Abstract

We provide evidence on earnings management by exploiting temporary exogenous shocks to utility firms’ sales arising from weather variation. We find that sample firms’ sales are highly sensitive to annual changes in average temperatures in the region where the firm operates, but this sensitivity disappears quickly as one moves down the income statement. This evidence, while indirect, is suggestive of earnings management activities. In search of direct evidence, we study charitable giving decisions by sample firms and uncover a significant positive sensitivity of charitable spending to weather-driven demand shocks, behavior that is highly consistent with the presence of real earnings management efforts. We find no convincing evidence supporting possible alternative explanations for this evidence, but we do find limited support for the presence of a larger giving–weather relation when earnings management incentives are likely to be elevated. If other real decisions with similar characteristics scale proportionally to charitable giving, our findings suggest that the overall magnitude of real earnings management activities could be quite substantial.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Assessing the quality of a firm’s reported earnings is a central issue in financial accounting. While earnings are certainly an indicator of the true economic performance of a firm, they are also influenced by a variety of managerial decisions (Dechow et al., 2010a). If these decisions are managed strategically, reported income figures will lose information content, possibly impacting real decisions made by outsiders (e.g., transaction prices in securities’ sales or acquisitions). Moreover, changes in real operating decisions in response to concerns about reported earnings will be deleterious to firm value whenever they lead a firm to deviate from first-best operating policies. Not surprisingly, these concerns have attracted much research attention (Roychowdhury et al. (2019)).

While prior work on earnings management has generated a host of interesting findings, much of the evidence is indirect. Researchers often identify firms that they suspect managed earnings, for example, by just meeting a certain earnings threshold, and proceed to work backward to identify the accounting or operating choices that allowed the firm to meet the target or expectation. While evidence of this type is informative, the ex post nature of these investigations often does not allow one to gauge the importance or magnitude of earnings management activities for a general firm population. Moreover, it remains possible that the earnings characteristic that qualifies an observation for investigation, and the firm choice(s) that are studied, are jointly determined by external circumstances that are unrelated to earnings management motivations (Cohen et al., 2020).

In this paper, we study earnings management by working forward from exogenous shocks that should affect unmanaged earnings. After identifying these shocks, we examine their impact on reported earnings and on operating choices that may be influenced by a firm’s earnings management efforts. We conduct this investigation in the context of the electric and gas utility industry. The main driver of demand at utilities is ambient air temperature, with cold (warm) weather driving heating (cooling) demand in the winter (summer). Variations in weather conditions that deviate from long-term trends are essentially exogenous and unpredictable at an annual frequency. Thus, annual weather shocks are ideal episodes to study, as they have no information content regarding the future economic environment of the firm but have a sharp impact on current revenues.

In a sample of 51 utilities from 2000 to 2016, we detect evidence of a strong sensitivity of annual revenues to weather variation, confirming that weather shocks are an exogenous demand shifter. However, when we look down the income statement, the estimated sensitivity of both EBITDA and net income (and items in between) to weather is small in magnitude and statistically insignificant. Since the utility business is capital intensive, we would expect aggregate (unmanaged) costs to vary less than proportionally with revenues. Thus, this evidence on EBITDA and net income is puzzling and highly suggestive of earnings management behavior. While some prior studies exclude utilities on the grounds that regulation may impact their earnings management incentives, our evidence is consistent with that of prior authors whose findings extend to regulated firms (e.g., Burgstahler and Dichev 1997; Cheong and Thomas 2011).

Several authors discuss how modifying real decisions may be a particularly effective way to opaquely manage earnings (e.g., Roychowdhury 2006). Clearly, the ability to undertake these modifications depends on the ease and speed with which real decisions can be altered. In the face of weather shocks experienced by the firms we study, particularly those occurring near the end of the fiscal year, there may be few real activities that can be modified to smooth earnings. The ideal candidates would include expensed discretionary items with low explicit modification costs—for example, spending on executive education classes or employee training. Importantly, the optimal level of spending on these types of investments would appear to be independent of current idiosyncratic weather shocks, absent concerns about reported earnings.

One particularly important spending decision of this type in the electric and gas utility industry is charitable giving. Since utilities are highly regulated, they often invest heavily in public relations activities to best position themselves during the politicized rate-setting process (Masulis and Reza 2015). Thus, not surprisingly, utilities routinely land on lists of large corporate givers. Many utilities sponsor a charitable foundation to coordinate their giving efforts, with final decisions on total giving frequently deferred until the end of the year. However, as we describe below, the actual level of giving is somewhat opaque, as it is not a standardized item in financial reports. Because of these features, we examine variation in charitable giving choices as a lens into understanding more generally how firms can modify opaque real decisions to accomplish earnings management goals.

To conduct this investigation, we hand-collect data on charitable giving and proceed to estimate models that relate giving levels to weather variation. Our analysis reveals a strong and significant relation between giving and weather, with increased (decreased) giving in response to demand-increasing (decreasing) weather shocks. This is precisely what we would expect if, in the face of unexpected temporary demand variation, firms modify charitable giving from planned/optimal levels in order to achieve certain earnings goals. We consider several other possible explanations for this finding but uncover no evidence in support of them. However, we do find limited support for the presence of a larger giving–weather relation when earnings management incentives are likely to be elevated.

Collectively, the evidence we present is highly supportive of the hypothesis that sample firms use charitable giving as an earnings management tool. Moreover, it seems reasonable to expect that other spending decisions with similar salient features (i.e., opaque discretionary purchases) will display similar behavior. Thus, our evidence appears highly consistent with the hypothesis that real earnings management activities are a significant component to the surprisingly smooth earnings we observe at sample firms even in the face of large demand shocks.

The rest of the paper is organized as follows. In Section 2, we review the related literature and outline our empirical strategy. In Section 3, we describe the data, sample, and variable constructions. Our main findings on the sensitivity of sales, income, and charitable giving to weather are reported in Section 4. Section 5 concludes.

2 Background, motivation, and empirical strategy

2.1 Earnings management in its many forms

A large literature attempts to identify whether firms deliberately make choices to manage earnings to certain levels.Footnote 1 Substantial evidence indicates that earnings often cluster around focal thresholds to an abnormally high degree, strongly suggesting earnings management activities (Burgstahler and Dichev 1997; Degeorge et al., 1999). In addition, studies of the statistical properties of earnings, both cross-sectionally and over time, detect patterns consistent with active efforts by managers to smooth earnings (e.g., Cheong and Thomas (2011, 2018)). Doyle et al. (2013) report that these types of efforts extend to firms’ attempts to define non-GAAP “street” earnings to maximize certain managerial objectives. Perhaps most convincingly, survey evidence of practicing managers indicates that earnings management efforts are common (Graham et al., 2005; Dichev et al., 2013).

There is not only ample general evidence that firms actively manage earnings but also specific evidence that firms tend to manage earnings more when the incentives to do so are elevated. In particular, earnings management behavior appears to heighten around control contests (Erickson and Wang 1999; Louis 2004) and security sales (Kothari et al., 2016), and in response to incentives induced by particular market and governance features (Matsumoto 2002; McInnis and Collins, 2011; Irani and Oesch 2016; Chu et al., 2019). This evidence provides useful insights into the motivations underlying earnings management efforts.

In addition to accounting choices, managers may also modify operating decisions in anticipation of the effect of those decisions on earnings. Roychowdhury (2006) provides evidence of this behavior across a variety of activities. These real earnings management efforts are particularly concerning, as they suggest an inefficiency in resource allocation decisions and possibly negative welfare consequences.Footnote 2 Real decisions for which there is evidence of earnings management efforts include R&D choices (Bushee 1998), advertising spending (Cohen et al., 2020), labor spending (Dierynck et al., 2012), pension funding choices (Bergstresser et al., 2006; Naughton 2019), securitization decisions (Dechow et al., 2010b), and capital spending (Bens et al., 2002).

