Abstract

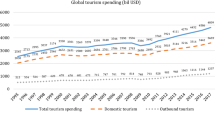

Across several destinations, tourism receipts and the aspects of tourism industry has continued to influence the quality of life of the people as well contributing to the national development and sustainable growth. However, the uncertainties and risks experienced in the tourism industry and other economy sectors have remained the drawback of most economies and destinations. As such, the panel of 20 selected destinations is investigated via the common correlated effect method to examine the nexus of economic policy uncertainty and tourism development over the period 2001–2017. Interestingly, the result established a long term relationship between the economic policy uncertainty index and outbound tourism expenditures. Specifically, the finding revealed that outbound tourism expenditures are affected negatively by the rise of uncertainty in economic policies, thus suggesting instability of economic-related policy is the bane of tourism development in the destinations. This result stands to have important policy guide for especially for tourism-related activities in the panel of 20 selected countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The concept of uncertainty in the economy has been ascribed to the crucial role of underpinning economic events ever since the theoretical and seminar work of Keynes’ entitled “General Employment, Interest and Money Theory” (Hodgson 2011; Gozgor and Ongan 2017). However, since the work of Keynes, the impacts of uncertainties in the context of the economy, especially in different sectors of the economy such as the tourism sector has continously created concrete attention (Davis 2017; Tahir 2020). In recent years, several effort have been devoted to measuring the level of economic uncertainty. Particularly, the economic policy uncertainty (EPU) index which was developed by Baker et al. (2016) has been widely utilized to investigate the impacts of policy uncertainty. The impacts of economic policy uncertainty have been studied by many researchers (Bordo et al. 2016; Akadiri et al. 2020). Nonetheless, only a few research studies have focused on the impact of economic policy uncertainty on the tourism sector.

In term of other aspect of the economy, Demir and Ersan (2017) revealed the negative impacts of both domestic and international EPU on stock prices. More importantly, in the area of tourism, Gozgor and Ongan (2017) examined the impact of the EPU on outbound tourism expenditures (OTE) and concluded that the expenditures had declined in the long-run. Ongan and Gozgor (2018) investigated the impacts of economic uncertainty on Japanese tourists visiting the United States (USA). Their findings indicated that a standard deviation increase in the EPU index led to a 4.7% drop in the number of Japanese tourists visiting the USA in the long-run. Singh et al. (2019) detected the existence of a small impact of policy uncertainty on tourist arrivals. Demir and Gözgör (2018) claimed that the high level of uncertainty in the countries reduced the demand for outbound tourism. Tiwari et al. (2019) found that economic policy uncertainty had short-term outcomes on tourist arrivals. Despite all these research efforts, the impacts of EPU on OTE have not been tested large number of destinations especially by using the panel cointegration analysis. This is an indication of some missing aspects of the literature.

The tourism sector is one of the most rapidly growing sectors in the world, but it is extremely vulnerable to uncertainties and crises. For instance, the uncertainty that followed the events such as Bali bombings, Paris attacks, September 11 attacks, severe acute respiratory syndrome (SARS), outbreak of the avian flu, Indian Ocean tsunami, Hurricane Katrina and Iran-Iraq War greatly affected outbound tourism demand and expenditures (Wu and Wu 2018). Terrorism, political risk, political uncertainty, and corruption are considered as potential uncertainty factors affecting tourism indicators (Tekin 2015). Individuals tend to be reluctant about traveling abroad in times of uncertainty. If there are instability and uncertainty in an economy, the consumption of individuals may decrease and this may lead to a decrease and delay in tourism expenditures (Dragouni et al. 2016; Demir and Gözgör 2018; Wu and Wu 2019a, b).

Furthermore, uncertainty compels consumers to reduce or postpone their current consumption needs or demand for specific services (Liao et al. 2019). This is due to the desire to avoid possible economic crises (Ghosh 2019). For example, in uncertain situations, the demands for luxury goods and services decrease more than the demand for basic requirements. Research studies indicate that tourists give up spending throughout the processes of both economic and political instability (Clements and Georgiou 1998; Fletcher and Morakabati 2008; Esmail 2016). Economic policy uncertainty has negative impacts on consumption, investment and economic growth (Kaplan 2018; Alola et al. 2019; Uzuner et al. 2020; Musa et al. 2021). Such negative impacts may also be subjected to OTE. In this study, based on the theoretical basis mentioned above, the EPU is expected to reduce OTE.

