Abstract

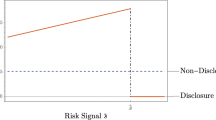

Prior studies suggest that accounting information risk, primarily idiosyncratic in nature, can be diversified away. I show that accounting information risk, proxied by accruals quality, is priced even if it is entirely idiosyncratic. Building on a model developed in the ambiguity literature, I predict that, (1) in an under-diversified market, idiosyncratic information risk is priced even if it is diversifiable, and (2) in a well-diversified market, idiosyncratic information risk is priced when information is subject to managers’ discretion and thus ambiguous. The empirical results corroborate the predictions from the model. An association is observed between (unambiguous if risky) innate accruals quality and cost of capital. This association can be largely mitigated through diversification. However, diversification has little impact on the association between (ambiguous) discretionary accruals quality and cost of capital.

Similar content being viewed by others

Notes

By idiosyncratic risk (or unsystematic risk), I refer to risk that is specific to an asset or a small group of assets. Systematic risk, on the other hand, affects the whole market or economy.

Knight (1921) calls it “uncertainty” as opposed to “risk.” Thus, some later studies use “Knight uncertainty” to refer to ambiguity.

The probability of drawing a red ball is 25 % with one red ball and three black balls, 50 % with two red balls and two black balls, or 75 % with three red balls and one black ball.

The probability of drawing a red ball is 75 %.

In fact, the implications of the Epstein–Schneider model apply to all management disclosures broadly. In this paper, I focus on the specific context in which managers are making accrual choices.

An example of the dual motives in accruals choices can be illustrated by the valuation allowance for deferred tax assets. While Miller and Skinner (1998) find that this allowance reflects managers’ expected future taxable income (i.e., signalling motive), Schrand and Wong (2003) document evidence of earnings management through manipulating this allowance (i.e., opportunistic motive).

Note that, relative to innate information, investors’ experience is of less help to investors in interpreting discretionary information, and it is difficult to attach a prior probability to the two motives. First, in contrast to economic fundamentals, managers’ motives are seldom revealed, making it difficult for investors to judge which motive applies, even ex post. Second, each time an estimate is made, it is case-specific, and what happened in the past may not apply to the current situation managers face before making estimates.

Related to this paper, two recent studies document that investor competition has an effect on how the information risk affects the cost of capital (Armstrong et al. 2011; Akins et al. 2012). Essentially, investor competition differs from the notion of diversification. Untabulated results show that after removing variations related to investor competition from my diversification proxy, the main inferences are unchanged, indicating that results in this paper are not driven by investor competition.

In Williams (2015), the VIX index, constructed by the Chicago Board Options Exchange (CBOE), represents the implied volatility of an at-the-money option for the S&P 100 index with a maturity of 1 month.

See their Equation (10) on p. 209.

Admittedly, holding a market portfolio is not a necessary condition for investors to eliminate exposure to idiosyncratic risk. In a large market, it is possible that holding a portfolio that is sufficiently large but smaller than a market portfolio can be good enough to be well diversified. However, this possibility introduces a conservative bias for my tests. In particular, misclassifying a well-diversified stock to be under-diversified would make it harder to detect variation of the pricing effect of accruals quality under different extents of diversification.

Bushee and Goodman (2010) estimate this regression using the full sample period. In the robustness tests, I use the full period and find that the inferences remain unchanged.

Following Bushee and Goodman (2010), I only consider institutional investors in constructing this measure. Williams (2015) shows that ambiguity reversion is less severe for institutional investors than individual investors. In this case, only including institutional investors thus introduces a conservative bias into my analysis and makes it harder to find the results. However, the inferences remain unchanged if I account for individual investors by assuming they are fully under-diversified, i.e., \(R^2\) = 0. Specifically, I recalculate the average \(R^2\) and assign an \(R^2=0\) for individual investors weighted by their ownership.

The main inferences remain unchanged after eliminating low-priced stocks (i.e., stocks with prices lower than $5).

