Abstract

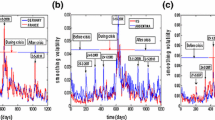

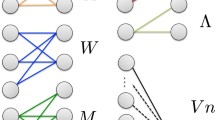

In this paper, we examine linear and nonlinear co-movements that appear in the real exchange rates of a group of 28 developed and developing countries. The matrix of Pearson correlation and Phase Synchronous coefficients have been used in order to construct a topology and hierarchy of countries by using the Minimum Spanning Tree (MST). In addition, the MST cost and global correlation coefficients have been calculated to observe the co-movements’ dynamics throughout the time sample. By comparing Pearson and Phase Synchronous information, a new methodology is emphasized; one that can uncover meaningful information pertaining to the contagion economic issue and, more generally, the debate surrounding interdependence and/or contagion in financial time series. Our results suggest some evidence of contagion in the Asian currency crises; however, this contagion is driven by previous and stable interdependence.

Similar content being viewed by others

Notes

We have used the real exchange rate, instead of the nominal exchange rate, to avoid the influence of hyperinflation episodes in some countries during the considered period. Moreover, returns of real exchange rates have been used in order to stabilize time series, making them suitable for further analysis.

In Sect. 2.2 the phase synchronization concept is explained in depth.

Different number of data points have been used in both cases; 155 months in Ortega and Matesanz (2006) and 128 months in the present work.

References

Arestis, P., Caporale, G.M., Cipollini, A., Spagnolo, N.: Testing for financial contagion between developed and emerging markets during the 1997 East Asian crisis. Int. J. Finance Econ. 10(4), 359–367 (2005)

Beben, M., Orlowski, A.: Correlations in financial time series: established versus emerging Markets. Eur. Phys. J. B 20, 527–530 (2001)

Bialkowski, J., Dobromil, S.: Financial contagion, spillovers and causality in the Markov switching framework. Quant. Finance 5(1), 123–131 (2005)

Bonanno, G., Lillo, F., Mantegna, R.N.: Levels of complexity in financial markets. Phys. A 299, 16–27 (2001a)

Bonanno, G., Lillo, F., Mantegna, R.N.: High frequency cross-correlation in a set of stocks. Quant. Finance 1, 96–104 (2001b)

Brida, J.G., Risso, W.A.: Dynamics and structure of the main Italian companies. Int. J. Modern Phys. C 18(11), 1783–1794 (2007)

Candelon, B., Hecq, A., Verschoor, W.F.C.: Measuring common cyclical features during financial turmoil: evidence of interdependence not contagion. J. Int. Money Finance 24, 1317–1334 (2005)

Corsetti, G., Pericoli, M., Sbracia, M.: Some contagion, some interdependence: more pitfalls in tests of financial contagion. J. Int. Money Finance 24, 1177–1199 (2005)

Darbellay, G.A., Wuertz, D.: The entropy as a tool for analysing statistical dependences in financial time series. Phys A 287, 429–439 (2000)

Dungey, M., Fry, R., Martin, V., Gonzlez-Hermosillo, B.: Empirical modeling of contagion: a review of methodologies. Quant Finance 5(1), 9–24 (2005)

Dungey, M., Fry, R., Martin, V.L.: Correlation, contagion, and Asian evidence Asian. Econ Papers 5(2), 32–72 (2006)

Eichengreen, B., Rose, A.K., Wyplosz, C.: Contagious currency crises: first tests. Scand. J. Econ. 98, 463–484 (1996)

Fazio, G.: Extreme interdependence and extreme contagion between emerging markets. J. Int. Money Finance 26, 1261–1291 (2007)

Forbes, K.J., Rigobon, R.: No contagion, only interdependence: measuring stock market co-movements. J. Finance 57(5), 2223–2261 (2002)

García, Domínguez L., Wennberg, R.A., Gaetz, W., Cheyne, D., Snead, O.C., Perez Velazquez, J.L.: Enhanced synchrony in epileptiform activity? Local versus distant phase synchronization in generalized seizures. J. Neurosci. 25(35), 8077–8084 (2005)

Gower, J.C.: Some distance properties of latent root and vector methods used in multivariate analysis. Biometrik 53, 325–338 (1966)

Gravelle, T., Kichian, M., Morley, J.: Detecting shift-contagion in currency and bond markets. J. Int. Econ. 68, 409–423 (2006)

Hatemi, J.A., Hacker, R.S.: An alternative method to test for contagion with an application to the Asian financial crisis. Appl. Financial Econ. Lett. 1, 343–347 (2005)

Huang, N.E., Shen, Z., Long, S.R., Wu, M.C., Shih, E.H., Zheng, Q., Tung, C.C., Liu, H.H.: The empirical mode decomposition and the Hilbert Spectrum for nonlinear and non-stationary time series analysis. Proc. R. Soc. Lond. A454, 903–909 (1998)

