Abstract

The SEC limits sell-side analysts’ research activities on IPO firms both before and immediately after going public (the IPO quiet period). However, during the IPO quiet period, analysts provide regular coverage of IPO peer firms, which is potentially relevant to investors seeking to glean information about the IPO firm itself. We examine whether, despite the restrictions on analyst research of IPO firms during the quiet period, investors uncover information about the IPO firm indirectly through analyst research of peer firms. We find that, on the IPO date, institutional investors trade on the information in analysts’ recommendation revisions of peer firms that were issued earlier in the quiet period. Institutional investors also trade in the short window around analyst revisions of peer firms that are issued later in the quiet period (after the IPO date) but before analysts initiate coverage of the IPO firm. Retail investors, however, are inattentive to the information available in analyst research of peer firms. Importantly, our findings vary predictably with attributes of the issuing analyst, which helps rule out firm- and industry-level alternative explanations. Lastly, we find that recommendation revisions analysts issue for peer firms predict future IPO-firm performance, suggesting that analyst research of peer firms during the quiet period conveys meaningful information about the IPO firm that results in an information advantage for institutional investors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Prior literature documents various advantages institutional investors have over retail investors (Blankespoor et al. 2020). We study institutional investors’ information advantages in a setting—the IPO quiet period—where the SEC has taken deliberate action to mitigate these advantages. In particular, the SEC has limited the information available about IPO firms outside of the publicly disclosed prospectus. These limits include restrictions on analysts’ ability to provide reports, earnings estimates, and stock recommendations about the IPO firm during the quiet period. However, analysts’ coverage of the IPO firm’s peers continues unrestricted during this period. We examine the role of analysts’ coverage of peer firms during the IPO quiet period on institutional investors’ information advantage over retail investors.

To the extent that analyst research of peer firms is relevant to pricing the IPO firm, it would represent an indirect information channel about the IPO firm. However, institutional and retail investors may not be uniformly aware of and able to effectively process the implications of this research for the IPO firm (Blankespoor et al. 2020). Understanding this issue is important because one motivation for regulatory limits on the information that companies disclose and that analysts produce during the quiet period is that the information may be less accessible or salient to certain investors (Bushee et al. 2020). In general, regulators seek to create a level playing field and limit institutional investors’ informational advantage, and we examine whether one source of indirect and unconventional information—analysts’ research of the IPO firm’s peers—is a source of useful information for institutional and retail investors.

We first explore how pre-IPO recommendation revisions of peer firms inform post-IPO trading for both institutional and retail investors.Prior research suggests a positive association between the performance of the IPO firm’s industry and the performance of the IPO firm itself (Spiegel and Tookes 2020). Therefore, when analysts upgrade (downgrade) their stock recommendation of the peer firm during the IPO quiet period, we predict that investors will be more likely to purchase (sell) shares of the IPO firm on the IPO date.Footnote 1 Consistent with this prediction, we find more buy-initiated (sell-initiated) trading volume in the IPO firm among institutional investors when analysts have upgraded (downgraded) the peer firm’s stock during the quiet period, suggesting that institutional investors consider the information in analyst recommendations of peer firms when pricing the IPO firm itself. However, while we find that institutional investors trade based on analysts’ recommendation revisions of peer firms, we find no such pattern among retail investors. These findings are robust to a series of controls, including other concurrent sources of information (e.g., press releases and news articles) during the quiet period that may impact both analyst output and IPO-day trading.

We next show that IPO trading in response to recommendation revisions for peer firms varies predictably with attributes of the issuing analyst. In particular, we find that institutional investors are more likely to trade on the recommendation revisions of peer firms when the analyst has greater industry expertise, in response to recommendation revisions issued by analysts from the same brokerage that is underwriting the IPO (affiliated analysts), or in response to revisions issued by less busy analysts. These findings help link the trading behavior we document to the activity of peer firm analysts during the quiet period (rather than to some confounding event) because analyst characteristics are unlikely to be associated with confounding firm-level or industry-level factors that could impact IPO-day trading.

Although our primary findings associate peer firm recommendation changes during the pre-IPO period (i.e., the registration period) with investor trading on the IPO date, we acknowledge that this registration period begins several months prior to the IPO date, which raises the possibility that other news during this period is driving both the recommendation revisions for peer firms and the IPO-day trading we observe. Therefore, although our cross-sectional tests that document predictable variation in IPO trading based on analyst characteristics help rule out concerns about confounding sources of information, we also replicate our tests using only the recommendation changes for peer firms issued after the IPO date but before the expiration of the quiet period. This test allows us to measure trading reactions over the two-day window starting on the announcement date of the recommendation revision. For an omitted variable to drive our results, it would have to both coincide with the announcement date of a stock recommendation revision for a peer firm and be directionally consistent with the analyst’s revision. The results of this test continues to support the conclusion that institutional investors (but not retail investors) trade based on the information analysts provide about peer firms during the quiet period.

We also address the concern that IPO-day trading is driven by information conveyed to both investors and analysts during the roadshow, which typically occurs in the two weeks immediately preceding the IPO date. Our results are robust to excluding peer firm recommendation revisions issued during the two weeks leading up to the IPO date, suggesting that our findings are not driven by information conveyed to investors during the roadshow.

While our results suggest that only institutional investors trade on recommendation revisions of peer firms, it is unclear whether this trading advantages these investors over retail investors. Therefore, we assess whether analyst research of peer firms during the quiet period conveys meaningful information about the IPO firm. We find that stock recommendation changes of peer firms during the IPO quiet period are positively associated with the future performance of the IPO firm. Specifically, an upgrade (downgrade) to the stock recommendation of the peer firm in the pre-IPO period is associated with better (worse) long-term performance of the IPO firm. This finding helps explain the IPO-day trading that happens in response to these recommendation revisions.

We also consider the extent to which our findings—that institutional investors gain information about IPO firms from analyst research of peer firms—are unique to the IPO quiet period, as opposed to being a phenomenon we observe across investors outside of the quiet period. We find a differential effect across institutional and retail investors during the quiet period, but we fail to find a similar effect one year after the IPO, which suggests our results are particular to the quiet period and therefore relevant to regulation intended to level the playing field around IPOs.

Finally, we recognize that analysts could either intentionally or inadvertently convey information about the IPO firm to investors through their research of peer firms. As a preliminary test of this question, we compare the profitability of analysts’ recommendation revisions for peer firms issued during the quiet period to those issued for the same peer firms outside the quiet period. If analysts are intentionally using research of peer firms to signal information about the IPO firm, then their recommendation revisions during the quiet period would arguably be less informative about the peer firm than other recommendations they issue about the same peer firm. Our results are broadly consistent with this idea, although we cannot rule out alternative explanations for this finding.

Our study contributes to several streams of research. First, our findings add to the literature documenting ways in which retail investors are at a disadvantage relative to institutional investors, both in general and in the context of IPOs. For example, prior literature suggests retail investors are less likely to trade in response to costly acquisition of complex information or when they are unfamiliar with the firm (e.g., Asthana et al. 2004; Barber and Odean 2008; Miller 2010; Blankespoor et al. 2018). In the IPO setting, Bushee et al. (2020) document that media coverage during the IPO quiet period leads to inferior outcomes (i.e., attention-driven trading) for retail investors. Our study adds to this literature by suggesting retail investors are inattentive to, unable to process, or lack access to analyst recommendation revisions for peer firms during the quiet period.

