Abstract

Broadband projects nowadays represent a valid investment alternative to pursuing smart city goals, particularly considering the rapid development that has affected the telecommunications industry. However, for potential investors, the valuation of these projects is a demanding activity because they are characterized by the uncertainty of future user demands, the competition risk, and the sequential nature of investment. In this paper we propose an innovative methodology to valuate the broadband projects taking into account these three peculiarities. This model consists of combining the compound real options approach (ROA), able to price the sequential uncertain projects, with the Options Game (OG) approach used in the literature to valuate uncertain investments affected by competition risk. This paper contributes to the existing literature by expanding the OG model to fit the broadband characteristics in discrete time. We also propose a case study to implement the theoretical approach. Results show that, despite their uncertain nature and competition risks, broadband investments represent a profitable investment alternative when pursuing smart city goals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Broadband projects nowadays represent a very important opportunity for governments and for investors. This is because in recent years the telecommunications industry has been characterized by rapid development, considering that broadband innovations are the following step in the evolution of the Internet (Langdale 1997). For governments, the creation of a broadband society represents a relevant goal (Papacharissi and Zaks 2006), because sometimes these projects are integrated into smart city concepts (Zygiaris 2013). For investors, the broadband projects can represent an investment opportunity even if they are characterized by high-level uncertainty, unstable market conditions and competitive interactions (Angelou and Economides 2008). Their uncertain nature is given by the risks that affect these projects, which could be related to an uncertain number of users causing unstable revenues during a particular period of time, or operational uncertainty referring to the failure of a certain task during the operating stage. The unstable market conditions could be related to fluctuating revenues or costs of projects. The competitive interactions refer to the fact that, in the future, another broadband company can enter the market and reduce the revenues of the existing firm as a consequence of market share reduction. All these peculiarities make the valuation of the broadband projects a hard task. For this reason it is important to find a reliable methodology able to fit broadband project characteristics.

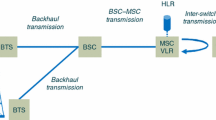

In fact, classical and static valuation methodologies, such as the Net Present Value (NPV), are inadequate to make a reliable assessment. This happens because NPV, just like other Discounted Cash Flow (DCF) approaches, does not allow the opportunity to change investment decisions during the project’s lifetime as a consequence of unexpected market conditions (Trigeorgis 1996). Ross (1995) explained that NPV can cause some valuation problems, such as the rejection of a project, when it should be accepted. This happens because NPV is not able to take into account the managerial flexibility, also called “optionality”, to abandon the project if it turns unprofitable, on account of unpredictable aspects such as its volatility, or future market scenarios. Thus, the Real Options Approach (ROA) has become the most appropriate methodology to price uncertain investments (Trigeorgis 1996). Different to classical NPV, the ROA can embed specific aspects such as volatility, project value evolution and managerial flexibility that allow adequately pricing the investments characterized by uncertainty like the broadband projects. Previous studies have applied ROA to broadband projects valuations. For example, Krychowski (2008) used real options to valuate the value of an investment in ADSL infrastructure located in areas characterized by low population density. Angelou et al. (2004) applied the real options methodology to valuate the strategic decision to roll out an optical fibre network along the national motorway in Greece called “Egnatia Odos” . Tarifa-Fernandéz et al. (2019) proposed a model to valuate the implementation of Internet of Things technologies using ROA. They focus on the possibility to expand the project by investing in the digital technology. In this sense the methodology would act as guidance in the decision-making process. The results of these analyses concluded that, different from static approaches, the ROA offers a reliable valuation method of broadband projects. However, the above literature does not consider the multi-stage nature of the broadband projects. In fact, in addition to the uncertain aspects, the broadband projects are characterized by various stages making them sequentially organized investments. Generally, as shown in the “Guide to High-Speed Broadband Investment” on the official the European Union website, there are various steps to execute these projects and to pursue an action plan.

