary systematically with the sex of the counterparty agent: βFM = βFF from (15). This result contrasts with Gneezy et al. (2003) and Holm (2000) that women behave more competitively when they know the opponent is female and with Niederle and Vesterlund (2008) that women perform worse in mixed-sex negotiation than in a single-sex setting. On the other hand, when compared with female listing agents, male listing agents exhibit weaker relative bargaining power when dealing with either male or female selling agents: the insignificant LAMSAF and LAMSAM coefficients imply βMF < βFF and βMM < βFF using (16) and (17), although we cannot conclude anything about the relative size of βMF versus βMM. This combination of results also means that female agents exhibit the same or stronger ex post bargaining power when bringing the buyer to the transaction than when brining the seller to the transactions. Nonetheless, it appears that the listing price analysis implying property sellers’ ex ante beliefs that male listing agents exhibit stronger bargaining power on average are not borne out in the completed transactions.

Looking at the estimates for the strong expansionary market phase over 1999-2006 in Model (3) and the declining market over 2007-2009 in Model (4), we find that the price discount and liquidity premium associated with male dual agents for the full sample does not hold in the rising market, while it does in the declining market phase. All of the other conclusions regarding nondual agent transactions for the pooled sample extend to the rising market subsample as well: weaker bargaining power for male listing agents facing either female or male selling agents. The declining market subsample reported, on the other hand, exhibits a significantly negative price effect for nondual agent properties both listed and sold by males. Applying (17) to this estimate implies βMM < βFF, which is the same conclusion for the pooled sample and the rising market subsample; all of the conclusions regarding bargaining power in mixed agent settings are consistent across the three samples.

Drawing these results together, the evidence indicates that while previous empirical studies do not control for the simultaneous effects of agent sex and agent role in the transaction, doing so matters. Relative bargaining power appears to vary with agent sex but only when taking into account the role of the agent in the transaction. Male agents exhibit weaker bargaining power in the role of listing agents, regardless of the counterparty agent sex. At the same time, female agents generally enjoy greater bargaining power when bringing the buyer to the transaction than when bringing the seller to the transaction. What is also interesting is that the listing price analysis indicates that house sellers do not fully apprehend these differences in ex post agent bargaining power.

Robustness Analysis

Table 3 shows that the type of house varies across listing and selling agent sex. As in the listing price analysis undertaken earlier, this raises concerns that selection effects may be influencing our estimates. We take three different approaches to address this issue, drawing on matched sample analysis and structural selection correction methods.

The first and second robustness tests apply the PSM matched sample procedure outlined earlier, the first approach constructing a matched sample for houses listed by male agents and the second constructing a matched sample for houses sold by male agents. For the first robustness test, we estimate a logit function using the LAM indicator variable as the dependent variable and the house characteristics, location fixed effects and year and month fixed effects as the independent variables. For each house listed by a male agent, the matching house is identified as the house listed by a female agent that has the same predicted probability of being listed by a male agent using the estimated logit. We then estimate the 3SLS price-liquidity model using the matched sample. Model (1) in Table 6 reports the coefficient estimates for the key agent related variables. The second robustness test estimates a logit using the SAM indicator variable as the dependent variable, using the resultant predicted logit values to identify the transaction matching each male selling agent transaction to construct the matching sample. Model (2) in Table 6 reports the key 3SLS estimates for the price-liquidity model using this matched sample.

Table 6 shows that both matched samples yield similar estimates. Particularly, the coefficient on DUAL MALE is negative and significant in the price equation either when we use LAM as the treatment or SAM as the treatment, but no difference in marketing time, similar to the rising market results (Model 4) in Table 5. None of the agent sex mix coefficients is significantly different from zero. Using these matched samples to control for agent property selection effects yields lower prices for dual male agents when compared with LAFSAF transactions. Other than those differences, all of the sex mix conclusions for the full sample remain unaltered; while sellers believe male listing agents have stronger average bargaining power, the transactions outcomes indicate they exhibit weaker bargaining power ex post whether facing male or female selling agents.

