Abstract

Mortgage credit risk measurement hinges on the choice of a house price stress path, which is used to project loan losses and determine financial capital requirements. House price paths are commonly constructed at national or state levels and shock scenarios are created to mimic historical adverse market conditions. We provide evidence that this level of geographic aggregation is not granular enough in many cases—collateral risk often varies within cities. Using local house price indices that cover the United States from 1975 to 2016, we focus on house price performance in the years immediately following sustained periods of rapid acceleration. Price accelerations tend to exhibit temporal clustering and occur with greater frequency in large versus small cities. We exploit within-city variation in price dynamics to provide evidence that price initially overshoot sustainable levels but, in some areas, dynamics may reflect positive underlying economic fundamentals and can be sustained. After accelerating, price reach their trough after 4 or 5 years. Small cities show uniform declines whereas large cities exhibit greater price decreases farther away from city centers. These findings suggest differential collateral risk exists in large cities, financial losses can be predictable based on real estate location theory, and localized house price paths could aid credit risk management.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Mortgage risk management involves assessing credit risk at different points in the housing cycle. The goal is to estimate the extent of losses under a plausible yet stressful economic scenario. House price paths are a key input for determining how severe a scenario will be and how long it will last. Often, these paths are based on projected changes to national or state house price levels.Footnote 1 This paper provides evidence that additional granularity may be informative for risk management because house price cycles can vary significantly between and within cities.

Leading up to the Great Recession, many areas of the country experienced rapid house price growth, yet we have observed substantial variation in post-boom price dynamics. How might we determine whether a rapid rise in house price is sustainable, or if price will eventually fall? As Case and Shiller (2003) make clear, price dynamics following a positive demand shock are dependent on the extent of new construction in the area. However, within a city, there is substantial variation in existing density and the supply of buildable sites, leading to different local supply responses. For example, in suburban locations where land is plentiful, it is often easier to expand residential development. If the housing supply is expanded too rapidly, it may exacerbate traffic congestion and increase the relative desirability of center-city housing. These differential supply and congestion effects can lead to unique price dynamics between and within cities, which are often masked at traditional levels of aggregation. This is emphasized by Mian and Sufi (2009), Guerrieri et al. (2013), and others who have examined house price movements since the 1990s, finding broad, differential patterns of house price appreciation rates within cities. We explore local dynamics using a new panel of house price indices (HPIs) between 1975 and 2016 which spans ZIP codes across the entire United States.Footnote 2 We then make two contributions.

First, we document the incidence of acceleration episodes between and within cities beginning in the early 1980s. Given the earlier emphasis on tracking stressful conditions, accelerations are defined by increasingly large gains over a short period, or cumulative real house price growth in excess of 50% (log-difference of 0.4) over a 4-years period that is at least 22% (log-difference of 0.2) higher than the cumulative growth in the prior 4-years period. There are four main acceleration periods in the United States since 1980: the private equity boom of the late 1980s, the “dot-com” boom of the late 1990s, the subprime boom of the mid 2000s, and the oil boom of the early 2010s. In general, large cities (over 500,000 housing units in the metropolitan area) experience nearly twice as frequent price accelerations as small cities. Within the city, there is no clear pattern regarding which acceleration episodes occur first within a major cycle, with some time periods led by accelerations in the suburbs (1980s) and others by the center-city (1990s–2010s).

Second, we analyze local price dynamics following a substantial acceleration. In the first four to 5 years after an acceleration episode, real house price decline, irrespective of location or time period. However, the speed and extent of adjustments fluctuate between areas. For instance, price in large cities fall less than in small cities, and areas near the centers of large cities fall by less than areas in the suburbs. Additionally, cities with an inelastic housing supply, including those with a highly regulated housing market or those in a state of long-run economic decline, experience less of a drop in price. Cities with declines in real price prior to the acceleration observe smaller price decreases relative to cities where the acceleration was preceded by a period of slow-but-steady increases. Finally, we provide evidence about recoveries across areas within cities, as well as between certain sizes and types of cities.

Given the richness of our data, we can measure cycles over several historical periods of market volatility. We find evidence that the initial price declines following an acceleration overshoot, on average, as real price changes in years four through eight following an acceleration are generally positive. Overall, when taking into account the full 12 years of analysis (4 years of acceleration and the 8 years post-acceleration), real house price are, generally, at or above pre-acceleration levels in all city types for all locations within the city. These findings are consistent with a dynamic, rational expectations model with location-specific housing supply constraints, similar to Glaeser et al. (2014) and Head et al. (2014),Footnote 3 where a permanent demand shift leads to a sharp initial increase in price. This price response induces new construction, and price fall over the succeeding years as quantities absorb some of the demand change. Over the course of the next 4 years, price often fall back to pre-shock levels (or even more in supply-elastic areas) but, subsequently, recover. By 8 years post-acceleration, most areas are above pre-shock levels. It appears as though accelerations are initiated by changes to long-run perceptions of a location’s desirability, in the vein of Lee et al. (2015), who suggest that a high price level indicates strong current and future expectations of economic fundamentals.

While some areas experience cumulative real appreciation that is positive, that is not always the case. In particular places, the real price level at the end of the 12 year window is below pre-acceleration levels. This reflects a temporary demand shock combined with a housing construction response, such as in the case of Favara and Imbs (2015). For instance, there is broad evidence that lending standards and credit constraints may be temporarily relaxed in a subprime boom (Dell’Ariccia et al. 2012). If there is no construction response, then real house price are more likely to be bounded below by the pre-shock levels (Ortalo-Magné and Rady, 2006). Combined, our results indicate an adjustment process where an initial demand shock leads to a period of price acceleration, real house price overshoot when supply is constrained in the short-run, and then price eventually adjust to a new equilibrium based upon changes in the housing stock as well as the persistence of the demand shock.

