Abstract

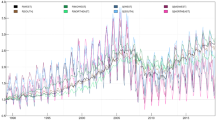

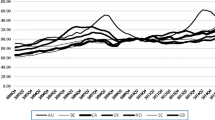

This paper examines persistence in price movements and predictability of the US housing market both on a local level across 20 cities in the US and on a nationwide level. We use a time series approach instead of often applied multivariate approaches to exclude potential biases across local markets and provide trading strategies to compare predictability across markets and to test whether or not the detected persistence can be exploited by investors to earn excess returns. The results from the monthly and quarterly transaction-based S&P/Case-Shiller house price indices from 1987 to 2009 provide empirical evidence on strong persistence. This is confirmed by both parametric and non-parametric tests for nominal and real house prices based on expected inflation. Furthermore, the empirical findings suggest that investors might be able to obtain excess returns from both autocorrelation-based and moving average-based trading strategies compared to a buy-and-hold strategy, although the results depend on the transaction costs individual investors face.

Similar content being viewed by others

Notes

A random walk process means that any shock to the index is permanent and that there is no tendency for the index level to return to a trend path over time. In contrast, if indices follow a mean-reverting process, there generally exists a tendency for the index level to return to its trend path over time, and investors may be able to forecast future index changes by using information on past price changes (Chaudhuri and Wu, 2003).

See Standard and Poor’s (2009) for further information on index construction methodology.

However, the monthly indices are moving averages of the actual month and the two preceding months. Thus, the results from short-term autocorrelation like autocorrelation of order one and two are highly influenced by this index construction methodology. This has to be considered when analyzing the results in “Empirical Results from Analyzing Persistence in Nominal Changes in S&P/CS HPI”. Furthermore, the variance ratio with lag interval q = 2 suffers from the same problem. As a robustness check, higher order autocorrelation and variance ratios with higher lag intervals are calculated as well.

See Standard and Poor’s (2009). The data for the stock, the average value, and the aggregate value of single-family housing are reported for 2000 only, since the data are based on the decennial US Census.

The descriptive statistics for the non-overlapping quarterly price changes of the S&P/CS HPI are presented in Table 13.

The authors thank an anonymous referee for offering this valuable comment.

In addition to the autoregressive model, we also specified a model using Hondrick-Prescott filters. However, the time series of expected inflation rates is smooth. Applying this time series for deflating house prices does not significantly change the characteristics of the time series of the nominal house prices, meaning that the statistical results from testing persistence do not differ much. For brevity, the results from the rational expectation formation model are not presented but available from the author upon request. In comparison to the AR model, the test statistics are similar and persistence is very high even if the strongest effect on deflating house prices and thus the lowest level of persistence in deflated house prices is expected.

The difference of one month in the time span can be neglected and is not crucial for the performance.

The two trading strategies are also conducted for inflation-adjusted data. However, the results do not mainly differ and are available from the authors upon request.

References

Abraham, A., Fazal, F. J., & Alsakran, S. A. (2002). Testing the random walk behavior and efficiency of the gulf stock markets. Financial Review, 37(3), 469–480.

Agbeyegbe, T. D. (1994). Some stylised facts about the Jamaica stock market. Social and Economic Studies, 43(4), 143–156.

Barkham, R. J., & Geltner, D. M. (1996). Price discovery and efficiency in the UK housing market. Journal of Housing Economics, 5(1), 41–63.

Barnes, P. (1986). Thin trading and stock market efficiency: the case of the Kuala Lumpur stock exchange. Journal of Business Finance and Accounting, 13(4), 609–617.

Bertus, M., Hollans, H., & Swidler, S. (2008). Hedging house price risk with CME futures contracts: the case of Las Vegas residential real estate. Journal of Real Estate Finance and Economics, 37(3), 265–279.

Butler, K. C., & Malaikah, S. J. (1992). Efficiency and inefficiency in thinly traded stock markets: Kuwait and Saudi Arabia. Journal of Banking & Finance, 16(1), 197–210.

Campbell, J. Y., Lo, A. W., & MacKinlay, A. C. (1997). The econometrics of financial markets. Princeton.

Case, K. E., & Shiller, R. J. (1989). The efficiency of the market for single-family homes. The American Economic Review, 79(1), 125–137.

Case, K. E., & Shiller, R. J. (1990). Forecasting prices and excess returns in the housing market. Journal of the American Real Estate and Urban Economics Association, 18(3), 253–273.

Case, K. E., Shiller, R. J., & Weiss, A. N. (1991). Index-based futures and options markets in real estate. Cowles Foundation Discussion Paper, No. 1006.

