Abstract

This paper provides evidence that the #MeToo movement revised investors’ beliefs about the costs (benefits) of fostering an exclusive (inclusive) culture, as reflected by the absence (presence of a critical mass) of women directors in the board room. Tracking a timeline of events associated with the #MeToo movement that begin with the Harvey Weinstein exposé in October 2017 in the New York Times, we document contrasting market reactions to the movement depending on the existing culture of the firm. Firms that historically excluded women from their board experienced a negative market response as momentum for the cause increased, whereas investors responded favorably to firms that historically embraced the inclusion of women on their boards. In contrast, we do not detect differences in the market’s response to randomly generated pseudo-events during the same time frame when comparing firms with exclusive and inclusive cultures. In the context of increased regulator attention to board gender diversity, as well as the ESG activist campaigns by large institutional investors, our study documents a shift in investors’ beliefs about the risks associated with sexual misconduct and about the value of having women in the boardroom shaping the culture of the firm.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Good corporate governance is a bedrock of corporate America, with a central tenet being the board of directors’ role in effectively overseeing and monitoring the firm. Recently, institutional investors have focused on changing board composition with respect to gender. Beginning in 2017, two of the “Big 3″ institutional investors, State Street and BlackRock, launched ESG activist campaigns for their portfolio firms to include women on their board of directors, voting consistently against directors on the nominating committee if the firm presented a ballot of directors with zero women (Baer, 2017; Hunnicutt, 2017).Footnote 1 In 2020, Goldman Sachs joined this campaign by announcing that it would not underwrite IPOs in the U.S for firms with all-male boards of directors (Elsesser, 2020). Generally, their reason for promoting board gender diversity is that it leads to higher-quality decision-making, which in turn improves shareholder value (Krouse, 2018). Studies supporting this view for seasoned firms include Dezsö and Ross (2012), Chen et al. (2018), and Coles et al. (2020).Footnote 2

Given the voting and financial clout of these institutions, it is not surprising that their activism wielded significant influence in this governance area.Footnote 3 Between 2017 and 2020, the number of S&P 1500 firms having all-male boards dropped from 179 to 30, with no S&P 500 board having an all-male board. In 2020, of the top 25 U.S. IPOs, just one company, Dun & Bradstreet, went public with an all-male board, compared to 12 IPOs in 2018 (Green, 2021). Government and regulators also have responded. In 2018, California passed legislation mandating that most of the publicly traded companies that are based there have at least three women on their boards by the end of 2021. And in 2021, NASDAQ adopted a change to its corporate governance listing requirements by mandating the inclusion (or explanation of the non-inclusion) of at least one woman board member.Footnote 4

These events suggest that board gender, and in particular the lack of women on the board, should be a concern to shareholders. Some papers address this conjecture by demonstrating that women directors possess special skills (Kim & Starks, 2016) or are more risk-averse (Chen et al., 2019) and thus bring new ideas and backgrounds to board decision making. Other papers examine how a change in gender composition via a mandated shock to gender representation (e.g., Ahern & Dittmar, 2012; Greene et al., 2020) or through an instrumented addition of a woman to the board (e.g., Adams & Ferreira, 2009) affects firm value. These papers, however, produce mixed results. With regard to the California law, Allen and Wahid (2021) document significantly positive stock price reactions around the law’s passage for firms with boards that currently exclude women; other papers (Greene et al., 2020; Hwang et al., 2018; von Meyerinck et al., 2021) find the opposite result when examining a narrower set of event dates.

In this paper, we take a different approach. We use the history of board gender diversity as a measure of the corporate culture within a firm with respect to its inclusivity or exclusivity of women. We then identify an economic shock in which gender itself may matter to investors. The shock we exploit is the modern #MeToo Movement, which we propose shifted investors’ views of the economic risks associated with gender exclusivity in the workplace. The risks of such exclusivity can be revelations of future sexual misconduct within the workplace, unrevealed internal incidents of sexual misconduct, or other risks associated with gender exclusivity (for example, the firm having difficulties hiring and retaining qualified women due to inequities in pay or advancement or to inhospitable working conditions).

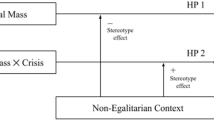

We posit that firms with all-male boards are associated with an internal culture that is exclusive to women and therefore earn significantly negative abnormal returns as the revelations of the #MeToo movement become more apparent. Conversely, we propose that firms with boards incorporating a large number of women directors are indicative of an internal culture that is inclusive of women, so we expect these firms to be less affected by the shock, as evidenced by less negative or even positive abnormal stock returns. Thus, our paper examines whether board diversity per se is a reflection of the firm’s culture and, if so, whether investors price in the costs (benefits) of fostering an exclusive (inclusive) environment. Our paper also speaks directly to a corporate governance agenda that forcefully advocates against all-male boards of directors—an agenda that has been criticized as being “political at [its] core” (Levitt, 2021).

The #MeToo movement began in October 2017 when actress Alyssa Milano responded to developing scandals with the inclusion of the #MeToo hashtag in a tweet describing her personal experiences of sexual harassment in the workplace.Footnote 5 Within 48 hours of Milano’s initial tweet, nearly two million responses used the #MeToo hashtag, thus creating a newfound attention to the issue of sexual harassment in the workplace.Footnote 6 As illustrated in Fig. 1, both Dow Jones/Factiva counts of new items discussing “sexual harassment” (Panel A) and Google searches on the phrase #MeToo (Panel B) spiked dramatically after Milano’s initial tweet.

Sexual Harassment in the News. (a) documents the spike in news media mentions of sexual harassment in 2017 and 2018, which is consistent with a shock to attention to the issue. (b) documents the spike in the popularity of “#MeToo” on Google Trends*. [Sources: Dow Jones / Factiva and Google Trends.] * Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term

Firms, investors, and Wall Street responded to the #MeToo movement in various ways. For example, in July 2018, the stock price of CBS Corporation dropped 6% upon the news that its CEO, Les Moonves, would face misconduct allegations in an upcoming story reported in the New Yorker by Ronan Farrow, who had recently won the Pulitzer Prize in Public Service for his investigative reporting in relation to the #MeToo Movement (Farrow, 2018; Garber & McAlone, 2018). Moonves denied the allegations, but two months later CBS fired him, causing further declines in the company’s stock price and triggering shareholders to sue the company—arguing that as the #MeToo Movement gained momentum and the likelihood that their “star” CEO would get taken down by scandal increased, the company failed to disclose this risk (Spangler, 2018).Footnote 7 In January 2020, the court denied CBS’s motion to dismiss the lawsuit, noting that a single theory of securities fraud underpins the shareholders’ complaint:

Plaintiffs allege that Moonves and other managers and officers sexually harassed and threatened female employees behind the scenes for years, fostering a crude and hostile workplace culture. This behavior and culture created a risk that CBS would lose Moonves, its star executive, should his dirty laundry come to light. Plaintiffs’ securities fraud theory is that, with the advent of the #MeToo movement, the risk of losing Moonves to sexual scandal increased, and yet Defendants failed to disclose the risk even as they touted CBS’s ethical culture and Moonves’s importance to the Company’s financial performance. [See page 11 of Opinion and Order filed on January 15, 2020 re: Civil Action Docket No. 1:18-cv-07796, emphasis added.]

A very similar story played out for Steve Wynn, the CEO-founder of Wynn Resorts and Casinos, with shareholders again alleging that the company failed to disclose that the company was at “grave risk” of losing its leader to scandal.Footnote 8 In fact, after the initial revelation of the #MeToo movement, over 200 male executives were dismissed or demoted following allegations of sexual misconduct, with many of these men being replaced by women (Bach, 2018; Carlsen et al., 2018).

Wall Street responded by adding “Weinstein Clauses” (named after Harvey Weinstein, the former CEO of Miramax and the Weinstein Company) and “#MeToo representations” into merger documents, providing economic recourse to bidders via clawback provisions if sexual misconduct is discovered after the deal is closed (Ahmed, 2018; Reints, 2018). Private equity and tech investors also sought ways to acknowledge the risk of a #MeToo scandal in their contracts (Fletcher, 2018; Ram, 2019). And institutional investors increased their pressure on firms to add gender diversity on their boards by voting against board members of nominating committees that put forth all-male ballots during their annual meetings (Baer, 2017; Hunnicutt, 2017).

