Abstract

The current research tries to contribute to the prospect theory by examining how personality factors affect behaviour biases. Moreover, the study tries to inspect how risk-tolerance behaviour moderates the relationship between personality traits and behavior biases. The research considered a cross-sectional research design to collect responses from 847 individual investors through a questionnaire. The study considered a convenience sampling technique. Further to examine the hypotheses, the study used SEM and PROCESS macro v3.0 for SPSS. The findings of the study suggest that conscientiousness and extroversion traits significantly influence behaviour biases. The findings also explain that neuroticism was associated with herding, disposition, and anchoring bias. The findings confirmed the moderating effect of risk-tolerance on the association between personality traits and behaviour biases. The findings contribute to the existing literature of behaviour finance by focusing on the prospect theory as well as some practical implications for investors and financial advisors. The study suggests to the individual investors with different traits how they can overcome these biases while investing. The study suggests that financial advisors should educate their clients and also establish a lock-gain point and stop-loss point to reduce the effect of such biases. The study also suggests that investment advisors should provide information more efficiently so that investors’ portfolios could be amassed into a well-diversified investment and tries to set up efficient approaches associated with investment quality and give swapping options as per their risk-tolerance behavior. The research contributes to behaviour finance literature by signifying the moderation effect of risk tolerance on the association amid personality factors and behavioural biases and how it reduces the influence of biases while taking investment decisions among Indian investors. To the best of our knowledge, this is the first comprehensive study that examines the moderation effect of risk-tolerance among the relationship between personality traits and behaviour biases. Furthermore, it demonstrates that an individual’s risk-tolerance enhances their involvement in the decision-making process, allowing them to make the best financial option possible.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Traditional financial theories like the modern portfolio theory, Modigliani and Miller arbitrage theory, and the efficient market hypothesis (Markowitz 1952; Modigliani and Miller 1958; Malkiel and Fama 1970) assume that financial markets are completely competent, and while investing, investors are rational. In opposition to traditional theories, the prospect theory stated that investors do not use all of the available information and their decisions are influenced by their perceptions of their own usefulness (Kahneman and Tversky 2013), resulting in irrational decision-making (Adil et al. 2022; Kumar et al. 2021). The prospect theory also posits that individuals’ decisions are influenced by possible gains and losses (Emami et al. 2020) and that, when the choice arises, individuals choose profit over losses (Madaan and Singh 2019). In another way, investors make decisions based on expected profits rather than expected losses (Ishfaq et al. 2020).

The research studies based on the prospect theory recommend that individuals’ investment decisions-process involve heuristic biases (Ceschi et al. 2016) and cognitive biases (Mittal 2019). According to Kahneman and Tversky (2013), cognitive bias is a type of thinking error that affects one's judgments and decisions. Past literature on behaviour finance established that behavior bias can induce an individual to deviate from rational decision-making and considered these biases as the significant factor that influence investors decision-making process (Kumar and Goyal 2015; Adil et al. 2021; Baker et al. 2019a, bc). It has been also stated by several researchers that during the decision-making process, investors exhibit several behavior biases but, the most recurrent among them are these five i.e., herding behaviour (tendency to follow the crowd), disposition effect (tendency to keep losing stock too long and sell gaining stock too soon), overconfidence bias (tendency to overestimate their knowledge and abilities), representativeness (tendency to evaluate the possibility of an occasion by associating it with a prior experience), and anchoring (tendency to estimate about the future returns, which are an unknown value, then they usually begin with some benchmark) (Adil et al. 2021; Baker et al. 2019a, b, c; Ahmad 2020).

The existing literature of behaviour finance stated that investors' decision-making process is based on a complicated mixing of personal characteristics (personality traits, risk tolerance, emotions, etc.) (Ishfaq et al. 2020; Ahmad 2020; Baker et al. 2021), demographics (i.e., gender, age, education level, etc.) (Adil et al. 2021; Menyeh 2021; Ozmen and Sumer 2011), markets (i.e., rate of return, anticipated risk, market environment, etc.) (Lim et al. 2021; Mitchell and Pulvino 2001; Mayfield and Shapiro 2010) and associated factors. However, amid all the factors affecting an individual's behaviour, personality traits have been recognized as the most significant (Fung and Durand 2014). In a study, Durand et al. (2013b) reported that personality is crucial in comprehending the investment decision-making process and aids in the creation of a coherent finance theory with behavioural foundations.

According to the literature, personality traits have a long history in psychology, and investors differ in terms of personality traits, which influence behavioural bias exposure in different ways (Fung and Durand, 2014). Studies like Durand et al. (2019) and Lin (2011ab) reasoned that investors' psychological characteristics, such as personality traits, increase their possibility of displaying behaviour biases while investing. For instance, extrovert investors are optimistic and overreact to market information which leads to displaying overconfidence bias (Ahmad 2020; Bashir et al. 2013a, b) and due to their outgoing traits, they also display herding behaviour (Baker et al. 2021; Kumar et al 2021). In a study, Rzeszutek (2015a, b) examines the linkage between Eysenck and Eysenck’s (1978) personality traits (empathy, venturesomeness, and impulsivity) and individual overconfidence behavior among Polish investors. Along similar line, Baddeley et al. (2010a, b) recognize a relationship amid Eysenck and Eysenck’s personality traits and herding bias among British investors. In the recent time, a growing literature of behaviour finance confirms the relationship among personality traits and behaviour biases concerning the stock market investors of developed economies (Durand et al. 2008; Baddeley et al. 2010a, b; Fung and Durand, 2014; Durand et al. 2019; Oehler et al. 2018). But there is a lack of literature in a developing economy like India (Baker et al. 2021). Therefore, it is significant to investigate “how personality traits influence the likelihood of exhibiting cognitive biases while investing among Indian stock market investors?”.

Since, it has been a topic of discussion among researchers that existing literature has focused on examining the direct linkage amid personality traits and psychological biases, paying less consideration to the underlying mechanism that impacts the direction or/and strength of the association amid independent and dependent variables (Baker et al. 2021). Hence, the authors feel a demand to introduce a moderator (i.e., risk-tolerance) to understand how personality traits affect individuals' behaviour in the presence of risk-tolerance as a moderator. Studies (i.e., Yang and Qiu 2005; Durand et al. 2013a) provide sufficient proof which established that investors decision-making process is significantly influenced by risk-tolerance capacity. The literature of behaviour finance considered risk-tolerance capacity as the most significant element that influences investment decisions (Chavali and Mohanraj 2016). For instance, every investment opportunity is associated with risk and investors have to look at the risk involved in it before taking any decision (Oehler et al. 2018). Recent work on behaviour finance proves the importance of risk-tolerance behaviour and its association with behaviour biases (Ahmad and Shah 2020; Ahmad 2020) and personality traits (Ferreira 2019; Liu et al. 2016). For instance, extrovert investors are more desirous to take risk and display overconfidence behaviour while investing (Sadi et al. 2011a). Further, Dickason and Ferreira (2018), stated that individuals usually take investment choices based on their personality and how much investment risk they are ready to take. It has been observed that investors view risk differently with according to their personality (Brooks and Williams 2021). Researchers began to see risk-tolerance capacity as a trait that can be modified depending on the situation (Kumari and Sar 2017) and choose the most suitable investment according to their risk personality (Millroth et al. 2020). According to Nicholson et al. (2005) and Ishfaq et al. (2020) personality profile is an significant determinant of risk-tolerance and helps to explain why people behave differently. For instance, individuals with impulsive, impetuous and extravert traits are high risk-takers (Pompian 2006a, b; Zuckerman and Kuhlman 2000); neurotic individuals avoid risk due to their pessimistic outlook (Nga and Yein 2013). Hence, it can be stated that individuals’ risk-tolerance behaviour can be related to personality traits. These findings draw a conclusion that there is a significant association between personality traits-risk tolerance and behaviour biases-risk tolerance. But authors do not find any study which explains how investor risk-tolerance level affect the relationship between their personality traits and behaviour biases. Hence, it is worth investigating “how risk-tolerance moderates the relationship between personality traits and behaviour biases among Indian stock market investors”. Overall, the aim of current research is to examine the interface amid personality traits and behaviour biases while moderating these relationships by risk-tolerance behavior. As a result, this study will investigate the following research questions:

- RQ1:

-

What is the association amid personality traits and behaviour biases among Indian stock market investors?

- RQ2:

-

What is the association amid risk-tolerance and behaviour biases among Indian stock market investors?

- RQ3:

-

What is the moderating role of risk-tolerance behaviour on the relationship amid personality traits and behaviour biases among Indian stock market investors?

