Abstract

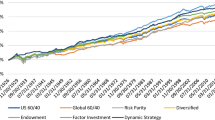

Diversification benefits of three “hot” asset classes—Commodity, Real Estate Investment Trusts (REITs), and Treasury Inflation-Protected Securities (TIPS)—are well-studied on an individual basis and in a static setting. Using data from 1970 to 2010, this paper documents both that the three asset classes are in general not substitutes for each other, and that diversification benefits of each asset class change substantially over time. Therefore, all three asset classes ought to be included in investors’ portfolios. Furthermore, we show that the observed time variation in diversification benefits can be explained by time-varying return correlations. To see the implications of these findings for asset allocation in practice, we examine the out-of-sample performance of portfolio strategies, based on a variety of correlation structures. We find that the Dynamic Conditional Correlation (DCC) model (Engle, J Bus Econ Stat 20(3):339–350, 2002) outperforms other correlation structures, such as rolling-window, historical, and constant correlations. Our findings suggest that diversification benefits of the three asset classes should be examined in a dynamic setting, and that investors need to use appropriate correlation estimates to adjust for such time variation.

Similar content being viewed by others

Notes

Gorton and Rouwenhorst (2006) find negative correlations only in low frequency data (quarterly and annually) but not in monthly data. Our result here is based on daily data, and, to some extent, complements their finding.

We also try alternative lags from 1 to 24 and find that our results are robust to the choice of different lags.

This is because all the intermediate value of v between \(v_\textrm{min}\) and \(v_\textrm{max}\) will satisfy Eq. 4 as long as both \(v_\textrm{min}\) and \(v_\textrm{max}\) do. The proof of this statement is straightforward.

The DCC model is estimated using the UCSD GARCH Toolbox provided by Kelvin Sheppard. See http://www.kevinsheppard.com/research/.

References

Andrews, D. W. (1991). Heteroskedasticity and autocorrelation consistent covariance matrix estimation. Econometrica, 59(3), 817–858.

Bekaert, G., & Urias, M. S. (1996). Diversification, integration, and emerging market closed-end funds. Journal of Finance, 51(3), 835–869.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307–327.

Cappiello, L., Engle, R., & Sheppard, K. (2006). Asymmetric dynamics in the correlations of global equity and bond returns. Journal of Financial Econometrics, 4(4), 537–572.

Case, B., Yang, Y., & Yildirim, Y. (2010). Dynamic correlations among asset classes: REIT and stock returns. Journal of Real Estate Finance and Economics, forthcoming.

Chen, H.-C., Ho, K.-Y., Lu, C., & Wu, C.-H. (2005). Real estate investment trusts: An asset allocation perspective. Journal of Portfolio Management: Real Estate Special Issue, 31(5), 46–54.

Chun, G. H., Sa-Aadu, J., & Shilling, J. D. (2004). The role of real estate in an institutional investor’s portfolio revisited. Journal of Real Estate Finance and Economics, 29(3), 295–320.

Cochrane, J. H. (1996). A cross-sectional test of an investment-based asset pricing model. Journal of Political Economy, 104(3), 572–621.

De Roon, F. A., & Nijman, T. E. (2001). Testing for mean-variance spanning: A survey. Journal of Empirical Finance, 8(2), 111–155.

De Roon, F. A., Nijman, T. E., & Werker, B. J. (2001). Testing for mean variance spanning with short sales constraints and transaction costs: The case of emerging markets. Journal of Finance, 56 (2), 721–742.

De Santis, G. (1994). Asset pricing and portfolio diversification: Evidence from emerging financial markets. In M. Howell (Ed.), Investing in emerging markets. London: Euromoney Books.

De Santis, G. (1995). Volatility bounds for stochastic discount factors: Tests and implications from international financial markets. Working paper, University of Southern California.

Elton, E. J., & Gruber, M. J. (1973). Estimating the dependence structure of share prices—Implications for portfolio selection. Journal of Finance, 28(5), 1203–1232.

Elton, E. J., Gruber, M. J., & Spitzer, J. (2006). Improved estimates of correlation coefficients and their impact on optimum portfolios. European Financial Management, 12(3), 303–318.

