Abstract

We examine stock sales as a managerial incentive to help explain the discontinuity around the analyst forecast benchmark. We find that the likelihood of just meeting versus just missing the analyst forecast is strongly associated with subsequent managerial stock sales. Moreover, we provide evidence that managers manage earnings prior to just meeting the threshold and selling their shares. Finally, the relation between just meeting and subsequently selling shares does not hold for non-manager insiders, who arguably cannot affect the earnings outcome, and is weaker in the presence of an independent board, suggesting that good corporate governance mitigates this strategic behavior.

Similar content being viewed by others

Notes

The inability to measure a manager’s intent or “scienter” directly is well known in the legal literature (Bainbridge, 2000). Economists (and lawyers) therefore use the concept of “revealed preference” to infer intent from various patterns in observed data (Kreps, 1990, Chapter 2). From an institutional perspective, the only ex ante disclosure that managers have to file is Form 144, in which they document their intent to sell. However, managers are not obligated to sell all the shares they say they will, so most managers just keep a large open balance of shares on Form 144. Therefore, we cannot use Form 144 as a measure of the intent to sell.

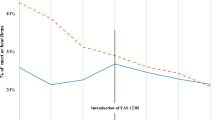

Durtschi and Easton (2005) has the greatest relevance in our setting, as our focus is on the zero analyst forecast error discontinuity. They argue that the kink around zero analyst forecast error is largely driven by analyst optimism versus pessimism—essentially that when analysts miss, they miss big, creating a dearth of observations in the just missed region that is not necessarily due to earnings management. Their conjecture does not prohibit our examination of this region. The shortage of firms in this region should only serve to weaken the power of our tests, as we examine whether managers who would have just missed exert additional effort to jump the hurdle when they plan to sell their shares. Our claim is not that the discontinuity around the zero analyst forecast is exclusively due to earnings management, but that trading incentives accentuate this kink.

In related work, Ke (2004) examines the prior earnings threshold and finds that managers with more equity incentives are more likely to manage earnings to report longer earnings strings. Ke (2004) also finds that these managers sell significant amounts of stock in the two to six quarters prior to a break in a string of consecutive earnings increases. Cheng and Warfield (2005) also examine the role of managerial motives in the context of the analyst forecast error discontinuity. They find that managers with high levels of equity incentives are more likely to have met the analyst forecast.

These empirical studies are validated by theoretical work that shows that stock prices are extraordinarily sensitive to small events such as firms just missing earnings thresholds. This theoretical result obtains both when a) investors have behavioral biases (e.g., Rabin, 2002), and (b) when investors are rational, but have incomplete information about the firm’s future prospects (Hart & Kreps, 1986; Stein, 1987). The intuition in Hart and Kreps (1986) is that speculators are always in search of the “the next big stock,” resulting in extreme volatility in price relative to small changes in fundamentals.

We realize that in a more complex setting, a rational forward-looking manager will conduct a long-range optimization, weighing the impact of managing earnings today on future period earnings and future period stock incentive dynamics. We abstract from this complex setting and focus on a single period setting (see Bolton, Scheinkman, & Xiong, 2006 for a multi-period model).

To shed light on the possibility of price-drop-based penalties, we examine the subsequent returns following the trades by management, beginning one day following the managerial trade and ending one day before the manager files the trade with the SEC. The subsequent market-adjusted returns following managerial sales, though significantly lower than for those where the manager purchased shares, remain positive. This finding is consistent with Bartov et al. (2002)—that regardless of how the benchmark is met, there is a premium to meeting the benchmark. This premium alleviates concerns about price-drop-based insider trading penalties.

The quarterly consensus analyst forecast is the median EPS forecast computed over the set of the analysts’ most recent forecasts that are no earlier than two months before the quarterly earnings release date. This procedure avoids the problem of stale analyst forecasts. We use the unadjusted I/B/E/S forecasts to avoid losing the precision in the decimal places of the forecasts due to the I/B/E/S adjustments of prior forecasts for subsequent stock splits (Baber & Kang, 2002; Payne & Thomas, 2003). Actual earnings realizations are also obtained from I/B/E/S. Note that stock splits are not an issue for insider stock sales because we scale this measure by contemporaneous insider stock holdings.