For example, the highest correlation among them is the one between \(R^2\) and the number of institutional investors. The Pearson (Spearman) correlation is 13 % (10 %).

McInnis (2010) finds that the optimism in analyst forecasts yields implied cost of capital estimates that are systematically too high for firms with volatile earnings. To ensure the results are not driven by earnings volatility, I further control for earnings smoothness as defined in McInnis (2010). Untabulated results show that the inferences remain unchanged after controlling for earnings smoothness.

The references remain the same when data is pooled and standard errors are clustered by year and firm.

The results are robust to the quintile and percentile ranks.

The inferences remain unchanged when cost of capital estimates are estimated using the method introduced in Larocque (2013).

Untabulated results show that the first principal component explains 70 % of the total variance.

Realized returns are measured in the same period as the implied cost of capital estimates, i.e., from 1982 to 2010. Following Kim and Qi (2010), I eliminate low-priced stocks (i.e., stocks with price lower than $5) in the sample.

I thank the discussant for suggesting this measure.

On average, individual investors are less capable of diversifying their portfolios. The findings in this paper are consistent with an emerging literature suggesting that information risk has a bigger impact on individual investors’ investment decisions than on institutional investors (Miller 2010; Lawrence 2013).

References

Abarbanell, J., Bushee, B., & Raedy, J. (2003). Institutional investor preferences and price pressure: The case of corporate spin-offs. The Journal of Business, 76, 233–261.

Aboody, D., Hughes, J., & Liu, J. (2005). Earnings quality, insider trading, and cost of capital. Journal of Accounting Research, 43, 651–673.

Akins, B. K., Ng, J., & Verdi, R. S. (2012). Investor competition over information and the pricing of information asymmetry. The Accounting Review, 87, 35–58.

Ali, A., Hwang, L.-S., & Trombley, M. A. (2003). Arbitrage risk and the book-to-market anomaly. Journal of Financial Economics, 69, 355–373.

Armstrong, C. S., Core, J. E., Taylor, D. J., & Verrecchia, R. E. (2011). When does information asymmetry affect the cost of capital? Journal of Accounting Research, 49, 1–40.

Ball, R., Kothari, S. P., & Shanken, J. (1995). Problems in measuring portfolio performance: An application to contrarian investment strategies. Journal of Financial Economics, 38, 79–107.

Barth, M. E., Konchitchki, Y., & Landsman, W. R. (2013). Cost of capital and earnings transparency. Journal of Accounting and Economics, 55, 206–224.

Beyer, A., Cohen, D. A., Lys, T. Z., & Walther, B. R. (2010). The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics, 50, 296–343.

Bhattacharya, U., Daouk, H., & Welker, M. (2003). The world price of earnings opacity. The Accounting Review, 78, 641–678.

Bhattacharya, N., Ecker, F., Olsson, P., & Schipper, K. (2012). Direct and mediated associations among earnings quality, information asymmetry, and the cost of equity. The Accounting Review, 87, 449–482.

Botosan, C. A., Plumlee, M. A., & Wen, H. (2011). The relation between expected returns, realized returns, and firm risk characteristics. Contemporary Accounting Research, 28, 1085–1122.

Botosan, C. A., Plumlee, M. A., & Xie, Y. (2004). The role of information precision in determining the cost of equity capital. Review of Accounting Studies, 9, 233–259.

Bushee, B. J. (2001). Do institutional investors prefer near-term earnings over long-run value? Contemporary Accounting Research, 18, 207–246.

Bushee, B. J., & Goodman, T. H. (2010). Institutional investor diversification and the pricing of risk. http://www.ibrarian.net/navon/paper/Institutional_Investor_Diversification_and_the_Pr.pdf?paperid=16188411

Callen, J. L., Khan, M., & Lu, H. (2012). Accounting quality, stock price delay and future stock returns. Contemporary Accounting Research, 30, 269–295.

Camerer, C., & Weber, M. (1992). Recent developments in modeling preferences: Uncertainty and ambiguity. Journal of Risk and Uncertainty, 5, 325–370.