The current study uses data from 847 stock market investors and analysed it using the structural equation modelling (SEM) technique to address these research questions. This study tries to illustrate prospect theory. Prospect theory stated that an investor's investment decision is influenced by cognitive biases and this study tries to expand the theory by explaining that these biases are also under the influence of certain factors (i.e., personality traits and risk-tolerance behavior), and this would ultimately affect investment decision. The construct on prospect theory to suggest that during investment decision-making process, the association amid personality traits and behaviour biases is moderated by investors’ risk-tolerance behaviour. The results will help to contribute a better understanding of how personality traits, risk tolerance, and behavioural biases are linked. Finally, by replying to these questions, the current research also seeks to deliver some practical implications that will help wealth managers and financial advisors in working with their clients and to offer more refined investment options. The results of this study might aid individual in making better-informed financial decisions resulting in maximization of wealth.

2 Literature and hypothesis formulation

2.1 Brief description of personality traits

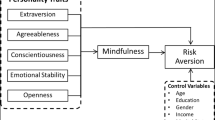

Personality denotes how an individual behaves, reacts, and associates with others and a perception of feelings, behaviors, and thoughts that discriminate an individual from another and also reflects the propensity to react in a precise manner under particular situations (Crysel et al. 2012; Roberts 2009). The individual personality is explicit and unique; these traits of personality impact the investor’s behavior in the financial market (Akhtar et al. 2018a, b; Slovic 2005). As per the psychology of personality, personality conducts an essential part in deciding investors' behavior and influences their investment decision (Bucciol and Zarri 2015a, b; Borghans et al. 2008). The research on personality traits of individuals frequently emphasizes particular areas like investment choice (Sadi et al. 2011a; Hunter and Kemp 2004) risk tolerance (Ksendzova et al. 2017; Ferguson et al. 2011a, b; Mayfield et al. 2008), and financial satisfaction (Tharp et al. 2020; Ng et al. 2019). Limited researches lay emphasis on the association among personality traits and connects it with diverse behavioral biases among investors of the stock market (Rzeszutek 2015ab; Baker et al. 2021). Among various personality models in the field of Psychology and Management research, the Big Five model is extensively acknowledged (Mayfield et al. 2008; Costa and McCrae 1992a; Bucciol and Zarri 2015a, b). The key elements of the model are extraversion, neuroticism, agreeableness, conscientiousness, and openness to experience. Authors consider conscientiousness extraversion, and neuroticism in the study, since past literature has revealed that these traits have a significant influence on behaviour biases (Baker et al. 2021; Kumar 2021; Ahmad 2020) and investment decision-making (Oehler et al. 2018).

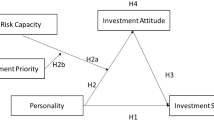

2.2 Hypotheses development

The association among the Big-five personality traits components, behaviour biases, and risk-tolerance is elucidated hereunder:

2.2.1 Association between conscientiousness trait and behaviour biases

Conscientiousness trait indicates a high level of strong-willed, determined, organized, purposeful, and punctuality. Individuals with conscientious traits are more likely to be self-disciplined highly competent, and exhibit active participation in decision making (Picone 2021; Zahera and Bansal 2018). Existing literature proves the linkage between conscientiousness trait and behaviour biases (Rosales-Pérez et al. 2021; Lin 2011a, b). Studies (like Baker et al. 2021; Zaidi and Tauni 2012) inspect the effect of personality traits on overconfidence bias. The study found out that investors with conscientiousness trait and more likely to display overconfidence behaviour. Further, Durand et al. (2013b) found out that investors value their knowledge and ability and do not pay attention to others' suggestions. Since they depend on their own information and knowledge, conscientious investors are less likely to engage in herding behaviour and display more overconfidence behavior. In a similar study, Yadav and Narayanan (2021) demonstrate that personality traits are associated with behaviour biases, i.e., the disposition effect (tendency to hold losing stocks and sell gaining stocks). It has been concluded that by retaining losing stocks and selling winning stocks early, they make less informed investment decisions which display disposition effect. According to Bahir et al. (2013) conscious investors display anchoring bias while investing. The study stated that investors with conscientiousness trait are well-organised and due to this they rely on past trends of the market. Further, Kübilay and Bayrakdaroğlu, (2016) examine the influence of conscientiousness trait on representativeness bias. The study found out that organized and purposeful investors are more likely to consider their purchase prices while selling out the stock and this shows their representativeness behavior. Hence, the author proposes the following hypotheses:

H1:

Conscientiousness trait significantly influences overconfidence bias (a), herding behaviour (b), disposition effect (c), representativeness (d), and anchoring (e).

2.2.2 Association between extroversion trait and behaviour biases

Extraversion trait specifies a high level of talkativeness, assertiveness, optimism, energy, and sociability (Costa and McCrae 1992a, b, c). A growing body of literature emphasizes on possible influence of extraversion on investment decisions (Gambetti and Giusberti 2019; Keil et al. 2007) and behaviour biases (Kumar 2021; Ahmad 2020). Extraversion encourages a positive attitude which influences individuals' estimation of the likelihood of winning and may result in overconfidence while making investment decisions (Lai 2019; Bashir et al. 2013a, b). According to Pallier et al. (2002) stated that extroversion traits significantly influence behaviour biases. The study also stated that extrovert investors prefer to appreciate instant earning to demonstrate that they have gained a favourable profit and have employed lucrative techniques. This happens due to their sociability influence which leads to the disposition effect. In the study of Lin (2011a, b) it has been stated that extroversion traits show significant influence on herding and overconfidence behaviour while investing. Author explains that extrovert investors are outgoing and enjoy exchanging ideas with others, and they value people's advice over their own. Hence, display herding behaviour. Further, the study also states that extroverts are naturally optimistic and overreact to market information, resulting in biases decision-making and hence, display overconfidence. Moreover, Goyal 2017 explains that investors' personality traits significantly influence behaviour biases. The study also stated that individual with extroversion trait evaluates the possibility of an outcome and rely on past performance due to their optimism behaviour which leads to display representativeness bias and anchoring. Hence, the author proposes the following hypotheses:

H2:

Extraversion traits significantly influence overconfidence bias (a), herding behaviour (b), disposition effect (c), representativeness (d), and anchoring (e).

2.2.3 Association between neuroticism trait and behaviour biases

Neuroticism trait indicates a high level of neuroticism tend to be more anxious, (Niszczota 2014a and b) and more pessimistic, are more depressed (Williams 1992), and seem to give little consideration to positive information and more consideration to negative information (Bolger 1990; Bolger et al. 1991). In a study, De Bortoli et al. (2019) backed up this claim by finding that neurotic people are more afraid of uncertainty and ambiguity and wish to avoid them. In an investment situation, researchers stated that neurotic investors tend to have a negative attitude. This may influence their propensity to take risk while investing. Hence, chooses less risky investment portfolios (Becker et al. 2012; Mayfield et al. 2008; Gambetti and Giusberti 2019). However, the results of various researches contradict the risk-averse behaviour among investors with neuroticism traits and stated that more neurotic investors bear a higher portfolio risk (Durand et al. 2008; Durand et al. 2013a, b). This vast literature on personality stated that neuroticism significantly affects decision-making (Oehler et al. 2018) and behaviour biases in security markets (Lai 2010; Goyal 2017). According to Statman et al. (2006), investors' personality traits significantly influence behaviour biases. The study reveals that investors with neuroticism trait show low confidence while taking investment decision as they are nervous and emotionally unbalanced. Further, Lin (2011a, b) examined how personality traits are associated with behaviour biases. The study explains that individuals with neuroticism traits are anxious and nervous, and they prefer to make a quick return while keeping deprived assets for a longer time. Hence, they display disposition behavior. In a research, Durand et al. 2013a examine the influence of neuroticism traits on herding behaviour. The study explains that due to low level of self-confidence investors with neuroticism traits follow the instructions and advice of friends and advisors while making investment decisions, which leads to herding behaviour. Furthermore, Baker et al. 2021 stated that investors with negative thoughts considered past performance as a significant factor for better returns. Hence, follow past performance and compare it with future outcomes which leads them to display representativeness and anchoring bias. Therefore, the author proposes the following hypotheses:

H3:

Neuroticism traits significantly influence overconfidence bias (a), herding behaviour (b), disposition effect (c), representativeness (d), and anchoring (e).