Also note that our tests include all firm-quarters in which the firm just met or just missed the analyst forecast. We do not use a matched sample approach, which Palepu (1986) argues biases the results by distorting the baseline proportions of the treatment firms.

The use of realized outcomes as a proxy for intent is widespread in studies that examine earnings patterns prior to an event such as stock issuance, option grants and cash pay (e.g., Aboody & Kasznik, 2000; Rangan, 1998; Teoh, Welch & Wong, 1998). In all these cases, when managers take the action prior to the event, they are anticipating that the event of interest will subsequently happen. Like our study, these studies use the actual realization of the event in their empirical tests, not the managers’ ex ante anticipation.

Ke et al. (2003) use a similar trading window (see pp. 322–323). Results are not sensitive to using the entire quarter, which is reasonable, because insiders typically do not sell prior to earnings releases. In our sample, 92% of all manager insider trades in a quarter (and 88% of non-manager insider trades) occur after the earnings announcement in that quarter.

The officer shareholdings listed on the SEC filing of a trade can sometimes be very small. To mitigate the generation of outliers due to this small denominator effect, we add back the shares traded in a transaction to the corresponding ownership level figure for all observations. We also exclude option exercises, because the conversion of an option to a share is not really a true purchase. Of course, we include all sales of such shares. Finally, note that we ignore option holdings in the denominator, because the insider trading data do not include option holdings. Substantiating the validity of our metric, alternative insider trading measures such as the square root of the dollar value of insider sales (Noe, 1999, p. 311), and the Net Shares Traded metric (Beneish & Vargus, 2002, p. 761) are correlated with our metric at .86 and .94, respectively.

Hribar and Collins (2002) prescribe the cash flow method to calculate accruals. However, using quarterly data, the cash flow method for our sample period results in a reduction of more than half of the sample. We do, however, replicate our results on this subset of the sample and note our results in Sect. 3.2.

Skinner and Sloan (2002) find that high-growth firms have a more negative stock price reaction to missing versus meeting the analyst forecast than non-high-growth firms. Consistent with these firms having a greater incentive to meet the analyst forecast, we find that growth, as a control variable, is positively associated with just meeting versus just missing the analyst forecast. However, it is also possible that there is an interactive effect. To explore this, we interact I/B/E/S expected long-term growth and insider sales. The sign on the interaction term is positive, as expected, but only marginally significant (p-value = .109; not tabulated).

As noted in Sect. 2.2.3, Hribar and Collins (2002) prescribe the cash flow method to calculate accruals. However, using quarterly data, the cash flow method for our sample period results in a reduction of more than half of the sample (from 11,939 in Table 4 to 5,204 firm-quarter observations). We replicate our results on this subset of the sample and results are similar, though weaker (.018; p-value = .196 vs. .015; p-value = .076 in Table 4). This appears to be due to low power, as the main effect on managerial sales is also very weak (.035; p-value = .240 vs. .035; p-value = .017 in Table 4).

As an additional robustness check (not tabulated), we re-estimate Eq. 3 and include the ranked interaction of DWC q with the quarter q (lagged) insider sales measure. The addition of this new interaction term does not change the results and the new interaction term itself is not significant, suggesting that our results are not simply an artifact of firms that have more insider sales in general. Rather, the timing of insider sales matters.

Note that these results are not consistent with those in Richardson et al. (2004). However, we focus only on those firms that just met the analyst forecast, rather than all firms that met the analyst forecast. Furthermore, Richardson et al. (2004) exclude all observations that met the analyst forecast but began the period with a pessimistic forecast. If we regress meeting the analyst forecast versus missing the analyst forecast for the entire earnings forecast region on the interaction of the unexpected forecast and managerial insider sales, we obtain a positive and significant coefficient on the interaction term, consistent with Richardson et al. (2004).

Clearly, there are many differences between managerial and non-managerial insiders beyond their ability to affect earnings outcomes. This test alone does not provide definitive evidence that managers are actively meeting the analyst forecast before selling shares, but instead complements the findings in Hypothesis 1 and Hypothesis 2, adding to our aggregate evidence on active earnings or forecast management by managerial insiders to meet the analyst forecast.