While the existing evidence is both interesting and compelling, most of these studies rely on endogenous variations in firms’ economic environments as a starting point for examining either general or real earnings management. This reliance is problematic, since the omitted factor that drives the firm’s underlying economic environment may be correlated in a complicated and unknown way with the decisions that are used to identify earnings management. Dechow et al. (2012) and Cohen et al. (2020) discuss econometric modeling approaches to ameliorate this problem. Our complementary approach, which shares some features with an instrumental variable strategy, is to identify exogenous shocks that should shift unmanaged earnings and to search for evidence that actual reported earnings are modified in a manner that indicates managerial efforts to counteract the impact of the shock.Footnote 3

2.2 Charitable giving

A small literature considers the causes and consequences of charitable giving. Researchers have hypothesized several benefits to firms from charitable giving, including higher future sales and an enhanced reputation (e.g., Lev et al., 2010; and Bertrand et al., 2018). Consistent with the hypothesis that these types of benefits are particularly important to regulated firms, Masulis and Reza (2015) report that firms in highly regulated industries tend to give at higher levels than other firms.

There is an active debate as to whether firms optimally invest in charitable giving from a shareholder value perspective. Some researchers report evidence that charitable giving is a symptom of managerial agency problems (e.g., Masulis and Reza 2015), while others report that charitable giving specifically, and corporate social responsibility (CSR) activities more generally, are causally associated with enhanced shareholder value (Ferrell et al., 2016; Liang and Renneboog 2017). Earlier evidence by Brown et al. (2006) supports both possibilities for different subsets of firms.

This prior literature establishes that charitable spending can be viewed as a type of intangible investment that is important for the types of firms we study. The returns from this investment are difficult to quantify, which could explain the mixed evidence on whether firms are optimizing on this dimension. Whatever the verdict, firms must have some decision rules in place regarding the desired level of charitable spending arising from the maximization of an objective function. Absent concerns about earnings, it would appear quite unlikely that the optimal giving path would depend on temporary variations in weather, although we do consider some possibilities along these lines below. At the same time, since charitable giving is expensed, discretionary, and often deferred until the end of the year, it seems like a natural item to alter in order to smooth reported income in response to exogenous economic shocks. Petrovits (2006) provides supportive evidence of this by showing that the firms that she identifies as potential earnings managers often display abnormal giving patterns. Our study complements hers but takes a very different empirical approach.

2.3 Weather

Several recent papers explore the role of weather in the economic environment of firms. Perez-Gonzalez and Yun (2013) report that utility firms’ revenues are sensitive to weather variation and that the availability of weather derivatives allows these firms to partially hedge this risk.Footnote 4 Along related lines, Brown et al. (2021) find that many private firms that have weather-sensitive demand rely heavily on banks to financially buffer them from extreme weather shocks. Dessaint and Matray (2017) demonstrate that some firms may even overreact in their financial response to extreme weather events (hurricanes) because of a managerial bias to overweight recent experiences.

These prior studies provide evidence that weather shocks are important and substantive demand shifters for many firms, with the potential to significantly affect firms’ financial performance and policy choices. Utilities figure prominently in this literature, given the naturally weather-sensitive nature of their revenues. Many utilities are large, publicly traded, included in major indexes, and widely followed by analysts. This raises the possibility that, for these firms, the desire to meet certain earnings expectations will clash with uncooperative (or overly cooperative) weather shocks. This provides an interesting laboratory in which to examine earnings management questions.Footnote 5

2.4 Regulated utilities

Given their incentives to maximize shareholder value, we expect managers of publicly traded electric utilities to have similar incentives to other listed firms in how they choose to disclose information to investors in their public filings. Anecdotally, in their investor communication materials, many utilities appear quite concerned with reporting smooth and growing earnings to investors, even in the presence of large weather shocks. For example, CMS Energy, a Michigan utility in the S&P 500, typically includes in its earnings call presentations a graph of adjustments made to achieve smooth earnings growth in the face of weather variation.

There is a small prior literature on earnings management in the utility industry that provides some additional context for our study. Several authors have noted that utilities may have an incentive to make accounting choices that understate their profits in order to justify rate increases when they present their cases to public utility commissions (Abdel-Khalik 1988; Paek 2001). However, since utilities are required to maintain separate regulatory accounting books (for details, see Hahne and Aliff (1989)), it is unclear the extent to which these incentives apply to standard SEC financial filings. Researchers who have searched for earnings-management in this industry have reported mixed evidence (Hughes II et al., 2012; Li et al., 2016). To the extent that any earnings management is detected, limited evidence suggests that utilities may attempt to lower reported earnings prior to rate-setting proceedings. Since the scheduling of these events should be uncorrelated with weather shocks, we expect this type of earnings management to be quite independent of the behavior we investigate.

2.5 Empirical strategy

The discussion above helps motivate our empirical strategy. We first select a set of large utilities and match them with government-derived weather data. We then consider whether the sales of these firms are sensitive to weather, as they should be if the prior literature correctly characterizes this industry. After establishing this baseline finding, the natural question raised by the earnings management literature is whether these exogenous demand shocks are transmitted all the way down the income statement to a firm’s net income. If the transmission is small or nonexistent, this would suggest that firms take actions to mitigate the effect of sales shocks on the bottom line, providing indirect evidence of general earnings-smoothing behavior.Footnote 6

To provide more direct evidence on the underlying choices that could lead to this smoothing, we next examine whether firms change their charitable giving in response to weather shocks. Viewing charitable giving as a real (intangible) investment activity with an optimal level that should be insensitive to transitory weather shocks, any significant sensitivity of giving to weather can be viewed as direct evidence of firms actively modifying real decisions to manage earnings. If other types of intangible investment scale proportionally with charitable giving (e.g., public relations or lobbying investments, executive education spending, training, etc.), the magnitude of overall real earnings management could be quite large, perhaps explaining all or most of the observed income smoothing in this industry.Footnote 7

Many papers in the prior literature undertake empirical comparative statics exercises to investigate whether earnings management activities are heightened in situations where the incentives to manage earnings are magnified. Thus, we also consider extensions along these lines. There are some challenges in doing so, as the predicted signs are, in some cases, theoretically unclear. In addition, our sample is small, potentially leading to power issues. Nevertheless, extensions along these lines have the potential to be informative and more richly illustrate firm behavior. While we motivate specific tests as they are introduced, our general strategy considers variation by (a) timing of weather shocks during the fiscal year, (b) past evidence of earnings management behavior at a firm, and (c) a firm’s ownership/incentive structure.

3 Sample selection and description

3.1 Initial sample selection

We first identify all Compustat firms with SIC codes of 4911, 4922, 4931, and 4932. Our charitable contribution data commences in 2000, thus we study the period 2000–2016. Since there was some substantive consolidation in electric and gas utilities during this period, we account for large mergers or divestitures that would result in non-comparable spending numbers for a given firm over time. Specifically, in all cases in which a firm’s annual gross property, plant, and equipment (PPE) expenditure differs by more than ±10% from the prior year’s number incremented by its capital expenditures, we treat the firm from that point on as a new (or reincarnated) firm for the purposes of differencing or including firm fixed effects. Our selection criteria plus this treatment yield a sample of 276 firms with 1261 firm-year observations. We successfully obtain weather data for this entire sample, so requiring weather information does not result in any dropped observations.

3.2 Charitable giving information

Firms do not report charitable giving as a separate accounting item, but many firms report this information separately from their formal financial statements or sponsor a nonprofit foundation that is required to file an IRS 990-PF.Footnote 8 For each sample firm, we collect annual information on the firm’s direct cash charitable giving and cash donations to charitable foundations by aggregating all figures reported in available IRS 990 filings, firm foundation websites, available issues of the National Directory of Corporate Giving, and 10 K filings. Consistent with prior research, we find the 990 filings to be the most useful source of disclosed charitable spending information.

To remove unobserved firm-level heterogeneity, our empirical analysis relies on the time variation in a firm’s charitable spending. Given this treatment, it is important that a given firm’s time series represent a consistently reported set of expenditure items. Thus, we are careful to use the same data sources and data aggregation procedure for each individual firm that we follow over time. In addition, to avoid using differences of more than a single year, we only include a firm-year in the charitable giving sample if we observe charitable spending for, at a minimum, the prior or subsequent firm-year.