2.3 Association between risk-tolerance and behaviour biases

Risk-tolerance behaviour refers to an individual's willingness to take a risk (Ahmad 2020). Risk tolerance has been found to significantly impact financial decision-making in stock markets (Samsuri et al. 2019; Ishfaq et al. 2020) and considered as one of the factors that are usually needed by investors to thrive in stock market (Grable and Roszkowski, 2008). According to Borghans et al. (2009) the differences in risk assessment and uncertainty are linked with investor cognitive traits. The literature of behaviour finance explains a significant association amid individual risk-tolerance and behaviour biases during investment decision-making (Ahmad 2019; Siddiqui 2019). Researches also stated that investors with different cognitive biases look at risk in different way. For instance, overconfident investors are more risk-taker (Barber and Odean 2001) while investors with disposition effect bias display risk-averse behaviour (Zahera and Bansal 2018). Researcher (like Gustafsson and Omark 2015; Lin 2012; Mallik et al. 2017) claim that investors with high risk tolerance displays overconfidence and earn high returns (Kourtidis et al. 2011). Further, Pak and Mahmood (2015) claim that high risk-tolerance investors are more likely to display heuristics-bias while investing. In a similar line, Ahmad (2020) found that investors with high risk-taking capacity have higher levels of overconfidence and are more likely to display biases. The author also observed that these investors avoid the recent information and use heuristics due to past experience. Furthermore, the results also reveal that individuals with high risk tolerance utilize a heuristic approach while the individual with low risk-tolerance follows a systematic decision-making process. Hence, authors propose the following hypotheses:

H4:

Risk tolerance behaviour significantly influences herding behaviour (a), disposition effect (b), overconfidence bias (c), representativeness (d), and anchoring (e).

2.4 Moderation effect of risk-tolerance among the association between personality traits and behaviour biases

Risk-tolerance capacity of individual play a significant role in the relationship between personality traits and behaviour biases (Ahmad 2020). For instance, investors with neuroticism traits display low confidence in their own ability and follow the advice of peer groups, hence, try to avoid risky investments. In the study, Barnewall (1987) divided individuals into two categories: active investors and passive investors. He found out that active investors are high risk-taker and choose high-risk investments in a view to earn high return, whereas passive investors are more risk avoider and prefer to engage in safe investments. Further, Nicholson et al. (2005) found out that personality traits deliver an understanding for investor’s risk-tolerance behavior and the impact of variance in personality traits on it. The study reveals that risk behavior is related with a low degree of conscientiousness, neuroticism, and agreeableness, and a high degree of extraversion and openness. Hence, investors' risk-tolerance behaviour differs across personality traits. Varying personality traits may impact the investment decision-making process by inducing a different risk-tolerance behavior for different investors. (Nicholson et al. 2005). Kuhnen and Knutson (2011) found out that investors with negative feelings are more anxious and consider low-risk investments. Though, individuals with positive feelings are more confident and choose risky investments. Similarly, Lerner and Keltner (2001) provide that fearful investor are more pessimistic and choose low-risk investment avenues, while, an angry investor is more optimistic and choose risky investment. In a similar line, Mayfield et al. (2008) also explain that individuals with conscientious traits are less likely to take risks and individuals with openness and experienced traits are inclined to make new trials and take higher risks Past researcher tries to provide sufficient proof which explains that due to individual risk-tolerance capacity, the influence of personality traits on behaviour biases affect. Similarly, Ahmad, (2019) stated that risk-averse investors reduce their propensity to display disposition effect as their extroversion level increases. He also found out that risk-averse investors enhance their propensity to display anchoring bias as their neuroticism level increases. Hence, it can be assumed that individual risk-tolerance behavior moderates the relationship amid personality traits and behaviour biases. Therefore, the authors propose the following hypotheses:

H5:

The association between personality traits and behavioral biases is moderated by risk-tolerance behaviour.

H5.1:

The association between conscientiousness traits and overconfidence bias (a), herding behaviour (b), disposition effect (c), representativeness (d), and anchoring (e) is moderated by risk-tolerance behaviour.

H5.2:

The association between extroversion traits and overconfidence bias (a), herding behaviour (b), disposition effect (c), representativeness (d), and anchoring (e) is moderated by risk-tolerance behaviour.

H5.3:

The association between neuroticism traits and overconfidence bias (a), herding behaviour (b), disposition effect (c), representativeness (d), and anchoring (e) is moderated by risk-tolerance behaviour.

2.5 Research methodology

2.6 Research design

This research considers a cross-sectional study design, as this research is focused on belief and attitude, which permitted the investigator to directly face respondents’ thoughts, views, and feelings and also assisted in the exact generalization of the results (Creswell and Creswell 2017). The current research attempts to review the influence of personality traits on behaviour biases, besides examining the moderating influence of individual risk-tolerance among personality traits and behaviour biases.

2.7 Questionnaire development

A questionnaire was prepared for the research to obtain primary data relating to the objective of the study. The questionnaire contained 37 questions to collect information regarding personality traits, behavior biases, and risk tolerance of individual investors. Numerous studies have predicted several aspects of assessing a person's personality, the most common of which are, Bailard et al. 1986 model i.e., BB and K model of personality types, Rotter 1966 model i.e., internal and external personality factors, Myers et al. (1985) model i.e., Myers-Briggs type personality indicators, and Costa and McCrae 1992a, b, c model i.e., big five personality traits. The present research considers the big five personality traits model of Costa and McCrae 1992a, b, c as it is enormously recognized and acknowledged model of personality (Mayfield et al. 2008; Costa and McCrae 1992a). The first segment is encompassing 7 questions on socioeconomic and demographic multiple choices. The next segment comprises of 12 questions (five-point Likert scale) related to personality traits (Big Five personality traits) adapted from Mayfield et al. (2008) & McCrae and Costa (2003).

The third segment has 4 questions to measure risk tolerance. Gomez-Mejia and Balkin (1989) developed a scale for risk-tolerance. Mayfield et al. (2008) revised the scale to fit the exact situation of personal and behavioral finance. A high rating displays a risk-averse behaviour of an individual and a low rating signifies risk-taker behaviour of an individual. The scales provided by Statman et al. (2006), Baker et al. (2021), Shefrin and Statman (1985, 1994), Lin (2011a, b), Scharfstein and Stein (1990) were used to measure herding behavior, overconfidence, and disposition effect, representativeness, anchoring at five-point Likert scale. Appendix 1 represents measurement items list with their adoption sources.

2.8 Data collection

This study considered a survey technique to gather data from Indian stock market investors. The study considered Indian stock market investors because India is an emerging economy as opposed to an established economy in many ways like political situation, technology, financial structure etc. Likewise, individual’s beliefs, perceptions, and attitudes are also different amid them, which are shown in their investment decision (Khan et al. 2017). Furthermore, it would be problematic to extrapolate the conclusion of those research (Fünfgeld and Wang, 2009) in Indian context due to differences in habit of spending and saving, life style, culture, personality traits, literacy level, risk attitude, etc. Therefore, there is a demand for a study among Indian stock market investors and this can also help financial advisors and their clients to build portfolios based on their psychological and personality characteristics. The authors used the convenience sampling method trailed by the snowball sampling method as the data is gathered during the phase of Covid-19. In this research, a well-structured questionnaire was used for getting the replies from the Indian stock market investors. Initially, well-known brokerage houses in the cities like Delhi-NCR, Aligarh, Dehradun, Bangalore, Kishan Ganj, Malappuram, and Murshidabad were recognised. With the help of the managers of the trading organisation, the author compiles a list of persons with at least investment experience of two years in the Indian stock market. Respondents were contacted in person, by e-mail, and over the phone. They were also asked to share the information with more people to enhance the sample size. A total of 960 people were contacted, and over 915 questionnaires were sent. 880 completed questionnaires were received in total, but 33 were rejected owing to missing information. By removing the information dismissal fault and extreme outliers, the complete 847 replies were considered for data analysis.

2.9 Data screening

The assembled data were first checked for outliers and missing values. The greater statistics of missing data were revealed to be 7%, which is less than the ten percent threshold limit (Cohen et al. 2014; Kline 1998). To substitute missing data, “regression imputation” was utilised, as suggested by Lynch in 2003. To recognize outliers, Cook’s distance was considered. Thirteen responses were deleted because they surpassed the threshold limit of one (Stevens 2012). The ultimate data set of 847 respondents (Table 1) was then formed. According to Kline (2011), each item should have a maximum of ten responses. The total number of items in the questionnaire is 37; hence the 847 responses met the prior premise. Furthermore, Kline (1998) recommends the use of kurtosis and skewness metrics to detect non-normality, with values ranging from + 2 to − 2. The statistics of the research were under the suggested limit. Hence, the data were ordinary. In this research, the data for independent, moderating, and dependent variables were gathered simultaneously; thus, there was a risk of common method bias (CMB) (Chang et al. 2010). To observe the CMB's existence in this research, the authors run Harman’s one-factor test. The finding displays that one single factor can describe 36.74% variance which is less than the threshold limit of fifty percent (see Table 2). This portrayed that CMB was not a cause of worry for the current research.

3 Data analysis and results

The research performed both inferential and descriptive analyses. For descriptive analysis, SPSS 20.0 was used. For inferential analysis, AMOS 20.0 software was considered to execute the structural equation modelling (SEM). As per the recommendation of Anderson and Gerbing 1988, the authors used confirmatory factor analysis for confirming the divergent and convergent validity along with model fitness of the data which is followed by executing SEM to statistically examine the hypothesised framework. The following are the reasons for employing structural modelling techniques:

-

(1)

It gives a way to examine construct-indicator associations and investigate interactions among constructs in a single model (Hair et al. 2010).