The existence of a majority of outside directors may mitigate this opportunistic behavior through various mechanisms. For example, these firms may be subject to greater accounting scrutiny (e.g., Klein, 2002) or have additional restrictions on insider trading (Seyhun, 1998). We do not explore the mechanism by which outside directors mitigate this opportunistic behavior.

Because the comparable prior period earnings may have been managed, Dopuch et al. (2003) use a time-series model to arrive at a proxy for prior period earnings. This estimation requires at least 16 quarters of data to estimate. For simplicity and to maximize our sample size, we simply use one year ago quarterly earnings.

References

Aboody, D., & Kasznik, R. (2000). CEO stock option awards and the timing of corporate voluntary disclosures. Journal of Accounting and Economics, 29, 73–100.

Ayers, B., Jiang, J., & Yeung, E. (2006). Discretionary accruals and earnings management: An analysis of pseudo earnings targets. The Accounting Review, 81, 617–652.

Baber, W., & Kang, S. (2002). The impact of split adjusting and rounding on analysts’ forecast error calculations. Accounting Horizons, 16, 277–289.

Bainbridge, S. (2000). Insider trading. The encyclopedia of law and economics, Vol. III. New York: Edward Elgar Publishing, pp. 772–812.

Baker, T., Collins, D., & Reitenga, A. (2003). Stock option compensation and earnings management incentives. Journal of Accounting, Auditing and Finance, 18, 557–582.

Bar-Gill, O., & Bebchuk, L. (2003). Misreporting corporate performance. Harvard Law School Discussion Paper No. 400.

Bartov, E., Givoly, D., & Hayn, C. (2002). The rewards to meeting or beating earnings expectations. Journal of Accounting and Economics, 33, 173–204.

Bartov, E., & Mohanram, P. (2004). Private information, earnings manipulations, and executive stock option exercises. The Accounting Review, 79, 889–920.

Beaver, W., McNichols, M., & K. Nelson. (2003). An alternative interpretation of the discontinuity in earnings distributions. Working Paper, Stanford University.

Beneish, D. (1999). Incentives and penalties related to earnings overstatements that violate GAAP. The Accounting Review, 74, 425–457.

Beneish, D., & Vargus, M. (2002). Insider trading, earnings quality, and accrual mispricing. The Accounting Review, 77, 755–792.

Beneish, D., Press, E., & Vargus, M. (2004). Insider trading and incentives to manage earnings. Working Paper, Indiana University.

Berenson, A. (2003). The number: How the drive for quarterly earnings corrupted wall street and corporate America. New York: Random House Publishers.

Bertrand, M., & Mullainathan, S. (2001). Are CEOs rewarded for luck? The ones without principals are. Quarterly Journal of Economics, 116, 901–932.

Bettis, J., Coles, J., & Lemmon, M. (2000). Corporate policies restricting trading by insiders. Journal of Financial Economics, 57, 191–220.

Bhojraj, S., P. Hribar, P., & Picconi, M. (2003). Making sense of cents: an examination of firms that marginally miss or beat analysts forecasts. Working Paper, Cornell University.

Bolton, P., Scheinkman, J. & Xiong, W. (2006). “Executive compensation and short-termist behavior in speculative markets.” Working Paper, Princeton University.

Brown, L. (2001). A temporal analysis of earnings surprises: profits versus losses. Journal of Accounting Research, 39, 221–241.

Brown, L., & Caylor, M. (2005). A temporal analysis of quarterly earnings thresholds: Propensities and valuation consequences. The Accounting Review, 80, 423–440.

Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24, 99–126.

Bushman, R., & Indjejikian, R. (1995). Voluntary disclosures and the trading behavior of corporate insiders. Journal of Accounting Research, 33, 293–316.

Bushman, R., & Smith, A. (2001). Financial accounting information and corporate governance. Journal of Accounting and Economics, 32, 237–334.

Cheng, Q., & Warfield, T. (2005). Equity incentives and earnings management. The Accounting Review, 80, 441–476.

