Abstract

Exploiting regional heterogeneity in population dynamics across more than 10,000 municipalities in Germany, we provide robust empirical evidence that population aging depresses real estate prices and rents. Using millions of individual real estate listings and detailed demographic data at the municipality level, we estimate that average sales prices in 2020 would have been up to 12% higher if the population age distribution had been the same as in 2008. We show that population aging not only reduces prices but also increases the availability of real estate. In addition, we document substantial heterogeneity in price responses across dwelling type, property characteristics, and urban-rural status, suggesting that lower housing demand and life-cycle dissaving are driving our results. We predict that population aging will continue to exert downward pressure on house prices and exacerbate regional disparities in Germany.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Germany is aging quickly as life expectancy rises constantly and fertility rates have remained below replacement levels for decades. In this paper, we investigate how these unprecedented demographic shifts affect the value of one of the most important household assets: real estate. Starting with the seminal paper by Mankiw and Weil (1989), population aging has been suspected to reduce real estate prices, because declining demand for living space or life-cycle dissaving in old-age, might increase the number of potential sellers relative to the number of buyers in an aging society. While the time series approach of Mankiw and Weil (1989) has been criticized (Engelhardt and Poterba 1991; Holland 1991; Swan 1995), more recent studies using country level data (Takáts 2012; Jäger and Schmidt 2017) have confirmed the relevance of changing demographics for the value of real estate. Surprisingly, few studies have analyzed the impact of population aging on real estate prices on the municipality level, although housing markets are typically very local. Hiller and Lerbs (2016), who find that house prices are negatively associated with the old-age-dependency ratio in 87 major German cities in the period 1995 to 2014, are a notable exception.

In this paper we go beyond the previous literature and exploit the substantial regional heterogeneity in population dynamics across more than 10,000 German municipalities, covering 98.5% of the German population, to estimate the impact of a graying age-distribution on housing prices and rents. We combine detailed demographic data on the municipality level with a dataset containing millions of individual real estate offers from the internet platform ImmobilienScout24 for the period 2008 to 2020. Our rich dataset enables us to make three novel contributions.

First, we show that the negative relationship between population aging and real estate prices is not only limited to urban areas (as documented by Hiller and Lerbs 2016), but holds for all of Germany. We estimate that average German real estate prices would have been up to 12% higher in 2020 if the age distribution had remained constant since 2008. The predicted price drop shrinks by about half if we only hold the old-age-dependency ratio constant. Focusing on the old-age-dependency ratio, as typically done in the literature, assumes that the negative price effect sets in only after age 65. We add age group-specific effects following an approach by Fair and Dominguez (1991) for 13 age groups. Adding to the literature, our results suggest that real estate prices are already negatively related to the share of people aged 50+. In contrast to most studies, we also explicitly control for net migration (including both, migration movements within Germany and from other countries) on the municipality level, which potentially affect both, housing prices and age-structure shifts.

Second, we provide novel evidence that population aging does not only affect prices but also the availability of real estate on the market, as proxied by the number of ImmobilienScout24 offers (per household). In line with our theoretical prior, a higher share of elderly people increases the amount of available real estate in a municipality, which likely drives down prices. Third, we document previously unrecognized heterogeneity in price responses by dwelling type, real estate characteristics and urban-rural status. Demographic shifts induce larger price changes for apartments compared to houses, and for sales prices compared to rents. The latter results suggest that live-cycle dissaving and a lower demand for living space are driving our results. In line with a smaller demand for living space in old age, we find that a higher share of elderly people has more pronounced negative effects on larger residential units (150m2+). In contrast, prices for apartments on the first floor, which are arguably more elderly friendly, are less affected by population aging. Finally, we show that effects are larger for urban compared to rural regions. The existence of space constraints in urban areas, lowering the price elasticity of housing supply, are a plausible explanation.

We predict that population aging will continue to put downward pressure on real estate prices. Assuming that our estimated age-structure coefficients remain stable over time, demographic shifts would lower real estate prices by up to 18% (based on shifts in the whole age distribution) or more than 28% (based on the old-age-dependency ratio) until 2050. Since demographic change likely remains uneven across municipalities, we expect that regional real estate prices will continue to diverge in the future.

