Abstract

Economic polarisation in a society may be defined as the creation of groups with strong within-group identity and significant distance from other groups, where the distance is measured in terms of income. The literature on social conflicts considers polarisation a menace to political stability. Italy is characterised by a wide economic divide between the north and the south. This paper investigates the polarisation among Italian macro-regions in 2004–2016. We find that polarisation is low across the country. Paradoxically, the large inequalities inside each region, by hampering the formation of group identity, have hindered the increase in polarisation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Enhancing territorial cohesion is an important goal established by the European Union.Footnote 1 Large regional economic disparities are considered a severe menace to this target.

In this paper, we consider economic polarisation as an appropriate measure for territorial cohesion, but we depart from the original definition of polarisation based on income originally proposed by Esteban and Ray (1994) to adopt a measure of polarisation based on self-perceived economic hardship among Italian macro-regions in a period (2004–2016) that has been characterised by the occurrence of two economic recessions (the 2008 recession and the 2012 recession).Footnote 2

On a theoretical footing, polarisation refers to the creation of groups within a society with a high degree of intra-group homogeneity (group identity) and inter-group heterogeneity (alienation).

Hence, a country with highly polarised regions is also a country where territorial cohesion is at risk.

The Italian case is interesting because it is one of the countries where the impact of the economic recessions has hit hardest and for the longest period in Europe. Despite this, at least to the best of our knowledge, there is no research investigating how polarisation has evolved over time. Interestingly, Ciani and Torrini (2019) reported that inequality in Italy has increased during both the recession and recovery years and that this increase is mainly driven by the rise of inequality in southern Italy. However, the relative distance among Italian regions has remained substantially constant. Concluding that polarisation among Italian regions has decreased since southern Italy has become less homogeneous, despite tempting, may be misleading if homogeneity within the northern part of the country has increased and, therefore, the within-group identity has become stronger in this area. Thus, without an empirical analysis, it is impossible to define a priori the effect of the recession on polarisation.

Another reason to be interested in the Italian case is the consolidated North–South economic divide (see, for instance, Daniele and Malanima 2017). Hence, a relevant question is the following: have the recent Italian economic difficulties increased polarisation in economic hardship among macro- regions? Answering this question can be crucial for the social stability of a country characterised by wide economic differences between different geographical areas.

According to the answers given to the 2017–2020 World Value Survey, we find that in both Italy and Spain people feel closer to their town than to their country (respectively, 87% of the Italian respondents feel themselves very close or close to their town, while the percentage is 78% when the country is considered, similarly 84% and 75% for Spain) while the opposite holds for Germany and France, where people report higher percentages with regard to feeling close to their countries. We are reminded that Spain has been characterised by a strong Spanish–Catalan contrast, resulting in an unauthorised Catalan independence referendum in 2017.Footnote 3 Obviously, this does not mean that for Italy, too, such deep territorial contrasts are knocking at the door, but given the significant economic gap between the areas of the country and the high percentage of people identifying themselves mainly in their local context rather than in their country, an assessment of the level of polarisation is of interest.Footnote 4

A secondary aim of this paper is to propose a relatively simple method to obtain an indicator of polarisation in the case of an ordered response variable. Indeed, economic hardship is measured using a Likert scale (from 1 to 5) by which individuals report the level of difficulty in meeting the family needs given their family resources. To investigate this topic, we use the data from the biennial Survey on Household Income and Wealth (SHIW) carried out by the Bank of Italy for 2004–2016 (before, during and after the two recessions).

As it will be clearer in the Method section, our indicator is mainly based on the decomposition of the Leti index in within- and between-groups’ heterogeneity proposed by Grilli and Rampichini (2002). The proposed indicator of polarisation can be obtained simply by dividing the between-group heterogeneity (our measure of alienation) for within-group heterogeneity (our measure of group identification).

In addition, multilevel ordered logit models are used to ensure that our proposed indicator is cleansed from the population compositional effects. Indeed, eventual territorial differences in economic hardship may stem, for instance, from a different age structure of the regional population. A younger population is, in general, more subjected to labour market fluctuations than an older one (see Jaimovich and Siu 2009 for a discussion). If this aspect is not taken into account in the construction of an indicator, one cannot conclude whether the observed regional heterogeneity is driven by demographic factors or by a structural gap in regional economies. Therefore, we propose to use a multilevel model to get predictions of people’s self-reported level of difficulty in meeting family needs by fixing the same population characteristics for each Italian macro-region. However, it must be said that other techniques have also been implemented to ensure that our results do not depend on the statistical model used to get the predictions.

We find that polarisation is low across the country. Paradoxically, the large inequalities inside each region, by hampering the formation of group identity, have hindered the increase in polarisation.

Interestingly, the results of our multilevel model indicate that younger individuals are more likely to be in a condition of economic hardship with respect to older ones. In addition to the labour market explanation given above, we believe that this is caused by the peculiar Italian welfare system that tends to protect the elderly especially, while leaving youngsters to rely on assistance from their own families.

The paper is organised as follows: the second section first of all clarifies the concept of polarisation and its relationship with inequality and territorial cohesion, while its subsection presents the reasons to focus on a measure of self-perceived material hardship rather than on income. The third section and its related subsection present the data and methods. The following section reports the results and some robustness checks. Finally, conclusions are drawn.

2 Polarisation, material hardship, income, territorial cohesion

2.1 The concept of polarisation and its relationship with inequality and territorial cohesion

The concept of economic polarisation was formally introduced in the econometric literature by Esteban and Ray (1994), and even though it may be viewed as akin to inequality, the two concepts are not coincident.

As explained by Labeaga et al. (2007), from the empirical point of view, an inequality index is a convex linear combination, weighted by frequencies of income differentials, whereas a polarisation index is a convex linear combination of frequencies, where the weights are the relative income differentials. Esteban and Ray (1994) concluded that it is perfectly possible that in a polarised society, the level of inequality may be low, but individuals belonging to a group may feel very distant from the other groups. Indeed, polarisation is related to the ‘alienation that individuals and groups feel from one another, but such alienation is fuelled by notions of within-group identity’ (Duclos et al. 2004). In other words, traditional measures of economic inequality capture only individual alienation and do not consider group identity.

To better understand the difference between inequality and polarisation, consider a society composed of two groups i and j, with the income distribution of group i that is first stochastically dominated by the income distribution of group j. Suppose that an event, for instance, a recession, leads to a further increase in the economic distance between the two groups. At the same time, suppose that the economic distance inside each group decreases as an additional consequence of the recession. This will lead to a situation where inequality inside each group is decreasing but at the same time, the two groups are characterised by both higher within homogeneity and higher between heterogeneity, and this will result in increased polarisation. Thus, a low polarised society is also a cohesive one, in the sense that it is characterised by low economic disparities among groups, and vice versa, a highly polarised society is not.