In light of all this above motivation, the effect of economic policy uncertainties on OTE is further re-examined. Given the revelation from the extant literature, a few numbers of studies have examined the relationship between uncertainties in economy and OTE (Tekin 2015; Gozgor and Demir 2018; Tiwari et al. 2019). Nonetheless, the related studies were mostly conducted for a single country and even when it is explored for a panel study such as of Gozgor and Demir (2018), Wu and Wu (2018), and Kuok et al. (2022), the selected countries were not essentially destination countries and the empirical methods employed were either the first generation panel cointegration or panel causality analyses. Whereas, the cross-sectional dependence and homogeneity assumptions should not have been overlooked in the panel cointegration and panel causality analyses. The reason is that the results of the analyses performed without performing the tests on the assumptions of crosssectional dependence and homogeneity may differ. Therefore, the current study mitigates this deficiency in the literature by taking the test procedures related to the assumption of crosssectional dependence and homogeneity into consideration and by using panel cointegration and panel causality tests. This situation emphasizes the originality of the research and its contribution to the literature.

In order to enhance the readability of the study, the other sections are outlined in a specific pattern such that a synopsis of theoretical framework along with the study hypothesis is presented in Sect. 2. The description of the dataset with empirical methodology is captured in Sect. 3 while the result of the investigation is outlined in Sect. 4. Section 5 is dedicated for the summary of the study alongside policy recommendation.

2 Theoretical synopsis

In the study of Clements and Georgiou (1998), the state of political instability in the Eastern Mediterranean and Agean Sea is observed to be a driving force of the region’s tourism attractiveness. Specifically, the internatl tension between the Greek-Cypriot and the Turkish Cypriot especially in the year 1997 is seen as a significant determinant of geographically divided island. As such, the notable tension in the island country (Cyprus) arising form the installation of the Russian-made S-300 surface-to-air missiles by the Southern Greek-Cyprus was largely associated with the high level of uncertainty in the tourism industry’s pattronage. The same notion that political instability remained a detrimental factor for the case of Cyprus was further explored in the study of Seddighi et al. (2002).

Similaryly, Fletcher and Morakabati (2008) specifically indicated that a higher level of uncertainty is attributed to political instability in comparison with the uncertainties from natural disaster occurences, thus both the number of tourists and the expected expenditure are more affected by political instability. At such instance of political instability or other source of perceived threat to the tourist well-beign, Fletcher and Morakabati (2008) opined that the risk perceptions attributed to the tourists (perceived uncertainty) is always a significant determinant of the destination’s tourism performance. Within the current scope, many extant literature have explore the determinant of outbound tourism expenditure and to a large extent the tourism industry for different cases (Bordeaux et al. 2016; Dragouni et al. 2016; Esmail 2016; Gozgor and Ongan 2017; Demir and Ersan 2018; Gozgor and Demir 2018; Wu and Wu 2018; Alola et al. 2019; Liao et al. 2019; Singh et al. 2019; Tiwari et al. 2019; Wu and Wu 2019a, b; Usman et al. 2022). Giving th the aforementioned conceptual framework, Fig. 1 illustrates the adopted model and hypotheses testing for the current study.

H1

There is a long term relationship between the EPU index and OTE.

H2

There is a negative relationship between EPU index and OTE.

3 Data and econometric procedure

3.1 Data

The EPU index is calculated for 23 countries while the OTE data are obtained for 20 of these countries. In this context, in order to utilize the largest data range, EPU index and OTE’s data of 20 countries (see country list in Table 1) over the period from 2001 to 2017 are used. The EPU index is developed by Baker et al. (2016) based on the analysis of media content. The EPU index generated in this study is calculated for 23 countries separately. The relevant index is calculated by taking various keywords into account by thoroughly searching the national newspapers of the countries. OTE are the spendings of international visitors departing from other countries, including payments to foreign carriers for international transportation and retrieved from the World Bank database (in US dollars). The EPU index data are obtained from the website http://www.policyuncertainty.com. The investigated countries and the descriptive statistics of the variable employed are respectively given in Tables 1 and 2.