The California legislature responded by mandating minimum thresholds of women on boards (Baer, 2017; Hunnicutt, 2017), and the NASDAQ changed its listing requirements by introducing a consent or explain disclosure requirement for inclusion of at least one woman board member. State legislatures reacted by passing laws significantly restricting or prohibiting employers from using nondisclosure agreements when resolving sexual harassment complaints, thus increasing the likelihood that future revelations of sexual harassment will come to the public’s attention (Haigh & Wirtz, 2020; Tippett, 2018).Footnote 9 In February 2022, the U.S. Congress approved legislation banning the use of clauses, in employment contracts, that force victims of sexual assault and harassment to pursue their cases in forced arbitration—clauses that shield accused perpetrators from public disclosures.Footnote 10

Our main predictions and tests rely on whether and how board gender diversity reflects inclusive and exclusive gender cultures within a firm. We define an “exclusive” culture to be one in which the board room was exclusively male over 2012–2016, the five-year period immediately preceding the advent of the #MeToo movement. Following “critical mass” theory of group dynamics (Kanter, 1977), we identify firms with “inclusive” cultures as those that entered the #MeToo time frame with three or more women in the board room continuously over the same time period. Critical mass theory contrasts sharply with papers that use an indicator for the presence or absence of women, a percentage threshold, or a continuous percentage of women variable to measure inclusivity.Footnote 11 Because our time period precedes the gender activist campaigns of BlackRock, State Street, and others (as well as regulations requiring the inclusion of women in the board room), firms were not under pressure to tailor their board representations along gender lines. Further, by using a continuous five-year period, we ensure that the firms had a history of board gender exclusion or inclusion, providing a more valid representation of corporate culture. Using these criteria identifies 481 gender exclusive and 122 gender inclusive firms, respectively.

Using these delineations, we document systematic differences in culture between the exclusive and inclusive subsamples. Focusing on executive characteristics, we find that firms that left women out of the board room also neglected to hire (or promote) women executives, a finding consistent with other studies using samples from earlier periods (e.g., Carter et al., 2017; Matsa & Miller, 2011). Moreover, examining external evaluations of firm culture (as maintained by Glassdoor, Fortune, and two proprietary databases), we document that differences in gender diversity spanned broadly throughout all levels of the workforce, with exclusive (inclusive) boards being a reflection of their respective firms’ cultures.

We next turn to our main question: Did the #MeToo movement revise investors’ beliefs about the value of having women in the board room? To answer this question, we conduct an event study over 37 event dates occurring during the first nine months of the #MeToo movement. The sample we study is not limited to those firms named in complaints or directly affected by a scandal; instead, we study a broad-based sample of firms listed on the major U.S. stock exchanges.

Our findings consistently support the view that exclusive firms experienced negative abnormal market returns as momentum for the cause increased, while inclusive firms earned abnormal positive returns as the #MeToo events unfolded. The discrepancy in cumulative returns between groups grew over time, reflecting the increased momentum of the #MeToo movement as more allegations of sexual harassment surfaced. These findings hold regardless of our approach to benchmarking abnormal performance and after taking various approaches to controlling for covariates between firm types. In contrast, placebo tests conducted over the same time period (replacing #MeToo dates with randomly generated pseudo-event dates) produce insignificant differences in market price movements between the two groups, suggesting that the return patterns we document stem from the #MeToo movement itself and not from other firm characteristics. Our findings also hold after removing confounding events—for example, earnings announcements—and are robust to alternative measurements and the inclusion of additional control variables.

Exploring the dynamics surrounding our main findings, we document important variations in market reaction depending on the presence of a “critical mass” as compared to a “token presence” in the board room (Adams & Ferreira, 2009; Farrell & Hersch, 2005). Consistent with the notion that investors do not reward firms for tokenism, when we lower the threshold for inclusiveness to capture firms with just one or two women directors, we no longer detect a positive market response to the #MeToo events. This finding supports critical mass theory and provides insights into when gender representation at the board level has meaningful board policy implications (Erkut et al., 2008; Konrad et al., 2008; Torchia et al., 2011). It also supports the California law’s premise that gender diversity should include at least three women directors.

We also examine if investors feared that the #MeToo movement would result in firms with all-male boards altering their boards in a suboptimal way by adding a woman director. In theory, firms and boards use cost-benefit analyses to structure their boards (Hermalin & Weisbach, 1998), a phenomenon borne out by empirical evidence (Coles et al., 2008; Klein, 1998). Because our designation of exclusive and inclusive boards encompasses gender diversity prior to the advent of the #MeToo movement, the ESG engagements by BlackRock and State Street, and the California law, it could be argued that these firms used criteria other than gender to optimally create their slates of board members. Thus, if firms with all-male boards felt pressured to nominate or to appoint a woman to their boards in response to the #MeToo movement, we should observe negative stock market reactions around the appointments of these women. We find no evidence that investors believe these appointments harmed firm value.

Collectively, our paper is consistent with the #MeToo movement revising investors’ beliefs about the costs (benefits) of fostering a culture that excludes (includes) women, as reflected by the absence (presence) of women in the board room.

Our paper contributes to several lines of literature. First, it adds to studies examining how board gender diversity relates to firm value. Because board composition and firm value are intricately related, most studies seek to find an exogenous shock to gender composition (Ahern & Dittmar, 2012) or use an instrumented addition of a woman to the board (Adams & Ferreira, 2009) to examine this link. In contrast, we treat the board’s gender composition as endogenously determined and exploit a shock to investors’ beliefs about the costs of fostering a culture that excludes women to see its effects on shareholder value. Our findings support the view that firms with all-male boards are deemed by the market to be more exposed to the risks associated with sexual misconduct than firms with boards containing a critical mass of women.

Second, our paper contributes to the literature demonstrating the futility associated with firms taking a tokenism approach to board diversity (e.g., Adams & Ferreira, 2009; Erkut et al., 2008; Farrell & Hersch, 2005). Our findings of no significant association between excess stock returns and boards with just one woman are consistent with these prior studies. Thus, we caution the reader not to interpret our findings to indicate that a firm can remedy its negative impression simply by adding a woman to its board. Nor do we take the position that the California law, the NASDAQ proposal, or even the ESG activism by BlackRock and State Street necessarily will foster a better culture within the firm. Instead, we interpret our findings as being consistent with the view that boards that endogenously exclude (or include) women reflect the culture of the firm. This reflection may signal a tone at the top that filters down to the rest of the firm. Alternatively, board gender composition may serve as a proxy for the corporate culture that arises organically within a firm. Consequently, our findings inform advisors, regulators, and other stakeholders as they consider approaches to fostering diversity and inclusion in ways that have a meaningful impact on firm value.

2 Background and firm culture

2.1 Sexual harassment: Explicit and implicit implications to the firm

Our study relies on using market returns to calibrate investor reactions to events surrounding the #MeToo movement; therefore, a natural question to ask is whether investors, on average, punish firms when they announce sexual harassment complaints. Borelli-Kjaer et al. (2021) examine the price impact of sexual harassment scandals for a broad sample of international firms reporting such scandals between January 2005 and February 2019. They find that market value, on average, falls 1.5% in response to the announcement of a sexual harassment scandal, thus validating the view that the market places a tangible cost on firms engaging in these types of behavior. In Appendix 1, we corroborate Borelli-Kjaer et al.’s (2021) findings by documenting an overall negative price response to 92 sexual harassment scandal announcements affecting NASDAQ and NYSE-listed U.S. firms that overlap with our sample. Thus, on average, investors place a jaundiced eye towards firms engaging in sexual harassment.

From a legal standpoint, sexual harassment is a form of employment discrimination that falls under Title VII of the Civil Rights Act of 1964. However, its inclusion as a violation of the Civil Rights Act was not immediate. Administratively, the Equal Employment Opportunity Commission (EEOC) began considering sexual harassment to be an action prohibited by Title VII in 1980,Footnote 12 a view upheld by the U.S. Supreme Court in a 1986 unanimous decision in the case of Meritor Savings Bank v. Vinson (see Tippett (2018) for a discussion of Meritor and subsequent Supreme Court rulings that refined and explained the conditions behind the existing law). In addition, many states have their own laws prohibiting sexual harassment—for example, the New Jersey Laws Against Discrimination and the Pennsylvania Humans Relations Act.