The literature on social conflicts (Esteban and Ray 1994, 2011; Montalvo and Reynal-Querol 2005; Østby 2008) has indeed shown that economic polarisation rather than economic inequality is the main trigger of conflict outbreak. As noted in the seminal paper by Esteban and Ray (1994), a limit in the existing literature is that polarisation is measured mainly in terms of convergence in GDP per capita, without considering the concepts of identification and alienation depicted above. Similarly, Frieden and Walter (2017) discussed the role of economic disparities in the emersion of conflicts among European countries. They remark that the emersion of a high degree of economic polarisation between debtor and creditor countries can lead to a failure of the European monetary union (see also Kapeller et al. 2017).

We believe that polarisation may also be used as an indicator of territorial cohesion. Although it is not easy to define what is intended for territorial cohesion (Abrahams 2014), for a long time the term has been used by the EU to indicate regional disparities in the economic output. Thus, policies aimed at increasing territorial cohesion were substantially oriented to improving the economic performance of the regions, especially in the new member states, to bring them to converge with the EU average.

Weckroth and Moisio (2020) observed that in the last few years, there had been a qualitative shift in the concept of territorial cohesion, which now also considers the individual conditions of European citizens and not only the macroeconomic aggregates. In particular, they argue that territorial cohesion seems to be increasingly related to a concept of spatial justice according to which people should be not disadvantaged in terms of economic opportunity and social inclusion from living in a specific region instead of another one. This is also reflected by the attempts to complement GDP with other measures that take into account people’s health, income per household, economic, social and environmental sustainability. An interesting attempt to define territorial cohesion has been made by Camagni (2010). Specifically, according to Camagni, territorial cohesion may be understood using three dimensions: (1) territorial efficiency; (2) territorial quality; (3) territorial identity. To summarise and very much simplifying Camagni’s schematisation, territorial efficiency results from the interplay of economic cohesion and environmental sustainability, territorial quality refers to the social cohesion and to environmental protection, while territorial identity is related with socio-economic cohesion. This last dimension, together with the existence of deep economic regional disparities (this is an element of the territorial quality dimension), are the most relevant for the current paper. Indeed, territorial identity includes the capability of developing a shared vision of the future (see also Abrahams 2014). We believe that the existence of a high degree of regional polarisation may undermine this very capability, thus leading to growing conflicts at the territorial level. In particular, Tormos (2019) argued that intensification of the above-mentioned Spanish–Catalan conflict could be thought of as a consequence of the generalised decline in trust in Spanish central government (but not in local authorities) registered in Catalonia, which was in turn triggered by the increase of people in economic hardship during the 2008 economic recession. This seems to suggest the idea that the increased economic difficulties may have raised both group identity and alienation from other groups. From another perspective, the increase in territorial polarisation may also be indicative of the presence of bonding social capital (i.e. internal group ties) but at the same time, a paucity of bridging social capital, i.e. the social cohesion between groups that are different in terms of socio-economic and other characteristics (Leonardi 1995). Therefore, we may have that when bridging social capital is low, economic difficulties tend to divide social groups because of the lack of inter-group solidarity (see again Weckroth and Moisio (2020) on the importance of solidarity for territorial cohesion) and this may lead to perceive themselves as distant from the others. It must be declared that this paper’s scope is not to investigate the relationship between social capital and polarisation. Despite this, we believe that offering a measure of polarisation in self-perceived economic hardship is also a way to monitor territorial cohesion, particularly the territorial identity dimension of this multidimensional concept. That is, when territorial polarisation increases, we may have as a side consequence a sort of fragmentation in territorial identity that leads people to share their vision of the future only with those that belong to the same territory.

An alternative measure of territorial cohesion has been recently proposed by Medeiros (2016). To our knowledge this represents the unique attempt to offer a measurement of this complex concept Empirical attempts have been indeed hindered by the difficulties of defining the same concept of territorial cohesion. Medeiros’s indicator is based on a factorial analysis carried out on a wide set of indicators capturing salient elements of territorial cohesion. Even though Medeiros’s approach is admittedly more complete than the one proposed in this paper, we believe that studying polarisation is relatively easier and gives a more immediate picture of two important elements of territorial cohesion, i.e. regional disparities and territorial identity. In addition, Medeiros’s approach has the limitation of using an explorative multivariate technique as factorial analysis, therefore the factors extracted for one particular country may be very different from those obtained from another one. Thus, this limits the possibilities of carrying out a cross-countries comparison.

2.2 Self-perceived material hardship and income

As per Mirowsky and Ross (1999), economic hardship can be defined as: “lack of the money needed to meet family needs for food, clothing, shelter, and medical care” (p. 549). The choice of focusing on material hardship rather than considering income is driven by several theoretical and empirical considerations.

First of all, economic hardship seems to be more appropriate than income in registering the variations in well-being deriving from economic downturns. For instance, Gudmundsdottir (2013) has shown that in the 2008 economic recession in Iceland, the fall in income was not a significant predictor of the observed decline in perceived happiness while economic hardship was (see also Reeskens and Vandecasteele 2017). Hence, an indicator based on perceived hardship seems to be more suited than an income-based measure to capture the negative consequences of economic difficulties for the well-being of society.

Finally, a decline in income does not automatically imply the inability of meeting family needs. In hard times, consumption may be financed through savings, selling valuables, welfare support, or the social network’s help. Coherently with this view, Gudmundsdottir (2013) found that families reporting economic hardship were not clustered in low-income groups but instead among those who reported being in debt. In addition, as observed by Diener and Biswas-Diener (2002), a fall in income may also be caused by a voluntary reduction in working hours.

From the empirical point of view, the mere use of income for appraising people’s economic difficulties has indeed also been questioned in other ambits of economic analysis. Mayer and Jencks (1989) were the first to note that defining poverty thresholds only on the basis of income distribution frequently leads to both an underestimation of the actual conditions of several demographic and social groups (e.g. lone parents, those in poor health, etc.) and conversely an upward bias in the evaluation of the conditions of other categories (especially the elderly). They proposed measuring material deprivation not only on the basis of incomes but also considering consumption. Several papers propose indicators to capture material hardship (Ayala et al. 2011; Laite et al. 2001; Meyer and Sullivan 1993; etc.). Watson and Webb (2009) and Deidda (2015) proposed using a self-reported indicator of economic hardship to overcome problems related to households’ unobserved preferences. In brief, the proposed indicator is based on survey questions where respondents are invited to assess, given their income, the difficulty in meeting the family’s monthly needs. In addition, in the case of Italy, where the cost of living varies considerably among macro-regions (Boeri et al. 2019), but the nominal wage rates only slightly change across the country (being determined by national collective bargaining), studying economic hardship on the basis of income may be misleading.Footnote 5 Furthermore, it is well known that surveys’ respondents tend to underreport their income or to report it inaccurately (maybe because of recall bias), determining a downward bias in income estimates (see Cabral et al. 2020 for a discussion). This may be viewed as another reason for using perceived economic hardship rather than income to analyse polarisation among Italian macro-regions.