The paper is organized as follows: Sect. 2 outlines the theoretical background. Section 3 describes the underlying econometric model and the dataset. Main results, heterogeneity analyses and economic significance of our estimates are discussed in Sect. 4. Sect. 5 concludes.

2 The relationship between aging and real estate prices

Population aging impacts the size as well as the age structure of the population. In this paper, we focus on the graying age structure, which is the most salient feature of population aging in Germany. Due to positive net migration, population size in Germany is not declining, although deaths exceed births since the 1970s. The old-age-dependency ratio (people aged 65+ divided by those aged between 15 and 64), in contrast, is increasing constantly since the 1990s.

The graying age structure may affect real estate demand through two channels: lower demand for living space and live-cycle dissaving.Footnote 1 First, using the German Socio-Economic Panel (GSOEP), Fig. 1 shows that the demand for living spaceFootnote 2 varies over the life cycle. Same has been shown by Mankiw and Weil (1989)Footnote 3. This seminal paper gives the underlying regression design of the results. In detail, Fig. 1 shows that demand is relatively flat up to the early 20s, then increases rapidly, peaks at around 50, and starts to decline again afterwards.

Demand for Living Space by Age (Own calculations based on the German Socio-Economic Panel. Wave v37 (1984–2020), age coefficients from a regression of living space (in m2) on the number of household members in each age group (similar to Mankiw and Weil 1989) and annual survey fixed effects. Based on N = 407,996 observations from 55,883 households. Households are observed in several waves in the panel structure of the SOEP. 95% confidence bands. Standard errors clustered at the household level. 90 includes everybody aged 90 or older)

Second, the life-cycle hypothesis (Modigliani 1986) predicts that people accumulate assets, including real estate, when income is high and sell these assets when income is low (e.g. after retirement). Empirical evidence was given by Mankiw and Weil (1989), analyzing the age-specific demand for housing based on US census data. Since then, there is no clear evidence for the demographic effect on the real estate market. Studies show that an ageing population leads to a significant decline in real house prices, e.g., Hiller and Lerbs (2016), Saita et al. (2016) and Takáts (2012). Others, including e.g., Heo (2022), Eichholtz and Lindenthal (2014), Chen et al. (2012), Hort (1998) and Green and Hendershott (1996), do not find evidence for the life-cycle hypothesis in housing prices.

Figure 2 shows that homeownership rates rise quickly during young adulthood, the increase slows down after 40, peaks at 70 and declines slightly afterwards. In contrast to the standard life-cycle hypothesis, the decline in old age is relatively modest, which might be driven by the existence of other saving motives (e.g., bequests, or nursing home care), the relatively generous Germany pension systems or the indivisibility (and thus illiquidity) of real estate.

Share of People Living in their Own House by Age of Household Head (Source: Own calculations based on the German Socio-Economic Panel. Wave v37 (1984–2020), age coefficients from the regression of ownership status on age of the household head and annual birth cohort fixed effects. N = 414,402, 57,468 households. 95% confidence bands. Standard errors clustered at the household level. Omitted Reference age group: Age < 20. 90 includes everybody aged 90 or older)

Based on Figs. 1 and 2, we expect that real estate demand varies with the age structure of the population: demand should be positively correlated with the share of the population that rapidly increases demand for living space and homeownership (20–40) and negatively correlated with the population that decrease demand for living space and homeownership (70+). The relationship between a changing share of the age-groups in-between (40–70) and housing demand is less clear. On the one hand (regarding the increasing share of homeowners), more houses are bought than sold by this age group and demand for living space is high. On the other hand, the buying rate is lower compared to younger adults.

If housing supply is not infinitely elastic, which is plausible given the characteristics of the housing market, any shift in housing demand will translate into prices. Hence, we would expect that shifting demographics should affect real estate prices. Given that demographic swings are to a certain degree deterministic, real estate prices might already adjust in anticipation of foreseeable demographic shifts in the future, for instance because capital costs (via the risk premium) are affected (Hiller and Lerbs 2016). The actual contemporaneous relationship between the age structure and house prices is therefore theoretically unclear. Thus, we will estimate the relationship empirically.

