Abstract

This paper seeks to test the intra-city convergence of house prices using the comprehensive suburban house price and census data for a key Australian city. It applies the regression-based β-convergence test combined with spatial econometric models to examine the conditional convergence of house prices across 300+ suburbs in the Melbourne metropolitan area. This paper finds evidence of house price convergence when the econometric model controls for spatial effects and a few other suburban characteristics, such as population size, economic profile, education and employment profile, and crime rate. However, the convergence rate is found to be decelerated in the post-GFC periods. The estimation results suggest a faster convergence rate for units/apartments than for freestanding houses. There is also evidence of spatial effects, implying that house price growth in Melbourne suburbs is spilling over into the neighboring suburbs. These findings are expected to shed new light on understanding the residential real estate market and price dynamics within a city in the context of a developed nation and help design relevant housing policies.

Similar content being viewed by others

Notes

According to the Australian Bureau of Statistics (2019), housing makes up 57% of Australians’ wealth, with 42% coming from the owner-occupied home and 15% from investment properties.

For details, see the Economist Intelligence Unit (2017).

See Glaeser and Gyourko (2007) for details on the implications of spatial and financial arbitrage conditions for the housing market.

The number of suburbs taken for the analysis varied across the two time periods and two types of dwellings considered, depending on the data availability for all variables.

The weight matrix can be based on economic distance as well. For example, Zhang et al. (2019) use economic distance, such as differences in GDP, along with the geographical distance to analyse the spatial dependence in the Canadian housing market. However, economic distance is less relevant in our study as it is concerned with an intra-city housing market rather than an inter-city market across the whole country.

Lesage and Pace (2009) first used the term SAC for the model that combines SAR and SEM without explaining what this acronym stands for. SDM and SDEM stand for spatial Durbin model and spatial Durbin error model.

Gibbons and Overman (2012) criticize these spatial econometric models mainly on the ground of identification and reflection problems. However, they have also noted that the parameters of the spatial model can still be identified as long as the weight matrix is known and is not an idempotent matrix.

The direct and indirect effects in alternative spatial models are explained in Appendix B. Also see Elhorst (2014) for details on the direct and indirect effects of an explanatory variable on the dependent variable in alternative spatial models.

As discussed in Elhorst (2014), the LR test statistic can be computed as −2(logLrestricted - logLunrestricted) and this statistic has a Chi squared distribution with degrees of freedom equal to the number of restrictions imposed.

For example, comparing the OLS and SLX for the 2011–16 period, the LR statistic is 8.24, which exceeds the relevant critical value of 3.84 at the 5% significance level. This indicates that the OLS model should be rejected in favour of the SLX. Log-likelihood values in other models are larger than in SLX, so OLS should be rejected against other models as well. This approach can be applied for all the nested spatial models we consider.

As a rule of thumb, it will take about 70/β years to remove the half of initial gap.

To be precise this approach can be called the single-difference approach as it considers differences in time periods only.

References

Akimov, A., Stevenson, S., & Young, J. (2015). Synchronisation and commonalities in metropolitan housing market cycles. Urban Studies, 52(9), 1665–1682.

Alonso, W. (1964). Location and land use: Toward a general theory of land rent. Cambridge: Harvard University Press.

Anselin, L. (1988). Spatial econometrics: Methods and models. Dordrecht, the Netherlands: Kluwer Academic Publishers.

Anselin, L. (1990). Some robust approaches to testing and estimation in spatial econometrics. Regional Science and Urban Economics, 20(2), 141–163.

Australian Bureau of Statistics. (2019). Household Income and Wealth, Australia, 2017–18 (Cat. No. 6523.0).

Barro, R. J. (1991). Economic growth in a cross section of countries. The Quarterly Journal of Economics, 106(2), 407–443.

Barro, R, J., & Sala-i-Martin, X. (1990). Economic growth and convergence across the United States (working paper no. w3419). National Bureau of economic research.

Barro, R. J., & Sala-i-Martin, X. (1992). Convergence. Journal of Political Economy, 100(2), 223–251.

Barro, R, J., Sala-i-Martin, X., Blanchard, O, J., & Hall, R, E. (1991). Convergence across states and regions. Brookings Papers on Economic Activity, 107–182.

Birrell, B., & McCloskey, D. (2015). The housing affordability crisis in Sydney and Melbourne report one: The demographic foundations. The Australian Population Research Institute.

Blake, J. P., & Gharleghi, B. (2018). The ripple effect at an inter-suburban level in the Sydney metropolitan area. International Journal of Housing Markets and Analysis, 11(1), 2–33.