Many firms either do not appear in these data sources or do not specifically discuss/disclose charitable giving. Thus, the charitable giving data requirement results in a substantially smaller sample of 51 firms and 340 firm-year observations. We refer to this as the charitable giving sample.Footnote 9 Note that we do not drop an observation if our data sources report a charitable spending level of zero, as happens in some cases (i.e., we record a spending level of zero if our data sources report it). Thus, missing data is truly missing, and often arises because a firm does not have an associated foundation and does not routinely report charitable giving in its filings, press releases, or other sources tracked by charitable giving directories/databases. As we discuss below, utilities that disclose charitable giving tend to be larger than average.

3.3 Weather information

We obtain weather data at the zip code level from the data vendor Frontier Weather. The data includes a monthly report on cooling (heating) degree days at the zip code level defined to scale linearly with the amount of time during the month that the temperature was above (below) 65 degrees Fahrenheit. Most of the underlying data is derived from official government sources (i.e., the National Oceanic and Atmospheric Administration’s National Weather Service). These cooling and heating measures, abbreviated as CDD and HDD, respectively, are common proxies in the industry for the level of demand for energy arising from consumers’ cooling and heating activities. They are frequently summed into a total degree day (TDD) figure that serves as a simple aggregate indicator of total energy demand.

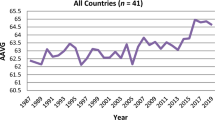

For each firm, we identify its headquarters location zip code in the first year it appears in the sample. Since most utilities are geographically concentrated, the weather for this zip code should be closely related to the overall demand for the firm’s output. We use weather, as measured by TDD at the zip code level, aggregated over the 12 months of the year, as our basic annual weather measure (calendar and fiscal years are concurrent for all sample observations).

3.4 Sample description

Basic summary statistics for the final charitable giving sample are reported in Table 1. All figures are inflation-adjusted to 2016 dollars and winsorized at the 1% tails. The statistics on ratios reported in the table are comparable to figures that others have reported for utilities, but the firms in the final sample are larger than the typical utility. For example, the sample median assets (sales) figure reported in the table is 1.38 (1.18) times as large as the corresponding figure for the sample before requiring the availability of charitable giving data.

The weather data indicates that the typical utility has a much higher level of heating degree days than cooling degree days, so we would expect weather variation in the peak winter months to be particularly important for sample firms. The reported mean TDD for the charitable giving sample of 5933.46 can be divided by 365 to reveal that, on an average day, the typical weather in the headquarters zip code of a sample utility is ±16.27 degrees away from the 65-degrees-Fahrenheit point. There is reasonable variation in the TDD variable, with an interquartile range of approximately one-third of the mean and median values.

Turning to charitable spending, the mean sample firm gives $5.58 million annually, and the mean ratio of charitable spending to net income is 1.00%. As is typical of skewed distributions related to spending, medians are substantially smaller. Certainly, it appears that charitable giving is a nontrivial spending item for many utilities. Moreover, under the reasonable assumption that tracked charitable spending is closely related to both untracked charitable giving and other expenditures with similar characteristics (i.e., discretionary opaque expenditures that can be quickly adjusted and are expensed), our inferences will understate the overall magnitude of any economic effects.Footnote 10 The interquartile range in spending and the average magnitude of annual spending changes suggest that there is substantial cross-firm and within-firm variation in giving behavior.

4 Weather shocks, income items, and charitable giving

4.1 Weather shocks and reported income items

We now turn to the role of weather on sample firms’ reported income items. Given the high degree of serial correlation in the data, coupled with Wooldridge’s (2010) discussion of the likely superiority of first-difference estimates in these settings, our default choice is to estimate models using first differences. We begin by estimating models that predict sales as a function of weather to confirm that weather is a key exogenous driver of demand for utilities. These models also allow us to gauge the magnitude of the underlying demand relation. We then turn to components further down the income statement to investigate whether firms appear to buffer these sales shocks in a way that minimizes the impact on the bottom line.

There are a variety of reasonable specification choices to model to select from. To span a wide set of these choices, we focus on three distinct specifications. In what we refer to as specification 1, we model the dependent variable quantity of interest (i.e., annual changes in sales, EBITDA, net income), normalized by the start of period book assets, as a function of changes in zip-code level weather (i.e., change in total degree days in units of 1000). To minimize the role of extremely large changes and to estimate a coefficient with an elasticity interpretation, in specification 2 we take natural logarithms and predict changes in the log of the dependent variable values as a function of changes in the log of weather values.Footnote 11 Finally, in specification 3, we create an alternative elasticity type model by dividing the change in the dependent variable by the firm’s average value in the five years preceding the first year the firm enters the sample, while simultaneously dividing the change in weather variable by the headquarters zip code level average calculated over a pre-sample window.

Coefficient estimates for models predicting income statement items as a function of weather for these three alternative specifications are reported in Table 2. All models include year dummy variables. Reported standard errors, listed in parentheses under each coefficient estimate, are clustered at the firm level.

In the first three columns of Panel A of Table 2, we consider models predicting sales. The positive and highly significant coefficient of .020 on the weather variable in the first column of this panel indicates a strong role for the weather as a determinant of a utility firm’s revenues. This estimate implies that a change in temperature of 1000-degree days, which roughly corresponds to a one-quartile change, is associated with a 2.0% increase in sales measured relative to assets. Since the sample-wide mean and median sales-to-assets ratios are approximately one-third (see Table 1), this implies a roughly 6% increase in sales. The corresponding coefficient for the logarithmic specification in column 2, .238, is highly significant and implies an effect of similar magnitude, with a 2.38% increase in the sales-to-assets ratio for each 10% increase in weather degree days. Similarly, the highly significant coefficient of .262 in the normalized change specification in column 3 implies that when degree days increase by 10% measured relative to the estimated normal degree-day level for the zip code, the sales-to-assets ratio will increase by 2.62%, measured relative to the firm’s estimated normal level. Again, dividing these figures by a typical sales-to-assets ratio of one-third implies reasonably large sales–weather elasticities.

These initial estimates in Table 2 provide strong evidence that utility sales are, as expected, quite sensitive to exogenous weather variation in the geographic region where the utility operates. If a firm’s profit margins are relatively fixed or even elevated (depressed) in times of high (low) demand because of the capital-intensive nature of the business, we would expect to observe similar positive and significant sensitivities of overall profit measures to weather. However, if firms smooth earnings via accounting choices and/or real earnings management, the impact of weather variation on profits should be muted.

To investigate, in the first three columns of Panel B of Table 2, we present an analogous set of regressions but use EBITDA in place of a firm’s sales in constructing the dependent variables. Interestingly, in all three specifications, the weather coefficient is small in magnitude and statistically insignificant. If the EBITDA/Sales ratios were fixed, we would expect these coefficients to be of similar statistical significance and roughly one-fourth the magnitude of the corresponding coefficients in the sales models, as the typical EBITDA/Sales ratio hovers around .25 (see Table 1). The estimated magnitudes of the coefficients reported in the table are far smaller than these predicted values, and are effectively zero from an economic magnitude perspective.

It appears from Panel B that while sales shift up and down sharply with the weather, firms report offsetting cost variation that largely eliminates the weather’s impact on EBITDA. While surely many costs scale proportionally with sales—for example, raw fuel costs and variable labor costs—it is difficult to envision a scenario in which these costs, in aggregate, scale more than proportionally with sales, particularly given the capital-intensive nature of the business.Footnote 12 Thus, the fact that EBITDA is not highly sensitive to weather is strongly suggestive of some type of earnings management (real or non-real), although, of course, the evidence is indirect.

Our initial suspicion was that EBITDA might show some sensitivity to weather shocks, even if those effects disappear by the time net income is calculated. Given that weather sensitivity already largely disappears in moving from sales to EBITDA, we expect to find a similar lack of sensitivity for all subsequent income items (EBIT, income before extraordinary items, net income, etc.). We have confirmed that this is, in fact, the case, and we report the actual estimates for corresponding net income models in the first three models of Panel C of Table 2. As the figures reveal, the estimated coefficients on the weather variable are statistically insignificant, with economic magnitudes close to zero and coefficients, in some cases, of the wrong sign (i.e., negative).