3 Empirical strategy and data

3.1 Empirical model

We estimate the effect of the age structure on real estate prices and rents per square meter (yikt) using the following regression:

where i represents the individual real estate offer, k the municipality and t time.

The key variable of the interest—agekt—varies at the municipality level and is captured in two different ways. First, we use the old-age-dependency ratio, defined as the ratio of people aged 65+ divided by those aged between 15 and 64. The old-age-dependency ratio is easy to interpret and commonly applied in the literature. However, the definition of “old” (and young) is not always clear-cut and people might in fact adjust more gradually. Thus, we also estimate a more flexible age-structure model, pioneered by Fair and Dominguez (1991) and further modified by Higgins (1998). The model allows us to include the entire age distribution, measured by using 14 age group shares. Using the model by Fair and Dominguez (1991) allows to derive age structure coefficients from a few estimated parameters. It is based on the assumption that all age-structure coefficients sum up to zero. Applying this approach, we use a parsimonious but still flexible cubic polynomial approach and thus approximate the age structure by three estimated coefficients as in Higgins (1998).

In general, the applied regression are based on a hedonic price model. It follows the idea that the housing price can be described as the combination of the house’s characteristics and its surroundings as originally laid out by Rosen (1974). We control for characteristics of the object (Zikt)Footnote 4, as well as for other municipality-specific demographic shifts. These are the net migration per 1000 inhabitants and the respective logs of, births and deaths as well as purchasing power (Xkt). Municipality—as well as time (by month-year)—fixed effects are included to control for constant unobserved heterogeneity. Standard errors are clustered at the municipality level.

3.2 Data

We estimate our model using a dataset that contains millions of individual housing offers from the internet platform ImmobilienScout24 (RWI-GEO-RED).Footnote 5 The RWI-GEO-RED is a systematic collection of all German apartments and houses for sale and rent that were advertised on the internet platform ImmobilienScout24 for the years 2008 to 2020.Footnote 6 We combine monthly real estate data with annual municipality data from the German Federal Statistical Office for the period 2008 to 2020 on (i) the total population by age group, (ii) the total numbers of emigrants and immigrants and (iii) the total number of births and deaths as well as an indicator for rural or urban areas.Footnote 7 We also add data from the RWI-GEO-GRID with information on income on the municipality level.Footnote 8 We drop municipalities without real estate offers on ImmobilienScout24.

The dataset includes more than 10,000 German municipalities for the years 2008 to 2020. Over that time, 6.6 million houses for sale (typically owner-occupied single-family houses), 4.5 million apartments for sale and 13.1 million apartments for rent are observed.Footnote 9 We drop some (mainly very small) municipalities, because no housing offers are observed during our sample period. For houses sales, we can rely on data for 10,508 out of 11,168 German municipalities (in the 2015 boundaries), which represent 98.5% of the total German population.Footnote 10

The RWI-GEO-RED data gives information on housing offers which include asking prices for sales of houses and apartments as well as rents. We believe that our offer data adequately represents trends in actual transactions prices. Thomschke (2015) has shown that asking prices are indeed often in line with final transaction prices. More recently, Lyons (2019) also demonstrated that even in unpredictable market settings, price indices based on listing prices capture final transaction prices well. We control for a range of object specific characteristics such as the number of rooms, year of construction, number of floors, heating energy source and the overall state of the apartment/house (e.g., “First occupancy”, “Completely renovated” or “Dilapidated”). To avoid duplicates, we only use the information from the last spell that an object is offered on ImmobilienScout24.Footnote 11 Furthermore, we drop outliers that are below/above the 1st/99th percentile of the price and size distribution to avoid biased estimates from incorrect entries on the platform.