3 Data and methods

3.1 Data

The proposed analysis is based on data provided by the biennial survey conducted by the Bank of Italy on Italian households’ incomes and wealth between 2004 and 2016. SHIW provides data to the Eurosystem’s Household Finance and Consumption Survey (EU-SILC). In each wave, about 8,000 families (20,000 individuals) are surveyed, collecting information such as age, sex, educational level, occupational status, incomes, wealth and detailed financial investments of Italian families, etc.

The sample design for each survey consists of two stages, with municipalities and households representing the primary and secondary sampling units, respectively.

Municipalities are first of all stratified by region and demographic size. Within each stratum, all the municipalities with more than 40,000 inhabitants are considered self-representing and included in the sample, while those smaller than this threshold are selected on the basis of probability proportional to size sampling. The households to be interviewed are then randomly selected from the civic register of the municipalities selected in the first stage. The same Bank of Italy furnishes the weights to guarantee the possibility to extend the sample results to the national level and to take into account the small differences in the sample design in each wave. It must be said that the survey is designed to be representative at NUTS 0 level and not at the subnational one. However, Annoni and Weziak-Bialowolska (2016) have recently shown that results at the NUTS 1 level (hence the subnational division in five macro regions given by north-western Italy, north-eastern Italy, central Italy, southern Italy, Islands) could also be considered reliable. In particular, they show that the population distribution broken down by gender and age classes obtained from this source is not statistically different from that deriving from the Eurostat-based population share. At the same time, Baffigi et al. (2016) do not recommend using SHIW data for obtaining estimates at NUTS 2 level (i.e. Italian regions) because regional sample sizes are considered too small. Hence, following Annoni and Weziak-Bialowolska and Baffigi et al. we limit our analysis to the NUTS 1 level.Footnote 6

Turning back to the contents of SHIW, since 2004 this survey has been collecting data on perceived economic hardship.Footnote 7 In particular, the following question is asked of survey participants: ‘is your household’s income sufficient to see you through to the end of the month?’ The possible answers are as follows: 1 ‘with great difficulty’; 2 ‘with difficulty’; 3 ‘with some difficulty’; 4 ‘fairly easily’; 5 ‘easily’; 6 ‘very easily’. This variable will be named condgen.

It should be noted that individuals’ feeling of making ends meet may be influenced by their reference groups (friends, peers, neighbours, etc.). Hence, even an indicator based on this measure is subject to the problem of defining these groups. However, as will be made clearer in the following section, we believe that this possible limitation could be easily resolved on the empirical ground.

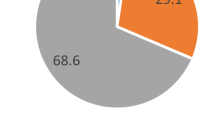

The sample comprises about 135,000 observations. In Table 1 some descriptive statistics about average family income and wealth, broken down by year and macro-regions (north-west, north-east, centre, south, islands) are reported. All the values are expressed in 2016 Euros using the ISTAT currency revaluation coefficients. In Fig. 1, the distribution of the relative frequencies of the answers to the above-reported question on economic hardship for Italy in 2004–2016 is shown.

Distribution of the relative frequencies of the answers to the questions on perceived economic hardship. Italy, 2004–2016. In 2012, the frequency associated with the answer ‘with great difficulty’ reached 20% (it was around 14% in 2010) and at the same time the frequency associated with ‘fairly easily’ dropped to 24.9% (it was 28.4% in 2010)

Hence, it seems that this kind of question is able to capture the increase in economic difficulties due to a worsening macroeconomic background.

Note that also, after the economic recessions in 2008 and 2012, both the average incomes and wealth in all the macro-regions decreased (Table 1), while maintaining a substantial distance between the average income in north-eastern Italy and the average income in southern Italy (in 2004 the average family income was 58.1% higher in the north-east, while after a drop in the relative distance to 46.7%, it has started again to grow from 2014 and peaked to the 58.6% in 2016).

The larger economic difficulties in southern Italy are also highlighted by the higher unemployment rates. Figure 2 reports the official unemployment rates of Italian macro-regions between 2004 and 2016 (Panel A) produced by the Italian National Institute of Statistics (ISTAT), and the percentage of unemployed individuals over unemployed plus employed individuals in our sample (Panel B). Note that in the ISTAT data, the south and islands are grouped together and, obviously, data for each year are available. To allow comparability in Fig. 2, we thus put together the south and islands.

The unemployment rates calculated in our sample do not differ very much with respect to the ISTAT data. Obviously, official data are more reliable indicators of each macro-region’s economic conditions since ISTAT uses larger samples of the workforce, and the statistics are updated over the whole year, while Bank of Italy data are cross-section collected at a unique point of time in the year. However, the fact that the two rates are quite similar is an indication of the quality of the data collected by the Bank of Italy. This further supports the conclusions reached by Annoni and Weziak-Bialowolska (2016).

Other descriptive statistics are reported in the Appendix.

3.2 Method

Consider a generic ordinal variable yi with I categories. The Leti index is a measure of heterogeneity for an ordinal variable proposed by Leti (1983) and could be calculated as follows:

where F(yi) is the cumulative relative frequency of yi.

The Leti index equals 0 if frequencies are concentrated in one category (homogeneity), while it is equal to (I−1)/2 if heterogeneity is highest (in the case of an even number of categories). The latter case occurs when frequencies are equally split between category 1 and the highest category I. Grilli and Rampichini (2002) have shown that the Leti index can be decomposed by groups.Footnote 8 In particular, suppose that a population of size n can be divided in j groups (j = 1,…,J); thus, we will indicate with ni,j the frequency observed for category i in group j, while nj indicates the size of group j. The within-group heterogeneity can be calculated as follows:

where Lj is the Leti index calculated inside each group j. The between-group heterogeneity is instead given by:

where F(yij) is the cumulative relative frequency of yi in group j. Thus, a simple measure of polarisation is given byFootnote 9:

The index of polarisation is equal to 0, when all the groups have the same relative frequency distribution, in other words, when there is not ‘between-groups heterogeneity’. The index goes up as between-groups heterogeneity increases. At the same time, PM decreases as LW increases, since an increase in within-group heterogeneity also implies that people have more difficulty in identifying themselves as part of a particular group. The number one at the denominator is used to avoid the positive divergence of PM when LW = 0. In the latter case, we have that PM = L = LB, and also that max (PM) = max (L). In the case of condgen, we have that max (L) = 2.5. Thus, the polarisation index assumes the maximum value when there is not heterogeneity inside each group, but a large heterogeneity between groups exists. Furthermore, the addition of one at the denominator is also useful to avoid that PM = 1 when LW = LB. This represents a situation in which heterogeneity inside each group is as large as that between groups, hence the key element of polarisation, the identification in a group and the simultaneous alienation from the others, is missing.Footnote 10

It is noteworthy that an indicator referring to a year is perfectly comparable with an indicator calculated for another year since it is not dependent on population size. Therefore, this makes it possible to assess whether or not polarisation increases.

