Abstract

We examine the association between online apartment rental searches and fundamental real estate market variables namely, vacancy rates, rental rates and real estate asset price returns. We find that consumer real estate searches are significantly associated with the market fundamentals after controlling for known determinants of these variables. In particular, we show that apartment rental-related online searches are endogenously and contemporaneously associated with reduced vacancy rate. However, the association between the searches and rental rates is not significant. The searches are also contemporaneously associated with positive returns on the appraised values of multifamily assets. There is some evidence that the searches are fundamentally associated with REIT returns in the short run and that REIT investors watch the online search trends to inform their stock pricing decisions.

Similar content being viewed by others

Notes

See http://www.businessweek.com/articles/2012-08-09/google-central-banks-new-economic-indicator. Retrieved February 9, 2014.

See “Getting real-time: Internet economic indicator”s, June 14 2011 issue of The Economist.

See http://forbesindia.com/printcontent/22482. Retrieved February 9, 2014.

See http://libertystreeteconomics.newyorkfed.org/2012/01/forecasting-with-internet-search-data.html. Retrieved February 9, 2014.

The MSAs in our sample include: Phoenix (AZ), Los Angeles (CA), San Diego (CA), San Francisco (CA), Denver (CO), Washington (DC), Fort Lauderdale (FL), Orlando (FL), Tampa (FL), West Palm Beach (FL), Atlanta (GA), Chicago (IL), Baltimore (MD), Bethesda (MD), Charlotte (NC), New York (NY), Portland (OR), Austin (TX), Dallas (TX), Fort Worth (TX), and Houston (TX).

They measure illiquidity as the ratio of the absolute daily return to trading volume summed over a month.

See https://support.google.com/trends. Retrieved February 9, 2014.

See http://support.google.com/insights/bin/answer.py?hl=en&answer=94792. Retrieved February 9, 2014.

Rental rate and operating expense data for San Francisco for the 2010 Q3 was imputed by straight-lining the adjacent quarter values. The I4S data from Miami was applied to Fort Lauderdale, FL. The Washington DC I4S data was applied to Bethesda, MD. Also, the same I4S data was repeated for Dallas, TX and Fort Worth, TX metros.

Ticker symbols of REITs included are: AIV, AVB, BMR, CPT, CUZ, DEI, EQR, EQY, ESS, FRT, HME, MAA, PIR, PPS, UDR, VNO and WRE.

See appendix Note 1 for details.

Details are available upon request.

We also examine the model that replaces the average of the last 4 quarters of the I4S by the quarterly averaged I4S. The results are similar.

Although not reported, results from such models are similar and are available upon request.

See Derwall et al. (2009) for the expected coefficient signs.

Detailed results are available upon request.

References

Bank, M., & Larch, M. P. (2011). Google search volume and its influence on liquidity and returns of German stocks. Financial Markets and Portfolio Management, 25, 239–264.

Barber, B. M., & Odean, T. (2008). All that glitters: the effect of attention and news on the buying behavior of individual and institutional investors. Review of Financial Studies, 21(2), 785–818.

Beracha, E., & Wintoki, M. B. (2013). Forecasting residential real estate price changes from online search activity. Journal of Real Estate Research, 35(3), 283–312.

Bolster, P. J., Trahan, E., & Venkateswaran, A. (2012). How mad is mad money? Jim Cramer as a stock picker and portfolio manager. Journal of Investing, 21(2), 27–39.

Chervachidze, S., Costello, J., & Wheaton, W. C. (2009). The secular and cyclic determinants of capitalization rates: the role of property fundamentals, macroeconomic factors, and “structural changes”. The Journal of Portfolio Management, 35(5), 50–69.

Choi, H., & Varian, H. (2009, April). Predicting the Present with Google Trends. Retrieved September 12, 2009, from Google, Inc.: http://static.googleusercontent.com/external_content/untrusted_dlcp/www.google.com/en/us/googleblogs/pdfs/google_predicting_the_present.pdf.

Clayton, J., Ling, D. C., & Naranjo, A. (2009). Commercial real estate valuation: fundamentals versus investor sentiments. Journal of Real Estate Finance and Economics, 38, 5–37.

Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. Journal of Finance LXVI, 5, 1461–1499.

Derwall, J., Huij, J., Brounen, D., & Marquering, W. (2009). REIT momentum and the performance of real estate mutual funds. Financial Analyst Journal, 65(5), 24–34.

Drake, M. S., Roulstone, D. T., Thornock, J. R. (2012). Investor information demand: evidence from google searches around earnings announcements. Journal of Accounting Research, Forthcoming.