Both a firm and its employees can be punished for sexual harassment within the workplace. For example, in 1998, the U.S. Supreme Court held that an employer can be found vicariously liable for sexual harassment committed by one of its supervisory employees (see Faragher v. City of Boca Raton). Monetary damages against employers found liable for sexual harassment under federal or state statutes include lost wages, compensatory and punitive damages, and victims’ court and legal fees. In addition, as discussed earlier, revelations of sexual harassment can result in the dismissal of management or key employees, which can materially impact the strategic trajectory of the firm. Legally, they can spawn costly contracting clauses and trigger the passage of new regulation, such as the California law. Other substantive indirect costs include poor employee morale, bad publicity, and a hit to the firm’s reputation.

However, not all sexual misconduct incidents are publicly revealed by the firm, by the victim(s), or through a publicly documented initiation of a sexual harassment lawsuit. For example, firms historically have used nondisclosure agreements and arbitration agreements to suppress or hide the public disclosure of these violations, thus keeping their sexual harassment complaints within house (Tippett, 2018). More commonly, many complaints go unreported or are not vigorously pursued by the firm. According to a 2016 survey by the Merit Systems Protection Board (MSPB, 2018), only 11% of employees who endured any form of workplace sexual harassment filed a formal complaint; more common survey responses included the employee ignoring the incident, asking for the harassment to stop, or changing jobs.

There are substantive nonlegal costs associated with sexual misconduct incidents, both revealed and unreported. These costs include being absent from work, reduced productivity, job turnover, and the opportunity cost of manager time in handling complaints (Deloitte, 2019; Rizzo et al., 2018; Sandroff, 1988). In dollar terms, Sandroff (1988), in a survey of individuals across 160 Fortune 500 companies, estimated the average organizational costs of workplace sexual harassment to be $6.7 million per firm. Deloitte (2019), using survey data from the Australian Human Rights Commission (2018), reports an estimated $1053 cost per employee (for all employees, not just the targets) for Australian firms, with these costs stemming from absenteeism ($297), reduced productivity ($171), staff turnover ($336), and manager time ($250). Notably, Deloitte finds strong evidence that staff turnover encompasses not only the perpetrator and the person being harassed, but also bystanders who witness the incident.

If, as we contend, the #MeToo Movement increased investors’ concerns about the future costs of sexual harassment incidents within a firm, then the abnormal returns around the events surrounding this movement would be a reflection both of these costs and the perceived likelihood of future sexual misconduct existing within the firm.

2.2 Firm culture: Inclusive vs. exclusive cultures

Kreps (1990) defines corporate culture as an intangible asset designed to meet unforeseen contingencies as they arise (see also Camerer and Vepsalainen (1988)). Basically, because a firm cannot contract on unforeseen circumstances, it can create a culture consonant with shared beliefs, assumptions, and values that help employees understand which behaviors are and are not appropriate (Grennan, 2019; Schein, 1990). Importantly, corporate culture evolves over time (Cheng & Groysberg, 2021; Schein, 1990), suggesting both a stickiness in change and a historical perspective on what that culture is.

The corporate culture we examine is the implicit attitude toward the inclusion or exclusion of women within the firm’s workplace. Firms with inclusive workplaces based on gender or race have been shown to be more innovative towards their customers’ needs (Jain-Link et al., 2020); more likely to create a learning culture, i.e., one which emphasizes flexibility and independence among its employees (Cheng & Groysberg, 2021); and more likely to act in the interests of a broader set of stakeholders, i.e., not just shareholders (Chen et al., 2021). Conversely, exclusive workplaces—defined by Cheng and Groysberg (2021) as organizations where differing perspectives are silenced, ignored, or neglected—are more likely to struggle with managing, hiring, and retaining qualified and diverse employees (Cheng & Groysberg, 2021).

2.3 Using board composition to measure an inclusive vs. exclusive corporate culture

One role of the board of directors is to “set the framework of values” (FRC, 2018), thus shaping its corporate culture. However, according to two surveys by Graham et al. (2016, 2022), boards do not directly choose a firm’s culture. Instead, they embody the firm culture and, accordingly, influence it through their actions—for example, via their choice of CEO (see also Sandford, 2014). In recognition of this embodiment, law firms (e.g., Akin Gump, 2019) and accounting consulting groups (e.g., Klemash & Dettmann, 2019) increasingly have counseled boards to consider the oversight of their firms’ corporate cultures as an important priority.

Our assumption that investors use board composition as a partitioning variable in assessing a firm’s corporate culture hails from Camerer and Vepsalainen (1988), who define a visible firm culture as one that can be seen from outside the firm. Since board composition is visible to outside investors, we propose that the market uses this composition in assessing the inclusivity or exclusivity of firm culture as it relates to gender. Further, consistent with Schein (1990), who states that corporate cultures evolve over time, we expect the market to consider long-term trends in gender composition as better indicators of the firm’s corporate culture vis-à-vis the most recent year.

3 Data and sample selection

3.1 #MeToo timeline of event dates

As in any event study, our inferences depend critically on the proper identification of events. To avoid subjectivity in our selection of dates and the potential for bias, we use the #MeToo event timeline maintained by the Chicago Tribune for our analyses.Footnote 13 This timeline remains the top search result from Google and Bing search engines (using the search terms of “#MeToo” and “timeline”), underscoring the awareness and influence of this source.

Our analyses focus on the events in the first nine months of the #MeToo timeline, i.e., the 37 event dates from October 2017 through May 2018 (see Appendix 2 for the dates and headlines of each event). We begin on October 5, 2017 [E1], when allegations of sexual harassment by Ashley Judd against Harvey Weinstein of Miramax were reported in the news, and we conclude with the indictment of Harvey Weinstein on May 25, 2018 [E37]. This timeline allows the market to evaluate the growing momentum of this social movement.

3.2 Sample selection and descriptive statistics

We assemble a sample of U.S. public companies with available stock return data from CRSP, financial statement data from Compustat, and board composition data from BoardEx. As shown in Table 1, we begin with the 5385 firms listed in the Compustat-CRSP merged database as of 2016, which represents the last full year of available data prior to the start of the #MeToo movement in 2017. Removing 884 foreign firms and 1097 firms with missing daily return data at any point during the nine-month sample period, we arrive at 3404 firms with available data for our market reaction tests. Although the BoardEx coverage expanded considerably in the past decade, we still lose 525 of these firms due to a lack of BoardEx data. After removing another 276 firms with either inconsistent BoardEx data (20 firms) or missing Compustat data (256 firms), we have a sample of 2603 firms with all available data at the end of 2016. We further add the restriction that each firm has available BoardEx data over the years 2012 through 2016 inclusive, which allows us to create subsamples of firms with multi-year inclusions and exclusions. After excluding the 578 firms with missing years, we arrive at our final sample of 2025 firms available for our tests.

Panel A of Table 2 provides descriptive statistics for the sample. The typical (based on mean or median) firm in our sample has nine directors on its board, which includes one woman. As shown in Fig. 2, women’s board representation steadily increased in the years leading up to the #MeToo movement. While nearly 40% of firms in our sample excluded women from the board room in 2012, only 27% did so as of 2016. Nevertheless, the percentage of firms welcoming just one woman into the board room each year held steady over this same time period, as approximately one-third of boards included only one woman from 2012 through 2016.

Our upcoming tests focus on the differential reaction to the #MeToo movement based on firms’ inclusive versus exclusive cultures. Accordingly, we identify subsamples of firms based on the presence or the absence of women in their board rooms. Specifically, we narrow our focus to firms that, as of the start of the #MeToo movement, had traditionally excluded women from their board. For contrast, we also identify firms that had already embraced the inclusion of women on their board, as evidenced by the presence of three or more women.