We have experimented with a wide variety of robustness checks and extensions to the models in columns 1–3 of Table 2, but they offer little additional insight into the behavior of firms. Fixed-effects models generally have coefficient magnitudes that are comparable to the reported first-difference coefficients in the table, but often with larger standard errors and thus lower significance levels. If we consider larger sets of firms, for example, by not requiring membership in the charity sample, the coefficients generally tell the same story. In all cases sales remain highly dependent on the weather. In a few limited cases, the positive coefficient on EBITDA becomes marginally significant, but this significance always disappears by the time we consider net income. Thus, the general finding that sales are highly sensitive to weather shocks and that weather sensitivities disappear as one moves down the income statement appears quite robust.

We have also explored whether this evidence varies by the direction of the weather shock, as the scope for strategically managing costs or recording revenues may differ across economic environments. When we allow the weather slope coefficient to vary by the sign of the shock in the Table 2 models, the difference in coefficients between positive and negative shocks is insignificant in all cases. Thus, our data do not reveal any differences, although our detection power may be limited.

4.2 Income item variation across regulatory regimes

Since utility rates are fixed by regulation, demand shocks should translate into sales changes if the regulatory process does not immediately adjust rates to neutralize the impact of any change in demand. This seems like a reasonable assumption, given the slowness of the regulatory rate-setting process, which typically spans several years (Bonbright et al., 1988). Moreover, the sales regressions discussed above are measured net of any rate changes, so it must be the case that, in an average sense, weather demand shocks are an important driver of utility revenues. Notwithstanding this observation, there has been a trend to adjust regulated utility rates to somewhat neutralize the impact of demand variation, primarily to incentivize utilities to encourage more efficient uses of energy. States that adopt this rate structure are commonly known as “decouplers” (i.e., their rates automatically adjust to at least somewhat decouple revenues from demand changes).

To investigate how this industry feature may affect our inferences, we set a decouple dummy variable equal to 1 for all years in which the state of a utility’s headquarters had adopted some decoupling in the rate structure as reported in the state-by-state list compiled by Chu et al. (2019). Approximately 42% of sample observations are considered decoupled using this assignment procedure. We then estimate models in which we allow weather sensitivities to vary by decoupler status in the final column of Table 2.

Consistent with the notion that decoupling weakens the sales–weather link, we detect in model 4 of Panel A of Table 2 a negative and marginally significant (t = 1.73) weakening of the relation between sales and weather for decoupled observations compared to others. This (weakly) indicates that any effort to smooth earnings will be more (less) challenging for firms without (with) a decoupled regulatory structure. When we turn to the corresponding EBITDA model in Panel B, the point estimates on weather and weather interacted with the decouple variable have signs suggestive of a small positive (negative) relation between EBITDA and weather for firms not in (in) a decoupled regime, but these estimates are far from significant. Thus, while the evidence is suggestive of a more challenging route to smoothing earnings for the non-decoupled observations, even these firms appear to achieve smooth-enough EBITDA that a statistically significant relation with weather cannot be detected.

Once we move to net income (Panel C), the picture looks complete. Point estimates here suggest a negative and insignificant relation between net income and weather for observations in either regulatory regime. While all column 4 estimates are derived using the percent specification (i.e., specification 3), the character of these findings is unaltered if we estimate parallel models using the other two specifications (raw changes, log changes). Taken as a whole, this evidence strongly suggests that utilities manage to report earnings that are immune from weather shocks, even when the regulatory structure would appear to make this a more challenging task.

4.3 Charitable giving and weather shocks

The preceding evidence is strongly suggestive of earnings management behavior in which managers take deliberate actions to minimize the impact of exogenous demand shocks. However, the evidence of this is indirect. Thus, we next turn our attention to directly detecting the types of firm actions/decisions that might allow earnings smoothing to take place. As we discuss above, charitable giving is an ideal firm decision to investigate, as this investment spending is (a) expensed, (b) often deferred until near the end of the year, and (c) unlikely to have an optimal level that is related to idiosyncratic weather shocks absent earnings management concerns.

Since detected charitable spending does not scale linearly with firm size, we estimate models that exactly parallel our earlier models for sales and income, but with raw (i.e., non-normalized) charitable spending (in millions of dollars) used in the construction of the dependent variable.Footnote 13 Models predicting changes in this spending as a function of weather for the three types of specifications are reported in the first three columns of Panel A of Table 3.

As the table illustrates, all three models in Panel A indicate a significant positive relation between charitable giving and weather demand shocks. The coefficient in column 1 implies that a 1000-degree day change (approximately a one-quartile move) is associated with a $5.69 million increase in charitable spending, a figure that is slightly larger than the interquartile range for this item. This suggests a large sensitivity of charity to weather, consistent with the presence of real earnings management behavior.

The elasticity-type models in columns 2 and 3 of the same panel tell a similar story, with large positive and statistically significant coefficients on the weather explanatory variables. The column 2 estimate using a log model indicates a change in charitable spending of 13.90% for each 1% change in weather, while the column 3 estimate implies an estimated 4.48% change in charitable spending measured relative to an imputed normal level when weather (TDD) deviates 1% from its baseline level.Footnote 14 While these varying specifications all weigh the data variation differently, the fact that they all indicate an economically large and statistically significant relation between charitable spending and weather shocks provides compelling evidence of an underlying relation.

To check that this evidence is robust to even very conservative weightings of large data variations, we consider a coarse model that uses only discrete variables. Specifically, we create a dependent variable that assumes a value of +1 for charitable spending changes in the top sample quartile, 0 for changes in the middle two quartiles, and − 1 for changes in the bottom quartile. Similarly, we create a discrete weather change variable that assumes a value of +1 for TDD changes in the top quartile, −1 for changes in the bottom quartile, and 0 otherwise. In calculating these two variables, we normalize both charitable giving changes and weather changes by the estimated normal/baseline levels for each firm, so these variables flag large changes in a relative sense. As we report in the final column of Table 3, when we regress this discrete giving change variable against the discrete weather shock variable, we again detect a significant positive relation. The estimated coefficient of .161 (p value = 0.041) can be approximately interpreted as indicating that a top quartile weather shock raises the probability of a top quartile charitable spending increase by 16.1%.

As an additional robustness check, we estimate fixed effects (FE) models that correspond to the three first difference (FD) models discussed above. Grieser and Hadlock (2019) recommend comparing these two sets of estimates, even when efficiency concerns related to high levels of serial correlation dictate a preference for emphasizing the first difference estimates. As we report in panel B of Table 3, the resulting fixed effects coefficients are reasonably close in magnitude to the first difference estimates, particularly for the elasticity models (columns 2 and 3). Despite efficiency concerns, the estimated coefficients on the weather variable are significant at the 10% level or better in all cases.

4.4 Alternative explanations

The perspective we take above is that the optimal level of charitable giving should not depend on temporary weather variation absent earnings management concerns. If charitable giving is similar in economic character to more tangible investments, this assumption seems almost sure to hold, as the future economic environment of the firm is unaffected by temporary weather shocks. However, it remains possible that charitable giving in the utility industry has certain features that make it sensitive to weather for reasons not directly related to a desire to smooth earnings.

