Abstract

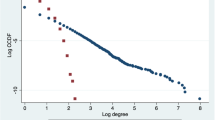

In this paper we propose an adjustment to the Herfindahl–Hirschman concentration index for explicitly considering the role of the topology of financial economic networks on market concentration. The case study of the Italian stock market serves for outlining the relevance of the shareholding network in the measurement of effective concentration. Moreover, we deepen the analysis of the network comparing network centrality measures, that are a well known method for understanding the relative relevance of network nodes. The correlations among them show their relation, and the fact that none of them can completely substitute the information contained in the size of companies. Such analysis constitutes the base for randomized experiments aiming at understanding to which extent the topology of this financial economic network is constraining the market concentration, so we derive and comment the results on the maximum value of HH \(_{i}\) under the scale-free constraint. We also show the fragility of the network under random rewiring, both unconstrained and constrained by the network topology.

Similar content being viewed by others

Notes

We used the sectoral allocation by Italy’s main Stock Exchange Borsa Italiana Group.

Note that the lower bound approaches zero in the case of an atomistic market and that the sensitivity of \(\textit{HH}_{i}\) to the increase of sample size decreases the larger the number of firms considered.

The Herfindahl–Hirschman plays a significant role in the enforcement process of US antitrust laws. Since 1982, the Merger Guidelines have provided an indication for the identification of post merger markets as unconcentrated, mildly concentrated, or highly concentrated based on the value of \(\textit{HH}_{i}\), http://www.stanfordlawreview.org/online/obama-antitrust-enforcement.

When using \(\textit{HH}_{i}\), the antitrust enforcement agencies consider both the post-merger level of \(\textit{HH}_{i}\) and the increase in \(\textit{HH}_{i}\) resulting from the merger. US Department of Justice & FTC, Horizontal Merger Guidelines 5.2 (2010), http://www.justice.gov/atr/public/guidelines/hmg-2010.html#5c.

Consob is the public authority responsible for regulating the Italian securities market.

For more details see http://www.consob.it/main/emittenti/societa_quotate/index.html.

A deeper analysis carried out on the different subsectors of the three main areas Financials, Industrials, Services of the “Entire market” sample has led to partially increasing values for \(\textit{HH}_{i}\), denoting a more robust level of concentration for some economic segment. Apart the value 0.83 of the automobile sector, that can be explained by the absence of the main competitors of Fiat from the sample, the highest value for \(\textit{HH}_{i}\) is linked to the insurance sector, that is really dominated by Generali and Fondiaria Sai SpA. Similar deduction for the banking sector, with the giants Intesa San Paolo and Unicredit overlooking the sample, as they share out the 68 % of the market, or for the “Holding Companies” sector, with Premafin and Italmobiliare that control 43 % of market share. A thorough analysis of the micro-sectors could be only on a global sample, for this reason we limited this analysis to the “Entire market”, as the breaking up of samples of limited size could draw out subsamples with limited economic and statistical significance. Details and data are available upon request.

European Central Bank, EU Banking Structures, Frankfurt am Mein, 2010, available at www.ecb.int/pub/pdf/other/structralindicatorseubankingsector201001en.pdf.

The price/sales ratio is a revenue multiple used in financial valuation. It is the ratio of the market value to the company’s revenues in the fiscal year, and relates the value of the business to the total revenues that it generates. The ratio varies widely across industries.

\(sign(x)=\left\{ {{\begin{array}{cl} 1&{} {x>0} \\ 0&{} {x=0} \\ {-1}&{} {x<0} \\ \end{array} }} \right. \).

References

Amaral, L.A.N., Buldyrev, S.V., Havlin, S., Leschhorn, H., Maass, P., Salinger, M.A., Stanley, H.E., Stanley, M.H.R.: Scaling behavior in economics: I. Empirical results for company growth. J. Phys. I France 7, 621–633 (1997)

Axtell, R.: Zipf distribution of U.S. firm sizes. Science 293, 1818–1820 (2001)

Baravelli, M., Minetti, F.: Il corporate relationship banking tra teoria e pratica: il caso italiano, Bancaria 10, Bancaria Editrice (2011)

Berger, A.N., Black, L.K.: Bank size, lending technologies, and small business finance. J. Bank. Financ. 35, 724–735 (2011)

Bertoni, F., Randone, P.A.: The Small-World of Italian Finance: Ownership Interconnections and Board Interlocks Amongst Italian Listed Companies (2006). SSRN: http://ssrn.com/abstract=917587 or doi: 10.2139/ssrn.917587

Chapelle, A., Szafarz, A.: Controlling firms through the majority voting rule. Physica A 355, 509–529 (2005)

Cotugno, M., Monferrà, S., Sampagnaro, G.: Relationship lending, hierarchical distance and credit tightening: evidence from the financial crisis. J. Bank. Financ. (2012). doi: 10.1016/j.jbankfin.2012.07.026

D’Errico, M., Grassi, R., Stefani, S., Torriero, A.: Shareholding networks and centrality: an application to the Italian financial market. In: Naimzada, A., Stefani, S., Torriero, A. (Eds.) Network, Topology and Dynamics. Theory and Applications to Economics and Social Systems, pp. 215–228. Springer, Berlin (2008)