Our group partition is based on macro-regions. Obviously, if economic hardship is directly calculated among these groups, our results may be influenced by other population compositional effects (for instance, level of education, the level of cumulated wealth, the number of family members, etc.). Thus, we need to consider other confounding effects to be sure that we are capturing polarisation among macro-regions.

In order to isolate the polarisation across macro-regions, we run a random intercept (at the family level) ordered logit regression, where the dependent variable is condgen, while the right-hand side variables are age of the respondents, level of education, civil status, level of wealth and income, being a foreign-born individual, size of the town, number of income earners, family size, and a dummy for each macro-region (north-west, -east, centre, south, islands). Since data are collected for each member of the family, our data have a hierarchical structure in which all the individuals are nested in their respective families. For this reason, the assumption of observation independence is clearly violated in our data. This is why we use a multilevel model to account for this hierarchical data structure.Footnote 11 In particular, we have that, conditional on a set of fixed effects xij, a set of cut-off points κk = (κ1, κ2,.., κI-1) where I is the number of possible outcomes, and a set of random effects uj, the cumulative probability of the response being in a category higher than k is:

where H is the logistic cumulative distribution.

\(x_{ij}\) represents the vector of the covariates with regression coefficients \(\beta_{1}\).. Nij is a set of dummy variables capturing the macro-area of the individual i nested in the family j, \(\beta_{2}\) are the associated coefficients. The random effects uj are M realisations (we have M clusters represented by the M families surveyed in our sample) from a multivariate normal distribution with mean 0 and Σ variance matrix.

The model may also be rewritten in terms of a latent linear response, where observed ordinal responses condgenij are generated from the latent continuous responses, as it follows:

The errors \(\varepsilon_{ij}\) are distributed as logistic with mean 0 and variance π2/3 and are independent of uj.Footnote 12

After estimating our random intercept model, we keep only the variable capturing the macro-region and the year fixed effect free to vary among individuals, while all other controls are fixed to the same value for every i.

Note that the ordered model assumes that the coefficients associated to right-hand-side variables are equal across o each category of condgen – that is, they exert the same effect on the odds of going to a higher category everywhere along the scale (the so-called proportional odds assumption). This hypothesis is relaxed in an alternative model as the multinomial logit model. However, it must be said that the latter model neglects the ordering in the modalities of the dependent variable, hence, at least from a theoretical point of view, multinominal logit is not the most suited model for our analysis. We checked the differences in the polarisation index that may turn out using these two alternative approaches. The results are reported in the robustness check section.

Then, we predict at the individual level the probability of being in each separate condgen category. Finally, we assigned each individual to the category for which the probability is higher by obtaining a new variable called bw_condgen. This new variable will be free from the individual heterogeneity attributable to demographic and socio-economic traits (since we are assigning the same characteristics to all the individuals), but it will be mainly determined by the structural difference in reacting to difficult economic times between macro-regions. Thus, this variable will be used to calculate LB as reported in Eq. 3.

To obtain a measure of within-group heterogeneity, we run a separate ordered logit model for each macro-region. Therefore, for each individual i belonging to region j (with J = NW, NE, C; S, I), we predict the probability of being in each one of the condgen categories. Then, we assign each individual to the category for which the probability is the highest, obtaining, therefore, a new variable that we call wi_condgen. The latter variable will be used to calculate Lw, as reported in Eq. 2. Finally, note also that since we assign the same probability to individuals with similar characteristics, this should solve the problem of the possible dependence of the perception of the ability to make ends meet on the definition of a reference group.

Finally, the indicator of polarisation among Italian macro-regions may be calculated according to Eq. 4.

4 Results

4.1 Main results

Table 2 reports the results of the regression models. Even though the main goal of the analysis is to obtain an indicator of polarisation, we believe that the reasonability of these results is a prerequisite for the reliability of the proposed indicator. In particular, the random intercept ordered logit model estimated to obtain the variable bw_condgen is reported in column 1,Footnote 13 while the separated regressions for each macro-region are reported from column (2) to column (6).Footnote 14 Please note that the results in columns 2–6 are used to calculate the within-group heterogeneity. The names of the variables used as regressors are in large part self-explanatory, and we will give further details in the text when needed.

In general, all the results are very intuitive. Most educated people, married people and singles have a higher probability of easily arriving at the end of the month with enough money compared to both divorced and widows. Foreign-born individuals are less likely to easily arrive at the end of the month with enough money.Footnote 15 This result is not surprising given that, in Italy, the immigrant workforce is prevalently unskilled and therefore employed in low-wage jobs (see Bratti and Conti 2018).

The larger the family (variable Family size), the lower the probability of declaring that it is easy to meet the monthly needs of the family. Obviously, the higher the level of income and wealth, and the greater the income of earners in the family, the easier it is to arrive at the end of the month with enough money. Unsurprisingly, unemployed persons are those in greater economic difficulties with respect to all the other occupational statuses. In addition, living in larger cities where the cost of living is higher implies a lower probability of arriving easily at the end of the month with enough money.Footnote 16

An interesting result is that associated with age; indeed, the results show that older individuals (in particular, those who are over 65) tend to have fewer difficulties than younger individuals (with the exception of the north-east and the south). Note that age is not entered linearly in the econometric model because the consumption/saving behaviour among different age groups may be very different, and this may produce in turn consequences on the perceived economic hardship. Indeed, our result seems to be in line with Mirowsky and Ross (1999), who, using survey data on US individuals, found that even though older individuals have lower incomes than younger persons, they are less likely to be in a situation of economic hardship than the latter. They surmise that this is also due to the adoption of a more moderate lifestyle in the older age. This hypothesis seems to be empirically supported by Olafsson and Pagel (2018), who, using very detailed data on the income and expenditure of more than 20% of Iceland’s population, found that older individuals tend to reduce their spending on leisure goods. Italy is characterised by a generous pension scheme for older individuals. For instance, a full-career average worker who started to work before 1996 (the notional defined contribution pension system, which is definitively less generous, does not apply to these workers), hence the current older part of the population, receives a net replacement that is near 100%.Footnote 17 A publicly funded health-care system also exists. In contrast, unemployment benefits require a relatively long job tenure, and the duration of the benefit is relatively short.Footnote 18 Therefore, in addition to the ‘moderation in lifestyle’, the difference among age groups in Italy may be determined by the characteristics of the Italian welfare system, which though protecting older individuals from economic downturns, does not support younger individuals. The main source of support for a young individual has to be sought from within the family. In turn, this family-based support undermines a younger individual’s ability to be autonomous (see Dalla Zuanna 2001; Saraceno 2016). Accordingly, ISTAT (2020) reported that the incidence of poverty was lower in those households where the age of the household reference person was over 64 years.

Therefore, two completely different stories may explain why in southern and in north-eastern Italy individuals over 65 are no more likely than younger individuals to reach the end of the month with enough money. In particular, in southern Italy, where the unemployment rate is very high, young individuals rely on their parents (or even on their grandparents) for economic support. This obviously also increases the economic difficulties for the older population.