We select three women as our threshold for three main reasons. First, this number avoids the tokenism documented by prior work (Adams & Ferreira, 2009; Farrell & Hersch, 2005). Indeed, the steady trend of the percentage of firms with just one woman on the board (as shown in Fig. 2) is indicative of tokenism. Second, a threshold of three women follows critical mass theory of group dynamics. Kanter (1977) argues that a minority subgroup’s degree of influence within any full group is felt only when the size of that group reaches a certain dimension; Kanter refers to this as a “critical mass” theory. Erkut et al. (2008), Konrad et al. (2008), and Torchia et al. (2011) examine this theory on gender representation within a firm’s board of directors. Using survey data of women directors, they present evidence that achieving a critical mass of at least three women on the board enhances the board’s working dynamics in general and also its outlook on firm innovation. As Erkut et al. (2008) note, “One woman is the invisibility phase; two women is the conspiracy phase; three women is mainstream” (p. 227). Finally, the threshold of three women is consistent with the new California law requiring all California-based firms with boards of at least six directors to have a minimum of three women directors by the end of the 2021 calendar year.Footnote 14

Because we are interested in measuring the culture of the firm leading up to the advent of the #MeToo Movement, we use the gender composition of the firm’s board over the five-year window 2012–2016 to categorize a firm as being exclusive or inclusive of women. Specifically, we categorize a firm as being EXCLUSIVE if over the full five years, its board was comprised entirely of men; symmetrically, we categorize a firm as being INCLUSIVE if over the same time period, its board continuously had at least three women directors. Our approach reflects a more stable, long-term board environment.

Over the five-year period, we find that 481 firms enter the #MeToo time frame without ever having included a woman on their board, while 122 firms enter 2017 with a persistent critical mass of at least three women directors. In terms of industry composition, as shown in Panel B of Table 2, both the EXCLUSIVE and INCLUSIVE subsamples include many financial firms—with the exclusive sample concentrating in the business equipment industry and the inclusive sample concentrating in the wholesale/retail sector.

As shown in Panel C of Table 2, comparing firm characteristics between the subsamples of EXCLUSIVE and INCLUSIVE firms produces a number of significant differences. INCLUSIVE firms tend to be larger (SIZE and SALES), better performing (ROA), and less volatile (RETURN VOLATILITY), and have higher growth (lower BOOK-TO-MARKET), higher leverage, and larger, more independent boards (# of DIRECTORS and % INDEP DIR). Consistent with other papers (Ahern and Dittmar 201; Kim & Starks, 2016; Matsa & Miller, 2011), we control for a number of these factors in our upcoming multivariate tests. In addition, our tests consider various approaches to benchmarking firm performance, all of which aim to control for differences across subsamples. Moreover, to explore whether unobserved (and, thus, uncontrolled) differences between these two subsamples—unattributable to the unfolding #MeToo movement—explain our findings, we calculate pseudo-returns based on random event dates.

4 Findings

4.1 Does gender representation on the board of directors provide a signal about firm culture?

We begin by presenting univariate evidence to corroborate our approach to identifying EXCLUSIVE versus INCLUSIVE firm cultures. Table 3, Panel A tests for differences in executive characteristics among firms, while Panel B tests for differences in external evaluations of firm culture across firms. In both panels, sample sizes vary depending on data availability for each measure.

The evidence in Table 3 consistently supports the notion that sorting firms based on the presence or absence of women in the board room is effective in identifying firms with exclusive versus inclusive cultures. In Panel A, we use ExecuComp data to identify the five highest-compensated executives in each firm, which reduces our sample to 1173 firms.Footnote 15 None of the EXCLUSIVE firms have a woman CEO in 2016Footnote 16; this contrasts with 18% of the INCLUSIVE firms. When comparing the incidence of having any woman executive, we find that 76% of the EXCLUSIVE firms and 41% of INCLUSIVE firms had no women executives in 2016. Equally striking, when looking across 2012–2016, 67% of EXCLUSIVE firms had no women executives over the entire five-year period; in contrast, 31% of INCLUSIVE firms had the same lack of women in their executive suites. These findings are consistent with Matsa and Miller (2011) who, using an earlier period (1997–2009), find similar associations between a firm having women on its board and the gender of its top five executives. Thus, the trend connecting the exclusivity or inclusivity of women on the board of directors with the gender make-up of the C-suite appears to span an almost 20-year period, beginning in 1997 (Matsa & Miller, 2011) and ending in 2016, the year prior to the #MeToo movement.

In Panel B, we turn from the executive suite to external evaluations of firm culture. Again, in support of the premise that gender representation on the board provides a signal about the culture of the firm, we detect significant differences in the likelihood that the firm is recognized by Glassdoor or Fortune on their lists of “Best Places to Work” at any point during 2012 through 2016, with INCLUSIVE firms appearing more frequently. These findings are consistent with Au et al. (2021), who employ a textual analysis on online job reviews from Glassdoor.com and Indeed.com to determine a measure of sexual harassment within a firm’s workplace. Using these data, they find a negative association between seven-year (2011–2017) stock returns and the prevalence of sexual harassment within a firm.

In Panel B, we also document superior diversity and inclusion (D&I) scores, as measured by composite scores compiled by TruValue Labs and Arabesque. Both companies maintain proprietary databases with the aim of uncovering ESG data that offer insights into various dimensions of diversity and inclusion at the firm level. As the panel shows, our measure of board-based inclusivity correlates with the higher likelihood of the firm having higher D&I scores. Additional (untabulated) analyses contrasting specific datapoints collected by Arabesque indicate that inclusive firms differ from exclusive firms in a number of key aspects that collectively suggest broad cultural differences. For example, as compared to exclusive firms, inclusive firms are more likely to (1) offer more flexible work schedules, (2) provide child daycare services, (3) favor internal promotion, (4) set performance targets/objectives based on diversity and equal opportunity, (5) have formal policies to drive diversity and equal opportunities, and (6) have formal policies against forced or child labor.

The evidence presented in Table 3 corroborates our use of board gender representation as a signal of firm culture. In addition, these findings are consistent with several survey papers (e.g., Graham et al., 2016, 2022) that document that directors believe they can influence their firm’s corporate culture through their actions and behavior.

4.2 Do investors respond to the #MeToo movement?

We turn our attention to assessing investors’ reactions to the #MeToo movement, beginning with an initial examination of cumulative abnormal returns (CAR) associated with the #MeToo movement events listed in Appendix 2. The CAR is the summation of the abnormal return around day 0 for each of the 37 event dates. We use seven alternative models as our benchmark for returns: (1) the Fama-French five-factor model (FF5), (2) the Fama-French-Carhart four-factor model (FFC4), (3) the Fama-French three-factor model (FF3), the CAPM model using (4) equally weighted and (5) value-weighted market returns (CAPM_EW and CAPM_VW), and the Daniel et al. (1997) model using (6) equally weighted and (7) value-weighted benchmark returns (DGTW_EW and DGTW_VW). We describe each approach in detail in Appendix 3. As shown in the first column of Table 4, depending on the model used to cumulate abnormal returns, we detect a significantly negative overall market reaction to the event dates of the #MeToo movement. In particular, we document negative overall market reactions ranging from −0.32% for the DGTW_VW model (insignificant, t = −0.97) to −1.98% for the CAPM_EW model (significant, t = −5.11). Recall, however, that our prediction focuses on the relative market reaction to the #MeToo movement depending on the existing culture of the firm.

4.3 Does the market reaction to the #MeToo movement vary depending on firm culture?

To examine whether investor reactions to #MeToo movement vary based on gender representation on the board, the latter columns of Table 4 contrast the CAR for the subsample of exclusive firms with the CAR for the subsample of inclusive firms. Regardless of the model we use to calculate expected returns, we find that exclusive firms experience significantly negative abnormal returns as compared to the significantly positive abnormal returns enjoyed by inclusive firms. For example, using the FF5 model, we find that the sample of exclusive firms earn a CAR of −3.25%, whereas the sample of inclusive firms have a CAR of 2.33%; testing for a difference in the means produces a t-stat of 2.66 (p < 0.01). Thus, on a univariate basis, we find distinct differences in market reactions to the #MeToo movement based on whether a firm’s board excludes or includes women, with firms with zero board gender diversity, on average, shouldering the lion’s share of the negative abnormal stock return reaction.

Next, in Table 5 we test whether these differing reactions remain in a multivariate setting. To some extent, our seven alternative approaches to benchmarking abnormal returns control for differences in firm characteristics (e.g., SIZE and BOOK-TO-MARKET ratios). Yet, as we noted in our discussion of Table 2, there are other fundamental differences in firm characteristics for firms with boards with zero women vis-à-vis firms with boards with three or more women. Based on the significant differences found in Table 2, we estimate cross-sectional regressions that control for additional covariates—Ln (BOARD SIZE), LEVERAGE, ROA, % INDEP DIR, RETURN VOLATILITY, and SIZE.Footnote 17 Based on Table 2, Panel B, we also include industry fixed effects. The dependent variable is the #MeToo CAR multiplied by 100, and our variables of interest are the EXCLUSIVE and INCLUSIVE indicator variables.

