Abstract

Globalization of the financial markets may have undermined co-movement between stock and housing markets, at least in small open economies. This paper provides an empirical study on the long-term dynamic interrelation between stock and housing markets in a small open economy with special attention to the effect of foreign investors on the dynamics. The empirical findings, based on a quarterly dataset from Finland over 1970-2006, do not support the hypothesis of diminished co-movement between Finnish stock and housing markets after the abolishment of the foreign ownership restrictions of stocks in 1993. The markets still appear to be tightly interdependent in the long run. Nevertheless, the results suggest that the substantial growth in the foreign ownership of Finnish stocks induced a large and long-lasting deviation from the cointegrating long-run relation between stock and housing prices. The results also imply that diversification between stock and housing markets works the worse the longer the investment horizon is.

Similar content being viewed by others

Notes

Piazzesi et al. (2007) and Hwang and Lum (Examining Asset Pricing in a CCAPM Framework with Housing, Paper presented at the International Conference on Real Estate and the Macroeconomy, July 24-25, 2006) present empirical results in support of the model.

Results of Antell (2004) indicate that the importance of volatility linkages is small in the Finnish financial markets even when using weekly data. As quarterly data has to be used when housing is included in the analysis, the significance of the possible volatility linkages is likely to be negligible.

In general, volatility of stock and housing returns is driven by capital returns. Hence, the correlation coefficients are similar whether total returns or only price movements are employed.

Results by Quan and Titman (1999) imply that positive correlation between commercial real estate prices and stock prices arises because of current economic fundamentals and not because of expectations about future growth.

Englund et al. (2002) estimate the correlation coefficients by a VAR model. If two or more return series are actually cointegrated, the reported figures may underestimate the true horizon effect.

For example Wilson and Zurbruegg (2003) present a review of correlation instability especially between different real estate returns.

In Finland the housing market is divided into two sectors. Privately financed housing can be bought and sold at market prices without any restrictions. That sector covers approximately 80% of the market. In the publicly regulated sector, instead, selling prices and rental prices are controlled.

None of the results presented in the paper change notably if the average price index is used for the whole sample period. Another option would have been to use the average sales price index throughout the sample period. It seems more reasonable to use quality-adjusted index for part of the sample period than not to use it at all, however.

The two datasources appear to correspond to each other well: the non-transformed level of foreign ownership in 1994Q4 is 30.7% according to Ali-Yrkkö and Ylä-Anttila, while the figure reported by the Central Securities Depository is 30.6%.

Nokia is an outlier also concerning the foreign ownership rate of large companies in OMXH. The exclusion of Nokia’s impact on F would not have any impact on the results of the empirical analysis, however. This is due to the fact that the correlation between the F including Nokia’s effect and the F excluding Nokia is over .99 both in levels and in differences. The rate excluding Nokia is just somewhat (on average 4.2%-points) lower than the one employed in the analysis.

Findings by Koskela et al. (1992) indicate that rising marginal tax rate increased housing prices in Finland by raising the deductibility of mortgage interest payments and thereby increasing the rate of return on housing in the 1970s and 80s.

Note that F exceeded 0% even before 1993, since some limited foreign ownership was allowed in HEX before the abolishment of the restrictions.

For instance, the share of foreign buyers in real estate transaction (excluding flats) increased only from .3% before 1993 to .4% in 1993–1999.

Volatility of the value of Finnmark and Euro relative to the other main currencies does not appear to be notably smaller after 1996 than that of Finnmark prior to 1996.

The EMU membership may have an effect on the housing market as well. However, so far foreign investors operating in the Finnish real estate market have concentrated on commercial real estate.

Unit root in T cannot be rejected even when allowing for a structural break in 1993Q1.

According to a Monte Carlo analysis conducted by Doornik et al. (1998) adopting a model with a trend in the cointegration space has low cost even when the data generating process does not actually have one. The cost of excluding the trend term when there should be one is markedly larger.

In the actual estimated model the constant term is taken account of by the drift term in the short-run model.

The Bartlett small-sample corrected LR test statistics by Johansen (2000) are used throughout the analysis when testing if one or more variables can be excluded from the long-run relation.