In contrast, in north-eastern Italy, even during the worst phase of the economic recession, the unemployment rate was the lowest in the country. In this area, the fact that there are no substantial differences among age groups may indicate a more equal distribution of resources among the age distribution. Note also that in column 1, the coefficient of the dummy associated with coming from the north-east indicates that this is the area where the likelihood of arriving very easily at the end of the month is highest.

Finally, in Fig. 3, we report the evolution of the polarisation in economic hardship among Italian macro-regions in 2004–2016. Additionally, the two components of the indicators are reported in the plot (note that the values corresponding to Lw are reported in the secondary vertical axis).

Despite the large economic divide across Italian regions, polarisation during the studied period was low, even at the peak of the economic recession in 2012. In fact, the value of the indicator is equal to 0.04 (hence close to the minimum). With the beginning of Italy’s economic difficulties in 2008, the PM index continuously increased until 2012, while only a slight decline is observable after this year. It is interesting that in a period of relatively good economic performance for Italy, 2004–2006, the between heterogeneity was decreasing, whereas within heterogeneity was increasing, leading to a decrease in the indicator of polarisation. Italy’s economic troubles seem to have interrupted the reduction of heterogeneity among macro-regions. That being said, as also underlined by Ciani and Torrini (2019), the increase in inequality during the recession has reduced within-group homogeneity, and this has led to only a slight growth in polarisation. In 2014–2016, a timid recovery of the Italian economy was sufficient to induce a decrease in between heterogeneity, which was the main driver of the slight reduction in polarisation (given that within heterogeneity went in the opposite direction).

In Fig. 4, we report the relative frequency distribution of the variable lb_condgen for each macro-region in the selected years 2006 (before the recession), 2008 (during the first recession), 2010 (after the first recession), 2012 (second recession) and 2016 (after recession). It is interesting to see that the increase in the between heterogeneity reflects mainly the increased distance between north-eastern Italy and the rest of the country (even with respect to north-western Italy) in the years of recession. At the same time, the increased similarity between the distribution of the relative frequencies in the north-west/center and the south has contributed to limiting the increase in between heterogeneity.

The distributions of the relative frequency in north-eastern and north-western Italy were substantially the same in 2006: two modes were observed for the category ‘fairly easily’ and ‘easily’. Starting from 2008, the distribution in the north-west became unimodal and the highest relative frequency was registered for the category ‘fairly easily’. Additionally, in the north-east, the distribution became unimodal, but the highest relative frequency was registered for the category ‘easily’.

Another interesting finding is associated with the Leti index, which is calculated separately for each macro-region (Fig. 5).Footnote 19

Indeed, the Leti index based on self-reported economic hardship indicates that heterogeneity is higher in southern Italy (and in the Islands) than in northern Italy, thus highlighting a more variegated concentration of individuals among the categories of the variable condgen. This seems to align with the evidence reported by Ciani and Torrini (2019) but using a very different way of measuring inequality. Note also that starting from 2012, the Leti index inside each macro-region decreased.

Overall, we believe that our results support the idea that polarisation may be used to monitor, at least in part, two crucial components of territorial cohesion. Indeed, given the large economic divide between northern and southern Italy, one may simply conclude that the country has problems in terms of cohesion – at least, according to the traditional view of this concept. However, this view will capture only a part of one dimension (i.e. territorial quality) without considering other aspects of this intricate concept. Analysing territorial polarisation means to explore at the same time alienation (thus regional disparities) and the within-group identification. When both are high, this leads to a polarised society, i.e. a society where territorial quality is low and national identity is fragmented. The Italian case highlights one important lesson. All the measures aimed, for instance, at reducing social exclusion by diminishing economic inequality that can be applied at the regional level may indeed produce an unexpected adverse effect at the national one if they produce a fragmented identification. In other words, this marks the importance of working simultaneously on both the reduction of regional differences and on fighting inequalities at the local level. Polarisation in Italy is indeed kept low by within-macro-region heterogeneity. Interventions to reduce social exclusion in southern Italy are frequently invoked in the Italian political debate; however, our results suggest that if a real process of regional convergence does not accompany these interventions, this will produce a harmful effect in terms of polarisation.

4.2 Robustness check

As a robustness check, we have also calculated polarisation using the frequencies of the variable condgen without running the multilevel ordered logit for taking into account population compositional effects; that is, we have calculated Lw and LB directly from raw data without doing the multivariate analyses for getting the variables wi_condgen and bw_condgen.

For comparative purpose, we have also calculated an income-based index of polarisation. In particular, we have defined an ordered variable going from 1 to 6 on the basis of the following six income intervals: (1) Income ≤ 17,200€; (2) 17,200€ < Income ≤ 24,200€; (3) 24,200€ < Income ≤ 32,000€; (4) 32,000€ < Income ≤ 41,600€; (5) 41,600€ < Income ≤ 55,600€; (6) Income > 55,600€.Footnote 20

The decision to consider six categories is made to allow a better comparison with the results obtained using condgen, given that the maximum value of the Leti index depends on the number of categories of the ordered variable. Next, we have estimated a multilevel linear regression model where the dependent variable is log of earnings while the right-hand-side variables are the same as those used when condgen is the response variable (with the obvious exception of income and wealth). Then, we fixed individual characteristics as done for calculating bw_condgen to predict individual earnings. This predicted variable is used to attribute the income-category to each individual and then to calculate the LB as described above. The LW is instead calculated by running a separate multilevel regression for each macro-area and then predicting the income category for each individual.

Obviously, the choice of the income intervals exposes the analysis to a certain degree of arbitrariness. For this reason, we also propose the results obtained using different income intervals (these are reported in the Appendix).

In Fig. 6, we report the polarisation index, the within and the between heterogeneity calculated directly using raw data without the adjustment for population compositional effects. The results do not change a lot compared to those reported in Fig. 3. Between heterogeneity decreases more rapidly after the 2012 recession in Fig. 6 than in Fig. 4; however, a small reduction in within heterogeneity happens after 2010 in Fig. 6. Overall, this leads to a very similar evolution of the polarisation index. In addition, in Figure 9 (see the Appendix), we also report the results obtained using a recoded version of the variable condgen obtained by merging as it follows its categories: 1: ‘with great difficulty’ or ‘with difficulty’; 2 ‘with some difficulty’; 3 ‘fairly easily’; 4 ‘easily’ or ‘very easily’. The same indications also emerge in this case. This was done to take into account that those declaring having reached the end of the month with great difficulty (respectively, very easily) may feel close to those who have answered with difficulty (respectively, easily).