-

(2)

Second, it is a trustworthy and potent statistical apparatus for examining complicated models (Arwab et al. 2022; Hair et al. 2010).

3.1 Sample profile

It has been observed from Table 1 that male respondents are in majority with 54.07% and the females are 45.93%. The 43.32% respondents were from the age bar of 31–40 years; 22.65% are from 41–50 years and followed by 20.66% and 13.37% from the group of under 30 and 51–60 respectively. The majority of the 45.11% respondents are post-graduate and followed by graduate, 35.18; intermediate, 19.71. The majority of the 46.15% respondents are businessmen and followed by private job, 28.80; government job, 25.02. Moreover, 57.61% respondents are married and 42.39% are unmarried.

3.2 Confirmatory factor analysis (CFA), validity and reliability

Authors considered CFA to check items' reliability and validity and to find out the goodness of fit statistics, the extremely general measures of model fit were taken into account, namely: comparative fit index (CFI), normative fit index (NFI), the goodness of fit index (GFI), root mean square of approximation (RMSEA), incremental fit index (IFI), and Tucker–Lewis index (TLI) method. The outcome of CFA displays a satisfactory model fit by considering following indices: χ2 = CMIN/df = 1.57, CFI = 0.95, RMSEA = 0.04, TLI = 0.91, GFI = 0.92, IFI = 0.93 (See Table 4). The estimated reliability of each construct was inspected considering composite reliability (CR) and Cronbach's alpha (limit 0.6) (Bagozzi et al. 1998) and (limit 0.7) (Hair et al. 2010), respectively. Table 3 displays the reliability of all the constructs and their dimensions. To check the constructs validity, convergent and discriminant validity are taken into account. Average variance was extracted (AVE) (limit 0.5) (Hair et al. 2010) for convergent validity, and Pearson's correlation matrix was run (limit 0.8) for discriminant validity (Brown 2015). The findings displayed in Tables 3 and 5 stated that the constructs were satisfied both discriminately and convergently. Furthermore, for each construct, the square root of AVE was greater than its correlation (Chin et al. 1997) (Table 5).

3.3 Hypothesis testing

3.3.1 Structural equation modelling (SEM)

SEM has been run to inspect the association among exogenous and endogenous variables. The finding of the research displays that extraversion trait has significant and positive influence on overconfidence bias (β-value = 0.22), herding behaviour (β-value = 0.35), disposition effect (β-value = 0.17), representativeness (β-value = 0.15), anchoring (β-value = 0.29). Hence, confirm H2a, H2b, H2c, H2d, H2e respectively. It has also been observed that conscientiousness significantly influences overconfidence bias (β-value = 0.34), disposition effect (β-value = 0.29), and representativeness (β-value = 0.21). hence confirm hypotheses H1a, H1c, and H2d respectively. The finding of the study stated that neuroticism significantly influence herding behaviour (β-value = 0.41), disposition effect (β-value = 0.33), and anchoring (β-value = 0.36). Hence, confirm hypotheses H3b, H3c, and H3e respectively. Furthermore, the result also stated that risk-tolerance displays a significant influence on disposition effect (β-value = 0.17), representativeness (β-value = -0.23) and anchoring (β-value = 0.27). Hence, confirm hypothesis H4c, H4d, and H4e respectively.

3.3.2 Moderation analysis

In this research, H5 was assumed to inspect the interaction influence of risk-tolerance on the association amid personality traits (i.e., conscientiousness, extraversion, and neuroticism) and behavior biases (i.e., overconfidence, herding, disposition effect, representativeness, and anchoring bias). As per the suggestion of (Hayes 2017), the research used model 1 in PROCESS macro v3.0 for SPSS, using bootstrapping effect at 5000 to check the moderation effects. The findings are shown in Table 6, which suggests that risk tolerance behavior moderates the association between conscientiousness, overconfidence, and representativeness with a coefficient value of − 0.19 and − 0.13 respectively. Hence, confirm hypotheses H5.1a and H54.1d. It has been also observed that risk tolerance behavior moderates the relationship among extraversion, disposition effects and representativeness behaviour with a coefficient value of -0.29 and -0.31 respectively. Hence, confirm hypotheses H5.2c and H5.1d. Furthermore, the results also reveal that risk tolerance behavior moderates the relationship between neuroticism, herding, anchoring behavior with a β-value of 0.26 and 0.15 respectively. Hence, confirm hypotheses H5.2b and H5.2e.

4 Discussion and conclusion

The present study tries to investigate how personality factors affect behavioural biases while taking investment. Moreover, the research also inspects the moderation effect of risk tolerance among the association amid personality and behavior biases. According to the model, personality traits are the source of behavioural biases exhibited in investors' investment patterns. The discussion and conclusion of the study is split into five subsets. The following five subsets discuss the impact of personality traits, risk-tolerance, and the moderation effect of risk-tolerance on overconfidence, herding behaviour, disposition effect, representativeness, and anchoring bias.

4.1 Conscientiousness trait

The findings of the research demonstrate a significant impact of conscientiousness on investor's overconfidence biases which suggests that optimistic, social and strong-willed investors are self-confident and rely on their own abilities. They avoid recent information of market and retain past biased beliefs (Pompian 2006a, b). Hence, they follow the prospect theory approach. This evidence is similar with the findings of Durand et al. (2013b). The study also reveals that conscientiousness positively and significantly influences investor's disposition effect which suggests that investors with conscientiousness traits are strong-willed, organized and trust on their own abilities while investing. As a result, investors avoid recent market info and gather risky stock in their portfolio by keeping losing and selling winning stock. Furthermore, the result also suggests that conscientiousness traits significantly influence representativeness which means that investors with conscientious traits believe in their ability. Therefore, they predict the probability of occurring an event and this leads to display representativeness bias. The result is similar with the finding of Baker et al. 2021.

4.2 Extroversion trait

The study displays that the extroversion traits significantly influence overconfidence behaviour of investors which suggests that investors with extrovert traits will continue to hold loss assets because investors believe that there will be an increase on those loss assets, as they are more optimistic about their investment decision. Hence, more inclined toward overconfidence bias (Ahmad 2020). The results support the findings of Van de Venter and Michayluk 2008. In addition, the results also show that extraversion has a significant impact in determining herding behaviour which suggests that outgoing and sociable investors follow the suggestion of others as they enjoy exchanging ideas with others, and they value other people's advice which explains extrovert investors are highly confident about peer suggestions. The results support the finding of Kumar et al. (2021). The results suggest that extraversion was found to be significantly positively related to the disposition effect which exposes those investors who are talkative, optimistic, and social and want to demonstrate that they have gained a favourable profit and have employed lucrative techniques by thoroughly analysing the market. Hence, they retain their losses and realize early profits which lead to display disposition effect (Durand et al. 2013a). Further, the results also stated that extroversion trait significantly influences representativeness which suggests that investors with this trait are more self-confident and believe in their capabilities and judge the likelihood of a particular investment outcome. This behaviour display representativeness bias. Furthermore, the results also stated that extroversion traits significantly influence anchoring bias which suggests that extrovert investors are very active and acquire complete knowledge about the market. Hence, they follow the past performance or rely on the past performance which leads to display anchoring bias.

4.3 Neuroticism

The findings of the study reveal that between herding and disposition, herding behavior is significantly influenced by neuroticism. The findings show that anxiety, tenseness, and investor's negative emotions reduce individual self-confidence regarding their capabilities and value others advice over their own. Hence, display herding behaviour which supports the finding of Ahmad 2020. The findings also explain that neuroticism is significantly linked to the disposition effect which explains that anxious and nervous investors prefer to make a quick profit while keeping losing assets for a longer period. Hence, they display disposition behaviour. This evidence is supporting the results of Goyal (2017). Moreover, the findings of the study also stated that neuroticism trait significantly influences anchoring bias which suggests that investors who are tense, impulsive, and shy follow past trends. Hence, they display anchoring bias.

4.4 Risk-tolerance

The findings explain that risk-tolerance behavior influences the disposition effect which recommends that investors who avoid risk appreciate small returns to evade the risk of loss in expectation of abnormal profits. While doing this, investors are likely to hold the deprived stock to evade the loss, after increasing the risk in their portfolio (Statman 2011). The result of the study stated that risk-tolerance behaviour significantly influences representativeness and anchoring bias which suggests that risk-averse investors have low self-confidence and unable to analyse the market. Hence, this leads them to follow past trends and they do not judge the likelihood of an event or outcome.