Second, we contribute to the nascent literature on IPO quiet periods. Prior research has examined the role of analysts in IPO firms but has mainly focused on analyst research immediately after the quiet period ends (e.g., Bradley et al. 2003, 2004, 2008; James and Karceski 2006; Highfield et al. 2008; Lach et al. 2012; Dambra et al. 2018; Jin et al. 2024). One exception is Pisciotta (2023), who also examines analysts’ research of peer firms during the IPO process but who focuses on the attributes of analyst research of non-IPO portfolio firms. Our study, in contrast, examines the implications of this research for institutional and retail investors’ trading in the IPO firm itself.Another notable exception is Bushee et al. (2020), who document that heightened media coverage of IPO firms during the quiet period results in worse outcomes for retail investors who engage in attention-driven trading but find no evidence that institutional investors engage in this form of attention-driven trading during the quiet period. In contrast, our finding that institutional investors trade on analyst outputs of peer firms provides an important contrast between the roles served by different information intermediaries surrounding the IPO. In particular, media coverage of IPO firms during the quiet period is uninformative to institutional investors and only retail investors trade on this information (Bushee et al. 2020), whereas analyst research of peer firms during the quiet period is informative about IPO firms’ prospects, and only institutional investors trade on this information.

Lastly, we contribute to the literature highlighting spillovers of analyst research (Piotroski and Roulstone 2004; Chan and Hameed 2006; Akhigbe et al. 2006; Muslu et al. 2014). While the prior literature mainly focuses on spillovers in non-IPO setting, Shroff et al. (2017) study the information environment of peer firms in the few years immediately following the IPO. Our work differs by focusing on the differential effect of information spillovers on different groups of investors, while prior studies provide evidence of a general information spillover of analyst research without examining whether spillovers differentially impact institutional and retail investors.

2 Background and prior literature

2.1 The IPO quiet period

The IPO begins when the firm files a preliminary prospectus that must be reviewed and approved by the SEC before the firm is permitted to commence marketing their shares (typically through a roadshow) and selling shares to interested investors (often with the help of an underwriter). The prospectus provides relevant information regarding various aspects of firm strategy, competitive dynamics, proprietary technologies, performance history, future plans, and leadership composition, among other topics. Because the prospectus is intended to be the exclusive direct source of public information about the IPO firm, the SEC carefully reviews it and often requests that firms expand disclosure in areas likely helpful to investors (e.g., Lowry et al. 2020).

Once the prospectus is filed, the IPO firm, the underwriters, and any affiliated analysts—those employed in the research division of the investment bank underwriting the IPO—are generally prohibited from certain communications with potential investors.Footnote 2 While unaffiliated analysts are under no restrictions regarding their coverage of an IPO firm, prior research suggests they voluntarily delay the initiation of coverage until after the quiet period and that their first research report is issued after that of the affiliated analyst (James and Karceski 2006; Dambra et al. 2018).Footnote 3

The purpose of the quiet period is to create a level playing field among investors by constraining information about the IPO firm to the prospectus, which is filed with the SEC and closely reviewed by SEC staff (Bradley et al. 2003). While a level playing field is always an important objective of market regulation, the time leading up to the IPO is arguably of elevated importance because of highly volatile returns around the IPO, combined with investor speculation and incomplete information about the firm. As a result, unsophisticated investors are particularly vulnerable to harm at this time (Bushee et al. 2020).

While some of the rules governing the quiet period have been relaxed in recent years, the prevailing practice has been largely unchanged. Specifically, the Jumpstart Our Business Startups (JOBS) Act of 2012 permitted affiliated analysts to initiate coverage, soon after the IPO, for the subset of IPO firms designated as Emerging Growth Companies (EGCs).Footnote 4 Affiliated analysts nonetheless are still prohibited from issuing reports prior to the IPO date. In practice, few analysts covering EGC firms changed their behavior, in part because of uncertainty about the new regulation and its expected enforcement (Latham and Watkins 2014; Dambra et al. 2018). Therefore, following the JOBS Act, analysts continue to withhold initiating coverage on EGC IPOs until 25 days following the IPO, on average (Dambra et al. 2018). In summary, both affiliated and unaffiliated analysts typically do not initiate coverage of IPO firms until after the expiration of the quiet period, which is 25 days after the IPO issue date. Figure 1 presents a timeline of the IPO process and restrictions on analyst reports.

2.2 Information acquisition during the quiet period

Although the prospectus is the primary direct source of information about the IPO firm, investors have strong incentives to gain any possible information advantage during the IPO process. Prior literature on indirect public information sources during IPOs focuses on the news media, given that news coverage of the IPO firm is outside the regulatory jurisdiction of the SEC and is therefore unaffected by quiet period restrictions. For example, Liu et al. (2014) show that the intensity of pre-IPO media coverage is positively associated with post-IPO long-run liquidity, analyst coverage, and institutional ownership. More closely related to our study, Bushee et al. (2020) find that significant media coverage of firms during the IPO process harms retail investors through an increase in attention-driven trading.

Our approach complements these studies by analyzing a previously unexplored indirect source of information about the IPO firm during the quiet period, namely, sell-side analyst research of peer firms. One distinctive feature of our setting is that, unlike news articles, sell-side research is subject to SEC regulation, which has a stated objective of maintaining a level playing field among investors during the quiet period. Furthermore, while Bushee et al. (2020) show that retail investors are harmed by placing too much emphasis on news coverage, our study explores another possible mechanism—sell-side research—through which retail investors may be disadvantaged by placing too little emphasis on valuable information. Our study thus explores an important contrast between the roles served by these two information intermediaries (the media and analysts) surrounding the IPO.

While the information environment contains various sources of potentially relevant information about IPO firms during the quiet period (e.g., macro-level information or disclosures provided by peer firms), we focus on analysts because of their role as industry experts who cover multiple firms that compete with the IPO firm (Kadan et al. 2012). As a result, analysts have a unique perspective that may be useful to investors interested in the IPO firm and in assessing its prospects. Further, prior literature documents an increase in stock price synchronicity of peers due to analyst research (e.g., Piotroski and Roulstone 2004; Chan and Hameed 2006; Howe et al. 2009; Muslu et al. 2014; Hameed et al. 2015; Israelsen 2016), and Akhigbe et al. (2006) show that analyst recommendation revisions are informative about peer firms, suggesting that analysts may be a source of indirect information flows in the IPO setting. Our setting, however, is unique because (a) the IPO process is characterized by limited direct information flows about the IPO firm, (b) regulators have a keen interest in retail and institutional investors’ relative access to information during the quiet period, and (c) investors cannot immediately trade on any information gleaned about the IPO firm from analyst research of rival firms.

We also note that, while prior the literature has found spillover effects of peer firm analyst research, we examine the differential effects of information spillovers on institutional and retail investors. In addition, we study spillovers specifically in the IPO setting, where analysts have limited experience with the IPO firm and may not be sufficiently informed to convey relevant information to investors. Importantly, Pisciotta (2023) finds that affiliated analysts provide less informative research about non-IPO portfolio firms surrounding a focal firm’s IPO. However, we note that, while affiliated analysts’ research is less informative about portfolio firms, this research may still be informative about the IPO firm itself, especially if the reason affiliated analysts provide less informative research about portfolio firms is because of their focus on the IPO firm. Thus affiliated analysts’ revisions may be relatively uninformative about peer firms themselves while still providing informative research about the IPO firm. Overall it remains an empirical question whether peer firm analyst research impacts IPO firm outcomes.

2.3 Analyst research on peer firms and trading by institutional and retail investors

We examine the impact of analyst recommendation revisions of peer firms during the quiet period on institutional and retail investors’ trading behavior at the IPO date. Spiegel and Tookes (2020) argue that IPOs are often driven by common industry shocks, which predicts a positive association between analysts’ recommendations of peer firms and future IPO firm performance. Thus an IPO signals an expected change in future performance that is similar for both the newly public firm and its peers.Footnote 5 If investors trade appropriately on any relevant information in analyst research of peer firms, we expect a positive association between purchases of the IPO firm’s shares on the IPO date and the average recommendation revision analysts issue for peer firms during the quiet period.