Consistent with our univariate results, we observe contrasting coefficients for our EXCLUSIVE and INCLUSIVE indicators. That is, we observe significantly negative (positive) coefficients for the exclusive (inclusive) firms, suggesting that the dissimilar returns we documented in Table 4 remain after including additional controls for firm and industry characteristics. F-tests comparing the EXCLUSIVE and INCLUSIVE coefficients confirm significant differences between the two subsamples. For example, in column [1], using the FF5 model to benchmark returns, the F-test comparing the two coefficients is significant at the 0.001 level. Thus, the analysis in Table 5 indicates that the change in investors’ beliefs about the risks injected by the #MeToo movement vary predictably in the cross-section, based on investors’ perceptions of firm culture (as signaled by gender diversity in the board room).

To depict the dynamics of the cumulative market reaction that we observe in Table 5, we plot the cumulative differences in market reactions for the EXCLUSIVE and INCLUSIVE subsamples over the 37 #MeToo event dates. The plot in Panel A of Fig. 3 illustrates a striking contrast in market reactions between the two subsamples as the movement gained momentum. We observe a steady increase in the size of the coefficient for the INCLUSIVE firms through the first nine event dates and continued growth of the coefficient throughout the movement. More importantly, considering the pattern for the EXCLUSIVE firms, we note a symmetric decrease in the coefficient for the EXCLUSIVE firms. These findings highlight the importance of simultaneously considering both the presence and absence of women in the boardroom. In addition, the growing contrast in returns between the two groups over the full nine-month timeframe underscores the value of using an extended timeline instead of narrowly focusing on the start of the movement.

Cumulative Differences in Market Reactions to the #MeToo Movement. This figure plots the cumulative differences in market reactions to the #MeToo events, comparing the EXCLUSIVE versus INCLUSIVE culture subsamples. The plotted variables are the coefficient estimates for EXCLUSIVE and INCLUSIVE obtained from 37 individual regressions of the FF5 CAR (successively cumulating event date returns over the timeline) on the EXCLUSIVE and INCLUSIVE indicators and controls (see column 1 of Table 5) as well as industry fixed effects. Figure 3(a) uses the 37 #MeToo events described in Appendix 2; Fig. 3(b) uses 37 machine-generated pseudo-events randomly drawn using the seed of “123” in Stata

Collectively, this picture suggests that the unfolding of the #MeToo movement continuously revised investors beliefs about the costs of fostering a culture that excludes women vis-à-vis one that creates an inclusive work place.

4.4 Does the same cross-sectional variation emerge using pseudo-event dates?

Despite our efforts to appropriately benchmark return performance and to control for observed differences between the two subsamples, a natural question remains as to whether unobserved differences between the two subsamples—unattributable to the unfolding #MeToo movement—drive these documented differences. To address this question, we test whether the same set of results emerges when we replace the #MeToo event dates with 37 randomly generated “pseudo” event dates from the same time period. Specifically, we re-estimate the analysis provided in Table 5, replacing the dependent variable with the cumulative abnormal returns associated with 37 machine-generated pseudo-events randomly drawn using the seed of “123” in Stata, computed using our seven alternative models to compute the benchmark returns. We also plot the cumulative market reaction over these 37 pseudo-event dates.

As shown in Table 6, when using these randomly generated pseudo-events, we no longer detect differences in the market response between firms with exclusive and inclusive cultures. In particular, the coefficients on our EXCLUSIVE and INCLUSIVE indicator variables no longer exhibit significance; nor do they contrast in sign. Further, in contrast to the results shown in Table 5, the F-tests for differences between the coefficients for EXCLUSIVE and INCLUSIVE no longer detect differences between the two subsamples. Moreover, as shown in Panel B of Fig. 3, plotting the cumulative differences in market reactions over the 37 pseudo-event dates does not produce the striking pattern shown in Panel A.

In an untabulated analysis, we repeat the placebo test using ten alternative seeds to randomly draw the 37 pseudo-events. In each of these ten additional rounds of placebo testing, we do not detect significant differences in cumulative market reactions between the EXCLUSIVE and INCLUSIVE subsamples. As such, the contrasting patterns documented in Panel A of Fig. 3 do not manifest for these alternative pseudo-event dates. This offers further evidence in support of the conclusion that the documented return patterns for the #MeToo event timeline stem from the growing momentum of the cause.

4.5 Does the reaction differ depending on the presence of a critical mass as opposed to a token presence?

Thus far, our tests have compared the absence of women to the presence of at least three women. Yet, a question remains as to whether the market reaction differs depending on the presence of a critical mass of women as opposed to a token presence.

According to Kanter (1977), a minority group cannot exert influence over a larger body of people unless its numerical size reaches a critical mass. Our choice of designating three as the minimum critical mass is based on the survey evidence provided by Erkut et al. (2008), Konrad et al. (2008), and Torchia et al. (2011), who conclude that having at least this many women serving on corporate boards exacts changes within their firms. In this section, we take the question to the data and see whether our results hold for alternative thresholds of at least one or two women directors, instead.

Specifically, we create two TOKENISM variables: an indicator representing boards with at least one woman from 2012 to 2016 inclusive, and a second indicator for boards with two or more women during the same timeframe. Using these two indicators, we re-run the regressions shown in Table 5 with each variable (in lieu of using our INCLUSIVE indicator). Column [1] in Table 7 mirrors our analysis in Table 5, documenting contrasting negative and positive coefficients for EXCLUSIVE and INCLUSIVE firms, respectively. Yet, the inclusion of our TOKENISM variables in the remaining two specifications does not produce the same pattern (columns [2] and [3]). That is, these alternative approaches to measuring the inclusion of women on the board do not detect significant reactions by investors.

The findings in Table 7, along with those reported earlier in Tables 5 and 6, are consistent with several views about the role of women on the board. First, the market does not reward firms for having a token woman on its board, as evidenced by the insignificant coefficient on the TOKENISM variables. Second, our findings corroborate lawmakers’ choice of three women as the threshold guiding the inclusion of women on the boards of California-based firms. Finally, our findings suggest that examining the impact of having women on boards might be more nuanced than merely creating an indicator for the presence of women on the board (as several papers do) (Adhikari et al., 2019). That is, our findings support the view that having three or more women directors constitutes a critical mass of women, as it relates to creating a corporate culture that values women within the workplace. They also raise a question as to whether identifying inclusivity as a percentage of the board is appropriate, particularly if one ignores board size. We examine this issue next.

4.6 Does the same cross-sectional variation emerge using alternative approaches to measuring culture?

In Table 8, we explore the extent to which our findings change when we use alternative approaches to identify EXCLUSIVE and INCLUSIVE firms. We begin by identifying INCLUSIVE firms as those meeting or exceeding a threshold percentage (instead of a number) of women on the board. Beginning in 2007, Norway mandated a gender quota for listed companies of 40% women. Other European nations followed, including Belgium (33%) in 2012, Austria (35%) in 2013, France (40%) and Italy (33%) in 2014, and Germany (30%) in 2015. During this time, other European countries and the European Union itself took a softer approach by providing recommended thresholds but not actual gender quotas. In column [1], we continue to identify EXCLUSIVE firms (n = 481) based on the historical absence of women on the board (dating back to 2012) but make our threshold for inclusivity more restrictive by focusing on the 40 firms where women held at least 30% of the board seats since 2012. Despite the reduced sample size on INCLUSIVE, we continue to document significant, contrasting coefficients for the EXCLUSIVE and INCLUSIVE subsamples, as well as a significant difference between the two coefficients (F-test Pr[EXCL = INCL] = 0.001).Footnote 18

In column [2], we return to our original thresholds for exclusivity and inclusivity, but we now limit our scope of consideration to the board gender diversity as of the end of 2016 and no longer factor in the board composition prior to 2016. Ignoring the historical perspective in our measurement increases the size of the EXCLUSIVE subsample by 15% (from 481 to 555 firms). Not surprisingly given the upward trend documented in Fig. 2, limiting attention to board gender composition as of 2016 leads to a striking increase in the number of firms identified as INCLUSIVE, from 122 to 316 (259%). As shown in column [2], using this more lenient approach to identifying INCLUSIVE cultures, the negative coefficient for the EXCLUSIVE firms remains robust, but the positive coefficient for INCLUSIVE firms no longer exhibits significance. This supports our choice of using a longer period of time, i.e., five years, to evaluate the culture of the firm, a choice consistent with the notion of corporate culture displaying a stickiness over time (Cheng & Groysberg, 2021; Schein, 1990). We, however, continue to detect the predicted significant difference across the two subsamples (F-test Pr[EXCL = INCL] = 0.006).