Note that inclusion of lending rate or gdp, i.e. variables that might help to detect a long-run relation between S and H because of their impact on the discount factor and on the current and expected cash flows of the assets, does not help to find a cointegrating relation between S and H over 1970–2006 or during 1980–2006.

A simple AR(1)-model supports the hypothesis of more efficient stock market since the mid 1990s. The adjusted R2 coefficient of an AR(1)-model employing data over 1970Q1-1993Q4 is .23, while it is only .05 during 1994Q1-2006Q4.

The market value data are obtained from Datastream.

If H2, S and T were assumed to form a stationary long-run relation, the estimated coefficient on S would have the wrong sign (i.e. negative). In the model including H2, S and F, instead, the sign is correct and of reasonable magnitude.

For instance, the transfer tax payable on the transfer of a flat is 1.6% in Finland while it is 4% in the case of single-family housing, in general.

Annual correlations between regional housing markets in Finland have been typically around 0.9 (see Oikarinen 2006).

References

Ali-Yrkkö, J., & Ylä-Anttila, P. (2003). Globalization of Business in a Small Country – Does Ownership Matter. In A. Hyytinen & M. Pajarinen (Eds.), Financial Systems and Firm Performance: Theoretical and Empirical Perspectives. Helsinki: Taloustieto Oy.

Antell, J. (2004). Essays on the Linkages between Financial Markets and Risk Asymmetries. Helsinki: Swedish School of Economics and Business Administration.

Barakova, I., Bostic, R. W., Calem, P. S., & Wachter, S. M. (2003). Does credit quality matter for homeownership? J Hous Econ, 12(4), 318–336. doi:10.1016/j.jhe.2003.09.002.

Barot, B., & Takala, K. (1998). House Prices and Inflation: A Cointegration Analysis for Finland and Sweden. Helsinki: Bank of Finland Discussion Papers 12/98.

Benjamin, J. D., Chinloy, P., & Jud, G. D. (2004). Real estate versus financial wealth in consumption. J Real Estate Finance Econ, 29(3), 341–354. doi:10.1023/B:REAL.0000036677.42950.98.

Bossaerts, P. (1988). Common nonstationary components of asset prices. J Econ Dyn Control, 12(2–3), 347–364. doi:10.1016/0165-1889(88)90045-0.

Campbell JY, Cocco JF (2004). How Do House Prices Affect Consumption? Evidence from Micro Data, Harvard Institute of Economic Research, Discussion Paper Number 2045.

Case KE, Quigley JM, Shiller RJ (2001). Comparing wealth effects: the stock market versus the housing market, National Bureau of Economic Research, Working Paper 8606.

Chen, N.-K. (2001). Asset price fluctuations in Taiwan: Evidence from stock and real estate prices 1973 to 1992. J Asian Econ, 12(2), 215–232. doi:10.1016/S1049-0078(01)00083-5.

Cochrane, J. H. (2001). Asset Pricing. Princeton: Princeton University Press.

Dennis, J. G. (2006). CATS in RATS, Cointegration Analysis of Time Series, Version 2. Evanston, Illinois: Estima.

Dipasquale, D., & Wheaton, W. C. (1994). Housing market dynamics and the future of housing prices. J Urban Econ, 35(1), 1–27. doi:10.1006/juec.1994.1001.

Doornik, J. A. (1998). Approximations to the asymptotic distributions of cointegration tests. J Econ Surv, 12(5), 573–593. doi:10.1111/1467-6419.00068.

Doornik, J. A., Hendry, D. F., & Nielsen, B. (1998). Inference in cointegrated models: UK M1 revisited. J Econ Surv, 12(5), 533–572. doi:10.1111/1467-6419.00067.

Englund, P., Hwang, M., & Quigley, J. M. (2002). Hedging housing risk. J Real Estate Finance Econ, 24(1–2), 167–200. doi:10.1023/A:1013942607458.

Fu, Y., & Ng, L. K. (2001). Market efficiency and return statistics: Evidence from real estate and stock markets using a present-value approach. Real Estate Econ, 29(2), 227–250. doi:10.1111/1080-8620.00009.

Gyourko, J., & Keim, D. B. (1992). What does the stock market tell us about real estate returns? J Am Real Estate Urban Econ Assoc, 20(3), 457–485. doi:10.1111/1540-6229.00591.