Cotter, J., Tuna, I., & Wysocki, P. (2006). The expectations management game: Do analysts act independently of explicit management earnings guidance? Contemporary Accounting Research, forthcoming.

Dechow, P., Sloan, R., & Sweeney, A. (1996). Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemporary Accounting Research, 13, 1–36.

Dechow, P., Richardson, S., & Tuna, I. (2000). Are benchmark beaters doing anything wrong? Working Paper, University of Michigan.

Dechow, P., Richardson, S., & Tuna, I. (2003). Why are earnings kinky? An examination of the earnings management explanation. Review of Accounting Studies, 8, 355–384.

DeFond, M., & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17, 145–176.

Degeorge, F., Patel, J., & Zeckhauser, R. (1999). Earnings management to exceed thresholds. Journal of Business, 72, 1–33.

Dopuch, N., Seethamraju, C., & Xu, W. (2003). An empirical assessment of the credibility premium associated with meeting or beating both time-series earnings expectations and analysts Forecasts. Working Paper, Washington University, St. Louis.

Durtschi, C., & Easton, P. (2005). Earnings management? The shapes of the frequency distributions of earnings metrics are not evidence ipso facto. Journal of Accounting Research, 43, 557–592.

Erickson, M., Hanlon, M., & Maydew, E. (2006). Is there a link between executive equity incentives and accounting fraud? Journal of Accounting Research, 44, 113–143.

Freeman, R., & Tse, S. (1992). A nonlinear model of security price responses to unexpected earnings. Journal of Accounting Research, 30, 185–214.

Gao, P., & Shrieves, R. (2002). Earnings management and executive compensation: A case of overdose of option and underdose of salary? Working Paper, University of Tennessee.

Garfinkel, J. (1997). New evidence on the effects of federal regulations on insider trading: ITSFEA. Journal of Corporate Finance, 3, 89–111.

Graham, J., Harvey, C., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40, 3–73.

Guttman, I., Kadan, O., & Kandel, E. (2006). A rational expectations theory of the kinks in financial reporting. The Accounting Review, 81, 811–848

Hall, B., & Liebman, J. (1998). Are CEOs really paid like bureaucrats? Quarterly Journal of Economics, 133, 653–691.

Hart, O., & Kreps, D. (1986). Price destabilizing speculation. Journal of Political Economy, 94, 927–952.

Hayn, C. (1995). The information content of losses. Journal of Accounting and Economics, 20, 125–153.

Heath, C., Huddart, S., & Lang, M. (1999). Psychological factors and stock option exercise. Quarterly Journal of Economics, 114, 601–627.

Hribar, P., & Collins, D. (2002). Errors in estimating accruals: Implications for empirical research. Journal of Accounting Research, 40, 105–134.

Jensen, M. (2004). Agency costs of overvalued equity. Working Paper, Harvard Business School.

Jenter, D. (2005). Market timing and managerial portfolio decisions. Journal of Finance, 60, 1903–1949.

Kasznik, R., & McNichols, M. (2002). Does meeting earnings expectations matter? Evidence from analyst forecast revisions and share prices. Journal of Accounting Research, 40, 727–759.

Ke, B. (2004). Do equity-based incentives induce CEOs to manage earnings to report strings of consecutive earnings increases? Working Paper, Penn State University.

Ke, B., Huddart, S., & Petroni, K. (2003). What insiders know about future earnings and how they use it: Evidence from insider trades. Journal of Accounting and Economics, 35, 315–346.

Klein, A. (2002). Audit committee, board of director characteristics, and earnings management. Journal of Accounting and Economics, 33, 375–395.

Kreps, D. (1990). A course in microeconomic theory. Princeton: The Princeton University Press.

Lakonishok, J., & Lee, I. (2001). Are insider trades informative? Review of Financial Studies, 14, 79–111.

Larcker, D., & Rusticus, T. (2005). On the use of instrumental variables in accounting research. Working Paper, University of Pennsylvania.

Lin, H., & McNichols, M. (1998). Underwriting relationships, analysts’ earnings forecasts and investment recommendations. Journal of Accounting and Economics, 25, 101–127.