As anticipated in the method section, a further robustness check consists of repeating our estimation using a multinomial logit model instead of the ordered model. The results are reported in Fig. 7.Footnote 21

In Fig. 8, the polarisation income-based index, the associated LB and the LW, and the Leti index calculated for each macro-region are reported respectively in panel A and B.Footnote 22

Although the pattern followed by the income-based polarisation index is to some extent different by that reported in Figs. 3 and 6, also in this case polarisation assumes low values. As explained in the introduction, the reduction of income due to a recession does not automatically imply material hardship. Hence, we believe that it is perfectly normal that the two indicators follow a partly different pattern. The eventual divergence in the indication offered by the income-based index and the self-reported hardship index may be more problematic in interpreting what is going on in a given society. However, this is not the case since both measures indicate a low level of polarisation. Note also that using an income-based measure of LB we have that the general increase in unemployment in the 2012 recession with the associated reduction in income (the 2008 effect is only barely detectable) has heavily affected all the macro-regions determining a temporary reduction of their relative distance, which, however, has started to increase again in 2016. As explained in Sect. 2, family needs can be satisfied from sources other than income. For this reason, when we look at between heterogeneity through the lens of the indicator based on perceived hardship, the higher availability of wealth to finance consumption in the northern part of Italy is likely to explain why we observe the opposite pattern of LB in Fig. 3.

Similarly, the evolution of within heterogeneity is similar to that described by Ciani and Torrini (2019), i.e. a small reduction in 2014 is followed by a new increase in inequality. However, also in this case we have that the reduction in inequality is driven by the generalised reduction of income inside each macro-area, but this does not automatically imply that the difficulties in meeting the family needs have been the same for high- and low-wealth families.

We believe that these pieces of evidence further support the necessity of also adding to the traditional measures of income inequality the evaluation of polarisation in terms of perceived economic hardship. Even though the two approaches lead to roughly the same conclusion about the level of polarisation, we have that the indicator obtained using self-perceived hardship in meeting family ends may be viewed as a more genuine representation of the difficulties that low-wealth families have faced in a period of generalised reduction of income.

Note that a similar pattern can be observed between Fig. 7 and Fig. 8 (Panel A). However, it should be noted that even though in Fig. 7 we observe a decreasing trend in LB and in the polarisation index, these decreases are substantially in the order of the third decimal phase of the indicators. The indicator represented in Fig. 7 suggests that between heterogeneity remained roughly stable in the observed period, while within-groups heterogeneity decreased after 2010 and this has led to a slight decrease in polarisation. Also, this indicator suggests that polarisation among macro-regions is low, but we have less confidence in it since it is constructed ignoring the ordered nature of the variable condgen and this implies that: (1) this type of model usually has more parameters than necessary; (2) implies a loss in the precision of the estimator; (3) the results are very difficult to interpret.Footnote 23

When the Leti index for each macro-area is considered (Fig. 8 – Panel B), the picture is different from that offered in Fig. 5. It is immediately clear that southern Italy and islands are in this case characterised by the lowest degree of heterogeneity. We believe that this is likely to be because we are grouping together people in only six income classes and this is artificially increasing homogeneity inside each category.

The Leti index is indeed a measure of heterogeneity for ordinal variables, hence even though we have categorised income, it seems to be not suited for quantitative variables.

5 Conclusions

It is generally recognised that Italy is characterised by a wide economic divide between the north and the south, which the recent economic recession has further exacerbated, at least if we consider traditional measures of the economic condition of a population, as for instance the GDP per capita or the unemployment rate. Therefore, this paper investigated the polarisation in economic hardship among Italian macro-regions before, during and after the two recessions that hit Italy in the first 20 years of the twenty-first century. Despite a modest increase in polarisation during the years of economic difficulties, we find that polarisation is low in the country. Paradoxically, the large inequalities within each region, which hamper the formation of group identity, represent the main obstacles to the increase in polarisation.

This obviously does not mean that economic inequality among individuals should not be reduced within a society, but that a reduction of between-group economic distance (in the Italian case the north–south divide) should also be one of the first goals on the political agenda. In other words, if the economic divide between Italian regions is not reduced, then the reduction of economic inequality among individuals could turn out to be, paradoxically, harmful for Italian social cohesion.

The system of conditional minimum guaranteed income, the so-called reddito di cittadinanza (from hereon RDC) introduced in Italy in 2019 and aimed at furnishing economic support to people who are outside the workforce and have a family wealth below a given threshold, may be viewed as a way to reduce the share of the population in severe economic hardship. The report published by the National Social Insurance Agency (INPS) in September 2021 highlights that 54.8% of the families that have required the RDC in the period January–August 2021 were from the southern part of the country (this percentage was 58% in 2020), while 27.9% were from northern Italy. On the one hand, this again underlines the economic gap between the two parts of the country. On the other, it will be interesting to measure polarisation in the very next years. Indeed, the RDC may have increased homogeneity in southern Italy without substantially resolving the structural gap between the two parts of the country. We believe that our paper contributed on methodological grounds by proposing a relatively simple way to obtain an index of polarisation based on a self-reported ordinal measure of economic hardship. Therefore, our index may be viewed as an easy and rapid method to monitor the consequence in terms of polarisation of the introduction of policy measures such as the RDC.

Even though our analysis was limited to Italy, the calculation could be easily extended to European regions using EU-SILC data. Hence, polarisation in economic hardship could be considered a further instrument with which to monitor the cohesion inside the EU together with the traditional measure of convergence in GDP per capita. In particular, we believe that our measure is particularly suitable to capture elements coming from two out of three of Camagni’s territorial cohesion dimensions. That is, when regional disparities are large, as in the Italian case, this reflects a low territorial quality and this aspect should be in turn reflected in the alienation dimension of the concept of polarisation. At the same time, when groups are homogeneous within them (strong identification), this may lead to a potential risk for the capability to project a shared vision of the future among groups (typical of a highly polarised society). Except for Medeiros’s (2016) proposal, there is a lack of a summary indicator to measure a multidimensional concept such as territorial cohesion. However, Medeiros’s approach is based on a data synthesis technique, such as factorial analysis, and then has the limitation of being applicable only to territorial comparison inside a given country, since nothing can grant that the same factors will be extracted in different countries.

Another interesting point raised by this paper is that associated with the relationship between age and economic hardship. Even, according to OECD (2017), older individuals are those characterised by the highest risk of ending up in a situation of economic hardship, we find that the opposite is true in Italy, or at least in three out of the five Italian macro-regions. However, this is not totally surprising given the country’s family-based welfare system (see Saraceno 2016). We believe that future research may better shed light on why in north-eastern and southern Italy, there are no significant differences in economic hardship among age groups.

The main limitation of this work is its data source. SHIW data are indeed designed to be representative at the national level and not at the subnational one. However, previous researches have shown that data could be considered reliable at the NUTS 1 level.

Another obvious limitation is that the researcher has defined the group partition (in our case macro-areas). Hence, even though we found low polarisation, this does not mean that that using another grouping variable would produce the same results. However, we believe that this problem is in part limited by having taken into account the compositional effect of the population.

Finally, another limitation is in the use of survey questions to investigate the economic conditions of families. Several problems of underreporting or imprecise reporting may be relevant when income is considered. At the same time, the perception of material hardship may be influenced by the living standards of the respondent’s reference group. However, we believe that the latter problem could be tackled on the empirical ground by assigning individuals with similar socio-economic characteristics similar predicted categories of the associated ordered response variable.