Table 1 gives an overview about prices per square meter for house sales, apartment sales and apartment rents as well as the old-age-dependency ratio (and its change over time). To demonstrate the substantial regional heterogeneity that we rely on for our estimation, we average prices and demographics for each municipality and then calculate summary statistics based on the municipality means (left side). Prices and demographics vary substantially across time and space. While some municipalities have seen no rise or even a decrease in the old-age-dependency ratio between 2008 and 2020, the top 1% of the fastest aging municipalities show an increase of the old-age-dependency ratio by more than 14 percentage points. Table 1 also reveals that the dependency rates are higher in 2020 as well as their increase between 2008 and 2020 is higher in rural municipalities. We also calculate average prices and demographics for Germany as a whole (right side). Not surprisingly the results differ slightly, because the unweighted mean of the municipality means overrepresents small rural municipalities, which typically are characterized by lower real estate prices and an older population. By estimating Eq. 1 on the object level, we make sure that our results are not driven by these small rural municipalities, because they are given a very low weight (based on the number of observed real estate offers) in the regression. A standard overview on summary statistics of the object characteristics used in the regression model is outlined in table 7 in the appendix.

3.3 Threats to identification

Changes in the age structure are mostly predetermined and therefore to a certain degree exogeneous with respect to the current economic conditions. Especially at the subnational level, however, migration flows might bias the estimates as migrants are typically younger than the local population and react to economic conditions which also drive real estate prices. Furthermore, migration itself might also affect house prices e.g., through increasing housing demand. Therefore, we explicitly control for migration flows in our empirical analysis to disentangle exogenous aging and migration effects.

Theoretically, prices of real estate might also directly affect the determinants of demographic change. Including fertility, mortality and migration may result in potential simultaneity bias. House price shocks for instance might influence fertility decisions because they affect wealth and the cost of childbearing (Dettling and Kearney 2014). In our setting, reverse causality of fertility rates is only a limited concern given that we use the old-age-dependency ratio (population 65+/population 15–64) in most specifications, which is not directly affected by a changing fertility. Mortality might also respond to house price shocks via the wealth channel; however, recent studies have suggested that the effect of wealth shocks on mortality is limited in countries with an extensive welfare state like Germany (Cesarini et al. 2016). Finally, house price shocks might also drive migration decisions. We cannot rule out a relationship, however, it should arguably rather work against a negative aging effect as lower real estate prices should attract more migrants.

4 Results

4.1 The effect of the age structure on real estate prices

Table 2 shows that a higher share of elderly people is associated with lower real estate prices and rents. The effect is strongest for apartment sales. An increase of the old-age-dependency ratio by 1 percentage point decreases apartment prices by 1.8%. The stronger response of apartment prices is not caused by a different underlying municipality sample,Footnote 12 but likely driven by a combination of life-cycle dissaving and a lower demand for living space. Houses are mostly owner-occupied, which potentially raises transaction costs (e.g., due to emotional attachment) and makes them harder to sell. In contrast, apartments in Germany often explicitly serve as a saving vehicle and are frequently leased out to third parties, which could explain the stronger impact on apartment compared to house prices. Regarding the case of rental apartments, the hypothesis of life-cycle dissaving does not help to explain the negative effect of the old-age-dependency. The fact that rents also substantially respond to shifting demographics suggests that a lower demand for living space also partly drives our results. By definition, the effects on rents (which have no component of an investment) cannot be explained by life-cycle dissaving.

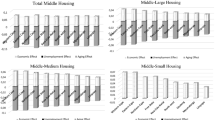

Looking at the whole age distribution (figure 3) reveals that the negative price effect sets in well below the age of 65. In fact, house (Fig. 3a) and apartment prices (fig. 3b) are already negatively correlated with all age groups above the age of 45 (houses) and 55 (apartments). As expected, a higher share of people aged 20 to 39, who typically are net buyers of real estate and rapidly increase demand for living space (see figures 1 and 2), increase prices. A higher share of children (0–19) is also positively related to prices, likely because more children imply a growing demand for real estate in the future and couples may more likely decide to have children when they are homeowners. In line with the old-age-dependency ratio estimates, the age-structure coefficients are typically larger for apartment compared to house prices, suggesting that apartment prices respond more to demographic swings. The age-structure effect on rents is more muted than for sales (fig. 3c), which supports the idea that sales prices are not only driven by changes in demand for living space, but also by life-cycle savings behavior.