To our knowledge, this is the first paper to provide broad evidence of both between and within-city variation in post-acceleration price dynamics. The localized nature of these price movements emphasizes the importance of studying more granular house price paths.Footnote 4 Our results also suggest that differential magnitudes and speeds of adjustment are predictable based on not just city-level characteristics, but sub-market characteristics as well using real estate location theory. While these estimates cover four major periods and may thus face issues of macroeconomic generalizability, patterns across areas are clear and robust.

The remainder of this paper is structured as follows. The next section defines how local house price data can be used to identify substantial acceleration episodes. The third section describes the incidence and location of such accelerations. The fourth section documents, after acceleration episodes, the extent to which real house price decline and whether they subsequently recover. We show significant variation in price dynamics both across and within cities. Concluding remarks are in the final section.

Identifying Local House Price Accelerations

When risk practitioners model stressful economic scenarios, house price paths are designed to mimic historical adverse market conditions. There is no singular rule which states exactly how to construct or apply the paths. In practice, the national decline or recovery path is usually applied across all loans in a portfolio. However, such a generic prescription may not be appropriate for all areas. In this section, we outline a flexible but more rigorous way to define accelerations and suggest that post-acceleration paths can diverge even across places that experienced similarly sharp appreciations.

We define substantial growth acceleration episodes by adapting the technique of Hausmann et al. (2010) as described in their analysis of cross-country GDP growth. Their method requires three criteria to be met in order to classify a period as an acceleration: 1) a growth rate threshold, 2) an acceleration threshold, and 3) a global maximum in the level of the series. The first two restrict the sample to areas with high and increasing growth rates, and the third ensures the acceleration is not a recovery from a prior bust. In this paper, we apply and calibrate these criteria to the study of real house price in U.S. ZIP codes between 1975 and 2016.

Our base dataset draws from house price indices constructed by Bogin et al. (2017), who calculate repeat sales house price indices for 18,000 ZIP codes using nearly 100 million underlying mortgage transactions. The repeat sales methodology is attractive because changes in an index can be interpreted as constant-quality appreciation between sales. We focus on ZIP codes that include properties that are all within a single Core-Based Statistical Area (CBSA) and that have a populated price index beginning in at least 1990.Footnote 5 This limits the analysis to 12,942 unique ZIP codes with over 386,000 ZIP-year observations. In the United States, house price acceleration episodes are often short (several years), but price level changes are large in magnitude. The cutoff for the first criterion is set at a log-difference of 0.4 (about 50% growth rate) over a 4-years period. The second criterion requires the growth rate exceeds the prior 4-years growth rate by a log-difference of at least 0.2 (22%).Footnote 6 We omit the third criterion, instead preferring to study the dynamics of accelerations preceded by both house price growth and declines.Footnote 7

Describing the Incidence, Location, and Timing of Accelerations

After applying these criteria, we identify over 4729 instances of substantial house price acceleration episodes between 1975 and 2016. Two commonly observed acceleration episode types are illustrated in Fig. 1. The first vertical line in each figure indicates the start of the acceleration episode and the second vertical line denotes the end. ZIP code 20003 (in the Capitol Hill neighborhood of the Washington, DC, MSA) depicts an area where an initial downturn is reversed and the subsequent appreciation is sustained; ZIP code 90210 (in the Beverly Hills neighborhood of the Los Angeles, CA, MSA) illustrates modest growth followed by rapid growth then a correction.Footnote 8

Acceleration episodes occur most frequently in the late 1980s and early 2000s but, as Fig. 2 shows, every year has at least one ZIP code with an identified acceleration with the exception of 1993 and 2010.Footnote 9 The left panel shows the number of identified accelerations in each year of our sample, which peak in 2005 (with 953 of 12,055 ZIP codes).Footnote 10 Because the later years have a greater number of populated indices, we compute another time series for the fraction of ZIP codes with real house price accelerations. Local peaks occur at 7% in 1987, 6% in 1989, and a third time at 8% in 2005. The sample ends with a fraction of 4% in 2016, or similar to the share in 2004. We also track ongoing accelerations in the right panel, which are defined as the sum of identified accelerations in the current year and each of the next 3 years. There are two peaks in this series, in 1986 when 27% of all ZIP codes in the U.S. are accelerating then again in 2003 or 2004 when 20% are accelerating. This second figure highlights the main peaks and troughs of the major national house price cycles of the last 40 years. This figure also portends the beginning of a third cycle in 2010.

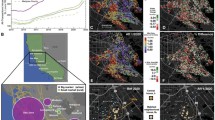

Acceleration episodes are clustered in certain ranges of years based on Fig. 2. These clusters indicate four major acceleration periods, occurring in 1985–1990, 1999–2003, 2004–2006 and 2014–2016. The first episode coincides with the private equity boom of the late 1980s, and includes rapidly rising house price in coastal areas and the Pacific Northwest. The second episode begins at the end of the “dot-com” boom and continues for several years after the collapse of the tech bubble. This high-acceleration period is limited to the coasts in California, Florida, and New England. For these reasons, we classify it as distinct from the third episode, which is characterized by the massive subprime boom leading up to the Great Recession. This third period shows house price accelerations radiating out from those coastal areas and starting in the southwest. The final period of acceleration coincides with the post-Recession recovery, but some areas that never declined begin accelerating as well, such as in oil-rich regions of the Midwest. The geographic distribution of accelerations in these four periods is shown in Fig. 3. A larger fraction of accelerating ZIP codes within a CBSA is depicted with a warmer color shade (e.g., green is equal to 0%, yellow is above 0% to 1% (inclusive), orange is above 1% up to 10% (inclusive), and red is above 10%). Across the maps, the warmest colors consistently appear in regions like California, Florida and the northeast.