4.5 Moderation effect of risk-tolerance

The findings show that risk-tolerance behaviour significantly moderates the relationship amid conscientiousness and overconfidence which recommends risk-averse investors with high degree of conscientiousness analytically consider investment options that decline investment riskiness. Investors reduce overconfident behavior and confirm decisions that decline the investment riskiness. Moreover, the finding also exhibits that risk-tolerance behaviour has a negative and significant interaction influence on the association amid representativeness and conscientiousness which suggests that risk-averse investors reduce their tendency to display representativeness as their conscientiousness level increases. The results show that investors who are organized, efficient and determined investigated market information thoroughly and believe that market is uncertain. Hence, this leads them to reduce representativeness bias.

The findings also exhibit that risk-tolerance behaviour has a negative and significant interaction influence on the association amid disposition effect and extraversion. The result proposes that risk-averse investors reduce their propensity to display disposition effect as their extroversion level increases. The results show that investors with high socialism, self-confidence, and optimism carefully investigated new information of the market and are less willing to enhance the investment risk by selling gaining and holding deprived investments. Moreover, the finding also exhibits that risk-tolerance behaviour has a negative and significant interaction effect on the association amid representativeness and extraversion which suggests that risk-averse investors reduce their tendency to display representativeness as their extroversion level increases. The results show that high degree of extrovert in risk-averse tolerance among investors with extrovert trait investigated market information thoroughly and believe that market is uncertain. Hence, this leads them to diminish representativeness bias.

The findings of the research exhibit that risk-tolerance behaviour significantly moderates the association amid neuroticism and herding behaviour. The results elucidate that high level of negative emotions in risk-averse investors is highly inclined to display herding behavior. In simple words, risk-averse investors with insecurity, anxiety, and moodiness are investors who have low confidence in their abilities and are highly inclined to follow the suggestions of others (Baker et al. 2021). Moreover, the findings also exhibit that risk-tolerance behaviour has a negative and significant interaction effect on the association amid anchoring bias and neuroticism which suggest that risk-averse investors enhance their propensity to display anchoring bias as their negative emotions increase. Risk-averse investors with insecurity, anxiety, and moodiness are investors who have low confidence in their abilities and are highly inclined to follow past performance.

5 Implications of the study

5.1 Theoretical implications

The results of current research brought out vital practical as well as theoretical suggestions for the individuals of various sections of society. This research contributes to the growing literature of behaviour finance related to investor’s personality traits and financial behavior in Indian context, which is a developing country and where very few researches exist. The research findings confirmed that the anticipated “investment model” to examine the strategy and essence of individual’s personality trait is suitable in our study environment. This research also contributes to prospect theory, as it elucidates how behaviour biases are associated with investors’ personality traits and risk-tolerance behavior during investment decision-making process. Moreover, the study also lends significance to the existing knowledge of financial studies concerning investor’s financial behaviour, by showing the influence of personality traits and risk-tolerance on behaviour biases as well as the moderation effects of risk-tolerance in the association between individual personality traits and behaviour biases while taking investment decision. This contributes a reference for future research in developed countries concerning the socio-psychological dimensions of individual investors.

5.2 Managerial implications

The research proposes some suggestions to financial or investment advisors for designing better investment portfolios. Firstly, the relationship between conscientious investors and biases are significant which suggests that investors are wary and not likely to be affected by others, they still may depend on stock’s prior performance and display biases represenativeness. Hence, financial advisors should educate them so that they can analyse the market information and reduce representativeness bias. We also advise investors with more conscientiousness traits should establish a lock-gain point and stop-loss point because these types of individuals seem stubborn while investing, hence, they should consult experts to prevent generating disposition effect. The study also delivers suggestion to financial advisors that they should recommend such investors to concentrate on the long-term. Else, they are more prone to let overconfidence leads to extreme trading and huge transaction costs, which decrease returns. On the basis of moderation results, authors suggest investors to push-up their risk-tolerance level which helps investors (i.e., conscientious and extrovert investors) to reduce the effect of biases.

Second, understand the link amid investors with extroverted traits and behavioral biases. The results suggest that extrovert investors usually take decisions by considering past performance of stock and the advice of their peer group. In this situation, investment advisor can educate their customer by delivering investment knowledge that can assist them in minimizing the influence of these biases and enhancing their financial well-being. For instance, investors often consider the heuristic bias of using prior performance as a reference to future performance. The issue with this heuristic is that past great winners could turn out to be future big losers. This heuristic might work in extreme short time period, but beyond this horizon, forecasting ability is inconsistent.

Third, the link between investors with neuroticism and behavioural biases tries to understand why investors depend on past performance and have a tendency to hold on to their losing equities while selling their winning stocks too quickly. We propose that investors with a higher neuroticism trait set a “stop-loss” and a “lock-gain” point to avoid losses caused by the herding bias and disposition effect. The study also provides suggestions to wealth managers and financial advisors that they should educate their clients with neuroticism traits consider stop-loss orders to minimize extreme losses while taking benefit of “tax-loss harvesting”, which is the technique of selling a loss-making stock. By using this technique, investors can counterbalance taxes on both income and gain. Investors could therefore exchange the sold stock with an identical one, preserving the ideal investment allocation and expected returns (Baker et al. 2021).

Lastly, the significant link between risk-tolerance and investors behavior suggests that financial advisor could ask for an individual’s exact priority and construct a portfolio based on their risk-tolerance and establish planned retention programs, thus developing a “behavioral portfolio” as per the personality trait and risk tolerance of their customers, so that the outcome from their investment matches their investment confidence. The investment advisor should provide information more efficiently so that investor's portfolios could be amassed into a well-diversified investment and give swapping options as per their risk-tolerance behavior.

Like any research, the current study also has some limitations. The study considered the Big-five personality traits model (conscientiousness extraversion, and neuroticism) and five behavioral variables i.e., overconfidence, herding, disposition effect, representativeness, and anchoring. Further study can be conducted by considering some other cognitive variables (i.e., home bias, hindsight bias, mental accounting, emotional bias, etc.) and other personality traits models (i.e., Durand et al. 2013a, b). Individuals personality can be measured considering numerous models such as “internal/external personality” proposed by Rotter (1966); investor types (i.e., “BB & K model” proposed by “Bailard et al. 1986” and “Myers-Briggs Type Indicator (MBTI)” by “Myers and McCaulley 1985”. Secondly, the current research avoids considering real-time investment information like Durand et al. (2008) do, to capture individual behavior. Future researchers can follow Patterson and Diagler (2014) for experimental methodology.

References

Acker, D., Duck, N.W.: Cross-cultural overconfidence and biased self-attribution. J. Socio-Econ. 37(5), 1815–1824 (2008)

Adil, M., Singh, Y., Ansari, M.S.: How financial literacy moderate the association between behaviour biases and investment decision? Asian J. Account. Res. 7(1), 17–30 (2022). https://doi.org/10.1108/AJAR-09-2020-0086

Adil, M., Singh, Y., Ansari, M.S.: Does financial literacy affect investor's planned behavior as a moderator?. Manag. Financ. (2022). https://doi.org/10.1108/MF-03-2021-0130

Ahmad, F.: Personality traits as predictor of cognitive biases: moderating role of risk-attitude. Qual. Res. Financ. Mark. 12(4), 465–484 (2020). https://doi.org/10.1108/QRFM-10-2019-0123

Ahmad, M., Shah, S.Z.A., Abbass, Y.: The role of heuristic-driven biases in entrepreneurial strategic decision-making: evidence from an emerging economy. Manag. Decis. 59(3), 669–691 (2021). https://doi.org/10.1108/MD-09-2019-1231

Ahmad, M., Shah, S.Z.A.: Overconfidence heuristic-driven bias in investment decision-making and performance: mediating effects of risk perception and moderating effects of financial literacy. J. Econ. Adm. Sci. (2020)

Akhtar, F., Thyagaraj, K.S., Das, N.: Perceived investment performance of individual investors is related to the Big-Five and the general factor of personality (GPF). Glob. Bus. Rev. 19(2), 342–356 (2018a)

Akhtar, F., Thyagaraj, K.S., Das, N.: The impact of social influence on the relationship between personality traits and perceived investment performance of individual investors:evidence from Indian stock market. Int. J. Manag. Finance 14(1), 130–148 (2018b)

Akhtar, F., Das, N.: Investor personality and investment performance: from the perspective of psychological traits. Qual. Res. Financ. Mark. (2020)

Ali, I., &Waheed, M. S.: Determinants of small equity investor’s risk assumption attitude. In Paper presented at the Anual Meeting for the Society of 2nd. -International Conference on Humanities, London, June 17–18 (2013)

Allport, G.W.: Pattern and growth in personality (1961)

Anderson, J.C., Gerbing, D.W.: Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 103(3), 411 (1988)

Arwab, M., Adil, M., Nasir, M. Ali, M.A.: Task performance and training of employees: the mediating role of employee engagement in the tourism and hospitality industry. Eu. J. Train. Dev. (2022). https://doi.org/10.1108/EJTD-01-2022-0008