Impact of Aging on Real Estate Prices using the Entire Age Distribution(a House Sales, b Apartment Sales, c Apartment Rents; Note: Age-structure coefficients derived from a third-order polynomial in the spirit of Fair and Dominguez (1991) and Higgins (1998). Full set of object level and municipality control variables included. Standard errors clustered at the municipality level)

4.2 The effect of the age structure on the number of real estate offers

Going beyond the pure price effect of aging, we provide evidence that the share of elderly people does also affect the amount of real estate available on the market. Therefore, we regress the number of dwellings (Nkt) offered in a municipality k in year t (scaled by the number of households in the municipality) on the old-age-dependency ratio (agekt) in the following model.

In addition to the indicator for elderly people, we include the mean price level of houses in municipality k in year t (ykt) and municipality controls for birth, deaths and newborns as well as an indicator for the municipality’s purchasing power. For this purpose, we collapse the full dataset on the level of individual offers on the municipality level using the sum of observations on the left hand side and the mean of prices (per square meter on the right hand side). Table 3 shows that population aging, as expected, increases the number of real estate offers. The increased supply is likely responsible for the price decline. In contrast to the price regressions, the increase in offers is smallest for apartment sales, and largest for housing sales, which might point to different price elasticities of different dwelling types or transaction practices.

4.3 Heterogeneity by real estate characteristics

Preferences for real estate features likely differ by age. Thus, we investigate if the size of living space and the floor number—two characteristics that are almost always reported in real estate offers—affect the demographic impact on real estate prices. Therefore, we interact the old-age-dependency ratio with a dummy variable that is 1 for very large residential units (with living space of more than 150m2) and, in a separate regression, with a dummy that is 1 if the apartment is located on the first floor.

Based on Fig. 1 showing the lower demand for living space in old age, we expect that elderly people demand smaller real estate units. Table 4 indicates that sales prices for very large residential units indeed decline more if the old-age-dependency ratio increases. The coefficient for rents is of a similar size than for sales prices, however, it is measured less precisely and hence not statistically significant. Table 4 also reveals that prices of apartments on the first floor, which are arguably more elderly friendly, are less affected by population aging. The coefficient for rents is of the same sign, however, much smaller and not statistically significant.

4.4 The urban-Rural split

The effect of aging on real estate might differ between urban and rural areas. In urban areas, land is relatively scarce and the construction of an additional house or apartment more expensive. Thus, the price elasticity of housing supply should be lower than in rural areas and we expect that demographically induced demand swings have larger price effects in urban areas.

Table 5 showing the estimates of regression (1) separately for urban and rural regions, confirms our theoretical prior. For every dwelling type, an increase in the share of elderly people has larger price effects in urban compared to rural regions. The urban-rural difference is especially pronounced for houses, which are relatively less abundant in urban compared to rural areas. This finding supports the idea that the relatively scarcity of real estate matters for the aging-house price nexus.

4.5 Economic significance and projections

In the following, we investigate the economic significance of our estimates by multiplying them with the observed (2008–2020) and predicted demographic change in the future (2020–2050). We predict prices for Germany as a whole and at the 1st (P1, the slowest aging) and 99th (P99, the fastest aging) percentile of municipalities.

Focusing only on the old-age-dependency ratio, our estimates suggest that population aging had only a modest negative impact on average German house prices during our sample period (see Table 6). Taking our estimates of Table 2 at face value, the 3.3 percentage point increase of the old-age-dependency ratio (from 30.8 to 34.1) in Germany between 2008 and 2020, translates into a reduction in prices by around 3.4% (houses) to 6.0% (apartments) and rents by 4.0%. The effects are substantially larger if we take the shift in the entire age distribution into account, ranging between −7.3% (houses), −12.1% (apartments) and −7.2% for rents. Between 2008 and 2020, Germany was not only characterized by an increase in the share of people 65+, but also by a decline in the share of younger individuals (0–39), who are typically associated with higher real estate prices.