In general, for uncertain investments organized in a phased manner, previous studies used compound ROA. For example, Cassimon et al. (2004) and Hauschild and Reimsbach (2015) applied the compound ROA to valuate R &D investment that are characterized by various steps from the discovery of the new drug applications to their commercialization. Different to the simple ROA, the compound ROA allows capturing the sequential logic of projects according to which the investor obtains the possibility to proceed with the following investment steps only if the previous steps have proved financially profitable. In this regard, Cassimon et al. (2011) applied the compound ROA to analyze the multi-stage software application of a prominent big mobile phone operator. This model was characterized using phase specific volatility.

Another aspect that can influence a broadband project’s performance is the competition risk. There is no doubt about the presence of competition in the Information and Communications Technology (ICT) project. Moreover, there also exists regulatory policy on competition between broadband projects. Bouckaert et al. (2010) identified three types of regulated competition between the providers of broadband internet access: intern-platform competition, facilities-based intra-platform competition, and service-based intra-platform competition. The competition risk can be adequately monitored by Game Theory (GT). In general, GT has been applied in the literature to valuate ICT projects, considering different players for each analyzed scenario. In a recent work, Praveen et al. (2022) applied a game theoretic approach to analyze a green base station for electricity consumption in order to provide energy to fifth generation (5G) technology. An interesting aspect of this work is that the analysis considers a smart city scenario. Some studies combined the simple ROA with GT to include the competition risk in the valuation of uncertain projects. This combination generates a merged methodology called the Option Games (OG) approach. Chevalier-Roignant and Trigeorgis (2011) showed the usefulness of OG to provide a reliable methodological tool for management in order to adequately price uncertain projects considering a conflicting strategic choice. Some applications of the OG approach have been demonstrated by Zeng and Chen (2020) who applied a real OG model to analyze the socially optimal incentive policy of an energy storage system for microgrids. In this case, the combination between the evolutionary game theory with a real option allowed finding the most influential incentive policy on the development of the microgrid. Lee and Jang (2021) also used the real OG model to analyze the investment options related to a groundwater development project located in South Korea’s Jeju island. Villani (2009) applied the real OG analysis to valuate R &D projects by considering the information revelation that can be derived from a cooperation between two firms. Finally, focusing on the IT field, Zhang et al. (2019) adopted the OG theory to create a decision making model in B2B platforms information technology, where they considered the specific case of an asymmetric duopoly.

To sum up, some studies used the simple ROA to price broadband projects; some studies applied the compound ROA in order to also consider the sequential nature of these investments; and others merged the simple ROA with GT by obtaining the OG approach in order to also capture the competition risk. However, none of them provide a valuation methodology able to consider the sequential nature, uncertainty and competition risks in a closed formula in discrete time.

The need to have a closed formula in discrete time that is able to consider broadband characteristics is a relevant goal towards creating a tool for potential investors, practitioners or academic scholars. This would allow for a reliable valuation of these investments by considering factors that can influence a broadband project’s performance. In this study, we propose a reliable valuation of the broadband projects by combining the compound ROA with GT in order to obtain a merged methodology called compound OG approach. The inclusion of GT in the compound options logic allows adequately capturing a broadband project’s characteristics: on one hand the compound ROA is able to capture the uncertain sequential nature of the ICT projects and, on the other hand, GT is able to embed the competition possibility in the project valuation. This work contributes to the existing literature by expanding the OG methodology in the discrete time to fit the broadband characteristics and by providing a reliable valuation tool for investors, practitioners and academic scholars.

This paper is organized as follows: Sect. 2 provides the model created to valuate a typical broadband project organized in a phased manner. Section 3 provides a case study by using likely data. The conclusive remarks are provided in Sect. 4.

2 Methodology

In this section we describe the methodology to valuate the broadband investment by considering the project uncertainty, the sequential nature and the competitive interactions. We use a compound OG approach that combines the compound options logic with the OG approach. In this way, the compound options logic is able to capture the sequential nature and project uncertainty while the OG approach is able to capture the potential competitive interactions.

2.1 The broadband projects: sequential nature and competition

The uncertain nature of the broadband projects imply that its value can change during the time according to its volatility. The project evolution starts from time \(t_{0}\) until the maturity T. The project is characterized by two sequential investments: the first, P, represents the capital required for the broadband planning and the second, K, represents the capital required to construct the network. Before proceeding to invest P, the potential investor should choose whether to invest early at time \(t_{0}\) or wait to obtain information about market demand from another broadband competitor. In this sense, we have two players who decide between two investment options: to invest early at time \(t_{0}\) and thus obtain the first mover advantage, or wait and invest at time \(t_{1}\) and obtain information from the other broadband firm.