Babajide, A.A., Adetiloye, K.A.: Investors’ behavioural biases and the security market: an empirical study of the Nigerian security market. Account. Finance Res. 1(1), 219–229 (2012)

Baddeley, M., Burke, C., Schultz, W., Tobler, T.: “Impacts of personality on herding in financial decision-making”, unpublished manuscript, Faculty of Economics, University of Cambridge, Cambridge, available ‘www.repository.cam.ac.uk/bitstream/handle/1810/257205/cwpe1006.pdf?sequence=1&isAllowed=y’ (2010a)

Baddeley, M., Burke, C., Schultz, W., Tobler, T.: Impacts of personality on herding in financial decision-making (2010b)

Bagozzi, R.P., Yi, Y., Nassen, K.D.: Representation of measurement error in marketing variables: Review of approaches and extension to three-facet designs. J. Econ. 89(1–2), 393–421 (1998)

Bailard, T., Biehl, D., Kaiser, R.: Personal Money Management, 5th edn. Science Research Associates, Chicago (1986)

Baker, H.K., Nofsinger, J.R. (eds.): Behavioral finance: investors, corporations, and markets, vol. 6. John Wiley and Sons, New Jersey (2010)

Baker, H.K., Nofsinger, J.R.: Psychological biases of investors. Financ. Serv. Rev. 11(2), 97 (2002)

Baker, M., Wurgler, J.: Investor sentiment in the stock market. J. Econ. Perspect. 21(2), 129–152 (2007)

Baker, H.K., Kumar, S., Goyal, N., Gaur, V.: How financial literacy and demographic variables relate to behavioral biases. Manag. Financ. 45(1), 124–146 (2019c). https://doi.org/10.1108/MF-01-2018-0003

Baker, H.K., Kumar, S., Goyal, N.: Personality traits and investor sentiment. Rev. Behav. Finance 13(4), 354–369 (2021). https://doi.org/10.1108/RBF-08-2017-0077

Baker, H. K., Kumar, S., Goyal, N.: Personality traits and investor sentiment. Rev. Behav. Finance (2019a)

Baker, H. K., Kumar, S., Goyal, N., Gaur, V.: How financial literacy and demographic variables relate to behavioral biases. Manag. Finance (2019b)

Barber, B.M., Odean, T.: Boys will be boys: Gender, overconfidence, and common stock investment. Q. J. Econ. 116(1), 261–292 (2001)

Barberis, N., Thaler, R.: A Survey of Behavioral Finance, pp. 1–76. Princeton University Press (2005)

Barnewall, M.M.: Psychological Characteristics of the IndividualInvestor. In Droms, W. (ed.) Asset Allocation for the Individual Investor. Charlottesville, VA.: The Institute of Chartered Finan-cial Analysts, (1987)

Bashir, T., Azam, N., Butt, A. A., Javed, A., Tanvir, A.: Are behavioral biases influenced by demographic characteristics and personality traits? Evidence from Pakistan. Eur. Sci. J. 9(29), (2013a)

Bashir, T., Azam, N., Butt, A.A., Javed, A., Tanvir, A.: Are behavioral biases influenced by demographic characteristics and personality traits? Evidence from Pakistan, Eur. Sci. J. ESJ, 9(29), (2013b)

Becker, A., Deckers, T., Dohmen, T., Falk, A., Kosse, F.: The relationship between economic preferences and psychological personality measures. Annu. Rev. Econ. 4(1), 453–478 (2012)

Bolger, N.: Coping as a personality process: a prospective study. J. Pers. Soc. Psychol. 59(3), 525 (1990)

Bolger, N., Schilling, E.A.: Personality and the problems of everyday life: The role of neuroticism in exposure and reactivity to daily stressors. J. Pers. 59(3), 355–386 (1991)

Borghans, L., Duckworth, A.L., Heckman, J.J., Ter Weel, B.: The economics and psychologyof personality traits. J. Human Resour. 43(4), 972–1059 (2008)

Brooks, C., Williams, L.: The impact of personality traits on attitude to financial risk. Res. Int. Bus. Finance 58, 101501 (2021). https://doi.org/10.1016/j.ribaf.2021.101501

Brown, T. A.: Confirmatory Factor Analysis for Applied Research. Guilford publications (2015)

Bucciol, A., Zarri, L.: Does Investors' Personality Influence their Portfolios? (2015a)

Bucciol, A., Zarri, L.: The shadow of the past: Financial risk taking and negative life events. J. Econ. Psychol. 48, 1–16 (2015b)

Ceschi, A., Costantini, A., Scalco, A., Charkhabi, M., Sartori, R.: The relationship between the big five personality traits and job performance in business workers and employees’ perception. Int. J. Bus. Res. 16, 63–76 (2016). https://doi.org/10.18374/ijbr-16-2.5

Chaffai, M., Medhioub, I.: Behavioral finance: An empirical study of the Tunisian stock market. Int. J. Econ. Financ. Issues 4(3), 527 (2014)

Chang, S. J., Van Witteloostuijn, A., Eden, L.: From the Editors: Common Method Variance in International Business research (2010)

Chavali, K., Mohanraj, M.P.: Impact of demographic variables and risk tolerance on investment decisions–an empirical analysis. Int. J. Econ. Financ. Issues 6(1), 169–175 (2016)

Chen, T.H., Ho, R.J., Liu, Y.W.: Investor personality predicts investment performance? A statistics and machine learning model investigation. Comput. Hum. Behav. 101, 409–416 (2019)

Chen, T.H., Ho, R.J., Liu, Y.W.: Investor personality predicts investment performance? Astatistics and machine learning model investigation. Comput. Human Behav. (2018)

Chin, W.W., Gopal, A., Salisbury, W.D.: Advancing the theory of adaptive structuration: the development of a scale to measure faithfulness of appropriation. Inf. Syst. Res. (1997)

Chitra, K., & Ramya Sreedevi, V.: Does personality traits influence the choice of investment?. IUP J. Behav. Finance 8(2), (2011)

Christie, W.G., Huang, R.D.: Following the Pied-Piper: do individual returns herd around the market? Financ. Anal. J. 51(4), 31–37 (1995)

Chuang, W.I., Lee, B.S.: An empirical evaluation of the overconfidence hypothesis. J. Bank. Finance 30(9), 2489–2515 (2006)

Cohen, P., West, S.G., Aiken, L.S.: Applied multiple regression/correlation analysis for the behavioral sciences. Psychology press (2014)

Costa, P.T., Jr., McCrae, R.R.: The five-factor model of personality and its relevance to personality disorders. J. Pers. Disord. 6(4), 343–359 (1992a)

Costa, P.T., McCrae, R.R.: Normal personality assessment in clinical practice: The NEO Personality Inventory. Psychol. Assess. 4, 5–13 (1992b)

Costa, P.T., McCrae, R.R.: Professional Manual: Revised NEO Personality Inventory (NEO-PI-R) and NEO five-Factor Inventory (NEO-FFI). Psychological Assessment Resources Inc, Lutz (1992c)

Creswell, J.W., Creswell, J.D.: Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. Sage publications (2017)

Crysel, L., Crosier, B., Webster, G.: “The dark triad and risk behavior. Personal. Individ. Differ. 54(1), 35–40 (2012)

Dar, F.A., Hakeem, I.A.: The influence of behavioural factors oninvestors investment decisions: a conceptual model. Int. J. Res. Econ. Soc. Sci. 5(10), 51–65 (2015)

Davis, K., Runyan, R.C.: Personality traits and financial satisfaction: Investigation of a hierarchical approach. J. Financ. Couns. Plan. 27(1), 47–60 (2016)

De Bondt, W.F.: A portrait of the individual investor. Eur. Econ. Rev. 42(3–5), 831–844 (1998)

De Bortoli, D., da Costa Jr, N., Goulart, M., Campara, J.: Personality traits and investor profile analysis: A behavioral finance study. PLoS ONE 14(3), e0214062 (2019)

Devenow, A., Welch, I.: Rational herding in financial economics. Eur. Econ. Rev. 40(3–5), 603–615 (1996)

Dickason, Z., Ferreira, S.: Establishing a link between risk tolerance, investor personality and behavioural finance in South Africa. Cogent Econ. Finance 6(1), 1519898 (2018)

Donnelly, G., Iyer, R., Howell, R.T.: The Big Five personality traits, material values, and financial well-being of self-described money managers. J. Econ. Psychol. 33(6), 1129–1142 (2012)

Durand, R.B., Newby, R., Sanghani, J.: An intimate portrait of the individual investor. J. Behav. Finance 9(4), 193–208 (2008)

Durand, R.B., Newby, R., Peggs, L., Siekierka, M.: Personality. J. Behav. Finance 14(2), 116–133 (2013b)

Durand, R.B., Fung, L., Limkriangkrai, M.: Myopic loss aversion, personality, and gender. J. Behav. Financ. 20(3), 1–15 (2019)