Case, K. E., Shiller, R. J., & Weiss, A. N. (1995). Mortgage default risk and real estate prices: the use of index-based futures and options in real estate. NBER Working Paper Series, No. 5078.

Chang, K.-P., & Ting, K.-S. (2000). A variance ratio test of the random walk hypothesis for Taiwan’s stock market. Applied Financial Economics, 10(5), 525–532.

Chaudhuri, K., & Wu, Y. (2003). Random walk versus breaking trend in stock prices: evidence from emerging markets. Journal of Banking & Finance, 27(4), 575–595.

Chow, K. V., & Denning, K. C. (1993). A simple multiple variance ratio test. Journal of Econometrics, 58(3), 385–401.

Clayton, J. (1998). Further evidence on real estate market efficiency. Journal of Real Estate Research, 15(1/2), 41–57.

Errunza, V. R., & Losq, E. (1985). The behavior of stock prices on LDC markets. Journal of Banking & Finance, 9(4), 561–575.

Fama, E. F. (1970). Efficient capital markets: a review of theory and empirical work. The Journal of Finance, 25(2), 383–417.

Fama, E. F. (1991). Efficient capital markets: II. The Journal of Finance, 46(5), 1575–1617.

Fama, E. F., & French, K. R. (1988). Permanent and temporary components of stock market prices. Journal of Political Economy, 96(2), 246–273.

Gatzlaff, D. H. (1994). Excess returns, inflation and the efficiency of the housing market. Journal of the American Real Estate and Urban Economics Association, 22(4), 553–581.

Gatzlaff, D. H., & Tirtiroglu, D. (1995). Real estate market efficiency: issues and evidence. Journal of Real Estate Literature, 3(2), 157–189.

Gau, G. W. (1984). Weak form test of the efficiency of real estate investment markets. Financial Review, 19(4), 301–320.

Gau, G. W. (1985). Public information and abnormal returns in real estate investemnt. Journal of the American Real Estate and Urban Economics Association, 13(1), 15–31.

Graff, R. A., & Young, M. S. (1997). Serial persistence in equity REIT returns. Journal of Real Estate Research, 14(3), 183–214.

Grieb, T., & Reyes, M. G. (1999). Random walk tests for Latin American equity indexes and individual firms. Journal of Financial Research, 22(4), 371–383.

Gu, A. Y. (2002). The predictability of house prices. Journal of Real Estate Research, 24(3), 213–233.

Hahn, G. R., & Hendrickson, R. W. (1971). A table of percentage points of the distribution of large absolute value of k Student t variates and its applications. Biometrika, 58(2), 323–332.

Hosios, A. J., & Pesando, J. E. (1991). Measuring prices in resale housing markets in Canada: evidence and implications. Journal of Housing Economics, 1(4), 303–317.

Huang, B. (1995). Do Asian stock market prices follow random walks? Evidence from the variance ratio test. Applied Financial Economics, 5(4), 251–256.

Jarque, C. M., & Bera, A. K. (1980). Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economic Letters, 6(3), 255–259.

Karemera, D., Ojah, K., & Cole, J. A. (1999). Random walks and market efficiency tests: evidence from emerging equity markets. Review of Quantitative Finance and Accounting, 13(2), 171–188.

Kleiman, R. T., Payne, J. E., & Sahu, A. P. (2002). Random walk and market efficiency: evidence from international real estate markets. Journal of Real Estate Research, 24(3), 279–297.

Kuhle, J. L., & Alvayay, J. R. (2000). The efficiency of equity REIT prices. Journal of Real Estate Portfolio Management, 6(4), 349–354.

Kuo, C.-L. (1996). Serial correlation and seasonality in the real estate market. Journal of Real Estate Finance and Economics, 12(2), 139–162.

Larsen, E. R., & Weum, S. (2008). Testing the efficiency of the Norwegian housing market. Journal of Urban Economics, 64(2), 510–517.

Laurence, M. M. (1986). Weak form efficiency in the Kuala Lumpur and Singapore stock markets. Journal of Banking & Finance, 10(3), 431–445.

Li, Y., & Wang, K. (1995). The predictability of REIT returns and market segmentation. Journal of Real Estate Research, 10(4), 471–482.

Liao, H.-H., & Mei, J. (1998). Risk characteristics of real estate related securities: an extension of Liu and Mei (1992). Journal of Real Estate Research, 16(3), 279–290.

Lim, K.-P., Habibullah, M. S., & Hinich, M. J. (2009). The weak-form efficiency of Chinese stock markets: thin trading, nonlinearity and episodic serial dependencies. Journal of Emerging Market Finance, 8(2), 133–163.

Linneman, P. (1986). An empirical test of the efficiency of the housing market. Journal of Urban Economics, 20(2), 140–154.

