Abstract

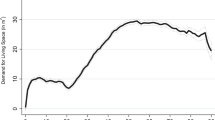

The aging of a housing structure not only leads to depreciation but also increases the possibility of redevelopment. If redevelopment accompanies an increase in structural density in order to accommodate the increased demand for housing, it provides large capital gains to the existing owners. In this case, expectations of redevelopment in the near future and the eventual announcement of redevelopment plans can have a strong positive impact on the current price of housing. We test this hypothesis using a hedonic pricing model designed to decompose the age effects into depreciation effect and redevelopment effect. Based on 3,474 observations on apartments in Seoul in 2001, estimation results confirm our hypothesis. While the depreciation effect dominates the redevelopment effect until 15 to 19 years of age, depending on the specification, the redevelopment effect eventually dominates the depreciation effect thereafter, causing the apartment price to increase. At 27 years of age, the apartment price decreases by as much as 45∼53 percent of the initial value, due to depreciation. However, the redevelopment effect increases the price by as much as 28∼32 percent, driving the price up to 76∼87 percent of the original value.

Similar content being viewed by others

References

Amin, K., and D. R. Capozza. (1993). “Sequential Development,” Journal of Urban Economics 34, 142–158.

Arnott, R. J. (1980). “A Simple Urban Growth Model with Durable Housing,” Regional Science and Urban Economics 10, 53–76.

Benson, E. D., J. L. Hensen, A. L. Schwartz, Jr., and G. T. Smersh. (1998). “Pricing Residential Amenities: The Value of a View,” Journal of Real Estate Finance and Economics 16(1), 55–73.

Blackley, D. M., J. R. Follain, and H. Lee. (1986). “An Evaluation of Hedonic Price Indexes for Thirty-four Large SMSAs,” AREUEA Journal 14(1), 179–205.

Braid, R. M. (2001). “Spatial Growth and Redevelopment with Perfect Foresight and Durable Housing,” Journal of Urban Economics 49, 425–452.

Brueckner, J. K. (1980). “A Vintage Model of Urban Growth,” Journal of Urban Economics 8, 389–402.

Cannaday, R. E., and M. A. Sunderman. (1986). “Estimation of Depreciation of Singl-Family Appraisals,” AREUEA Journal 14(2), 255–273.

Capozza, D., and Y. Li. (1994). “The Intensity and Timing of Investment: The Case of Land,” The American Economic Review 84(4), 889–904.

Capozza, D., and G. Sick. (1991). “Valuing Long Term Leases: The Option to Redevelop,” Journal of Real Estate Finance and Economics 4(2), 209–223.

Childs, P. D., T. J. Riddiough, and A. J. Triantis. (1996). “Mixed Uses and the Redevelopment Option,” Real Estate Economics 24, 317–339.

Clapp, J. M., and C. Giaccoto. (1994). “The Influence of Economic Variables on Local House Price Dynamics,” Journal of Urban Economics 36, 161–183.

Clapp, J. M., and C. Giaccoto. (1998). “Residential Hedonic Models: A Rational Expectations Approach to Age Effects,” Journal of Urban Economics 44, 415–437.

Driscoll, P., J. Alwang, and B. Dietz. (1994). “Welfare Analysis When Budget Constraints Are Nonlinear: The Case of Flood Hazard Protection,” Journal of Environmental Economics and Management 26, 181–199.

Goodman, A. C. (1988). “An Econometric Model of Housing Price, Permanent Income, Tenure Choice, and Housing Demand,” Journal of Urban Economics 23, 327–353.

Goodman, A. C., and T. Thibodeau. (1995). “Age-Related Heteroskedasticity in Hedonic House Price Equations,” Journal of Housing Research 6(1), 25–42.

Goodman, A. C., and T. Thibodeau. (1997). “Dwelling-Age-Related Heteroskedasticity in Hedonic House Price Equations: An Extension,” Journal of Housing Research 8(2), 299–317.

Grether, D. M., and P. Mieszkowski. (1974). “Determinants of Real Estate Values,” Journal of Urban Economics 1, 127–146.

Gunnelin, A. (2001). “The Option to Change the Use of a Property when Future Property Values and Construction Costs are Uncertain,” Managerial and Decision Economics 22, 345–354.

Haurin, D. R., and D. M. Brasington. (1996). “The Impact of School Quality on Real House Prices: Interjurisdictional Effects,” Journal of Housing Economics 5, 351–368.