De Mitri, S., Gobbi, G., Sette, E.: Relationship Lending in a Financial Turmoil, Bank of Italy “Temi di Discussione”, Working Paper No. 772 (2010). http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1788037 or doi: 10.2139/ssrn.1788037

Dietzenbacher, E., Temurshoev, U.: Ownership relations in the presence of cross-shareholding. J. Econ. 95(3), 89–212 (2008)

Ferri, G, Riggi, M.R., Rotondi, Z.: Inside the crisis: the importance of the bank-firm relationship in harsh times. In: Bracchi, G., Masciandaro, D. (Eds.) Quattordicesimo Rapporto sul Sistema Finanziario Italiano, Edibank (2009)

Flath, D.: Indirect share holding within Japan’s business groups. Econ. Lett. 38, 223–227 (1992)

Gaffeo, E., Gallegati, M., Palestrini, A.: On the size distribution of firms. Additional evidence from the G7 countries. Physica A 324, 117–123 (2003)

Garlaschelli, D., Battiston, S., Castri, M.V., Servedio, D.P., Caldarelli, G.: The scale-free topology of market investments. Physica A 350, 491–499 (2005)

Glattfelder, J.B., Battiston, S.: Backbone of complex networks of corporations: the flow of control. Phys. Rev. E 80, 036104 (2009)

Grassi, R.: Vertex centrality as a measure of information flow in Italian corporate board networks. Physica A 389, 2455–2464 (2010)

Grassi, R., Stefani, S., Torriero, A.: Some new results on the eigenvector centrality. J. Math. Sociol. 31(3), 237–24 (2007)

Grassi, R., Scapellato, R., Stefani, S., Torriero, A.: Betweenness centrality: extremal values and structural properties. In: Naimzada, A., Stefani, S., Torriero, A. (Eds.) Network, Topology and Dynamics. Theory and Applications to Economics and Social Systems, pp. 161–176. Springer, Berlin (2009)

Grassi, R., Stefani, S., Torriero, A.: Extremal properties of graphs and eigencentrality in trees with a given degree sequence. J. Math. Sociol. 34(2), 115–135 (2010)

Herfindahl, O.C.: Concentration in the Steel Industry, Ph.D. Thesis, Columbia University (1950)

Hirschman, A.O.: The paternity of an index. Am. Econ. Rev. 54(5), 761 (1964)

Huber, J., Ryll, S.: Kapitalbeteiligungen von Bund und Laendern. Eine Analyse auf Basis einer Verflechtungsrechnung, Zeitschrift fur öffentliche und gemeinwirtschaftliche Unternehmen 12(3), 287–305 (1989)

Iori, G., De Masi, G., Precup, V., Gabbi, G., Caldarelli, G.: A network analysis of the Italian overnight money market. J. Econ. Dyn. Control 32(1), 259–278 (2008)

Lee, K.M., Yang, J.S., Kim, G., Lee, J., Goh, K.I., Kim, I.: Impact of the topology of global economic network on the spreading of economic crises. PloS One 6, e18443 (2011). doi:10.1371/journal.pone.0018443

Milakoviç, M., Alfarano, S., Lux, T.: The Small Core of the German Corporate Board Network, Working Paper, Kiel Institute for, the World Economy, No. 1446 (2008)

Newman, M., Barabasi, A.L., Watts, D.J.: The Structure and Dynamics of Networks, Princeton Studies in Complexity. Princeton University Press, Princeton (2006)

Palestrini, A.: Analysis of industrial dynamics: a note on the relationship between firms’ size and growth rate. Econ. Lett. 94(3), 367–371 (2007)

Rotundo, G., D’Arcangelis, A.M.: Ownership and control in shareholding networks. J. Econ. Interact. Coord. 5(2), 191–219 (2010a). doi: 10.1007/s11403-010-0068-4; ISSN 1860–711X

Rotundo, G., D’Arcangelis, A.M.: Network analysis of ownership and control structure in the Italian stock market. Adv. Appl. Stat. Sci. 2(2), 255–273 (2010b)

Schoenmaker, D.: The European Banking Landscape After the Crisis, Duisenberg School of Finance Policy Paper (2011)

Schweitzer, F., Fagiolo, G., Sornette, D., Vega-Redondo, F., Vespignani, A., White, D.R.: Economic networks: the new challenges. Science 325(5939), 422–425 (2009)

Souma, W., Aoyama, H., Fujiwara, Y., Ikeda, Y., Iyetomi, H., Kaizoji, T.: Correlation in business networks. Physica A 370, 151–155 (2006)

Valente, T.W., Coronges, K., Lakon, C., Costenbader, E.: How correlated are network centrality measures? Connections (Toronto, Ont.) 28(1), 16–26 (2008)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rotundo, G., D’Arcangelis, A.M. Network of companies: an analysis of market concentration in the Italian stock market. Qual Quant 48, 1893–1910 (2014). https://doi.org/10.1007/s11135-013-9858-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-013-9858-9