A major advantage of geographically disaggregated data is that we can go from a national to a local scope to investigate accelerations at different locations within a city. We label four main sub-regions within the city: the center-city, mid-city, suburbs, and exurbs. The center-city represents ZIP codes less than 5 miles from the Central Business District (CBD); the mid-city falls between 5 and 15 miles; the suburbs are between 15 and 25 miles; and the exurbs are ZIP codes greater than 25 miles from the CBD.Footnote 11 We also distinguish between ZIP codes in large cities (with greater than 500,000 housing units) and small cities.

Table 1 offers the total frequencies of accelerations by distance from the CBD and the size of the CBSA. Fig. 4 takes this a step further by graphing the frequencies and fractions of accelerations on an annual basis. Overall, acceleration episodes occur twice as often in large cities and most frequently in the mid-city area.Footnote 12 Several patterns emerge from a further breakdown. First, growth accelerations occur at greater rates in large cities versus small cities at nearly all points in time. Second, there is no clear pattern regarding which part of the city “leads” other parts of the city in accelerating within a particular period. In the private equity boom, the suburban accelerations precede the center-city accelerations. On the other hand, in all other periods, the center-city area precedes the suburbs. Third, accelerations tend to occur with similar frequency in different locations within the city.Footnote 13 This result echoes the empirical findings of Davidoff (2013), who finds house price growth occurred in the early 2000s irrespective of housing supply elasticity, and the standard urban model (SUM), which hypothesizes that an increase in demand for housing in a city raises house price everywhere due to the within-city iso-utility condition.Footnote 14 While different parts of the city may accelerate first, other areas eventually rise as well.

Another stylized fact of acceleration episodes is that most occur in certain markets.Footnote 15 Fig. 5 shows that far more acceleration episodes are observed in areas with high regulation, or relatively inelastic housing supply. Low regulation cities have seen a rise in acceleration episodes mainly during last decade’s boom and over the last several years. There is some evidence in the literature that supply elasticity is related to mean reversion. This figure suggests that post-acceleration price behavior could be influenced by either elasticity or sample period.

The last three figures in this section show that substantial house price accelerations are concentrated in particular regions of the country (California and Florida account for over 40%) and in certain parts of cities (with the most, or around one-third, in the mid-city region of 5–15 miles from the CBD). This could be concerning from a risk management perspective if mortgage collateral is over-represented in such areas or if the severity of house price declines varies by location. The next section explores what happens to house price after acceleration episodes.

Are House Price Accelerations Sustainable or will they Decline?

This section explores the degree of mean reversion in real house price following an acceleration episode. We follow Davis and Weinstein (2002), who use an elegant empirical strategy to measure the dynamic response of a series to an initial change.Footnote 16 In this framework, future growth through period t + h is estimated as a function of the magnitude of the prior change, in this case, the cumulative price change between time t-4 and t. The parameter 0 > β > − 1 in Eq. 1 indicates partial mean reversion, and β = − 1 indicates full reversion to the prior level.Footnote 17

This equation includes time period fixed effects to control for national trends, and time period clustering of residuals to account for period-specific variance. It is estimated over a sample consisting of identified growth accelerations. Several sub-samples are considered, including pre-2000, post-2000, and if the acceleration was preceded by a 4-years decline in price or a 4-years growth in price. The time period sub-samples serve the purpose of determining the extent of mean reversion with and without the Great Recession. For ease of exposition and comparison, size differences across cities and geography within cities are given mutually exclusive fixed effects with no omitted categories. The parameter estimates for each combination are thus to be interpreted as the full, reduced-form effect.

Measuring House Price Paths after Accelerations

Mean reversion results after an acceleration episode are presented in Table 2. To describe post-acceleration behavior, the table is split into analyses of two distinct time horizons. Columns 1 to 5 detail real house price growth in the medium-run (4 years) while columns 6 to 10 detail house price growth in the long-run (8 years).Footnote 18 Three main findings emerge to describe real house price growth patterns 4 years after the acceleration episode. First, most areas of cities experience at least 50% mean reversion over the 4-years post-acceleration period regardless of the sample period, preceding house price growth conditions, or location within the city. This is striking because the minimum real house price growth rate to be termed an acceleration is 50%, which suggests that housing in all areas depreciates by at least 25% over the next 4 years.Footnote 19 Second, the level of mean reversion has a consistent ordering. In large cities, the center-city has the lowest level of mean reversion and the mid-city has the second lowest level. On the other hand, the suburbs of large cities and all areas of small cities have similar levels of mean reversion.Footnote 20,Footnote 21 Finally, accelerations preceded by declining real price are more sustainable in all areas than accelerations preceded by growth.Footnote 22

These results fit well within existing ideas about price dynamics in high versus low housing supply elasticity areas. Because construction is a major mechanism through which price fall in periods following a positive demand shock in a full information, rational expectations framework, sustained real house price appreciation might be seen as unusual in areas with high supply elasticity. Glaeser et al. (2008) argue that such areas are unlikely to experience prolonged real appreciation and price are likely to fall back towards housing input costs as supply responds. Any real appreciation, therefore, may be ephemeral.

