Abstract

An owner delegates investment decisions to a better informed manager whose time preferences are unknown to the owner. Due to exogenous capital constraints, not all profitable projects can be undertaken, and therefore the owner wants the manager to select the NPV-maximizing set of projects. We show that the relative benefit cost allocation scheme proposed by prior literature does not solve this problem. Adopting the same information structure as in Rogerson (J Polit Econ 105, 770–795, 1997) and Reichelstein (Rev Account Stud 2, 157–180, 1997), we demonstrate how to obtain robust goal congruence using residual income. The resulting revenue recognition and cost allocation rules lead to a performance measure reflecting the expected NPV-ranking of projects in each and every period.

Similar content being viewed by others

Notes

Consistent with prevalent corporate practice, it is plausible to think of this constraint in the context of “soft” rather than “hard” rationing. Hingorani and Mukherjee (1999) survey 102 Fortune 500 firms and find that capital rationing (forgoing positive NPV investments) is largely present (64% of the firms surveyed operate under capital rationing at least some of the time) and is predominately internal (82% of firms). Many firms’ capital constraints are “soft” constraints adopted by headquarters as an aid to financial control, see e.g., Antle and Eppen (1985) and Antle and Fellingham (1990). We find the following reason more plausible in our setting. In some cases management may believe that very rapid corporate growth could impose intolerable strains on management and the organization. Since it is difficult to quantify such constraints explicitly, the capital constraint (budget) may be used as a proxy. For further discussion see, for example, Brealey and Myers (1996, p. 104).

The decision to accept or reject a particular project is assumed to have no impact on future investment opportunities or future capital allocations. Thus, for example, if the manager decides not to undertake P i , that investment opportunity is irretrievably lost.

The project space may contain projects whose useful life is between zero and n. Of course, if a project does not generate (expected) cash flows beyond period j < n, then by definition, for this project, x ti = 0, t = j,…,n.

One of the reasons proposed for this impatience is that with some probability, the manager may leave the firm before the full benefit of a project he undertakes is realized. In other words, the principal and the agent have different planning horizons, with the principal’s planning horizon exceeding the life span of the possible projects, and the agent’s horizon being shorter. Another explanation for managerial impatience is that the manager intrinsically puts more weight on current versus future consumption, and wealth constraints may prevent him from borrowing at the rate available to the owner. In any case, it should be noted that our results carry over to a situation where the manager is more patient than the owner.

The conservation property of residual income, given the clean surplus relation, is well documented in the accounting literature. It dates back to Preinreich (1937), and was brought to full attention in the valuation models of Ohlson (1995) and Feltham and Ohlson (1995), and in a performance measurement framework by Reichelstein (1997). The latter shows that it still holds for a set of projects. Besides earlier research has shown residual income to be unique among accounting-based performance measures in its ability to induce goal congruence, see, for example, Proposition 3 in Reichelstein (1997).

In contrast to the case where the agent and the principal have identical time preferences, the depreciation schedule here is determined uniquely by Eq. 6.

Dutta and Reichelstein (2005) refer their notation of goal congruence solely to residual income as a performance measure.

Egginton 1995 analyzes the maintainable residual income. He uses a depreciation charge that gives a constant ex ante residual income in each year of a project’s life. But it provides periodic consistency only for projects of equal life, it cannot cope the ranking of unequal lives. The most critical point of his method is the information structure. To control the performance measure the principal has to know the NPV of a project. In that case, the principal could directly base the agent’s premium on the NPV.

In the following lemma, we use a parameter γ t for which we will get later on some concrete accounting interpretation.

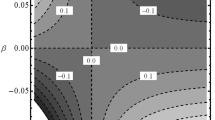

Also Eq. 6 induces, that the principal has to ensure the same portion of each expected NPV as performance measure in each period. She does not know the discount factor of the agent, so she can just ensure that \({\frac{x_{ti}}{\sum \nolimits_{\tau =1}^n{x_{\tau i \cdot (1+r)^{-\tau}}}}}\) is the same factor for each project in each period.

For example, Antle and Demski (1989) and Antle, Demski, and Ryan (1994) adopt an “information content” approach and study recognition as an information signal rather than as a fundamental measure. They examine tradeoffs between the quality and timeliness of information in the contexts of consumption planning and investment in securities. Dutta and Zhang (2002) and Liang (2000) examine revenue recognition from a management control perspective.

For a discussion on the implications of this separation for the revenue recognition rule, see Bareket (2001).

We will discuss later on, why it is not possible for a robust goal congruent revenue recognition rule to fulfill this condition ex post in the face of an uncertain environment. However, ex ante, the expected returns and expected cash flow are in line with that condition. Ex post the last period may deviate.

For further discussion see Bareket (2001).

We are grateful to Katherine Schipper for this observation. This condition may allow some early revenue recognition rules. However, since future cash flows are unobserved by the owner, this should require some arbitrary upper bounds, or additional information, in order not to violate the rule that one cannot recognize accounting revenues in excess of total cash inflows from a project.

We could also assume that the profitability parameters do not equal one. However, that does not affect our result. Since we use a counter proof, it is sufficient to show one contradicting case.

It is interesting to note that Stern Stewart & Co. recommends to companies with long-lived equipment to use the sinking-fund depreciation as one of the adjustments to GAAP in implementing EVA®. See Ehrbar (1998).

Thereafter, the market-to-book ratio with respect to the investment asset will not necessarily be greater than one, albeit adopting only positive NPV projects.

References

Antle, R., & Eppen, G. (1985). Capital rationing and organizational slack in capital budgeting. Management Science, 31, 163–174.