3.2 Methodology

Crosssectional dependence and homogeneity tests are performed for the variables prior to the unit root and causality analyses. Crosssectional dependence and homogeneity test results are critical for selecting unit root tests and cointegration tests to be used in the analysis. For the crosssectional dependence, the “CD” test developed by Pesaran (2004) is used to determine whether or not there is any dependence between the crosssections (countries). The test was developed for cases in which the crosssectional dimension is greater than the time dimension (N > T). This test is only used when the crosssectional dimension is greater than the time dimension (Kar et al. 2011; Menyah et al. 2014).

3.2.1 Homogeneity, cross-sectional dependence and unit root tests

The Slope Homogeneity test developed by Pesaran and Yamagata (2008) is performed to determine whether or not the cointegration coefficients are homogeneous, in other words, whether or not the coefficients of the explanatory variables change from one crosssection to another. Im et al. (2003) first-generation unit root tests and as well as CADF second generation unit root test developed by Pesaran (2007) are used to determine whether or not the data are stationary according to the results of crosssectional dependence and homogeneity tests. IM Pesaran and Shin (2003) unit root test is mostly preferred in the assumption of the heterogeneous model, whereas the CADF test developed by Pesaran (2007) is preferred in the assumption of crosssectional dependence. The CIPS statistic is calculated by taking the arithmetic mean of the CADF statistic determined for each country in order to determine the presence of unit root for the overall panel.

3.2.2 Long-run estimate

In the study, the cointegration test developed by Westerlund (2008) based on the Durbin-Hausman test is used to determine the long term relationship between the variables. The main features of the Westerlund Durbin-Hausman cointegration test involve its applicability under crosssectional dependence, for both homogeneous and heterogeneous panels, and the fact that time dimension is greater than the crosssectional dimension (T > N). Moreover, the relevant test can be used even if the independent variables contain unit roots at the level, provided that the dependent variable contains unit root at the level (Westerlund 2008). This test, panel statistics for homogeneous data are calculated separately for heterogeneous data and for group statistics. In the Westerlund Durbin-Hausman cointegration test, the null hypothesis of no cointegration for all crosssections is tested for panel statistic, whereas the null hypothesis of no cointegration for some crosssections is tested for the group mean statistic. Durbin-Hausmann panel and group test statistics are given in Eq. 1 and Eq. 2 (Westerlund 2008, p. 203).

The CCE (Common Correlated Effect) model developed by Pesaran (2006) is used to determine the coefficients of the long term relationship between the variables. The CCE model is based on the assumption that the crosssectional dependence is used, but can also be used if the time dimension is greater than the crosssectional dimension (T > N) or if the crosssectional dimension is greater than the time dimension (N > T). The CCE model developed by Pesaran (2006) uses average crosssections that can be consistently predicted in the following auxiliary regression:

In the CCE model, two estimators are used to estimate long term cointegration coefficients. The first, known as the Common Correlated Effects Mean Group (CCEMG) estimator, is a simple average of the individual CCE estimator. The second is the CCE Pooled (CCEP) estimator, which gains efficiency from pooling observations. Both estimators are given in Eqs. 4 and 5, respectively (Moscone and Tosetti 2010: 1390).

4 Results and discussion

4.1 Preliminary results

Firstly, following the estimation of the descriptive statistics of the variables (see Table 2), it is seen that the volatility of OTE is higher than the volatility in the EPU index.

Additionally, the crosssection dependency and homogeneity tests are performed prior to conducting the unit root tests on the dataset. The selection of unit root, cointegration and causality analyses to be used are crucial according to both test results. The crosssectional dependency and homogeneity test results of the variables are illustrated in Table 3.

According to the crosssectional dependency CD test result given in Table 3 above, the null hypothesis claiming no crosssectional dependence is rejected. According to the relevant test results, the series of the countries of which the crosssection is comprised affect each other. In Table 3, it is also tested whether or not the slope coefficient is homogeneous. According to the results obtained from the related tests, the hypothesis claiming that the slope coefficient is homogeneous at a 1% significance level is rejected. Table 4 reveals the unit root test results in determining whether or not the data are stationary.

According to the results of the unit root test given in Table 4, it is detected that the data contained unit roots at the level series and the data are stationary in the difference series.

4.2 Cointegration result

Moving forward from the unit results, cointegration analysis can be performed using the level values of variables. The results of the Westerland Durbin-Hausman cointegration test performed in order to determine whether or not the variables are cointegrated in the long-run are given in Table 5.