The duration of acceleration episodes and subsequent house price changes is constrained to be the same across elastic and inelastic markets. Although this does not have to be the case and we find that the extent of a bust might vary between elastic or inelastic cities in a shorter horizon (0–4 years), the cumulative changes are comparable in longer horizons (8 years out they are all at the same relative levels). This could imply that (a) local regulations are apt for reducing declines in highly regulated inelastic cities or (b) market forces are successful at removing speculative transactions and rebound well in low regulated elastic cities. Practically, these results might be driven by sample coverage in certain time periods and further exploration is conducted later in our robustness checks in Table 4. Financially, we believe this demonstrates an important insight for risk management and could be helpful for investors or developers who self-select into certain market areas because of their risk appetite profiles.

While longer time horizons are less useful for stress-testing exercises, they are useful in other contexts. These may include the informing of policies targeted to delinquent borrowers such as mortgage prevention and mortgage modification programs, and pricing of securities that include a high percentage of defaulted loans. We estimate Eq. 1 with the same 4-years acceleration on the right-hand-side, but with the following 8-years growth rate as the dependent variable. Results of this model over the five sub-samples are presented in the second part of Table 2 (columns 6 to 10). Of the three main results in columns 1 to 5 regarding the average level of mean reversion, ordinal rankings between geographic categories are maintained in the 8-years period. However, in general, mean reversion is less over 8 years than it is over 4 years. Combined with the 4-years post-acceleration results, it appears that real house price cycles follow similar patterns in all areas: an acceleration in price is followed by real price declines that tend to overshoot initially but, subsequently, recover.

We can also use these long-run price changes to infer supply and demand dynamics, including the permanence of the demand shock that led to the acceleration. It should be stated at the outset that for many cases, it is impossible to determine the underlying source of the dynamics using price information alone. For instance, complete mean reversion in price (β = − 1) could be due to either a fully temporary demand shock combined with no housing supply response, or a fully permanent demand shock combined with a perfectly elastic housing supply. However, for two specific cases, we are able to infer the permanence of the housing demand shock and the nature of the supply response based on the price dynamics: (1) if price remain above pre-acceleration levels (β > − 1), the demand shock that caused the initial appreciation must contain a permanent component and (2) if price fall below pre-acceleration levels (β < − 1), the demand shock was temporary, but elicited a supply response.

In the center- and mid-cities of large cities (i.e. areas within 15 miles of the CBD), the extent of mean reversion is less than in other geographic categories, with β > − 1 in all cases. Based on these price dynamics alone, we infer that center-cities experienced permanent demand shocks that led to the initial price acceleration episode, regardless of whether price were growing or declining in the period prior to the acceleration. A single additional assumption can help us make additional conjectures about the nature of demand versus supply responses in suburban areas and in small cities. If we assume housing is relatively elastically supplied in these locations, then that implies there was a construction response to the initial price acceleration. Then, conditional on a supply response, the return of price to pre-acceleration levels—but no lower—suggests that there must be a permanent demand increase.

Combined with the center-city results, we can then conclude based on the 8-years recovery panel of results that the average growth acceleration appears to be a legitimate signal of a permanent shift in a location’s economic fundamentals.Footnote 23 In large cities, price are consistently higher than the pre-acceleration price level.Footnote 24 In small cities, real price gains are weakly positive.

Robustness Checks: Parameters, Elasticities, and Recovery Dynamics

Our results are potentially sensitive across several dimensions, such as the cutoffs (e.g, for the growth rate, acceleration criterion, and the measurement window) that define house price acceleration episodes. In addition, the empirical methods implicitly assume each acceleration occurs in a representative city of a given size. In reality, elasticity differentials exist across areas, potentially affecting dynamics. Below, we discuss robustness tests related to these assumptions, paying particular attention to post-acceleration dynamics.

Alternative Classification Parameters

Table 3 tests post-acceleration growth rates under different parameter assumptions involved in the creation of the acceleration measures. The first column in Table 3 presents the baseline results from all ZIP codes in Table 2. The second and third columns increase and decrease the growth threshold, respectively, and the fourth and fifth columns increase and decrease the acceleration threshold. Finally, the sixth and seventh columns present results of expanding and contracting the window over which the acceleration is measured. Estimates in columns 2 through 7 are broadly consistent with the baseline in column 1. Ordinally, center-cities face less mean-reversion than suburban areas in large cities. In small cities, all types of areas behave similarly.

The robustness checks show estimated coefficients change most after drastic changes to the sample size when more observations temper the average acceleration or fewer observations heighten the acuteness of increases. The direction of change is not limited to making a single adjustment—there are often two ways to achieve the same effect. For example, the general level of mean reversion is higher in the baseline than when we impose a 0.2 growth rate (column 3) or a 5-years window (column 6) criteria.Footnote 25 Both of those changes lower the minimum annualized rate threshold, which very effectively increase the sample size (column 3 increases the sample size by more than 2.5 times and column 6 increases it by 25%) to include episodes where accelerations were not nearly as drastic. Less severe rises lead to moderate declines and gradual recoveries. In contrast, greater mean reversion is observed with a 0.6 growth rate (column 2) or a 3-years window (column 7) but the observation count decreases significantly. The sample size and its composition are less sensitive to the acceleration criterion. Recall that the acceleration criterion ensure the growth rate exceeds the prior 4-years growth rate so columns 4 and 5 alter the magnitude of the rate of change but the second derivative is still positive.