Elton, E. J., Gruber, M. J., & Urich, T. J. (1978). Are betas best? Journal of Finance, 33(5), 1375–1384.

Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business and Economic Statistics, 20(3), 339–350.

Engle, R., & Colacito, R. (2006). Testing and valuing dynamic correlations for asset allocation. Journal of Business and Economic Statistics, 24(2), 238–253.

Engle, R., & Sheppard, K. (2005). Theoretical and empirical properties of dynamic conditional correlation multivariate GARCH. Working paper, New York University.

Ferson, W. E., Foerster, S. R., & Keim, D. B. (1993). General tests of latent variable models and mean-variance spanning. Journal of Finance, 48(1), 131–156.

Ferson, W. E., & Schadt, R. (1996). Measuring fund strategy and performance in changing economic conditions. Journal of Finance, 51(2), 425–461.

Gibbons, M. R., Ross, S. A., & Shanken, J. (1989). A test of the efficiency of a given portfolio. Econometrica, 57(5), 1121–1152.

Gorton, G., & Rouwenhorst, K. G. (2006). Facts and fantasies about commodity futures. Financial Analysts Journal, 62(2), 47–68.

Gourieroux, C., Holly, A., & Monfort, A. (1982). Likelihood ratio test, Wald test, and Kuhn–Tucker test in linear models with inequality constraints on the regression parameters. Econometrica, 50(1), 63–80.

Hansen, L. P. (1982). Large sample properties of generalized method of moments estimators. Econometrica, 50(4), 1029–1054.

Harvey, C. R. (1995). Predictable risk and returns in emerging markets. Review of Financial Studies, 8(3), 773–816.

Huberman, G., & Kandel, S. (1987). Mean-variance spanning. Journal of Finance, 42(4), 873–888.

Hunter, D. M., & Simon, D. P. (2005). Are TIPS the “real” deal?: A conditional assessment of their role in a nominal portfolio. Journal of Banking and Finance, 29(2), 347–368.

Kan, R., & Zhou, G. (2008). Tests of mean-variance spanning. Working paper, Washington University.

Kodde, D. A., & Palm, F. C. (1986). Wald criteria for jointly testing equality and inequality restrictions. Econometrica, 54(5), 1243–1248.

Kothari, S., & Shanken, J. (2004). Asset allocation with inflation-protected bonds. Financial Analysts Journal, 60(1), 54–70.

Mamun, A., & Visaltanachoti, N. (2006). Diversification benefits of treasury inflation protected securities: An empirical puzzle. Working Paper, Massey University.

Newey, W., & West, K. (1987). A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(3), 703–708.

Roll, R. (2004). Empirical TIPS. Financial Analysts Journal, 60(1), 31–53.

Sa-Aadu, J., Shilling, J., & Tiwari, A. (2010). On the portfolio properties of real estate in good times and bad times. Real Estate Economics, 38(3), 529–565.

Shanken, J. (1990). Intertemporal asset pricing: An empirical investigation. Journal of Econometrics, 45(1–2), 99–120.

Yang, J., Zhou, Y., & Leung, W. K. (2010). Asymmetric correlation and volatility dynamics among stock, bond, and securitized real estate markets. Journal of Real Estate Finance and Economics, forthcoming.

Acknowledgements

We thank Charles Cao, Ian Cooper, Zekeriya Eser, Bill Kracaw, C.F. Lee, Jiang Wang, Fan Yu, Hao Zhou, and seminar participants at the 2006 FMA Annual Meeting in Salt Lake City, the 2006 Journal of Banking and Finance 30th Anniversary Conference in Beijing, and the 2006 China International Conference in Finance in Xi’an for their helpful comments and suggestions. Special thanks go to an anonymous referee and James B. Kau (the Editor) for their valuable suggestions that significantly improved the focus of our paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, Jz., Zhong, Z.(. Time Variation in Diversification Benefits of Commodity, REITs, and TIPS. J Real Estate Finan Econ 46, 152–192 (2013). https://doi.org/10.1007/s11146-011-9311-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9311-6