We argue that peer firm analyst outputs are likely to be informative, even for institutional investors, who may possess private information about the IPO firm. Analysts’ industry expertise allows them to provide insights potentially incremental to what is possessed by managers and is therefore very likely to be incrementally informative relative to information institutional investors acquire privately (Kadan et al. 2012; Bradley et al. 2017). Analysts are also a valuable source of information on macroeconomic factors because of resources available at their brokerages that are often unavailable to managers or investors (Hutton et al. 2012; Hugon et al. 2016). Thus we contend that analysts help inform sophisticated institutional investors.

In contrast, prior literature documents various limitations that impair retail investors’ ability to incorporate information into trading decisions. For example, Barber and Odean (2008), Engelberg and Parsons (2011), and Hirshleifer and Teoh (2003) show that retail investors face limited attention constraints arising from disclosure processing costs (Blankespoor et al. 2020). Although information is costly for all investors to obtain and process, retail investors often lack the resources (i.e., staff, data access, computing power, analytical capabilities) necessary to limit these costs.

In our setting, these processing costs imply that retail investors may not have ready access to sell-side research, may be unaware when analysts release new reports or revise their recommendations, or may be unable to understand the implications of analyst research of peer firms for IPO firms in the industry. Thus retail investors may not respond to informative signals about the IPO firm, and prior research suggests retail investors are less likely to be aware of firm disclosures compared to institutional investors (Blankespoor et al. 2020). Given that peer firm recommendation revisions are an even less salient disclosure relative to a focal firm’s disclosures, retail investors are even less likely to be aware of these signals or know how to use them. Therefore, conditional on analyst research of peer firms revealing information about IPO firms, we examine whether retail investors trade on this information and whether they are less likely than institutional investors to do so. To the extent that institutional investors can better trade on information conveyed by research of peer firms, it would imply that analyst research of peer firms creates an information disadvantage for retail investors during the quiet period, despite restrictions on analysts’ direct coverage of IPO firms during this period.Footnote 6

3 Sample

We collect data on IPOs from Refinitiv’s Securities Data Company (SDC) database. Our initial sample consists of all U.S. IPOs between January 1, 2010, and December 31, 2021. We begin our sample in 2010 because that is the year in which data to construct trading measures for retail investors becomes widely available (Boehmer et al. 2021), and we end our sample in 2021 because the Hoberg-Phillips’ 10-K Text-based Network Industry Classifications (TNIC) database (which we use to identify peer firms) is available only through 2021.Footnote 7 We limit our sample to offerings on the American, New York, and NASDAQ stock exchanges. We exclude financial firms, unit issues, blank check companies, and rights issues. After merging this IPO sample with Compustat and CRSP, we exclude IPOs with no matches to Compustat or CRSP and those with missing historical financial and market information necessary to construct our variables.Footnote 8

We then match each IPO firm with the top three peer firms from the Hoberg-Phillips TNIC database, which describes multiple peers for each firm based on similarity of product descriptions from 10-K filings.Footnote 9 IPOs with no matches to the TNIC database are excluded from the sample. We also require stock recommendation data from the IBES analyst recommendation database. Finally, we restrict our analyses to IPOs with at least one recommendation revision by an analyst for a peer firm during the IPO registration period, which yields 632 unique IPOs.Footnote 10 These IPOs are associated with 4,174 stock recommendation revisions during the IPO registration period for 1,083 peer firms. Table 1 summarizes sample selection.

Table 2 compares our main sample of IPO firms to the sample of IPO firms with no recommendation revisions by peer firms during the IPO firm’s registration period. Not surprisingly, in Panel A, we show that the IPO firms excluded from our sample are smaller (Assets, Revenue) and younger (Age) than those included in our sample. This is consistent with prior literature, which suggests small firms are less likely to be covered by analysts (e.g., Bhushan 1989; Barth et al. 2001). We also find that the IPO firms excluded from our sample tend to be riskier (e.g., ROA, BTM). In Panel B, we compare the distribution of IPO firms across the years in our sample. Overall these two samples tend to exhibit similar patterns, with an increase in IPO frequency in 2013 and 2014 after the enactment of the JOBS Act in 2012, along with another increase towards the end of our sample period. Lastly, in Panel C, we compare the industry distributions across the two samples. In both samples, a significant portion of IPOs are in the business services (Fama–French industry 6) and pharmaceutical products (Fama–French industry 10) industries.

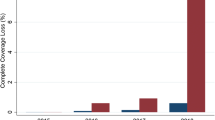

Table 3 Panel A provides descriptive statistics for our variables and shows that, in our sample, the average (median) aggregated peer firm recommendation revisions at the IPO level (Mean_Revision) is -0.01 (0), while the interquartile range is -0.5 to 0.5, suggesting there are similar numbers of upgrades and downgrades in our sample. Note that Mean_Revision includes all revisions for the IPO firm’s peers during the quiet period, across multiple analysts and also potentially including multiple revisions from a single analyst.Footnote 11 The average (median) IPO firm experiences a -4.9% (-13.3%) return over the year after the IPO date and a -3.8% (-31.8%) return over the three years after. We observe significant selling activity, on average, on the first day of trading for institutional investors (NetVol_Institutional) but greater purchasing activity for retail investors (NetVol_Retail). The average IPO firm is operating at a loss (ROA), is audited by a Big Four firm (Big4), and is listed on the NASDAQ stock exchange (Nasdaq). Approximately 45% of the IPOs are backed by venture capital.

Table 3 Panel B provides descriptive statistics for the variables used in our analysis by tercile of average recommendation revision (Mean_Revision). While IPO firms across the three groups are of similar age, they nonetheless increase in size across the terciles (Assets, Revenue). Not surprisingly, IPO firms in the top tercile experience greater average returns over a 90-day (Returns_90days), one-year (Returns_1yr), and three-year (Returns_3yr) window. The peer firms in the top tercile also exhibit greater analyst following (Analysts_Peer) and are more likely to meet or beat analyst forecasts (MOB_Peer) relative to peer firms in the bottom tercile. The appendix includes detailed definitions of all variables included in our analyses.

4 Research design and empirical results

In this section, we examine whether institutional and retail investors trade on any information conveyed in analysts’ pre-IPO recommendation revisions for peer firms. We predict that investors will be more likely to buy (sell) shares of the IPO firm when analysts have upgraded (downgraded) their recommendation of peer firms. We test this prediction by estimating the following regression:

The dependent variable, NetVol, is defined as either NetVol_Total, NetVol_Institutional, or NetVol_Retail. NetVol_Total measures the trading volume of buy-initiated transactions minus sell-initiated transactions for all trades. NetVol_Institutional (NetVol_Retail) measures the trading volume of buy-initiated transactions minus sell-initiated transactions for institutional (retail) investors. Equation (1) tests the sensitivity of IPO-day trading to analyst recommendation revisions for peer firms during the registration period. We rely on prior research that uses trade sizes greater than $50,000 to identify institutional investor trades (Lee and Ready 1991; Bushee et al. 2020). Following Barber et al. (2023), we measure retail trades as those (i) reported in the Trade and Quote Database (TAQ) as exchange code D and (ii) that have received a price improvement (a fraction of a cent) over the existing bid or offer. We identify the sign of the trades by comparing the price of the trade relative to the midpoint of the national best bid and offer.

Mean_Revision is the average recommendation revision of all peer firms associated with the IPO firm, aggregated across all analysts covering the corresponding peer firms during the registration period.Footnote 12 If investors buy (sell) shares of the IPO firm when analysts have upgraded (downgraded) stock recommendations during the registration period of peer firms, we expect a positive coefficient on \({\beta }_{1}\) (Mean_Revision).