The ability to achieve the same outcome with multiple adjustments is fortuitous. In practice, house price stress paths are often constructed in a similar but simplistic way that depends on an underlying sample to define the paths. Concerns include factors like deciding how far house price will drop from a peak, how long they remain at a trough region, and then how quickly price recover to either a prior level or pre-defined trend. As the robustness checks show, the first concern can be controlled with several kinds of parameter adjustments. Conservative but not overly burdensome parameter criteria (like column 1) might be preferable. The risk of using other sets of acceleration parameters (like columns 3 or 6) is the elimination of larger declines, with a repercussion being insufficient capital calculations for diversified portfolios. For a financial institution with holdings concentrated in areas having flatter growth trends, such adjustments might be reasonable. The next subsection explores these location concerns by adjusting the sample instead of the acceleration parameters.

City-Wide Differences in the Elasticity of Housing Supply

The second set of robustness estimates relaxes the representative city assumption to consider differential dynamics with respect to the elasticity of housing supply. Much of the differences in dynamics in the prior section is attributed to differences in center-city versus suburban elasticities of housing supply in large cities. Following this logic, it is possible that house price fall slower in low supply elasticity cities compared to high elasticity cities if a demand shock is permanent. There is substantial research on this subject, including Glaeser and Gyourko (2005) who find a lower elasticity of housing supply in areas in long-run economic decline; Gyourko et al. (2008) who present the Wharton Residential Land Use Regulatory Index (WRLURI) and argue that this index acts as a measure of the elasticity of housing supply; and Saiz (2010) who finds restricted topography is associated with supply inelasticity.Footnote 26 Overall, theory predicts that high supply elasticity is associated with a greater construction response to a demand shock, implying a higher degree of mean reversion. Therefore, high regulation, high topographic interruption, and cities previously in a state of decline are predicted to have more sustainable levels of real house price following a growth acceleration when the demand shock leading to the acceleration is permanent.

Table 4 presents results of models investigating whether house price elasticities affect acceleration episodes. The 4-years mean reversion is tested across samples partitioned by different housing supply elasticity variables at the sample median for the particular indicator. The first column, again, gives the baseline estimate from the first column of Table 2. Columns 2 and 3 present dynamics in high versus low housing regulation areas, estimated using the WRLURI. While this variable is calculated in the mid-2000s, and may suffer from endogeneity bias, this is the best available variable measuring regulation over a cross-section of cities. Columns 4 and 5 present estimates for samples with high and low levels of topographic interruption, using the elasticity estimates of Saiz (2010). Columns 6 and 7 show differences between cities in long-run decline versus those with stable or growing economies.Footnote 27

The number of observations in each regression indicate a higher number of growth accelerations in high regulation, high topographically interrupted, and non-declining cities. Because the number of accelerations is not similar across areas of different elasticities, this result reinforces the argument of Davidoff (2014), who argues that supply elasticity measures are often correlated with demand factors.Footnote 28 Estimates in this table show that real house price accelerations have less mean reversion in high regulation cities, as is consistent with theory. The degree of topographic interruption appears to have less of an effect on mean reversion.Footnote 29 Finally, for areas in long-run decline, in the rare occurrence of a growth acceleration, price dynamics are somewhat more permanent than an equivalent acceleration in a growing area. For risk management, this result implies that house price shock paths could be adjusted based on growth trends (i.e. they could be less severe in declining areas).

The Dynamics of Declines and Recoveries

The extent of the mean reversion is defined by the length of the post-acceleration period, or number of years, after the acceleration cycle ends. The length is presented as either 4 or 8 years in Table 2. To provide a fuller picture of post-acceleration dynamics, we estimate how real house price adjust in each subsequent year (e.g. 1 year later, 2 years later, etc.) after an acceleration episode. We recover the \( \widehat{\beta} \)s in these regressions and construct a time series of the degree of mean reversion for each subsequent year after an acceleration episode.Footnote 30

Price dynamics are shown in Fig. 6 for different levels of housing market regulation and whether real house price were increasing or decreasing prior to the acceleration. Several additional findings stand out from these figures. First, mean reversion has a consistent ordinal relationship with distance to the CBD within large cities at virtually all time horizons. Second, price troughs occur in years four or five in all areas of all cities. Finally, differences between CBD and suburban dynamics are most apparent in large cities.Footnote 31 This last point suggests that the severity of house price declines is not the same between different sized cities or within large cities. Credit risk management could be improved by better understanding real estate forces at a local level.

Concluding Remarks and Discussion

Mortgage risk management often uses national or state-level trends in housing markets for stress testing. This paper shows that house price cycles often vary at a local level and in predictable ways. We use a new dataset to identify substantial real house price growth accelerations within small and large cities across the United States from 1975 to 2016. This paper produces generalizable results about house price cycles between cities, variations within cities, and the dynamic recoveries of house price after substantial accelerations.

There are several stylized facts related to local acceleration episodes. Price accelerations exhibit temporal clustering and are more frequent in large cities. We identify four periods over the last 40 years when extraordinary accelerations occur on a wide scale: the private equity boom of the late 1980s, the “dot-com” boom of the late 1990s, the subprime boom of the mid 2000s, and the oil boom of the early 2010s. While California, Florida, and New England accelerate in all four periods, most areas accelerate in only one or two episodes, such as the Pacific Northwest in the late 1980s and oil-producing areas in the early 2010s.