Cao, H. H., Wang, T., & Zhang, H. H. (2005). Model uncertainty, limited market participation, and asset prices. Review of Financial Studies, 18, 1219–1251.

Caskey, J. A. (2009). Information in equity markets with ambiguity-averse investors. Review of Financial Studies, 22, 3595–3627.

Caskey, J., Hughes, J. S., & Liu, J. (2015). Strategic informed trades, diversification, and expected returns. The Accounting Review. http://aaapubs.org/doi/abs/10.2308/accr-51026.

Chen, C., Huang, A. G., & Jha, R. (2012). Idiosyncratic return volatility and the information quality underlying managerial discretion. Journal of Financial and Quantitative Analysis, 47, 873–899.

Chordia, T., & Swaminathan, B. (2000). Trading volume and cross-autocorrelations in stock returns. The Journal of Finance, 55, 913–935.

Claus, J., & Thomas, J. (2001). Equity premia as low as three percent: Evidence from analysts’ earnings forecasts for domestic and international stock markets. The Journal of Finance, 56, 1629–1666.

Collins, D. W., Gong, G., & Hribar, P. (2003). Investor sophistication and the mispricing of accruals. Review of Accounting Studies, 8, 251–276.

Conrad, J., Cornell, B., & Landsman, W. R. (2002). When is bad news really bad news? The Journal of Finance, 57, 2507–2532.

Core, J. E., Guay, W. R., & Verdi, R. (2008). Is accruals quality a priced risk factor? Journal of Accounting and Economics, 46, 2–22.

Daniel, K., & Titman, S. (2006). Market reactions to tangible and intangible information. The Journal of Finance, 61, 1605–1643.

Dechow, P. M., & Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77, 35–59.

Dimson, E. (1979). Risk measurement when shares are subject to infrequent trading. Journal of Financial Economics, 7, 197–226.

Easley, D., & O’Hara, M. (2004). Information and the cost of capital. The Journal of Finance, 59, 1553–1583.

Easton, P. D. (2004). PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. The Accounting Review, 79, 73–95.

Easton, P. D., & Monahan, S. J. (2005). An evaluation of accounting-based measures of expected returns. The Accounting Review, 80, 501–538.

Easton, P. D., & Sommers, G. A. (2007). Effect of analysts’ optimism on estimates of the expected rate of return implied by earnings forecasts. Journal of Accounting Research, 45, 983–1015.

Ellsberg, D. (1961). Risk, ambiguity, and the savage axioms. The Quarterly Journal of Economics, 75, 643–669.

Epstein, L. G., & Miao, J. (2003). A two-person dynamic equilibrium under ambiguity. Journal of Economic Dynamics and Control, 27, 1253–1288.

Epstein, L. G., & Schneider, M. (2008). Ambiguity, information quality, and asset pricing. The Journal of Finance, 63, 197–228.

Fama, E. F. (1991). Efficient capital markets: II. The Journal of Finance, 46, 1575–1617.

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. Journal of Finance, 47, 427–465.

Fama, E. F., & French, K. R. (1997). Industry costs of equity. Journal of Financial Economics, 43, 153–193.

Fama, E. F., & French, K. R. (2007). Disagreement, tastes, and asset prices. Journal of Financial Economics, 83, 667–689.

Fama, E. F., & MacBeth, J. D. (1973). Risk, return, and equilibrium: Empirical tests. The Journal of Political Economy, 81, 607–636.

Francis, J., Huang, A. H., Rajgopal, S., & Zang, A. Y. (2008). CEO reputation and earnings quality. Contemporary Accounting Research, 25, 109–147.

Francis, J., LaFond, R., Olsson, P., & Schipper, K. (2004). Costs of equity and earnings attributes. The Accounting Review, 79, 967–1010.

Francis, J., LaFond, R., Olsson, P., & Schipper, K. (2005). The market pricing of accruals quality. Journal of Accounting and Economics, 39, 295–327.

Gebhardt, W. R., Lee, C. M. C., & Swaminathan, B. (2001). Toward an implied cost of capital. Journal of Accounting Research, 39, 135–176.