Several papers correlate corporate culture with the presence or percentage of women in the C-suite (Kunze & Miller, 2017; Tate & Yang, 2015), including Lins et al. (2022), who examine the association between women executives and investor response to the #MeToo movement. Accordingly, we consider the presence of women executives at the firm, as collected by ExecuComp, as an indicator of gender inclusivity. Ideally, we would like to replicate our methodology comparing C-suites with zero women over the same five-year period with C-suites with a critical mass of three or more women over the same time period. However, given that ExecuComp (1) covers a smaller sample of firms than BoardEx and (2) only lists the five highly compensated employees (as mandated by the 14A filing rules), our critical mass group comprises only four firms. Thus, we turn to alternative indicators of gender inclusivity.

In column [3], we require EXCLUSIVE firms to exclude women from both the board room and the C-suite dating back to 2012, and we require INCLUSIVE firms to have at least one woman on their board and at least one woman executive in the C-suite each year since 2012. This additional restriction based on executive gender diversity changes the EXCLUSIVE and INCLUSIVE samples to 122 firms and 200 firms, respectively. In column [4], we focus exclusively on executive characteristics in our measurement of culture. To do so, we identify EXCLUSIVE (INCLUSIVE) firms based on the absence of women (presence of at least one woman) in the C-suite dating back to 2012. This alternative approach ignores board gender diversity and results in sample sizes of 669 EXCLUSIVE firms and 247 INCLUSIVE firms.

As shown in columns [3] and [4], we no longer find the differing pattern in stock returns between the INCLUSIVE and EXCLUSIVE groups. Whereas the coefficients on EXCLUSIVE remain negative, they are no longer significantly different from zero; the coefficients on INCLUSIVE flip from positive to negative (albeit insignificantly different from zero). Further, testing for the differences between coefficients no longer produces significant differences between the two classifications.Footnote 19

In the remaining specifications (shown in columns [5] through [8]), we replicate the analyses in columns [1] through [4] but replace the #MeToo event dates with the 37 randomly generated pseudo-event dates examined earlier in Table 6. Consistent with our earlier analyses based on pseudo-events, we no longer detect differences in the market response between firms with EXCLUSIVE and INCLUSIVE cultures—regardless of our approach to measuring culture. And, again, the F-tests for differences between the coefficients for EXCLUSIVE and INCLUSIVE no longer detect differences between the two subsamples.

The evidence presented in Table 8 indicates that our results are sensitive to alternative approaches to measuring corporate culture—particularly those based on executive characteristics. Yet, we caution readers against interpreting these findings as indicative of gender diversity in the C-suite being unimportant to a firm’s culture. As shown in Table 3, gender diversity in the C-suite and the boardroom are correlated, and both likely provide a signal of firm culture to investors. We further caveat the results shown in Table 8 by acknowledging the data limitations in the ExecuComp database, which reduce the power of these tests.

4.7 How does the market respond to the appointment of a woman to an EXCLUSIVE board?

Collectively, the evidence suggests that investors respond negatively to the events tracking the timeline of the #MeToo movement for firms with an absence of women on their boards between 2012 and 2016. We interpret these findings as suggesting that investors’ perceptions of culture (as signaled by board gender diversity) shape their response to the unfolding #MeToo movement. An alternative view of the evidence may be that the negative response potentially reflects investors’ fear that this movement will force women into the board room and, in so doing, push the firm out of its optimal board composition (Ahern & Dittmar, 2012; Greene et al., 2020; Levitt, 2021). To explore this possibility, we examine the market reactions to a subsequent appointment of a woman (or women) to boards for our sample of EXCLUSIVE firms that have historically excluded women. We examine appointments from October 2017 (the beginning of the #MeToo movement) through May 2020.

Table 9 documents the cumulative abnormal returns for three windows surrounding the announcement dates: day [0] only, days [0,+1], and days [−1,+1]. We use two methods to determine the event dates. In Panel A, we hand-collect new director appointment announcements by searching for the firms’ earliest press releases or third-party media articles using both firms’ names and the directors’ names as keywords. Of the 163 announcements contained in our sample, 154 encompass the appointment of one woman only and nine encompass the appointment of two women. In Panel B, we use BoardEx as our source for “role effective” dates (Green & Homroy, 2018). Accordingly, Panel B includes 194 appointments.

As both panels indicate, there is little to no positive or negative stock market reaction to the appointment of a woman to a previously all-male board of directors. Thus, we find no evidence that investors believe these appointments harm firm value. Our findings contradict the notion that the earlier #MeToo CARs reflect investors’ worry that firms would be pushed out of their optimal board structure in an effort to include women.

4.8 Robustness

The multivariate regressions in Tables 5, 6, 7 annd 8 control for various firm and industry characteristics. In Panel A of Table 10, we provide evidence that our main finding—of a differential market reaction to the #MeToo Movement when comparing firms with exclusive cultures to firms with inclusive cultures—is robust to alternative approaches to constructing matched samples. As shown in the first column of Panel A, we continue to detect contrasting market reactions to the movement depending on the existing culture of the firm when we execute propensity-score matching (using the control variables included in our earlier multivariate analyses) to identify similarly situated control firms. In column [2], we find the results are robust to using entropy balancing to construct the matched sample. In untabulated analyses, results continue to hold when we execute a “hard matching” approach to identify the nearest neighbors in terms of SIZE, ROA, and INDUSTRY. Consistent with our earlier findings, we continue to detect no significant coefficients or differences between subsamples when we replace our #MeToo event dates with the pseudo-event dates (columns [3] and [4]).

In Panel B of Table 10, we conduct several additional robustness tests. In the first two columns, we consider potential confounding events. In column [1], we exclude 857 firms that announce earnings on any of the 37 #MeToo event dates. Consistent with the expectation that earnings announcement confounds are evenly distributed across the full sample, this reduces the exclusive and inclusive subsamples by 40% and 39%, respectively. Despite the considerable reduction in power associated with the reduction in sample size, we continue to detect significant differences in market reactions across the two subsamples, as evidenced by a significant F-test that manifests only when we examine the actual #MeToo event dates (as opposed to the pseudo #MeToo event dates, as shown in column [5]). In an untabulated analysis, we drop the #MeToo event dates that fall within the week surrounding an earnings announcement event and use the FF5 model to compute the average abnormal return on the remaining #MeToo event or pseudo-event dates. Again, we continue to document contrasting market reactions between the inclusive and exclusive firms along the MeToo event dates. In column [2] we exclude 18 firms with sexual harassment scandal revelations during the nine-month #MeToo period. We continue to detect significant differences in market reactions across the two subsamples, as demonstrated by a significant F-test that manifests only when we examine the actual #MeToo event dates (as opposed to the pseudo #MeToo event dates, as shown in column [6]).

We next turn our attention to controlling for firm size (using alternative approaches) and sales growth. In column [3], we document that our results are robust to the inclusion of the log of assets and sales growth in the regression. In column [4], we examine whether our results hold when we concentrate on boards with six or more directors only. The California gender diversity law that requires public companies headquartered in California to maintain a board with at least three women applies only to those companies with six or more directors. We find that our results are robust to eliminating the 177 firms with less than six directors.

Finally, we examine whether California firms are more likely to have boards with three or more women during our 2012–2016 timeframe, compared to firms headquartered in other states. In 2013, the California legislature passed a resolution encouraging (but not mandating) all publicly held firms in California to have a minimum number of women on their boards by December 2016.Footnote 20 We find that of the 122 INCLUSIVE firms, only 10 were headquartered in California. In the same vein, the inclusion of state fixed effects in our main analyses does not alter our findings (untabulated).

5 Conclusion

In this study, we identify a novel setting in which gender itself may matter to investors. That is, we use gender to measure culture, as opposed to using it to identify specific skills brought to the table, which has been a focus of prior studies. In so doing, we take board composition as a given and instead focus on changes in investors’ beliefs about gender-related firm risk.