We also explore dynamics following a period of acceleration. After several years of acceleration, price declines tend to occur everywhere. The location and extent of the declines have important implications for geographically-concentrated mortgage portfolios or products. The centers of large cities and areas in a state of long-run economic decline are most resilient to price corrections. Small cities and suburbs of large cities are most vulnerable. The full sample results are consistent with a dynamic, rational expectations model where sustained, high price are unusual for areas with high supply elasticity. Low regulation cities appear to be susceptible to more severe declines but they have only recently recorded rapid acceleration episodes—a similar pattern is produced when the dynamic results are recomputed with the high regulation sample limited to post-2000 acceleration episodes. Explained differently, in the last 15 years, the story of house price declines and recoveries seems to be less about elasticity and more that large urban areas have submarkets with differing price appreciations, declines, and recoveries. This reiterates Edlund et al.’s (2015) finding of a steepening house value gradient and Bogin et al.’s (2017) observation of steepening house price gradients in large cities over the last four decades. These facts, in turn, are potentially symptomatic of increased traffic congestion in large cities due to an increase in the number of housing units outpacing transportation network improvements.

When preceded by declining price, an acceleration results in a price level that is more sustainable than one where the acceleration was preceded by moderate growth. This reinforces concepts of long-run mean reversion common in empirical equilibrium correction models in supply elastic areas (i.e., in the suburbs of large cities and all areas of small cities) but not in the center-cities of large cities. This is another important finding for risk management and could enhance the precision of stress testing. These results therefore call into question the use of rent-price ratio, income-price ratio, or long-run trend analysis for constructing house price paths in areas near the centers of large cities.

Overall, our results indicate that initial accelerations, while perhaps overshooting, may be representative of a positive change to an area’s fundamentals. Risk measurement might be enhanced by incorporating local house price paths. Supply, demand, and price dynamics can be obscured when stress paths are constructed at the state or national level. While these dynamics may be offsetting for aggregated portfolios, use of disaggregated metrics could result in a more efficient use of capital for less geographically diversified holdings.

Change history

07 November 2019

The article Local House Price Paths: Accelerations, Declines, and Recoveries written by Alexander N. Bogin, William M. Doerner and William D. Larson was originally published electronically on the publisher���s internet portal (currently SpringerLink) on December 2017 without open access.

Notes

After last decade’s crisis and the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, large banks and regulated financial institutions have been required to estimate capital sufficiency using scenarios provided by the Federal Reserve Board as part of their annual Comprehensive Capital Analysis and Review (CCAR) report. These scenarios include a national house price stress path which is based upon the historical decline between 2007 and 2009. Recent press release announcements suggest that a more dynamic methodology might be used in the future.

Both Mian and Sufi (2009) and Guerrieri et al. (2013) rely on data from the Case-Shiller ZIP code-level house price indices. This data series is proprietary and begins in the late 1980s, with coverage including 1498 ZIP codes beginning in 1990 (see Column 3 of Table 2 in Guerrieri et al. 2013). The data used in our study is the Bogin et al. (2017) dataset, which is publicly available and spans nearly six times as many ZIP codes beginning in 1990 (nearly 9000). This dataset has coverage dating back to the mid-1980s, with over 4400 beginning before 1980 and over 6000 before 1985, making it ideal to study within-city house price cycles over a 40 year period. It was first released in May 2016 and updated with new data in February 2017.

House price paths have important practical uses for financial valuation. To provide a few examples, portfolio managers might need to know how quickly house price could accelerate to determine interest rate risk from prepayments or to place non-housing investments in shorter-term durations to later purchase more mortgage assets, modelers might be interested in how far house price could fall to compute potential losses and either sell off certain risky assets or purchase adequate hedges, or mortgage security issuers might want to know how quickly house price could accelerate to better estimate prepayment speeds that will affect reference pools and trigger events that alter investor payouts and security price.

CBSAs are metropolitan and micropolitan geographic areas defined by the White House’s Office of Management and Budget using Census data. We rely on the February 2013 definitions that were revised on July 2015. Nominal price are converted into real terms using the all items consumer price index for all urban consumers produced by the Bureau of Labor Statistics.

Robustness tests for these and other criteria are presented in Table 3. The results are qualitatively similar to our primary findings.

These measures may be vulnerable to estimation error in the indices during the first or fourth year of the acceleration. This may cause inappropriate classifications of acceleration episodes, and may bias findings towards mean reversion.

While these two cases are clearly confounded by contemporaneous economic events, necessitating control variables, they serve to illustrate two of the more common dynamic responses to an acceleration episode.

Since it takes 4 years to identify episodes, we drop ZIP codes before 1980 and where the end of the acceleration is undefined. To preserve data observations, the second criterion is not treated as binding in the first 8 years that an index is observed.

To focus on unique acceleration episodes, once a ZIP code has been identified as accelerating it cannot be identified again for another 4 years.

The CBD ZIP code is calculated as the maximum value within the CBSA of the inverse of the standardized land area plus the standardized share of housing units in 20+ unit structures. Land area data are from the Census’ TIGER line shapefiles, and structure type is from the 1990 Decennial Census, the earliest census for which ZIP code data are available. Distance to the CBD is calculated as the distance between a ZIP code’s centroid and the CBD ZIP code’s centroid.

Per a referee’s suggestion, we also created this figure for high regulation and low regulation cities. High regulation, or relatively inelastic, cities exhibit far more acceleration episodes. Low regulation cities, though, have seen a rise in acceleration episodes mainly during last decade’s boom and over the last several years.

An exception to this finding is the period between 1999 and 2003, when accelerations are found primarily in the centers of large cities.

The SUM of Alonso (1964), Mills (1967), and Muth (1969) assumes that households can freely migrate within a city. This results in a house price gradient within a city as a function of commuting costs, often represented as a function of distance to the CBD. A positive demand shock for housing in a city therefore results in a shift of house price in all areas of the city. The SUM with one household type and linear transportation costs is incompatible with differential appreciation rates within the city because of Muth’s Equation. However, household heterogeneity may give multiple bid rent curves and housing construction in a congested city may cause rotations of the bid-rent curve. Thus, differential dynamics are consistent with simple extensions of the model.