We include a broad set control variables from three categories of factors—IPO firm characteristics, peer firm characteristics, and the analyst’s prior recommendation—that might explain variation in our dependent variables. The IPO firm characteristics are based on variables shown in prior literature to be associated with IPO underpricing (Barth et al. 2017). While we do not study underpricing, we use these same control variables because they are likely to be associated with investor trading soon after the IPO. The IPO firm control variables are total assets (Assets), revenue in the year before the IPO (Revenue), firm age (Age), profitability (ROA), R&D intensity (R&D), an indicator for a Big Four auditor (Big4), growth opportunities (BTM), high-tech industry membership (Tech), ownership retention (Pct_Retained), whether the IPO was backed by venture capital investors (VC), whether the IPO was listed on the NASDAQ (Nasdaq), and the reputation of the IPO’s underwriter (Underwriter). We also control for other sources of information that could be correlated with analyst recommendation revisions. Specifically, we control for concurrent information released by the firm (PressReleases), concurrent news released about the firm by the business press (News), the number of amendments to the S-1 IPO filing (Amendments), and the change in IPO price between the initial proposed value in the S-1 filing to the final IPO offer price (PriceRevision).Footnote 13

In addition to IPO firm characteristics, we include peer and industry characteristics that can simultaneously impact analyst recommendations and IPO first-day trading. Specifically, we control for industry returns (Industry_Returns) because industry-wide news and trends could be correlated with both analyst recommendation revisions and investor trading. In addition, we control for the possibility that analyst recommendations, IPO trading, or both are driven by hot IPO markets, which could confound our results (Lowry and Schwert 2002; Pastor and Veronesi 2005; Alti 2006; Cao 2011). Specifically, we control for the number of IPOs in the same industry in the previous 90 days (IPOVol_90days) to control for the intensity of the IPO market. We also control for the level of investor demand for IPOs in the industry using the average underpricing of IPOs in the previous 90 days (AvgUnderpricing_90days). Lastly, we control for peer firms’ information environments, which may be driving analysts’ recommendation revisions and may be informative signals about the IPO firm as well. Specifically, we include peer firm profitability (ROA_Peer), the likelihood of meeting or beating quarterly earnings benchmarks (MOB_Peer), analyst following (Analysts_Peer), and the number of forecasts management of peer firms voluntarily disclose (Guidance_Peer). Lastly, we control for analysts’ prior recommendations by including the average analyst recommendation immediately preceding the revision (Mean_Orig_Rec). All financial information is measured in the fiscal year prior to the IPO year. We include time (IPO year) and industry (Fama French 12) fixed effects and cluster standard errors by time (IPO year-quarter) and industry (Fama French 48).

Column 1 of Table 4 reports the results for total trading volume across both institutional and retail investors. We observe a positive and statistically significant coefficient on Mean_Revision (t-stat = 3.71). Columns 2 and 3 report the results for institutional investors and retail investors, respectively. We observe a positive and statistically significant coefficient on Mean_Revision in Column 2 (t-stat = 2.34) but not in Column 3 (t-stat = -0.60).Footnote 14 More importantly, we find that the coefficient estimate on Mean_Revision is significantly greater for institutional investor trading than for retail investor trading (p-value = 0.01). These findings suggest that, on the IPO date, institutional investors trade on analysts’ recommendation revisions of peer firms that were issued during the registration period and that retail investors do not incorporate this information in their trading decisions on average.Footnote 15,Footnote 16

5 Potential confounding effects

Our primary tests include a robust set of control variables, including various aspects of the IPO firm’s performance, industry-wide stock returns, contemporaneous disclosures and media coverage, and IPO characteristics, which are designed to address possible alternative explanations for our findings. In this section, we consider further the possibility that confounding events impact our finding that analysts’ stock recommendation revisions for peer firms are associated with IPO-day trading.

5.1 Cross-sectional tests

We conduct cross-sectional tests based on characteristics of the issuing analyst. In particular, we examine variation in investors’ IPO-day trading based on analyst industry specialization, the analyst’s affiliation with the IPO’s underwriter, and analyst busyness. These tests speak to our ability to attribute IPO-day trading to the recommendation revisions of the analysts covering peer firms, rather than to alternative firm or industry sources of information that do not vary by analyst. For example, if we document variation in the association between IPO-day trading and analyst research of peer firms and if that variation is predictable based on attributes of the issuing analysts, then it would increase our confidence that analysts’ coverage of peer firms explains our findings. Therefore, these tests help address concerns that our results are attributable to other confounds that may be at play during the quiet period.

5.1.1 Analysts’ industry expertise

The first characteristic we examine is the analyst’s industry specialization. We argue that industry specialization is likely to affect the extent to which investors rely on the analyst’s recommendation revisions to understand IPO firms. We identify analysts covering fewer (more) than the sample mean number of industries as having high (low) industry expertise. In other words, when an analyst’s coverage portfolio is concentrated in relatively few industries, that analyst is likely to be more knowledgeable about these industries (Clement 1999; Dunn and Nathan 2005).Footnote 17 We then measure the average recommendation revision for all analysts covering peer firms during the IPO’s registration period, separately for analysts with high and low industry expertise. We expect the association between recommendation revisions for peer firms and investors’ IPO-day trading to strengthen when these recommendations are issued by analysts with high industry expertise.

Panel A of Table 5 reports the results. Columns 1 and 2 report results when examining NetVol_Total. Our findings suggest the association between peer firm recommendation revisions and trading volume is concentrated in the revisions of analysts with high industry expertise (Column 1) but is not present among analysts with low industry expertise (Column 2). However, the difference in the coefficient estimates on Mean_Revision across Columns 1 and 2 is insignificant (Chi-squared statistic = 2.54). In Columns 3 and 4, we examine the effect of industry expertise on the association between peer firm recommendation revisions and institutional investor trading (NetVol_Institutional). We find that the association is concentrated in the revisions of analysts with high industry expertise (Column 3) but not low industry expertise (Column 4). The difference in coefficient estimates across the two groups is statistically significant (Chi-squared statistic = 2.87). In contrast, we do not find a significant association between peer firm recommendation revisions and IPO-day trading among retail investors, regardless of the analysts’ industry expertise. This finding is consistent with retail investors failing to incorporate analyst industry expertise (and the corresponding information conveyed by their recommendation revisions) into their trading decisions. While analyst expertise may influence investors’ reactions to the recommendation revisions they issue, analyst expertise is unlikely to be associated with new information about the IPO firm that investors could learn from any other source.

5.1.2 Analyst affiliation

We next partition the sample based on whether the analyst revising his or her stock recommendation of a peer firm works for the IPO’s underwriter (i.e., an affiliated analyst). Affiliated analysts likely have private information about the IPO firm (Green et al. 2014).Footnote 18 This information advantage may also help them assess the implications of the IPO on peer firms. If so, we expect investors to place more weight on stock recommendation changes of peer firms issued by affiliated analysts. Note that this test focuses only on investors’ trading in response to research provided by affiliated and non-affiliated analysts, rather than on the underlying informativeness of the research these analysts produce.

We identify affiliated analysts by manually matching the name of the lead underwriter for the IPO firm (in the SDC database) with the last name and brokerage affiliation of the corresponding analyst in the IBES recommendations file. We use data on conference call transcripts to improve the accuracy of the match because IBES provides a masked identification field for the name of the brokerage that, in some cases, is insufficient to definitively identify the brokerage. The conference call data provides full names for both the analyst and brokerage (and the firm covered by the analyst), which we use to link participating analysts to the last names and brokerage affiliation of analysts in IBES. For each IPO firm, we then calculate the average recommendation revision for peer firm analysts during the registration period, separately for affiliated and unaffiliated analysts. If investors perceive that affiliated analysts covering peer firms can better convey information relevant to the IPO firm, we expect the association between recommendation revisions for peer firms and investors’ IPO-day trading to strengthen for recommendations revisions issued by affiliated analysts.