In particular, we exploit a shock in investor attention to the issue of sexual misconduct in the workplace to provide evidence that the #MeToo movement revised investors’ beliefs about the costs of fostering a culture that excludes women, as reflected by the absence of women directors in the board room. Tracking the timeline of events associated with the #MeToo movement (beginning with the Harvey Weinstein exposé in October 2017 in the New York Times), we document contrasting market reactions to the movement, depending on the existing culture of the firm. While firms that have traditionally excluded women from their board experienced a negative market response as momentum for the cause increased, firms that embraced the inclusion of three or more women on their board enjoyed positive returns. We also present evidence that the market does not reward firms for tokenism (i.e., having only one or two women directors in the boardroom).

In the context of increased regulatory attention to board gender diversity, as well as the ESG activist campaigns by large institutional investors to diversify boards, our study documents a shift in investors’ beliefs about the costs and benefits of fostering an exclusive or inclusive firm culture, as reflected by the gender diversity of the boardroom. Accordingly, our findings inform advisors, regulators, and other stakeholders as they consider approaches to advancing diversity and inclusion in ways that have a meaningful impact on firm value.

Notes

Prominent proxy advisors, including ISS and Glass Lewis, also have advanced voting policy guidelines that reflect commitments to board gender diversity (see https://www.issgovernance.com/file/policy/latest/americas/US-Voting-Guidelines.pdf and https://www.wlrk.com/docs/2021_Glass_Lewis_U.S._Voting_Guidelines.pdf).

Rau et al. (2022) find that IPOs with gender diverse boards between 2010 and 2018 earn higher initial returns than those with less diverse boards. Yet, they find no evidence that IPOs with diverse boards are more profitable or earn abnormal stock market returns in the period following the IPO. Thus, their paper supports Goldman Sachs CEO David Solomon’s assertion that IPOs of more diverse companies perform better, but also other papers showing no cross-sectional relation between gender diversity and firm performance (e.g., Adams & Ferreira, 2009).

State Street and BlackRock had combined assets under management of about $9 trillion in 2017. Similarly, Goldman Sachs was the lead U.S. underwriter in 2019, capturing 24% of total U.S. deals worth over $55.9 billion.

See California Senate Bill No. 826 and Securities Exchange Act Release No. 34–92,590.

The phrase “Me Too” was originally coined by activist Tarana Burke in 2006 in an effort reach out to sexual abuse survivors.

See Civil Action Docket No. 1:18-cv-07796.

See Civil Action Docket No. 2:18-cv-00479.

According to Haigh and Wirtz (2020), as of February 2020, Illinois, Maryland, Nevada, New Jersey, Oregon, Tennessee, Vermont, Virginia, and Washington had enacted legislation that restricts an employer’s use of NDAs, with California, Nevada, and New Jersey specifically prohibiting such agreements when resolving a sexual harassment claim.

See H.R.4445 – 117th Congress; S.2342 – 117th Congress.

In a later section, we examine alternative approaches to measuring culture.

According to the EEOC, sexual harassment includes “unwelcome sexual advances, requests for sexual favors, and other verbal or physical harassment of a sexual nature” (www.eeoc.gov). The website further states that sexual harassment need not be of a sexual nature only. For example, frequent or severe teasing or offhand comments can be construed as creating a “hostile or offensive” work environment, which also falls under the EEOC’s sexual harassment umbrella.

When enacting the law, lawmakers cited research supporting critical mass theory as guiding their choice of three women as the threshold. See https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201720180SB826.

ExecuComp collects data directly from each company’s proxy statement, including disclosures of the compensation paid to the firms’ CEOs, CFOs, and three remaining highest-paid executives. ExecuComp covers firms included in the S&P 500, the S&P 400 MidCap, and the S&P SmallCap 600 indices.

This is not surprising given that the CEO almost always sits on the firm’s board, so, by definition, a board with zero women most likely will not have a woman CEO.

As we discuss later in the paper, our results are robust to various alternative approaches to controlling for firm characteristics, including using ln (ASSETS) or ln (SALES) instead of ASSETS; firm growth (Kuzmina & Melentyeva, 2021); coarsened exact matching to obtain benchmark returns; entropy balancing; and propensity matching to obtain benchmark returns.

Our reduced sample size for INCLUSIVE hales from the fact that the average (median) board size of the 122 inclusive firms is 11.77 (11.00), compared to an average (median) board size of 6.85 (7.00) for firms in the EXCLUSIVE group. In fact, when examining the distribution of board size for the inclusive group, we find a range of eight to 19 directors and that over two-thirds of the firms have a board size greater than or equal to 11. Thus, whereas the latter boards have three or more women, they do not reach the 30% threshold. We also examine if there are decreasing returns for firms that have more than three women directors. There are 26 firms with four or more women directors over the 2012–2016 timeframe, and two firms with five women directors. We find no decrease in returns after the critical mass of three is reached. In fact, we find the opposite result—the coefficient on INCLUSIVE increases in magnitude and significance level when we use the threshold of four or more women.

We also use a threshold of three women in the boardroom and one woman in the executive suite as our measure of inclusivity. This reduces our inclusivity sample to 40 firms only. Despite the loss of sample size, our results remain qualitatively similar. In addition, to consider whether the presence of women in the C-suite drives our main findings, we re-estimate our main analysis with our measure of INCLUSIVITY (> = 3 women directors from 2012 to 2016) but also add an indicator for the presence of one, two, or three women executives, respectively, to our regression analysis (Lins et al., 2022). Inconsistent with the notion that the presence of women in the C-suite subsumes the impact of having a critical mass of women in the boardroom, our inclusive indicator is significantly positive (p < 0.05 for all specifications), whereas the coefficients on the indicators for the number of women executives are insignificantly different from zero.

See California Senate Concurrent Resolution No. 62 (September 20, 2013).

References

Adams, R., and D. Ferreira. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94 (2): 291–309.

Adhikari, B., A. Agrawal, and J. Malm. (2019). Do women managers keep firms out of trouble? Evidence from corporate litigation policies. Journal of Accounting and Economics 67 (1): 202–225.

Ahern, K., and A. Dittmar. (2012). The changing of the boards: The impact on firm valuation of mandated female board representation. The Quarterly Journal of Economics 127 (1): 137–197.

Ahmed, N. (2018). Wall street is adding a new ‘Weinstein clause’ before making deals. Bloomberg. August 1, 2018. https://www.bloomberg.com/news/articles/2018-08-01/-weinstein-clause-creeps-into-deals-as-wary-buyers-seek-cover (Accessed May 31, 2022.)

Akin Gump Strauss Hauer & Feld LLP (Akin Gump). (2019). Top 10 topics for directors in 2019. Akingup.com. https://www.akingump.com/images/content/1/0/v4/100176/Top10-Directors-Digital-121818-5.pdf (Accessed May 31, 2022.)

Allen, A., and A. Wahid. (2021). Regulating gender diversity: Evidence from California senate bill 826 Working Paper.

Au, S-Y., M. Dong, and A. Tremblay. (2021). Employee sexual harassment reviews and firm value, Working Paper. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3437444 (Accessed May 31, 2022.)

Australian Human Rights Commission. (2018). Everyone’s business: Fourth national survey on sexual harassment in Australian workplaces. Canberra: Australian Government.

Bach, N. (2018). Almost half of the men brought down by the #MeToo movement have been replaced by women. Fortune. October 23, 2018. http://fortune.com/2018/10/23/metoo-movement-female-replacements/ (Accessed May 31, 2022.)

Baer, J. (2017). State Street votes against 400 companies citing gender diversity. The Wall Street Journal. https://www.wsj.com/articles/state-street-votes-against-400-companies-citing-gender-diversity-1501029490 (Accessed May 31, 2022.)

Borelli-Kjaer, M., L. Moehl Schack, and U. Nielsson. (2021). #MeToo: Sexual harassment and company value. Journal of Corporate Finance 67 (2021): 101875.

Camerer, C., and A. Vepsalainen. (1988). The economic efficiency of corporate culture. Strategic Management Journal 9: 115–126.