Gode, D., & Mohanram, P. (2003). Inferring the cost of capital using the ohlson-juettner model. Review of Accounting Studies, 8, 399–431.

Goetzmann, W. N., & Kumar, A. (2008). Equity portfolio diversification. Review of Finance, 12, 433–463.

Grossman, S. J., & Stiglitz, J. E. (1980). On the impossibility of informationally efficient markets. The American Economic Review, 70, 393–408.

Guay, W., Kothari, S. P., & Shu, S. (2011). Properties of implied cost of capital using analysts’ forecasts. Australian Journal of Management, 36, 125–149.

Hail, L., & Leuz, C. (2006). International differences in the cost of equity capital: Do legal institutions and securities regulation matter? Journal of Accounting Research, 44, 485–531.

Hail, L., & Leuz, C. (2009). Cost of capital effects and changes in growth expectations around U.S. cross-listings. Journal of Financial Economics, 93, 428–454.

Halevy, Y. (2007). Ellsberg revisited: An experimental study. Econometrica, 75, 503–536.

Hand, J. R. M. (1990). A test of the extended functional fixation hypothesis. The Accounting Review, 65, 740–763.

Hayn, C. (1995). The information content of losses. Journal of Accounting and Economics, 20, 125–153.

Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13, 365–383.

Hughes, J. S., Liu, J., & Liu, J. (2007). Information asymmetry, diversification, and cost of capital. The Accounting Review, 82, 705–729.

Hughes, J., Liu, J., & Su, W. (2008). On the relation between predictable market returns and predictable analyst forecast errors. Review of Accounting Studies, 13, 266–291.

Jiambalvo, J., Rajgopal, S., & Venkatachalam, M. (2002). Institutional ownership and the extent to which stock prices reflect future earnings. Contemporary Accounting Research, 19, 117–145.

Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29, 193–228.

Keynes, J. M. (1921). A treatise on probability. London: Macmillan.

Kim, D., & Qi, Y. (2010). Accruals quality, stock returns, and macroeconomic conditions. The Accounting Review, 85, 937–978.

Knight, H. F. (1921). Risk, uncertainty, and profit. Boston, MA: Houghton Miffiin.

Kravet, T., & Shevlin, T. (2010). Accounting restatements and information risk. Review of Accounting Studies, 15, 264–294.

Lambert, R., Leuz, C., & Verrecchia, R. E. (2007). Accounting information, disclosure, and the cost of capital. Journal of Accounting Research, 45, 385–420.

Lambert, R., Leuz, C., & Verrecchia, R. E. (2012). Information asymmetry, information precision, and the cost of capital. Review of Finance, 16, 1–29.

Larocque, S. (2013). Analysts’ earnings forecast errors and cost of equity capital estimates. Review of Accounting Studies, 18, 135–166.

Lawrence, A. (2013). Individual investors and financial disclosure. Journal of Accounting and Economics, 56, 130–147.

Levy, H. (1978). Equilibrium in an imperfect market: A constraint on the number of securities in the portfolio. The American Economic Review, 68, 643–658.

Lipe, R. C., Bryant, L., & Widener, S. K. (1998). Do nonlinearity, firm-specific coefficients, and losses represent distinct factors in the relation between stock returns and accounting earnings? Journal of Accounting and Economics, 25, 195–214.

Mashruwala, C. A., & Mashruwala, S. D. (2011). The pricing of accruals quality: January versus the rest of the year. The Accounting Review, 86, 1349–1381.

McInnis, J. (2010). Earnings smoothness, average returns, and implied cost of equity capital. The Accounting Review, 85, 315–341.

McNichols, M. F. (2002). Discussion of the quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77, 61–69.

Merton, R. C. (1987). A simple model of capital market equilibrium with incomplete information. Journal of Finance, 42, 483–510.

Miller, B. P. (2010). The effects of reporting complexity on small and large investor trading. The Accounting Review, 85, 2107–2143.