Columns 1 and 2 of Panel B of Table 5 report the results of this analysis when NetVol_Total is the dependent variable. We find a positive association between peer firm recommendation revisions and IPO-day trading for affiliated analysts (Column 1) but not for unaffiliated analysts (Column 2). The difference in the coefficient estimates on Mean_Revision across Columns 1 and 2 is insignificant (Chi-squared statistic = 1.15). Turning to institutional investors, we continue to find that the association between peer firm recommendation revisions and institutional investor trading is concentrated in revisions made by affiliated analysts (Column 3) but not unaffiliated analysts (Column 4), although the difference in these coefficients is not statistically significant (Chi-squared statistic = 1.82). These results suggest that institutional investors believe affiliated analysts have an information advantage, perhaps due to increased access to management and other information about the IPO firm. We next examine retail investors’ use of information provided by affiliated (Column 5) and unaffiliated (Column 6) analysts. We do not find a significant association between peer firm recommendation revisions and retail investor trading, regardless of the analysts’ affiliation. These findings suggest that retail investors are inattentive to peer firm analyst research.Footnote 19

5.1.3 Analyst busyness

The final analyst characteristic we examine is analyst busyness. We argue that busy analysts are less likely to provide timely and accurate research (Clement 1999; Driskill et al. 2020), suggesting that investors are less likely to rely on busy analysts. We classify analysts covering more (fewer) than the sample mean number of firms as busy (not busy) analysts. To the extent that investors believe busy analysts provide less informative research, we expect a weaker association between recommendation revisions and IPO-day trading for recommendations issued by busy analysts.

Columns 1 and 2 of Table 5 Panel C report the results when NetVol_Total is the dependent variable. We find a positive and significant association between recommendation revisions and IPO-day trading for less busy analysts (Column 1) but not those that are busier (Column 2). The difference in coefficient estimates across the two columns is statistically significant (Chi-squared = 3.49). In Columns 3 and 4, we examine the impact of analyst busyness on institutional trading. Among institutional investors, we continue to find that association between recommendation revisions and trading is stronger for analysts who are less busy (Column 3). The difference in coefficients across Columns 3 and 4 is also statistically significant (Chi-squared = 2.89). Turning to retail investors, we find no significant association between recommendation revisions and IPO-day trading, regardless of analyst busyness.

In summary, we interpret the findings in Table 5 as evidence that the extent to which IPO investors trade based on information analysts provide for industry peers during the quiet period varies based on characteristics of the issuing analyst. These findings suggest that our primary results are unlikely to be fully driven by other information sources potentially available during the quiet period. As a result, these tests alleviate concerns about confounding factors impacting the inferences of our tests because any alternative explanations would not explain variation in IPO trading based on these analyst characteristics. Therefore these findings speak to a unique role for sell-side analysts in informing IPO investors.

5.2 Recommendation revisions and post-IPO trading

In our primary test examining IPO-day trading (Table 4), we examine analyst recommendation changes that are issued for peer firms at any point during the registration period and associate these revisions—some of which precede the IPO date by a few weeks—with a single day of trading on the IPO issue date. This raises the possibility that the IPO-day trading we observe is driven by other news events during the registration period. In this section, we examine investor trading in response to analyst recommendation revisions of peer firms issued in the 25-day window after the IPO issue date but before the expiration of the quiet period. While restricting this analysis to recommendation revisions in the 25 days after the IPO issue date significantly reduces the number of recommendations considered in this analysis, it allows us to observe trading reactions in the short window immediately surrounding the recommendation changes, minimizing concerns of confounding effects. Specifically, we estimate the following regression:

NetVol is the volume of buy-initiated trades minus the volume of sell-initiated trades measured over the two-day window starting on the date of the recommendation revision. Revision is an individual recommendation revision issued by an analyst for an IPO firm’s peer.Footnote 20 In addition to the previously described variables, we include an indicator variable equal to one if the revision is announced on the same day as the IPO firm’s first post-IPO earnings announcement or zero otherwise (EA_Day).

Table 6 reports the results. Column 1 reports results when examining total trading, and Column 2 (Column 3) reports results when examining the trading of institutional (retail) investors. We find a positive and statistically significant coefficient on Revision in Column 1 (t-stat = 1.82) and Column 2 (t-stat = 1.77) but an insignificant coefficient on Revision in Column 3 (t-stat = 0.02). For industry-wide information unrelated to analyst recommendations to influence these results, it would have to coincide with the timing of these revisions.Footnote 21 In sum, these findings corroborate the conclusions from our main analysis, suggesting that confounding industry news is unlikely to explain our findings.

Note that the number of recommendation revisions in the 25 days after the IPO issue date and before the expiration of the quiet period is only 777. In comparison, in our main tests, we examine 4,174 recommendation revisions that are issued after the IPO filing date but before the IPO issue date (i.e., the registration period). That is, there are more than five times as many revisions during the registration period, suggesting that most of the information analysts communicate about peer firms during the quiet period occurs before the IPO issue date (rather than after the IPO issue date and before the expiration of the quiet period). Nevertheless, we continue to find results consistent with the main findings

5.3 Information acquisition during the IPO roadshow

Another potential alternative explanation for our findings is that institutional investors gain an information advantage over retail investors through the IPO roadshow, rather than through analyst recommendation revisions of peer firms. Thus information conveyed to both institutional investors and analysts during the roadshow could confound our analysis (Blankespoor et al. 2023).

To address this concern, we replicate our main analysis after excluding analyst recommendation revisions issued in the final weeks prior to the IPO issue date. Because IPO roadshows typically happen in the two weeks leading up to the IPO issue date (Blankespoor et al. 2023), our focus on stock recommendations revisions for peer firms that are issued before this window (and before the roadshow) allows us to draw inferences about the association between analyst research of peer firms and IPO-day trading, without the potentially confounding effect of information conveyed during the roadshow.Footnote 22 Table 7 presents the results of this analysis after excluding recommendation revisions during the two weeks prior to the IPO issue date. In Column 1, we report the results when examining total trading volume. In Column 2 (Column 3), we report results when examining the trading behavior of institutional (retail) investors. Similar to our main findings, we find a positive and statistically significant coefficient on Mean_Revision in Columns 1 (t-stat = 3.01) and 2 (t-stat = 2.40) but an insignificant coefficient in Column 3 (t-stat = -1.14). We interpret these findings as evidence that information conveyed during the roadshow is not a credible alternative explanation of our results.

5.4 Other confounding variables – ITCV analysis

In the previous sections, we attempt to mitigate concerns related to specific alternative explanations for our results. We acknowledge that other potential observable or unobservable factors could confound our inferences. To further mitigate these concerns, we use the impact threshold of a confounding variable (ITCV) to quantify the sensitivity of our results to a potentially confounding omitted variable. In our setting, the ITCV indicates how influential a correlated omitted variable would need to be to overturn a significant result (Frank 2000). The results of this analysis are tabulated in Table 8. We report both the raw impact and the partial impact of each control variable. When examining the raw impact, we find that the impact of an omitted variable on the association between analysts’ revisions of peer firms and institutional investors’ IPO trading would need to be 3.18 times larger than the influence of the variable already in the model that has the largest influence on this association and 0.87 times larger when examining the partial impact. Considering that these two variables are PriceRevision, which has been shown to strongly determine first-day returns in prior literature, and Mean_Orig_Rec, which is the prior recommendation revision for peer firms, an unidentified confounding variable of that magnitude seems unlikely.