The third robustness test applies the Heckman (1979) selection model for selection bias by introducing the Inverse Mills Ratio (IMR) into the price model in order to adjust the conditional error terms to yield zero means.Footnote 5 This method represents a popular approach to dealing with selection issues include pricing and duration studies that exclude unsold properties (Gatzlaff and Haurin 1998; Wentland et al. 2014; Munneke and Slade 2000), realtor versus non-realtor agents (Huang and Rutherford 2007), and owner-agent properties (Rutherford et al. 2007). In this study, the possibility of selection bias arises in terms of the sex of the listing and/or selling agent choosing properties with particular characteristics and/or amenities.

We apply an extension of the Heckman two step procedure to account for possible selection bias introduced by listing agent sex and the exclusion of unsold properties. We recognize that the choice of a male or female listing agent and the probability of the house being sold might be jointly determined. Hence following Elder et al. (2000), we first use a biprobit to jointly estimate two choice models: LAM=1 if property is listed by a male listing agent, and SOLD =1 if house is sold. Elder et al. (2000) also suggest that if the two choice models are not linked then the biprobit estimation will collapse to independent equations. Second, we use local competition (C) which captures competition from houses listed nearby and the listing density (LD) which measures the number of overlapping listings per day on the market to help with identification problem. We include these competition and listing density variables in the first-stage biprobit estimation but not in the second-stage reduced form price equation. We then construct two IMRs, LAMIMR and SOLDIMR, and include them in the second-stage price equation, following Henning and Henningsen (2007). The second stage includes the two predicted IMRs for each property in the OLS price model for the full sample, the rising market, and the declining and recovering market phases.

Table 7 reports the second stage key parameter estimates for the price function. Note that, as this selection correction approach precludes liquidity analysis, the estimated second stage price functions exclude the endogenous liquidity variable on the right-hand-side.Footnote 6 Thus, the estimated price equation should be interpreted as a reduced form price equation from the simultaneous price-liquidity system estimated above. The two IMRs exhibit significant coefficients in the full sample and the rising market phase; indicating that selectivity exists but it is only prominent in the rising market and not in the declining market. Regardless, the coefficient estimates yield bargaining power conclusions that are the same as those found earlier.

Conclusion

The literature concerning sex and work performance has been largely concerned with the behavior of interacting coworkers, colleagues or rivals in situations that often obscure individual performance. This paper adds to the literature by focusing on the role of sex in one-on-one, face-to-face negotiations in which individual performance is easier to define and infer directly from observed outcomes. Since women play a prominent role in real estate brokerage, the resale market for existing houses provides an excellent environment to examine how women and men perform as agents on different sides of transactions representing sellers and buyers in one-on-one negotiations.

Agents are not the sellers (or buyers) in the housing market but instead advise and influence sellers (buyers). “Bargaining power” is an amorphous term and the literature concerned with bargaining power is not always clear about how the term is being used. In our case, what we identify as bargaining power is an amalgamation of the various ways in which an agent influences seller (or buyer) decisions, either subtly or directly, to promote the interests of the seller (in the case of listing agents) or buyer (in the case of selling agents). In this sense, our bargaining power definition captures the broad notion of how effective an agent is in influencing the transaction outcome, whether through advice to their client or applying subtle pressure to follow particular strategies throughout the transaction process.

This paper offers two contributions. First, it presents a stylized search and bargaining model that is essential to translate the empirical parameter estimates into conclusions about relative bargaining power of real estate agents when facing same sex or opposite sex agents on the other side of transactions. The theoretical model distinguishes the role of the house seller’s perceptions of their listing agent’s expected bargaining power relative to others in the market and the consequences of ex post bargaining power when dealing with a specific counterparty in the resultant transaction. Each seller’s ex ante expectations or beliefs are reflected in their choice of listing price while ex post bargaining power is reflected in the realized selling price and liquidity.