Durand, R., Newby, R., Tant, K., Trepongkaruna, S.: Overconfidence, overreaction and personality. Rev. Behav. Finance (2013a)

Emami, A., Welsh, D.H., Ramadani, V., Davari, A.: The impact of judgment and framing on entrepreneurs’ decision-making. J. Small Bus. Entrepr. 32, 79–100 (2020). https://doi.org/10.1080/08276331.2018.1551461

Endler, N.S., Magnusson, D.: Toward an interactional psychology of personality. Psychol. Bull. 83(5), 956 (1976)

Eysenck, S.B., Eysenck H.J.: Eysenck Impulsiveness and Venturesomeness: Their Position in a Dimensional System of Personality Description. Psychol. Rep. 43(3_suppl), 1247–1255 (1978). https://doi.org/10.2466/pr0.1978.43.3f.1247

Ferguson, E., Heckman, J., Corr, P.: Personality and economics: overview and proposed framework. Personal. Individ. Differ. 51(3), 201–209 (2011a)

Ferguson, E., Heckman, J.J., Corr, P.: Personality and economics: overview and proposed framework. Personal. Individ. Differ. 51(3), 201–209 (2011b)

Ferreira, S.J.: Is financial risk tolerance influenced by personality traits?. In Proceedings of Economics and Finance Conferences (No. 9511451). International Institute of Social and Economic Sciences (2019)

Fünfgeld, B., Wang, M.: Attitudes and behaviour in everyday finance: evidence from Switzerland. Int. J. Bank Market. 27(2), 108–128 (2009)

Gambetti, E., Giusberti, F.: Personality, decision-making styles and investments. J. Behav. Exp. Econ. 80, 14–24 (2019)

Gavrilakis, N., Floros, C.: The impact of heuristic and herding biases on portfolio construction and performance: the case of Greece. Rev. Behav. Finance (2021)

Gomez-Mejia, L.R., Balkin, D.B.: Effectiveness of individual and aggregate compensation strategies. Ind. Relat. J. Econ. Soc. 28(3), 431–445 (1989)

Goyal, N.: “Financial Literacy and Behavioural Biases-A Study of Indian Investors”. (Doctoral dissertation, MNIT Jaipur) (2017)

Grable, J.E., Roszkowski, M.J.: The influence of mood on the willingness to take financial risks. J. Risk Res. 11(7), 905–923 (2008)

Gustafsson, C., Omark, L.: Financial literacy’s effect on financial risk tolerance: A quantitative study on whether financial literacy has an increasing or decreasing impact on financial risk tolerance (2015)

Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E.: Multivariate data analysis: a global perspective, 7th ed. Pearson Prentice Hall, NJ (2010)

Harnett, D., Cummings, L.: The Person in Bargaining. In: Harnett, D., Cummings, L. (eds.) Bargaining Behavior An International Study. Dame Publications, Houston (1980)

Hayes, A.F.: Introduction to mediation, moderation, and conditional process analysis: a regression-based approach. Guilford publications (2017)

Hirschey, M., Nofsinger, J.: Investments: Analysis and Behaviour. Published by Tata McGraw Hill. Ed. SIE, p. 210 (2008)

Hirshleifer, D., Luo, G.Y.: On the survival of overconfident traders in a competitive securities market. J. Financ. Mark. 4(1), 73–84 (2001)

Hogan, R., Hogan, J., Roberts, B.W.: Personality measurement and employment decisions: Questions and answers. Am. Psychol. 51(5), 469 (1996)

Hopfensitz, A., Wrank, T.: How to adapt to changing markets: experience and personality in repeated investment game, TSE Working Paper 09-122 (2009)

Howell, R.T., Ksendzova, M., Nestingen, E., Yerahian, C., Iyer, R.: Your personality on a good day: How trait and state personality predict daily well-being. J. Res. Pers. 69, 250–263 (2017)

Hunter, K., Kemp, S.: The personality of e-commerce investors. J. Econ. Psychol. 25(4), 529–537 (2004)

Ishfaq, M., Nazir, M.S., Qamar, M.A.J., Usman, M.: Cognitive Bias and the Extraversion Personality Shaping the Behavior of Investors. Front. Psychol. 11, 556506 (2020). https://doi.org/10.3389/fpsyg.2020.556506

Jamshidinavid, B., Chavoshani, C., Amiri, S.: The impact of demographic and psychological characteristics on the investment prejudices in Tehran stock. Eur. J. Bus. Soc. Sci. 1(5), 41–53 (2012)

Javed, H., Bagh, T., Razzaq, S.: Herding effects, over confidence, availability bias and representativeness as behavioral determinants of perceived investment performance: an empirical evidence from Pakistan stock exchange (PSX). J. Glob. Econ. 6(01), 1–13 (2017)

Joo, S.H., Grable, J.E.: An exploratory framework of the determinants of financial satisfaction. J. Fam. Econ. Issues 25(1), 25–50 (2004)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I, pp. 99–127 (2013)

Keil, M., Depledge, G., Rai, A.: ‘Escalation: the role of problem recognition and cognitive bias.’ Decis. Sci. 38(3), 391–421 (2007)

Khan, H.H., Naz, I., Qureshi, F., Ghafoor, A.: Heuristics and stock buying decision: Evidence from Malaysian and Pakistani stock markets. Borsa Istan. Rev. 17(2), 97–110 (2017)

Kline, R.B.: Software review: Software programs for structural equation modeling: Amos, EQS, and LISREL. J. Psychoeduc. Assess. 16(4), 343–364 (1998)

Kline, R.B.: Convergence of structural equation modeling and multilevel modelling (2011)

Kogan, N., Wallach, M.A.: Group risk taking as a function of members’ anxiety and defensiveness levels 1. J. Pers. 35(1), 50–63 (1967)

Kourtidis, D., Šević, Ž, Chatzoglou, P.: Investors’ trading activity: A behavioural perspective and empirical results. J. Socio-Econ. 40(5), 548–557 (2011)

Kowert, P.A., Hermann, M.G.: Who takes risks? Daring and caution in foreign policy making. J. Conflict Resolut. 41(5), 611–637 (1997)

Kubilay, B., Bayrakdaroglu, A.: An empirical research on investor biases in financial decision-making, financial risk tolerance and financial personality. Int. J. Financ. Res. 7(2), 171–182 (2016)

Kuhnen, C.M., Knutson, B.: The influence of affect on beliefs, preferences, and financial decisions. J. Financ. Quant. Anal. 46(3), 605–626 (2011)

Kumar, V., Dudani, R.: The big five personality traits and psychological biases: an exploratory study. Curr. Psychol., pp. 1–11 (2021)

Kumar, V., Dudani, R.: The big five personality traits and psychological biases: an exploratory study. Curr. Psychol. (2021). https://doi.org/10.1007/s12144-021-01999-

Kumar, S., Goyal, N.: Behavioural biases in investment decision making – a systematic literature review. Qual. Res. Financ. Mark. 7(1), 88–108 (2015). https://doi.org/10.1108/QRFM-07-2014-0022

Kumari, N., Sar, A.K.: Recent developments in behavioral finance. J. Wealth Manage. 19(1), 235–250 (2017). https://doi.org/10.3905/jwm.2000.320376

Lai, C.: ‘How financial attitudes and practices influence impulsive buying behavior of college and university students.’ Soc. Behav. Personal. 38(3), 373–380 (2010)

Lai, C.P.: Personality traits and stock investment of individuals. Sustainability 11(19), 5474. (2019)

Landberg, W.: Fear, greed and madness of markets. J. Account. 195(4), 79–82 (2003)

Le, H., Oh, I.S., Robbins, S.B., Ilies, R., Holland, E., Westrick, P.: Too much of a good thing: curvilinear relationships between personality traits and job performance. J. Appl. Psychol. 96(1), 113 (2011)

Lim, S., Donkers, B., van Dijl, P., Dellaert, B.G.: Digital customization of consumer investments in multiple funds: virtual integration improves risk–return decisions. J. Acad. Mark. Sci. 49(4) 723–742 (2021). https://doi.org/10.1007/s11747-020-00740-4

Lin, H.W.: Elucidating the influence of demographics and psychological traits on investment biases. Int. J. Econ. Manage. Eng. 5(5), 424–429 (2011a)

Lin, H.W.: Elucidating rational investment decisions and behavioral biases: evidence from the Taiwanese stock market. Afr. J. Bus. Manage. 5(5), 1630 (2011b)

Lin, S.W., Huang, S.W.: Effects of overconfidence and dependence on aggregated probability judgments. J. Modell. Manage. (2012)

Lipe, M.G.: Individual investors’ risk judgments and investment decisions: The impact of accounting and market data. Acc. Organ. Soc. 23(7), 625–640 (1998)