6 Additional analysis and discussion

6.1 Do peer firm recommendation changes predict future IPO performance?

In our next analysis, we examine whether analysts’ recommendation revisions for peer firms during the IPO registration period predict future performance of the IPO firm. We estimate the following regression:

Returns_PostIPO is either Returns_90days, Returns_1yr, or Returns_3yr. Returns_90days (Returns_1yr) [Returns_3yr] is the IPO firm’s buy-and-hold returns, adjusted for the value-weighted market return, over a 90-day (one-year) [three-year] window starting the day after the IPO issue date. We use these three windows to capture short-, medium-, and long-term returns. All other variables are as defined previously. We include the same control variables that are included in Eq. 1.

We report the results of this analysis in Table 9. We find that the coefficient on Mean_Revision is positive but insignificant in the first column (t-stat = 0.58) and positive and significant in both the second and third columns (t-stat = 1.78 in Column 2; t-stat = 2.22 in Column 3).Footnote 23 These findings are consistent with analyst stock recommendation revisions of peer firms during the registration period conveying information about the medium- and long-term prospects of the IPO firm.Footnote 24 In particular, an upgrade (downgrade) of the peer firm in the pre-IPO period is predictive of stronger (weaker) long-term IPO performance. This positive association between peer firm recommendation revisions and post-IPO performance is consistent with recent literature showing that a significant proportion of IPOs are motivated by anticipated industry trends (Spiegel and Tookes 2020). More fundamentally, these findings show that analysts provide meaningful information that investors can incorporate into their assessments of the IPO firm.

6.2 Incremental effects during the quiet period

Our evidence suggests that institutional investors (but not retail investors) incorporate information in analysts’ recommendation revisions of peer firms into their trading. However, we acknowledge that our findings may reflect a broader phenomenon about information spillovers that exists beyond the IPO quiet period (e.g., Miller 2010; Blankespoor et al. 2014). We contend that retail investors are particularly vulnerable to being harmed during the quiet period because of institutional investors’ superior ability to glean information from unconventional or indirect sources (i.e., analyst information about peer firms), which may be less relevant after the IPO quiet period, when direct information about the firm becomes more readily available.

Therefore, in the following test, we examine whether the associations we find during the IPO quiet period are incremental to the general phenomenon of retail investors being disadvantaged relative to institutional investors. Specifically, we test whether peer firm analyst research is incrementally informative to institutional investors during the quiet period relative to a placebo period one year after the IPO. We assign a placebo event date exactly one year following the IPO and collect peer firm recommendation revisions during the 25 days after this placebo date. We then compare the trading behavior during this placebo period to the trading we document with our sample in Table 6.

As reported in Table 10, we find evidence of an incremental effect of analyst recommendation revisions during the quiet period among institutional investors (Chi-squared = 3.57) but no incremental effect on retail trading (Chi-squared = 0.24). Furthermore, while the difference in coefficient estimates between institutional investor trading (Column 3) and retail investor trading (Column 5) during the quiet period is significant (p-value = 0.09), we fail to find a significant difference between the two investor groups in the placebo period (i.e., Columns 4 and 6) (p-value = 0.58). We interpret these results as evidence that the spillover effect we document for institutional investors is uniquely strong during the quiet period.

6.3 Possible role of analyst intent

Given how closely regulators have scrutinized the information available to investors during the IPO quiet period, the issue of whether analysts intentionally convey information about IPO firms through their research of peer firms warrants consideration. In particular, analysts may use peer firm research to deliberately signal information about the IPO firm. This motivation for our findings seems unlikely, given that analysts have other (arguably less costly) ways to provide insights on IPO firms, especially considering that unaffiliated analysts are not technically prohibited from providing coverage of IPO firms during the quiet period. In contrast, analysts may simply incorporate information about IPO firms (including news of the IPO itself) into their research of peer firms as part of their standard coverage of peer firms, without any deliberate effort to provide information useful to IPO investors.

We mostly leave this issue for future research, given that our main purpose is not to speak to analyst intent. With that said, in untabulated analysis, we compare the profitability of analysts’ recommendation revisions for peer firms during the quiet period relative to the profitability of their recommendation revisions in an equally long window before the IPO filing date. The intuition for this test is that, if analysts are intentionally using their research of peer firms to signal information about the IPO firm, their recommendation revisions for the peer firm will be less profitable (i.e., less informative about the prospects of the peer firm itself) because of analysts’ efforts to convey information about the IPO firm. In untabulated results, we find that peer firm recommendation revisions during the quiet period are less profitable than their stock recommendation revisions issued prior to the quiet period, which is broadly consistent with analysts intentionally signaling information about the IPO firm through their research of peer firms. We acknowledge that this test is preliminary and that alternative explanations for this result remain, including the possibility that this finding reflects analysts’ difficulty in anticipating the prospects of peer firms when an industry peer is pursuing an IPO.

7 Conclusion

We study the indirect information role of sell-side analysts for IPO firms during the IPO quiet period. Although analysts are generally prohibited from providing information directly about the IPO firm during the quiet period, investors continue to have strong incentives to gain insights about the IPO firm and its prospects at this time. We find that only institutional investors trade on analysts’ recommendation revisions of peer firms on the IPO issue date, while retail investors do not. We also find that IPO trading varies predictably with analyst characteristics, mitigating concerns that industry trends are confounding our results. In addition, these recommendation revisions for peer firms are predictive of the IPO firm’s future performance. Collectively, our findings suggest analysts provide informative signals about IPO firms during the quiet period through their recommendation changes for peer firms and that institutional investors—but not retail investors—benefit from their research.

Our results contribute to several streams of literature. First, we contribute to the literature that documents various ways in which retail investors are inattentive to different sources of information. Second, we contribute to the literature on the role of analysts during the quiet period. To date, the literature has mainly focused on analyst research issued after the expiration of the quiet period, whereas we contribute by showing that analysts also provide informative signals about the IPO firm during the quiet period. Lastly, we contribute to the literature on the IPO quiet period by showing that analysts provide an indirect source of information during the IPO process and that institutional investors disproportionately benefit from this information.

Notes

We focus on analyst recommendation revisions, instead of other analyst research (i.e., quarterly or annual earnings forecasts), because recommendation revisions are arguably less noisy measures of analysts’ beliefs, given that they are not short-term in nature and are not impacted by the walkdown effect associated with analysts’ earnings forecasts (Richardson, Teoh, and Wysocki 2004).

Some communications are permitted during the quiet period, including marketing of shares through the roadshow and associated private communications with investors, but even these communications are limited to information disclosed in the prospectus.

The SEC previously defined the end of the quiet period as 25 days after the IPO issue date, but with the Global Settlement it was changed to 40 days after the IPO issue date.

Relaxing the quiet period restrictions under the JOBS Act only applies to companies meeting the EGC designation, which requires firms to be below $1 billion in revenues at the time of the IPO, among other restrictions. Thus the regulations maintaining the quiet period remain in effect for IPO firms without the EGC designation, even following the JOBS Act.

Hsu et al. (2010) suggest the IPO gives the IPO firm a competitive advantage in the industry, which would predict a negative relationship between the recommendation revision and future IPO performance. However, Spiegel and Tookes (2020) find that this competitive advantage motivation explains only a small minority of IPOs.

Although the information in analyst revisions of peer firms is revealed before the IPO date, there are several reasons why this information is unlikely to be fully reflected in the IPO offer price. Prior literature documents that the parties involved in setting the IPO offer price often have incentives for that price to deviate from the price that would fully reflect all public information about the IPO firm (Benveniste and Spindt 1989; Loughran and Ritter 2002). For example, the literature documents a positive association between the final revisions to the offer price and first-day returns, which is known as the “partial adjustment” phenomenon (Hanley 1993).

We thank Gerard Hoberg and Gordon Phillips for publicly providing the data used in Hoberg and Phillips (2010, 2016) on their website. The data is available at https://hobergphillips.tuck.dartmouth.edu/

We thank Jay Ritter for publicly providing the Field-Ritter dataset of company founding dates used by Field and Karpoff (2002) and Loughran and Ritter (2004), which allows us to include firm age as a control variable in our analyses. The data is available at https://site.warrington.ufl.edu/ritter/ipo-data/

We use the IPO firm’s first 10-K filing as a public company to match to peer firms.