The distinction between shifts in the old-age-dependency ratio and the entire age distribution also matters for the projections until 2050. Note that these projections, which rely on the mid-range variant (G2L2W2) of the population projection from the German Federal Statistical Office, should not be interpreted as actual forecasts, because there are many reasons to believe that the age structure-real estate price relationship is not constant over time (e.g., due to shifts in the effective retirement age, health status of the elderly population etc.). The projections, however, will allow us to contrast the magnitude of the predicted effect for the past (2008–2020) with the future (2020–2050). Not surprisingly, looking at the old-age-dependency ratio, which is projected to increase substantially, the negative demographic effect on real estate prices will intensify in the future. Looking at shifts in the entire age distribution, the picture is more nuanced. While the predicted demographic effect on apartments sales and rents is much smaller than in the old-age-dependency projection, the effect remains substantial. The predicted decline in house prices by 6.3% over a 30-year period, however, is very modest. Nonetheless, all projections suggest that the demographic downward pressure on German real estate prices will persist, and at some time even point to an accelerated demographic headwind.

Table 6 also reveals the considerable regional heterogeneity in predicted real estate price changes. The change in the old-age-dependency ratio varying between −6.4 (P1) to +14.1 (P99) percentage points during our sample period, implies a predicted price range of +11.6–25.7%. We expect that population aging will remain uneven across municipalities which will likely exacerbate existing differences in regional price trends. Using population projections for German municipalities (RWI-GEO-GRID-POP-Forecast, Breidenbach et al. 2019), we calculate that the predicted demographic impact shows an even larger variation, ranging between 11.1–87.4%, for the period 2020 to 2050.

5 Conclusion

In this paper, we provide evidence using millions of individual real estate offers across more than 10,000 municipalities that population aging has put downward pressure on real estate prices in Germany. Our results also suggest that demographics change will remain a drag on real estate prices in the future. We expect the uneven pace of population aging across municipalities to continue, which will exacerbate differences in regional price trends. In contrast to the previous decade, however, factors that have previously overcompensated the demographic headwind such as low interest rates and robust economic growth, are likely to provide less support in Germany over the coming decades. Thus, the rapid growth in real estate prices of the past years might come to end soon.

Notes

Both channels may explain effects of aging on house prices. Effects of aging on rent prices can only be explained by the lower demand for living space.

The demand for living space is measured by the actual household’s consumption. The actual demand from households may differ from the actual living space used. For example, legal framework conditions can lead to shrinking households not adapting their living space to actual demand. Lock-in effects can lead to growing households not adapting their housing to the increased demand.

The vector Z includes the size, the age, number of rooms and floors, the condition, the heating type and the equipment of the house. Additionally, we have binary indicators whether the listed object has a cellar, a balcony, a kitchen or a garden. For the case of apartments, we also have information on the floor.

According to its website, ImmobilienScout24 receives about 1.5 million different properties either for rent or for sale per month. It has more than 2 billion page impressions per month, with over 100,000 property sellers.

For a documentation of this dataset, see Schaffner (2020).

Urban-Rural classification according to the German Federal Office for Building and Regional Planning (BBSR). Urban areas include cities with more than 100,000 inhabitants and regions with a population density of over 150 inhabitants per square kilometer.

The dataset “RWI-GEO-GRID” is based on information from microm Geo-Marketing GmbH. We refer to the variable “purchasing power” as an indication of income. The purchasing power gives a net income information. The variable purchasing power represents net income less social security contributions. Regular payments for insurance, rent or living expenses are not deducted. A documentation of the dataset is available in Breidenbach and Eilers (2018).

Houses for rent are not included as the number of observation is far beyond the given numbers for the other three categories.

The municipalities with offers, covered in our dataset comprise about 81 million inhabitants in 2015 (in contrast to a total population of about 82 million inhabitants in Germany).

Due to updated information, it is possible that an object appears several times with the same object ID in the data set. For more information see Breidenbach and Schaffner (2020).

In a range of small rural municipalities, we do not observe offers for apartments, and thus drop them in the estimation. We have re-run our house price regression restricted only on those municipalities that also report apartment sales. The old-age dependency coefficient for houses changes only slightly from −0.0104 to −0.0112, and thus remains substantially lower than for apartments.