Liu, C.C., Woo, K.Y., Hon, T.Y.: The relationship between personality traits and investment risk preference. Int. J. Revenue Manage. 9(1), 57–71 (2016)

Liu, N., Zhou, L., Li, A.M., Hui, Q.S., Zhou, Y.R., Zhang, Y.Y.: Neuroticism and risk-taking: the role of competition with a former winner or loser. Personal. Individ. Differ. 179, 110917 (2021)

Lommen, M.J., Engelhard, I.M., van den Hout, M.A.: Neuroticism and avoidance of ambiguous stimuli: Better safe than sorry? Personal. Individ. Differ. 49(8), 1001–1006 (2010)

Le Luong, P., &Thi Thu Ha, D.: Behavioral factors influencing individual investors decision-making and performance: a survey at the Ho Chi Minh Stock Exchange (2011)

Lynch, S.M.: Cohort and life-course patterns in the relationship between education and health: a hierarchical approach. Demography 40(2), 309–331 (2003)

Madaan, G., Singh, S.: An analysis of behavioral biases in investment decision-making. Int. J. Financ. Res. 10(4), 55–67 (2019)

Malkiel, B.G., Fama, E.F.: Efficient capital markets: a review of theory and empirical work. J. Financ. 25, 383–417 (1970). https://doi.org/10.2307/2325486

Mallik, K.A., Munir, M.A., Sarwar, S.: Impact of overconfidence and loss aversion biases oninvestor decision making behavior: mediating role of risk perception, Int. J. Publ. Finance Law Tax. (Online ISSN: 2581-3420), 1(1) (2017)

Markowitz, H.M.: Portfolio Selection/harry Markowitz. J. Financ. 7, 77–91 (1952)

Mayfield, S., Shapiro, M.: Gender and risk: women, risk taking and risk aversion. Gender Manage. Int. J. 25(7), 586–604 (2010)

Mayfield, C., Perdue, G., Wooten, K.: Investment management and personality type. Financ. Serv. Rev. 17(3), 219–236 (2008)

McCrae, R.R., Costa, P.T.: Personality in adulthood: A five-factor theory perspective. Guilford Press (2003)

Mehregan, M.R., Hosseinzadeh, M., Emadi, M.M.: The mediating role of affect in the relationship between the big five factor personality and risk aversion: a structural model. Int. J. Appl. Behav. Sci. 5(2), 28–36 (2019)

Menyeh, B.O.: Financing electricity access in Africa: A choice experiment study of household investor preferences for renewable energy investments in Ghana. Renew. Sustain. Energy Rev. 146, 111132 (2021). https://doi.org/10.1016/j.rser.2021.111132

Millroth, P., Juslin, P., Winman, A., Nilsson, H., Lindskog, M.: Preference or ability: Exploring the relations between risk preference, personality, and cognitive abilities. J. Behav. Decis. Mak. 33(4), 477–491 (2020)

Mitchell, M., Pulvino, T.: Characteristics of risk and return in risk arbitrage. J. Finance 56(6), 2135–2175 (2001)

Mittal, S.K.: Behavior biases and investment decision: theoretical and research framework. Qual. Res. Financ. Mark. (2019). https://doi.org/10.1108/QRFM-09-2017-0085

Modigliani, F., Miller, M.H.: The cost of capital, corporation finance and the theory of investment. American 1, 261–297 (1958)

Myers, I.B., McCaulley, M.H.: Manual: A Guide to the Development and Use of the Myers-Briggs Type Indicator. Consulting Psychologists Press, Palo Alto (1985)

Ng, W., Russell Kua, W.S., Kang, S.H.: The relative importance of personality, financial satisfaction, and autonomy for different subjective well-being facets. J. Psychol. 153(7), 680–700 (2019)

Nga, J.K.H., Yien, L.K.: The influence of personality trait and demographics on financial decision making among Generation Y. Young Consum. 14(3), 230–243 (2013)

Nicholson, N., Soane, E., Fenton-Ocreevy, M., Willman, P.: Domain specific risk taking and personality. J. Risk Res. 8(2), 157–176 (2005)

Niszczota, P.: Cross-country differences in personality and the foreign bias in international equity portfolios. Eur. J. Finance 20(10), 934–956 (2014a)

Niszczota, P.: Neuroticism, uncertainty, and foreign investment. Available at SSRN 2431188 (2014b)

Odean, T.: Are investors reluctant to realize their losses? J. Financ. 53(5), 1775–1798 (1998)

Oehler, A., Wendt, S., Wedlich, F., Horn, M.: Investors’ personality influences investment decisions: Experimental evidence on extraversion and neuroticism. J. Behav. Financ. 19(1), 30–48 (2018)

Özmen, O., Sümer, Z.H.: Predictors of risk-taking behaviors among Turkish adolescents. Pers. Individ. Differ. 50(1), 4–9 (2011). https://doi.org/10.1016/j.paid.2010.07.015

Pak, O., Mahmood, M.: Impact of personality on risk tolerance and investment decisions. Int. J. Commer. Manage. (2015)

Pallier, G., Wilkinson, R., Danthiir, V., Kleitman, S., Knezevic, G., Stankov, L., Roberts, R.D.: The role of individual differences in the accuracy of confidence judgments. J. General Psychol. 129(3), 257–299 (2002)

Park, J., Konana, P., Gu, B., Kumar, A., Raghunathan, R.: Confirmation bias, overconfidence, and investment performance: Evidence from stock message boards. McCombs Research Paper Series No. IROM-07-10 (2010)

Patterson, F.M., Daigler, R.T.: The abnormal psychology of investment performance. Rev. Financ. Econ. 23(2), 55–63 (2014)

Picone, P.M., De Massis, A., Tang, Y., Piccolo, R.F.: The psychological foundations of management in family firms: Values, biases, and heuristics. Fam. Bus. Rev. 34(1), 12–32 (2021)

Pompian, M.: Behavioral Finance and Wealth Management. Wiley (2006a)

Pompian, M.M.: Behavioral Finance and Wealth Management: How to Build Optimal Portfolios for Investor Biases. John Wiley and Sons Inc, Hoboken (2006b)

Pompian, M.M.: Behavioral Finance and Investor Types: Managing Behavior to Make Better Investment Decisions. John Wiley and Sons (2012)

RBI Household Finance Committee. Indian Household Finance. Reserve Bank of India (2017)

Ricciardi, V.: The psychology of risk: The behavioral finance perspective. Handbook of finance, 2 (2008)

Rizvi, S., Fatima, A.: Behavioral finance: a study of correlation between personality traits with the investment patterns in the stock market. In Managing in Recovering Markets. pp. 143–155. Springer, New Delhi (2015)

Roberts, B.W.: Back to the future: Personality and assessment and personality development. J. Res. Pers. 43(2), 137–145 (2009)

Roldán, J.L., Sánchez-Franco, M.J.: Variance-based structural equation modeling: Guidelines for using partial least squares in information systems research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems, pp. 193–221. IGI Global (2012)

Rosales-Pérez, A.M., Fernández-Gámez, M.A., Torroba-Díaz, M., Molina-Gómez, J.: A study of the emotional intelligence and personality traits of university finance students. Educ. Sci. 11(1), 25 (2021)

Rotter, J.B.: Generalized expectancies for internal versus external control of reinforcement. Psychol. Monogr. Gen. Appl. 80(1), 1 (1966)

Rzeszutek, M.: Personality traits and susceptibility to behavioral biases among a sample of Polish stock market investors. Int. J. Manage. Econ. 47(1), 71–81 (2015a)

Rzeszutek, M.: Personality traits and susceptibility to behavioral biases among a sample ofpolish stock market investors. Int. J. Manage. Econ. 47(1), 71–81 (2015b)

Rzeszutek, M., Szyszka, A., Czerwonka, M.: Investors’ expertise, personality traits and susceptibility to behavioral biases in the decision making process. Contemp. Econ. 9(3), 237–352 (2015)

Sadi, R., Asl, H.G., Rostami, M.R., Gholipour, A., Gholipour, F.: Behavioral finance: The explanation of investors’ personality and perceptual biases effects on financial decisions. Int. J. Econ. Financ. 3(5), 234–241 (2011a)

Sadiq, M., Amna, H.: Impact of personality traits on risk tolerance and investors’ decision making. Int. J. Appl. Behav. Econ. (IJABE) 8(1), 1–20 (2019)

Samsuri, A., Ismiyanti, F., Narsa, I.M.: The effects of risk tolerance and financial literacy to investment intentions. Int. J. Innov. Creat. Change 10(9): 40–54 (2019)

Schaefer, P.S., Williams, C.C., Goodie, A.S., Campbell, W.K.: Overconfidence and the bigfive. J. Res. Pers. 38(5), 473–480 (2004)

Scharfstein, D.S., Stein, J.C.: Herd behavior and investment. Am. Econ. Rev. pp. 465–479 (1990)