According to Durbin-Hausmann cointegration test results, a long term relationship between EPU index and OTE is detected. Based on these findings, the hypothesis H1 is accepted. According to this result, it can be stated that the EPU index and OTE tend to move together in the long term, thus indicating that a shock on the EPU is a significant source of distortion in the OTE. Furthermore, the result of the CCEMG analysis which provides the cointegration coefficients is illustred in Table 6.

Going by the CCEMG test results given in Table 5, there is a negative relationship between OTE and the EPU index. According to this result, the hypothesis H2 is accepted. One unit change in the EPU index leads to a 0.09 unit change in OTE, thus suggesting that tourism development is potentially hindered by vulnerabilities economic-related policies.

The result indicate that a high level of economic policy uncertainty will yield a statistically significant declice in the OTE in the panel of investigated countries. In corroborating this statistical evidence, both the Granger causality and cointegration evidence between the EPU and tourism indicator has been established in extant literature (Gozgor and Ongan 2017; Demir and Ersan 2018; Ongan and Gozgor 2018; Wu and Wu 2019a, b). For instance, Wu and Wu (2019a, b) found short-run unidirectional Granger causality from the European EPU to international tourism receipt but a bidirectional Granger causality relationship was later presented in the long-run.

5 Conclusion and policy dircetion

Tourism is one of the most crucial sectors for the economy to survive in many countries. The sustainability of tourism is required to be maintained in order to ensure the continuity of this situation. The main factor for the sustainability of tourism is the return of foreign tourists providing input to the country. For these reasons, factors affecting OTE should be put forward. Accordingly, the impact of economic policy uncertainty on OTE are investigated in this study and the result revealing a long term relationship between OTE and the EPU index.

According to another finding obtained from the study, a negative relationship between the EPU index and OTE is proven to exist. This result indicates that changes in the economy directly affect OTE. Moreover, the increase in economic uncertainties reduces tourists’ spending. Because consumers would be able to evaluate the possibility of a crisis due to uncertainty in financial markets and may constrain the consumption expenditures. In this context, the first cutback in consumption expenditures will occur in vacation expenditures with the high price elasticity of demand. The best example of this is the 2008 global crisis, which has led to high volatility in the markets as well as major reductions in tourism revenues (Akdağ et al. 2019). Although tourism has been handled with different dimensions recently, it is a luxury need. The research findings confirm this assumption since, in an environment of economic uncertainty, people would wish to meet their mandatory needs first and would not take risks.

5.1 Policy direction

As a result of the study, it is found that economic policy uncertainty is a factor to be taken into account upon measuring and assessing the OTE. Therefore, it is essential to take both national and international causation of uncertainties from all aspects of the economy into consideration especially in projecting the future of the tourism sector. It suggests that, depending on the country-specific sitauion(s), issues of internal division/factionalization/conflict, political partisanship, and religion tolerance, as well as external factors and economic-related situations should be carefully handled in order to put the forms of uncertainties under control. Furthermore, it is believed that the avoidance of markets’ uncertainties and operation of more transparent policy would contribute to the sound structure of the tourism sector.

5.2 Implication and recommendation for future study

In future research studies, other factors that could affect OTE can be considered with different sampling especially by looking at the perspective of regional or country-level scenario. For further contribution to the literature, the examination of the sectoral-level uncertainties could be examined from the perspective of tourism development.

Availability of data and materials

Not Applicable.

References

Akadiri, S.S., Alola, A.A., Uzuner, G.: Economic policy uncertainty and tourism: evidence from the heterogeneous panel. Curr. Issue Tour. 23(20), 2507–2514 (2020)

Akdağ, S., Kiliç, İ, Yildirim, H.: Does VIX scare stocks of tourism companies? Lett. Spat. Resour. Sci. 12(3), 215–232 (2019)

Alola, U.V., Cop, S., Adewale Alola, A.: The spillover effects of tourism receipts, political risk, real exchange rate, and trade indicators in Turkey. Int. J. Tour. Res. (2019). https://doi.org/10.1002/jtr.2307

Baker, S.R., Bloom, N., Davis, S.J.: Measuring economic policy uncertainty. Q. J. Econ. 131(4), 1593–1636 (2016)