2.2 Compound Options Game approach

The project value at time \(t_{0}\) is represented by the present value of expected revenues of a broadband project, V, derived by cash inflows paid by the users for the Internet services. By considering a period that contains k time instants that go from \(t_{0}=0\) to T, which represents the maturity, the value of V is calculated as follows:

where k represents the time instants; ER represents the value of expected revenues and r is the discount rate. The evolution of project value V depends on its volatility \(\sigma\) evolving as a binary random-walk through two movements: up (u) with a risk neutral probability \(\pi\) and down (d) with a probability \((1-\pi )\). Assuming the absence of arbitrage and denoting \(r_{f}\) as the annual risk-free interest rate, the value of \(\pi\) is calculated as follows:

where \(u=e^{\sigma \sqrt{\varDelta t}}\) and \(d=e^{-\sigma \sqrt{\varDelta t}}\).

The analysis starts by computing the binomial lattice of users demand over a certain period \(t=0,1,\ldots ,T\) as shown in Fig. 1.

Players should consider a trade-off between investing early (I) to build up a competitive advantage over rivals, versus delaying investment by adopting the waiting strategy (W) to acquire more information and mitigate the potentially unfavorable impacts of market uncertainty. So, we model this situation as a Stackelberg competition in which the initial broadband firm represents the leader (L) and the private competitor represents the follower (F). The game is represented graphically in Fig. 2.

Figure 2 shows the case in which two players should decide whether to proceed to the next stage of investment based on the choice of the other player. L(W, W) and F(W, W) respectively represent the payoffs for the leader and the follower, in which both players wait; L(W, I) and F(W, I) respectively represent the payoffs for the leader and for the follower where the leader waits and the follower invests; L(I, W) and F(I, W) respectively represent the payoffs for the leader and for the follower where the leader invests and the follower waits; L(I, I) and F(I, I) respectively represent the payoffs for the leader and for the follower in which both players invest. We conduct the analysis over a time period between 0 and T considering two investments related to two different stages: the first is related to the broadband plan and the second to building the network. In this game both investors (leader and follower) should decide whether to start planning the investment at time \(t_{0}\) or wait and invest at time \(t_{1}\). The choice to wait has got some implications in terms of information revelation, since by waiting the player can capture positive or negative information about the investment performance of the player who decided to invest early at time \(t_{0}\). Dias (2005) and Villani (2009) calculated the probability of positive \(p^{+}\) or negative \(p^{-}\) information revelation by starting from these Bernoulli distributions:

and by calculating \(p^{+}\) and \(p^{-}\) as follows:

where \(\rho (L,F)\) is the correlation factor that represents the intensity of information that the follower is able to assimilate from the leader, whereas \(\rho (F,L)\) is the intensity of information that the leader is able to assimilate from the follower.

To apply the compound OG approach to price a broadband project, we adapt the model by Dias (2005) in discrete time by using binomial lattice model. At this point, we can now analyze the option game case by case, as follows:

-

L(I,I): The leader makes the planning investment \(P_{L}\) at time 0 in order to obtain the simple option value \(s(\alpha V, K_{L}, T)\) with a probability p at the following time T where \(K_{L}\) represents the building investment for the leader. The value of \(\alpha >\frac{1}{2}\) represents the market share of the leader and T represents the maturity time. The option value s is calculated considering the binary random walk during the discrete time period. This means that s fulfils the condition \(s=\max [ \alpha V u^{j}d^{n-j}-K_{L};0]\) at final time T, after that we continue with backward induction up to the time 0 by applying the binomial lattice model as follows:

$$\begin{aligned} L(I,I)= & {} -P_{L} + p\cdot \frac{1}{(1+r_f)^{T}}\sum \left( {\begin{array}{c}n\\ j\end{array}}\right) \pi ^{j}\cdot (1-\pi )^{n-j} \nonumber \\&\quad \cdot \max [\alpha Vu^{j}d^{n-j}-K_{L};0] \end{aligned}$$(4) -