Miller, G. S., & Skinner, D. J. (1998). Determinants of the valuation allowance for deferred tax assets under SFAS no. 109. Accounting Review, 73, 213–233.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. American Economic Review, 48, 261–298.

Mohanram, P., & Gode, D. (2013). Removing predictable analyst forecast errors to improve implied cost of equity estimates. Review of Accounting Studies, 18, 443–478.

Mohanram, P., & Rajgopal, S. (2009). Is pin priced risk? Journal of Accounting and Economics, 47, 226–243.

Newey, W. K., & West, K. D. (1987). Hypothesis testing with efficient method of moments estimation. International Economic Review, 28, 777–787.

Ogneva, M. (2012). Accrual quality, realized returns, and expected returns: The importance of controlling for cash flow shocks. The Accounting Review, 87, 1415–1444.

Piotroski, J. D., & Roulstone, D. T. (2004). The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm-specific information into stock prices. The Accounting Review, 79, 1119–1151.

Rajgopal, S., & Venkatachalam, M. (2011). Financial reporting quality and idiosyncratic return volatility. Journal of Accounting and Economics, 51, 1–20.

Sarin, R. K., & Weber, M. (1993). Effects of ambiguity in market experiments. Management Science, 39, 602–615.

Schrand, C. M., & Wong, M. H. F. (2003). Earnings management using the valuation allowance for deferred tax assets under SFAS no. 109. Contemporary Accounting Research, 20, 579–611.

Shevlin, T. (2013). Some personal observations on the debate on the link between financial reporting quality and the cost of equity capital. Australian Journal of Management, 38, 447–473.

Skinner, D., & Sloan, R. (2002). Earnings surprises, growth expectations, and stock returns or don’t let an earnings torpedo sink your portfolio. Review of Accounting Studies, 7, 289–312.

Smith, M. P. (1996). Shareholder activism by institutional investors: Evidence from CalPERS. The Journal of Finance, 51, 227–252.

Teoh, S. H., & Wong, T. J. (1993). Perceived auditor quality and the earnings response coefficient. The Accounting Review, 68, 346–366.

Williams, C.D. (2015). Asymmetric responses to good and bad news: An empirical case for ambiguity. The Accounting Review, 90, 785–817.

Acknowledgments

This paper is based on my dissertation at the Rotman School of Management, University of Toronto. I am deeply indebted to the members of my dissertation committee: Jeffrey Callen (co-chair), Partha Mohanram, Gordon Richardson (co-chair), and Liyan Yang for their time and guidance. I would also like to thank Judson Caskey (the discussant), Inder Khuruna (the external examiner), Richard Sloan (the editor), two anonymous referees, and other participants at the 2014 Review of Accounting Studies Conference. I am grateful to Ling Cen, Feng Chen, Ruihao Ke, Na Li, Kevin Li, Hai Lu, Matt Lyle, Mark Ma, Dan Thornton, Kevin Veenstra, Clare Wang, Mike Welker, Baohua Xin, and workshop participants at McGill University, Nanyang Technological University, National University of Singapore, Queen’s University, Singapore Management University, Tsinghua University, University of Toronto, University of Texas at Dallas, University of Utah, the 2013 AAA annual meeting, the 2013 CAAA annual meeting, and the First Ontario University Accounting Symposium for their help and valuable suggestions. I acknowledge financial support from University of Toronto and Queen’s University. The usual disclaimer applies

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Earnings quality models

This appendix describes two commonly used models to estimate accruals quality. The first model is a modified Dechow and Dichev (2002) model as follows:

where \(TCA= (\Delta CA-\Delta Cash)-(\Delta CL-\Delta STDEBT)\), \(TA= TCA-Dep\), \(\Delta CA= {\text {change in current assets}}\), \(\Delta Cash= {\text {change in cash/cash equivalents}}\), \(\Delta CL= {\text {change in current liabilities}}\), \(\Delta STDEBT= {\text {change in short-term debt}}\), \(\Delta Dep={\text {depreciation and amortization expense}}\), \(NIBE= \text {{net income before extraordinary items}}\), \(CFO= NIBE-TA\), \(\Delta Rev={\text {change in revenue}}\), \(PPE= {\text {gross property, plant, and equipment}}\)

All variables are scaled by average total assets. Equation (8) is estimated for each of Fama and French’s (1997) 48 industry groups with at least 20 firms in year t. Annual cross-sectional estimations yield firm- and year-specific residuals. \(DD_{j,t}=\sigma (v_j)_t\) is the standard deviation of firm j’s residuals, \(v_{j,t}\), calculated over years t − 4 through t. Larger standard deviations of residuals indicate poorer accruals quality.