Canarella, G., Miller, S., & Pollard, S. (2012). Unit roots and structural change: An application to US house price indices. Urban Studies, 49(4), 757–776.

Case, K. E., & Mayer, C. J. (1996). Housing price dynamics within a metropolitan area. Regional Science and Urban Economics, 26(3–4), 387–407.

Churchill, S. A., Inekwe, J., & Ivanovski, K. (2018). House price convergence: Evidence from Australian cities. Economics Letters, 170, 88–90.

Clark, S. P., & Coggin, D. (2009). Trends, cycles, and convergence in US regional house prices. Journal of Real Estate Finance and Economics, 39(3), 264–283.

Cook, S. (2003). The convergence of regional house prices in the UK. Urban Studies, 40(11), 2285–2294.

Cook, S. (2012). β-Convergence and the cyclical dynamics of UK regional house prices. Urban Studies, 49(1), 203–218.

Cook, S., & Vougas, D. (2009). Unit root testing against an ST–MTAR alternative: Finite-sample properties and an application to the UK housing market. Applied Economics, 41(11), 1397–1404.

Drake, L. (1995). Testing for convergence between UK regional house prices. Regional Studies, 29(4), 357–366.

Drennan, M. P., & Lobo, J. (1999). A simple test for convergence of metropolitan income in the United States. Journal of Urban Economics, 46(3), 350–359.

Economist Intelligence Unit (2017). The global liveability report 2017: A free overview. Economist.

Egger, P., & Pfaffermayr, M. (2006). Spatial convergence. Papers in Regional Science, 85(2), 199–215.

Elhorst, J. P. (2014). Linear spatial dependence models for cross-section data. In Spatial econometrics (pp. 5–36). Berlin, Heidelberg: Springer.

Gibbons, S., & Overman, H. G. (2012). Mostly pointless spatial econometrics? Journal of Regional Science, 52(2), 172–191.

Glaeser, E, L., & Gyourko, J. (2007). Arbitrage in housing markets (no. w13704). National Bureau of Economic Research.

Glaeser, E. L., Kolko, J., & Saiz, A. (2001). Consumer city. Journal of Economic Geography, 1(1), 27–50.

Gong, Y., Hu, J., & Boelhouwer, P. J. (2016). Spatial interrelations of Chinese housing markets: Spatial causality, convergence and diffusion. Regional Science and Urban Economics, 59, 103–117.

Guerrieri, V., Hartley, D., & Hurst, E. (2013). Endogenous gentrification and housing price dynamics. Journal of Public Economics, 100, 45–60.

Holmes, M., & Grimes, A. (2008). Is there long-run convergence among regional house prices in the UK? Urban Studies, 45(8), 1531–1544.

Holmes, M., Otero, J., & Panagiotidis, T. (2011). Investigating regional house price convergence in the United States: Evidence from a pair-wise approach. Economic Modelling, 28(6), 2369–2376.

Holmes, M. J., Otero, J., & Panagiotidis, T. (2017). A pair-wise analysis of intra-city price convergence within the Paris housing market. The Journal of Real Estate Finance and Economics, 54(1), 1–16.

Kelejian, H. H., & Prucha, I. R. (2001). On the asymptotic distribution of the Moran I test statistic with applications. Journal of Econometrics, 104(2), 219–257.

Kendall, R., & Tulip, P. (2018). The effect of zoning on housing prices (no. rdp2018-03). Reserve Bank of Australia.

Kim, Y. S., & Rous, J. J. (2012). House price convergence: Evidence from US state and metropolitan area panels. Journal of Housing Economics, 21(2), 169–186.

Lee, L. F. (2004). Asymptotic distributions of quasi-maximum likelihood estimators for spatial autoregressive models. Econometrica, 72(6), 1899–1925.

LeSage, J. P., & Pace, R. K. (2009). Introduction to spatial econometrics. Boca Raton, FL: CRC Press.

Luo, Z. Q., Liu, C., & Picken, D. (2007). Housing price diffusion pattern of Australia’s state capital cities. International Journal of Strategic Property Management, 11(4), 227–242.

Mills, E. S. (1967). An aggregative model of resource allocation in a metropolitan area. The American Economic Review, 57(2), 197–210.

Montagnoli, A., & Nagayasu, J. (2015). UK house price convergence clubs and spillovers. Journal of Housing Economics, 30, 50–58.

Montañés, A., & Olmos, L. (2013). Convergence in US house prices. Economics Letters, 121(2), 152–155.