F(I,I): The follower makes the planning investment \(I_{F}\) at time 0 in order to obtain the simple option value \(s((1-\alpha ) V, K_{F}, T)\) with a probability p at the following time T, where \(K_{F}\) represents the building investment for the follower. The value of \(1-\alpha\) represents the market share of the leader. The option value s is calculated considering the binary random walk during the discrete time period where \(K_{F}\) represents the building investment. This means that s fulfils the condition \(\max [ (1-\alpha )V u^{j}d^{n-j}-K_{F};0]\), after that we continue with backward induction up to the time 0 by applying the binomial lattice model as follows:

$$\begin{aligned} F(I,I)= & {} -P_{F} + q\cdot \frac{1}{(1+r_f)^{T}}\sum \left( {\begin{array}{c}n\\ j\end{array}}\right) \pi ^{j}\cdot (1-\pi )^{n-j} \nonumber \\&\quad \cdot \max [ (1-\alpha )V u^{j}d^{n-j}-K_{F};0] \end{aligned}$$(5) -

L(I,W): In this case, the only difference from the payoff of L(I, I) is related to the market share \(\alpha _{1}\), which in this case is greater than \(\alpha\) as a consequence of first mover advantage for the leader. So, we obtain:

$$\begin{aligned} L(I,W)= & {} -P_{L} + p\cdot \frac{1}{(1+r_f)^{T}}\sum \left( {\begin{array}{c}n\\ j\end{array}}\right) \pi ^{j}\cdot (1-\pi )^{n-j} \nonumber \\&\quad \cdot \max [\alpha _{1} Vu^{j}d^{n-j}-K_{L};0] \end{aligned}$$(6) -

F(I,W): The follower decides to wait at time 0 and to invest at time \(t_{1}\) in order to obtain information about the investment q that can be positive \(q^{+}\) or negative \(q^{-}\). So, the value of waiting is calculated as a compound options (c) in which the follower could receive a positive feedback from information revelation:

$$\begin{aligned} c(q^{+})=c(q^{+}\cdot s ((1-\alpha _{1})V, K_{F}, T-t_{1}),P_{F},t_{1}) \end{aligned}$$(7)or a negative feedback from information revelation

$$\begin{aligned} c(q^{-})=c(q^{-}\cdot s ((1-\alpha _{1})V, K_{F}, T-t_{1}),P_{F},t_{1}) \end{aligned}$$(8)So, F(I, W) can be viewed as an expected value of these two possibility:

$$\begin{aligned} F(I,W)=p\cdot c(q^{+}) + (1-p) \cdot c(q^{-}) \end{aligned}$$(9) -

L(W,W): The wait option is valuated as a compound option c for the leader considering the success probability p:

$$\begin{aligned} L(W,W)= c (p\cdot s(\alpha V, K_{L}, T-t_{1}), P_{L},t_{1}) \end{aligned}$$(10) -

F(W,W): The wait option is valuated as a compound option c for the leader considering the success probability q:

$$\begin{aligned} F(W,W)= c (q\cdot s((1-\alpha ) V, K_{F}, T-t_{1}), P_{F},t_{1}) \end{aligned}$$(11) -

F(W,I): If the follower decides to invest considering that the leader waits, he should consider the simple option valuated at time \(t_{1}\) to which he should subtract the value of \(-I_{F}\). In this case we have \((1-\alpha _{2} )>(1-\alpha )\) as a consequence of first mover advantage for the follower, and so the payoff is:

$$\begin{aligned} F(W,I)= & {} -P_{F} + q\cdot \frac{1}{(1+r_f)^{T}}\sum \left( {\begin{array}{c}n\\ j\end{array}}\right) \pi ^{j}\cdot (1-\pi )^{n-j} \nonumber \\&\quad \cdot \max [ (1-\alpha _{2})V u^{j}d^{n-j}-K_{F};0] \end{aligned}$$(12) -