Maddala, G. (1977). Econometrics. New York: McGraw-Hill Book Company.

Matsumoto, D. (2002). Management’s incentives to avoid negative earnings surprises. The Accounting Reviewm, 77, 483–514.

Matsunaga, S., & Park, C. (2001). The effect of missing a quarterly earnings benchmark on the CEO’s annual bonus. The Accounting Review, 76, 313–332.

McNichols, M. (2000). Research design issues in earnings management studies. Journal of Accounting and Public Policy, 19, 313–345.

Noe, C. (1999). Voluntary disclosures and insider transactions. Journal of Accounting and Economics, 27, 305–326.

Ofek, E., & Yermack, D. (2000). Taking stock: Equity-Based compensation and the evolution of managerial ownership. Journal of Finance, 55, 1367–1384.

Palepu, K. (1986). Predicting takeover targets: A methodological and empirical analysis. Journal of Accounting and Economics, 8, 3–35.

Payne, J., & Thomas, W. (2003). The implications of using stock-split adjusted I/B/E/S data in empirical research. The Accounting Review, 78, 1049–1067.

Phillips, J., Pincus, M., & Rego, S. (2003). Earnings management: New evidence based on deferred tax expense. The Accounting Review, 78, 491–521.

Piotroski, J., & Roulstone, D. (2005). Do insider trades reflect both contrarian beliefs and superior knowledge about future cash flow realizations? Journal of Accounting and Economics, 39, 59–81.

Rabin, M. (2002). Inference by believers in the law of small numbers. Quarterly Journal of Economics, 117, 775–816.

Rangan, S. (1998). Earnings management and the performance of seasoned equity offerings. Journal of Financial Economics, 50, 101–122.

Richardson, S., Teoh, S. H., & Wysocki, P. (2004). The walk-down to beatable analyst forecasts: The role of equity issuance and insider trading incentives. Contemporary Accounting Research, 21, 885–924.

Rose, N., & Wolfram, C. (2000). Has the “Million-Dollar Cap” affected CEO pay? American Economic Review, 90, 197–202.

Roulstone, D. (2004). Insider trading and the information content of earnings announcements. Working Paper, University of Chicago.

Rozeff, M., & Zaman, M. (1998). Overreaction and insider trading: Evidence from growth and value portfolios. Journal of Finance, 53, 701–716.

Seyhun, N. (1998). Investment intelligence from insider trading. Cambridge: MIT Press.

Skinner, D., & Sloan, R. (2002). Earnings surprises, growth expectations, and stock returns or don’t let an earnings torpedo sink your portfolio. Review of Accounting Studies, 7, 289–312.

Stein, J. (1987). Informational externalities and welfare-reducing speculation. Journal of Political Economy, 95, 1123–1145.

Stock, G., Wright, J., & Yogo, M. (2002). A survey of weak instruments and weak identification in generalized method of moments. Journal of Business and Economics Statistics, 20, 518–529.

Summers, S., & Sweeney, J. (1998). Fraudulently misstated financial statements and insider trading: An empirical analysis. The Accounting Review,73, 131–146.

Teoh, S., Welch, I., & Wong, T. (1998). Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics, 50, 63–99.

Yermack, D. (1997). Good timing: CEO stock option awards and company news announcements. Journal of Finance, 52, 449–476.

Acknowledgements

We are grateful for the comments of two anonymous reviewers, Dan Bens, Adam Gileski, Michelle Hanlon, Clement Har, Russell Lundholm, Karen Nelson, Madhav Rajan, Scott Richardson, Peter Wysocki and workshop participants at the 5th Annual Utah Winter Conference, 12th Conference on the Theories and Practices of Securities and Financial Markets, 2005 Financial and Reporting Section Mid-Year Meeting, 2005 Western Regional Conference, and the University of Michigan. We also thank I/B/E/S International Inc. for providing data on analyst earnings estimates and other information.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

McVay, S., Nagar, V. & Tang, V.W. Trading incentives to meet the analyst forecast. Rev Acc Stud 11, 575–598 (2006). https://doi.org/10.1007/s11142-006-9017-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-006-9017-9