Bordo, M.D., Duca, J.V., Koch, C.: Economic policy uncertainty and the credit channel: aggregate and bank level US evidence over several decades. J. Financ. Stab. 26, 90–106 (2016)

Clements, M.A., Georgiou, A.: The impact of political instability on a fragile tourism product. Tour. Manage. 19(3), 283–288 (1998)

Davis, J.: The continuing relevance of Keynes’s philosophical thinking: reflexivity, complexity, and uncertainty. Ann. Fond. Luigi Einaudi Interdiscip. J. Econ. Hist. Polit. Sci. 51(1), 55–76 (2017)

Demir, E., Ersan, O.: Economic policy uncertainty and cash holdings: evidence from BRIC countries. Emerg. Mark. Rev. 33, 189–200 (2017)

Demir, E., Ersan, O.: The impact of economic policy uncertainty on stock returns of Turkish tourism companies. Curr. Issue Tour. 21(8), 847–855 (2018)

Demir, E., Gözgör, G.: Does economic policy uncertainty affect tourism? Ann. Tour. Res. 69(C), 15–17 (2018)

Dragouni, M., Filis, G., Gavriilidis, K., Santamaria, D.: Sentiment, mood and outbound tourism demand. Ann. Tour. Res. 60, 80–96 (2016)

EPU, Ekonomik Politika Belirsizlik Endeksi, Erişim Adresi: http://www.policyuncertainty.com, Erişim Tarihi 03 Apr 2019.

Esmail, H.A.H.: Impact of terrorism and instability on the tourism industry in Egypt and Tunisia after revolution. Bus. Manag. Rev. 7(5), 469 (2016)

Fletcher, J., Morakabati, Y.: Tourism activity, terrorism and political instability within the commonwealth: the cases of Fiji and Kenya. Int. J. Tour. Res. 10(6), 537–556 (2008)

Ghosh, S.: Uncertainty, economic growth its impact on tourism, some country experiences. Asia Pac. J. Tour. Res. 24(1), 83–107 (2019)

Gozgor, G., Demir, E.: The effects of economic policy uncertainty on outbound travel expenditures. J. Compet. 10(3), 5 (2018)

Gozgor, G., Ongan, S.: Economic policy uncertainty and tourism demand: empirical evidence from the USA. Int. J. Tour. Res. 19(1), 99–106 (2017)

Hodgson, G.M.: The eclipse of the uncertainty concept in mainstream economics. J. Econ. Issues 45(1), 159–176 (2011)

Im, K.S., Pesaran, M.H., Shin, Y.: Testing for unit roots in heterogeneous panels. J. Econom. 115, 53–74 (2003)

Kaplan, Y.: Analysing instability as a future for an institutionalization process: the EU, Turkey and the issue of migration. Eur. J. Futures Res. 6(1), 16 (2018)

Kar, M., Nazlıoğlu, Ş, Ağır, H.: Financial development and economic growth nexus in the MENA countries: bootstrap panel granger causality analysis. Econ. Model. 28(1–2), 685–693 (2011)

Kuok, R.U.K., Koo, T.T., Lim, C.: Economic policy uncertainty and international tourism demand: a global vector autoregressive approach. J. Travel Res. (2022). https://doi.org/10.1177/00472875211072551

Liao, F.N., Ji, X.L., Wang, Z.P.: Firms’ sustainability: Does economic policy uncertainty affect internal control? Sustainability 11(3), 794 (2019)

Menyah, K., Nazlioglu, S., Wolde-Rufael, Y.: Financial development, trade openness and economic growth in African countries: new insights from a panel causality approach. Econ. Model. 37, 386–394 (2014)

Moscone, F., Tosetti, E.: Health expenditure and income in the United States. Health Econ. 19(12), 1385–1403 (2010)

Musa, M.S., Jelilov, G., Iorember, P.T., Usman, O.: Effects of tourism, financial development, and renewable energy on environmental performance in EU-28: Does institutional quality matter? Environ. Sci. Pollut. Res. 28(38), 53328–53339 (2021)

Ongan, S., Gozgor, G.: Tourism demand analysis: the impact of the economic policy uncertainty on the arrival of Japanese tourists to the USA. Int. J. Tour. Res. 20(3), 308–316 (2018)