Before turning to specific tests to address these possibilities, we first note that the magnitudes of our estimated giving–weather sensitivities are sufficiently large that they would appear quite unlikely to be characterized as optimal investment dynamics under reasonable technological parameters.Footnote 15 Prior work borrows from the q theory of investment (Hayashi 1982; Fazzari et al., 1988) and highlights the sensitivity of giving to Tobin’s q as an indicator of charitable giving investment demand. Of note, the Masulis and Reza (2015) estimates indicate that a 0.5 (roughly one quartile) change in Tobin’s q is associated with a $13,476 predicted increase in charitable spending.Footnote 16 This estimated relation is more than three orders of magnitude weaker than what we report above for the estimated role of a one quartile movement in weather on charitable spending. Unless the weather is hundreds of times more important than Tobin’s q as a determinant of (economically) optimal charitable spending decisions (an unlikely scenario), it does not appear that our results can be explained through a traditional optimal investment lens.Footnote 17

The tendency to give more (less) when the local weather is severe (mild) may be influenced by the firm’s concerns about giving an “appropriate” amount for public relations reasons. If this were the case, we might expect a greater sensitivity of giving to weather in geographic areas where philanthropy is emphasized relatively more by the local population. To investigate, we collect data on the proportion of the headquarter county’s population that gives to charity according to the most recent data reported by the Chronicle of Philanthropy.Footnote 18 We create a generosity dummy variable that assumes a value of 1 for locations with a median or above giving propensity and add an interaction of this generosity variable with weather to our baseline models (i.e., the Panel A, Table 3 models). As we report in Panel A of Table 4, we find no evidence of an elevated sensitivity of giving to weather in the more generous locations, as might be expected if firms are catering to local perceptions. This evidence casts doubt on nonfinancial motivations that might explain some of our findings.

An alternative explanation for some of our findings is that they reflect the presence of financial constraints that limit charitable giving when negative demand shocks occur. While we find this explanation unlikely given the healthy finances of most of our sample firms, it remains possible that the presence of constraints does affect giving.Footnote 19 To investigate, we use a dummy variable to flag all sample observations with a start-of-year Hadlock and Pierce (2010) index of financial constraints at or above the sample annual cohort median. When we augment the charitable giving models to include terms that interact weather with this indicator variable, the estimated coefficients, reported in Panel B of Table 4, are in all cases small and insignificant and in some cases of the wrong sign. Similar results are obtained if we instead use the Whited and Wu (2006) financial constraints index to categorize firms. Thus, the data do not appear to offer even weak support for the presence of financial constraints driving our findings.

A final possible explanation for the observed variation of charitable giving and the weather may arise from tax considerations.Footnote 20 In particular, utilities may prefer to move income across periods by strategically timing their giving, and the resulting behavior could generate a positive correlation between giving and weather under some scenarios. To investigate, we create a dummy variable indicating whether a firm’s annual marginal tax rate in the observation year was greater than or equal to the median of the sample annual cohort. Estimated marginal tax rates are derived from Graham’s (1996a, 1996b) algorithm, as updated and supplied generously by that author via his website link. When we interact weather with a high tax indicator variable, the estimated coefficients are in all cases of the wrong sign (negative) and insignificant, as we report in Panel C of Table 4. Thus, we detect no evidence supporting the hypothesis that the charitable giving behavior we identify reflects primarily tax motivations.

4.5 Additional evidence

The preceding evidence is highly consistent with firms actively altering spending on expensed discretionary items to deliberately smooth earnings. Moreover, there is no convincing evidence supporting several potential non-earnings-related motivations behind our findings.Footnote 21 To add context to this evidence, we next consider variation in charitable giving–weather sensitivities along several dimensions.

If firms use charitable giving to assist in their real earnings management activities, it is possible that weather shocks that appear earlier in the year are less likely to impact charitable giving, as firms likely have multiple alternative levers to manage annual earnings before the year-end approaches.Footnote 22 To consider this possibility, we augment the charitable giving baseline models by adding a variable that represents the yearly weather change for quarters 1–3. Thus, the weather coefficient will represent the implied effect of fourth-quarter weather variation, and the coefficient on change in weather over quarters 1–3 will indicate whether this effect is lessened in the earlier quarters of the year.

As we report in Panel D of Table 4, the evidence of a weaker weather effect earlier in the year is suggestive but not overwhelming. As expected, the coefficient on the weather variable remains positive and highly significant in all cases. However, while the coefficient on the Q1–Q3 weather variable is in all cases negative, it is significant in only two of the four specifications. In untabulated results, we have also experimented with using a Q1–Q2 dummy, but the evidence with this alteration is similarly cloudy. Thus, the evidence here, while suggestive, is certainly not conclusive.

A second possibility we consider is that some firms may be more aggressive earnings managers than others, in which case these firms may exhibit a greater sensitivity of charitable giving to weather.Footnote 23 To investigate, we consider past earnings trajectories and identify firms that could have an elevated propensity to aggressively manage earnings. Specifically, we create an aggressive earnings manager dummy variable that assumes a value of 1 for firms in which the difference between the reported prior year’s earnings and the mean of IBES analyst estimates eight months prior to the fiscal year-end, all scaled by actual earnings, falls in the bottom quartile relative to the IBES industry-year cohort. This variable will identify firms that recently managed to land very close to earnings expectations, even when those expectations were formed early in the year.

In Panel E of Table 4, we present models of charitable spending that add an interaction of this aggressive manager dummy variable with the weather variable. The resulting evidence is quite weak, with none of the estimated coefficients on the interaction terms being significant and with one having the wrong sign (negative). We have experimented with using terciles to capture aggressive earnings managers and/or using analyst expectations 20 months prior to the fiscal year ending, but the findings with these alterations are substantively similar to what we report in the table. Given our small sample and the possibility of a high degree of noise in our aggressive earnings manager proxy, the power of these tests may be weak.

Finally, we consider the possibility that firms vary substantially in their concerns regarding, or exposure to, weather risk. If this is the case, our findings could primarily reflect the behavior of a distinct subset of firms. One possible indicator of a firm’s weather concerns is the degree to which the firm attempts to hedge weather risk, leading to the conjecture that weather hedgers may be more likely to modify their operating decisions, including charitable giving, in response to weather shocks.Footnote 24

To investigate, we inspect all sample firms’ 10 K statements in the first year that they appear in the sample and search for the words “hedge” and “derivatives.” Firms that mention an explicit program to hedge either weather risk directly or a weather-sensitive input (e.g., fuel costs) are categorized as weather hedgers, and all other firms are characterized as non-hedgers. When we add an interaction term for weather with a weather hedger dummy variable to the charitable giving models, the interaction terms are in all cases negative and insignificant, as we report in Panel F of Table 4. Thus, there is no evidence that weather hedgers are more likely to modify charitable spending in response to weather shocks, and no convincing evidence of any difference between the hedging and non-hedging groups.

4.6 Firm ownership structure and evidence for earnings management

Given the possibility of substantial noise in categorizing firms by past earnings behavior, we next follow a more traditional approach and consider differences across firms based on firm ownership characteristics. First, we consider sorts based on levels of institutional ownership, as Bushee (1998) and others present evidence that higher levels of institutional ownership may curb incentives to manage earnings (owing to a more patient investor base). Second, we sort firms by levels of managerial ownership, as some prior research suggests that firms with lower inside ownership may manage earnings more aggressively because of weaker incentives to manage for long-run value maximization.Footnote 25

In columns 1–3 of Table 5, we extend the earlier models of income items and charitable giving to allow the weather coefficient to vary by whether the level of institutional ownership from 13F filings was above the sample annual cohort median. If higher institutional ownership firms are less prone to managing earnings, we would expect a positive coefficient on the interaction of weather with a high institutional ownership dummy in the EBITDA and net income models (indicating a greater willingness to allow weather shocks to be transmitted to income), and perhaps a negative coefficient in the charitable giving models (indicating a greater reluctance to alter charitable giving in response to weather shocks to manage earnings).

As we report in these first three columns of Table 5, none of these predictions is borne out in the data. The coefficients in Panel A indicate that the sales sensitivity to weather is similar for both types of firms, but the signs on the weather variable in the EBITDA/income models in Panels B and C are all of the wrong sign, and significantly so in two of the six cases. The response of charitable giving to weather appears quite similar across the two groups. We conclude that there is no evidence suggestive of more limited earnings management by the higher institutional ownership firms in our sample.

Turning to managerial ownership, we flag low ownership firms using a dummy variable indicating whether the start-of-year direct managerial equity holdings, measured as the percentage held by the firm’s top five officers, is below the sample annual cohort median. We then augment the baseline models by interacting weather with the low managerial ownership dummy variable. The resulting estimates are reported in columns 4–6 of Table 5.