Huang, N.E., Wu, M.-L., Qu, W., Long, S.R., Shen, S.S.P.: Applications of Hilbert-Huang transform to non-stationary financial time series analysis. Appl. Stoch. Model Bus. Ind. 19, 245–268 (2003)

Kaminsky, G., Lizondo, S., Reinhart, C.M.: Leading indicators of currency crises. IMF Staff Papers 45, 1–56 (1998)

King, M., Wadhwani, S.: Transmission of volatility between stock markets. Rev. Financial Stud. 3(1), 5–33 (1990)

Mantegna, R.N.: Hierarchical structure in financial markets. Eur. Phys. J. B 11, 193–197 (1999)

Mantegna, R.N., Stanley, H.E.: An introduction to econophysics: correlations and complexity in finance. University Press, Cambridge (2000)

Marschinski, R., Kantz, H.: Analysing the information flow between financial time series. An improved estimator for transfer entropy. Eur. Phys. J. B 30, 275–281 (2002)

Matesanz, D., Ortega, G.J.: A (econophysics) note on volatility in exchange rate time series. Entropy as a ranking criterion. Int. J. Modern Phys. C 19, 1095–1103 (2008)

Mizuno, T., Takayasu, H., Takayasu, M.: Correlation networks among currencies. Phys A 364, 336–342 (2006)

Mormann, F., Lehnertz, K.D.P., Elger, C.E.: Mean phase coherence as a measure for phase synchronization and its application to the EEG of epilepsy patients. Phys. D 144, 358–369 (2000)

Naylor, M.J., Rose, L.C., Moyle, B.J.: Topology of foreign exchange markets using hierarchical structure methods. Phys. A 382, 199–208 (2007)

Ortega, G.J., Matesanz, D.: Cross-country hierarchical structure and currency crises. Int. J. Modern Phys. C 17(3), 333–341 (2006)

Perez, J.: Empirical identification of currency crises: differences and similarities between indicators. Appl. Financial Econ. Lett. 1(1), 41–46 (2005)

Pikovsky, A.S., Rosenblum, M.G., Osipov, G.V., Kurths, J.: Phase synchronization of chaotic oscillators by external driving. Phys. D 79, 219–238 (1997)

Plerou, V., et al.: Universal and nonuniversal properties of cross correlations in financial time series. Phys. Rev. Lett. 83, 1471–1474 (1999)

Rammal, R., Toulouse, G., Virasoro, M.A.: Ultrametricity for physicists. Rev. Modern Phys. 58(3), 765–788 (1986)

Rigobon, R.: Contagion: how to measure it. In: Edwards, S., Frankel, J. (eds.) Preventing Currency Crises in Emerging Markets. University of Chicago Press, Chicago (2001)

Rigobon, R.: On the measurement of international propagation of shocks: is the transmission stable? J. Int. Econ. 61, 261–283 (2003)

Rosenblum, M.G., Pikovsky, A.S., Kurths, J.: Phase synchronization of chaotic oscillators. Phys. Rev. Lett. 76, 1804–1807 (1996)

Rosenblum, M.G., Pikovsky, A., Schfer, C., Tass, P.A., Kurths, J.: Phase synchronization: from theory to data analysis. In: Moss, F., Gielen, S. (eds.) Handbook of Biological Physics. Elsevier Science, Amsterdam (2001)

Acknowledgments

DM thanks financial support from the Spanish Ministry of Education through the José Castillejo Program (JC2010-0273). GO thanks financial support from CONICET PIP (PIP 11420100100261) and Universidad Nacional de Quilmes PUNQ 1000/11.GO is member of CONICET Argentina. The authors are very grateful to Teressa Canosa for exhaustive language revision.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The 28 countries included in this work are as follows (order by increasing entropy):

Argentine (ARG), Malaysia (MAL), Thailand (THA), Mexico (MEX), Korea (KOR), Indonesia (INDO), Brazil (BRA), Venezuela (VEN), Peru (PER), India (INDI), Ecuador (ECU), Turkey (TUR), Colombia (COL), Singapore (SIN), Philippines (PHI), United Kingdom (U_K), Sweden (SWE), Italy (ITA), Ireland (IRE), Finland (FIN), Chile (CHI), Greece (GRE), Portugal (POR), Switzerland (SWI), Denmark (DEN), Spain (SPA), Norway (NOR), Australia (AUS).

Rights and permissions

About this article

Cite this article

Matesanz, D., Ortega, G.J. Network analysis of exchange data: interdependence drives crisis contagion. Qual Quant 48, 1835–1851 (2014). https://doi.org/10.1007/s11135-013-9855-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-013-9855-z