Hite, D., W. Chern, F. Hitzhusen, and A. Randall. (2001). “Property-Value Impacts of an Environmental Disamenity: The Case of Landfills,” Journal of Real Estate Finance and Economics 22(2/3), 185–202.

Hughes Jr., W. T., and C. F. Sirmans. (1992). “Traffic Externalities and Single-Family House Prices,” Journal of Regional Science 32(4), 487–500.

Huh, S., and S.-J. Kwak. (1997). “The Choice of Functional Form and Variables in the Hedonic Price Model in Seoul,” Urban Studies 34, 989–998.

Kennedy, P. E. (1981). “Estimation with Correctly Interpreted Dummy Variables in Semilogarithmic Equations,” American Economic Review 71, 801.

Korea National Statistical Office (2001). Preliminary Count of Population and Housing Census 2000.

Lee, S.-K., and W.-J. Shin. (2001). “The Effect of Reconstruction Probability on Apartment Price,” Journal of the Korean Planners Association 36(5), 101–110. (in Korean)

Malpezzi, S., L. Ozzane, and T. Thibodeau. (1987). “Microeconomic Estimates of Housing Depreciation,” Land Economics 63(4), 372–385.

Margolis, S. E. (1982). “Depreciation of Housing: An Empirical Consideration of the Filtering Hypothesis,” Review of Economics and Statistics 64, 90–96.

Mendelsohn, R. (1984). “Estimating the Structural Equations of Implicit Markets and Household Production Functions,” Review of Economics and Statistics 71, 673–677.

Mills, E. S., and R. Simenauer. (1996). “New Hedonic Estimates of Regional Constant Quality House Prices,” Journal of Urban Economics 39, 209–215.

Parsons, G. R. (1986). “An Almost Ideal Demand System for Housing Attributes,” Southern Economic Journal 53, 347–363.

Pogodzinski, J. M., and T. R. Sass. (1994). “Theory and Estimation of Endogenous Zoning,” Regional Science and Urban Economics 24, 601–630.

Quigley, J. M. (1984). “Nonlinear Budget Constraints and Consumer Demand: An Application of Public Program for Resident Housing,” Journal of Urban Economics 12, 177–201.

Randolph, W. C. (1988). “Estimation of Housing Depreciation: Short-Term Quality Change and Long-Term Vintage Effects,” Journal of Urban Economics 23, 162–178.

Rosen, S. (1974). “Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition,” Journal of Political Economy 82, 35–55.

Rubin, G. M. (1993). “Is Housing Age a Commodity? Hedonic Price Estimates of Unit Age,” Journal of Housing Research 4(1), 165–184.

Son, J.-Y., and K.-H. Kim. (1998). “Analysis of Urban Land Shortages: The Case of Korean Cities,” Journal of Urban Economics 43, 362–384.

Thibodeau, T. G. (1989). “Housing Price Indexes from the 1974–1983 SMSA Annual Housing Surveys,” AREUEA Journal 1(1), 100–117.

Thibodeau, T. G. (1995). “Housing Price Indices from 1984–92 MSA Annual Housing Surveys,” Journal of Housing Research 3, 439–487.

Thorsnes, P. (2000). “Internalizing Neighborhood Externalities: The Effect of Subdivision Size and Zoning on Residential Lot Prices,” Journal of Urban Economics 48, 397–418.

Wheaton, W. C. (1982). “Urban Spatial Development with Durable but Replaceable Capital,” Journal of Urban Economics 12, 53–67.

White, H. (1980). “A Heteroskedasticity-Consistent Covariance Matrix and a Direct Test for Heteroskedasticity,” Econometrica 48, 817–838.

Williams, J. (1991). “Real Estate Development as an Option,” Journal of Real Estate Finance and Economics 4(2), 191–208.

Williams, J. (1997). “Redevelopment of Real Assets,” Real Estate Economics 25, 387–407.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lee, B.S., Chung, EC. & Kim, Y.H. Dwelling Age, Redevelopment, and Housing Prices: The Case of Apartment Complexes in Seoul. J Real Estate Finan Econ 30, 55–80 (2005). https://doi.org/10.1007/s11146-004-4831-y

Issue Date:

DOI: https://doi.org/10.1007/s11146-004-4831-y