The point estimates on sales–weather sensitivities in Panel A weakly suggest a slightly lower sensitivity for the low managerial ownership firms, but none of the three interaction term estimates are statistically significant. However, turning to the EBITDA and net income models, all six coefficients on the ownership interaction terms are significant (one at the 10% level, all others at 5% or better), suggesting that the lower ownership firms are more aggressive in mitigating the impact of weather shocks on a firm’s reported EBITDA and net income. The point estimates on charitable giving in Panel D are positive in sign, which is consistent with more earnings management for the lower ownership firms, but all are statistically insignificant at conventional levels. We interpret this evidence on managerial ownership, taken as a whole, as moderately supportive of the hypothesis that aggregate earnings management efforts are somewhat more aggressive in firms with lower managerial ownership.

5 Conclusion

In this study, we investigate earnings management activity in response to exogenous weather shocks for a set of large utilities. We find that weather conditions have a substantial and significant impact on sample firms’ annual revenues. However, these same shocks have a negligible effect on firms’ reported incomes. Since it is hard to envision a scenario in which (unmanaged) average costs for sample firms would change in a way that would fully offset the identified exogenous revenue shocks, we argue that these findings provide indirect but highly suggestive evidence of earnings management activities by sample firms.

Motivated by these initial findings, we search for direct evidence of real earnings management activities by studying the charitable giving behavior of sample firms. Charitable donations are important expenditures for many utilities given their public relations concerns. Moreover, they are expensed items that are opaque to outsiders and are frequently finalized near the end of the fiscal year.

We detect strong evidence that charitable spending is sensitive to weather shocks with more (less) spending when weather-induced demand shocks are positive (negative). The estimated magnitudes of these effects, measured as elasticities, are quite large. Since the optimal level of charitable giving is unlikely to be highly sensitive to idiosyncratic weather shocks, these findings provide support for the hypothesis that firms are engaging in a form of real earnings management. We find no convincing evidence in support of alternative explanations for the relation we detect. If other types of spending with similar features to charitable giving behave in a related manner, the aggregate effect of real earnings management activities could explain much of the surprisingly smooth earnings behavior of sample firms, despite their high exposure to variation in the weather. We also present some limited evidence that earnings management is more acute when unanticipated weather shocks occur late in the year and when managers have relatively weak ownership incentives.

Our evidence supporting the presence of active earnings management efforts at utilities is interesting, particularly when juxtaposed with the findings of Perez-Gonzalez and Yun (2013). Those authors find that utilities are active users of weather derivatives, contracts that may assist in smoothing earnings or alleviating financial constraints. However, most large utilities are financially strong, with ample debt market access and high bond ratings, which presumably leads to few concerns about financial constraints. Thus, their findings and our results collectively suggest a strong desire to manage earnings. Of note, Perez-Gonzalez and Yun (2013) present evidence indicating that firm value is enhanced by access to hedging risk management tools. One possible explanation for this finding, suggested by our evidence, is that derivatives usage may be a relatively harmless way (in a valuation sense) of smoothing earnings, compared to, for example, altering investment spending on intangibles such as the charitable contributions. Certainly, this is an interesting issue for future research.

Notes

The incentive to manage earnings is often associated with market rewards for beating analyst expectations (e.g., Bartov et al., 2002). Since managers can also manage expectations, we would expect the equilibrium level of earnings and expectations management to be jointly determined (e.g., Das et al., 2012).

Welfare effects will be negative if, absent earnings management concerns, firms follow a value-maximizing strategy. Evidence in Vorst (2016), Kothari et al. (2016), and Greiner (2017) supports the presence of these negative welfare effects. If firms have a propensity to underspend or overspend on certain items, it is theoretically possible that the real earnings management could improve efficiency; some indirect supportive evidence of this is reported by Guo et al. (2019). For general evidence on earnings management and market valuations, see Barth et al. (1999).

The advantage of our approach is a potentially cleaner and more convincing set of findings regarding firm behavior. The obvious disadvantage is that we must focus on a specific industry with its own economic peculiarities, thus raising questions about external validity. Our approach is reminiscent of the strategy exploited by Hall (1993), Lamont (1997), and Han and Wang (1998), who exploit exogenous shocks to oil prices in specific industry contexts. An alternative approach that exploits exogenous variation in a firm’s legal environment to study real earnings management is exploited by Huang et al. (2020).

Purnanandam and Weagley (2016) show that government weather measurements become more accurate after the establishment of the weather derivatives market. These derivatives were widely available during our sample period.

If firms can completely hedge weather risk at a reasonable cost using derivatives, there may be no sensitivity of income or spending to weather variation. Practically speaking, weather derivatives have a substantial level of basis risk, and the costs from using these tools are likely substantial. Perez-Gonzalez and Yun (2013) report that only a minority of firms in their sample use weather derivatives, casting doubt on the possibility that income risk is usually eliminated. We consider the potential role of hedging activities below.

Managers may also alter real decisions because of financial constraints (e.g., Stein 2003). This would appear to be unlikely for our sample firms, as they tend to be financially strong with low levels of financial constraints. However, we do consider this possibility explicitly below.

In the final sample, ten pairs of “firms” share a GVKEY because of our (conservative) convention, outlined above, of treating an entity as a new firm if it likely experienced a major acquisition or restructuring event.

Ideally, we would also study these other types of expenditures. Unfortunately, the data is not available, and thus we focus on charitable giving as a lens into general spending behavior on discretionary and hard-to-observe (but, in aggregate, important) items.

For all logged variables in the paper, before taking logs we add one plus the absolute value of the minimum sample value if there are any negative values, and we simply add one before logging if the smallest value is zero. If the smallest value is positive, we do not make any adjustments before taking logs.

The ideal test would be to exploit a direct measure of unmanaged costs and then to compare this to actual costs. However, since we cannot observe unmanaged costs, we must make indirect inferences based on behavior observed in the context of the sample firms’ operating environments.

The issue of whether to normalize by size is largely unimportant in specifications 2 and 3, since these elasticity models effectively adjust for size. The findings in Table 2 (Table 3) are substantively unchanged if we drop (add) the normalization of the dependent variables by start-of-period firm assets.

We do not have charitable spending data for the pre-sample period, thus we impute a “normal” level of charitable giving by running a regression of spending against firm size in the first sample year. We use the predicted value from the regression coefficients as a measure of a typical spending level for the normalizations in specifications 3 and 4.

Unfortunately, existing theoretical models of optimal giving (e.g., Navarro (1988)) are not rich enough to allow for dynamics that might permit a direct calibration exercise.

The .5 figure is equal to the interquartile range for q reported by Masulis and Reza (2015) in their Table 1, divided by 2, and rounded to the closest one decimal point. The implied change in giving is calculated as the Masulis and Reza (2015) dy/dx estimate for q in Panel B of their Table 2 of .003, multiplied by .5, to arrive at an implied .0015 or .15% change in the charitable giving ratio (and thus also in total dollars given). Multiplying .0015 by the mean total giving in their sample yields the $13,476 figure.

If we replace the weather variable with Tobin’s q in the Panel A models of Table 3, the coefficients on q are in all cases small and statistically insignificant. The insignificance likely reflects our small sample size relative to Masulis and Reza (2015). The fact that weather effects are evident in our small sample, even when Tobin’s q effects are not, also tends to cast doubt on a simple optimal investment explanation for our findings.

The underlying source of this data, accessed at www.philanthropy.com, is 2015 tax return information for individuals in the county who itemize deductions on their federal tax returns. The county-level giving propensity is based on the set of all itemizers.

The mean level of the Hadlock and Pierce (2010) index of financial constraints for our sample falls in the 6th percentile when measured relative to the entire Compustat universe.

Lev et al. (2010) provide some cross-sectional evidence on taxes and corporate giving.

Since there may be other unidentified non-earnings-management explanations for our evidence, we cannot guarantee that intentional earnings management underlies our findings. However, viewed as a whole, the collective set of evidence we present seems quite compelling.