Antle, R., & Fellingham, J. (1990). Resource rationing and organizational slack in a two period model. Journal of Accounting Research, 28, 1–24.

Antle, R., & Demski, J.S. (1989). Revenue recognition. Contemporary Accounting Research, 6, 423–451.

Antle, R., Demski, J. S., & Ryan, S. G. (1994). Multiple sources of information, valuation, and accounting earnings. Journal of Accounting, Auditing & Finance, 9, 675–696.

Baldenius, T., Dutta, S., & Reichelstein, S. (2006). Cost allocation for capital budgeting decisions. Working Paper. Stanford University.

Baldenius, T., & Reichelstein, S. (2005). Incentives for efficient inventory management: The role of historical cost. Management Science, 51, 1032–1045.

Bareket, M. (2001). Investment decisions under capital constraints: The role of revenue recognition in performance measurement. Working paper. Columbia University.

Brealey, R. A., & Myers, S. C. (1996). Principles of corporate finance (5th ed.). New York: McGraw-Hill.

Dutta, S., & Zhang, X. (2002). Revenue recognition in a multiperiod agency setting. Journal of Accounting Research, 40, 67–83.

Dutta, S., & Reichelstein, S. (2002). Controlling investment decisions: Depreciation- and capital charges. Review of Accounting Studies, 7, 253–281.

Dutta, S., & Reichelstein, S. (2005). Accrual accounting for performance evaluation. Review of Accounting Studies, 10, 527–552.

Egginton, D. (1995). Divisional performance measurement: Residual income and the asset base. Management Accounting Research, 6, 201–222.

Ehrbar, A. (1998). EVA the real key to creating wealth. New York: Wiley.

Feltham, G., & Ohlson, J. (1995). Valuation and clean surplus accounting for operating and financial decision. Contemporary Accounting Research, 11, 689–731.

Financial Accounting Standards Board (FASB) (1984). Statement of financial accounting standards no. 5. Recognition and measurement in financial statements of business enterprises. Norwalk, CT: FASB.

Hingorani, V. L., & Mukherjee, T. K. (1999). Capital rationing decisions of Fortune 500 firms: A survey. Financial Practice and Education, 1, 7–15.

Liang, P. J. (2000). Accounting recognition, moral hazard, and communication. Contemporary Accounting Research, 17, 457–490.

Mishra, B., & Vaysman, I. (2004). Delegating investment decision. Working Paper. University of Texas, Austin.

Mohnen, A. (2002). Performancemessung und die Steuerung von Investitionsentscheidungen. Beiträge zur betriebswirtschaftlichen Forschung, Wiesbaden: Gabler Verlag und Deutscher Universitätsverlag.

Mohnen, A. (2005). Good News für die Steuerung von Investitionsentscheidungen—Eine Verallgemeinerung des relativen Beitragsverfahrens. Zeitschrift für Betriebswirtschaft, 75(3), 277–297.

Ohlson, J., & Zhang, X. (1998). Accrual accounting and equity valuation. Journal of Accounting Research, 36, 85–112.

Ohlson, J. (1995). Earnings, book value and dividends in security valuation. Contemporary Accounting Research, 11, 661–687.

Preinreich, G. (1937). Valuation and amortization. The Accounting Review, 12, 209–226.

Ramakrishnan, R. (1988). Accrual accounting and incentives: Depreciation methods for investment centers. Working paper. Columbia University.

Reichelstein, S. (1997). Investment decisions and managerial performance evaluation. Review of Accounting Studies, 2, 157–180.

Rogerson, W. (1997). Inter-temporal cost allocation and managerial investment incentives. Journal of Political Economy, 105, 770–795.

Ryan, S. (1988). Structural models of the accounting process and earnings. Ph.D. Dissertation. Stanford University.

Stewart, B. (1991). The quest for value. New York: Harper Collins Publishers.

Wagenhofer, A. (2003). Accrual-based compensation, depreciation and investment decisions. European Accounting Review, 12, 287–309.

Wei, D. (2004). Inter-departmental cost allocation and investment incentives. Review of Accounting Studies, 9, 97–116.

Acknowledgements

For helpful comments and suggestions we want to thank the participants of research seminars at CUNY University-Baruch College, Carnegie Mellon University, Columbia University, Duke University, INSEAD, London School of Business, Northwestern University, New York University, Stanford University, University of California at Berkeley, University of Cologne, University of Pennsylvania, and Yale University. Additionally we are grateful for the comments at the workshop on Personnel Economics in Zurich, EIASAM Workshop of Accounting and Economics in Frankfurt, EEA in Prag, Annual Conference of the German Association of Economists in Dresden. Our special thanks go to Tim Baldenius, Qi Chen, Masako Darrough, Sunil Dutta, Yuji Ijiri, Deen Kemsley, Nahum Melumad, Jim Ohlson, Stephen Penman, Thomas Pfeiffer, Bharat Sarath, Katherine Schipper, Dirk Sliwka, Amir Ziv, two anonymous referees, and Stefan Reichelstein, the editor. Moshe Bareket acknowledges financial support from the Fuqua School of Business, Duke University. Alwine Mohnen thanks the German Research Foundation (DFG) for a research fellowship within the Postdoc-Program, MO-1663/1–1, supporting her stay at the GSB, Stanford University.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mohnen, A., Bareket, M. Performance measurement for investment decisions under capital constraints. Rev Acc Stud 12, 1–22 (2007). https://doi.org/10.1007/s11142-006-9020-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-006-9020-1

Keywords

- Accrual accounting

- Capital budgeting

- EVA

- NPV maximization

- Performance measurement

- Revenue recognition

- Residual income