Ghysels, E., Plazzi, A., Torous, W., Valkanov, R. (2012, July 1). Forecasting Real Estate Prices. Retrieved July 18, 2012, from UCSD: rady.ucsd.edu/faculty/directory/valkanov/docs/HandRE_GPTV.pdf

Grenadier, S. R. (1995). Local and national determinants of office vacancies. Journal of Urban Economics, 37(1), 57–71.

Hohenstatt, R., Käsbauer, M., & Schäfers, W. (2011). “Geco” and Its potential for real estate research: evidence from the US housing market. Journal of Real Estate Research, 33(4), 471–506.

Joseph, K., Wintoki, M. B., Zhang, Z. (2011). Forecasting abnormal stock returns and trading volume using investor sentiment: evidence from online search. International Journal of Forecasting, Forthcoming.

Kahneman, D. (1973). Attention and effort. Englewood Cliff: Prentice Hall.

Merton, R. (1987). A simple model of capital market equilibrium with incomplete information. The Journal of Finance, 42(3), 483–510.

Neumann, J. J., & Kenny, P. M. (2007). Does mad money make the market go mad? The Quarterly Review of Economics and Finance, 47, 602–615.

Peng, L., & Xiong, W. (2006). Investor attention, overconfidence and category learning. Journal of Financial Economics, 80, 563–602.

Rosen, K. T., & Smith, L. B. (1983). The price adjustment process and the natural vacancy rate. American Economic Review, 73, 779–786.

Vlastakis, N., & Markellos, R. N. (2012). Information demand and stock market volatility. Journal of Banking and Finance, 36, 1808–1821.

Voith, R., & Chrone, T. (1988). Natural vacancy rates and the persistence of shocks in U.S. office markets. AREUEA Journal, 16, 437–458.

Wu, L., & Brynjolfsson, E. (2009). The future of prediction: How google searches foreshadow housing prices and sales. Cambridge: MIT Working Papers.

Acknowledgments

An earlier version of this paper won the best manuscript award at the American Real Estate Society (ARES) annual conference in Seattle (2011). Authors are thankful to Jonathan Wiley, Karen Gibler and the anonymous reviewers for their intellectual contributions. The paper has benefitted from the participants at the AREUEA mid-year conference (2011, Washington DC). Feedback from the following persons is highly appreciated: Vivek Sah, Julian Diaz III, Tim Riddiough, Jay Hartzell, Alan Tidwell, Philip Seagraves, Julia Freybote, Dongshin Kim, SungHan Ro, Frank Gyamfi-Yeboah, Kenneth Soyeh, Patrick Smith, Alan Ferguson, Yu Liu, Paul Seguin.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Grenadier (1995) andVoith and Chrone (1988) detail the association between vacancy rates and natural vacancy rates. The current deviation of vacancy rates from the natural vacancy rates determines the degree to which a real estate market is out of equilibrium. The observed vacancy rate (VAC) in a market i during quarter t is the sum of the natural vacancy rate (Vn) and the deviation from it. Local fixed effects and time-varying macroeconomic factors determine the natural vacancy rate. For estimation purposes, the macroeconomic factors are shown as a polynomial of time. Grenadier (1995) proposes a fourth degree polynomial (i.e., j = 4). The deviation ε i,t exhibits persistence (ρ) such that it is an MA(1) process.

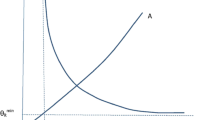

Comparing Old versus New I4S Series. Notes: Both graphs depict the Google Insights for Search (I4S) Indices extracted over different Time-frames. The Solid line depicts the new I4S sub-category series titled “Apartments and Residential Rentals”. The dotted line depicts the series from a corresponding older sub-category series (based on thee taxonomy was phased-out in 2011) titled “Rental Listings & Referrals”. The two time-series shown in the graph exhibit a correlation of 92.5 %

Comparing New I4S Series extracted over Different Time-Frames. Notes: Both graphs depict the Google Insights for Search (I4S) Index in ‘Apartments and Residential Rentals’ sub-category extracted over different time frames. The data for solid lines is extracted for January 2004 – December 2011 time-frame. The data for dotted lines is extracted for January 2004- December 2010 Time Windows. The two time-series exhibit a correlation of 98.7 %

Rights and permissions

About this article

Cite this article

Das, P., Ziobrowski, A. & Coulson, N.E. Online Information Search, Market Fundamentals and Apartment Real Estate. J Real Estate Finan Econ 51, 480–502 (2015). https://doi.org/10.1007/s11146-015-9496-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9496-1