Papatheodorou, A., Rosselló, J., Xiao, H.: Global economic crisis and tourism: consequences and perspectives. J. Travel Res. 49(1), 39–45 (2010)

Pesaran, H.M.: General diagnostic tests for cross section dependence in panels. Working Paper, 0435. University of Cambridge (2004)

Pesaran, H.M.: Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4), 967–1012 (2006)

Pesaran, H.M.: A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 22, 265–312 (2007)

Pesaran, H.M., Yamagata, T.: Testing slope homogeneity in large panels. J. Econom. 142, 50–93 (2008)

Seddighi, H.R., Theocharous, A.L., Nuttall, M.W.: Political instability and tourism: an empirical study with special reference to the microstate of Cyprus. Int. J. Hosp. Tour. Adm. 3(1), 61–84 (2002)

Singh, R., Das, D., Jana, R.K., Tiwari, A.K.: A wavelet analysis for exploring the relationship between economic policy uncertainty and tourist footfalls in the USA. Curr. Issue Tour. 22(15), 1789–1796 (2019)

Song, H., Kim, J.H., Yang, S.: Confidence intervals for tourism demand elasticity. Ann. Tour. Res. 37(2), 377–396 (2010)

Tahir, M.: Terrorism and its determinants: panel data evidence from 94 countries. Appl. Res. Qual. Life 15(1), 1–16 (2020)

Tekin, E.: The impacts of political and economic uncertainties on the tourism industry in Turkey. Mediterr. J. Soc. Sci. 6(2 S5), 265 (2015)

Tiwari, A.K., Das, D., Dutta, A.: Geopolitical risk, economic policy uncertainty and tourist arrivals: evidence from a developing country. Tour. Manage. 75, 323–327 (2019)

Usman, O., Alola, A.A., Ike, G.: Inbound tourism demand elasticities of MENA countries: the role of internal and external conflicts. Int. J. Emerg. Mark. (2022). https://doi.org/10.1108/IJOEM-04-2021-0650

Uzuner, G., Akadiri, S.S., Alola, A.A.: Tourist arrivals in four major economies: another side of economic policy uncertainty and fear. Environ. Sci. Pollut. Res. 27(23), 29659–29665 (2020)

Westerlund, J.: Panel cointegration tests of the Fisher effect. J. Appl. Economet. 23(2), 193–233 (2008)

World Bank, Data, International Tourism Expenditures, Erişim Adresi: https://data.worldbank.org/indicator/st.int.xpnd.cd, Erişim Tarihi 03 Apr 2019

Wu, T.P., Wu, H.C.: Causality between European economic policy uncertainty and tourism using wavelet-based approaches. J. Travel Res. (2018). https://doi.org/10.1177/00472875188032

Wu, T.P., Wu, H.C.: Causality between European economic policy uncertainty and tourism using wavelet-based approaches. J. Travel Res. 58(8), 1347–1356 (2019a)

Wu, T.P., Wu, H.C.: A multiple and partial wavelet analysis of the economic policy uncertainty and tourism nexus in BRIC. Curr. Issue Tour. (2019b). https://doi.org/10.1080/13683500.2019.1566302

Wu, T.P., Wu, H.C., Wang, C.M., Chen, F., Wu, S.T., Liao, S.Y.: Decomposing a time-frequency relationship between economic policy uncertainty and tourism in the G8 countries through wavelet analysis. J. Policy Res. Tour. Leisure Events 13(2), 266–284 (2021)

Acknowledgements

Author’s gratitude is extended to instructors in our respective departments as well as prospective editor and reviewers that will/have spared time to guide toward a successful publication.

Funding

We hereby declare that there is no form of funding received for this study.

Author information

Authors and Affiliations

Contributions

AA: Editing and corresponding. SA: Conceptualization, Formal analysis. İK: Investigation, Methodology. MG: Editing and Supervision.

Corresponding author

Ethics declarations

Conflict of interest

Authors declare that there is no known competing financial interests or personal relationship that could have influenced the study.

Ethical approval

Not Applicable.

Consent to participate

Not Applicable.

Consent to publish

Not Applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Akdağ, S., Kılıç, İ., Gürlek, M. et al. Does economic policy uncertainty drive outbound tourism expenditures in 20 selected destinations?. Qual Quant 57, 4327–4337 (2023). https://doi.org/10.1007/s11135-022-01538-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01538-y