L(W,I): The payoff for the leader where he waits and the follower invests, represents the opposite situation of F(W,I) described previously. So, we obtain that this payoff is calculated as follows:

$$\begin{aligned} L(W,I)=q \cdot c(p^{+})+ (1-q)\cdot c(p^{-}) \end{aligned}$$(13)where \(c(p^{+})\) and \(c(p^{-})\) are calculated as follows:

$$\begin{aligned} c(p^{+})= & {} c(p^{+}\cdot s (\alpha _{2} V, K_{L}, T-t_{1}),P_{L},t_{1}) \end{aligned}$$(14)$$\begin{aligned} c(p^{-})= & {} c(p^{-}\cdot s (\alpha _{2} V, K_{L}, T-t_{1}),P_{L},t_{1}) \end{aligned}$$(15)

Thus, in this section we have modelled the broadband investment process considering the Stackelmberg competition case by using OG approach. In this sense, we have proposed a reliable methodology valuation to make the initial broadband firm and the potential competitor aware about the broadband investment characteristics. The explicit calculations to obtain the compound options value are shown in Appendix A.

A basic model of compound OG logic for the leader is described in the Fig. 3 where, for the sake of simplicity, we use:

-

\(K_{i}\) and \(P_{i}\) where \(i=L,F\);

-

\(\omega\) to identify p, q, \(p^+\), \(p^-\), \(q^+\), \(q^-\);

-

\(\gamma\) to identify \(\alpha\), \(\alpha _1\), \(\alpha _2\), \(1-\alpha\), \(1-\alpha _1\), \(1-\alpha _2\).

3 Case study

3.1 Project description

In this section we provide an ideal case study to implement the theoretical model described in Sect. 2. We consider an investment in 3G wireless technologies by using the CDMA2000 system that is an evolution of CDMA (Code Division Multiple Access). These projects are characterized by a huge amount of capital required or capital expenditures to pursue them. The present value (PV) of these projects are represented by the discounted value of yearly revenues derived from subscribers for Internet services. For this example we use the European Average Revenues per Users (ARPU) of 2021, which is equal to €185514.3 per month, with the number of users starting from 500,000 at the initial operating year and growing by 50% each subsequent year as the consequence of increasing penetration of the new broadband Internet technology in the population. By using a discount rate of 11.68%, which is the result of intensive study of previous works to quite similar broadband projects (Angelou et al. 2004; Sinha and Gupta 2011; Tanguturi and Harmantzis 2006), the V in the current period assumed to be year 0 is equal to €1855.97 million. The cash inflows to obtain the project value have been shown in Table 1 where the revenues are assumed to start in year 2 once the planning and the construction of the network are completed.Footnote 1

The capital required to build the network K is equal to €2135.59 million. This value considers the base station equipment, construction of the broadband project, and operating expenses. The value of capital required to pursue the project has been chosen considering the investment cost used by Tanguturi and Harmantzis (2006) and by converting it into €. The cost for planning the project (I) is supposedly 4% of K, and so it is equal to €85.42 million. For the sake of simplicity, we assume that the investments costs for the leader and follower are the same:

The volatility \(\sigma\) is equal to 46.96%, extrapolated from the historical price movement of the Bombay Stock Exchange Technology, Media and Telecom Index (BSE TECk).Footnote 2 The strategic time instants identified to invest soon or, conversely, to adopt the waiting strategy are respectively \(t_{0}=0\) or \(t_{1}=3 \text{ years }\). The maturity T is equal to 10 years. By assuming that the leader success probability p is equal to 0.60 and the follower success probability q is equal to 0.55,Footnote 3 we can easily calculate the probabilities in the case of positive and negative information revelation for the leader (\(p^{+}\) and \(p^{-}\)) and follower (\(q^{+}\) and \(q^{-}\)). This is made by considering the same intensity of information revelation from the leader to the follower and from the follower to the leader equal to \(\rho =\rho (L,F)=\rho (F,L)=0.5\). By applying the Eq. 3 we obtain the following results:

At this point we have all the parameters to implement the compound OG approach. Table 2 summarizes the values required to calculate the payoffs for the leader and follower described in Sect. 3. Notice that the choices of the market shares (\(\alpha\), \(\alpha _{1}\), and \(\alpha _{2}\)) have been anticipated considering the first mover’s advantages. In theory, it is assumed that the leader should expect to obtain a higher market share than the follower \(\alpha =0.6>(1-\alpha )=0.4\). Moreover, if the leader acts as the first mover, he should expect a new market share higher than his previous one \(\alpha _1=0.7>\alpha =0.6\). Conversely, if the follower acts as the first mover, he should expect a higher market share, on account of his first mover advantage, than the market share of the leader who in this case, is the second one to invest \((1-\alpha _2)=0.55>\alpha _2=0.45\).