Data availability

The analyses presented in the paper are realised using STATA16. No ad hoc commands were programmed. The command lines used in the paper are available upon request to the corresponding author.

The analyses carried out in this paper are based on publicly available data. In, particular, the data are downable at: https://www.bancaditalia.it/statistiche/tematiche/indagini-famiglie-imprese/bilanci-famiglie/distribuzione-microdati/index.html?com.dotmarketing.htmlpage.language=1.

Notes

According to the Eurostat Business Cycle Clock, Italy has experienced two recessions in the period under analysis: the first, which registered the largest drop in GDP, started in the first quarter of 2008 and lasted until the second quarter of 2009; the second, which was longer than the first, started in the second quarter of 2011 and lasted until the second quarter of 2013, followed by a period of economic slowdown that persisted until the second quarter of 2015. See https://ec.europa.eu/eurostat/cache/bcc/bcc.html. Istat (2019) considers instead the first quarter of 2012 as the starting point of the second recession. For the sake of simplicity, we willl refer to the first and to the second recession, as the 2008 Recession and the 2012 Recession, respectively.

The referendum authorised by the Catalan Parliament was later declared unconstitutional and suspended in September 2017 by the Constitutional Court of Spain. The former premier of Catalonia, Carles Puigdemont, was removed from office by the Spanish Government and a European arrest warrant was issued against him and other members of the Catalan Government. It is curious to note that Puigdemont was recently arrested (and later released) in Sardinia (Italy), where he was invited as a guest to a conference of the Sardinian autonomist movement.

It should be noted that one of the main centre-right Italian parties, the ‘LEGA’, was born in 2019 from the LEGA Nord, a former party constituted for the final aim of a secession of the northern part of Italy from the rest of the country.

This obviously does not mean that, on average, income is equal between northern and southern Italy. The latter part of the country is indeed characterised by high structural unemployment, a significant incidence of the shadow economy, and a low female participation in the labour market. Destefanis and Pica (2011) have also shown that the regional difference in average wage is driven by the number of hours worked and not by local difference in the hourly wage rate.

The acronym NUTS stands for Nomenclature of Territorial Units for Statistics. NUTS 0 refers to the country, NUTS 1, NUTS 2, NUTS 3 indicate more fine territoral levels. For more information see https://ec.europa.eu/eurostat/web/nuts/background.

For more information on this survey, see https://www.bancaditalia.it/pubblicazioni/indagine-famiglie/index.html?com.dotmarketing.htmlpage.language=1 and Baffigi et al. (2016).

In particular, they show that the Leti index may be rewritten as the sum of the between-group heterogeneity component and the within-group component.

Mussini (2018) proposed a similar measure given by the ratio LB/LW. However, the indicator proposed by Mussini does not have a maximum.

As in Esteban and Ray (1994) we are obviously simplifying the analysis by considering economic hardship (instead of income) as the variable that determines the polarisation of a society. Polarisation may indeed be viewed as caused by a plethora of social determinants but we believe that our measure of hardship is a good proxy of the differences in the socio-economic conditions inside the population.

See Grilli and Rampichini (2014) for a review of multilevel modelling.

Another specification of the model could be a three levels’ model where individuals are nested in their family and family are nested in their regions. Unfortunately, problems in the maximisation algorithms has forced us to focus only on a two levels’ model. In any case, the regional dummies inserted in the model can be seen as a control for regional heterogeneity. Hence, we are not able to capture the eventual correlation due to cultural norms and/or local regulations that may influence how families living in the same region answer to our response variable. In any case, it can be noted that this regional heterogeneity is in part taken into account by the regional dummies.

To obtain the variable bw_condgen, in particular we fix the control variables at the following values: sex = male, age ≥ 41 – ≤ 50, title of study = high school, civil status = married, occupational status = white collar, country of birth = Italy, family size = 4, no of income earners = 2, family income = 37,800 (the mean income for Italy over the entire period), family wealth = 281,000 (the mean family wealth over the period 2004–2016), size of the town ≥ 20,000—≤ 40,000.

Note that the random effects are not directly estimated as model parameters but are instead summarised according to the unique elements of Σ, known as variance components.

Consider that this category includes immigrants. According to ISTAT official data, immigrants are mainly concentrated in northern and central Italy. See for istance https://www.istat.it/it/files//2017/11/EN-trasferimenti-di-residenza.pdf. See also Table 3 in the Appendix.

In north-eastern Italy, there is no city with a population over 500,000 inhabitants.

See Asenjo and Pignatti (2019) for details on the Italian unemployment insurance scheme. See also Floridi (2018) for an overview of the Italian welfare system.

These are the Lj in Eq. 2.

These values are obtained dividing the family earnings distribution for the whole of Italy and for the whole of the 2004–2016 period in six intervals, each containing about 16% of the observations.

The tables are available upon request to the corresponding authors. They are not reported here to save space.

The tables reporting the results of the multilevel regression estimated for obtaining LB and LW (not reported here) are available upon request to the corresponding author.

An alternative could be to estimate a partial proportional odds (PPO) model, i.e. where only the coefficients that violate the proportional odds assumption are let free to vary from a category to another. However, we were unable to extend a PPO model to the multilevel case. This could be a future improvement of our analysis.

References

Abrahams, G.: What “is” territorial cohesion? What does it “do”?: Essentialist versus pragmatic approaches to using concepts. Eur. Plan. Stud. 22(10), 2134–2215 (2014)

Annoni, P., Weziak-Bialowolska, D.: A measure to target antipoverty policies in the European union regions. App. Res. Qual. Life 11, 181–207 (2016)

Ayala, L., Jurado, A., Perez-Mayo, J.: Income poverty and multidimensional deprivation: lessons from cross-regional analysis. Rev. Income Wealth 57(1), 40–60 (2011)

Baffigi, A., Cannari, L., D’Alessio, G.:Cinquant’anni di indagini sui bilanci delle famiglie italiane: storia, metodi, prospettive. Bank of Italy, Questioni di Economia e Finanza (2016). https://www.bancaditalia.it/pubblicazioni/qef/2016-0368/index.html. Accessed 5 January 2020

Bank of Italy: Shiw Historical Database 1977–2016, version 07 October 2019

Boeri, T., Ichino, A., Moretti, E., Posch, J.: Wage Equalisation and Regional Misallocation: Evidence from Italian and German Provinces. Centre for Economic Policy Research, Discussion Paper DP13545 (2019). http://www.andreaichino.it/wp-content/uploads/2019/05/germany_italy.pdf. Accessed 1 March 2020

Bratti; M., Conti, C.: The effect of immigration on innovation in Italy. Reg Stud, 52(7), 934–947 (2018)

Cabral, A.C.G., Gemmell, N., Alinaghi, N.: Are survey-based self-employment income underreporting estimates biased? New evidence from matched register and survey data. Int. Tax Pub. Fin. (2020). https://doi.org/10.1007/s10797-020-09611-8