References

Breidenbach P, Eilers L (2018) RWI-GEO-GRID: socio-economic data on grid level. Jahrb Natl Okon Stat 238(6):609–616

Breidenbach P, Schaffner S (2020) Real estate data for Germany (RWI-GEO-RED). Ger Econ Rev 21(3):401–416

Breidenbach P, Kaeding M, Schaffner S (2019) Population projection for Germany 2015–2050 on grid level (RWI-GEO-GRID-POP-forecast). Jahrb Natl Okon Stat 239(4):733–745

Cesarini D, Lindqvist E, Östling R, Wallace B (2016) Wealth, health, and child development: evidence from administrative data on Swedish lottery players. Q J Econ 131(2):687–738

Chen Y, Gibb K, Leishman C, Wright R (2012) The impact of population ageing on house prices: a micro-simulation approach. Scottish J Political Eco 59(5):523–542

Dettling LJ, Kearney MS (2014) House prices and birth rates: the impact of the real estate market on the decision to have a baby. J Public Econ 110:82–100

Eichholtz P, Lindenthal T (2014) Demographics, human capital, and the demand for housing. J Hous Econ 26:19–32

Engelhardt GV, Poterba JM (1991) House prices and demographic change. Reg Sci Urban Econ 21(4):539–546

Fair RC, Dominguez KM (1991) Effects of the changing U.S. age distribution on macroeconomic equations. Am Econ Rev 81:1276–1294

Green R, Hendershott PH (1996) Age, housing demand, and real house prices. Reg Sci Urban Econ 26(5):465–480

Heo YJ (2022) Population aging and house prices: who are we calling old? J Econ Ageing 23:100417

Higgins M (1998) Demography, National Savings, and International Capital Flows. International Economic Review, 39(2):343–369. https://doi.org/10.2307/2527297

Hiller N, Lerbs OW (2016) Aging and urban house prices. Reg Sci Urban Econ 60(6):276–291

Holland AS (1991) The baby boom and the housing market. Reg Sci Urban Econ 21(4):565–571

Hort K (1998) The determinants of urban house price fluctuations in Sweden 1968–1994. J Hous Econ 7(2):93–120

Jäger P, Schmidt T (2017) Demographic change and house prices: headwind or tailwind? Econ Lett 160:82–85. https://doi.org/10.1016/j.econlet.2017.09.007

Lyons RC (2019) Can list prices accurately capture housing price trends? Insights from extreme markets conditions. Finance Res Lett 30:228–232

Mankiw NG, Weil DN (1989) The baby boom, the baby bust, and the housing market. Reg Sci Urban Econ 19(2):235–258

Modigliani F (1986) Life cycle, individual thrift, and the wealth of nations. Science 234(4777):704–712

Rosen S (1974) Hedonic prices and implicit markets: product differentiation in pure competition. J Polit Econ 82(1):34–55

Saita Y, Shimizu C, Watanabe T (2016) Aging and real estate prices: evidence from Japanese and US regional data. Int J Hous Mark Anal 9(1):66–87

Schaffner S (2020) FDZ data description: real-estate data for Germany (RWI-GEO-RED v3)-advertisements on the Internet platform Immobilienscout24. 2007–06/2020. RWI Projektberichte

Swan C (1995) Demography and the demand for housing A reinterpretation of the Mankiw-Weil demand variable. Reg Sci Urban Econ 25(1):41–58

Takáts E (2012) Aging and house prices. J Hous Econ 21(2):131–141

Thomschke L (2015) Changes in the distribution of rental prices in Berlin. Reg Sci Urban Econ 51(2):88–100

Funding

The authors gratefully acknowledge the financial support of the German Science Foundation (DFG) within the Priority Program 1764: The German Labor Market in a Globalized World: Challenges Through Trade, Technology and Demographics. All correspondence to breidenbach@rwi-essen.de.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Breidenbach, P., Jäger, P. & Taruttis, L. Aging and real estate prices in Germany. Rev Reg Res (2024). https://doi.org/10.1007/s10037-024-00210-2

Accepted:

Published:

DOI: https://doi.org/10.1007/s10037-024-00210-2