We impose this restriction because the absence of a recommendation revision during the registration period could mean the analyst maintains his or her previous recommendation or that the analyst is inattentive to the peer firm. In untabulated robustness tests, we include IPOs with peer firms that have an analyst stock recommendation revision in the pre-registration period but not during the IPO registration period and find similar results.

The number of distinct analysts per IPO firm-peer pair ranges from one to 11 analysts.

Recommendations are measured on a five-point scale: (1) strong buy, (2) buy, (3) hold, (4) sell, and (5) strong sell. Therefore a recommendation revision can range from 4 to -4.

The majority of IPO firms do not issue press releases or are not covered by the media in the 90-day window before the IPO. Of those that do issue press releases or are covered by the media, only a trivial amount of press releases or media articles overlap with peer firm analyst recommendation revisions. This reduces concerns about concurrent information driving our results.

Prior literature uses underpricing as a proxy for retail investor demand (Ofek and Richardson 2003; Cook, Kieschnick, and Van Ness 2006; Dorn 2009). In untabulated analysis, we use underpricing as an alternative proxy for retail investor trading and find no association between IPO underpricing and peer firm analyst recommendation revisions.

The results in Table 4 are qualitatively similar using an alternative definition of peer firms in which we find the closest three firms within the same four-digit SIC code when propensity score matching on control variables related to firm fundamentals (Assets, Revenue, ROA, R&D, and BTM).

The positive coefficient on ownership retention (Pct_Retained) is consistent with greater managerial ownership providing a positive signal about IPO value (Trueman 1986; Grinblatt and Hwang 1989; Courteau 1995). Prior research also suggests that firms listed on the NYSE experience greater benefits than those listed on the Nasdaq (e.g., Kadlec and McConnell 1994), which is consistent with the negative coefficient we find on Nasdaq. We also find a positive coefficient on Industry_Returns, which suggests that investors are more likely to purchase IPO firm shares when the industry is experiencing positive returns.

Based on our sample mean, analysts covering four industries or fewer are designated as having high industry expertise.

Anecdotal evidence also supports this claim (Jarzemsky and Demos 2013).

Pisciotta (2023) finds that affiliated analysts’ research is less informative about other portfolio firms around the time of an IPO. Note that affiliated analysts’ research may be less informative for peer firms while still being informative about the IPO firm itself, especially if the affiliated analyst issues less informative research for portfolio firms because of their focus on the IPO firm.

Revision differs from Mean_Revision in that it is estimated at the analyst recommendation level, while Mean_Revision is aggregated across all peer firms for each IPO firm.

We control for whether the peer firm recommendation revision coincides with the IPO firm’s first earnings announcement, and, in an untabulated analysis, we also control for whether the revision is issued on the same day as a firm-initiated press release or a media article. This analysis yields similar results. Given that we control for the largest sources of information during the quiet period, it is unlikely that our results are driven by correlated omitted variables.

Approximately 9% of the recommendation revisions in our sample occur during the two weeks immediately prior to the IPO date, suggesting that the majority of revisions precede the IPO roadshow.

Results are robust when measuring Returns_90days, Returns_1yr, and Returns_3yr after adjusting market returns using Fama–French five-by-five portfolios constructed by size and book-to-market ratio.

Our empirical analysis does not distinguish between (a) information that originates with analysts and (b) information that originates elsewhere and comes to the market through analysts’ role in integrating information from other sources (Bradshaw et al. 2017).

References

Akhigbe, A., J. Madura, and M. Newman. 2006. Industry effects of analyst stock revisions. Journal of Financial Research 29 (2): 181–198.

Alti, A. 2006. How persistent is the impact of market timing on capital structure? The Journal of Finance 61 (4): 1681–1710.

Asthana, S., S. Balsam, and S. Sankaraguruswamy. 2004. Differential response of small versus large investors to 10-K filings on EDGAR. The Accounting Review 79 (3): 571–589.

Barber, Brad M., Xing Huang, Philippe Jorion, Terrance Odean, and Christopher Schwarz. 2023. A (sub)penny for your thoughts: Tracking retail investor activity in TAQ. Journal of Finance. Forthcoming.

Barber, B.M., and T. Odean. 2008. All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies 21 (2): 785–818.

Barth, M.E., R. Kasznik, and M.F. McNichols. 2001. Analyst coverage and intangible assets. Journal of Accounting Research 39 (1): 1–34.

Barth, M.E., W.R. Landsman, and D.J. Taylor. 2017. The JOBS Act and information uncertainty in IPO firms. The Accounting Review 92 (6): 25–47.

Benveniste, L.M., and P.A. Spindt. 1989. How investment bankers determine the offer price and allocation of new issues. Journal of Financial Economics 24 (2): 343–361.

Bhushan, R. 1989. Firm characteristics and analyst following. Journal of Accounting and Economics 11 (2–3): 255–274.

Blankespoor, E., B.P. Miller, and H.D. White. 2014. Initial evidence on the market impact of the XBRL mandate. Review of Accounting Studies 19 (4): 1468–1503.

Blankespoor, E., E. deHaan, and C. Zhu. 2018. Capital market effects of media synthesis and dissemination: Evidence from robo-journalism. Review of Accounting Studies 23 (1): 1–36.

Blankespoor, E., E. deHaan, and I. Marinovic. 2020. Disclosure processing costs, investors’ information choice, and equity market outcomes: A review. Journal of Accounting and Economics 70 (2–3): 101344.

Blankespoor, E., B.E. Hendricks, and G.S. Miller. 2023. The Pitch: Managers’ Disclosure Choice during Initial Public Offering Roadshows. The Accounting Review 98 (2): 1–29.

Boehmer, E., C.M. Jones, X. Zhang, and X. Zhang. 2021. Tracking retail investor activity. The Journal of Finance 76 (5): 2249–2305.

Bradley, D.J., B.D. Jordan, and J.R. Ritter. 2003. The quiet period goes out with a bang. The Journal of Finance 58 (1): 1–36.

Bradley, D., B.D. Jordan, J. Ritter, and J. Wolf. 2004. The IPO quiet period revisited. Journal of Investment Management 2 (3): 1–11.

Bradley, D.J., B.D. Jordan, and J.R. Ritter. 2008. Analyst behavior following IPOs: The “bubble period” evidence. The Review of Financial Studies 21 (1): 101–133.

Bradley, D., S. Gokkaya, X. Liu, and F. Xie. 2017. Are all analysts created equal? Industry expertise and monitoring effectiveness of financial analysts. Journal of Accounting and Economics 63 (2–3): 179–206.

Bradshaw, M., Y. Ertimur, and P. O’Brien. 2017. Financial analysts and their contribution to well-functioning capital markets. Foundations and Trends® in Accounting 11 (3): 119–191.

Bushee, B., M. Cedergren, and J. Michels. 2020. Does the media help or hurt retail investors during the IPO quiet period? Journal of Accounting and Economics 69 (1): 101261.

Cao, J.X. 2011. IPO timing, buyout sponsors’ exit strategies, and firm performance of RLBOs. Journal of Financial and Quantitative Analysis 46 (4): 1001–1024.

Chan, K., and A. Hameed. 2006. Stock price synchronicity and analyst coverage in emerging markets. Journal of Financial Economics 80 (1): 115–147.

Clement, M.B. 1999. Analyst forecast accuracy: Do ability, resources, and portfolio complexity matter? Journal of Accounting and Economics 27 (3): 285–303.

Cook, D.O., R. Kieschnick, and R.A. Van Ness. 2006. On the marketing of IPOs. Journal of Financial Economics 82 (1): 35–61.