3.2 Results and discussion

The solution of the game is represented graphically in Fig. 4.

The results show that the best choice for the two players is to invest because:

-

if the leader decides to invest, the best choice for the follower is to invest (€68.98 million > €64.04 million);

-

if the leader decides to wait, the best choice for the follower is to invest (€173.68 million > €110.06 million );

-

if the follower decides to invest, the best choice for the leader is to invest (€239.65 million > €148.84 million);

-

if the follower decides to wait, the best choice for the leader is to invest (€324.49 million > €261.20 million).

Thus, the analysis suggests that, although the broadband projects pose some risk due to their uncertain nature and the possible competition risk, they represent a profitable investment alternative for potential investors.

4 Conclusive remarks

This paper proposes an innovative methodology to make a reliable valuation of the broadband projects considering their risky and multi-stage nature, and possible competition case. The methodology we have proposed is called compound Options Games and it allows embedding uncertainty of future demand, sequential nature and competition risk in the valuation. We have also proposed an ideal case study by using likely data, to implement the theoretical model and to show the attractiveness of the broadband projects. The results confirm that the compound Options Game approach is adequate to valuate these projects without underestimating them. Moreover, the analysis highlights the financial profitability of the broadband investments, while taking into consideration their particular characteristics. By highlighting the financial profitability of the broadband projects, this methodology makes potential investors aware of the real opportunity of these investments without underestimating them. Underestimation can happen by adopting the classical discounted cash flows method, which can not mitigate the risks without considering the managerial flexibility, as the compound OG approach can do. By encouraging broadband projects, this methodology can be used by government to attract new investors to finance these investments, which, in turn, allows further pursuing the smart city goal. Note that, for the implementation of the case study we consider the BSE TECk volatility closely related to the field of our project. However, future research could adopt other volatility parameters according to the need to adequately fit their analysis and goals.

Notes

Note that the values in Table 1 are rounded to the third decimal place. Although this can slightly change the results, the conclusions of the analysis remain the same.

The choice of volatility extrapolated by Bombay Stock Exchange Technology, Media and Telecom Index (BSE TECk) has been considered based on the study by Tanguturi and Harmantzis (2006), who studied the 3G wireless broadband internet.

The values of \(p=0.60\) and \(q=0.55\) have been chosen taking into account the study by Chang et al. (2016).

References

Angelou, G., Economides, A. A., Iatropoulos, A. D.: Broadband investments analysis using real options methodology: a case study for Egnatia Odos S.A. Commun. Strat. 55(3 and 4), 45–76 (2004)

Angelou, G., Economides, A.: A real options approach for prioritizing ICT business alternatives: a case study from broadband technology business field. J. Oper. Res. Soc. 59, 1340–1351 (2008)

Bouckaert, J., van Dijk, T., Verboven, F.: Access regulation, competition, and broadband penetration: an international study. Telecommun. Policy 34, 661–671 (2010)

Cassimon, D., Engelen, P.J., Thomassen, L., Van Wouwe, M.: The valuation of a NDA using a 6-fold compound option. Res. Policy 33, 41–51 (2004)

Cassimon, D., Engelen, P.J., Yordanov, V.: Compound real option valuation with phase-specific volatility: a multi-phase mobile payments case study. Technovation 31, 240–255 (2011)

Chang, S., Li, Y., Gao, F.: The impact of delaying on investment decision on R &D projects in real option game. Chaos Solit. Fract. 87, 182–189 (2016)

Chevalier, R.B., Trigeorgis, L.: Competitive Strategy. Options and Games (2011)

Dias, M.A.G.: Real options, learning measures, and Bernoulli revelation processes. Working paper, Puc-Rio, presented at 8th Annual International Conference on Real Options, Paris, June (2005)

Hauschild, B., Reimsbach, D.: Modeling sequential R &D investment: a binomial compound option approach. Bus. Res. 8, 39–59 (2015)