Carlsen, A., M. Salam, C.M. Miller, D. Lu, A. Ngu, J. Patel, and Z. Wichter. (2018). #MeToo brought down 201 powerful men. Nearly half of their replacements are women. New York times. October 29, 2018. https://www.nytimes.com/interactive/2018/10/23/us/metoo-replacements.html (Accessed May 31, 2022.)

Carter, M.E., F. Franco, and M. Gine. (2017). Executive gender pay gaps: The roles of female risk aversion and board representation. Contemporary Accounting Review 34: 1232–1264.

Chen, A.J., P.M. Dechow, and S. T. Tan. (2021). Beyond shareholder value? Why firms voluntarily disclosure support for black lives matter. Working Paper. University of Southern California. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3921985 (Accessed May 31, 2022.)

Chen, J., W.S. Leung, and K.P. Evans. (2018). Female board representation, corporate innovation and firm performance. Journal of Empirical Finance 48: 236–254.

Chen, J., W.S. Leung, W. Song, and M. Goergen. (2019). Why female board representation matters: The role of female directors in reducing male CEO overconfidence. Journal of Empirical Finance 53: 70–90.

Cheng, Y.-J., and B. Groysberg. (2021). Research: What inclusive companies have in common. Harvard Business Review. (June 2021).

Coles, J., N. Daniel, and L. Naveen. (2008). Boards: Does one size fit all? Journal of Financial Economics 87: 329–356.

Coles, J., N. Daniel, and L. Naveen. (2020). Director overlap: Groupthink versus teamwork. Working Paper. University of Utah. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3650609 (Accessed May 31, 2022.)

Daniel, K., M. Grinblatt, S. Titman, and R. Wermers. (1997). Measuring mutual fund performance with characteristic-based benchmarks. The Journal of Finance 52 (3): 1035–1058.

Deloitte, (2019). The economic costs of sexual harassment in the workplace. Deloitte Access Economics. March 2019. https://www2.deloitte.com/au/en/pages/economics/articles/economic-costs-sexual-harassment-workplace.html (Accessed May 31, 2022.)

Dezsö, C.L., and D.G. Ross. (2012). Does female representation in top management improve firm performance? A panel data investigation. Strategic Management Journal 33 (9): 1072–1089.

Elsesser, K. (2020). Goldman Sachs won’t take companies public if they have all-male corporate boards. Forbes 23: 2020.

Erkut, S., V.W. Kramer, and A.M. Konrad. (2008). Critical mass: Does the number of women on a corporate board make a difference? In Vinnicombe S., V. Singh, R. burke, D. Bilimoria, and M. Huse (eds), women on corporate boards of directors: International research and practice, (Edward Elgar, London), 222-232.

Farrell, K.A., and P.L. Hersch. (2005). Additions to corporate boards: The effect of gender. Journal of Corporate Finance 11: 85–106.

Farrow, R. (2018). Les Moonves and CBS face allegations of sexual misconduct. The New Yorker. July 27, 2018. https://www.newyorker.com/magazine/2018/08/06/les-moonves-and-cbs-face-allegations-of-sexual-misconduct (Accessed May 31, 2022.)

Financial Reporting Council (FRC). (2018). Guidance on board effectiveness July 2018.

Fletcher, L. 2018. Big investors seek a #MeToo clawback. Wall Street Journal. September 23, 2018. https://www.wsj.com/articles/big-investors-seek-a-metoo-clawback-1537754820 (Accessed May 31, 2022.)

Garber, J. and N. McAlone. (2018). CBS sinks after report says CEO les Moonves will be accused of sexual misconduct in an upcoming new Yorker story. Business Insider. July 27, 2018. https://www.businessinsider.com/cbs-les-moonves-sexual-stock-price-2018-7 (Accessed May 31, 2022.)

Graham, J. R., J. Grennan, C. R. Harvey, and S. Rajgopal. (2016). Corporate culture: The interview evidence. Working Paper. Duke University. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2842823 (Accessed May 31, 2022.)

Graham, J. R., J. Grennan, C. R. Harvey, and S. Rajgopal. (2022). Corporate culture: Evidence from the field. Working Paper. Duke University. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2805602 (Accessed May 31, 2022.)

Green, C., and S. Homroy. (2018). Female directors, board committees and firm performance. European Economic Review 102: 19–38.

Green, J. (2021). Just one major U.S. IPO debuted with an all-male board in (2020). Bloomberg. February 2021.

Greene, D., V.J. Intintoli, and K.M. Kahle. (2020). Do board gender quotas affect firm value? Evidence from California senate bill no. 826. Journal of Corporate Finance 60: 101526.

Grennan, J. (2019). A corporate culture channel: How increased shareholder governance reduces firm value. Working Paper. Duke University. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2345384 (Accessed May 31, 2022.)

Haigh, E., D. Wirtz. (2020). #MeToo: in defense of nondisclosure agreements. https://www.littler.com/publication-press/publication/metoo-defense-nondisclosure-agreements (Accessed May 31, 2022.)

Hermalin, B., and M.S. Weisbach. (1998). Endogenously chosen boards of directors and their monitoring of the CEO. American Economic Review 88 (1): 96–118.

Hunnicutt, T. (2017). BlackRock supports effort to boost number of women board members. Business Week.

Hwang, S., A. Shivdasani, and E. Simintzi. (2018). Mandating women on boards: Evidence from the United States. Kenan Institute of Private Enterprise research paper: 18-34.

Jain-Link, P., J.T. Kennedy, and T. Bourgeois. (2020). 5 strategies for creating an inclusive workplace. Harvard Business Review (January 2020).

Kanter, R.M. (1977). Some effects of proportions on group life: Skewed sex ratios and responses to token women. American Journal of Sociology 82: 965–990.

Kim, D., and L. Starks. (2016). Gender diversity on corporate boards: Do women contribute unique skills? American Economic Review: Papers & Proceedings 106 (5): 267–271.

Klein, A. (1998). Firm performance and board committee structure. The Journal of Law and Economics 41: 275–303.

Klemash, S. and J. Dettmann. (2019). Five ways to enhance board oversight of culture. EY. May 7, 2019. https://www.ey.com/en_us/board-matters/five-ways-to-enhance-board-oversight-of-culture (Accessed May 31, 2022.)

Konrad, A.M., V. Kramer, and S. Erkut. (2008). Critical mass: The impact of three or more women on corporate boards. Organizational Dynamics 37: 145–164.

Kreps, D.M. (1990). Corporate culture and economic theory. In perspectives on positive political economy. Edited by alt & K. Shepsle, Cambridge: Cambridge University Press: 90-143.

Krouse, S. (2018). BlackRock: Companies should have at least two female directors. The Wall Street Journal. February 2, 2018. https://www.wsj.com/articles/blackrock-companies-should-have-at-least-two-female-directors-1517598407 (Accessed May 31, 2022.)

Kunze, A., and A. Miller. (2017). Women helping women? Evidence from private sector data on workplace hierarchies. Review of Economics and Statistics 99: 769–755.

Kuzmina, O., and V. Melentyeva. (2021). Gender diversity in corporate boards: Evidence from quota-implied discontinuities. Working Paper, London School of Economics. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3805617 (Accessed May 31, 2022.)

Levitt, A. (2021). If corporate diversity works, show me the money. Wall Street Journal. January 20, 2021. https://www.wsj.com/articles/if-corporate-diversity-works-show-me-the-money-11611183633 (Accessed May 31, 2022.)

Lins, K., L. Roth, H. Servaes, and A. Tamayo. (2022). Sexism, culture and firm value: Evidence from the Harvey Weinstein scandal and the #MeToo movement. Working Paper, University of Utah. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3458312 (Accessed May 31, 2022.)

Matsa, D., and A. Miller. (2011). Chipping away at the glass ceiling: Gender spillovers in corporate leadership. American Economic Review: Papers & Proceedings 101 (3): 635–639.

Merit Systems Protection Board (MSPB). (2018). Update on sexual harassment in the federal workplace. U.S. Merit Systems Protection Board.

Ram, A. (2019). Tech investors include #MeToo clauses in start-up deals. Financial Times. March 18, 2019. https://www.ft.com/content/5d4ef400-4732-11e9-b168-96a37d002cd3 (Accessed May 31, 2022.)

Rau, P.R., Sandvik, J. and Vermaelen, T., (2022). Are women undervalued? Board gender diversity and IPO underpricing. Working Paper. University of Cambridge. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3783771 (Accessed May 31, 2022.)