Camagni, R.: Territorial cohesion: a theoretical and operational definition. Sci. Reg. (2010). https://doi.org/10.3280/SCRE2010-001007

Ciani, E., Torrini, R.: The geography of Italian income inequality: recent trends and the role of employment. Bank of Italy, Questioni di Economia e Finanza (2019). https://www.bancaditalia.it/pubblicazioni/qef/2019-0492/QEF_492_19.pdf. Accessed 15 February 2020

Dalla Zuanna, G.: The banquet of Aeolus.: a familistic interpretation of Italy’s lowest low fertility. Demogr. Res. 4(5), 133–162 (2001)

Daniele, V., Malanima, P.: Regional wages and the North-South disparity in Italy after the Unification. Riv. Storia. Econ. XXXII I(2), 117–158 (2017)

Deidda, M.: Economic hardship, housing cost burden and tenure status: evidence from EU-SILC. J. Fam. Econ. Iss. 36, 531–556 (2015)

Destefanis, S, Pica, G: The wage curve an italian perspective. CELPE Discussion Papers. 117, (2011)

Diener, E., Biswas-Diener, R.: Will money increase subjective well-being? A literature review andguide to needed research. Soc. Ind. Res. 57(2), 119–169 (2002)

Duclos, J.Y., Esteban, J.M., Ray, D.: Polarisation: Concepts, measurement, estimation. Econometrica 72, 1737–1772 (2004)

Esteban, J.M., Ray, D.: On the measurement of polarisation. Econometrica 62, 819–851 (1994)

Esteban, J.M., Ray, D.: Linking conflict to inequality and polarisation. Am. Econ. Rev. 101, 1345–1374 (2011)

Floridi, G.: Social policies and intergenerational support in Italy and South Korea. Contemp. Soc. Sci. (2018). https://doi.org/10.1080/21582041.2018.1448942

Frieden, J., Walter, S.: Understanding the political economy of the Eurozone crisis. Annu. Rev. Polit. Sci. 20, 371–390 (2017)

Grilli, L., Rampichini, C.: Scomposizione della dispersione per variabili statistiche ordinali. Statistica (bologna) 62, 111–116 (2002)

Grilli, L., Rampichini, C.: Specification of random effects in multilevel models: a review. Qual. Quant. (2014). https://doi.org/10.1007/s11135-014-0060-5

Gudmundsdottir, D.G.: The impact of economic crisis on happiness. Soc. Ind. Res. 110(3), 1083–1101 (2013)

INPS: Osservatorio sul reddito e pensione di cittadinza (2021). Available on line: https://www.inps.it/dati-ricerche-e-bilanci/osservatori-statistici-e-altre-statistiche/dati-cartacei-rdc

Istat: Poverty in Italy. 2020. July 2021. Available on line: https://www.istat.it/it/files/2021/07/Poverty_2020_En.pdf

Jaimovich, N., Siur, H.E.: The young, the old and the restless: demographics and business cycle volatility. Am. Econ. Rev. 99(3), 804–826 (2009)

Kapeller, J., Gräbner, C., Heimberger, P.: Economic polarisation in Europe: Causes and Policy Options. The vienna institute for international economic studies (2019). https://wiiw.ac.at/economic-polarisation-in-europe-causes-and-options-for-action-dlp-5022.pdf

Labeaga, J.M., Molina, J.A., Navarro, M.: Income satisfaction and deprivation in Spain. IZA Discussion Paper no.2702 (2007) https://www.econstor.eu/bitstream/10419/34552/1/550107282.pdf. Accessed 20 Feb 2020

Layte, R., Nolan, B., Whelan, C.T.: Reassessing income and deprivation approaches to the measurement of poverty in the Republic of Ireland. Econ. Soc. Rev. 32(3), 239–262 (2001)

Leonardi, R.: regional development in italy: social capital and the mezzogiorno. Oxford Rev. Econ. Policy 11(2), 165–179 (1995)

Leti, G.: Statistica descrittiva. Il Mulino, Bologna (1983). Medeiros, E.: Territorial Cohesion: An EU concept. Eur. J. Spat. Dev. 60 (2016). Available on line: http://www.nordregio.se/Global/EJSD/Refereedarticles/refereed60.pdf

Mayer, S.E., Jencks, C.: Poverty and the distribution of material hardship. J Hum Resour 24(1), 88–114 (1989)

Medeiros, E.: Territorial Cohesion: An EU concept. Eur J Spat Dev, 60 (2016). Available on. http://www.nordregio.se/Global/EJSD/Refereed articles/refereed60.pdf

Meyer, B.D., Sullivan, J.X.: Measuring the well-being of the poor using income and consumption. J. Hum. Resour. 38, Special issue on income volatility and implications for food assistance programs, 1180–1220 (1993)

Mirowsky, J., Ross, C.E.: Economic hardship across the life course. Am Soc Rev 64(4), 548–569 (1999)

Montalvo, J.G., Reynal-Querol, M.: Ethnic polarisation, potential conflict and civil wars. Am. Econ. Rev. 95(3), 796–816 (2005)

Mussini, M.: On measuring polarisation for ordinal data: an approach based on the decomposition of the Leti index. Stat. Transit. 19(2), 277–296 (2018)

OECD: Preventing Ageing Unequally - Action Plan. Paris (2017). Available on line https://www.oecd.org/social/C-MIN-2017-6-EN.pdf

Olafsson, A., Pagel, M.:The retirement-consumption puzzle: new evidences from personal finances. NBER working paper Nr. 24405 (2018). http://www.nber.org/papers/w24405. Accessed 20 Jan 2020

Østby, G.: Polarisation horizontal inequalities and violent civil conflict. J. Peace. Res. 45(2), 143–162 (2008)

Reeskens, T., Vandecasteele, L.: Economic hardship and well-being: examining the relative role of individual resources and welfare state effort in resilience against economic hardship. J. Happiness Stud. 18, 41–62 (2017)

Saraceno, C.: Varieties of familialism: Comparing four southern European and East Asian welfare regimes. J. Eur. Soc. Policy 26(4), 314–326 (2016)

Tormos, R.: Measuring personal economic hardship and its impact on political trust during the great recession. Soc. Ind. Res. 144, 1209–1232 (2019)

Watson, D., Webb, R.: Do Europeans view their homes as castles? Homeownership and poverty perception throughout Europe. Urban Stud. 46(9), 1787–1805 (2009)

Weckroth, M., Moisio, S.: Territorial cohesion of what and why? the challenge of spatial justice for EU’s cohesion policy. Soc. Inc. 8(4), 183–193 (2020)

Funding

The research activity of the first author has been in part financed by the “Fondo per il finanziamento dei dipartimenti universitari di eccellenza” (Law nr. 232/2016).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare of not having conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ruiu, G. Exploring polarisation in economic hardship among Italian macro-regions. Qual Quant 57, 787–817 (2023). https://doi.org/10.1007/s11135-022-01370-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01370-4