A similar argument based on fiscal year timing issues is made by Cohen et al. (2010) in their study of advertising. Inspired by Black et al. (2020), as a robustness check we have also estimated the baseline charitable giving models using weather in a pseudo-fiscal year composed of the first two quarters of the actual year combined with the last two quarters of the prior fiscal year. In all cases, this variable is an insignificant predictor of charitable giving.

The suspicion that some firms have an innately higher propensity to manage earnings is implicit in many prior studies. See, for example, Chu et al. (2019).

While we emphasize the information content in the decision to hedge, there are also mitigating effects arising from the consequences of hedging that could reverse the sign of this relation. That is, if hedging significantly alleviates weather risk, non-hedgers may be the firms that are more likely to feel the need to alter charitable spending in response to weather shocks.

Prior thinking on this issue is mixed. Some argue that higher managerial ownership will increase incentives to manage earnings in an effort to maximize the value of any impending personal equity sales (Cheng and Warfield 2005). However, others assert that managers who are less secure in their positions—e.g., managers with lower ownership—will tend to have greater incentives to manage earnings (Ali and Zhang 2015; Cheng et al., 2016. Given the convexity of option-induced incentives, we exclude options in all ownership calculations.

References

Abdel-Khalik, A. Rashad. 1988. Incentives for accruing costs and efficiency in regulated monopolies subject to ROE constraint. Journal of Accounting Research 26 (supplement): 144–174. https://doi.org/10.2307/2491186.

Ali, Ashiq, and Weining Zhang. 2015. CEO tenure and earnings management. Journal of Accounting and Economics 59-1: 60–79. https://doi.org/10.1016/j.jacceco.2014.11.004.

Barth, Mary E., John A. Elliott, and Mark W. Finn. 1999. Market rewards associated with patterns of increasing earnings. Journal of Accounting Research 37-2: 387–413. https://doi.org/10.2307/2491414.

Bartov, Eli, Dan Givoly, and Carla Hayn. 2002. The rewards to meeting or beating earnings expectations. Journal of Accounting and Economics 33-2: 173–204. https://doi.org/10.1016/s0165-4101(02)00045-9.

Bens, Daniel A., Venky Nagar, and M.H. Franco Wong. 2002. Real investment implications of employee stock option exercises. Journal of Accounting Research 40-2: 359–393. https://doi.org/10.1111/1475-679x.00052.

Bergstresser, Daniel, Mihir Desai, and Joshua Rauh. 2006. Earnings manipulation, pension assumptions, and managerial investment decisions. The Quarterly Journal of Economics 121-1: 157–195. https://doi.org/10.1093/qje/121.1.157.

Bertrand, Marianne, Matilde Bombardini, Raymond Fisman, and Francesco Trebbi. 2018. Tax-exempt lobbying: Corporate philanthropy as a tool for political influence. NBER working paper no. 24451. https://doi.org/10.2139/ssrn.3095686.

Black, Dirk E., Spencer Pierce, and Wayne B. Thomas. 2020. A test of income smoothing using Pseudo fiscal years. Working paper, University of Nebraska at Lincoln. https://doi.org/10.2139/ssrn.3026235

Bonbright, James C., Albert L. Danielsen, and David R. Kamerschen. 1988. Principles of public utility rates. 2nd. ed. Public Utilities Reports.

Brown, William O., Eric Helland, and Janet Smith. 2006. Corporate philanthropic practices. Journal of Corporate Finance 12-5: 855–877. https://doi.org/10.1016/j.jcorpfin.2006.02.001.

Brown, James R., Matthew Gustafson, Ivan Ivanov. 2021. Weathering cash flow shocks. Journal of Finance (forthcoming). https://doi.org/10.1111/jofi.13024

Burgstahler, David, and Ilia Dichev. 1997. Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics 24-1: 99–126. https://doi.org/10.1016/s0165-4101(97)00017-7.

Bushee, Brian J. 1998. The influence of institutional investors on Myopic R&D Investment Behavior. The Accounting Review 73-3: 305–333.

Cheng, Qiang, and Terry Warfield. 2005. Equity incentives and earnings management. The Accounting Review 80-2: 441–476. https://doi.org/10.2308/accr.2005.80.2.441.

Cheng, Qiang, Jimmy Lee, and Terry Shevlin. 2016. Internal governance and real earnings management. The Accounting Review 91-4: 1051–1085. https://doi.org/10.2308/accr-51275.

Cheong, Foong Soon, and Jacob Thomas. 2011. Why do EPS forecast error and dispersion not vary with scale? Implications for analyst and managerial behavior. Journal of Accounting Research 49-2: 359–401. https://doi.org/10.1111/j.1475-679x.2010.00387.x.

Cheong, Foong Soon, and Jacob Thomas. 2018. Management of reported and forecast EPS, investor responses, and research implications. Management Science 64-9: 4277–4301. https://doi.org/10.1287/mnsc.2017.2832.

Chu, Jenny, Patricia M. Dechow, Kai Wai Hui, and Annika Yu Wang. 2019. Maintaining a reputation for consistently beating earnings expectations and the slippery slope to earnings manipulation. Contemporary Accounting Research 36-4: 1966–1998. https://doi.org/10.1111/1911-3846.12492.

Cleveland, Megan, Logan Dunning, and Jesse Heibel, 2019. State policies for utility investment in energy efficiency. In Report for the National Conference of State Legislatures.

Cohen, Daniel A., Aiyesha Dey, and Thomas Z. Lys. 2008. Real and accrual-based earnings management in the pre- and Post-Sarbanes-Oxley periods. The Accounting Review 83-3: 757–787. https://doi.org/10.2308/accr.2008.83.3.757.

Cohen, Daniel A., Raj Mashruwala, and Tzachi Zach. 2010. The use of advertising activities to meet earnings benchmarks: Evidence from monthly data. Review of Accounting Studies 15-4: 808–832. https://doi.org/10.1007/s11142-009-9105-8.

Cohen, Daniel, Shailendra Pandit, Charles E. Wasley, and Tzachi Zach. 2020. Measuring real activity management. Contemporary Accounting Research 37-2: 1172–1198. https://doi.org/10.1111/1911-3846.12553.

Das, Somnath, Kyonghee Kim, and Sukesh Patro. 2012. On the anomalous stock Price response to management earnings forecasts. Journal of Business Finance & Accounting 39: 905–935. https://doi.org/10.1111/j.1468-5957.2012.02298.x.

Dechow, Patricia, Weili Ge, and Catherine Schrand. 2010a. Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50: 344–401. https://doi.org/10.1016/j.jacceco.2010.09.001.

Dechow, Patricia M., Linda A. Myers, and Catherine Shakespeare. 2010b. Fair value accounting and gains from asset securitizations: A convenient earnings management tool with compensation side-benefits. Journal of Accounting and Economics 49: 2–25. https://doi.org/10.1016/j.jacceco.2009.09.006.

Dechow, Patricia M., Amy P. Hutton, Jung Hoon Kim, and Richard G. Sloan. 2012. Detecting earnings management: A new approach. Journal of Accounting Research 50-2: 275–334. https://doi.org/10.1111/j.1475-679x.2012.00449.x.

Degeorge, François, Jayendu Patel, and Richard Zeckhauser. 1999. Earnings management to exceed thresholds. The Journal of Business 72-1: 1–33. https://doi.org/10.1086/209601.

Dessaint, Olivier, and Adrien Matray. 2017. Do managers overreact to salient risks? Evidence from hurricane strikes. Journal of Financial Economics 26-1: 97–121. https://doi.org/10.1016/j.jfineco.2017.07.002.

Dichev, Ilia, John Graham, Campbell Harvey, and Shiva Rajgopal. 2013. Earnings quality: Evidence from the field. Journal of Accounting and Economics 56: 1–33. https://doi.org/10.1016/j.jacceco.2013.05.004.