Hoesli, M., & Hamelink, F. (1997). An examination of the role of Geneva and Zurich housing in Swiss institutional portfolios. J Property Valuat Invest, 15(4), 354–371. doi:10.1108/14635789710693182.

Hutchison, N. E. (1994). Housing as an investment? A comparison of returns from housing with other types of investment. J Property Finance, 5(2), 47–61. doi:10.1108/09588689410076739.

Johansen, S. (1996). Likelihood-based Inference in Cointegrated Vector Autoregressive Models. Oxford: Oxford University Press.

Johansen, S. (2000). A Bartlett correction factor for tests on the cointegrating relations. Econometric Theory, 16(5), 740–778. doi:10.1017/S0266466600165065.

Johansen, S. (2002). A small sample correction of the test for cointegrating rank in the vector autoregressive model. Econometrica, 70(5), 1929–1961. doi:10.1111/1468-0262.00358.

Jud, G. D., & Winkler, D. T. (2002). The dynamics of metropolitan housing prices. J Real Estate Res, 23(1–2), 29–45.

Koskela, E., Loikkanen, H. A., & Virén, M. (1992). House prices, household savings and financial market liberalization in Finland. Eur Econ Rev, 36(2–3), 549–558. doi:10.1016/0014-2921(92)90112-A.

Kuosmanen, P. (2002). Risk and Return in Housing Markets. Vaasa: Acta Wasaensis. (The original publication is in Finnish)

Leung, C. (2004). Macroeconomics and housing: a review of the literature. J Hous Econ, 13(4), 249–267. doi:10.1016/j.jhe.2004.09.002.

Leung, C. K. Y. (2007). Equilibrium correlations of asset price and return. J Real Estate Finance Econ, 34(2), 233–256. doi:10.1007/s11146-007-9009-y.

Oikarinen, E. (2006). The diffusion of housing price movements from centre to surrounding areas. J Hous Res, 15(1), 2–28.

Ortalo-Magné, F., & Rady, S. (2006). Housing market dynamics: On the contribution of income shocks and credit constraints. Rev Econ Stud, 73(2), 459–485. doi:10.1111/j.1467-937X.2006.383_1.x.

Piazzesi, M., Schneider, M., & Tuzel, S. (2007). Housing, consumption and asset pricing. J Financ Econ, 83(3), 531–569. doi:10.1016/j.jfineco.2006.01.006.

Quan, D. C., & Titman, S. (1999). Do real estate prices and stock prices move together? An international analysis. Real Estate Econ, 27(2), 183–207. doi:10.1111/1540-6229.00771.

Riddel, M. (2004). Housing-market disequilibrium: An examination of housing-market price and stock dynamics 1967–1998. J Hous Econ, 13(2), 120–135. doi:10.1016/j.jhe.2004.04.002.

Takala, K., & Pere, P. (1991). Testing the cointegration of house and stock prices in Finland. Finn Econ Pap, 4(1), 33–51.

Wilson, P. J., & Zurbruegg, R. (2003). International diversification of real estate assets: Is it worth it? Evidence from the literature. J Real Estate Lit, 11(3), 259–277.

Acknowledgements

The author wishes to thank an anonymous reviewer for helpful comments and Jyrki Ali-Yrkkö and Pekka Ylä-Anttila for providing the foreign ownership data. Financial support from OKOBANK Research Foundation and The Finnish Foundation for Share Promotion is gratefully acknowledged. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

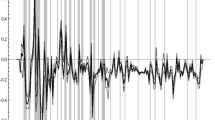

Recursive and backward recursive Max tests of constancy of the estimated long-run relation (H2 = 1.32 + .603S)f. f The test statistics are scaled by the 5% critical value. X refers to the test where all the parameters are re-estimated in each step, whereas in the R case only the long-run coefficients are re-estimated. The base sample for the standard (forward) recursion is 1986Q2-1991Q4 and for the backwards recursion 2001Q2-2006Q4.

Rights and permissions

About this article

Cite this article

Oikarinen, E. Foreign Ownership of Stocks and Long-run Interdependence Between National Housing and Stock Markets—Evidence from Finnish Data. J Real Estate Finan Econ 41, 486–509 (2010). https://doi.org/10.1007/s11146-009-9175-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-009-9175-1