We thank a referee for asking about how episodes vary across market elasticities and include Figure 5 as evidence.

Davis and Weinstein (2002) examine distinct changes in population demographics in Japan in the years following Allied bombings in World War II. In a similar manner, we adapt their approach to study the after-effects of a rapid appreciation of house price. We deliberately pick out very quick and large price increases because their speed and size suggest a delayed supply response. These appreciation episodes are likely to be transitory as new construction increases and existing stock turns over. The Davis and Weinstein approach is attractive because it studied the mean reversion after such a kind of shock and, with our data, it can offer information about both the amplitude (mean reversion) and frequency (how long it takes to get back to the same level) of house price cycles. Admittedly, house price shocks may not be completely exogenous. We test the robustness of our results against endogeneity concerns and discuss the results in footnote 21.

There is a large body of empirical literature on house price as mean-reverting series. This is based on the idea that a bubble exists if a price level is in excess of a long-run price/income ratio (Malpezzi 1999), house price/rental price ratio (Gallin 2006), or a long-run trend (Smith et al. 2015). These studies focus on MSAs or states, implicitly assuming that all submarkets within the region behave in the same manner. While these models may be predictive at the city or state level, they are unable to determine conditions related to differential rates of mean reversion within cities.

The table results include interactions of all four location groups with city size for consistency with earlier figures. Some areas, like the exurbs, might seem better defined without the interaction. However, we do find different point estimates and report them to encourage researchers who are interested in the dynamics of rural areas (particularly as that relates to mortgage collateral risk of the USDA and VA).

Note that a real decline in house price of 25% over four years will be due, in part, to inflation. Therefore, in periods with positive inflation, nominal price declines are lower. For instance, with an annual average rate of inflation of 2% per year, a real decline of 25% gives a nominal decline of approximately 17%.

While the hypothesis β = − 1 cannot be rejected for most parameters individually, a parsimonious but less illustrative model can reject the null of no effect of distance from the CBD interacted with city size. This model with clustered standard errors by year in parentheses is:

$$ \Delta {p}_{t,t+4}={\alpha}_t-3.70(0.32)\Delta {p}_{t-4,t}-0.01(0.01)k-0.07(0.01)n+0.21(0.02)n\Delta {p}_{t-4,t}+0.09(0.03)k\Delta {p}_{t-4,t}-0.009(0.002) nk\Delta {p}_{t-4,t} $$where n is the log population and k is the log distance to the CBD.

Per a referee’s suggestion, we also performed these estimations while instrumenting for post-2000 acceleration episodes using the percentage of subprime borrowers in each ZIP code as of December 1996. Our approach mirrors Mian and Sufi (2011) who use the same instrument to identify exogenous variation in ZIP code-level house price appreciation between 2002 and 2006. Our IV passes all the standard tests and we observe qualitatively similar results between the OLS and 2SLS specifications.

Two potential sources of bias should be noted that are both related to estimation error in the house price indices. The first biases results towards the finding of mean reversion, and is due to left-censoring of episodes classified as accelerations. The second biases results towards the finding of permanent effects, and is caused by attenuation in β.

This possibility is highlighted by Lee et al. (2015), who develop a model where the house price level is correlated with future appreciation. They argue that a high price level indicates strong current and future expectations of economic fundamentals. In this context, an acceleration in price could represent a permanent shift of housing demand in an area.

We caution against interpreting this as large cities having less credit risk or lower severity of predicted losses given default. As we will show later, the post-acceleration decline and recovery of price can vary by location in large cities. A singular shock path might be appropriate for small cities but could grossly overstate or understate the extent of mortgage losses in large cities where price and appreciations are more strongly related to location.

The adjustments are described in terms of mean reversion of house price levels because the literature takes that approach. We would prefer to frame these movements as a sinusoidal pattern (although not always symmetric house price have persistence and do not result from independent draws of shocks in each period) where column 3 includes episodes with lower amplitudes and column 6 stretches out the periodicity without also increasing the amplitude. Both effects serve to dampen the waves, leaving smaller average increases to be accompanied by muted decreases, and reducing the absolute magnitudes in the estimated coefficients.

The regulation and topography predictions are intuitive at first glance, but the decline prediction may not be. The logic for a lower elasticity of housing supply in a declining area is as follows. Cities in long-run decline often face home values far below the replacement cost of structures. Increases to demand for housing do not often increase the value of the existing housing stock above replacement cost. This demand shock results in limited housing construction, giving a low elasticity of housing supply.

Our long-run urban decline index is the standardized change in the aggregate value of the housing stock between 1970 and 1990. Positive values indicate decline. The housing stock value incorporates both price and quantity changes, making the measure both reflective of demand and invariant to differences in the elasticity of housing supply across areas. This is in contrast to quantity measures such as population and housing stock, which fail to identify demand in inelastic areas.

Acceleration episodes tend to occur more frequently in inelastic areas, i.e. high regulation or high topographic interruptions. Slightly more acceleration episodes fall in high regulation categories than in high topographic interruption. Comparing between the elasticity measures, over 3/4 of observed episodes fall in both inelastic categories, which results in similar magnitudes and patterns when comparing between those inelastic categories (Columns 2 and 4).

As a referee aptly pointed out, unlike their inelastic counterparts, the elastic subsamples exhibit dissimilar results and we believe there are two main causes. First, half as many episodes happen in low regulation areas, which leaves a small sample size and one that is concentrated with post-2000 episodes. Second, the two elastic subsamples flip their distributions across small and large city size—nearly 70% of low regulation areas are in small cities while nearly 70% of low topographic areas are in large cities. This is a stark contrast that is worth noting by researchers and policy makers when considering between elasticity measures.