Liu, C. Y., & He, J. (1991). A variance-ratio test of random walks in foreign exchange rates. Journal of Finance, 46(2), 773–785.

Liu, C. H., & Mei, J. (1992). The predictability of returns on equity REITs and their co-movement with other assets. Journal of Real Estate Finance and Economics, 5(4), 401–418.

Lo, A. W., & MacKinlay, A. C. (1988). Stock market prices do not follow random walks: evidence from a simple specification test. Review of Financial Studies, 1(1), 41–66.

Lo, A. W., & MacKinlay, A. C. (1989). The size and power of the variance ratio test in finite samples. Journal of Econometrics, 40(2), 203–238.

Maier, G., & Herath, S. (2009). Real estate market efficiency—a survey of literature. SRE-Discussion Paper, 2009–07.

McDuff, D. (2010). Home price risk, local market shocks, and index hedging. Journal of Real Estate Finance and Economics. doi:10.1007/s11146-010-9255-2.

Meen, G. (2000). Housing cycles and efficiency. Scottish Journal of Political Economy, 47(2), 114–140.

Mei, J., & Gao, B. (1995). Price reversal, transaction costs, and arbitrage profits in the real estate securities market. Journal of Real Estate Finance and Economics, 11(2), 153–165.

Mei, J., & Lee, A. (1994). Is there a real estate factor premium? Journal of Real Estate Finance and Economics, 9(2), 113–126.

Mei, J., & Liu, C. H. (1994). The predictability of real estate returns and market timing. Journal of Real Estate Finance and Economics, 8(2), 115–135.

Nelling, E., & Gyourko, J. (1998). The predictability of equity REIT returns. Journal of Real Estate Research, 16(3), 251–268.

OFHEO (2008). Revisiting the differences between the OFHEO and S&P/Case-Shiller house price indexes: new explanations. http://www.fhfa.gov/webfiles/1163/OFHEOSPCS12008.pdf.

Ojah, K., & Karemera, D. (1999). Random walk and market efficiency tests of Latin American emerging equity markets: a revisit. Financial Review, 34(2), 57–72.

Poterba, J., & Summers, L. (1988). Mean-reversion in stock prices: evidence and implications. Journal of Financial Economics, 22(1), 27–59.

Richardson, M., & Stock, J. H. (1989). Drawing inferences from statistics based on multiyear asset returns. Journal of Financial Economics, 15(2), 323–348.

Rosenthal, L. (2006). Efficiency and seasonality in the UK housing market, 1991–2001. Oxford Bulletin of Economics and Statistics, 68(3), 289–317.

Ryoo, H.-J., & Smith, G. (2002). Korean stock prices under price limits: variance ratio tests of random walks. Applied Financial Economics, 12(7), 545–553.

Schindler, F., Rottke, N., & Fuess, R. (2010). Testing the predictability and efficiency of securitized real estate markets. Journal of Real Estate Portfolio Management, 16(2), 159–179.

Serrano, C., & Hoesli, M. (2010). Are securitized real estate returns more predictable than stock returns? Journal of Real Estate Finance and Economics, 41(2), 170–192.

Shiller, R. J. (2008). Derivatives markets for home prices. No: NBER Working Paper Series. 13962.

Smith, G., Jefferis, K., & Ryoo, H.-J. (2002). African stock markets: multiple variance ratio tests of random walks. Applied Financial Economics, 12(7), 475–484.

Standard and Poor’s (2009). S&P/Case-Shiller home price indices—index methodology.

Stevenson, S. (2002). Momentum effects and mean reversion in real estate securities. Journal of Real Estate Research, 23(1/2), 47–64.

Stoline, M. R., & Ury, H. K. (1979). Tables of the studentized maximum modulus distribution and an application to multiple comparisons among means. Technometrics, 21(1), 87–93.

Summers, L. (1986). Does the stock market rationally reflect fundamental values? The Journal of Finance, 41(3), 591–600.

Urrutia, J. L. (1995). Tests of random walk and market efficiency for Latin American emerging equity markets. Journal of Financial Research, 43(3), 299–309.

Young, M. S., & Graff, R. A. (1996). Systematic behavior in real estate investment risk: performance persistence in NCREIF returns. Journal of Real Estate Research, 12(3), 369–381.

Acknowledgements

We thank the editor J. B. Kau, an anonymous referee, Roland Füss, Tim-Alexander Kröncke, and Peter Westerheide for very constructive and helpful comments. All errors are ours.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Schindler, F. Predictability and Persistence of the Price Movements of the S&P/Case-Shiller House Price Indices. J Real Estate Finan Econ 46, 44–90 (2013). https://doi.org/10.1007/s11146-011-9316-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9316-1