The second model is a modified Jones (1991) model as follows:

where \(\Delta AR_{j,t}\) is firm j’s change in accounts receivable between year t − 1 and year t. Equation 9 is estimated for each of Fama and French’s (1997) 48 industry groups with at least 20 firms in year t. The resulting measures of normal accruals and abnormal accruals are \(NA_{j,t}=\hat{\kappa _1}\frac{1}{Asset_{j,t-1}}+ \hat{\kappa _2}\frac{(\Delta Rev_{j,t}-\Delta AR_{j,t})}{Asset_{j,t-1}}+ \hat{\kappa _3}\frac{PPE_{j,t}}{Asset_{j,t-1}}\), and \(AA_{j,t}=TA_{j,t} - NA_{j,t}\). \(|AA_{j,t}|\) is the absolute value of \(AA_{j,t}\) with a greater number indicating poorer accruals quality.

Appendix 2: Implied cost of capital models

This appendix describes five accounting valuation models that are used to estimate the implied cost of capital in this paper.

Claus and Thomas (2001):

This is a special case of the residual income valuation model. It is assumed that residual income grows at rate \(\gamma\) after T = 5. bps is book value per share, \(ROE_{i,t+\tau }=eps_{i,t+\tau }/bps_{i,t+\tau -1}, eps_{i,t+\tau }=eps_{i,t+2}\times (1+ltg_i)^{\tau -2}\) for \(\forall \tau >2, ltg_i\) is IBES consensus long term growth rate, \(bps_{i,t+\tau }=bps_{i,t+\tau -1}+eps_{i,t+\tau }\times (1-K)\), K is the payout ratio, and \(\gamma\) is the 10-year government bond rate less 3 %. r or \(COC_{CT}\) is solved via an iterative procedure.

Gebhardt et al. (2001):

This is a special case of the residual income valuation model. It is assumed that residual income converges to industry-specific median return from T = 3 to T = 12. From T = 12 on, residual income is assumed to remain constant. \(ROE_{i,t+\tau }=eps_{i,t+\tau }/bps_{i,t+\tau -1}\) for \(\tau =1,2, ROE_{i,t+\tau }=ROE_{i,t+\tau }-fade \, \forall \tau >2, fade=(ROE_{i,t-2}-HIROE_t), HIROE\) is the industry median from ROE t − 4 to t, \(bps_{i,t+\tau }=bps_{i,t+\tau -1}+eps_{i,t+\tau }\times (1-K)\), and K is the payout ratio. r or \(COC_{GLS}\) is solved via an iterative procedure.

Gode and Mohanram (2003):

This model uses 1-year-ahead forecasted earnings and dividends per share as well as forecasts of short- and long-term abnormal earnings growth. It is assumed that dividends (dps) are a constant fraction of forecasted earnings. Long-term growth rate \(\Delta agr\) is set to be the 10-year government bond rate less 3 %. Solving r in this equation yields \(COC_{GM}\).

Easton (2004):

This model is a special case of the Gode and Mohanram (2003) model when T = 2 and \(\gamma =0\). It embeds the assumption that growth in abnormal earnings persists in perpetuity after the initial period. Solving for r in this equation yields \(COC_{PEG}\).

Rights and permissions

About this article

Cite this article

Hou, Y. The role of diversification in the pricing of accruals quality. Rev Account Stud 20, 1059–1092 (2015). https://doi.org/10.1007/s11142-015-9331-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-015-9331-1