Note this procedure does not impose any functional form or even mean reversion on the house price paths. We alter the dependent variable to different lengths since the peak and then construct time series with the estimated coefficients of different model samples to show the evolution.

Panel (d) shows exurbs do not follow traditional patterns for low regulation cities. Future research could explore whether these dynamics are an artifact of a small sample size or unique behavior in those rural areas.

References

Alonso, W. (1964). Location and land use: Toward a general theory of land rent. Cambridge: Harvard University Press.

Bogin, A., Doerner, W., & Larson, W. (2017). Local house price dynamics: New indices and stylized facts. Real Estate Economics, forthcoming.

Case, K. E., & Shiller, R. J. (1989). The efficiency of the market for single-family homes. American Economic Review, 79(1), 125–137.

Case, K. E., & Shiller, R. J. (2003). Is there a bubble in the housing market? Brookings Papers on Economic Activity, 2003(2), 299–342.

Davidoff, T. (2013). Supply elasticity and the housing cycle of the 2000s. Real Estate Economics, 41(4), 793–813.

Davidoff, T. (2014). Supply constraints are not valid instrumental variables for home price because they are correlated with many demand factors. Working paper series, Social Science Research Network.

Davis, D. R., & Weinstein, D. E. (2002). Bones, bombs, and break points: The geography of economic activity. The American Economic Review, 92(5), 1269–1289.

Dell’Ariccia, G., Igan, D., & Laeven, L. (2012). Credit booms and lending standards: evidence from the subprime mortgage market. Journal of Money, Credit and Banking, 44(2–3), 367–384.

Edlund, L., Machado, C., & Sviatchi, M. (2015). Bright minds, big rent: Gentrification and the rising returns to skill. Working Paper 21729, National Bureau of Economic Research.

Favara, G., & Imbs, J. (2015). Credit supply and the price of housing. American Economic Review, 105(3), 958–992.

Gallin, J. (2006). The long-run relationship between house price and income: evidence from local housing markets. Real Estate Economics, 34(3), 417–438.

Glaeser, E. L., & Gyourko, J. (2005). Urban decline and durable housing. Journal of Political Economy, 113(2), 345–375.

Glaeser, E. L., Gyourko, J., & Saiz, A. (2008). Housing supply and housing bubbles. Journal of Urban Economics, 64(2), 198–217.

Glaeser, E. L., Gyourko, J., Morales, E., & Nathanson, C. G. (2014). Housing dynamics: An urban approach. Journal of Urban Economics, 81, 45–56.

Guerrieri, V., Hartley, D., & Hurst, E. (2013). Endogenous gentrification and housing price dynamics. Journal of Public Economics, 100, 45–60.

Gyourko, J., Saiz, A., & Summers, A. (2008). A new measure of the local regulatory environment for housing markets: The Wharton residential land use regulatory index. Urban Studies, 45(3), 693–729.

Hausmann, R., Pritchett, L., & Rodrik, D. (2010). Growth accelerations. Journal of Economic Growth, 10(4), 303–329.

Head, A., Lloyd-Ellis, H., & Sun, H. (2014). Search, liquidity, and the dynamics of house price and construction. American Economic Review, 104(4), 1172–1210.

Lee, N. J., Seslen, T. N., & Wheaton, W. C. (2015). Do house price levels anticipate subsequent price changes within metropolitan areas? Real Estate Economics, 43(3), 782–806.

Malpezzi, S. (1999). A simple error correction model of house price. Journal of Housing Economics, 8(1), 27–62.

Mian, A., & Sufi, A. (2009). The consequences of mortgage credit expansion: Evidence from the U.S. mortgage default crisis. The Quarterly Journal of Economics, 124(4), 1449–1496.

Mian, A., & Sufi, A. (2011). House price, home equity-based borrowing, and the US household leverage crisis. The American Economic Review, 101(5), 2132–2156.

Mills, E. S. (1967). An aggregative model of resource allocation in a metropolitan area. American Economic Review, 57(2), 197–210.

Muth, R. F. (1969). Cities and housing: The spatial pattern of urban residential land use. Chicago: University of Chicago Press.

Ortalo-Magné, F. & Rady, S. (2006). Housing Market Dynamics: On the contribution of income shocks and credit constraints. The Review of Economic Studies, 73(2), 459–485.

Saiz, A. (2010). The geographic determinants of housing supply. The Quarterly Journal of Economics, 125(3), 1253–1296.

Smith, S., Fuller, D., Bogin, A., Polkovnichenko, N., & Weiher, J. (2015). Countercyclical capital regime revisited: Tests of robustness. Journal of Economics and Business, 84, 50–78.

Acknowledgements

The authors are grateful for thorough and constructive suggestions provided by an anonymous reviewer. They also thank Andy Leventis, Tony Yezer, and seminar participants at the Department of Housing and Urban Development, Freddie Mac, and the AREUEA mid-year meetings, who provided helpful questions, comments, and discussion. The analysis and conclusions are those of the authors and do not necessarily represent the views of the Federal Housing Finance Agency or the United States.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The authors declare that they have no conflict of interest and no outside funding was received.

Additional information

The original version of this article was revised due to a retrospective Open Access order

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, duplication, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

About this article

Cite this article

Bogin, A.N., Doerner, W.M. & Larson, W.D. Local House Price Paths: Accelerations, Declines, and Recoveries. J Real Estate Finan Econ 58, 201–222 (2019). https://doi.org/10.1007/s11146-017-9643-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-017-9643-y