Second, this paper presents empirical evidence that the mix of agents’ sexes affects transaction outcomes. Ten years of MLS data from Lynchburg Virginia yields estimates that are consistent with sellers’ perceiving stronger bargaining power on average for male listing agents. Yet, the price and liquidity function estimates reveal that sellers’ perceptions are not generally borne out once transactions are completed. Further, the relative bargaining power of agents not only depends on their sex but also the sex of the agent on the other side of the transaction. In particular, the relative bargaining power of female listing agents is the same when facing either female or male selling agents. The relative bargaining power of female listing agents is also generally stronger than the relative bargaining power of male listing agents, although we cannot directly measure the size of the difference in agent bargaining power. These conclusions are robust for price-liquidity models using full and matched samples used to mitigate agent-property selection bias. We acknowledge that the results might be limited due to possible omitted variable bias. Nonetheless, the results provide useful insights into how gender pairing might have an impact on the outcomes in the resale housing market and might help guide agents’ and property owners’ actions.

These results for real estate agents are consistent with the notion in the broader management and labor economics literatures that women and men do not behave the same when working in mixed sex groups and single sex groups. The broader literature concludes that women are more competitive when facing other women in negotiations. The transaction context examined here leaves the notion of “more competitive” behavior unclear, but we do find that female agent effects on outcomes varies with their role as listing or selling agent as well as the sex of the counterparty agent; female agents appear to behave differently when working with other female agents than when working with male agents on the other side of the transaction.

Change history

24 March 2021

A Correction to this paper has been published: https://doi.org/10.1007/s11146-021-09835-3

Notes

One consequence of this identification approach is that the liquidity variable coefficient in the price equation captures both liquidity and neighborhood competition effects. This study is not concerned with the liquidity effect on selling price per se, so this aspect of the model raises no concerns in this application.

The estimated models use T + 1 for time on the market when taking logs.

The vector of agent dummy variables identifies the mix of sexes of the listing and selling agents involved in the transaction, as explained when discussing the empirical results. Harding et al. (2003) propose a reduced form model to estimate bargaining power when the individuals whose bargaining powers are being estimated also value unobserved property characteristics. That approach also assumes that bargaining power does not depend on the individual’s role in the transaction process, i.e., whether the individual is a buyer or seller. Their approach is not valid in the setting considered here because we allow bargaining power to vary by agent’s role in the transaction (as the listing or selling agent) and across mix of agent sexes. In addition, individual agents derive no consumption value from property characteristics, whether observed or unobserved.

We thank an anonymous referee for suggesting this robustness test.

The results reported in Table 7 are qualitatively unchanged when the liquidity variable is included in the model.

References

Abelson, M. A., Kacmar, K. M., & Jackofsky, E. F. (1990). Factors influencing real estate brokerage sales staff performance. Journal of Real Estate Research, 5(2), 265–276.

Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291–309.

Andersen, S., Marx, J., Nielsen, K. M., & Vesterlund, L. (2020). Gender differences in negotiation: Evidence from real estate transactions. National Bureau of Economic Researching Working Paper. Retrieved November 17, 2020 from http://www.nber.org/papers/w27318.

Atkinson, S., Baird, S., & Frye, M. (2003). Do female fund managers manage differently? Journal of Financial Research, 26(1), 1–18.

Ayres, I. (1991). Fair driving: Gender and race discrimination in retail car negotiations. Harvard Law Review, 104(4), 817–872.

Ayres, I., & Siegelman, P. (1995). Race and gender discrimination in bargaining for a new Car. American Economic Review, 85(3), 304–321.

Barber, B., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. Quarterly Journal of Economics, 116(1), 261–292.

Bian, X., Turnbull, G. K., & Waller, B. D. (2017). Client externality effects of agents selling their own properties. Journal of Real Estate Finance and Economics, 54(2), 139–164.

Binmore, K., Rubinstein, A., & Wolinski, A. (1986). The Nash bargaining solution in economic modeling. RAND Journal of Economics, 17(2), 176–188.