Courteau, L. 1995. Under-diversification and retention commitments in IPOs. Journal of Financial and Quantitative Analysis 30 (4): 487–517.

Dambra, M., L.C. Field, M.T. Gustafson, and K. Pisciotta. 2018. The consequences to analyst involvement in the IPO process: Evidence surrounding the JOBS Act. Journal of Accounting and Economics 65 (2–3): 302–330.

Dorn, D. 2009. Does sentiment drive the retail demand for IPOs? Journal of Financial and Quantitative Analysis 44 (1): 85–108.

Driskill, M., M.P. Kirk, and J.W. Tucker. 2020. Concurrent earnings announcements and analysts’ information production. The Accounting Review 95 (1): 165–189.

Dunn, K., and S. Nathan. 2005. Analyst industry diversification and earnings forecast accuracy. The Journal of Investing 14 (2): 7–14.

Engelberg, J.E., and C.A. Parsons. 2011. The causal impact of media in financial markets. The Journal of Finance 66 (1): 67–97.

Field, L.C., and J.M. Karpoff. 2002. Takeover defenses of IPO firms. The Journal of Finance 57 (5): 1857–1889.

Frank, K.A. 2000. Impact of a confounding variable on a regression coefficient. Sociological Methods & Research 29 (2): 147–194.

Green, T.C., R. Jame, S. Markov, and M. Subasi. 2014. Access to management and the informativeness of analyst research. Journal of Financial Economics 114 (2): 239–255.

Grinblatt, M., and C.Y. Hwang. 1989. Signalling and the pricing of new issues. The Journal of Finance 44 (2): 393–420.

Hameed, A., R. Morck, J. Shen, and B. Yeung. 2015. Information, analysts, and stock return comovement. The Review of Financial Studies 28 (11): 3153–3187.

Hanley, K.W. 1993. The underpricing of initial public offerings and the partial adjustment phenomenon. Journal of Financial Economics 34 (2): 231–250.

Highfield, M.J., P.A. Lach, and L.R. White. 2008. The quiet period is making noise again. Applied Financial Economics 18 (17): 1363–1378.

Hirshleifer, D., and S.H. Teoh. 2003. Limited attention, information disclosure, and financial reporting. Journal of Accounting and Economics 36 (1–3): 337–386.

Hoberg, G., and G. Phillips. 2010. Product market synergies and competition in mergers and acquisitions: A text-based analysis. The Review of Financial Studies 23 (10): 3773–3811.

Hoberg, G., and G. Phillips. 2016. Text-based network industries and endogenous product differentiation. Journal of Political Economy 124 (5): 1423–1465.

Howe, J.S., E. Unlu, and X. Yan. 2009. The predictive content of aggregate analyst recommendations. Journal of Accounting Research 47 (3): 799–821.

Hsu, H.C., A.V. Reed, and J. Rocholl. 2010. The new game in town: Competitive effects of IPOs. The Journal of Finance 65 (2): 495–528.

Hugon, A., A. Kumar, and A.P. Lin. 2016. Analysts, macroeconomic news, and the benefit of active in-house economists. The Accounting Review 91 (2): 513–534.

Hutton, A.P., L.F. Lee, and S.Z. Shu. 2012. Do managers always know better? The relative accuracy of management and analyst forecasts. Journal of Accounting Research 50 (5): 1217–1244.

Israelsen, R.D. 2016. Does common analyst coverage explain excess comovement? Journal of Financial and Quantitative Analysis 51 (4): 1193–1229.

James, C., and J. Karceski. 2006. Strength of analyst coverage following IPOs. Journal of Financial Economics 82 (1): 1–34.

Jarzemsky, M., and T. Demos. 2013. Twitter investors’ random murky walk. The Wall Street Journal. https://www.wsj.com/articles/SB10001424052702303661404579180301018620832.

Jin, S., M.D. Kimbrough, and I.Y. Wang. 2024. Privileged information access, analyst consensus building, and stock return volatility: Evidence from the JOBS Act. Advances in Accounting 64: 100729.

Kadan, O., L. Madureira, R. Wang, and T. Zach. 2012. Analysts’ industry expertise. Journal of Accounting and Economics 54 (2–3): 95–120.

Lach, P.A., M.J. Highfield, and S.D. Treanor. 2012. The quiet period has something to say. Applied Financial Economics 22 (1): 71–86.

Latham and Watkins. 2014. The JOBS Act, Two Years Later: An Updated Look at the IPO Landscape. https://www.lw.com/thoughtLeadership/lw-jobs-act-ipos-second-year.

Lee, C.M., and M.J. Ready. 1991. Inferring trade direction from intraday data. The Journal of Finance 46 (2): 733–746.

Liu, L.X., A.E. Sherman, and Y. Zhang. 2014. The long-run role of the media: Evidence from initial public offerings. Management Science 60 (8): 1945–1964.

Loughran, T., and J. Ritter. 2004. Why has IPO underpricing changed over time? Financial Management 33: 5–37.

Loughran, T., and J.R. Ritter. 2002. Why don’t issuers get upset about leaving money on the table in IPOs? The Review of Financial Studies 15 (2): 413–444.

Lowry, M., and G.W. Schwert. 2002. IPO market cycles: Bubbles or sequential learning? The Journal of Finance 57 (3): 1171–1200.

Lowry, M., R. Michaely, and E. Volkova. 2020. Information revealed through the regulatory process: Interactions between the SEC and companies ahead of their IPO. The Review of Financial Studies 33 (12): 5510–5554.

Miller, B.P. 2010. The effects of reporting complexity on small and large investor trading. The Accounting Review 85 (6): 2107–2143.

Muslu, V., M. Rebello, and Y. Xu. 2014. Sell-side analyst research and stock comovement. Journal of Accounting Research 52 (4): 911–954.

Ofek, E., and M. Richardson. 2003. Dotcom mania: The rise and fall of internet stock prices. The Journal of Finance 58 (3): 1113–1137.

Pástor, Ľ, and P. Veronesi. 2005. Rational IPO waves. The Journal of Finance 60 (4): 1713–1757.

Piotroski, J.D., and D.T. Roulstone. 2004. The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm-specific information into stock prices. The Accounting Review 79 (4): 1119–1151.

Pisciotta, K. 2023. Analyst workload and information production: Evidence from IPO assignments. Contemporary Accounting Research 40 (3): 1605–1640.

Richardson, S., S.H. Teoh, and P.D. Wysocki. 2004. The walk-down to beatable analyst forecasts: The role of equity issuance and insider trading incentives. Contemporary Accounting Research 21 (4): 885–924.

Shroff, N., R.S. Verdi, and B.P. Yost. 2017. When does the peer information environment matter? Journal of Accounting and Economics 64 (2–3): 183–214.

Spiegel, M., and H. Tookes. 2020. Why does an IPO affect rival firms? The Review of Financial Studies 33 (7): 3205–3249.

Trueman, B. 1986. The relationship between the level of capital expenditures and firm value. Journal of Financial and Quantitative Analysis 21 (2): 115–129.

Acknowledgements

We thank two anonymous reviewers, Mark Bradshaw (discussant), Chad Ham, Brad Hendricks, Kevin Pisciotta, Richard Sloan (editor), Jessie Watkins, Chi Zhang (discussant), workshop and conference participants at the 2021 ASU/UA Joint Accounting Conference, 2022 FARS Midyear Meeting, 2022 Hawaii Accounting Research Conference, Hong Kong University, National University of Singapore, University of Bath, University of California – Irvine, University of Florida, University of Maryland, University of North Carolina at Chapel Hill, University of Washington, and Yale University for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Alhusaini, B., Call, A.C. & Chapman, K. Analyst information about peer firms during the IPO quiet period. Rev Account Stud (2024). https://doi.org/10.1007/s11142-024-09824-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s11142-024-09824-w