Moran, P. A. (1950). Notes on continuous stochastic phenomena. Biometrika, 37(1/2), 17–23.

Muth, R. (1969). Cities and housing, Chicago.

Phillips, P. C., & Sul, D. (2007). Transition modeling and econometric convergence tests. Econometrica, 75(6), 1771–1855.

Quah, D. (1993). Galton’s fallacy and tests of the convergence hypothesis. The Scandinavian Journal of Economics, 95, 427–443.

Rey, S. J., & Dev, B. (2006). σ-Convergence in the presence of spatial effects. Papers in Regional Science, 85(2), 217–234.

Roback, J. (1982). Wages, rents, and the quality of life. Journal of Political Economy, 90(6), 1257–1278.

Rosen, S. (1979). Wages-based indexes of urban quality of life. In P. Mieszkowski & M. Straszheim (Eds.), Current issues in urban economics (pp. 74–104). Baltimore, MD: Johns Hopkins University Press.

Sala-i-Martin, X. (1996). Regional cohesion: Evidence and theories of regional growth and convergence. European Economic Review, 40(6), 1325–1352.

Yates, J., & Berry, M. (2011). Housing and mortgage markets in turbulent times: Is Australia different? Housing Studies, 26(7–8), 1133–1156.

Zhang, Y., Sun, Y., & Stengos, T. (2019). Spatial dependence in the residential Canadian housing market. The Journal of Real Estate Finance and Economics, 58(2), 223–263.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix: A

List of variables and data description

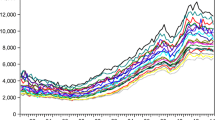

House price: The median house and unit price data for Melbourne metropolitan suburbs and Victorian LGAs were taken from the State Government of Victoria Department of Environment, Land, Water and Planning.

Population size: Data for the number of population in 2006 and 2011 for each suburb were taken from the SEIFA census database of the Australian Bureau of Statistics.

Education and employment index: The Index of Education and Occupation data for the years 2006 and 2011 were taken from the SEIFA census database of the Australian Bureau of Statistics. This index reflects the educational and occupational structure of communities. A suburb with a high score on this index indicates a high concentration of people with higher education qualifications or undergoing further education, and a high percentage of people employed in more skilled occupations living in the suburb.

Economic resource index: This index includes the level of income and wealth for the families living in each suburb. A higher score on the Index of Economic Resources indicates that the suburb has a higher proportion of families on high income, a lower proportion of low-income families, and more households living in large houses. Data on this index for 2006 and 2011 were collected from the SEIFA census database of the Australian Bureau of Statistics.

Rent: The average weekly rent data for metropolitan Melbourne suburbs were taken from the Department of Health and Human Services of the State Government of Victoria.

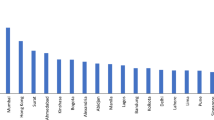

Crime rate: The number of non-aggravated burglary incidences per 1000 population was used as a proxy for the crime rate. The data were taken from the Crime Statistics Agency Victoria.

Appendix: B

Defining Direct and Indirect Effects in Alternative Spatial Models:

As specified in Elhorst (2014), let us consider a general nested spatial model:

where Y denotes the Nx1 vector of observations of the dependent variable, X denotes the Nxk matrix of all explanatory variables, ∝ is the intercept term and β is the kx1 vector of relevant coefficients. W is the spatial weight matrix, WY denotes the endogenous interaction effects among the dependent variable, WX the exogenous interaction effects among the independent variables, and Wu the interaction effects among the disturbance term of the different units. Here e is the i.i.d. disturbance term with zero mean and constant variance. ρ is called the autoregressive coefficient, λ the autocorrelation coefficient, and γ is the kx1 vector of coefficients to be estimated.

The direct and indirect effects of a change in an explanatory variable in alternative model specifications are defined as:

Direct Effect | Indirect Effect | |

|---|---|---|

OLS/SEM | βk | 0 |

SAR/SAC | Diagonal elements of (I − ρW)−1βk | Off-diagonal elements of (I − ρW)−1βk |

SLX/SDEM | βk | γk |

SDM/GNS | Diagonal elements of (I − ρW)−1(βk + Wγk) | Off-diagonal elements of (I − ρW)−1(βk + Wγk) |

Rights and permissions

About this article

Cite this article

Bashar, O.H.M.N. An Intra-City Analysis of House Price Convergence and Spatial Dependence. J Real Estate Finan Econ 63, 525–546 (2021). https://doi.org/10.1007/s11146-020-09799-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09799-w