Chinloy, P. (1988). The real estate brokerage: Commissioned sales and market values. Journal of Real Estate Research, 3(2), 37–51.

Crellin, G. E., Frew, J. R., & Jud, G. D. (1988). The earnings of REALTORS: Some empirical evidence. Journal of Real Estate Research, 3(2), 67–78.

Dawson, L. M. (1997). Ethical differences between men and women in the sales profession. Journal of Business Ethics, 16(11), 1143–1152.

Eckel, C. C., Oliveira, A., & Grossman, P. J. (2008). Gender and negotiation in the small: Are women perceived to be more cooperative than men? Negotiation Journal, 24(4), 429–445.

Elder, H. W., Zumpano, L. V., & Baryla, E. A. (2000). Buyer brokers: Do they make a difference? Their influence on selling price and search duration. Real Estate Economics, 28(2), 337–362.

Follain, J. R., Lutes, T., & Meier, D. A. (1987). Why do some real estate salespeople earn more than others? Journal of Real Estate Research, 2(1), 73–81.

Gatzlaff, D. H., & Haurin, D. R. (1998). Sample selection and biases in local house value indices. Journal of Urban Economics, 43(2), 199–222.

Gneezy, U., Niederle, M., & Rustichini, A. (2003). Performance in competitive environments: Gender differences. Quarterly Journal of Economics, 118(3), 1049–1074.

Harding, J. P., Rosenthal, S. S., & Sirmans, C. F. (2003). Estimating bargaining power in the market for existing homes. Review of Economics and Statistics, 85(1), 178–188.

Heckman, J. J. (1979). Sample selection Bias as a specification error. Econometric, 47(1), 153–161.

Henning, C. H., & Henningsen, A. (2007). Modeling farm households' price responses in the presence of transaction costs and heterogeneity in labor markets. American Journal of Agricultural Economics, 89(3), 665–681.

Holm, H. J. (2000). Gender-based focal points. Games and Economic Behavior, 32(2), 292–314.

Hsieh, C., & Moretti, E. (2003). Can free entry be inefficient? Fixed commissions and social waste in the real estate industry. Journal of Political Economy, 111(5), 1076–1122.

Huang, J., & Kisgen, D. J. (2013). Gender and corporate finance: Are male executives overconfident relative to female executives? Journal of Financial Economics, 108(3), 822–839.

Huang, B., & Rutherford, R. (2007). Who you going to call? Performance of realtors and non-realtors in a MLS setting. The Journal of Real Estate Finance and Economics, 35(1), 77–93.

Johnson, J. E., & Powell, P. L. (1994). Decision making, risk and gender: Are managers different? British Journal of Management, 5(2), 123–138.

Karremans, J. C., Verwijmeren, T., Pronk, T. M., & Reitsma, M. (2009). Interacting with women can impair men’s cognitive functioning. Journal of Experimental Social Psychology, 45(4), 1041–1044.

Knight, J. R., Sirmans, C. F., & Turnbull, G. K. (1994). List price signaling and buyer behavior in the housing market. Journal of Real Estate Finance and Economics, 9(3), 177–192.

Krainer, J. (2001). A theory of liquidity in residential real estate markets. Journal of Urban Economics, 49(1), 32–53.

Krishnan, H. A., & Park, D. (2005). A few good women on top management teams. Journal of Business Research, 59(12), 1712–1720.

Levitt, S. D., & Syverson, C. (2008). Market distortions when agents are better informed: The value of information in real estate transactions. Review of Economics and Statistics, 90(4), 599–611.

Lippman, S. A., & McCall, J. J. (1976). The economics of job search: A survey. Economic Inquiry, 14(2), 155–190.

Master, R., & Meier, R. (1988). Sex differences and risk taking propensity of entrepreneurs. Journal of Small Business Management, 26(1), 31–35.