Krychowski, C.: Investment decision in a broadband internet network: a real options approach. Commun. Strat. 67 (2008) (no. 70, 2nd quarter)

Langdale, J.: International competitiveness in East Asia: broadband telecommunications and interactive multimedia. Telecommun. Policy 21(3), 235–249 (1997)

Lee, J., Jang, H.: Groundwater extraction in the south Korea’s Jeju island: a real options game approach under price uncertainty. Sustainability 13, 3431 (2021)

Papacharissi, Z., Zaks, A.: Is broadband the future? An analysis of broadband technology potential and diffusion. Telecommun. Policy 30, 64–75 (2006)

Praveen, G., Anuj, D., Sandeep, J., Vinay, C., Mohsen, G.: A game theoretic analysis for power management and cost optimization of green base stations in 5G and beyond communication networks. In: IEEE Transactions on Network and Service Management (2022)

Ross, S.A.: Uses, abuses and alternatives to the net-present-value rule. Financial Manage. 24(3), 96–102 (1995)

Sinha, P., Gupta, A.: Analysis of WIMAX/BWA licensing in India: a real option approach. MPRA Paper (2011) (No. 31280, posted 11 Jun 2011)

Tanguturi, V.P., Harmantzis, F.C.: Migration to 3G wireless broadband internet and real options: the case of an operator in India. Telecommun. Policy 30, 400–419 (2006)

Tarifa-Fernandéz, J., Sánchez-Pérez, A.M., Cruz-Rambaud, S.: Internet of things and their coming perspectives: a real options approach. Sustainability 11, 3178 (2019)

Trigeorgis, L.: Real Options: Managerial Flexibility and Strategy in Resource Allocation. The MIT Press, Cambridge, MA (1996)

Villani, G.: R&D cooperation in real option game analysis. In: Nonlinear Dynamics in Economics, Finance and Social Sciences, pp. 95–115 (2009)

Zeng, Y., Chen, W.: The socially optimal energy storage incentives for microgrid: a real option game-theoretic approach. Sci. Total Environ. 710, 136199 (2020)

Zhang, H., Li, L, Zhu, X., He X.: Option game analysis in IT investment strategy of B2B e-intermediary. In: Proceedings of the 25th International Conference on Industrial Enginnering and Engineering Management (2019)

Zygiaris, S.: Smart city reference model: assisting planners to conceptualize the building of smart city innovation ecosystems. J. Knowl. Econ. 4(2), 217–231 (2013)

Funding

Open access funding provided by Università degli Studi di Bari Aldo Moro within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Contributions

Authors whose names appear on the submission have contributed sufficiently to the scientific work and therefore share collective responsibility and accountability for the results.

Corresponding author

Ethics declarations

Conflict of interest

This article does not contain any studies with human participants or animals performed by any of the authors. The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Explicit compound options formulas

Appendix A: Explicit compound options formulas

In this section we will show all the explicit formulas to price the waiting value captured by the compound ROA. For the sake of simplicity we use the denotations:

-

\(K_{i}\) and \(P_{i}\) where \(i=L,F\);

-

\(\omega\) to identify p, q, \(p^+\), \(p^-\), \(q^+\), \(q^-\);

-

\(\gamma\) to identify \(\alpha\), \(\alpha _1\), \(\alpha _2\), \(1-\alpha\), \(1-\alpha _1\), \(1-\alpha _2\).

Let’s denote \(\varDelta t= \frac{T}{n}\) so that, fixing \(t_1\) and T we have:

or alternatively \(n_2=n-n_1\) so that \(n_1+n_2=n\). Let’s denote the index:

When we price the compound options value, firstly we calculate the underlying asset that has j up and \(n-j\) down movements as follows:

Following the backward induction, we have:

The corresponding compound option at the same node \(t_1\) is:

So we have that:

An intuitive graphical exhibit that explains how the compound ROA works by using the binomial lattice model as shown in Fig. 5.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Di Bari, A., Villani, G. An Options Game approach to valuate broadband projects in a smart city context. Qual Quant 57, 1587–1601 (2023). https://doi.org/10.1007/s11135-022-01428-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01428-3