Dierynck, Bart, Wayne R. Landsman, and Annelies Renders. 2012. Do managerial incentives drive cost behavior? Evidence about the role of the zero earnings benchmark for labor cost behavior in private Belgian firms. The Accounting Review 87-4: 1219–1246. https://doi.org/10.2308/accr-50153.

Doyle, Jeffrey T., Jared N. Jennings, and Mark T. Soliman. 2013. Do managers define non-GAAP earnings to meet or beat analyst forecasts? Journal of Accounting and Economics 56-1: 40–56. https://doi.org/10.1016/j.jacceco.2013.03.002.

Erickson, Merle, and Shiing-wu Wang. 1999. Earnings management by acquiring firms in stock for stock mergers. Journal of Accounting and Economics 27-2: 149–176. https://doi.org/10.1016/s0165-4101(99)00008-7.

Fazzari, S.M., R.G. Hubbard, and B.C. Petersen. 1988. Financing constraints and corporate investment. Brookings Papers on Economic Activity 1988-1: 141–195. https://doi.org/10.2307/2534426.

Ferrell, Allen, Hao Liang, and Luc Renneboog. 2016. Socially responsible firms. Journal of Financial Economics 122-3: 585–606. https://doi.org/10.1016/j.jfineco.2015.12.003.

Graham, John. 1996a. Debt and the marginal tax rate. Journal of Financial Economics 41-1: 41–73. https://doi.org/10.1016/0304-405x(95)00857-b.

Graham, John. 1996b. Proxies for the corporate marginal tax rate. Journal of Financial Economics 42-2: 187–221. https://doi.org/10.1016/0304-405x(96)00879-3.

Graham, John, Campbell Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73. https://doi.org/10.1016/j.jacceco.2005.01.002.

Greiner, Adam. 2017. An examination of real activities management and corporate cash holdings. Advances in Accounting 39: 79–90. https://doi.org/10.1016/j.adiac.2017.10.002.

Grieser, William, and Charles J. Hadlock. 2019. Panel data estimation in finance: Testable assumptions and parameter (in)consistency. Journal of Financial and Quantitative Analysis 54-1: 1–29. https://doi.org/10.1017/s0022109018000996.

Guo, Bing, David Pérez-Castrillo, and Anna Toldrà-Simats. 2019. Firms’ innovation strategy under the shadow of analyst coverage. Journal of Financial Economics 131-2: 456–483. https://doi.org/10.1016/j.jfineco.2018.08.005.

Hadlock, Charles J., and Joshua R. Pierce. 2010. New evidence on measuring financial constraints: Moving beyond the KZ index. Review of Financial Studies 23-5: 1909–1940. https://doi.org/10.1093/rfs/hhq009.

Hahne, Robert L., and Gregory E. Aliff. 1989. Accounting for public utilities. Matthew Bender.

Hall, S.C. 1993. Political scrutiny and earnings management in the oil refining industry. Journal of Accounting and Public Policy 12-4: 325–351. https://doi.org/10.1016/0278-4254(93)90013-2.

Han, J.C., and S.W. Wang. 1998. Political costs and earnings management of oil companies during the 1990 Persian gulf crisis. The Accounting Review 73-1: 103–117.

Hayashi, Fumio. 1982. Tobin’s marginal Q and average Q: A neoclassical interpretation. Econometrica 50-1: 215–224. https://doi.org/10.2307/1912538.

Huang, Sterling, Sugata Roychowdhury, and Ewa Sletten. 2020. Does litigation deter or encourage real earnings management? The Accounting Review 95-3: 251–278. https://doi.org/10.2308/accr-52589.

Hughes, K.E., II, Joseph A. Johnston, Joseph B. Omonuk, and Michael T. Dugan. 2012. Rate regulation of US electric utilities: Does it deter earnings management? Advances in Accounting 28-1: 49–63. https://doi.org/10.1016/j.adiac.2012.02.003.

Irani, Rustom M., and Davis Oesch. 2016. Analyst coverage and real earnings management: Quasi-experimental evidence. Journal of Financial and Quantitative Analysis 51-2: 589–627. https://doi.org/10.1017/s0022109016000156.

Kahn, Faith Stevelman. 1997. Pandora’s box: Managerial discretion and the problem of corporate philanthropy. UCLA Law Review 44: 579–676.

Kothari, S.P., Natalie Mizik, and Sugata Roychowdhury. 2016. Managing for the moment: The role of earnings management via real activities versus accruals in SEO valuation. The Accounting Review 91-2: 559–586. https://doi.org/10.2308/accr-51153.

Lamont, Owen. 1997. Cash flow and investment: Evidence from internal capital markets. Journal of Finance 52-1: 83–109. https://doi.org/10.1111/j.1540-6261.1997.tb03809.x.

Lev, Baruch, Christine Petrovits, and Suresh Radhakrishnan. 2010. Is doing good good for you? How charitable contributions enhance revenue growth. Strategic Management Journal 31: 182–200. https://doi.org/10.1002/smj.810.

Li, Shiyou, Emeka Nwaeze, and Jenniofer Yin. 2016. Earnings management in the electric utility industry: Profit incentives. Review of Quantitative Finance and Accounting 46-3: 633–660. https://doi.org/10.1007/s11156-014-0481-1.

Liang, Hao, and Luc Renneboog. 2017. On the foundations of corporate social responsibility. The Journal of Finance 72-2: 853–910. https://doi.org/10.1111/jofi.12487.

Louis, Henock. 2004. Earnings management and the market performance of acquiring firms. Journal of Financial Economics 74-1: 121–148. https://doi.org/10.1016/j.jfineco.2003.08.004.

Masulis, Ronald W., and Syed Walid Reza. 2015. Agency problems of corporate philanthropy. The Review of Financial Studies 28-2: 592–636. https://doi.org/10.1093/rfs/hhu082.

Matsumoto, Dawn A. 2002. Management's incentives to avoid negative earnings surprises. The Accounting Review 77-3: 483–514. https://doi.org/10.2308/accr.2002.77.3.483.

McInnis, John, and Daniel W. Collins. 2011. The effect of cash flow forecasts on accrual quality and benchmark beating. Journal of Accounting and Economics 51-3: 219–338. https://doi.org/10.1016/j.jacceco.2010.10.005.

Naughton, James. 2019. Regulatory oversight and trade-offs in earnings management: Evidence from pension accounting. Review of Accounting Studies 24-2: 456–490. https://doi.org/10.1007/s11142-019-9482-6.

Navarro, Peter. 1988. Why do corporations give to charity? The Journal of Business 61-1: 65–93. https://doi.org/10.1086/296420.

Paek, Wonsun. 2001. Earnings management in the electric utility industry. Asia-Pacific Journal of Accounting & Economics 8-2: 109–126. https://doi.org/10.1080/16081625.2001.10510592.

Perez-Gonzalez, Francisco, and Hayong Yun. 2013. Risk management and firm value: Evidence from weather derivatives. Journal of Finance 68-5: 2143–2176. https://doi.org/10.1111/jofi.12061.

Petrovits, Christine M. 2006. Corporate-sponsored foundations and earnings management. Journal of Accounting and Economics 41-3: 335–362. https://doi.org/10.1016/j.jacceco.2005.12.001.

Purnanandam, Amiyatosh, and Daniel Weagley. 2016. Can markets discipline government agencies? Evidence from the weather derivatives market. Journal of Finance 71-1: 303–334. https://doi.org/10.1111/jofi.12366.

Roychowdhury, Sugata. 2006. Earnings management through real activities manipulation. Journal of Accounting and Economics 42-3: 335–370. https://doi.org/10.1016/j.jacceco.2006.01.002.

Roychowdhury, Sugata, Nemit Shroff, and Rodrigo S. Verdi. 2019. The effects of financial reporting and disclosure on corporate investment: A review. Journal of Accounting and Economics 68: 1–27. https://doi.org/10.1016/j.jacceco.2019.101246.

Stein, Jeremy C. 2003. Agency, information and corporate investment. In Handbook of the economics of finance, ed. George Constantinides, Milt Harris, and Rene Stulz, 111–165. North-Holland. https://doi.org/10.1016/s1574-0102(03)01006-9.