Munneke, H. J., & Slade, B. A. (2000). An empirical study of sample-selection bias in indices of commercial real estate. The Journal of Real Estate Finance and Economics, 21(1), 45–64.

Nash, J. (1950). The bargaining problem. Econometrica, 18(2), 155–162.

Nauts, S., Metzmacher, M., Verwijmeren, T., Rommeswinkel, V., & Karremans, J. C. (2012). The mere anticipation of an interaction with a woman can impair men's cognitive performance. Archives of Sexual Behavior, 41(4), 1051–1056.

Niederle, M., & Vesterlund, L. (2007). Do women shy away from competition? Do men compete too much? Quarterly Journal of Economics, 122(3), 1067–1101.

Niederle, M., & Vesterlund, L. (2008). Gender differences in competition. Negotiation Journal, 24(4), 447–463.

Onemu, O. (2014). Social relations, incentives, and gender in the workplace. Tinbergen Institute Discussion Papers, no 14-009/VII. Retrieved February 10, 2015 from https://papers.tinbergen.nl/14009.pdf..

Rutherford, R. C., Springer, T. M., & Yavas, A. (2005). Conflicts between principals and agents: Evidence from residential brokerage. Journal of Financial Economics, 76(3), 627–665.

Rutherford, R. C., Springer, T. M., & Yavas, A. (2007). Evidence of information asymmetries in the market for residential condominiums. The Journal of Real Estate Finance and Economics, 35(1), 23–38.

Salter, S. P., Mixon, F. G., & King, E. E. (2012). Broker beauty and boon: A study of physical attractiveness and its effect on real estate brokers' income and productivity. Applied Financial Economics, 22(10), 811–825.

Seagraves, P., & Gallimore, P. (2013). The gender gap in real estate sales: Negotiation skill or agent selection? Real Estate Economics, 41(3), 600–631.

Sirmans, G. S., & Swicegood, P. G. (1997). Determinants of real estate licensee income. Journal of Real Estate Research, 14(2), 137–154.

Sutter, M., Bosman, R., Kocher, M. G., & Winden, F. V. (2009). Gender pairing and bargaining--beware the same sex! Experimental Economics, 12(3), 318–331.

Turnbull, G. K., & Dombrow, J. (2006). Spatial competition and shopping externalities: Evidence from the housing market. Journal of Real Estate Finance and Economics, 32(4), 391–408.

Turnbull, G. K., & Dombrow, J. (2007). Individual agents, firms, and the real estate brokerage process. Journal of Real Estate Finance and Economics, 35(1), 57–76.

Turnbull, G. K., & Zahirovic-Herbert, V. (2011). Why do vacant houses sell for less: Bargaining power, holding cost or stigma? Real Estate Economics, 39(1), 19–43.

Vandergrift, D., & Yavas, A. (2009). Men, women, and competition: An experimental test of behavior. Journal of Economic Behavior and Organization, 72(1), 554–570.

Wentland, S., Waller, B., & Brastow, R. (2014). Estimating the effect of crime risk on property values and time on market: Evidence from Megan's law in Virginia. Real Estate Economics, 42(1), 223–251.

Zahirovic-Herbert, V., & Turnbull, G. K. (2008). School quality, house prices and liquidity. Journal of Real Estate Finance and Economics, 37(2), 113–130.

Zahirovic-Herbert, V., Turnbull, G. K., & Waller, B. D. (2020). Do home sellers know their market? Evidence from neighbourhood sober-living houses. Applied Economics Letters. https://doi.org/10.1080/13504851.2020.1782330\.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised: The word “Bargaining” was missing from the article title. The accurate title should be “Sex and Selling: Agent Gender and Bargaining Power in the Resale Housing Market.”

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pham, D.T., Turnbull, G.K. & Waller, B.D. Sex and Selling: Agent Gender and Bargaining Power in the Resale Housing Market. J Real Estate Finan Econ 64, 473–499 (2022). https://doi.org/10.1007/s11146-020-09811-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09811-3